Industrial Hemp Market Size and Forecast 2025 to 2034

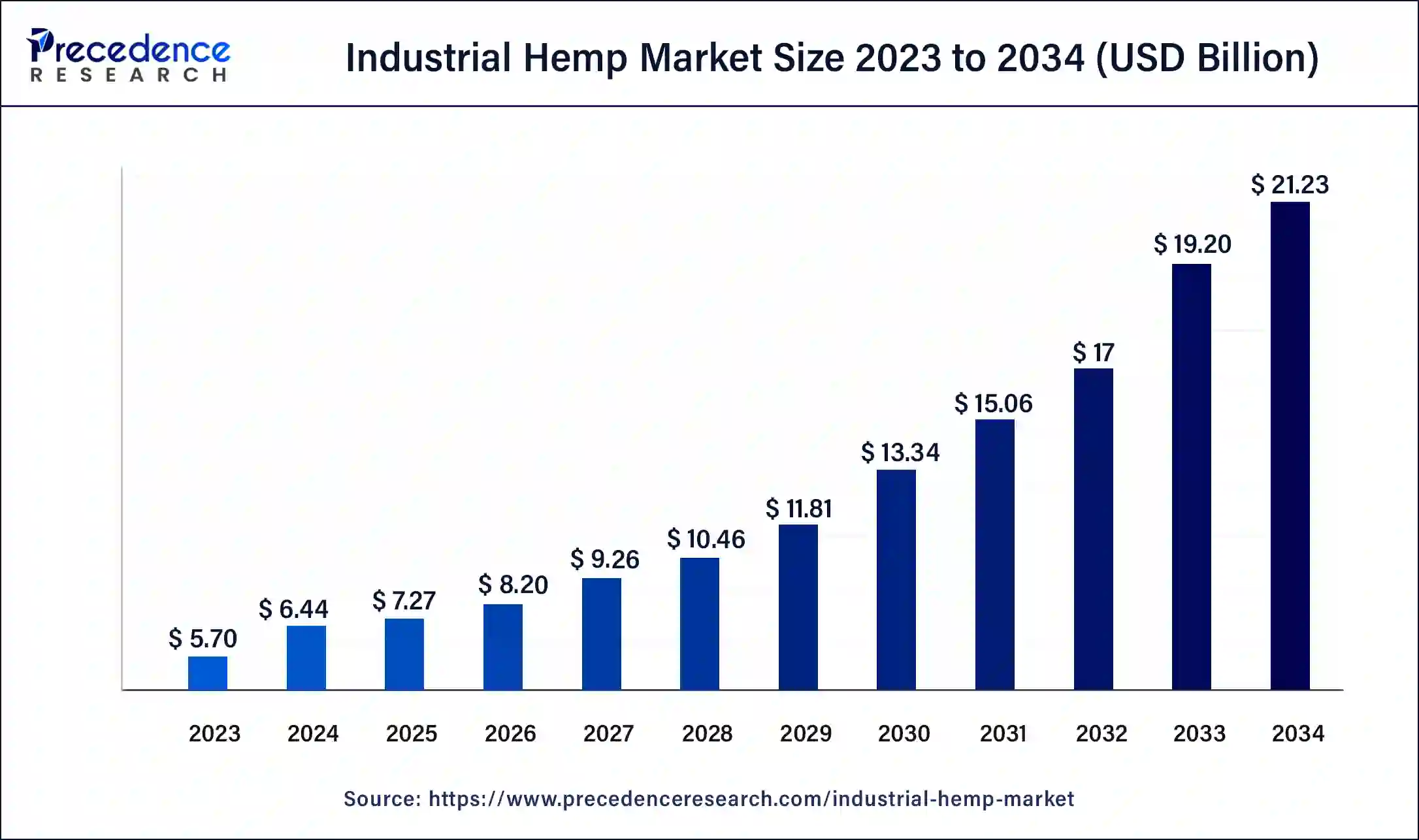

The global industrial hemp market size was calculated at USD 6.44 billion in 2024 and is expected to reach around USD 21.23 billion by 2034, expanding at a CAGR of 12.67% from 2025 to 2034.

Industrial Hemp Market Key Takeaways

- In terms of revenue, the industrial hemp market is valued at USD 7.27 billion in 2025.

- It is projected to reach USD 21.23 billion by 2034.

- The industrial hemp market is expected to grow at a CAGR of 12.67% from 2025 to 2034.

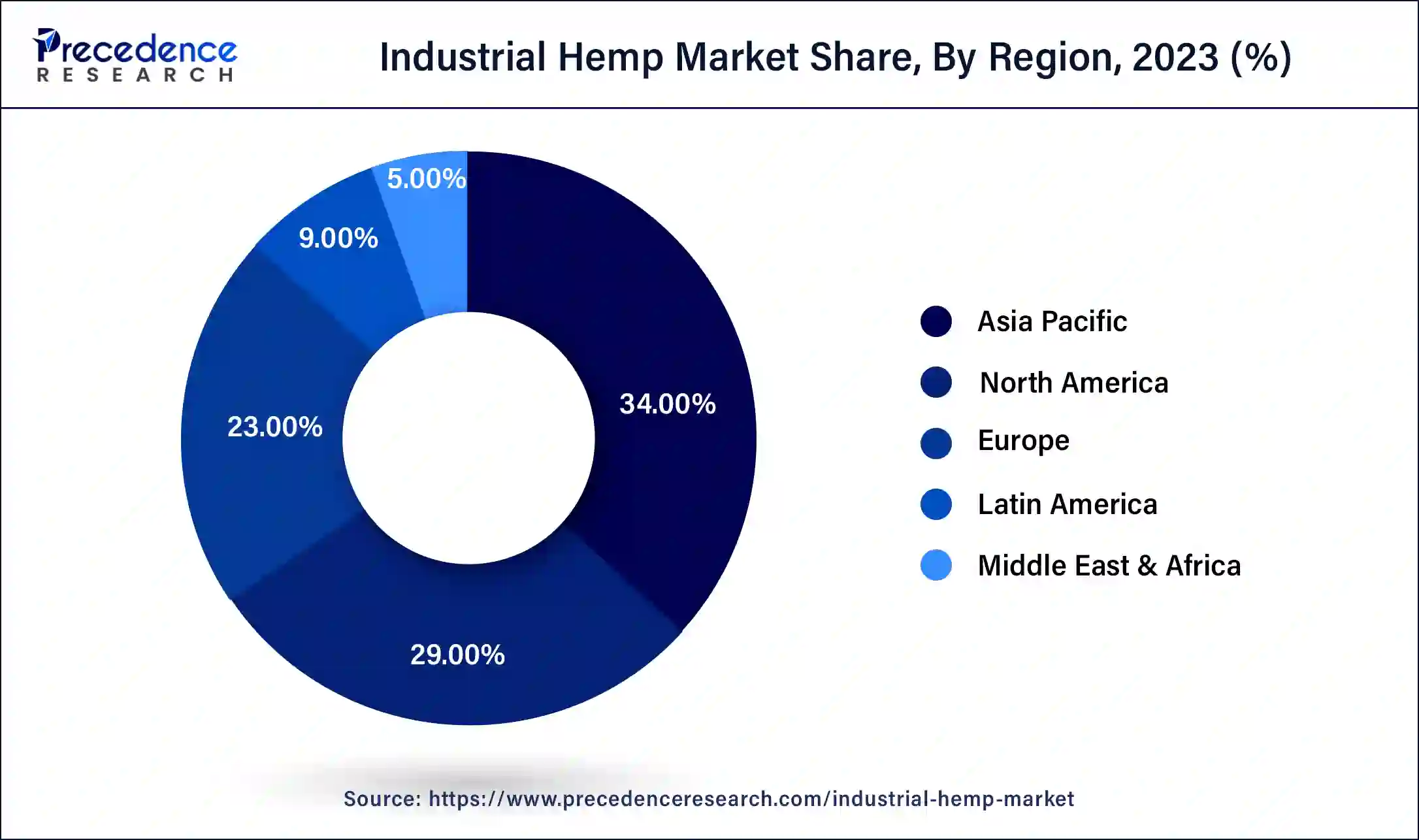

- Asia Pacific led the industrial hemp market with the largest share of 34% in 2024.

- By product, the hemp seeds segment dominated the market with the largest share of 30% in 2024.

- By product, the hemp fiber segment is expected to witness a significant growth in the market during the forecast period.

- By application, the textile application segment led the market in 2023 and accounted 28% revenue share.

- By application, the food and beverage segment is observed to witness a significant growth rate during the forecast period.

Asia Pacific Industrial Hemp Market Size and Growth 2025 to 2034

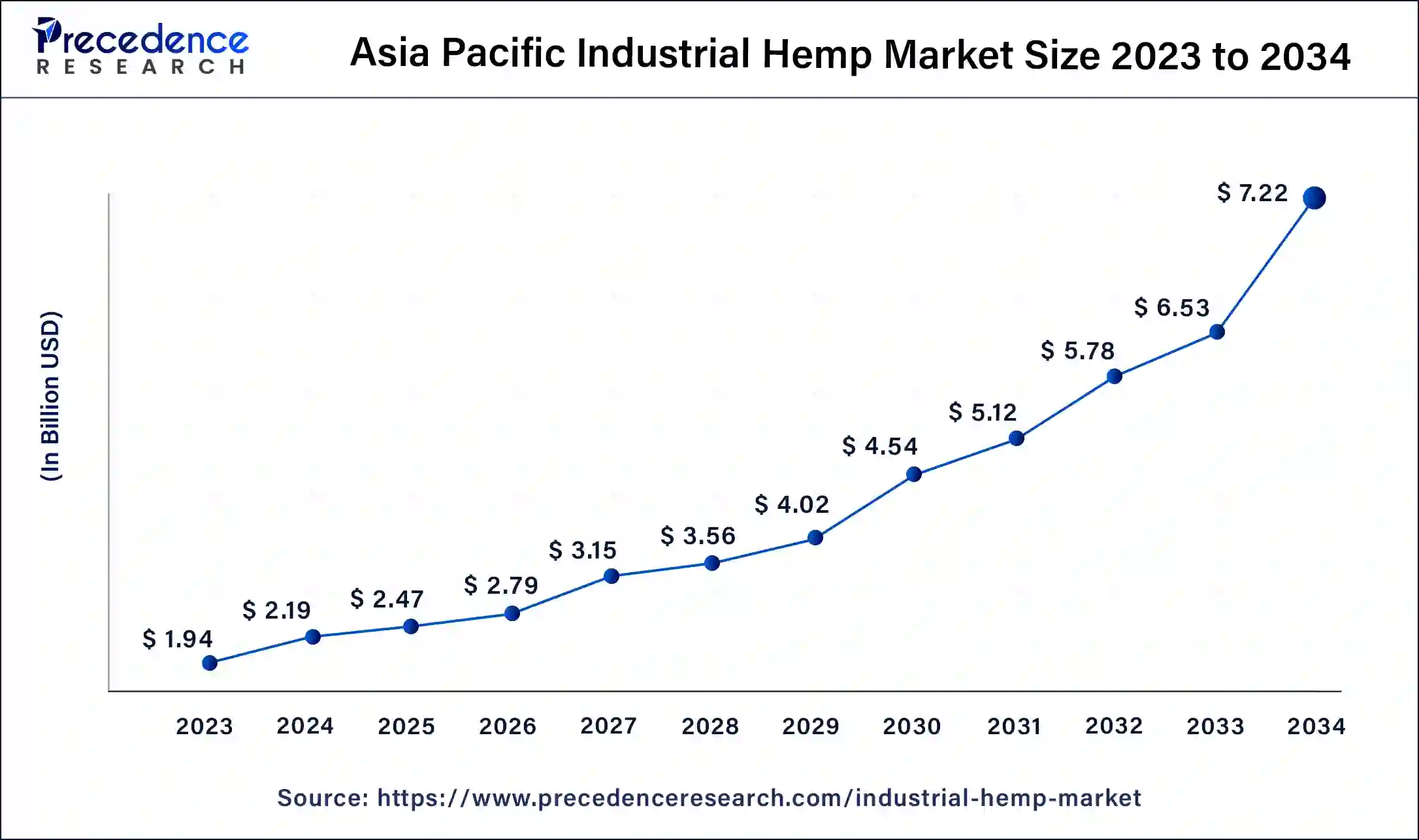

The Asia Pacific industrial hemp market size was estimated at USD 2.19 billion in 2024 and is projected to surpass around USD 7.22 billion by 2034 at a CAGR of 13% from 2025 to 2034.

Asia Pacific led the industrial hemp market with the largest size in 2024. The growth of the market is increasing due to the rising consumption and production of industrial hemp by the major regional countries for use in different applications which drives the demand for the market. The countries like China, Japan, India and Thailand are highly investing in the production, consumption, and distribution of hemp in different applications. The rising investments in technological advancements and innovations in the use of industrial hemp and making the harvesting of industrial hemp easier drive the growth of the market.

Additionally, the rising consumption of industrial hemp-based supplements, foods, and medicines in developing economies is further propelling the growth of the industrial hemp market in the region. Industrial hemp has a wide range of applications, including textiles, construction materials, food and beverages, personal care products, and pharmaceuticals.

The Asia-Pacific region has diverse industries that can benefit from hemp-derived products, driving demand across multiple sectors. There is a growing awareness and acceptance of the potential benefits of hemp-derived products in the Asia-Pacific region. This includes products such as hemp fiber, hemp seeds, hemp oil, and CBD-based products. As attitudes toward hemp and cannabis shift, there is a rising demand for these products in the region.

Currently, Asia Pacific is dominating the industrial hemp market. The contribution of the government is a major growth factor. The region's supportive climate conditions boost the developmental progress of this market in the region. The increasing demand for sustainable products is mainly driving the industrial hemp business.

North America is expected to witness the fastest growth in the industrial hemp market during the forecast period. The growth of the market in the region is increasing due to the rising use of industrial hemp in applications like personal care, construction activities, pharmaceuticals, etc., which is driving the demand for the market.

The rising production and distribution activities in the region and the increasing investments in research and development activities in the development of industrial hemp are accelerating the growth of the industrial hemp market in the region. The availability of capital and investment opportunities in the United States attracts investors and entrepreneurs to the hemp industry. This enables companies to expand operations, invest in research and development, and scale up production. The United States has a culture that fosters entrepreneurship and innovation. This has led to the emergence of numerous startups and small businesses in the hemp industry, driving growth and competition.

Market Overview

Hemp is a plant of the genus Cannabis that contains a delta-9 tetrahydrocannabinol (THC) concentration of 0.3% on a dry basis. The industrial hemp market offers hemp-associated materials for various applications or categories of industrial applications which include health and supplements, textiles, paper products, building materials, and others. Hemp contains CBD oil in a suitable proportion that is useful for its various medicinal properties and helps in treating diseases like diabetes, and tumors, and reducing pain which fuels the demand for the market. Industrial hemp is eco-friendly, faster in production, and has many other beneficial properties that are driving the expansion of the industrial hemp market.

Industrial Hemp Market Growth Factors

- The rising demand for nutrition-based food and beverages is due to the rising consumer awareness about the health and supplement intakes that drive the growth of the industrial hemp market.

- The rising demand for dietary supplements and the availability of nutritional and environmental benefits in industrial hemp are driving the demand for the market.

- The increasing infusion of industrial hemp to consumer applications such as food and beverages, animal care, and personal care is driving the demand for industrial hemp.

- The increasing competition in the national and international market players in the operations of industrial hemp that fueling the growth of the market.

- The rising demand for consumer applications such as personal care, hemp CBD, food and beverages, consumer textiles, etc. is driving the growth of the market.

- The increasing investments in the research and development program in the development and the innovative use cases of industrial hemp also contribute to the expansion of the industrial hemp market.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 12.67% |

| Market Size in 2024 | USD 6.44 Billion |

| Market Size in 2025 | USD 7.27 Billion |

| Market Size by 2034 | USD 21.23 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Source, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver:

Increasing demand for industrial hemp-based products

The increasing demand for industrial hemp-infused consumer products such as food, cosmetics, textiles, pharmaceuticals, and other consumer goods due to their nutritional value drives the demand for the market. The growing adoption of the healthy alternative to the diet and the increasing concern towards a healthy lifestyle in the population are contributing to the higher adoption of the industrial hemp market.

The rising demand for sustainable products by consumers is driving the growth of the market. Additionally, the rising government support for the production and distribution of industrial hemp across various countries is driving the growth of the industrial hemp market.

Restraint:

Government regulations

There are different government policies and norms for the production and distribution of hemp in the market in which several countries banned the use of hemp as a consumer product. Thus, the strict government regulation of the cultivation, production, and distribution limits the growth of the industrial hemp market. Due to the legal complexities surrounding hemp and cannabis, many financial institutions are hesitant to provide banking services to businesses operating in the hemp industry. This lack of access to banking services can create significant challenges for hemp businesses, including difficulties in obtaining loans, processing payments, and managing finances.

Opportunity:

Increasing demand from the construction industry

The growing demand for industrial hemp from the construction industry is driving the expansion of the industrial hemp market. Industrial hemp is an eco-friendly, sustainable, and low-carbon material which makes it ideal for construction and architectural use. Industrial hemp is considered a sustainable and modern alternative to the traditional approach in the construction and architectural industry with several advantages and revolutionizing the construction industry. The expanding construction industry owing to the increasing population worldwide and the rising global warming due to pollution has led to a higher demand for sustainable and eco-friendly alternatives to the construction industry which drives the demand for the industrial hemp market.

Technological Advancement

Technological advancements in the industrial hemp market feature automation, cultivation techniques, and extraction methods. AI and automation, a popular technology, control quality and optimize processing parameters. The cultivation techniques enhance the areas of precision farming and breeding. This enhances quality and crop yields. The extraction method approach extraction of advanced techniques and CO2, which provides quality cannabinoids in production, such as CBD and other compounds. The technology innovation expands the market to larger platforms connecting to various product applications. The CBD hemp-based product, industrial materials, and plant-based protein broaden market opportunity and increase consumer demand.

The advanced sustainable materials impact the industrial hemp market. The growth factor is highly dependent on the technology and new innovative efforts. These technologies lead to developmental projects that reshape the future of existing and new businesses from a competitive perspective.

Product Insights

The hemp seeds segment dominated the industrial hemp market in 2024. Hemp seeds are made from Cannabis Sativa plants, widely used for their intoxication properties. These tiny, brown seeds are packed full of fiber, protein, and other healthy fats including omega-3 and omega-6. Their antioxidant qualities may help to reduce the symptoms of numerous ailments, and they also strengthen the heart, skin, and joints. Hemp seeds have almost the same amount of protein as soybeans. Protein counts range from 9.46 grams (g) to almost 3 teaspoons per 30 grams (g) of seeds.

These seeds are regarded as a complete protein source since they provide each of the nine necessary amino acids. Significant amounts of omega-3 fatty acids and a beneficial ratio of omega-3 to omega-6 fatty acids are found in hemp seeds. Hemp seed oil is widely used in various applications such as personal care, animal feed, food and beverages, nutritional supplements, medicinal and therapeutic products, and others. Thus, the rising demand for hemp seed oil in consumer care products is driving the growth of the segment.

The hemp fiber segment is observed to witness a significant rate of growth in the industrial hemp market during the forecast period. Hemp fiber is a highly insulated material, lightweight, biodegradable, with superior strength, and thermodynamic properties. Hemp fiber is widely used in applications such as carpeting, paper, construction materials, home furnishing, auto parts, insulation materials, and others.

Application Insights

The textile application segment held the largest share of the industrial hemp market in 2024. The growth of the segment is attributed to its hypo-allergic, strong, and natural resistance to UV lights. Hemp fiber is the strongest fiber that is used in the manufacturing of textiles. Compared to other fabrics made of natural fibers, it offers superior ultraviolet (UV) protection and is noticeably tougher and more resilient than cotton. Additionally, hemp satisfies almost every requirement needed to be categorized as sustainable.

Farmers can benefit from its naturally occurring hypoallergenic, antiviral, antibacterial, and antimicrobial properties since they allow for a more environmentally friendly growing environment with a far lower demand for pesticides and fertilizers. It is widely accepted that soil is more regenerative than cotton growth, using less water to grow than cotton while also leaving the land in better shape.

The food and beverage segment is observed to witness growth at a significant rate during the forecast period in the industrial hemp market. The growth of the segment is attributed to the rising consumption of hemp due to its high nutritional value fatty acids, proteins, omega-3, and others. The rising consumer awareness among the population for the health and nutrition added to their food is driving the demand for industrial hemp in the food and beverages segment. The rising consumption of hemp in various other industries such as construction, pharmaceutical, and others is driving the growth of the market.

Industrial Hemp Market Companies

- Parkland Industrial Hemp Growers Cooperative Ltd.

- CBD Biotechnology Co.

- Botanical Genetics, LLC

- Marijuana Company of America Inc.

- HempMeds Brasil

- Terra Tech Corp.

- American Cannabis Company, Inc.

- HempFlax B.V.

- Industrial Hemp Manufacturing, LLC

- American Hemp

- Hemp, Inc.

- Boring Hemp Company

- Plains Industrial Hemp Processing Ltd.

- Ecofiber Industries Operations

- Valley Bio Limited

Recent Developments

- In May 2025, Ukraine's largest enterprise for the primary processing of industrial hemp launched the Ma'Rijany industrial park in the Zhytomyr region. The development has elevated the industrial hemp market. (Source: ubn.news )

- In May 2025, the International Congress on Industrial Hemp and Medicinal Cannabis gathered over 1,500 participants from diverse sectors in Argentina. The event highlighted science-based policy and industrial development of cannabis and hemp globally. (Source: born2invest.com )

- In October 2024, Rare Earth Global, a UK-based startup on a mission to simplify access to industrial hemp products for feed, construction, and energy, raised USD 1.3 million pre-seed round to expand its platform. (Source: agfundernews.com )

- In March 2024, LiveWire the division of Harley-Davidson's electric motorcycle introduced the S2 Mulholland, in which some bits are made from hemp. The S2 Mulholland contains some sustainable materials in some components which are available in the United States and Canada.

- In March 2024, Coast Smokes partnered with Willie's Remedy, Willie Nelson's legendary hemp brand, to launch the new hemp smokeables. The launch contributed to Willie's historic transition from cigarettes to cannabis. The organic hemp smoke is made with biodegradable filters with the combination of trios of CBD vapes — Elevate, Chill, and Slumber.

- In November 2023, HempStreet, a Cannabis-focused health tech raised $1 million in its pre-series funding round initiated by Carl Waahlin of Waahlin Holdings an existing investor.

Segments Covered in the Report

By Product

- Seeds

- Fiber

- Shivs

By Source

- Conventional

- Organic

By Application

- Animal Care

- Textiles

- Automotive

- Furniture

- Food & Beverages

- Paper

- Construction Materials

- Personal Care

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content