What is the Ingestible Sensors Market Size?

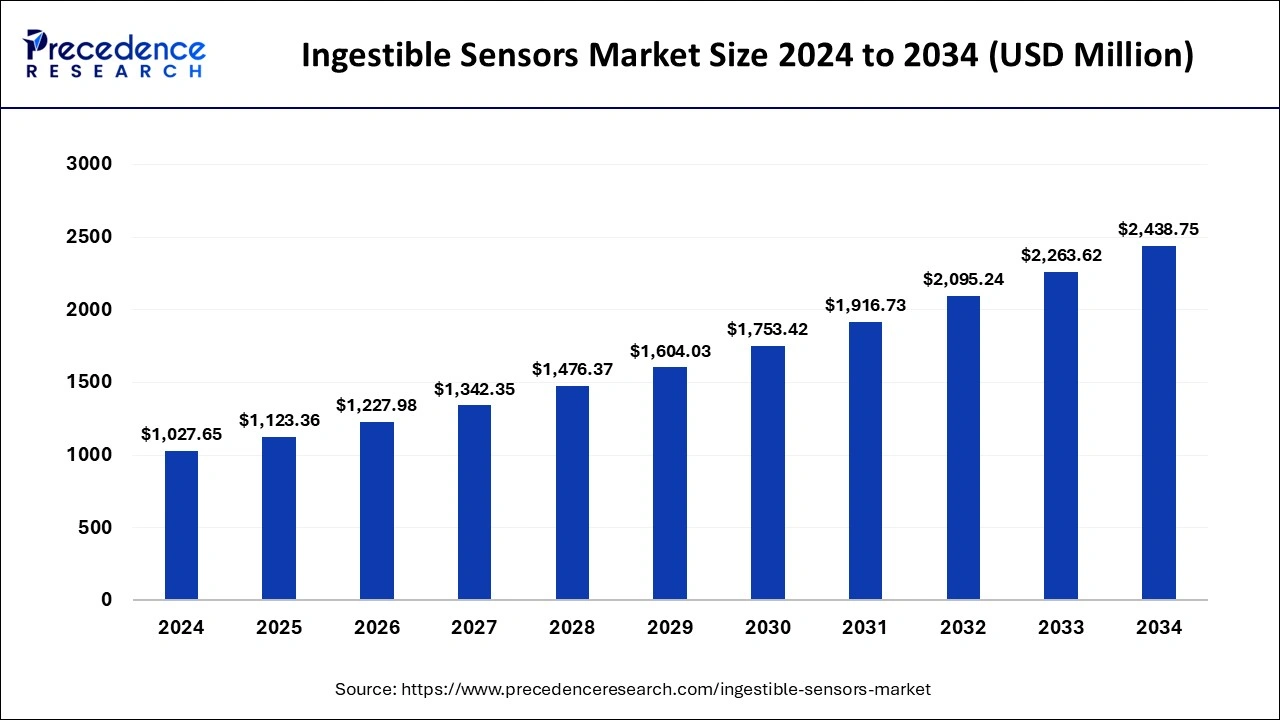

The global ingestible sensors market size was estimated at USD 1,123.36 million in 2025 and is predicted to increase from USD 1,227.98 million in 2026 to approximately USD 2,609.38 million by 2035, expanding at a CAGR of 8.79% from 2026 to 2035.

Ingestible Sensors Market Key Takeaways

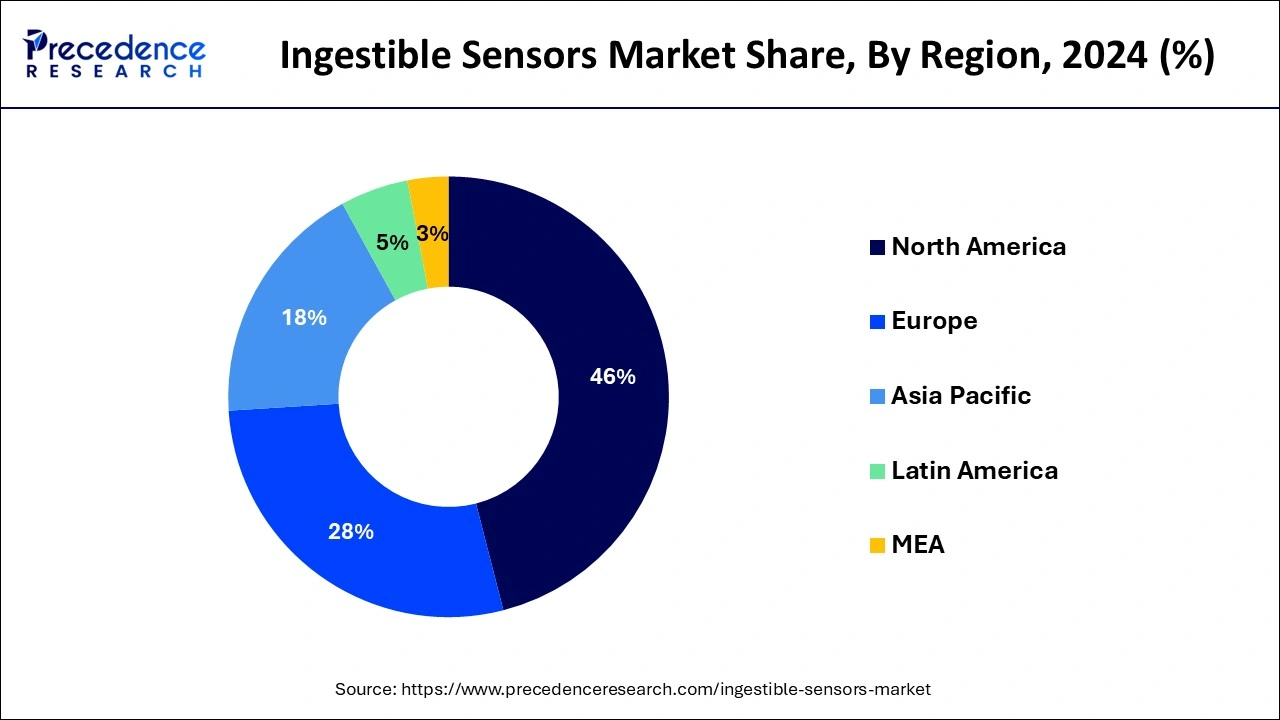

- North America generated more than 46% of the revenue share in 2025.

- By component, the sensors segment is captured for the maximum market share in 2025.

- By sensor type, the temperature sensor generated more than 36% of revenue share in 2025.

Market Overview

Ingestible sensors refer to tiny electronic devices that can be swallowed and are designed to monitor various aspects of a person's health from inside the body. These sensors are usually made up of biocompatible materials and are small enough to pass through the digestive system and exit the body naturally.

They can transmit data wirelessly to an external device, such as a smartphone or a wearable device, where the data can be analyzed and monitored. One primary application of ingestible sensors is in the field of healthcare. These sensors can monitor various health indicators, such as heart rate, body temperature, and blood sugar levels.

They can also monitor the effectiveness of medications and detect the presence of disease in the body. Ingestible sensors can benefit patients with chronic conditions, such as diabetes, who must monitor their blood sugar levels regularly.

How is AI Influencing the Ingestible Sensors Industry?

AI algorithms process large amounts of information from ingestible capsules, enabling the real-time detection of gastrointestinal diseases, like gastric cancer, by identifying gases in the gut. AI-driven predictive models predict potential health risks, allowing preemptive interventions in remote patient monitoring scenarios. Meanwhile, machine learning models determine patient-specific data to offer customized health insights, moving beyond generic monitoring to personalized diagnostics and treatment plans.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1,123.36 Million |

| Market Size in 2026 | USD 1,227.98 Million |

| Market Size by 2035 | USD 2,609.38 Million |

| Growth Rate from 2026 to 2035 | CAGR of 8.79% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Component, By Sensor Type, and By Industry Vertical |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of chronic diseases

The rising incidence of chronic diseases like diabetes, cardiovascular disease, and gastrointestinal disorders is one of the key factors driving the market for ingestible sensors. Due to these diseases' ongoing monitoring and management, there is an increased need for creative healthcare solutions that can offer real-time health monitoring and control.

For instance, in February 2022, Rani Therapeutics Holdings, Inc. revealed the creation of the RaniPill HC (High Capacity), an oral biologics device with significantly higher drug payload capacity than the company's current oral biologics capsule, capable of delivering over 500% more drug payload. Additionally, As the prevalence of chronic diseases continues to rise, the demand for innovative healthcare solutions like ingestible sensors is expected to grow, driving the growth of the ingestible sensors market.

Furthermore, in response to this ever-increasing healthcare challenge, healthcare providers are looking for new and innovative ways to monitor and manage chronic diseases. Ingestible sensors have emerged as a promising solution, as they allow for continuous monitoring of patients' health metrics in real time, even when not in a clinical setting.

Restraint

Expensive and time-consuming regulatory approvals

One of the principal restraints in the ingestible sensors market is regulatory hurdles. The regulatory approval process for ingestible sensors can be lengthy and expensive, delaying product launches and limiting market adoption. Additionally, there are concerns about data privacy and security when collecting and transmitting data from ingestible sensors. For instance, Medtronic faced a delay in PillCam COLON 2 approval.

This ingestible capsule is designed to aid in diagnosing colon cancer. Still, despite being first submitted to the FDA for approval in 2018, it received a "not approvable" letter in 2019 due to safety and effectiveness concerns. Although Medtronic resubmitted the device in 2020, the FDA issued another "not approvable" letter in early 2021, citing insufficient data.

As a result, Medtronic has faced challenges in bringing the device to market, creating uncertainty for patients who could benefit from its technology.

Furthermore, The high cost of regulatory approval is a significant challenge for companies in the ingestible sensors market, particularly for startups and smaller companies that may need more financial resources to navigate the regulatory landscape.

Opportunity

Improved access to remote patient monitoring

With the growing trend of telemedicine and remote healthcare, ingestible sensors can provide a non-invasive and convenient way for healthcare providers to monitor patients' health in real-time. For example, patients with chronic conditions such as diabetes, heart disease, or hypertension can benefit from ingestible sensors that monitor their vital signs and medication adherence.

The data collected by the sensors can be transmitted to healthcare providers, who can then use this information to adjust treatment plans, provide timely interventions, and prevent complications. This can improve patient outcomes and reduce healthcare costs associated with hospitalizations and emergency room visits.

Ingestible sensors can also benefit patients recovering from surgeries or undergoing other medical procedures. By tracking their vital signs and medication adherence, healthcare providers can monitor their progress remotely, reducing the need for in-person visits and providing more personalized care. Furthermore, ingestible sensors can be particularly valuable for elderly patients with difficulty remembering to take their medication or limited mobility.

By using ingestible sensors, healthcare providers can monitor their health and provide timely interventions, reducing the risk of complications and improving their quality of life.

Segment Insights

Component Insights

Based on component, the global ingestible sensors market is segmented into sensors, In 2025, the sensors segment accounted for the largest market share. Advancements in sensor technology have led to the development of more advanced and sophisticated ingestible sensors. For example, recent advances in wireless communication and data analytics have enabled ingestible sensors to transmit real-time data to healthcare providers, allowing for more accurate and efficient diagnosis and treatment.

Additionally, global healthcare expenditure has been increasing significantly over the years. The growing healthcare expenditure and the increasing burden of gastrointestinal diseases are expected to boost the demand for ingestible sensors. Furthermore, the rising demand for personalized medicine bolsters the growth of the ingestible sensors market.

Sensor Type Insights

Based on sensor type, the global ingestible sensors market is segmented into temperature sensors, pressure sensors, pH sensors, and image sensors. In 2025, the temperature sensors segment accounted for the largest market share. Increasing demand for temperature sensors in various industries dramatically fosters the growth of this segment.

Temperature sensors are growing in the automotive, healthcare, food and beverage, and HVAC industries. The growing demand for these sensors in various applications significantly drives the temperature sensor market's growth.

Additionally, the development of new temperature sensor technologies, such as infrared and fiber optic sensors, has expanded the range of applications for temperature sensors. These technological advancements have also improved temperature sensors' accuracy, reliability, and performance, making them more attractive to customers.

Furthermore, government regulations and standards related to safety and environmental protection drive the adoption of temperature sensors in various industries. For example, food safety and storage rules require temperature sensors to monitor and control the temperature in refrigerated environments.

Regional Insights

What is the U.S. Ingestible Sensors Market Size?

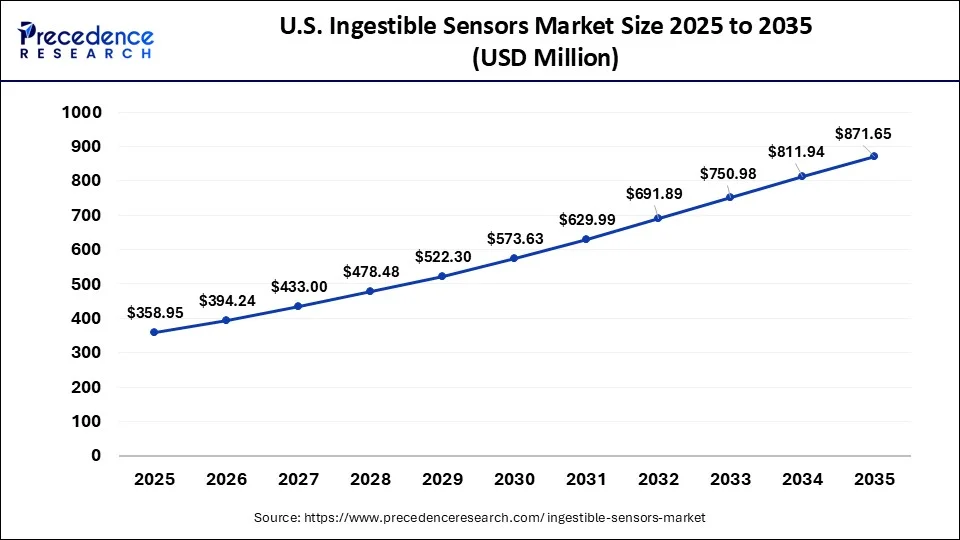

The U.S. ingestible sensors market size reached USD 358.95 million in 2025 and is anticipated to be worth around USD 871.65 million by 2035, poised to grow at a CAGR of 9.28% from 2026 to 2035.

North America dominated the global ingestible sensors market with the highest market share. The growth in this region is attributed to the high adoption rate of advanced healthcare technologies in the area. Additionally, increasing government initiatives and funding for developing advanced healthcare technologies are other factors contributing to the growth of the ingestible sensors market in this region.

For instance, the FDA has approved several ingestible sensors in the US market, such as the Proteus Digital Health ingestible sensor and the FDA-cleared PillCam COLON 2 capsule from Medtronic. This has helped to increase the adoption of ingestible sensors in the US healthcare system and other industries such as sports and fitness.

U.S. Ingestible Sensors Market Trends

The U.S. market is experiencing significant growth as healthcare providers, payers, and patients increasingly adopt digital health technologies to improve medication adherence, remote patient monitoring, and chronic disease management. Rising prevalence of chronic conditions and demand for real-time physiological data are driving interest in ingestible sensor solutions that can wirelessly transmit internal health metrics and support personalized care.

Digital Health Innovations Driving the Ingestible Sensors Market in the Asia Pacific

Asia Pacific is the fastest-growing market during the forecast period. It is driven by advancements in micro-electro-mechanical systems (MEMS) and even nanotechnology, which allow the creation of smaller, more reliable sensors that enhance patient comfort, making them easier to ingest. There is a strong, rising preference for proactive, preventive, and non-invasive diagnostic tools among elderly populations and those with sedentary lifestyles.

Japan Ingestible Sensors Market Trends

Japan's market is rapidly gaining traction as healthcare digitization and advanced diagnostic technologies become more integrated into clinical practice and chronic disease management. The market is expected to grow at a strong double-digit compound annual growth rate, nearly doubling in size by the end of the decade as adoption increases in hospitals, research centers, and long-term care settings.

Role of Ingestible Sensors in Remote Patient Monitoring and Diagnostics in Europe

Europe's market shows significant growth during the forecast period. It is driven by the demand for ingestible sensors that enable the analysis of gut biomarkers, allowing tailored treatments and personalized nutrition. By permitting remote, real-time data collection, these apparatuses reduce the demand for frequent hospital visits.

Germany Ingestible Sensors Market Trends: The country's growth is driven by rapid technological advancements and increasing healthcare demands. Innovations in miniaturization, sensor accuracy, and biocompatible materials have significantly enhanced the region's market position. Supportive regulatory frameworks, increased funding for health tech R&D, and a strong healthcare infrastructure are encouraging the commercialization and clinical implementation of ingestible devices.

What are the Key Trends in the Ingestible Sensors Market in Latin America?

Latin America is expected to witness substantial growth in the market, driven by an increase in healthcare expenditure and a rise in chronic diseases. Heavy investments by the top companies are boosting research and development initiatives, contributing to the region's growth. Countries such as Mexico and Brazil are expected to lead the region due to the increasing adoption of these medical devices for diagnostics and therapeutic purposes.

Brazil Ingestible Sensors Market Trends: The country's market landscape is driven by increasing healthcare digitization, rising prevalence of chronic diseases, and advancements in sensor technology. As technological maturity advances, the market is expected to grow even more.

How is the Middle East and Africa Region Growing in the Ingestible Sensors Market?

Middle East and Africa is expected to witness steady growth in the upcoming years. This is due to the region's rapidly aging population and a growing focus on personalized medicine. The region's robust healthcare system supports the integration of these advanced technologies, thus boosting adoption. Furthermore, the region benefits from favorable regulatory conditions and collaborative efforts between healthcare providers and technology firms.

Saudi Arabia Ingestible Sensors Market Trends: The country's growth and development is driven by an increasing adoption of advanced healthcare monitoring technologies, rising prevalence of chronic diseases and government initiatives that are aimed at promoting digital health.

Value Chain Analysis for the Ingestible Sensors Market

- Raw Material Procurement: It aims to acquire biocompatible materials, microelectronics, and even casing materials required to create "smart pills" or diagnostic capsules which can safely pass via the human gastrointestinal tract.

Key Players: Medtronic plc, CapsoVision, Inc., Olympus Corporation - Wafer Fabrication: It aims to create miniature, biocompatible, and even low-power devices, often referred to as smart pills, utilizing semiconductor MEMS (Micro-Electro-Mechanical Systems) technology.

Key Players: Atomica, Silex Microsystems, Teledyne Micralyne/DALSA - Photolithography and Etching: These are foundational, high-precision microfabrication techniques that allow the production of miniaturized, biocompatible, and even complex electronic components necessary for the market.

Key Players: CapsoVision, Inc., Olympus Corporation, IntroMedic Co., Ltd.

Ingestible Sensors Market Companies

- Medtronic

- Olympus

- Otsuka Holdings Co., Ltd.

- etectRx

- CapsoVision, Inc.

- H.Q., Inc.

- IntroMedic

- JINSHAN Science & Technology

- Check-Cap

- Seed Health

Recent Developments

- CapsoVision, a leading player in the gastroenterology diagnostics sector, showcased CapsoCam Plus at the Digestive Disease Week (DDW) event held in San Diego, CA in May 2022. This capsule endoscopy system is the only one that provides a complete 360° panoramic view.

- A digital health company called etectRx, Inc. announced a partnership with Pear Therapeutics, Inc. in January 2021 to develop up to two product candidates for the Central Nervous System that combine prescription digital therapeutics (PDTs) and adherence sensors. This collaboration is the first to look at the potential of integrating PDTs and digital pill solutions.

- Olympus Corporation unveiled the introduction of "PowerSpiral" in Europe and certain parts of the Asia-Pacific region, such as Hong Kong and India, in March 2019. This technology utilizes a motorized rotating attachment that delicately grasps the mucosa of the small intestine, assisting the endoscope in moving further into the intestine.

Segments Covered in the Report

By Component

- Sensor

- Wearable Patch/ Data Recorder

- Software

By Sensor Type

- Temperature Sensors

- Pressure Sensors

- pH Sensors

- Image Sensors

By Industry Vertical

- Medical

- Sports and Fitness

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting