Lactose Intolerance Treatment Market Size and Forecast 2025 to 2034

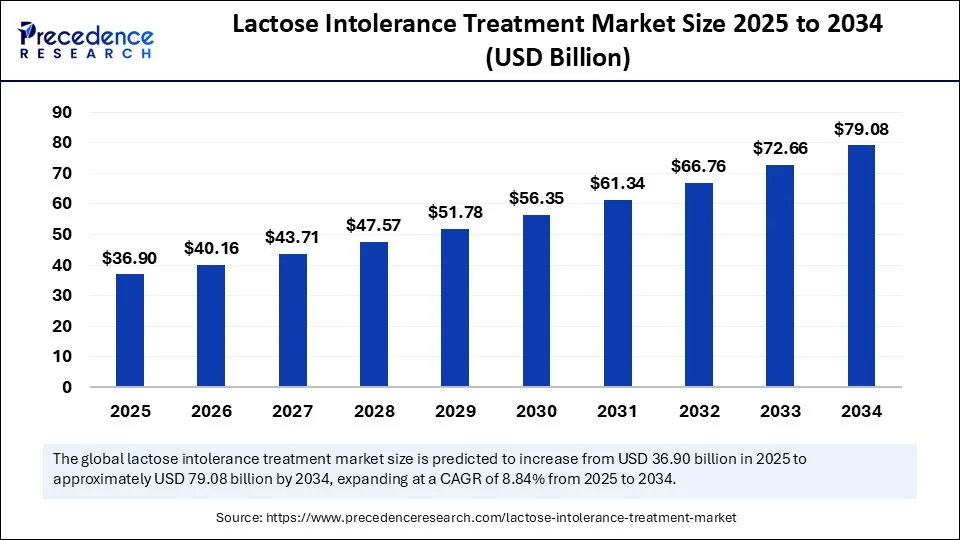

The global lactose intolerance treatment market size accounted for USD 33.9 billion in 2024 and is predicted to increase from USD 36.9 billion in 2025 to approximately USD 79.08 billion by 2034, expanding at a CAGR of 8.84% from 2025 to 2034. The lactose intolerance treatment market is growing steadily due to an increasing global incidence of lactose intolerance, increasing awareness of digestive health, and the increasing availability of lactose-free foods, enzyme supplements, and probiotics.

Lactose Intolerance Treatment MarketKey Takeaways

- In terms of revenue, the global lactose intolerance treatment market was valued at USD 33.9 billion in 2024.

- It is projected to reach USD 79.08 billion by 2034.

- The market is expected to grow at a CAGR of 8.84% from 2025 to 2034.

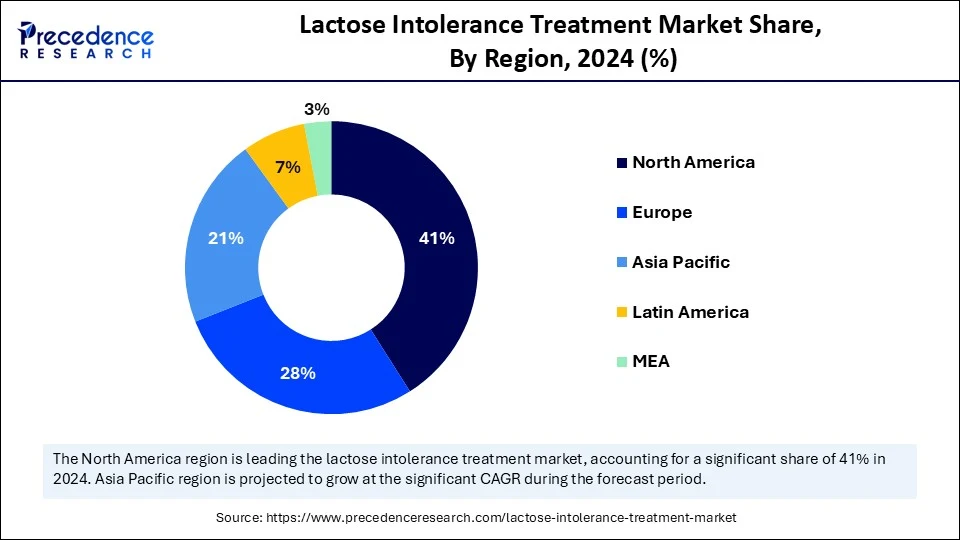

- North America dominated the lactose intolerance treatment market with the largest market share of 41% in 2024.

- Asia Pacific is estimated to expand at the fastest CAGR between 2025 and 2034.

- By treatment type, the lactase enzyme supplements segment held the biggest market share of 38% in 2024.

- By treatment type, the probiotic supplements segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By formulation, the solid (tablets & capsules) segment captured the highest market share of 42% in 2024.

- By formulation, the liquid (drops, RTD enzyme drinks) segment is expected to expand at a notable CAGR over the projected period.

- By distribution channel, the pharmacy and drug stores segment contributed the major market share of 35% in 2024.

- By distribution channel, the online retailers segment is expected to expand at a notable CAGR over the projected period.

- By end user, the adults segment held the largest market share of 57% in 2024.

- By end user, the children segment is expected to expand at a notable CAGR over the projected period.

- By source of enzyme, the fungal-derived lactase segment accounted for remarkable market share of 45% in 2024.

- By source of enzyme, the yeast-derived lactase segment is expected to expand at a notable CAGR over the projected period.

How does AI Help in the Lactose Intolerance Management?

Artificial intelligence enhances precision in the care of lactose intolerance by improving testing and enabling individualized treatment. Recently, a lab-on-phone genetic assay was launched, which can identify the lactase persistence gene variant (13910 C/T) from a buccal swab with an accuracy of 98.4% in under 90 minutes, enabling fast point-of-care diagnosis and treatment decisions. Convolutional neural networks, coupled with FTIR spectroscopy, were also able to achieve>95% classification accuracy in quantifying residual lactose in milk, with an R� value of> 92% in individuals who avoid lactose in their diet. (Source:https://pubmed.ncbi.nlm.nih.gov)

Furthermore, predictive machine learning algorithms utilizing gut microbiome and metabolome data from cohort studies have identified biomarkers associated with lactose intolerance, thereby opening pathways for patients to modify their diet prior to diagnosis. As a whole, these developments indicate a significant shift in the management of lactose intolerance, driven by AI and patient factors.

U.S. Lactose Intolerance Treatment Market Size and Growth 2025 to 2034

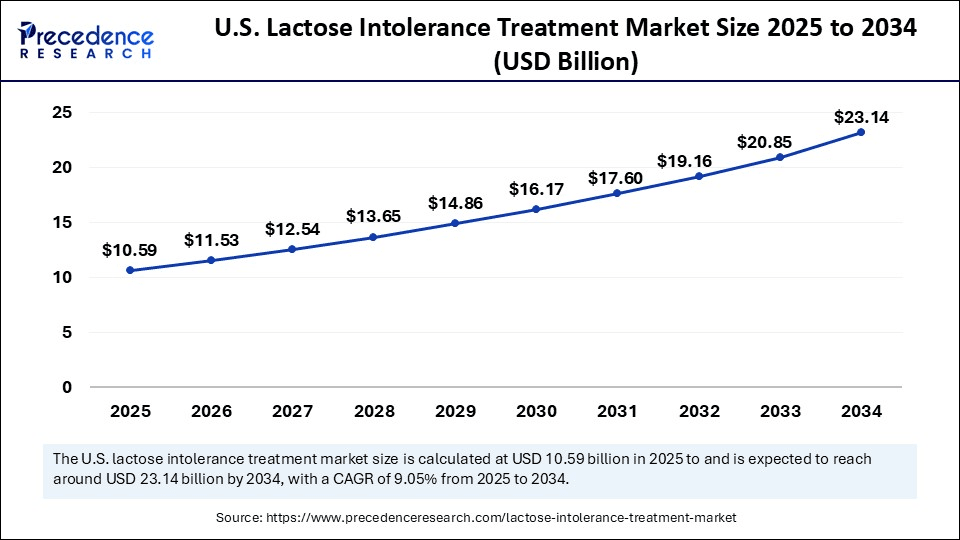

The U.S. lactose intolerance treatment market size was exhibited at USD 9.73 billion in 2024 and is projected to be worth around USD 23.14 billion by 2034, growing at a CAGR of 9.05% from 2025 to 2034.

What made North America the leading region in the lactose intolerance treatment market in 2024?

North America led the lactose intolerance treatment market while holding the largest share in 2024. This is mainly due to high consumer awareness, access to advanced testing, and demand for novel treatments. The region's well-established healthcare system and growing access to lactose-free products in supermarkets and pharmacies further bolstered regional market growth. Increased awareness campaigns on food sensitivities and research efforts on the underlying cause of lactose intolerance, coupled with routine testing leading to earlier detection of lactose intolerance, have contributed to North America's dominance.

The U.S. is a major contributor to the market growth. This is primarily due to the increasing number of health-conscious individuals and clinical research studies. The country is home to leading pharmaceutical and nutraceutical companies, such as Danone, which are actively launching lactase enzyme supplements or probiotic blends formulated to ease lactose digestion. Food manufacturers are developing novel products with less lactose and dairy-free alternatives. Routine screening, emphasized by healthcare providers and insurance coverage for diagnostic tests, has contributed to improved healthcare access. The intense interest from consumers, strong clinical support, and backing from healthcare organizations have made the U.S. a leader in this market.

What makes Asia Pacific the fastest-growing market for Lactose Intolerance Treatment?

Asia Pacific is the fastest-growing market due to the high prevalence of lactose intolerance, especially among East and Southeast Asian populations. The regional market growth is driven by increasing public awareness, rising health expenditure, expanding access to over-the-counter potential enzyme supplements, and a growing variety of products identified as lactose intolerance treatments in the region. As health consciousness increases across the region, governments and private entities are investing in education initiatives and affordable, accessible treatments, particularly in emerging economies, making the Asia Pacific the forefront of potential future market growth for lactose intolerance treatment.

China is a significant contributor to the lactose intolerance treatment market in Asia Pacific, as it has some of the highest rates of lactose intolerance in the world. With the high prevalence of lactose intolerance, domestic and multinational pharmaceutical companies are expanding their market presence in China by offering enzyme-based supplements and dairy-free alternatives tailored to the Chinese diet. In addition, many of China's leading e-commerce sites are supporting market growth by increasing access to OTC treatments.

Market Overview

The lactose intolerance treatment market refers to the industry focused on therapeutic approaches, dietary supplements, enzyme replacements, and functional foods that aid individuals in managing or alleviating symptoms associated with lactose intolerance, a condition characterized by the body's inability to digest lactose due to a deficiency of the lactase enzyme. This market encompasses pharmaceutical treatments, dietary management strategies, and novel interventions such as probiotics and lactase enzyme supplements, aimed at improving patient outcomes, digestive health, and nutritional adherence.

Lactose Intolerance Treatment MarketGrowth Factors

- Dairy-Free Innovation: Innovating products in lactose-free milk, yogurt, and plant-based beverages provides flavors that are easy to access, facilitates a portion of dietary change, and supports long-term symptom management while at the same time igniting consumer interest.

- Health Awareness Growth: An evolution in understanding digestive diseases and the identification of symptoms has led to increased early diagnosis for a majority of conditions, resulting in a positive impact on consumer demand for supplements and dietary modifications.

- Over-the-Counter Product Availability: The ease of access to over-the-counter lactase tablets and probiotics for self-directed treatment options leads to higher levels of adoption among consumers, thereby increasing market penetration.

- Enzyme Research Advancements: Research developments in enzyme replacement therapies and therapies targeting the microbiome are increasing efficiency and effectiveness while reducing costs and expanding the range of care options suitable for personalized nutrition.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 79.08 Billion |

| Market Size in 2025 | USD 36.9 Billion |

| Market Size in 2024 | USD 33.9 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.84% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Type, Formulation, Distribution Channel, End User, Source of Enzyme, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Could the global epidemic of lactose intolerance be a potential growth factor in the lactose intolerance treatment market?

The rising number of cases of lactose intolerance worldwide is a significant factor driving the growth of the market. Approximately 65% of adults globally report some form of lactose intolerance, generally most common in Asian countries, especially in East Asian countries, where about 70-100% of people show lactose intolerance. These statistics are based on analyses of global populations by the U.S. National Institutes of Health and global population datasets. (Source:https://worldpopulationreview.com)

Ultimately, individuals will continue to learn about lactose malabsorption, lactose intolerance, and many other aspects of their dietary and health needs to manage their culturally preferred diets. There are many treatment options, including lactase enzyme supplements, low-lactose or lactose-free dairy products, and dietitian consultations from clinical nutritionists offered through public or government health services (e.g., NIH, NIDDK) and trusted healthcare providers in America. There is still a substantial unmet need, verified by public health bodies and organizations; however, as this need is acknowledged by patient demand, it is apparent that the number of services previously offered in clinical environments and newer consumer-focused products will increase accordingly.

Restraint

Could the inconsistent efficacy of current treatments be limiting demand for lactose intolerance management options?

One of the main obstacles to managing lactose intolerance is the limited and inconsistent efficacy of current management options. For example, the NIH Consensus Development Conference highlighted that a large proportion of patients with self-diagnosed lactose intolerance rely solely on diet restriction or over-the-counter lactase products to manage symptoms. Patients often self-report treating themselves, and randomized trials have shown that symptom relief for lactose intolerance may be modest, inconsistent, and often no better than placebo.

There are clinical recommendations stating that most adults with lactose malabsorption can tolerate some lactose, up to 12 g at any meal, with a slight increase when ingested along with food. However, in practice, these clinical recommendations do not consistently deliver symptom control, particularly in those with overlapping functional gut disorders, such as IBS. This may dissuade patients from using their treatment or lead them to self-manage based on unnecessary restrictions, limiting demand for their dietetic counseling and treatment products and decreasing the overall growth of the treatment sector. (Source: https://www.ncbi.nlm.nih.gov)

Opportunity

Could plant-based lactose-free options spur innovation in lactose intolerance solutions?

An emerging opportunity in the lactose intolerance treatment market lies in the rapid development of plant-based, lactose-free dairy alternatives, which are transforming the dietary landscape for individuals with lactose intolerance. In addition to providing symptomatic relief for managing lactose intolerance symptoms, these products also address consumers' omnipresent demands such as sustainability, clean-label ingredients, and ethical sourcing. In February 2024, Danone ramped up production of oat- and almond-based yogurt throughout Europe, as demand has skyrocketed by a double-digit percentage. (Source:https://vegconomist.com)

Similarly, in November 2023, Nestl� developed N3 milk, prioritizing nutrients while making lactose more digestible. Enzymes in N3 Milk break down lactose and convert it into prebiotic fibers that support digestion and enhance gut health, providing functional options beyond traditional dairy. As consumer demand for clean-label, digestible options continues to rise, enzyme-treated dairy is a viable option for meeting the demand for drinking options that provide nutritional benefits, are clearly labeled, and are immediately gut-friendly for those sensitive to lactose.(Source: https://www.nestle.com)

Treatment Type Insights

Why did the lactase enzyme supplements segment dominate the lactose intolerance treatment market in 2024?

The lactase enzyme supplements segment dominated the market with the largest revenue share in 2024, as they are the most direct and effective remedy for managing symptoms. Lactase enzyme supplements are responsible for breaking down the lactose found in dairy products. These products help consumers continue to enjoy dairy products and dairy-related foods without discomfort. Lactase enzyme therapy is available in various over-the-counter forms, offering greater flexibility and accessibility, particularly since most adults with moderate to severe lactose intolerance do not regularly consume dairy products.

The probiotic supplements segment is expected to grow at the fastest rate in the coming years, as they support gut health and promote the ability to digest lactose naturally over time. Probiotic supplements work by increasing the number of beneficial bacteria in the gut, which aid in lactose metabolism and provide a more organic and sustainable remedy. Additionally, there are many reasons consumer preference is rising toward the use of natural alternatives for preventive health. The growing body of research supporting probiotics for digestive health has encouraged demand for such supplements, particularly from individuals seeking long-term relief and those with milder intolerances, who prefer daily gut support over reactive use of lactase.

Formulation Insights

How does the solid segment dominate the lactose intolerance treatment market in 2024?

The solid formulations, especially tablets and capsules, dominated the lactose intolerance treatment market in 2024, primarily due to their convenience, portability, and extended shelf life. They are all solid dosage forms that adults typically use to take on the go, and they are easy to incorporate into anyone's daily life. Orders of enzyme supplements, such as solids, can easily provide accurate dosing and are available in pharmacies and health food stores across the country. Also, solids are typically more stable for storage and shipping purposes.

The liquids segment is likely to grow at the fastest CAGR over the projection period due to the rising consumption of ready-to-drink enzyme drinks. They are easy to administer and suitable for all age groups, including children and the elderly. These formulations benefit food allergen consumers for immediate dosing and for mixing directly with milk or dairy products in order to have enzymatic actions completed quickly. Furthermore, as awareness among consumers increases to intervene early and create more flexibility in their diets, they are looking for liquid formulations to offer them more individualized dietary solutions.

Distribution Channel Insights

What made the pharmacy & drug stores segment the leading distribution channel?

The pharmacy & drug stores segment dominated the lactose intolerance treatment market because they are generally convenient, trusted, and carry a broad selection of products. Consumers often rely on a pharmacist's advice in choosing the right enzyme supplement or probiotic, especially when managing digestive health. These stores ensure a steady supply of prescription and over-the-counter medications, making them a popular go-to option when immediate relief is needed. Their prominence within urban, semi-urban, and established areas, combined with professional service, provides them with status as the distribution channel that most consumers access for trustworthy lactose intolerance sources.

The online retailers segment is expected to grow at the fastest rate in the upcoming period. The dominance of online retailers stems from their convenient services, home delivery, and the wide range of products they offer. Consumers are turning to e-commerce sites to access global brands, specialized formulations, and even subscription-based options for enzyme or probiotic supplements. Online platforms enable consumers to compare products from different brands and read reviews, facilitating informed decision-making.

End User Insights

Why did the adults segment dominate the lactose intolerance treatment market?

Adults, both young and middle-aged, are the primary end users of lactose intolerance treatment, as this age group is more likely to experience symptoms of lactose intolerance, resulting in compromised digestive efficiency. Many adults experience difficulty digesting dairy products as their digestive system begins to decline with age; therefore, using enzyme supplements and probiotics more frequently is recommended. Adults are also more likely to self-diagnose lactose intolerance and pursue over-the-counter or "natural" remedies.

Children are the fastest-growing end-user segment, as parents and healthcare providers are becoming increasingly aware of lactose intolerance in child populations. Pediatric formulations are prevalent in the market, featuring new liquid or chewable products that offer ease of use and optimal palatability. Diagnosis rates will continue to increase, whether through conventional means, improved pediatric screening, or dietary changes that motivate early intervention with enzyme drops and other probiotic supplements.

Source of Enzyme Insights

How does the fungal-derived lactase segment dominate the market in 2024?

The fungal-derived lactase segment dominated the lactose intolerance treatment market in 2024, as it is the leading source of enzymatic alternatives related to lactose intolerance due to its superior advantages in terms of enzyme activity and stability over a wide range of conditions. Derived from filamentous fungi like Aspergillus, fungal-derived alternatives exhibit excellent activity over a range of pH and temperatures, ensuring the enzyme can be utilized in tablets, capsules, and, in some cases, liquid formulations.

The yeast-derived lactase segment is expected to grow at a rapid pace over the projection period, as these lactases are identified as clean-label and vegan options. While yeast-derived alternatives are produced using genetically optimized yeast strains like Kluyveromyces lactis, this approach conforms to the increasing consumer demand for natural, plant-derived, or allergen-free supplements. Consumer product manufacturers must continue to note the incremental changes in dietary restrictions as this increases the choice of lactase can be used as lactose-free alternatives, promote digestive health, menu choices for lifestyle changes, and now even as part of different dietary approaches, as the use of yeast-generated lactase alternatives is infused in emerging markets and modern products.

Lactose Intolerance Treatment Market Companies

- Nestl� Health Science

- Johnson & Johnson (Lactaid)

- Danone S.A.

- NOW Health Group, Inc.

- Garden of Life

- Chr. Hansen Holding A/S

- Nature's Way Products, LLC

- GlaxoSmithKline plc

- Novozymes A/S

- Arla Foods

- Valio Ltd.

- Enzymedica, Inc.

- Deerland Probiotics & Enzymes

- Puritan's Pride

- Lifeway Foods, Inc.

- Amway (Nutrilite)

- BioGaia AB

- Ganeden Inc. (Part of Kerry Group)

- Vitacost (Kroger Co.)

- Schiff Vitamins (Reckitt Benckiser Group)

Recent Developments

- In April 2025, Japan's Asahi Group launched the country's first yeast-based milk, "LIKE MILK," via precision fermentation, devoid of 28 allergens, high in protein and calcium. It is a trending product for lactose intolerant and vegan consumers.(Source: https://foodtech-japan.com)

- In April 2025, Ombar launched vegan-friendly, dairy-free blonde chocolate in Tesco Extra stores throughout the UK. The oat-based product provides a creamy-like consistency without the dairy, satisfying the demands of both lactose intolerant and plant-based consumers.(Source: https://theyorkshirepress.co.uk)

- In February 2023, Keventers expanded its product offering and announced vegan milkshakes, with a focus on Indian dairy-free consumers in response to the growing demand plant-based food segment in dairy free or allergen free options for lactose intolerant consumers in search of indulgence.

(Source: https://www.business-standard.com)

Segments Covered in the Report

By Treatment Type

- Lactase Enzyme Supplements

- Tablets

- Capsules

- Chewable Tablets

- Liquid Drop

- Probiotic Supplements

- Single-Strain Probiotics

- Multi-Strain Probiotics

- Prebiotic & Probiotic Blends

- Food & Beverages

- Lactose-Free Dairy Products

- Milk

- Yogurt

- Cheese

- Ice Cream

- Lactose-Free Dairy Products

- Plant-Based Alternatives

-

- Almond Milk

- Soy Milk

- Oat Milk

- Coconut Milk

- Others

- Lactose-Reduced Products

-

- Pharmacological Therapies

- OTC Digestive Aids

- Prescription Digestive Enzymes

- Others

- Herbal Remedies

- Enzyme-Infused Chewing Gums

By Formulation

- Solid

- Tablets

- Capsules

- Powders

- Liquid

- Drops

- Syrups

- Ready-to-Drink Formulas

- Semi-Solid

- Yogurt

- Soft Chews

- Spreads

- Others

By Distribution Channel

- Pharmacy & Drug Stores

- Supermarkets & Hypermarkets

- Online Retailers

- Health & Specialty Stores

- Others (Direct-to-Consumer (DTC), Subscription Models)

By End User

- Adults

- Young Adults (18�35)

- Middle-aged Adults (36�59)

- Elderly (60+)

- Children

- Infants

By Source of Enzyme

- Fungal-derived Lactase

- Bacterial-derived Lactase

- Yeast-derived Lactase

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting