What is the Life Science Laboratory Automation Market Size?

The global life science laboratory automation market is expanding due to rising demand for high-throughput testing, precision workflows, and reduced manual errors.The life science laboratory automation market is driven by rising demand for high-throughput workflows, AI-enabled lab systems, expanding biopharma research, and the shift toward precision, error-free, and scalable laboratory operations.

Market Highlights

- North America led the life science laboratory automation market with approximately 46.8% share in 2025.

- The Asia Pacific is expected to expand the fastest CAGR of 9% between 2026 and 2035.

- By product/ component, the hardware segment captured around 53.6% of market share in 2025.

- By product/ component, the software segment is expanding at a strong CAGR of 8.4% between 2026 and 2035.

- By technology /instrument type, the liquid-handling & pipetting robots segment held approximate 38.6% market share in 2025.

- By technology /instrument type, the automated sample prep / NGS library-prep systems segment is projected to grow at a CAGR of 8.3% between 2026 and 2035.

- By application, the drug discovery & HTS segment contributed the biggest market share of 47.8% in 2025.

- By application, the Cloud / SaaS-Based segment is growing at a CAGR of 8% between 2026 and 2035.

- By end-user, the pharmaceutical & biotechnology companies segment held the major market share of 40.4% in 2025.

- By end-user, the clinical & diagnostic laboratories segment is expected to expand at the highest CAGR of 8.1% between 2026 and 2035.

- By deployment / integration model, the integrated / walk-away automation systems segment generated the biggest market share of 42.4% in 2025.

- By deployment / integration model, the Cloud-enabled orchestration / SaaS segment is expanding the fastest CAGR of 8.2% between 2026 and 2035.

The Future of Automated Laboratory Automation in the Life Sciences: What Factors Will Drive Its Growth?

Through robotics, software, and integrated instruments in the life science laboratory, technology has been developed that automates the laboratory workflow to streamline, standardize, and speed up processes. Automation also allows for fewer errors, higher productivity in laboratories, and more reliable data from research and diagnostics and drug development.

Laboratories are moving towards a more efficient, higher-throughput laboratory environment where all of a labs tasks are digitally managed; as a result, they are experiencing strong momentum. Increased demand for greater accuracy and efficiency in drug discovery, the growing number of genomics and proteomics workflows, and the ever-increasing adoption of A.I. platforms for automating complex assays are all driving the growth of this market. Organizations are increasingly focusing on lab productivity, regulatory compliance, and sample traceability to drive the need to upgrade from manual laboratory processes.

Smart Laboratories Surge: Artificial Intelligence Bringing Life Science Labs Back to Life

The automation of life science laboratories is changing rapidly as artificial intelligence advances. Self-driving laboratories, or laboratories augmented with artificial intelligence, will enable drugs in development, diagnostics, and biotechnology research to be discovered and developed more quickly and consistently than they are today.

- In March 2024, Cognizant established an Advanced AI Laboratory to spur innovation by applying artificial intelligence to research in AI. This shows the desire to establish the newest generation of AI systems.

- In addition, AICA received seed funding in March 2025 to expand its AI-powered automation platform, indicating increased investment across sectors (including life sciences) in robotics and automation technology.

Artificial intelligence will help laboratories become more advanced by enabling them to analyze large amounts of data, predict the outcome of experiments, optimize production processes, minimize the risk of human error, and help researchers spend more time innovating rather than performing repetitive tasks.

Trends in Life Science Laboratory Automation Market

- Artificial Intelligence (AI) as an Automation Process: Artificial Intelligence (AI) is being used for solving numerous laboratory activities, including planning your experiments, identifying errors that occur during your experiment, and optimizing your laboratory processes. The use of AI tools enhances reproducibility by speeding up and improving the processing of laboratory data. AI tools also enable more automated data interpretation and the automation of work processes across genomics, drug discovery, and molecular analysis.

- Modular Automation Systems: With the need to grow and change within the laboratory environment, laboratories are increasingly adopting modular automation systems, or modular automation platform solutions that provide the flexibility and configurability to accommodate changing research demands. Modular automation systems can be set up or changed very rapidly, support multiple assay configurations, and improve overall operational efficiency in the lab.

- Cloud Data Integration: Cloud data integration allows your teams to access their laboratory data, monitor experimental results in real time, and collaborate effectively across teams regardless of their location. Cloud connectivity improves laboratory data traceability, provides seamless data synchronization between Laboratory Information Management Systems (LIMS) and Electronic Laboratory Notebooks (ELNs), and improves the governance of laboratory data across complex workflows.

- High Throughput Robotics: Automated liquid handling devices and high-throughput robotic arms accelerate laboratory processes, sample analysis/screening, and data analysis, thereby reducing manual variability, increasing laboratory throughput capacity, and automating the most demanding laboratory workloads for drug discovery and genomic research.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

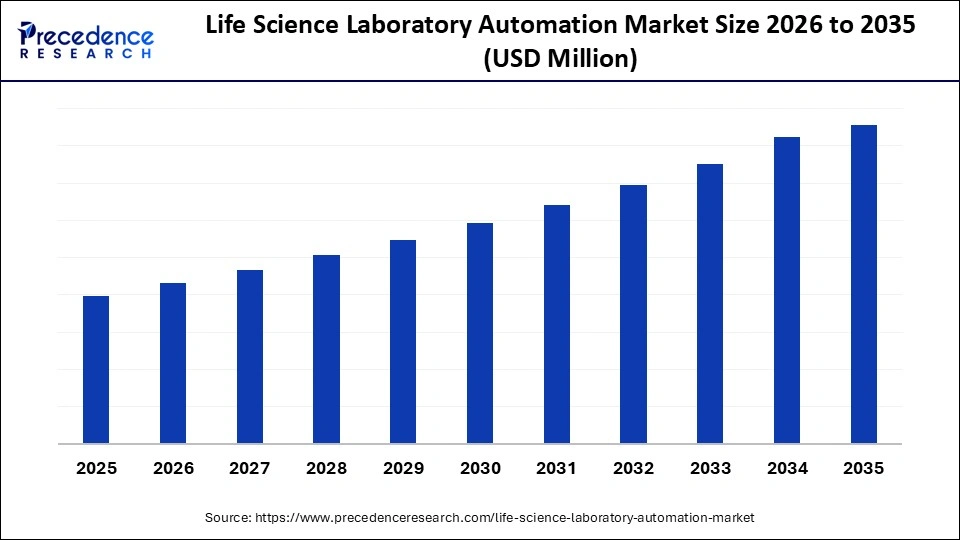

| Forecast Period | 2026 to 2035 |

| Segments Covered | Deployment Model, Function, End User, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Life Science Laboratory Automation Market Segment Insights

Product/Component Insights

Hardware (Liquid Handlers, Robotic Arms, Plate Readers, Storage & Incubators): The hardware segments dominated the life science laboratory automation market with a 53.6% share in 2025, driven by continued investment by laboratories in physical automation tools such as liquid handlers, robotic arms, plate readers, and storage/incubation containers. The large number of established physical automation tools used in laboratories has ensured they will continue to be part of lab operations across pharmaceuticals, biotech, and diagnostics. As laboratories expand the number of routine and regulated processes they perform, there will continue to be a high demand for laboratory hardware.

Software (LIMS, ELN, Orchestration, Analytics, Scheduling): Software is currently experiencing the fastest growth rate with a 8.4% CAGR, due to the ongoing transition to cloud-based Lab Management Systems (LIMS). The continued growth in the use of digital platforms will continue to provide laboratories with a way to manage lab data, schedule automated tasks, optimize throughput, and comply with regulatory requirements. The use of cloud/SaaS-based software architecture significantly reduces initial costs associated with software implementation. At the same time, the addition of Cloud-based solutions enables laboratories to monitor all operations remotely, and AI-enhanced software can optimize workflows, improve instrument uptime, and minimize errors through greater accuracy.

Technology/Instrument Type Insights

Liquid-Handling & Pipetting Robots: Liquid-handling robots are the dominant technology/instrument type in laboratories with a 38.6% share, as they play an integral role in nearly all automated processes, including sample dilution, reagent dispensing, assay setup, and indexing in high-throughput testing. The combination of precision and scalable compatibility across different assay formats drives continuous demand for these types of robots. The growth of companies focused on drug discovery, genomics, and clinical studies, along with an increase in the use of new precision pipetting and multi-plate processing technologies, supports continued growth and demand for liquid-handling robots.

Automated Sample Prep & Nucleic Acid Extraction Systems: Automation of sample preparation and next-generation sequencing (NGS) library preparation is another rapidly growing with a 8.3% CAGR, as genomic-based laboratories continue to move towards automating their complex workflows, including the extraction of DNA/RNA, four reactions, and reagent preparation to create libraries for sequencing. The demand for using NGS diagnostics in diagnostic studies involving large numbers of subjects or patients and for studying genomic expression across multiple subjects over time is expected to increase the adoption of automation in this area. Automated systems can reduce human error, increase processing speed, and improve the consistency of results, which is critical for laboratories aiming to achieve high throughput and produce standardised results.

Application Insights

Drug Discovery & High-Throughput Screening (HTS): The segment has become a dominant force in pharmaceutical/biotech research with a 47.8% share, primarily due to their ability to rapidly and repeatedly screen compounds, cellular assays, and biochemical reactions. Automation reduces variability, enables assay miniaturization, and enables parallel processing of thousands of samples. Therefore, Pharma and Biotech companies continue to push for faster lead identification, shorter development times, and scalable assay automation, in turn maintaining Drug Discovery and HTS as the largest segment in the global laboratory market.

Genomics & NGS Sample Preparation: The segment is set to grow at an 8% CAGR, more rapidly than any other segment of the global laboratory market, primarily due to a rapid decline in costs and increased adoption by both clinical and research laboratories, as well as by programs related to population genomics. Automation maximizes throughput, reduces cross-contamination, and standardizes some steps in the NGS workflow (e.g., extraction, indexing, and amplification). As precision medicine continues to expand and Multi-Omics pipelines become more prominent, many laboratories will turn to Automated Systems to address the rapid increase in sample volume and the complexity of sample preparation, and the growing use of Automation in NGS has only increased.

End User Insights

Pharmaceutical & Biotechnology Companies: Pharmaceutical and biotech companies are leading the life science laboratory automation market with a 40.4% share in 2025, as they have an ongoing need for high-throughput experimentation, compound screening, biologic development, and quality control testing. Automation helps pharmaceutical and biotech companies accelerate their R&D cycle, generate data with greater integrity, and conduct research to meet the strictest regulatory requirements. Additionally, investments in robotics, automated laboratory workflows, and digital solutions integrated with laboratory operations enable pharmaceutical and biotechnology organisations to maintain reproducibility of results and effectively manage their product pipelines. Thus, pharmaceutical and biotechnology companies will continue to dominate the marketplace.

Clinical & Diagnostic Laboratories: The segment is set to rapidly expand with a 8.1% CAGR due to a growing trend toward diagnostic workflows, rising sample volumes, the increasing use of molecular tests, and greater investment in automated diagnostic instruments. Automation improves overall laboratory quality and reduces the prevalence of human error, enables rapid turnaround times, and provides traceability in a regulated environment. Increasingly, the demand for infectious disease and genetic test development, as well as the decentralisation of laboratory services, is driving more clinical laboratories to adopt automated platforms.

Deployment/Integration Model Insights

Integrated/Walk-Away Automation Systems: The segment dominated the life science laboratory automation market with a 42.4% share in 2025, providing an end-to-end automated solution with minimal human intervention, enabling continuous processing of assays, plates, and samples. There are also integrated instruments, schedules, and environmental controls used in these systems, resulting in less reliance on the labor force and a more reliable operation. Labs looking to reproduce results, minimise the risk of contamination, and achieve higher operational uptime typically use Walk-Away Systems for their regular and high-throughput processes.

Cloud-Enabled Orchestration / Remote Management (SaaS): There is rapid growth in the segment expected, with an 8.2% CAGR in the coming years. A SaaS orchestration platform is a way to connect multiple instruments, show real-time analytics, and support compliance documentation. In addition to being scalable, SaaS orchestration platforms will allow smaller laboratories to use automation and provide centralised oversight of operations for larger facilities with distributed workflows.

Life Science Laboratory Automation Market Regional Insights

The laboratory automation life sciences market in North America is closely tied to the region where biotech companies and research institutions are located, with the region leading with a 46.8% share. It includes the instrument manufacturers for these companies. The laboratory automation industry in North America is distinct due to its advanced automation infrastructure, with the application of leading-edge technological advances, including cloud-based software and robotics enhanced by AI in many laboratories; some companies are now building science factories (i.e., automated, high-throughput workflows) that highlight the push toward fully autonomous workflows.

However, this evolutionary movement is mostly driven by the U.S. Recently, a U.S.-based biotech company announced a large expansion of its AI-driven drug-design workbench, indicating how fast U.S. labs are set to be first in line to adopt new automation technologies. In May 2025, Trilobio raised USD 8 million in a seed round to scale its fully automated lab-in-a-box platform in the U.S., enabling biologists to run entire workflows reproducibly via robotics and no-code software. Additionally, leading manufacturers of automation hardware, robotics, and lab informatics have made significant investments in their infrastructure for R&D and deployment of their products. Consequently, U.S. labs serve as test beds for new automation systems, which ultimately become the standards for laboratories worldwide.

The region is expected to grow at a 9% CAGR with an increasing number of laboratories in many Asia-Pacific countries have adopted automated systems like liquid-handling robots, sample-preparation modules and fully automated workcells, to deliver the productivity, repeatability and efficiency necessary to satisfy organizations requirements for increased productivity and efficiency through a variety of factors, including increasing healthcare infrastructure investments, increasing levels of research and development in the fields of biotechnology and pharmaceuticals, and growing demand for diagnostic testing. The growing investment in the capacity needed to conduct research and develop diagnostic tools is fueling demand for automated lab systems, which are being deployed by both government and private entities to modernize their laboratory environments. Additionally, there is a growing demand for precision medicine, genomics, and vaccine-related testing that necessitates the use of automated laboratory technolgies to produce results at scale for multi-population genetics.

China Life Science Laboratory Automation Market Trends

China has emerged as the leading country in the Asia-Pacific region in terms of the adoption of and growth potential for laboratory automation. Through strong government support of biopharma and biotechnology innovation, the establishment and expansion of clinical and research laboratories, and the establishment of modern, streamlined regulatory processes, China leads the region in the deployment of laboratory automation technologies. China also has a vast and growing pharmaceutical industry and an enormous diagnostics market, and is developing an interest in genomics and high-throughput screening. As a result of these factors combined, China will remain the leading entry point and growth center for laboratory automation vendors in the Asia Pacific region.

Europe has significant potential for growth in its life-science laboratory automation sector. Europe has a large and established biomedical research capacity, highly organized healthcare systems, and an infrastructure of regulations focused on the accuracy, reliability, and quality of data. To support this growth trend, all European countries have invested in upgrading to new automated technologies for their academic laboratories, national reference labs, and clinical diagnostics laboratories. The growth of life-science laboratory automation in Europe is further supported by Europes strong focus on precision medicine, integrated biobanking efforts, and initiatives to utilize automated technology to enhance sustainability by minimizing waste and increasing operational efficiency. Collaboration among research institutes and industry will continue to grow, accelerating the validation and deployment of advanced life-science laboratory automation platforms across therapeutic discovery, clinical microbiology, and translational research.

Germany Life Science Laboratory Automation Market Trends

Germany is a leader in life-science laboratory automation in Europe due to its extensive engineering base, established medical technology businesses, and the high concentration of university hospitals and pharmaceutical R&D facilities. In March 2025, a German company, Covestro, announced plans to open a new automated laboratory for coatings and adhesives formulation in 2025; the lab will use robotics and AI to test tens of thousands of formulations annually. Germany has a long track record of being an early adopter of modular robotics and automated diagnostic technology; therefore, Germany has established itself as an important site for testing next-generation laboratory automation solutions.

The Middle East & Africa are becoming a potential market for lab automation as the healthcare industry moves toward modernization and diagnostic needs increase. In particular, hospitals and diagnostic companies in the Middle East are transitioning to automated processes, including automated workflows, robotic systems, and AI-based diagnostics, to enhance the speed, reliability, and efficiency of diagnostic testing. A good example of this commitment to lab automation and reducing human error was demonstrated at a hospital in Dubai, where a fully automated diagnostics lab was opened, which has automated the entire diagnostic testing process and significantly reduced the time required to provide results.

UAE Life Science Laboratory Automation Market Trends

As the leading country adopting laboratory automation in the region, the UAE (United Arab Emirates) has a considerable lead in terms of modern hospital infrastructure, a favourable regulatory environment for laboratory automation, and a willingness to invest in it. Through its large-scale investment in both digitization and precision diagnostics, the UAE is establishing itself as an early adopter and as the Regional Hub for Laboratory Modernization.

Life Science Laboratory Automation Market Value Chain

Life Science Laboratory Automation Market Companies

Provides a comprehensive portfolio of automated solutions for life science laboratories, like automated liquid-handling, robotic workcells, and workflow software (e.g., Versette, robotics) to increase productivity, improve data quality, and accelerate scientific research.

Providing automated life science laboratory solutions, Biomek automated liquid-handling workstations for high-throughput sample prep.

Provider of automated solutions for life science laboratories, Bravo automated liquid-handling platform, and BenchCel plate-management workstations.

Provides JANUS automated liquid-handling workstations for configurable sample preparation.

Global supplier of laboratory automation solutions for life sciences, clinical diagnostics, provides Freedom EVO and Fluent automated workstations for scalable liquid handling.

Automated liquid handling workstations and laboratory automation technology, Microlab STAR series automated liquid-handling platforms with VENUS software.

Atellica/Aptio integrated lab automation and total-lab automation systems.

Automation for NGS library prep and high-throughput sequencer workflows (NovaSeq).

QIAcube Connect and automatable QIAGEN kit workflows for nucleic-acid extraction.

epMotion automated liquid-handling workstations (e.g., epMotion 5075 series).

Recent Developments

- In July 2025, Merck (via MilliporeSigma) launched the AA Automated Assay Workstation, powered by Opentrons Labworks, Inc., to automate routine lab assays, reducing manual workload and boosting reproducibility across protein, molecular, and cell-biology workflows.(Source: https://www.merckgroup.com)

- In October 2025, Adaptyv Biosystems raised USD 8 million in seed funding to launch a cloud-based automated lab platform for validating AI-designed proteins, enabling remote design-test-learn cycles and scaling protein engineering workflows.(Source: https://ggba.swiss)

- In November 2025, Integrated DNA Technologies (IDT) and Beckman Coulter Life Sciences announced a partnership to automate IDTs NGS assays using the new Biomek i3 benchtop liquid handler, streamlining genomic workflows for oncology and genetic-disease research with higher throughput and reproducibility.(Source:https://www.businesswire.com)

- In September 2025, Lila Sciences secured a US$235 million Series A funding round (bringing the total to US$550 million) to expand its AI Science Factories: autonomous, AI-driven research labs that aim to run the full scientific method, hypothesis, experiment, and learning at scale across biology, chemistry, and materials science.(Source: https://www.fiercebiotech.com)

- In March 2025, Thermo Fisher Scientific launched the Vulcan Automated Lab, a robotics-and AI-driven system to automate atomic-scale TEM metrology for semiconductor manufacturing, boosting data throughput and reducing costs.(Source: https://www.businesswire.com)

Exclusive Insights

According to analyst observations, the life sciences laboratory automation market is heading for continued growth due to demand for higher-throughput labs, increased reproducibility, and the use of AI analytics. Clinical diagnostics and biopharmaceutical R&D adoption will accelerate due to shorter cycle times and reduced operational costs enabled by automation. Still, the capital-intensive nature of automation and its limited interoperability with legacy systems pose barriers for some laboratories. Companies offering modular, cloud-based solutions with strong validation packages have the greatest opportunity to be successful with enterprise customers.

Opportunities exist in areas such as decentralized testing and single-use solutions for automation and software-as-a-service offerings associated with consumables. Regulatory compliance, workforce retraining, and reskilling will play a large role in how quickly laboratories transition from pilots to large-scale usage. Data security and supply chain stability are also important considerations.

Life Science Laboratory Automation MarketSegments Covered in the Report

By Product/Component

- Hardware (liquid handlers, robotic arms, plate readers, storage & incubators)

- Software (LIMS, ELN, orchestration, analytics, scheduling)

- Services (integration, validation, maintenance, managed automation)

By Technology/Instrument Type

- Liquid-handling & pipetting robots

- Automated sample prep & nucleic acid extraction systems

- Plate readers & detection instruments

- Robotic arms/pick-and-place/mobile robots

- Automated storage & sample management (freezers, biobanks)

By Application

- Drug discovery & high-throughput screening (HTS)

- Genomics & NGS sample preparation

- Clinical diagnostics & IVD automation

- Bioprocess development & QC automation

By End-User

- Pharmaceutical & biotechnology companies

- Clinical & diagnostic laboratories

- CROs & contract testing labs

- Academic & research institutes

By Deployment/Integration Model

- Standalone instruments (bench-top)

- Integrated/Walk-away automation systems

- Fully integrated LIMS/ELN + orchestration (on-premise)

- Cloud-enabled orchestration/remote management (SaaS)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting