What is Managed File Transfer Market Size?

The global managed file transfer market size was calculated at USD 2.45 billion in 2025 and is predicted to increase from USD 2.73 billion in 2026 to approximately USD 7.18 billion by 2035, expanding at a CAGR of 11.35% from 2026 to 2035.

Market Highlights

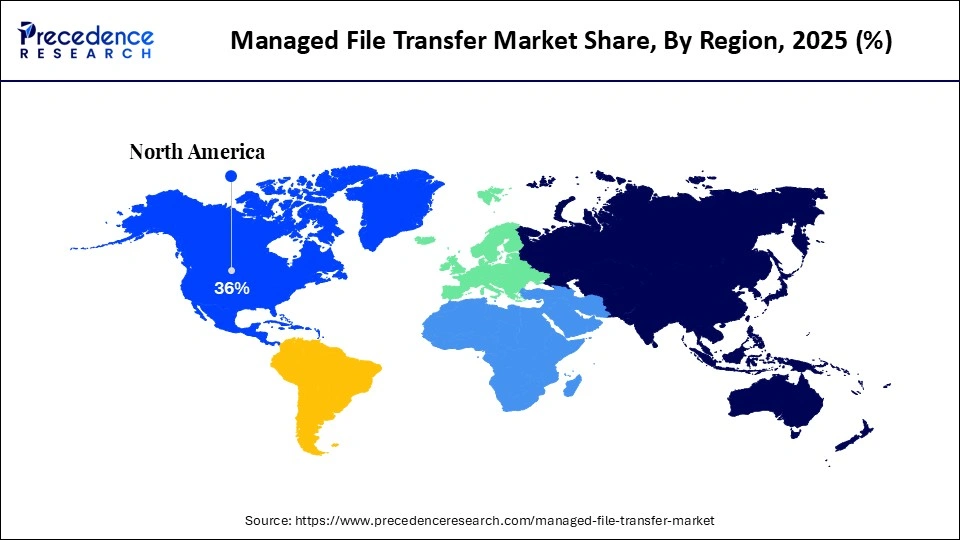

- North America dominated the managed file transfer market with the largest share of 36% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By deployment type, the on-premises segment held a dominant share in the market in 2025.

- By deployment, the cloud-based segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By organization size type, the large enterprise segment held the largest share of the market in 2025.

- By organization size, the small and medium-sized enterprise (SMEs) segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By solution type, the software segment held a major market share in 2025.

- By solution type, the services segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By end-user, the BFSI segment held the largest share of the market in 2025.

- By end-user, the telecommunications segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

- By use case, the Ad-Hoc File Transfer segment held a dominant position in the market in 2025.

- By use case, the application integration segment is expected to grow at the fastest CAGR in the market between 2026 and 2035.

Market Overview

Managed file transfer refers to secure, reliable, and compliant solutions used to exchange data between internal systems and business partners. MFT solutions offer key advantages such as enhanced data security, encryption, automated transfer schedules, and centralized monitoring that reduce errors and protect sensitive information. Market growth is being driven by rising regulatory compliance requirements, the need for secure collaboration across distributed enterprises, and increasing adoption of cloud services and digital transformation initiatives.

Key Technological Shift in Managed File Transfer Market

AI is transforming the Managed File Transfer (MFT) market by enabling intelligent automation of data workflows, predictive error detection, and anomaly monitoring to enhance reliability and reduce manual intervention. Machine learning algorithms help optimize routing, prioritize critical transfers, and identify potential security threats in real time. As a result, AI-driven MFT solutions improve operational efficiency, strengthen compliance, and provide more proactive, secure data management for enterprises.

Modern managed file transfer (MFT) solutions are replacing traditional FTP systems with secure, policy-driven platforms that provide encryption, authentication, access control, and comprehensive logging to enhance security and compliance. Designed for hybrid environments, they are deployed across on-premises data centers as well as private and public clouds. Leveraging APIs, microservices, and event triggers, MFT enables real-time data transfer and workflow automation, boosting operational efficiency. Features like advanced scheduling, business rule-based routing, and automated retries reduce manual intervention and improve reliability. Combined with zero-trust architecture, robust encryption, and continuous monitoring, these solutions deliver a highly secure and resilient data exchange infrastructure.

Key Market Trends

- Data privacy and security regulations are creating an increased need for compliance and auditable file transfer solutions.

- The evolution of MFT from a stand-alone device to being part of an organization's overall data pipeline and integrating into their corporate workflows.

- There is a significant and accelerating need for MFT from industries such as banking, financial services & insurance (BFSI), healthcare, manufacturing, retail, and logistics.

- Vendors are also shifting from traditional purchasing models to flexible subscription- and SaaS-based pricing, enabling mid-size businesses to access robust MFT capabilities without the high upfront costs of perpetual licenses.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.45 Billion |

| Market Size in 2026 | USD 2.73 Billion |

| Market Size by 2035 | USD 7.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.35% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Assessment Type, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Outlook

Deployment Type Insights

Why Did the On-Premises Segment Dominate the Managed File Transfer Market?

The on-premises segment dominated the market by holding the largest share in 2025, driven by its highly controlled, secure, and customizable nature. Big companies and industries that are controlled by government or regulations tend to have on-premises solutions because they need to have direct control over sensitive data and internal infrastructure. These deployments facilitate high compliance demands, internal governance, and legacy system integration. On-premises MFT platforms are particularly valued for handling high-volume, mission-critical data transfers. Organizations with complex IT environments benefit from the ability to customize settings and optimize performance to meet specific operational needs. While these solutions may involve higher upfront costs, their long-term reliability, security, and control continue to sustain strong demand.

The cloud-based segment is expected to expand at the fastest rate in the upcoming period, driven by its scalability, flexibility, and reduced capital expenditure. Cloud-based MFT solutions are gaining traction as businesses embrace remote operations and distributed ecosystems. These platforms enable faster deployment and seamless integration with cloud applications and services, making them particularly attractive to organizations with limited budgets due to subscription-based pricing models. Managed updates and built-in security features reduce the operational burden on IT teams, while increasing adoption of cloud infrastructure continues to drive strong demand for cloud-based MFT solutions.

Organization Size Insights

How Does the Large Enterprises Segment Dominate the Managed File Transfer Market?

The large enterprise segment dominated the market while holding a major revenue share in 2025. This is mainly due to the high volumes of data exchanged and the complexity of their organizational structures. These organizations manage vast amounts of sensitive information across internal systems, partner networks, and international locations, while stringent regulatory requirements necessitate secure and reliable file transfer solutions. Large enterprises also possess the financial and technical resources to implement advanced MFT platforms, and the integration with enterprise applications and legacy systems further drives adoption. As a result, large organizations remain the primary revenue contributors in the MFT market.

The small and medium-sized enterprises (SMEs) segment is expected to expand at the fastest rate over the projection period. This is mainly due to the rapid shift of SMEs to managed file transfer solutions to enhance the level of data security and efficient operation. Smaller organizations have fewer entry barriers since cloud-based services and subscription pricing models are available. The demand for secure data exchange is rising as digital supply chains and partner networks expand, creating opportunities for SMEs. They benefit from easy deployment, simplified infrastructure management, and a combination of cost-effectiveness and robust functionality. These advantages are driving the increasing adoption of managed file transfer solutions among small and medium-sized businesses.

Solution TypeInsights

What Made Software the Dominant Segment in the Managed File Transfer Market?

The software segment dominated the market with the largest share in 2025, as organizations are more focused on having direct control over data movement and data security policy. MFT software offers central management, automation, and reporting of compliance. Software platforms are used by enterprises to combine file transfer workflows with the current IT systems. Customization and scalability make software-based solutions highly adaptable, while both on-premises and cloud deployments implement core MFT capabilities. These factors have solidified software as the central component in the majority of MFT implementations.

The services segment is expected to grow at the fastest rate throughout the forecast period, driven by the increasing complexity of enterprise IT environments. Organizations are increasingly relying on services such as integration, compliance management, monitoring, and managed deployment to ensure seamless operations. Managed services reduce the burden on internal IT teams while maintaining 24/7 system availability, and consulting services are rising as companies upgrade legacy file transfer systems. Service providers also help optimize performance and enhance security posture, and this growing reliance on outsourced expertise is accelerating the expansion of the services segment.

End-User IndustryInsights

Why Did the BFSI Segment Dominate the Managed File Transfer Market?

The banking, financial services, and insurance (BFSI) segment dominated the market with the highest share in 2025 due to stringent security and compliance requirements. Financial institutions handle vast volumes of sensitive customer and transaction data, necessitating secure, auditable, and automated data transfers to meet regulatory and risk management standards. MFT solutions enable reliable data exchange between internal departments and external partners, while the need for high transaction volumes and real-time processing further drives adoption. Consequently, BFSI remains the most prominent end-user segment for MFT solutions.

The telecommunication segment is expected to grow at the fastest rate in the coming years, driven by increasing data traffic and the rising complexity of network operations. Telecom operators leverage Managed File Transfer (MFT) solutions to securely exchange operational, billing, and customer data. The adoption of advanced network technologies enables higher-volume and more frequent data transfers, while reliability and automation are critical for maintaining service continuity and performance. MFT platforms also facilitate seamless integration between diverse systems and partners, and these operational demands are accelerating adoption within the telecommunications sector.

Use CaseInsights

What Made Ad-Hoc File Transfer the Leading Segment in the Managed File Transfer Market?

The Ad-Hoc file transfer segment led the market in 2025 because of its widespread use in day-to-day business operations. Organizations often share files on an on-demand basis with internal and external partners. MFT solutions offer alternative and secure means to email and unsecured transfer solutions. Ad-hoc transfers are favored for their ease of use and speed, and their applications span industries and organizational sizes. As a result, ad-hoc file transfer remains the most common use case for MFT solutions.

The application integration segment is expected to grow at the fastest rate, as more enterprises adopt automation for data-driven workflows. MFT solutions enable seamless data exchange between enterprise applications and systems, supporting real-time business operations, analytics, and process automation. The rising use of microservices and APIs further fuels demand, as organizations seek stable and scalable solutions to ensure uninterrupted data flows. This growing emphasis on automation and integration is driving rapid expansion in this segment.

Regional Insights

How Big is the North America Managed File Transfer Market Size?

The North America managed file transfer market size is estimated at USD 882.00 billion in 2025 and is projected to reach approximately USD 2,620.70 million by 2035, with a 11.51% CAGR from 2026 and 2035. The market is growing as organizations prioritize secure, efficient, and compliant data exchange across enterprises and cloud environments.

What Made North America the Dominant Region in the Managed File Transfer Market?

North America dominated the managed file transfer market by capturing the largest share in 2025. This is mainly due to high cybersecurity awareness and rapid adoption of advanced digital technologies. Enterprises across the region are modernizing legacy file transfer systems to meet evolving security, compliance, and performance requirements. Strong demand from BFSI, healthcare, and technology sectors continues to accelerate MFT adoption. The region's leadership in cloud innovation and enterprise software development further supports market momentum, while increasing data volumes from digital ecosystems, remote work, and partner integrations amplify the need for secure, automated transfers.

What is the Size of the U.S.Managed File TransferMarket?

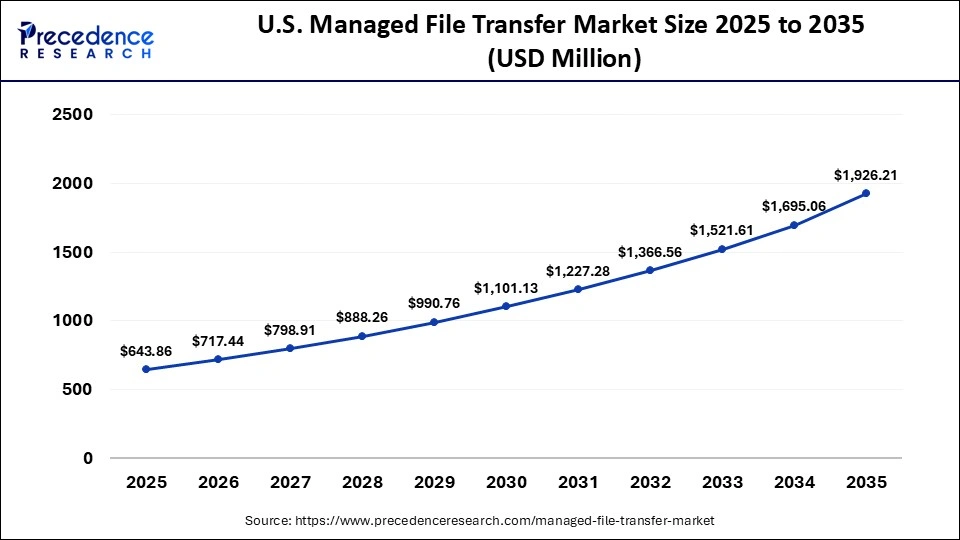

The U.S. managed file transfer market size is calculated at USD 643.86 billion in 2025 and is expected to reach nearly USD 1,926.21 million in 2035, accelerating at a strong CAGR of 11.58% between 2026 and 2035.

U.S. Market Analysis

The managed file transfer market in the U.S. is growing, driven by the rapid adoption of large-scale enterprise deployments, stringent data protection regulations, and substantial investments in cybersecurity infrastructure. Demand for cloud-based MFT solutions is particularly strong among financial institutions, healthcare providers, and cloud service providers, reflecting the need for secure, scalable, and compliant data transfer capabilities, supporting market growth.

Canada Market Analysis

In Canada, government-driven digital initiatives, rising enterprise migration to the cloud, and a strong focus on compliance, data sovereignty, and secure cross-border data transfers are supporting steady growth in the managed file transfer market. The presence of local technology vendors and systems integrators further strengthens the market growth.

What Makes Asia Pacific the Fastest-Growing Region in the Managed File Transfer Market?

Asia Pacific is expected to grow at the fastest rate in the market, driven by the rapid digital transformation across enterprises, rising adoption of cloud services, and increasing regulatory focus on data privacy and cybersecurity. Strong demand from sectors such as BFSI, healthcare, manufacturing, and e-commerce is driving the need for secure, automated, and scalable file transfer solutions. Additionally, the growth of remote work, cross-border collaborations, and investments in IT infrastructure across emerging economies are accelerating MFT adoption, making the region a key growth hotspot.

China Market Analysis

China continues to represent a significant growth opportunity for managed file transfer (MFT) solutions. The demand for MFT solutions is increasing, driven by the rapid expansion of e-commerce and the strengthening regulatory framework governing data exchange. Organizations with cross-border supply chain networks are increasingly leveraging MFT to monitor, manage, and streamline inbound and outbound shipments. In the pharmaceutical sector, for example, MFT solutions help companies perform regulatory audits, ensure compliance, and collaborate effectively with manufacturers, highlighting the technology's critical role in secure and efficient operations.

Who are the Major Players in the Managed File Transfer?

The major players in the managed file transfer include CA Technologies, Attunity, Ipswitch, Signiant, TIBCO, IBM, SSH, Hightail, Saison Information Systems, GlobalSCAPE, Axway, Micro Focus, Primeur, and Accellion

Recent Developments

- In October 2025, Progress Software unveiled Automate MFT, a new cloud-native managed file transfer solution aimed at simplifying and modernizing secure data movement for enterprises. The SaaS-based platform is designed to automate file transfer workflows, reduce dependence on legacy systems and manual scripting, and lower overall operational costs, with the company highlighting up to a 50% reduction in total cost of ownership. (source: https://markets-data-api-proxy.ft.com)

- In August 2025, Hyland entered into a strategic collaboration agreement with Amazon Web Services to strengthen their partnership and accelerate innovation in artificial intelligence and large-scale unstructured data management. Through deeper integration with AWS cloud services and joint go-to-market efforts, the collaboration aims to help organizations modernize, automate, and scale content-centric business processes more effectively.(source: https://www.hyland.com)

Segment Covered in the Report

By Deployment Type

- On-Premises

- Cloud-Based

By Organization Size

- Small and Medium-sized Enterprises (SMEs)

- Large Enterprises

By Solution Type

- Software

- Services

By End-User Industry

- Banking, Financial Services, and Insurance (BFSI)

- Healthcare and Pharmaceuticals

- Manufacturing

- Retail

- Government and Public Sector

- Energy and Utilities

- Telecommunications

- Others

By Use Case

- Ad-Hoc File Transfer

- Batch Processing

- Person-to-Person File Sharing

- Business-to-Business (B2B) Integration

- Application Integration

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content