What is Mental Health Digital Therapeutics (DTx) Market Size?

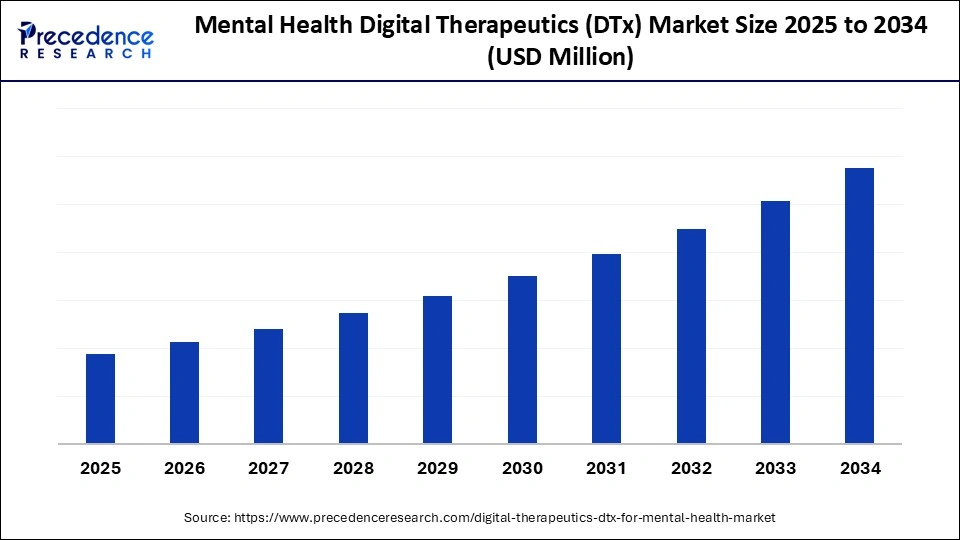

The global mental health digital therapeutics (DTx) market is witnessing rapid growth as digital platforms deliver clinically validated treatments for mental health conditions.This market is growing due to increasing awareness about mental well-being and the rising adoption of technology-driven, accessible treatment solutions.

Mental Health Digital Therapeutics (DTx) MarketKey Takeaways

- By region, North America dominated the market, holding the largest market share of 39% in 2024.

- By region, Asia Pacific is expected to grow at a notable rate of 18.8% in the mental health digital therapeutics (DTx) market.

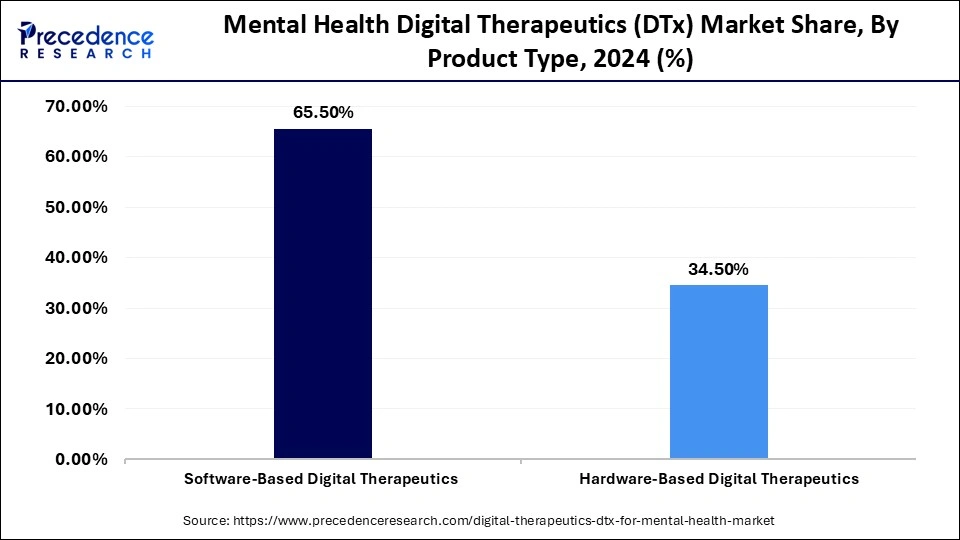

- By product type, the software-based digital therapeutics segment held the largest share of the market at 65.5% in 2024 and is expected to grow at the fastest rate during the forecast period.

- By disease indication, the depression segment held the largest market share of 34.4% in 2024.

- By disease indication, the anxiety disorders segment is expected to grow at the fastest rate of 17.4% during the forecast period.

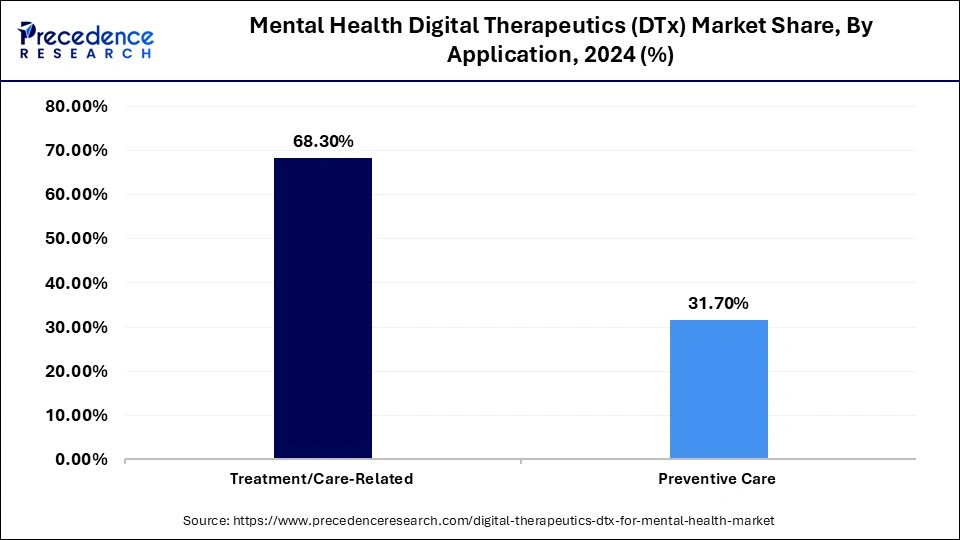

- By application, the treatment/care-related segment is expected to grow at the fastest rate of 68.3% in the mental health digital therapeutics (DTx) market.

- By application, the preventive care segment held the largest share in the market in 2024.

- By end user, the individual segment held the largest share at 58.3% in 2024.

- By end user, the healthcare providers segment is expected to grow at the fastest rate during the forecast period.

Market Overview

What is Mental Health Digital Therapeutics (DTx) Market?

The mental health digital therapeutics (DTx) market is experiencing significant growth, driven by the use of technology-based solutions and a greater understanding of mental health concerns. Technological developments in wearables, telehealth platforms, and artificial intelligence are expanding access to and personalization of mental health care.

- In September 2025, CMS proposed reimbursement for digital mental health therapies, boosting the adoption of apps and software for behavioral health.

Mental Health Digital Therapeutics (DTx) Market Outlook

- Industry Growth Overview: The mental health digital therapeutics (DTx) market is growing rapidly as more people look for flexible and easily accessible mental health solutions.Therapy is being delivered in a new way that is more individualized and accessible, thanks to the growing use of AI telehealth and connected devices. Digital-first methods are increasingly being used in mental health treatment.

- Sustainability Trends: Digital therapies are becoming more and more popular as a successful and efficient substitute for conventional treatments. They provide individualized care, lower healthcare costs, and aid in the management of mental health issues. Patients can receive consistent support outside of clinical settings thanks to the technology-driven approach.

- Startup Ecosystem: Digital solutions and personal therapy are being combined in hybrid care models, which are increasingly common. These models decrease wait times, increase access to high-quality care, and enhance patient engagement. Additionally, by streamlining administrative tasks, AI tools free up therapists to concentrate more on patient outcomes.

Key Technologies Shifts in the Mental Health Digital Therapeutics (DTx) Market

- Virtual & Augmented Reality: Immersion environments for exposure treatments in cognitive behavioral therapy and stress relief are being produced using VR and AR technologies. In secure online environments, these resources assist patients in facing their anxieties and managing PTSD phobias or social anxiety. Clinicians use VR-based applications to model real-world situations and evaluate patient reactions.

- Wearable Integration: Sensors and smartwatches monitor mood swings, heart rate, and sleep patterns. For ongoing emotional health monitoring, the data syncs with therapy apps. It assists users in earlystress trigger identification and promotes preventive care.

- Chatbots & Digital Counselors: AI chatbots provide 24/7 coping skills training and emotional support. Through instant communications, they help users between therapy sessions. This accessibility connects professional care and self-help.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Diseases Indication, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Restraint

Limited Awareness Among Clinicians

It is difficult to integrate digital therapeutics into standard care because many healthcare providers are still not familiar with them. Technology adoption may be slowed by a lack of training or confidence, particularly in underserved areas or smaller clinics.

- In January 2025, NICE recommended Sleepio, a digital CBT-based treatment for insomnia, showing increased clinician awareness and acceptance of digital solutions.

(Source: https://www.prevention.com)

Opportunity

Growing Acceptance of Digital Tools

Technologies in the mental health digital therapeutics (DTx) market are becoming more widely accepted as successful treatments by regulators and healthcare systems. Thispromotes integration into routine care and investments.

- In August 2025, Boehringer Ingelheim & Click Therapeutics FDA breakthrough device designation the collaboration received FDA breakthrough device designation for a prescription digital therapeutic targeting negative symptoms of schizophrenia, reflecting regulatory confidence in digital solutions.(Source: https://www.clicktherapeutics.com)

Segmental Insights

Product Type Insights

Why Did the Software-Based Digital Therapeutics Segment Dominate the Mental Health Digital Therapeutics (DTx) Market in 2024?

The software-based digital therapeutics dominated the mental health digital therapeutics (DTx) market with a 65.5% share in 2024, thanks to their extensive use, scalability, and ease of integration with tablets, smartphones, and other gadgets. Customers and healthcare professionals prefer software-based solutions because they provide accessible, affordable, and evidence-based mental health interventions.

Hardware-based digital therapeutics are expected to see notable growth in the market during the forecast period. This growth is driven by the increasing use of biofeedback-enabled tools, wearable technology, and VR/AR technologies, which enhance patient engagement in mental health interventions and personalize treatment.

Diseases Indication Insights

What Made the Depression Segment Lead the Mental Health Digital Therapeutics (DTx) Market?

The depression segment dominated the market for mental health digital therapeutics (DTx) with a 34.4% share in 2024 due to depression disorders being very common throughout the world, and there is a great need for digital interventions to supplement traditional therapy. CBT-based applications and mood tracking platforms are examples of digital therapies for depression that have gained popularity in both clinical and private settings, guaranteeing their broad use.

The anxiety disorders segment is expected to be the fastest-growing in the market during the forecast period, fueled by the rapid expansion in this sector due to factors like growing stress levels in contemporary lifestyles, growing awareness of anxiety management, and the availability of focused digital anxiety solutions.

Application Insights

What Made the Treatment/Care-Related Segment Dominate the Mental Health Digital Therapeutics (DTx) Market in 2024?

The treatment/care-related segment dominated the market with a 68.3% share in 2024 due as the main goal of digital therapeutics is to manage and treat mental health issues. The demand for applications by patients and healthcare providers that focus on therapy sessions, symptom monitoring, and behavioral interventions is still very high.

The preventive care segment is expected to be the fastest growing in the market during the forecast period. This growth is fueled by preventive digital therapeutics, such as mental wellness apps, stress management tools, and early intervention platforms, which are increasingly adopted as users seek proactive mental health maintenance.

End-User Insights

Why Did the Individual Segment Dominate the Mental Health Digital Therapeutics (DTx) Market in 2024?

The Individuals segment dominated the market with approximately 58.3% share in 2024, driven by privacy concerns, the growing popularity of self-management tools, and the increasing availability of web-based and mobile applications for mental health treatment.

The healthcare providers segment is predicted to be the fastest-growing, with a 16.2% CAGR in the market during the forecast period. Providers are increasingly adopting digital therapeutics to integrate into clinical workflows, support remote patient monitoring, and enhance the efficacy of mental health services.

Regional Insights

What Made North America Dominate the Mental Health Digital Therapeutics (DTx) Market?

North America dominated the mental health digital therapeutics (DTx) market with approximately 39% share in 2024 due to its strong foundation for digital health, the widespread recognition of mental health concerns, and substantial research and development expenditures. The region is now a leader in the global market thanks to the widespread use of mobile and web-based digital therapeutics and encouraging regulatory environments.

India Mental Health Digital Therapeutics (DTx) Market Trends

India is witnessing increasing demand for the mental health digital therapeutics (DTx) market due to expanding digital infrastructure, rising smartphone usage, and growing awareness of mental health issues. India is becoming one of the Asia Pacific region's fastest-growing markets for digital mental health solutions, thanks to public-private initiatives, pilot programs, and partnerships with startups.

Asia Pacific is expected to be the fastest-growing market during the forecast period, driven by increasing smartphone adoption, rapid digitization, rising mental health awareness, and government initiatives to support mental health programs. The need for digital therapeutic solutions as a practical and affordable substitute for conventional care is rising in India.

Canada Mental Health Digital Therapeutics (DTx) Market Trends

Canada's mental health digital therapeutics (DTx) market is expanding due to the increasing use of digital solutions by individuals and healthcare providers, supportive legislation, and rising investments in mental health facilities. These factors are accelerating the incorporation of digital therapeutics into routine care procedures.

Country-Level Investments/Funding Trends for Mental Health Digital Therapeutics (DTx) Market

| Country | Key Investments/Funding | Notable Companies/Projects | Focus Areas | Source |

| USA | $3.8B in Q1 2024 | Two chairs, Freenome, Qventus | Digital mental health platforms, AI-driven diagnostics, and teletherapy | (Source: https://www.galengrowth.com) |

| UK | $7.9B in H1 2025 | Draig Therapeutics, NHS | Severe depression, neurological disorders, digital CBT | (Source: https://www.ft.com) |

| Germany | Regulated reimbursement via DiGA | Deprexis, CureApp SC | Depression, anxiety, and smoking cessation | (Source: https://www.hitlab.org) |

| Japan | Pilot programs and regulatory support | CureApp SC | Smoking cessation, mental health apps | (Source:https://www.hitlab.org) |

| India | Seed and pilot funding via public-private initiatives | C-CAMP & NIMHANS, SilverCloud | Digital CBT, brain health startups | (Source: https://timesofindia.indiatimes.com) |

Analyst Insights: Mental Health Digital Therapeutics (DTx) Market

The mental health digital therapeutics (DTx) market is emerging as one of the most structurally transformative, yet operationally fragmented, subsectors within the broader digital health continuum. It occupies a unique intersection of behavioral science, regulatory-grade software development, and healthcare delivery reform, effectively reconstituting aspects of psychiatric and psychological care into data-driven, algorithmically administered interventions.

From an ecosystem standpoint, the market is evolving from a nascent, app-centric paradigm toward a clinical-grade, evidence-based architecture. Early-stage growth was predominantly consumer-driven and reimbursement-agnostic, but the market's current inflection reflects a pivot toward prescription DTx models, payer integration, and clinical validation, aligning with FDA and EMA regulatory frameworks. This transition, however, is introducing executional complexity, capital intensity, and longer commercialization cycles, which are beginning to separate transient digital wellness offerings from therapeutically rigorous platforms.

Structurally, analysts characterize the market through a tri-axial framework:

- Clinical Validation Axis: The competitive moat is increasingly defined by statistically robust RCT data and real-world evidence supporting efficacy across anxiety, depression, PTSD,ADHD, and substance use disorders.

- Commercial Integration Axis: Value capture depends on the ability to embed DTx solutions into payer pathways, EHR ecosystems, and employer mental health benefits, thereby transitioning from a B2C to a hybrid B2B2C model.

- Regulatory & Reimbursement Axis: The pathway toward scalable monetization hinges on the evolution of digital formularies and the institutionalization of CPT codes for remote behavioral therapy delivery.

Despite these tailwinds, the market's operational maturity remains uneven. Investor enthusiasm has moderated following the contraction in telehealth valuations and a recalibration of digital health multiples, yet the strategic logic of the DTx model remains intact. The sector continues to attract disciplined capital flows, oriented toward platforms capable of demonstrating clinical differentiation, adherence retention, and interoperable delivery within care networks.

From a macroeconomic and policy lens, several structural catalysts underpin the sector's long-term attractiveness:

- The global mental health care supply-demand disequilibrium, exacerbated by clinician shortages and rising prevalence rates, creates a systemic pull for scalable, software-mediated interventions.

- Regulatory legitimization, e.g., the FDA's evolving Software-as-a-Medical-Device (SaMD) framework, is institutionalizing DTx as a legitimate therapeutic modality rather than a digital adjunct.

- The integration of AI and biometrics is driving a paradigm shift from reactive treatment to predictive and continuous behavioral modulation, enhancing both therapeutic precision and data monetization potential.

However, analysts caution that the monetization architecture remains in flux. Reimbursement inertia, digital fatigue among end users, and the challenge of sustaining long-term engagement represent persistent friction points. Moreover, while clinical validation confers regulatory advantage, it also imposes pharma-like cost structures without commensurate pricing power, creating a potential margin squeeze for standalone DTx firms.

In aggregate, the Mental Health DTx market can be conceptualized as a convergence trade:

- Short-term equilibrium dominated by fragmented, direct-to-consumer applications with limited defensibility.

- Medium-term consolidation driven by partnerships between DTx developers, payers, and traditional pharma.

- Long-term upside resides in platform-based ecosystems capable of cross-indication scaling and longitudinal data leverage.

From a valuation standpoint, the sector's implied growth multiple reflects a “durable optionality” premium, contingent on the market's ability to cross the reimbursement chasm and demonstrate real-world cost offsets in mental health outcomes. The current analyst consensus views Mental Health DTx as a high-beta thematic exposure within digital health portfolios: volatile in the short term, but strategically indispensable in a healthcare economy trending toward value-based, technology-mediated behavioral care.

Top Companies in the Mental Health Digital Therapeutics (DTx) Market

- Big Health: Developer of digital therapeutics like Sleepio and Daylight, offering clinically validated cognitive behavioral therapy (CBT) programs for insomnia, anxiety, and depression.

- Akili Interactive Labs Inc.: Creator of EndeavorRx, the first FDA-approved prescription video game designed to improve attention function in children with ADHD through digital neurocognitive training.

- Woebot Health Inc.: Provides an AI-powered mental health chatbot that delivers evidence-based CBT interventions through conversational therapy to support anxiety and depression management.

- Mindstrong Health Inc.: Focuses on smartphone-based digital biomarkers and behavioral analytics to monitor and support patients with mood and psychiatric disorders.

- Cognoa Inc.: Develops digital diagnostics and therapeutics for pediatric behavioral health, including Canvas Dx, an FDA-authorized diagnostic aid for autism spectrum disorder.

- SilverCloud Health Ltd.: Offers a scalable online platform for mental and behavioral health therapy, delivering structured CBT and mindfulness-based programs across health systems.

- Livongo Health Inc.: Provides connected health management solutions integrating behavioral health with chronic disease monitoring, helping users manage stress and emotional well-being.

- Headspace Health Inc.: A global leader in mindfulness and meditation digital therapeutics, offering guided sessions and clinically backed mental wellness programs for stress and anxiety reduction.

- BetterHelp Inc.: Operates one of the world's largest online therapy platforms, connecting users with licensed therapists through messaging, calls, and video sessions.

- Kaia Health Software GmbH: Combines physical therapy, psychology, and mindfulness in its app-based solutions for pain and stress management, using AI-driven personalization.

- Click Therapeutics Inc.: Develops software-based prescription digital therapeutics (PDTs) targeting major depressive disorder (MDD), schizophrenia, and insomnia through cognitive and behavioral science.

- Aardvark Inc.: Creates digital therapeutic platforms for emotional resilience and mood improvement, using gamified interventions and cognitive training exercises.

- InStream Health Inc.: Focuses on delivering personalized mental health interventions through data-driven behavioral insights and digital care pathways.

- BehaVR Inc.: Utilizes virtual reality (VR) to create immersive digital therapeutic experiences for anxiety, stress reduction, and addiction recovery.

- Ginger Inc.: Provides on-demand mental health support through its AI-driven platform, combining self-care tools, behavioral coaching, and licensed therapy in real time.

Recent Developments

- In April 2024, Otsuka America Pharmaceutical and Click Therapeutics received FDA clearance for Rejiyn, a smartphone app for major depressive disorder. The app combines cognitive behavioral therapy and brain training to help manage symptoms.(Source: https://www.clicktherapeutics.com)

- In September 2024, DeepWell DTx received FDDA clearance for an interactive media-based digital therapeutic combining video games and other media to treat mental health conditions.(Source: https://www.biospace.com)

Segments covered in the Report

By Product Type

- Software-Based Digital Therapeutics

- Mobile Applications

- Web-Based Platforms

- Hardware-Based Digital Therapeutics

- Wearables

- Biofeedback Devices

By Diseases Indication

- Depression

- Anxiety Disorders

- Post-Traumatic Stress Disorder (PTSD)

- Substance Use Disorders

- Cognitive Disorders

- Bipolar Disorder

- Other Mental Health Disorders

By Application

- Treatment/Care-Related

- Depression

- Anxiety

- Post-Traumatic Stress Disorder (PTSD)

- Substance Use Disorders

- Cognitive Disorders

- Bipolar Disorder

- Other Mental Health Disorders

- Preventive Care

- Stress Management

- Sleep Disorders

- Mindfulness and Wellness

By End-User

- Individuals

- Patients

- Caregivers

- Healthcare Providers

- Clinics

- Hospitals

- Therapists

- Corporations

- Employers

- Insurance Companies

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting