Mental Health Clinical Trials Market Size and Forecast 2025 to 2034

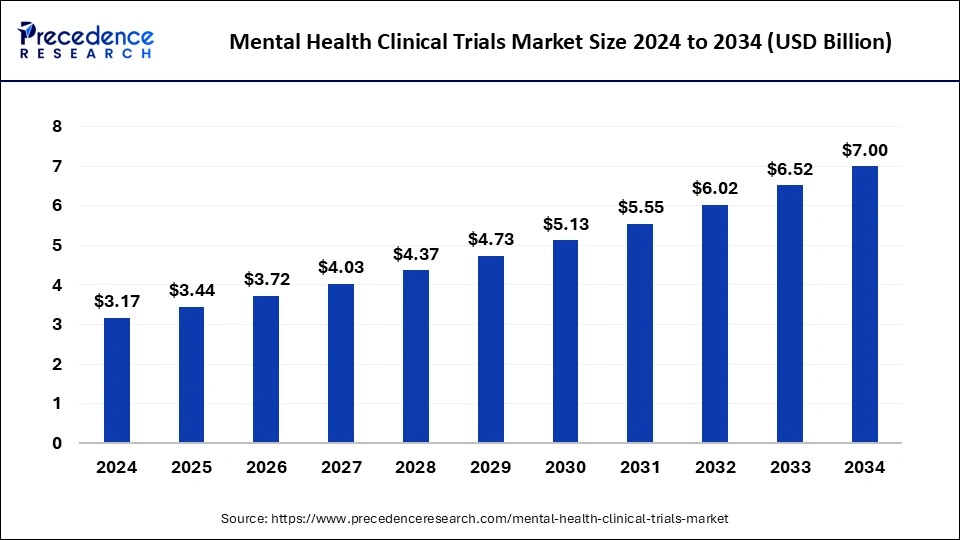

The global mental health clinical trials market size accounted at USD 3.17 billion in 2024 and is predicted to increase from USD 3.44 billion in 2025 to approximately USD 7.00 billion by 2034, expanding at a CAGR of 8.24% from 2025 to 2034. The rising prevalence of mental health disorders significantly grow the mental health clinical trials market.

Mental Health Clinical Trials Market Key Takeaways

- The global mental health clinical trials market was valued at USD 3.17 billion in 2024.

- It is projected to reach USD 7.00 billion by 2034.

- The mental health clinical trials market is expected to grow at a CAGR of 8.24% from 2025 to 2034.

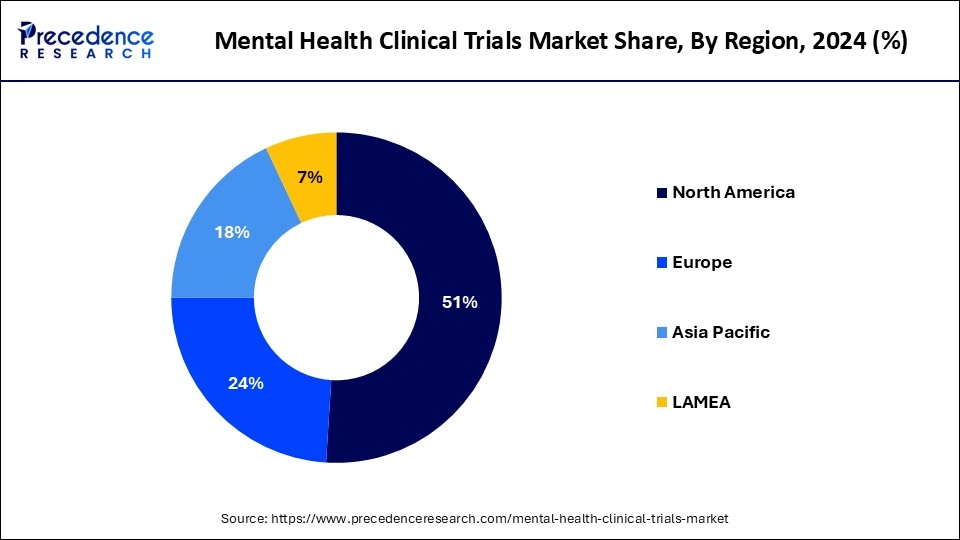

- North America dominated the mental health clinical trials market with the largest revenue share of 51% in 2024.

- Asia Pacific is expected to grow at the highest CAGR of 8.82% during the forecast period.

- By phase, the phase III segment has contributed more than 33% of revenue share in 2024.

- By phase, the phase I segment is projected to grow at the solid CAGR of 8.71% during the forecast period.

- By study design, the interventional segment has captured more than 66% of revenue share in 2024.

- By study design, the observational segment is expected to grow at the highest CAGR in the market during the forecast period.

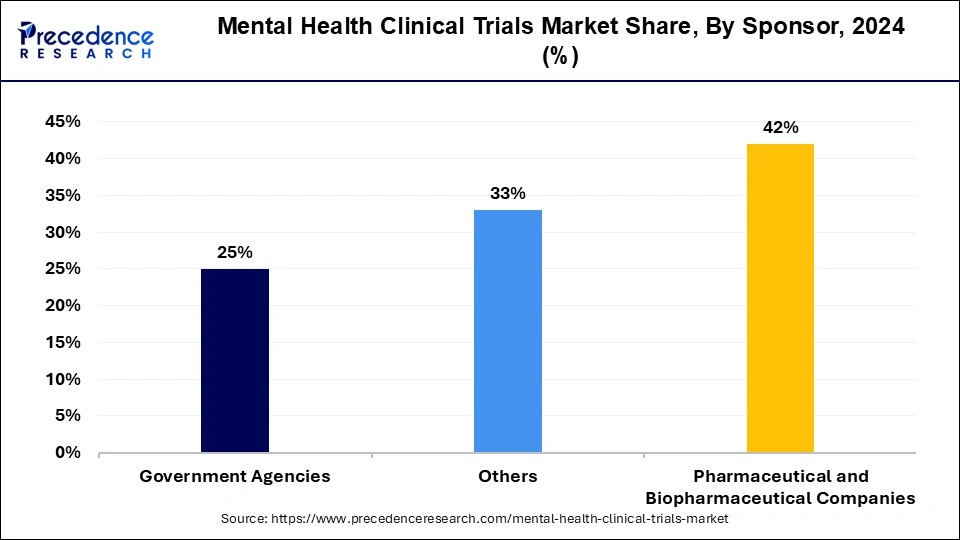

- By sponsor, the pharmaceutical & biopharmaceutical companies segment has recorded the biggest revenue share of 40% in 2024.

- By sponsor, the government agencies segment is growing at a highest CAGR of 8.53% during the forecast period.

- By disorder, the anxiety disorders segment dominated the market in 2024.

- By disorder, the depression segment is expected to grow at the highest CAGR in the market during the forecast period.

U.S. Mental Health Clinical Trials Market Size and Growth 2025 to 2034

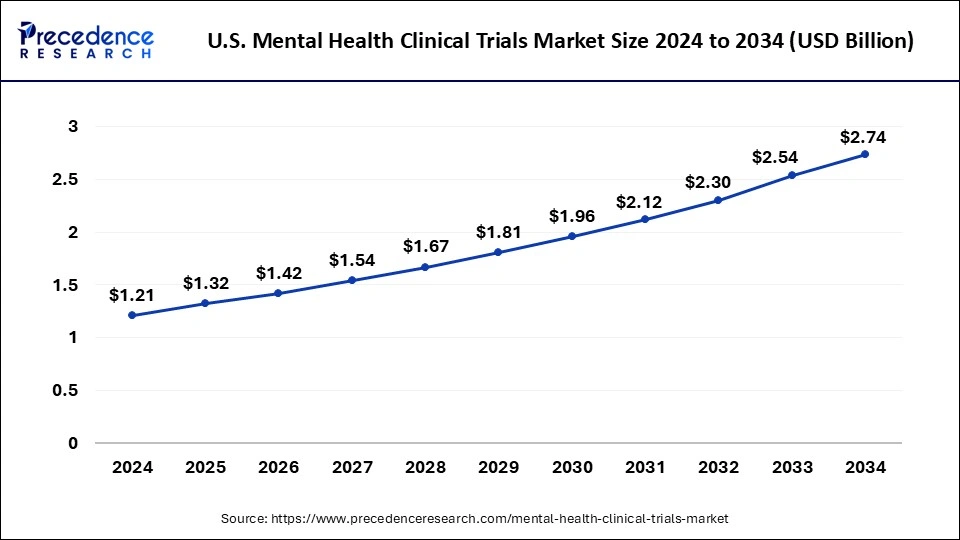

The U.S. mental health clinical trials market size was exhibited at USD 1.21 billion in 2024 and is projected to be worth around USD 2.74 billion by 2034, growing at a CAGR of 8.52% from 2025 to 2034.

North America dominated the mental health clinical trials market in 2024. North America has an extremely developed healthcare infrastructure, with well-established clinical research facilities, academic institutions, research organizations, and specialist mental health institutes. This is especially true of the United States and Canada. This infrastructure makes it possible to carry out excellent clinical trials in the field of mental health. The North American regulatory bodies with strict yet open regulatory frameworks for clinical trials include Health Canada and the Food and Drug Administration (FDA) in the United States. Sponsors and researchers are drawn to conduct trials in the region of the uniformity and clarity of the regulations. Research and development (R&D) expenditures from pharmaceutical corporations, biotech businesses, academic institutions, and government agencies are substantial in North America. This financing promotes clinical trial activity, encourages creativity, and aids in the creation of novel treatments for mental health illnesses.

- Over 6 million men in the U.S. experience depression each year. Men are more likely to report symptoms such as fatigue, irritability, and loss of interest in work or hobbies rather than feelings of sadness or worthlessness. 19.1 million adults in the U.S. ages 19 to 54 experience an anxiety disorder, and more than 3 million men experience panic disorder, agoraphobia, or other phobias.

Asia Pacific is expected to grow at the highest CAGR in the mental health clinical trials market during the forecast period. The healthcare infrastructure of several Asia Pacific nations, such as Australia, South Korea, China, India, Japan, and South Korea, is growing quickly. As a result, the area is becoming more and more appealing for conducting clinical trials. This includes the construction of cutting-edge hospitals, research institutions, and clinical trial facilities.

A wide spectrum of mental health illnesses is present in the population of Asia Pacific. This region is large and diversified. The opportunities for recruiting and enrolling participants in clinical trials are presented by the broad patient pool, particularly for research involving a variety of age groups, socioeconomic backgrounds, and ethnicities. Asia-Pacific governments are paying more and more attention to healthcare innovation, R&D, and development. They provide financing opportunities, grants, incentives, and supporting policies to promote clinical research, particularly studies on mental health.

Market Overview

The mental health clinical trials market refers to the industry that deals with studies aimed at assessing the efficacy, safety, and efficacy of treatments intended to treat or prevent mental illnesses. These studies are critical to the creation of novel therapies and the enhancement of current ones.

- The mental health clinical trials market is fragmented with multiple small-scale and large-scale players, such as Parexel International Corporation, Corcept, Labcorp Drug Development, ICON Plc, Caidya, Pharmaceutical Product Development, LLC, Syneous Health, Novo Nordisk, Eli Lilly Company, and IQVIA.

Mental Health Clinical Trials Market Growth Factors

- Rising funding from government companies or pharmaceutical and biotechnological industries may grow the mental health clinical trials market.

- The growing pressure at workplaces has led to mental stress buildup in employees worldwide. Acknowledgment and concern regarding the resulting recursion have caused major efforts in the mental healthcare sector.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 7.00 Billion |

| Market Size in 2025 | USD 3.44 Billion |

| Market Size in 2024 | USD 3.17 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.24% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Phase, Study Design, Sponsor, Disorder, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Rising awareness about mental health

The rising awareness about mental health can boost the mental health clinical trials market. Mental health conditions include anxiety disorder, depression, bipolar affective disorder, dissociation and dissociative disorders, and schizophrenia, so raising awareness about the causes and side effects of these mental health conditions can boost the market.

Restraint

The rising cost of mental health disorder medicines and treatments

The rising cost of mental health disorder medicines and treatments may slow down the mental health clinical trials market. Access to these advancements may be restricted by the high expense of novel drugs and therapies, especially for those with inadequate insurance or low incomes. The trial participants' reduced variety and representativeness as a result of this restricted access might possibly affect the generalizability of trial outcomes and slow down recruiting efforts.

Opportunity

Integration of artificial intelligence

The integration of artificial intelligence in mental health clinics can be an opportunity to boost the mental health clinical trials market. The growing discipline of mental health diagnosis has greatly benefited from the advancements made possible by artificial intelligence, especially with regard to machine learning (ML).

In order to find patterns suggestive of mental health problems, machine learning models are being utilized more and more to evaluate complex datasets generated from genetic profiles, electronic health records, and patient-reported outcomes. These models are capable of accurately predicting a person's risk of acquiring mental health problems, including schizophrenia, anxiety, and depression.

- In April 2024, Fortis Healthcare launched an artificial intelligence-empowered application that could help people with mental health issues.

Phase Insights

The phase III segment dominated the mental health clinical trials market in 2024. Investigations in Phase III are carried out when a medication or therapy has demonstrated efficacy in previous stages (Phase I and II). By now, the therapy is usually seen as having a better chance of working and drawing additional funding and resources. Compared to earlier phases, the phase III studies had a higher participant count.

This is required to ascertain if the therapy is working, to pinpoint any side effects, and to compile more thorough information about the treatment's safety and effectiveness. These trials' importance in the market may be attributed to the fact that their scope frequently necessitates large finance and coordination. Before a medication may be submitted for regulatory approval, Phase III trial success is frequently the last step. These studies are given priority by research organizations and pharmaceutical corporations.

The treatment's ability to pass Phase III studies is frequently the last need before it can be submitted for regulatory clearance. These trials are given top priority by pharmaceutical corporations and research organizations since they are essential to the commercialization of novel therapies. The emphasis on Phase III studies is partly fueled by the possibility of large returns on investment upon successful completion and approval. Phase III studies tend to draw greater investment from the public and private sectors due to their crucial nature for regulatory approval and commercialization. This funding infusion has the potential to increase the commercial prominence of Phase III studies.

The phase I segment is expected to grow at the highest CAGR in the mental health clinical trials market during the forecast period. An increasing pipeline of innovative treatments and therapeutic agents aimed at mental health issues is available. As science progresses, novel substances and therapeutic approaches make their way into the clinical trial stage, requiring Phase I studies to evaluate their preliminary effectiveness and safety.

The burden of mental health diseases worldwide is becoming more widely acknowledged, and this is driving more investment from the public and commercial sectors. Early-stage clinical trials, such as Phase I trials, to investigate novel medicines are supported by this funding increase. It is now possible to find novel therapy candidates more quickly because of developments in biotechnology, pharmacology, and data analytics. The start of Phase I studies to evaluate the safety profiles of these advanced medicines is accelerated by these developments. The early-phase studies are necessary in the field of mental health because of the increasing focus on customized and precision medicine.

Study Design Insights

The interventional segment dominated the mental health clinical trials market in 2024. The demand for innovative and efficient therapies for mental health issues is strong due to their substantial influence on global health. Developing these medicines and meeting unmet medical needs depend heavily on interventional studies, which evaluate novel therapies or interventions. Significant progress has been made in mental health treatment modalities, such as new drugs, psychotherapy methods, neuromodulation strategies, and digital therapies. Conducting interventional studies is crucial in assessing the safety and effectiveness of these novel modalities.

In the field of mental health, there is a rising movement toward precision and customized medicine, which entails adjusting therapies to the unique needs of each patient. To determine the best course of therapy, personalized medicine techniques such as genetic testing and biomarker analysis are frequently used in interventional studies.

The observational segment is expected to grow at the highest CAGR in the mental health clinical trials market during the forecast period. In the area of healthcare, particularly mental health, there is a rising emphasis on observational research and real-world evidence. By offering insights into treatment results, patient experiences, illness progression, and healthcare usage in real-world settings, these studies supplement interventional trials.

The natural history of mental health illnesses, the identification of risk factors, the assessment of treatment patterns, and the evaluation of long-term results all depend on observational studies, particularly those with longitudinal and epidemiological designs. These studies' longitudinal design makes it possible for researchers to monitor changes over time, which is essential for studying mental health issues. Observational studies are essential for post-market surveillance and safety monitoring of mental health medicines after receiving regulatory clearance. These studies track the efficacy of treatments, adverse events, and long-term safety profiles in a range of patient groups outside of the clinical setting.

Sponsor Insights

The pharmaceutical & biopharmaceutical companies segment dominated the mental health clinical trials market in 2024. The companies in the pharmaceutical and biopharmaceutical industries devote a significant amount of funding to R&D initiatives, including clinical trials. These businesses place a high priority on doing clinical research to find novel medicines and treatments due to the frequency and consequences of mental health issues.

A rising number of treatment strategies, biologics, and experimental medications are being developed to treat mental health issues such as depression, anxiety disorders, schizophrenia, and neurodegenerative diseases. The clinical trials are sponsored by pharmaceutical corporations in order to push these pipeline candidates through thorough testing and assessment.

The clinical trial is conducted using a specific skill set, infrastructure, and capability of pharmaceutical and biopharmaceutical organizations. They can organize, carry out, and oversee clinical research in mental health because they have access to research facilities, clinical trial locations, scientific staff, and regulatory understanding.

The government agencies segment is expected to grow at the highest CAGR in the mental health clinical trials market during the forecast period. The prevalence of mental health illnesses and the necessity for research to provide efficient therapies are being acknowledged by governments and public health organizations more and more. Consequently, increased money is being provided to assist clinical studies related to mental health, which is driving growth in the government agencies market. Governmental organizations frequently start public health campaigns and programs with the goal of enhancing mental health results.

The funding of clinical studies to assess treatments, interventions, and preventative measures for mental health illnesses may be one of these projects. Government organizations are dedicated to eliminating health inequalities and advancing health equality, which includes doing research on mental health. To guarantee that vulnerable individuals, diverse communities, and underserved populations have access to cutting-edge therapies and interventions, they can support clinical studies aimed at these populations.

Disorder Insights

The anxiety disorders segment dominated the mental health clinical trials market in 2024. Anxiety disorders are among the most common mental health illnesses worldwide. These diseases include panic disorder, social anxiety disorder (SAD), generalized anxiety disorder (GAD), and phobias. They touch a sizable segment of the populace and significantly impair functioning, quality of life, and use of healthcare resources. Despite the fact that anxiety disorders are common, there are still a lot of unmet treatment requirements and gaps in the field.

In order to close these gaps and enhance outcomes for people with anxiety disorders, clinical trials are essential to the development of novel treatments, interventions, and strategies. Due to the wide range of symptoms, subtypes, and comorbidities associated with anxiety disorders, diagnosis and therapy can be challenging. Tailored therapies are possible in anxiety disorders by focusing clinical trials on certain subtypes or symptom clusters within the larger category.

The percentage of Canadians aged 15 years and older who met diagnostic criteria for generalized anxiety disorder in the 12 months before the survey doubled from 2.6% to 5.2% between 2012 and 2022. Similar increases were observed for the 12-month prevalence of major depressive episodes, from 4.7% in 2012 to 7.6% in 2022, and bipolar disorders, from 1.5% in 2012 to 2.1% in 2022.

Mental Health Clinical Trials Market Companies

- ICON Plc

- Eli Lilly Company

- Caidya

- Syneous Health

- Novo Nordisk

- Pharmaceutical Product Development, LLC

- Parexel International Corporation

- Corcept

- Labcorp Drug Development

- IQVIA

Recent Developments

- In April 2024, the international pharmaceutical business Otsuka Pharmaceutical Development & Commercialization, Inc. (Otsuka) announced the opening of My Mental Health Journey, a longitudinal registry project with the goal of advancing mental health and depression research.

- In February 2024, the Bazouki Group declared the beginning of a new collaboration on a clinical study of a therapeutic ketogenic diet for bipolar illness with McLean Hospital in Belmont, Massachusetts. Investigating nutritional ketosis as a unique therapeutic approach and a crucial tool for comprehending the underlying processes of bipolar disease.

Segment Covered in the Report

By Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Study Design

- Interventional

- Observational

- Others

By Sponsor

- Pharmaceutical & Biopharmaceutical Companies

- Government Agencies

- Others

By Disorder

- Anxiety Disorders

- Depression

- Bipolar Affective Disorder

- Dissociation & Dissociative Disorders

- Schizophrenia

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content