What is the Mental Health Screening Market Size?

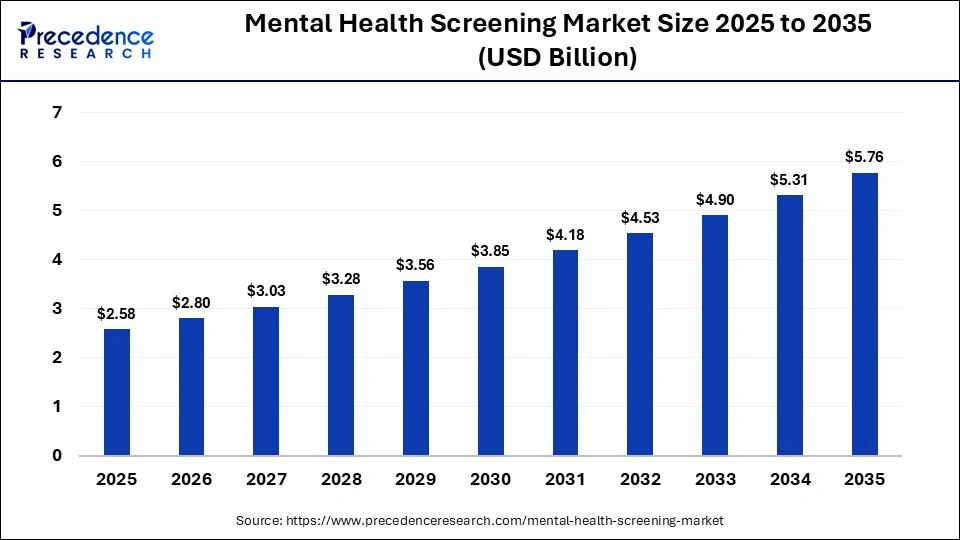

The global mental health screening market size was estimated at USD 2.58 billion in 2025 and is predicted to increase from USD 2.80 billion in 2026 to approximately USD 5.76 billion by 2035, expanding at a CAGR of 10.23% from 2026 to 2035. The mental health screening market continues to grow as a result of rising global mental health challenges faced by individuals.

Market Highlights

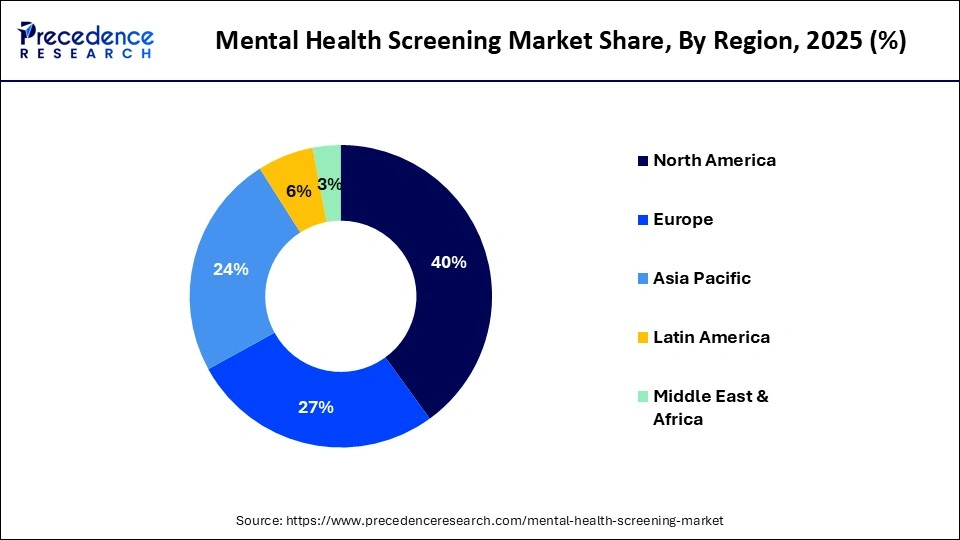

- North America dominated the mental health screening market with approximately 40% in 2025.

- Asia Pacific is expected to be the fastest-growing region with a CAGR of 10.5% during the forecast period.

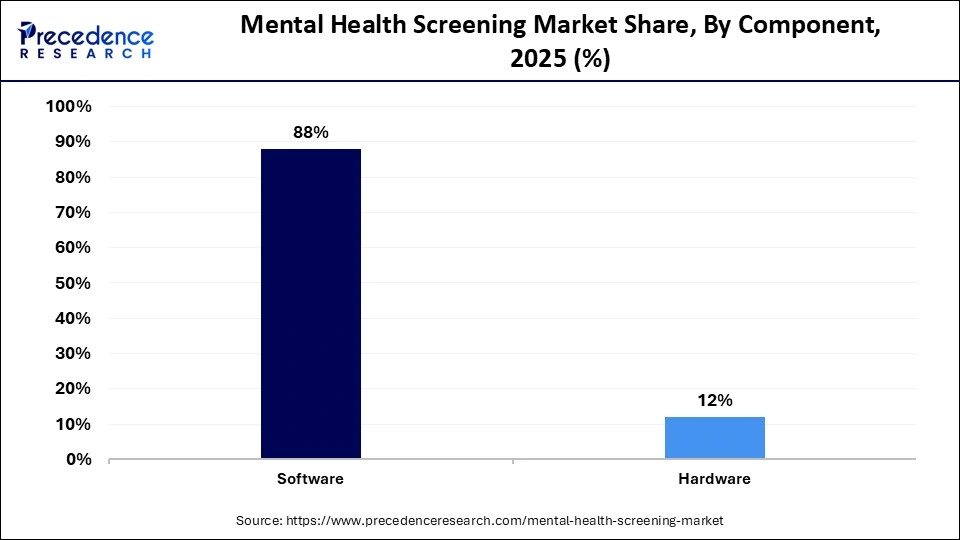

- By component, the software segment held the biggest revenue share of approximately 88% in 2025.

- By component, the hardware segment is expected to be the fastest growing with a CAGR of 9.7% during 2026-2035.

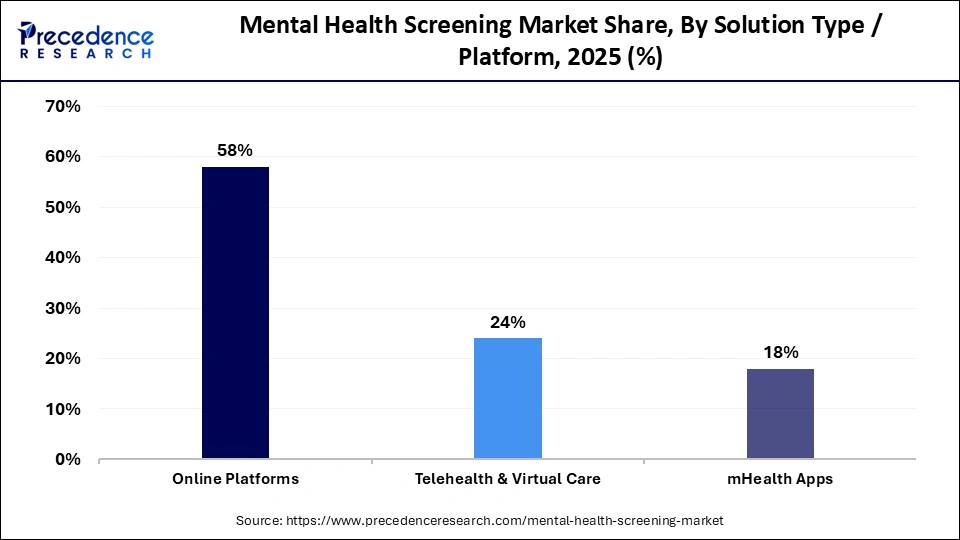

- By solution type/platform, the online platforms segment led the market with a share of approximately 58% in 2025.

- By solution type/platform, the mHealth apps segment is expected to be the fastest-growing segment with a CAGR of 9.5% during the forecast period.

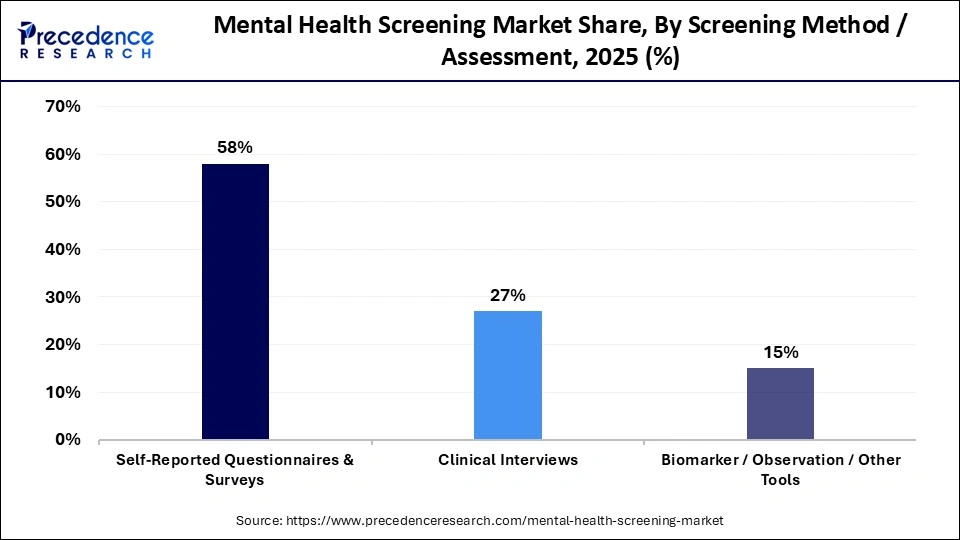

- By screening method/assessment, the self-reported questionnaires & survey segment dominated the market with a revenue of approximately 65% in 2025.

- By screening method/assessment, the biomarkers/observation/other tools segment is expected to be the fastest-growing with a CAGR of 9.2% during the forecast period.

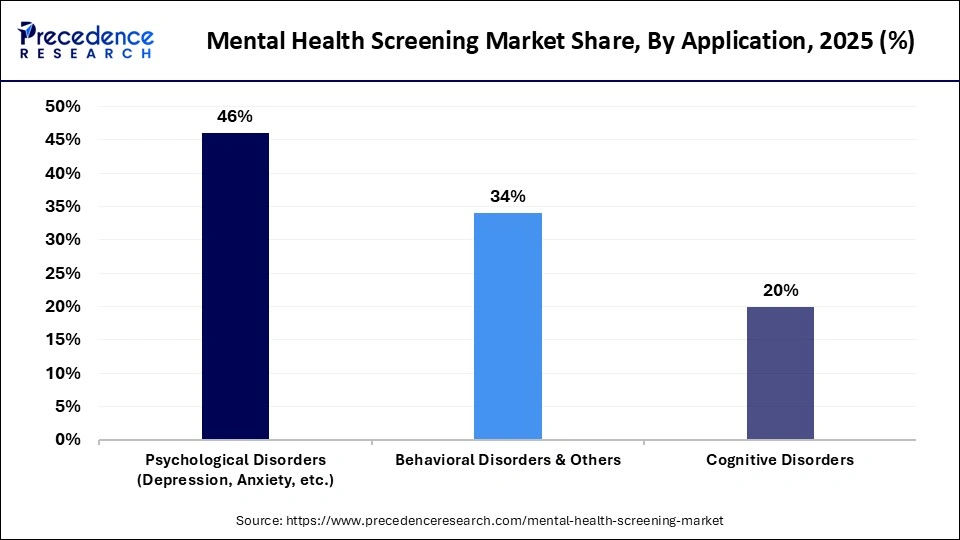

- By application, the physiological/psychological disorders segment dominated the mental health screening market with a share of approximately 46% in 2025.

- By application, the cognitive disorders segment is expected to be the fastest-growing, with a CAGR of 9.4% during the forecast period.

Market Overview

The mental health screening market includes tools, platforms, software, and services that detect early signs of psychological conditions such as depression, anxiety, PTSD, ADHD, and cognitive disorders. Screening can be conducted via online platforms, questionnaires, clinical interviews, wearable/sensing technologies, and telehealth solutions. Driven by rising mental health awareness, technology adoption, and preventive care needs, these solutions help clinicians, employers, and schools identify at-risk individuals for timely intervention, reducing the burden of untreated mental illness globally.

What is the Role of AI in the Market's Growth?

Artificial Intelligence plays a vital role in the revolution of the mental health screening market by acting as an intelligent, always available, and accessible companion, which helps with analyzing subtle cues from voice tones or text patterns, which helps with early detection. In the case of clinics, the AI automates initial triage by sifting through a vast symptoms database in order to generate a draft assessment that later on clinicians can refine and use. For the underserved regions, chatbots and adaptive algorithms deliver a multilingual screening almost 24/7 through smartphones, providing services where specialists are scarce.

For instance, in December 2025, the Shanghai Mental Health Center is implementing various artificial intelligence technologies to boost the efficiency of mental health consultations and address limitations in conventional clinical assessment methods.

What are the Different Market Trends?

- Digital platforms and telehealth solutions are growing, while prioritising user-friendly online tools and mobile apps that provide real-time tracking of symptoms and quick self-assessments.

- The policy-driven mandates have seen growth globally, while normalising screenings across all demographics, along with wearable monitoring to help keep track of physiological symptoms.

- The mental health screening market is driven by rising ESG (Environmental, Social, and Governance) mandates, and employers are transitioning from reactive Employee Assistance Programs (EAPs) to active, regular mental health screenings and "emotional check-ins" for employees, particularly younger demographics (Gen Z/Millennials).

- Wearable sensors (smartwatches, rings) and smartphone data (typing speed, app usage, sleep patterns) are being used to track behavioral metrics passively, allowing for early detection of mental health deteriorations, such as manic or depressive episodes, before they escalate.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.58 Billion |

| Market Size in 2026 | USD 2.80 Billion |

| Market Size by 2035 | USD 5.76 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.23% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component,Solution Type,Screening Method,Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Analysis

Component Insights

Why the Software Segment Dominated the Market in 2025?

The software segment dominated the mental health screening market in 2025, with a revenue of approximately 88%, because this segment consists of AI-based screening, mHealth apps, self-screening apps, remote platforms, and virtual care solutions. These tools help with user anonymity, multilingual support, and integration with telehealth, ultimately leading to adaptation of these services in schools, workplaces, and clinics. This segment thrives on smartphone universality and chatbots that provide real-time evaluations. This segment is widely accessible and cost-effective.

The hardware segment is estimated to grow at the fastest CAGR of 9.7% during the predicted timeframe. This segment includes wearables and biometric sensors that help with tracking physiological markers such as the heart rate or sleep patterns. These help software by giving real-time data, with its growth led by advancements in the vocal Biomarker and smartwatch integrations. The higher prices of these devices have led to limited purchase of them; however, the predictions showcase the growth by xx.

Solution Type/Platform Insights

What made the Online Platforms Segment Dominant in the Maret in 2025?

The online platforms segment held the dominant share of approximately 58% of the mental health screening market in 2025 because this segment offers web-based self-assessments, AI-driven questionnaires, and data analytics for a larger reach without the necessary involvement of physical infrastructures. Online platforms excel in real-time results, multilingual support, and integration of ERH systems, which helps to make them an ideal place for population screening in workplaces and communities. Online platforms create a safe space for individuals to take care of their emotional well-being.

The mHealth apps segment is anticipated to be the fastest-growing segment with a CAGR of 9.5% during 2026-2035. This segment focuses on mobile-first screening through apps like chatbots and gamified assessments for sought-after use. The strength of this segment lies in the smartphone's predominance and the push notifications for proactive monitoring. However, these applications do face some competition from more comprehensive platforms.

Screening Method/Assessment Insights

Which Screening Method Dominated the Market in 2025?

The self-reported questionnaires & survey segment dominated the mental health screening market with approximately 65% share in 2025, as these are particularly user-friendly tools where individuals answer questions regarding their thoughts, feelings, any symptoms, or behaviour. There are good examples of questionnaires, such as PHQ-9 for depression or GAD-7, which is for anxiety, that consist of simple checklists taking only a couple of minutes. These are useful and convenient, as individuals can do these privately on the apps or websites without necessarily needing the clinician's help. This segment helps individuals to get a better idea about their mental health and well-being.

The biomarkers/observation/other tools segment is anticipated to observe the highest growth rate of 9.2% during the forecast period. Biomarkers usually track the physiological signals, such as voice patterns for stress or elevated heart rate. These help with real-time updates. Observations involve symptoms and behavioural patterns or body language, social interactions in schools or at workplaces, noticed and noted by clinicians. Other tools, such as AI systems and chatbots, analyse speech and really help with monitoring and catching non-verbal cues. However, these tools require validation against clinical standards.

Application Insights

Which Application Dominated the Mental Health Screening Market in 2025?

The physiological/psychological disorders segment was dominant in the market with a revenue of approximately 46%. Physiological and psychological disorders are rising primarily due to increased chronic stress (linked to economic uncertainty and 24/7 digital connectivity), the long-term, and an aging global population. Additionally, environmental stressors, poor lifestyle choices, and widespread social media consumption contribute to "doom scrolling" and body image anxiety, which are accelerating the prevalence of depression and anxiety, especially among young people.

The cognitive disorders segment is anticipated to grow at the fastest rate of 9.4% during 2026-2035. Cognitive disorders are rising due to an aging population, increased awareness, and post-pandemic stress, driving demand for early detection, which fuels the mental health screening market's growth through digital tools, telehealth, employer programs, and primary care integration, despite challenges like stigma. This tech-driven expansion sees increased investment in accessible, AI-powered screening for better outcomes.

Regional Insights

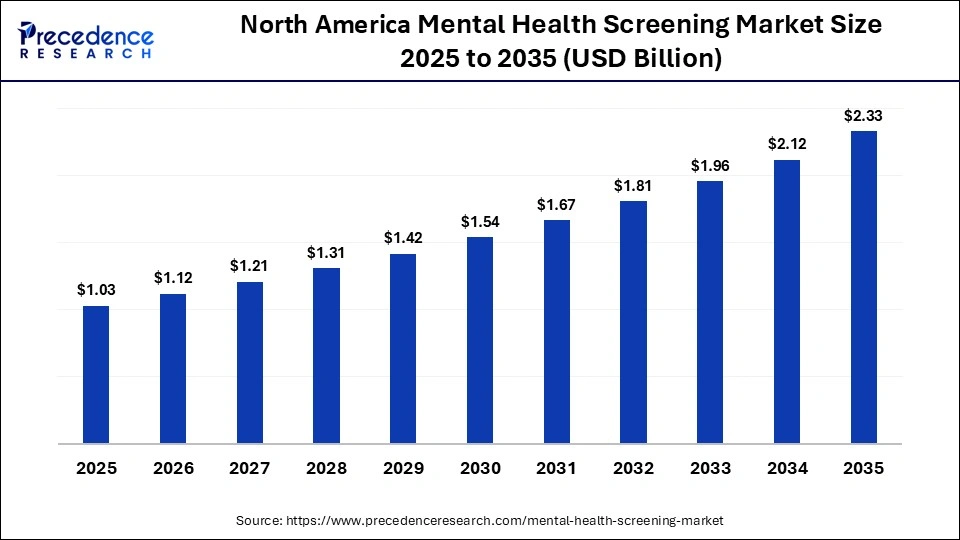

How Big is the North America Mental Health Screening Market Size?

The North America mental health screening market size is estimated at USD 1.03 billion in 2025 and is projected to reach approximately USD 2.33 billion by 2035, with a 8.51% CAGR from 2026 to 2035.

North America Mental Health Screening Market Analysis

North America dominated the market with approximately 40% share in 2025. In North America, the screenings have become an integral part of day-to-day life, such as healthy routines, yearly check-ups, with the help of easier digital access and policies that aid in early detection in schools, workplaces, and clinics. With the increase in the number of adults facing stress issues due to work and responsibilities, seeks help from quick check-ups such as PHQ-9 or AI chatbots, avoiding the stigma surrounding mental health help. Strong policies backed by the government promote routine screenings in primary care and communities, which help with the normalisation of conversations around anxiety and mental health issues.

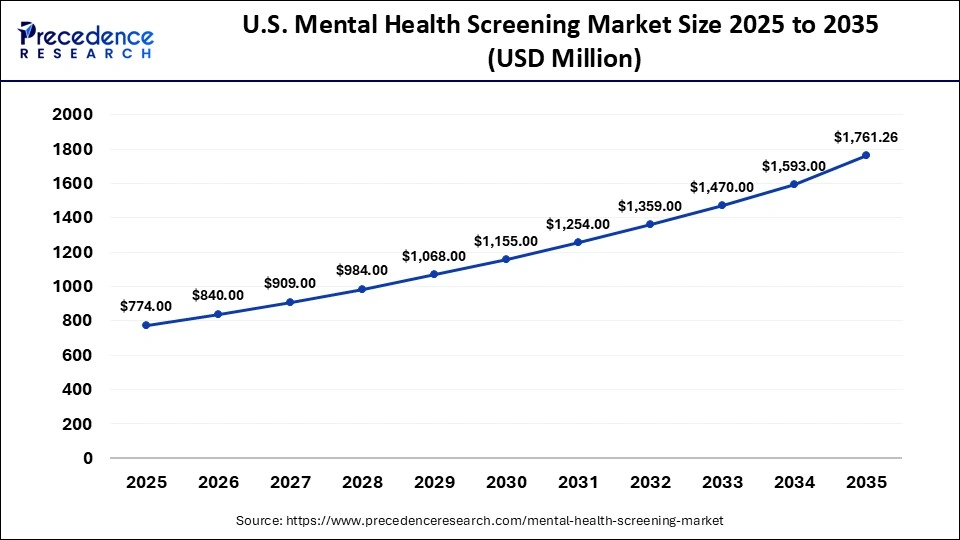

What is the Size of the U.S. Mental Health Screening Market?

The U.S. mental health screening market size is calculated at USD 774.00 million in 2025 and is expected to reach nearly USD 1,761.26 million in 2035, accelerating at a strong CAGR of 8.57% between 2026 and 2035.

The U.S. Market Trends

The U.S. dominates the North American mental health screening market due to high mental disorder prevalence, rising awareness, and reduced stigma. Key drivers include significant government funding, favorable reimbursement policies, and integration into primary care. Advanced AI, digital platforms, and workplace initiatives also fuel market expansion through increased early detection access.

For instance, in August 2025, Illinois became the first U.S. state to require yearly mental health screenings for students. Under a law signed by Governor JB Pritzker, public school children in grades 3 through 12 will receive at least one mental health check each year beginning in the 2027–28 school year. This step makes mental health screenings a routine part of school health care, alongside vision and hearing tests.

What Factors support the Asia Pacific's Market Growth?

Asia Pacific is estimated to be the fastest-growing region in the mental health screening market with a CAGR of 10.5% during 2026-2035. This region's screening reflects the mix of culture, traditions, and modernisation, in which case, tools adapt to the diverse cultures and nuances to help create a better reach and access. The growing awareness surrounding mental health helps people to quietly address their issues with the help of these applications without worrying about the judgements. These multilingual apps with easy accessibility help individuals to keep track of their emotional well-being.

China Market Trends

China dominated the Asia Pacific mental health screening market because of rapid, government-led, community-based initiatives and policy reforms, high smartphone/internet adoption powering digital tools, rising awareness of mental health disorders, and significant investments in technology and infrastructure to expand access to early intervention services in both urban and rural areas.

Who are the Major Players in the Global Mental Health Screening Market?

The major players in the mental health screening market include Adaptive Testing Technologies, Proem Behavioural Health, Aiberry, SonderMind Inc., Clarigent Health, Riverside Community Care, Kintsugi Mindful Wellness, Inc, Thymia Limited, Ellipsis Health Inc., Canary Speech, Inc., Headspace Health, Quartet Health, Inc., Modern Life, Inc., and Sonde Health, Inc.

Recent Developments in the Market

- In December 2025, after a nine-year hiatus, the central government has initiated a new National Mental Health Survey, covering all states and Union Territories to assess the country's post-COVID mental health landscape. (Source:https://timesofindia.indiatimes.com)

- In September 2025, at AIIMS Delhi, an AI-based mental health program ‘Never Alone' was launched. This application provides mental health screenings to each student at 70 paisa per day. This application was launched in the light of trying to raise awareness regarding suicide and minimise the stigma surrounding it. (Source:https://www.thehindu.com)

Segments Covered in the Report

By Component

- Software

- Hardware

By Solution Type/Platform

- Online Platforms

- Telehealth & Virtual Care

- mHealth Apps

By Screening Method/Assessment

- Self-Reported Questionnaires & Surveys

- Clinical Interviews

- Biomarker/Observation/Other Tools

By Application (Disorder Focus)

- Physiological/Psychological Disorders

- Cognitive Disorders

- Behavioral Disorders/Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content