What is the Methionine Market Size?

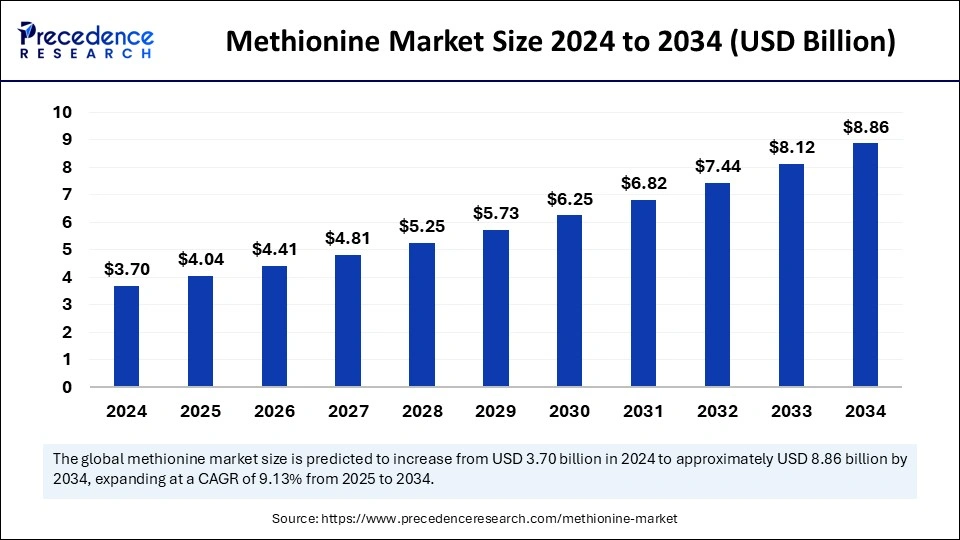

The global methionine market size was estimated at USD 4.04 billion in 2025 and is predicted to increase from USD 4.41 billion in 2026 to approximately USD 9.56 billion by 2035, expanding at a CAGR of 9% from 2026 to 2035. Increasing demand for methionine across the globe due to its benefits is the key factor driving market growth. Also, growing investment in research and development by market players coupled with the surging demand for animal-based products can fuel market growth further.

Methionine Market Key Takeaways

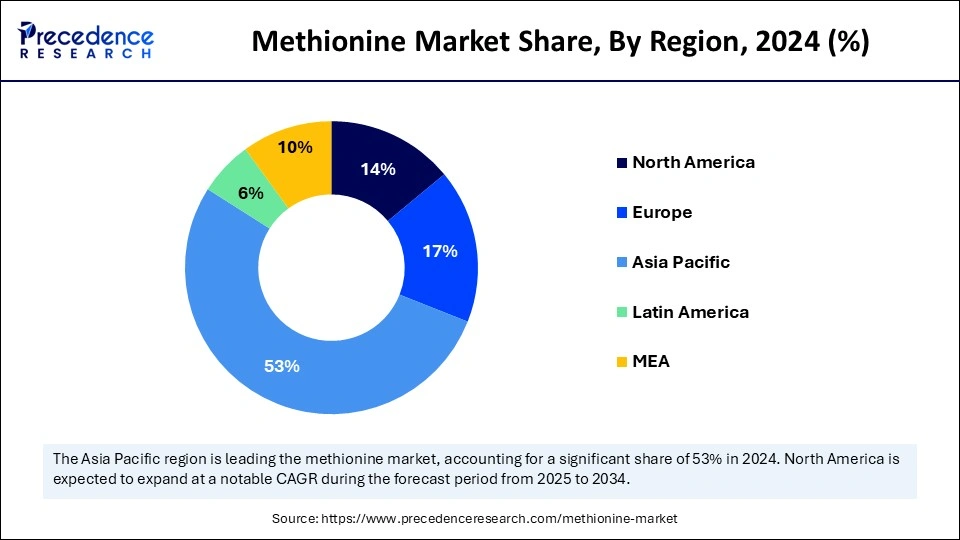

- Asia Pacific dominated the global market with the largest market share of 53% in 2025.

- North America is expected to grow at the fastest CAGR during the forecast period.

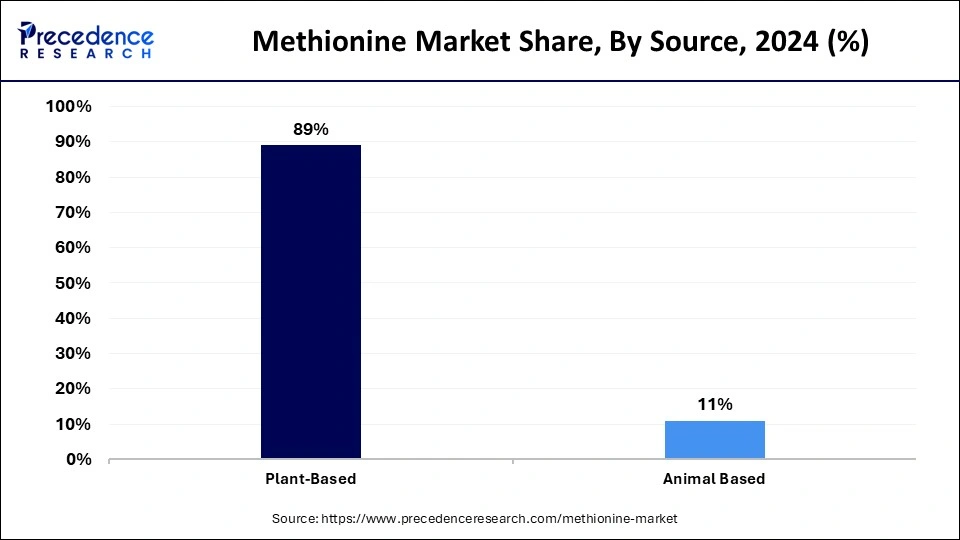

- By source, the plant-based segment contributed the highest market share of 89% in 2025.

- By source, the animal-based source is expected to grow at the fastest CAGR over the forecast period.

- By application, the animal feed segment captured the biggest market share of 62% in 2025.

- By application, the pharmaceuticals segment is anticipated to grow at the fastest CAGR over the projected period.

Impact of Artificial Intelligence (AI) on the Methionine Market

Artificial Intelligence systems can help to analyze a consumer's dietary habits, health metrics, health goals, and genetic data to make a cater supplement plan that is compatible with consumers' unique profile. Furthermore, AI can be utilized to assess extensive repositories of clinical studies, scientific literature, and emerging research to sort out the most recent data on supplement efficiency and safety. AI-powered virtual assistants and chatbots can present knowledge capsules such as infographics, articles, video content, and visuals.

- In July 2024, Bionic, the leader in AI-driven personalized supplements, announced the close of its USD 15 million Series B funding round. The oversubscribed round was led by Principal Investors HV Capital and Unbound, both leading European VCs. The company is valued at USD 75 million and will use the funds to further expand its global market share through continued disruption of the dietary supplements market.

Market Overview

Methionine is an amino acid compound containing sulfur. It is an essential amino acid in the human body. Methionine stimulates the growth of various cells in the body and has many health benefits. The sulfur present in methionine helps protect cells from contaminants and induces the growth and development of the human body. Innovative approaches to bio-based compound production offer end users friendly alternatives to traditional synthetic methods.

Top 5 nutraceutical companies of 2024

| Company | Revenues (2023) |

| Nestle | USD 16.98 billion |

| Danone | USD 8.92 billion |

| BASF | USD 8.69 billion |

| Herbalife | USD 5.2 billion |

| Ingredients | USD 4.93 billion |

Methionine Market Growth Factors

- Increasing demand for supplements among the majority of individuals is expected to fuel methionine market growth shortly.

- The rising adoption of high-quality animal feed to improve the effectiveness of livestock production can propel market growth soon.

- The growing global meat consumption, along with the expansion of the aquaculture sector, will likely contribute to the market expansion over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 9.56 Billion |

| Market Size in 2025 | USD 4.04 Billion |

| Market Size in 2026 | USD 4.41 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Source, Application, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Increasing demand for animal feed

The growing demand for animal feed is the major factor impacting the methionine market due to increasing global meat consumption and growing requirements for high-quality livestock products. Methionine is an indispensable amino acid that plays an important role in the well-being and growth of various animal groups. In addition, the growing need for top meat quality, in turn, resulted in the use of methionine in the formulation of feed, generating demand to raise consumption.

- In September 2023, Milk Specialties Global (MSG) has RPMet, a rumen-protected methionine supplement for dairy cows that utilizes a Ph-sensitive polymer coating. RPMet increases milk protein yields in dairy cows by delivering high levels of the amino acid methionine into a dairy cow's small intestine. RPMet uses a unique polymer-based coating that is designed to withstand the rigors of a cow's digestive tract.

Restraint

Implementation of strict regulatory frameworks

Regulatory norms such as quality standards, maximum allowable limits, and other safety regulations can facilitate complexity and compliance costs for producers in the methionine market. Sticking to these requirements may sometimes need substantial investments in research and documentation, influencing market competitiveness and creating major hurdles for market participants. Moreover, raw material prices are increasingly fluctuating.

Opportunity

Rising demand from the pharmaceutical and cosmetics sector

The growing demand for the compound from the pharmaceutical and cosmetics industry can create lucrative opportunities in the methionine market. Methionine is used in the formulation of pharmaceutical and cosmetic products and preparations due to its unique characteristics. Furthermore, the increasing need for methionine as an ingredient in both industries can impact market growth positively. Also, rising consumer awareness regarding wellness, health, and nutrition can propel the demand for dietary supplements with methionine further.

- In January 2024, Adisseo Group, a French animal nutrition provider, announced that they would begin construction of a powder methionine plant in Quanzhou, East China's Fujian province, in the first half. The company will invest 4.9 billion yuan (USD 681.2 million) in the venture. The plant will have an annual production capacity of 150,000 metric tons, with the factory located at the Sinochem Quanhui Petrochemical Park in Quanzhou expected to officially begin operations in 2027.

Segment Insights

Source Insights

The plant-based segment led the global methionine market in 2025. The dominance of the segment can be attributed to the increasing trend towards ethical and sustainable consumption practices, which has facilitated a trend towards plant-based goods and boosted demand for this segment. In addition, market players are adapting to fulfill this demand using methionine's diversity in animal supplements, feeds, and pharmaceuticals to generate revenue from its many applications. Plant-based methionine can easily be included in animal and human nutrition without any ethical concerns.

The animal-based segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the sustainability and dietary concerns associated with a plant-based source. The grade of methionine extracted from animal sources has a superior quality than that of plant-based sources. As an essential amino acid, methionine is necessary for maximum animal health and can't be created by the body on its own. However, animal-derived methionine possesses a superior bioavailability, promising efficient synthesis.

- In August 2023, Sumitomo Chemical held a completion ceremony for the new production line of its methionine feed additive at Ehime Works in Niihama City in Japan's Ehime prefecture. Following several trial runs, the new line will start commercial production soon. Sumitomo said the investment in the new manufacturing facility represents one of the largest investments it has ever made in Japan.

Application Insights

The animal feed segment dominated the methionine market in 2025. The dominance of the segment can be credited to the surging population growth, changing lifestyle and dietary habits, and increasing urbanization. The necessary calls for the manufacturing of more convenient and high-quality animal feeds are on the rise, which keeps animals productive and healthy. Additionally, the increasing need for good feed conversion ratios in the aquaculture sector boosted the dominance of animal feed in the market.

- In August 2024, German chemicals giant Evonik opened its expanded facility on Jurong Island. The expansion will increase annual output by 40,000 tonnes, making the complex the largest methionine production facility in the world, with a market share of over 40%. The chemical is used to feed farm animals.

The pharmaceuticals segment is anticipated to grow at the fastest rate over the projected period. The growth of the segment is driven by increasing demand for this compound from the pharmaceutical industry due to its various health benefits. To achieve the highest level of purity, pharma-grade methionine is necessary for end products. Furthermore, the pharma industry is very selective when it comes to choosing raw materials for product manufacturing. To fulfill these strict requirements, methionine suppliers use substantial resources that meet industry standards.

Regional Insights

What is the Asia Pacific Methionine Market Size?

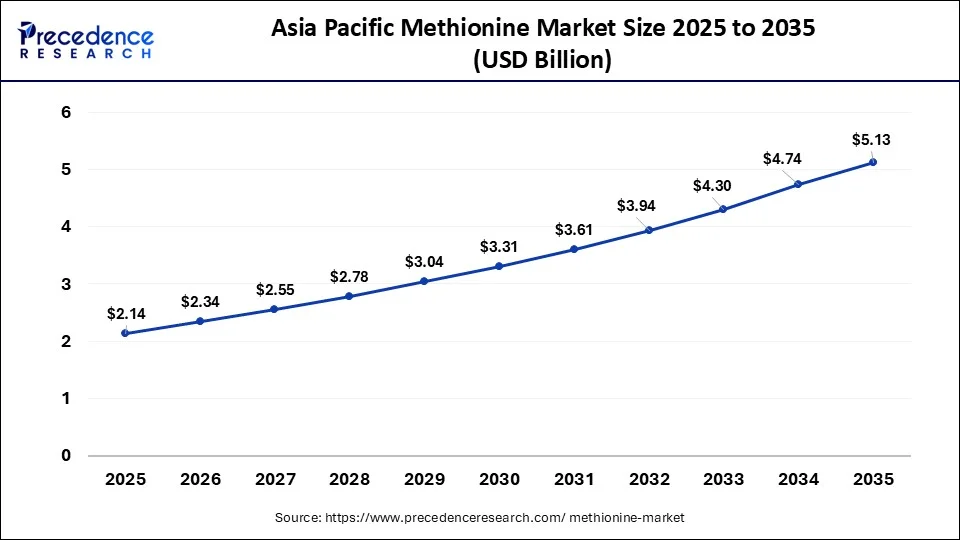

The Asia Pacific methionine market size was exhibited at USD 2.14 billion in 2025 and is projected to be worth around USD 5.13 billion by 2035, growing at a CAGR of 9.13% from 2026 to 2035.

Asia Pacific dominated the global methionine market in 2025. The dominance of the region can be attributed to the increasing disposable income coupled with the rapid urbanization in the region. The growing demand for meat has optimized the growth and the requirement for methionine in emerging economies such as China and India. Moreover, these countries are major players in aquaculture and leaders in the seafood market.

China Methionine Market Trends

Due to its cost-effectiveness and ease of usage in feed, liquid methionine is undergoing faster volumetric growth, with producers such as Adisseo expanding production capacities. Chinese, state-backed firms are increasing capacity, challenging international and market-dominant players such as Evonik and Adisseo by decreasing the competitive cost advantage of imports.

North America is expected to grow at the fastest rate in the methionine market during the forecast period. The growth of the region can be credited to the region's established food and pharmaceutical industries, which heavily depend on methionine, which is an important element in various products. In North America, the U.S. led the market owing to the large-scale production of swine, poultry, and cattle in the country that requires methionine supplements for animal diets.

- In March 2024, Novus International, Inc. completed the acquisition of BioResource International, Inc., acquiring all its products and intellectual property, as well as assuming control of BRI's U.S. facilities in North Carolina.

U.S. Methionine Market Trends

There is a significant shift towards organic as well as eco-friendly feed additives, working with consumer needs for sustainably produced meat. Beyond animal feed, methionine is seeing increased usage in human health applications, which include nutritional supplements as well as detoxification aids.

Animal Feed Applications Driving the Methionine Industry in Europe

Europe shows a significant growth during the forecast period. It is driven by the user demand for animal protein in Europe is driving the demand for better nutrition in the poultry and swine industries. Regulatory frameworks in Europe encouraging efficient farming, alongside the need to decrease nitrogen output, drive the acceptance of amino acid-fortified, high-quality feed.

Sustainable Feed Additives Shaping the Methionine Industry in Latin America

Latin America shows a notable growth during the forecast period. It is driven by the demand for cost-effective, eco-friendly, and even high-performance production. As a vital sulfur-containing amino acid for poultry, swine, and aquaculture, methionine reduces nitrogen waste, enhances feed conversion ratios, and supports sustainable farming, with the market anticipated to grow at a 4.96% CAGR in South America through 2031.

Advancement in Methionine Production Technologies in MEA

MEA shows a rapid growth during the forecast period. It is driven by the demand to support a rapidly expanding, modernized poultry and livestock sector, aiming to secure food supplies and decrease import dependency. The regional market is seeing a shift toward more efficient, sustainable, alongside, in some cases, localized production methods to satisfy the increasing need for high-quality animal protein.

Methionine Market Companies

- Ajinomoto Co., Inc.: Ajinomoto Co., Inc. is a key player in the amino acid market, offering L-Methionine mainly produced via advanced bio-fermentation processes.

- Prinova Group LLC: Prinova Group LLC provides a comprehensive range of products as well as services for the methionine market, specifically aiming at L-Methionine for human nutrition and even DL-Methionine for animal nutrition. As a distributor with a large, vertically integrated supply chain, they offer high-quality amino acids to sectors including food, beverage, and animal feed.

- AnaSpec: AnaSpec supports the methionine market by providing a variety of specialized methionine-related products mainly for research, development, and high-quality custom peptide synthesis.

Other Major Key Players

- Adisseo

- Novus International, Inc.

- Kemin Industries, Inc.

- Evonik Industries AG

- KYOWA HAKKO BIO CO., LTD.

- DSM

- CJ CHEILJEDANG CORP.

- Tokyo Chemical Industry (India) Pvt. Ltd.

- IRIS BIOTECH GMBH

- Phibro Animal Health Corporation.

- AMINO GmbH

Latest Announcement by Market Leaders

- In September 2024, Ginkgo Bioworks, which is building the leading platform for cell programming and biosecurity, announced its new partnership with NOVUS International, an innovator and leader in intelligent nutrition, to develop advanced feed additives designed to meet the evolving needs of the animal agriculture industry. By utilizing Ginkgo Enzyme Services, NOVUS will work with Ginkgo to build more efficient enzymes that can be produced cost-effectively.

- In October 2024, Evonik Industries announced that Evonik Oxeno is significantly expanding its production capacities for the INA-based plasticizers ELATUR CH (DINCH) and ELATUR DINCD. These products, introduced in recent years, have both now established themselves as new standard plasticizers with Evonik Oxeno customers.

Recent Developments

- In March 2024, Evonik Industries AG unveiled its latest MetAMINO ATLAS, a comprehensive set of 19 trials showcasing the relative bioavailability of supplementary methionine sources in animal diets, with results confirming 65% bioefficacy.

- In June 2023, Ingersoll Rand acquired SABIC's 50% share in Scientific Design Company, a global leader in catalysis. This was consolidation to a non-cyclical, technology-driven enterprise and moved it one step closer to reaching its goal of becoming a leading global specialist.

- In June 2023, Sumitomo Chemical announced that it received a gold medal in a sustainability assessment by EcoVadis (headquartered in France), which evaluates the corporate ESG-related initiatives for the fourth consecutive year. The gold medal is given to the top 5% of all evaluated companies.

Segments Covered in the Report

By Source

- Plant-Based

- Animal Based

By Application

- Animal Feed

- Food & Dietary Supplements

- Pharmaceuticals

- Others

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting