What is the Micro Mobile Data Center Market Size?

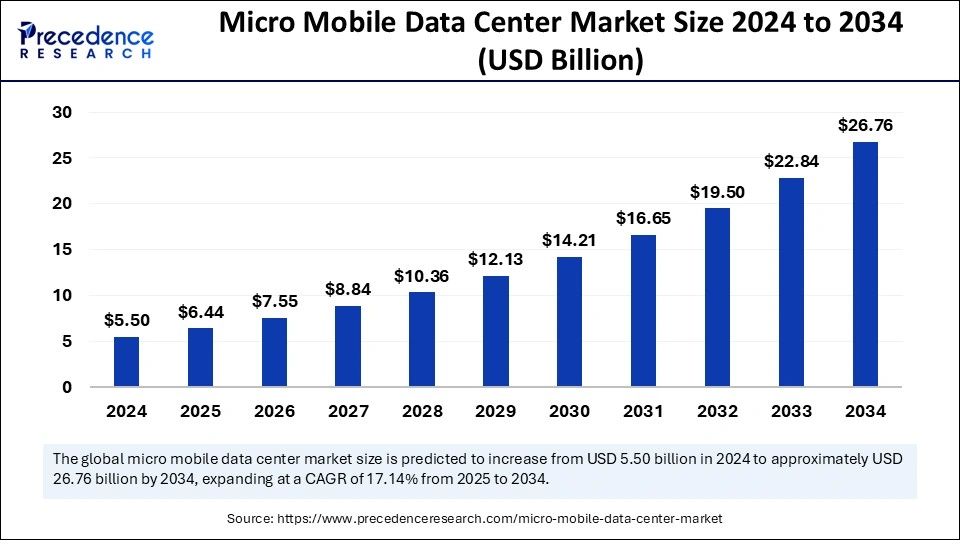

The global micro mobile data center market size is estimated at USD 6.44 billion in 2025 and is predicted to increase from USD 7.55 billion in 2026 to approximately USD 26.76 billion by 2034, expanding at a CAGR of 17.14% from 2025 to 2034. The growth of the market is driven by the increasing demand for low-latency data processing, the rising adoption of edge computing, and the rising deployment of scalable IT infrastructure across industries.

Micro Mobile Data Center Market Key Takeaways

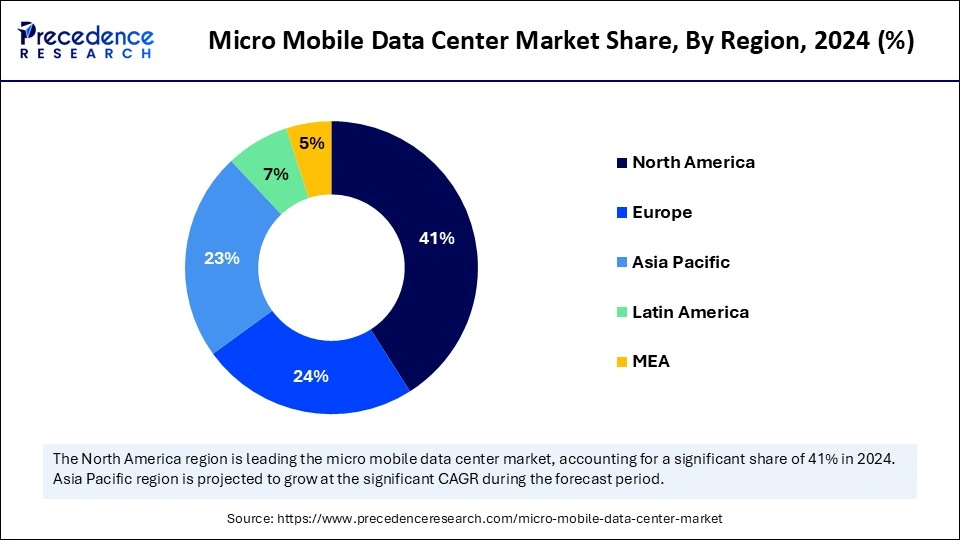

- North America dominated the global market with the largest market share of 41% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecast period.

- By rack unit, the above 40 RU segment held the largest market share, 43% in 2024.

- By rack unit, the 20 to 40 RU segment is expected to grow at the fastest CAGR of 18.64% between 2024 and 2034.

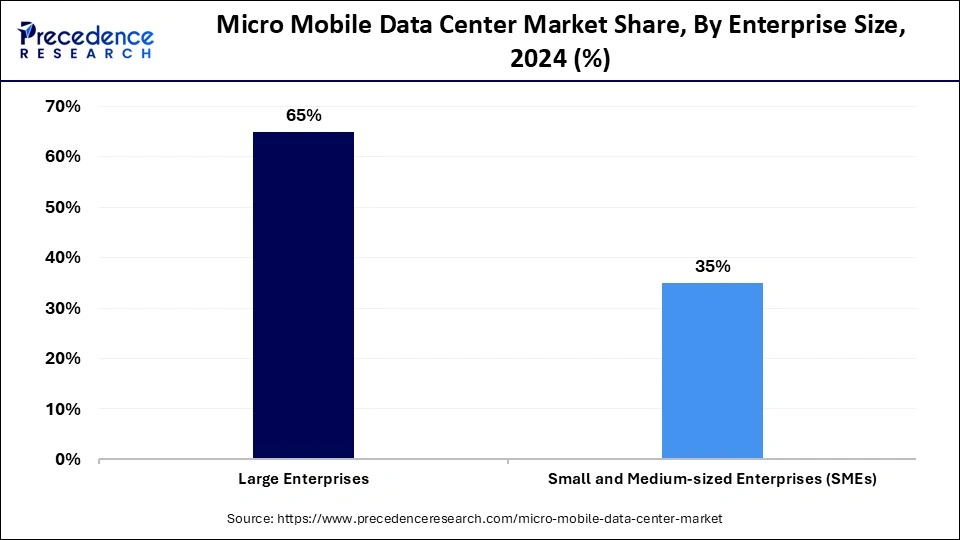

- By enterprise size, the large enterprises segment accounted for the largest market share of 65% in 2024.

- By enterprise size, the small and medium-sized enterprises (SMEs) segment is anticipated to grow at a significant CAGR during the studied period.

- By application, the edge computing segment contributed the highest market share of 45% in 2024.

- By application, the disaster recovery and emergency response segment is projected to expand at a notable CAGR in the coming years.

- By end-use, the IT and telecom segment generated the major market share of 34% in 2024.

- By end-use, the government and defense segment is expected to witness rapid growth in the near future.

What is a Micro Mobile Data Center?

Micro mobile data center units consist of integrated all-in-one data processing units that enhance both speed and performance through localized computing solutions. These centers unite components, including computing, storage, and networking, inside one sealed container to support rapid deployments across different settings. The micro mobile data center market is expected to grow at a rapid pace due to the rising digitization in the healthcare sector.

The World Health Organization (WHO) Global Strategy on Digital Health 2020-2025 report recognizes that digital health solutions with IoT technology and big data are transformative elements in healthcare service delivery. Furthermore, the increasing awareness about the importance of decentralized computing boosts the need for micro mobile data centers to serve as fundamental enablers for expanding data management needs.

What is the Impact of Artificial Intelligence on the Micro Mobile Data Center Industry?

Artificial intelligence brings advancements in operational effectiveness, security enhancements, and predictive maintenance capabilities. AI-driven automation optimizes resource management, which decreases operational interruptions and boosts energy efficiency levels. Machine learning models protect micro mobile data centers from security threats through their capability to detect impending attacks before they result in system interruptions. Edge AI, a combination of edge computing and AI, helps activate instant analysis, which leads to better speed and performance outputs for remote applications. Moreover, AI optimizes power consumption and resource allocations within micro data centers.

Micro Mobile Data Center Market Outlook

- Industry Growth Overview: The Micro Mobile Data Center Market is poised to grow rapidly between 2025 and 2030 because of the increasing desire for small, edge-friendly infrastructure. Companies began adopting micro data centers when they changed to low-latency computing, remote operations, and the use of scalable modular IT architecture. Growth was particularly strong in the telecom, BFSI, and industrial markets, with strong development in areas experiencing rapid digital transformation.

- Sustainability Trends: An area of development affecting the market was sustainability, as companies focused on energy-efficient micro data centers to drive power consumption and costs around cooling. Several vendors focused on recyclable materials, liquid cooling, and low-carbon building design. The advent of stricter global energy regulations drove manufacturers to improve overall energy efficiency ratings.

- Global Expansion:Major vendors extended operations into rapidly growing digital markets, including Southeast Asia, Eastern Europe, and Latin America, to capitalize on increased local assembly and teamed with manufacturers to reduce time logistics and related compliance in each region. Many companies made major investments in edge deployments close to potential areas for 5G rollout. The expansion of micro mobile data centers supported demand in cloud, retail, and manufacturing trades that wanted to provide fast, even onsite data.

- Major Investors: Private equity and strategic investors expressed a strong commitment, primarily driven by growth in edge computing to support enterprise adoption and the potential for astronomical returns. Investors looked at modular, containerized, and high-density micro data center solutions. Large capital funds are invested in companies with strong IP around cooling, security, and remote monitoring.

- Startup Ecosystem:The startup ecosystem emerged with companies that developed lightweight and plug-and-play micro data center platforms for harsh sites with edge AI workloads. The primary areas of focus were smart cooling, autonomous monitoring, and rapid deployment. Companies in the U.S., India, and Europe received VC funding by providing ultra-efficient designs for cellular tower sites, disaster recovery zones, and remote industrial operations.

What are the Growth Factors in the Micro Mobile Data Center Market?

- Growing Demand for AI-Driven Automation: Increasing integration of artificial intelligence for real-time data processing is expected to boost the demand for micro mobile data centers.

- Expansion of Smart City Projects: Rising investments in smart city infrastructure are anticipated to boost the demand for decentralized and scalable data center solutions.

- Surging Cloud Adoption in SMEs: Small and medium-sized enterprises are increasingly adopting cloud-based services, driving the need for localized data storage solutions.

- Rising Cybersecurity Threats: The escalating frequency of cyberattacks is projected to push enterprises toward secure, on-premises micro mobile data centers.

- Increased Adoption in Military & Defense:Governments are investing in portable and high-security data centers to support military operations and remote deployments.

- Growing Edge AI Processing Needs: Expanding use of edge AI applications in industries such as healthcare and manufacturing is expected to accelerate market growth.

- Expansion of Remote Work Infrastructure: Enterprises are focusing on scalable IT infrastructure to support hybrid and remote work models, fueling demand for micro mobile data centers.

Market Trends

Growing adoption of edge computing

The micro mobile data center market is witnessing unprecedented changes as companies prioritize scalability and efficiency for their IT infrastructure. One of the significant trends for the market is the increasing adoption of edge computing. Nearly 40% of enterprises are adapting micro-mobile data centers, which help to process the data at the edge, making it less vulnerable to unauthorized access.

Focus on low power consumption

The market is expanding due to another trend, which is an increasing focus on how to reduce energy consumption and increase system efficiency. This can be achieved by modular and prefabricated designs offering faster deployment while minimizing overall set-up cost. Industries like healthcare and retail have found extensive applications in micro-mobile data centers. Also, the integration of 5G networks has increased demand, with 45% of installations having low-latency applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.76 Billion |

| Market Size in 2026 | USD 7.55 Billion |

| Market Size in 2025 | USD 6.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Rack Unit, Enterprise Size, Application, End-use, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Edge Computing

Increasing adoption of edge computing is anticipated to drive the growth of the micro mobile data center market. As enterprises seek faster data processing with lower latency, the need for mobile data centers increases. The increasing number of Internet users further highlight the need for distributed computing power to effectively deal with the intensifying data transfer. The rising adoption of Internet of Things (IoT) devices, 5G, and AI also boost the demand for micro mobile data center technology. The adoption of compact data centers by communication companies and medical and manufacturing sectors near end-user locations enables instant data analysis while reducing network bottlenecks. Furthermore, the rise of edge computing demonstrates its fundamental position in addressing the expanding needs of data-oriented technology.

Restraint

High Initial Investment

Deploying micro mobile data centers requires high upfront investment in hardware and software, which creates challenges for small and medium-sized enterprises (SMEs) seeking scalable computing solutions. Building modular data centers requires substantial investments in sophisticated cooling systems, backup power systems, and enhanced security elements. Organizations facing budgetary restrictions tend to put off adopting superior data centers that operate efficiently as they maintain fundamental IT systems. Moreover, these data centers require regular maintenance, adding to operational costs. The financial difficulties and insufficient support for high-tech infrastructure development create obstacles for organizations.

Opportunity

High Need for Disaster Recovery Solutions

High reliance on digital infrastructure boosts the need for mobile and scalable disaster recovery solutions, creating immense opportunities for key players competing in the market. The growing dependence on digital infrastructure drives the need for mobile disaster recovery platforms, which leads to substantial business opportunities for micro mobile data centers. Organizations that encounter cyber threats, natural disasters, and system breakdowns invest in modular data centers for quick implementation and continual business operations.

There is a rising need for on-demand data center solutions as they deliver required assistance quickly when risks are high. Malicious cyber actors target enterprise networks through zero-day vulnerabilities on a growing scale, as the National Security Agency (NSA) reported in 2024, creating a strong requirement for efficient disaster recovery solutions. Furthermore, micro mobile data centers play an essential role in developing disaster recovery solutions for numerous industries with the current trends, further propelling the growth of the micro mobile data center market in the coming years.

Segment Insights

Rack Unit Insights

The above 40 RU segment dominated the micro mobile data center market with the largest share in 2024. This is mainly due to the rise in the need for dense computing systems. Large data-intensive organizations, together with enterprises, employed these larger rack units as they require extensive storage and processing capacity, mainly for big data analytics and large-scale virtualization applications. Organizations chose the above 40 RU micro mobile data centers for their portability that handle heavy IT workloads effectively.

The 20 to 40 RU segment is projected to grow at the fastest rate in the coming years as organizations highly demand adaptable and efficient data center solutions. The capacity level of these units matches well with their compact design that makes them appropriate for businesses of medium size and edge computing systems. Modern data centers need to be situated near data sources because of the increasing deployment of IoT devices and the growing adoption of edge computing. This further boosts the demand for reduced latency for real-time processing possibilities. Furthermore, 20 to 40 RU units are a leading factor in developing micro mobile data centers.

Enterprise Size Insights

The large enterprises segment held the largest share of the micro mobile data center market in 2024, as they possess large volumes of data, requiring scalable infrastructure. These organizations often installed micro mobile data centers across their operations to ensure both high system access and resilient disaster recovery protocols. The rapid deployment and flexible features of these data centers allow large enterprises to improve operational efficiency according to requirements. Businesses requiring adaptable data solution platforms for integrating advanced technologies, including artificial intelligence and big data analytics, accelerated their adoption of modern data center capabilities. The U.S. Census Bureau showed that data center employment grew by more than 60% around the entire nation between 2016 and 2023 due to increasing dependence on data-intensive work.

The small & medium medium-sized enterprises (SMEs) segment is anticipated to grow at a significant CAGR during the studied period, as SMEs adopt advanced digital systems while searching for scalable, efficient data centers that support their business expansion. SMEs are increasingly drawn to edge computing and localized data processing needs, which compels them to implement these deployable data center solutions. Micro mobile data centers are ideal for SMEs, especially those with budget constraints. The rising adoption of IoT and edge computing in SMEs further boosts the demand for micro mobile data centers.

Application Insights

The edge computing segment dominated the micro mobile data center market with the largest share in 2024. This is due to the rise in the adoption of IoT devices and rising requirements for real-time data processing. Manufacturing, healthcare, and telecommunications industries often prefer edge computing solutions as they cut down on latency and boost operational performance. The strategic placement of micro mobile data centers at network edges lets organizations make better decisions faster and lessens the demand for centralized centers for data processing. Furthermore, the ITU projected that global mobile traffic would reach a staggering 6.5 ZB by 2025, indicating a need for edge computing solutions.

The disaster recovery & emergency response segment is projected to expand at a notable rate in the coming years. Many organizations prioritize disaster recovery solutions, as these solutions protect vital data while ensuring continuous business operations in the case of cyber threats, natural disasters, and system failures. The rapid deployability and the scalability of micro mobile data centers make them the perfect choice for emergency response situations that need immediate data processing together with storage capacities. Additionally, U.S. utilities saw a nearly 70% increase in cyberattacks in 2024 compared to 2023, according to data from Check Point Research. This highlights the urgent need for disaster recovery solutions to address the escalating risks.

End-use Insights

The IT & telecom segment held the largest share of the micro mobile data center market in 2024 due to the rise in the need to process data at distributed points for cloud applications along with their role in handling increasing data transmission volumes. The expansion of 5G networks encouraged telecommunication companies to use micro mobile data centers, which helped them perform better network services while offering low-latency services. The increased cloud-based services and wireless connectivity usage expanded rapidly in the IT sector, which bolstered the segment.

The government and defense segment is expected to witness rapid growth in the near future. The rising demand for on-site data processing is encouraging the government and defense sectors to adopt micro mobile data centers. Military operations, together with homeland security agencies, utilize small mobile data centers to enhance battlefield communications while collecting intelligence information and performing immediate threat identification. The U.S. Department of Defense invests heavily in modular data centers to develop tactical cloud computing and establish safe access to vital mission data. Governments across the world are strengthening their cybersecurity standards, boosting the need for flexible data centers, such as micro mobile data centers.

Technological Advancements

Devices compatible with telemedicine

- At the beginning of 2024, approximately 20% of audiometers will be launched that are compatible with telemedicine applications. Nearly 30% of healthcare providers opt for a solution of remote audiology to treat patients from remote and underserved areas. These devices were a transformative step in the healthcare sector while offering convenient solutions by reaching the maximum number of patients who were looking for medical help.

Improved features of connectivity

- In 2024, manufacturers are looking to enhance connectivity between systems, resulting in nearly 25% of audiometers being launched with features like Wi-fi and Bluetooth. Such advancements have helped ease data sharing, along with electronic health records and cloud-operated systems have 20% more efficiency.

AI-integrated audiometers

- In 2023, nearly 15% of new diagnostic audiometers will be launched, had features like AI integration that seamlessly perform automated testing with increased precision. By using these devices, approximately 20% of diagnostic errors have been reduced, which enhances smooth workflows in clinics and hospitals across the globe.

Regional Insights

U.S. Micro Mobile Data Center Market Size and Growth 2025 to 2034

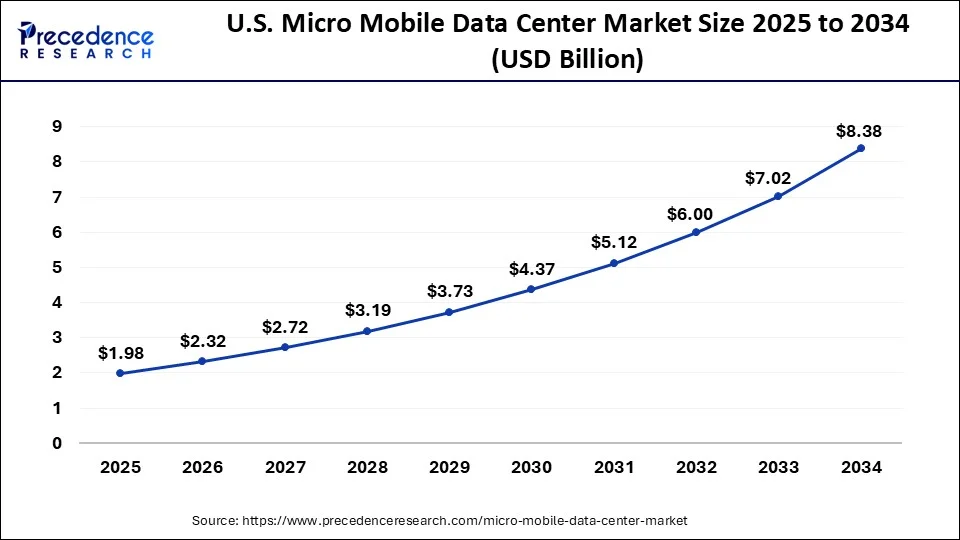

The U.S. micro mobile data center market size is exhibited at USD 2.32 billion in 2025 and is projected to be worth around USD 8.38 billion by 2034, growing at a CAGR of 17.36% from 2025 to 2034.

North America dominated the micro mobile data center market in 2024 by capturing the largest share. This is mainly due to its advanced IT infrastructure. The region is an early adopter of edge computing solutions. The rise in the need for data-intensive applications and Internet of Things devices boosted the need for localized data processing, which resulted in higher deployment of micro mobile data centers for fast and low-latency data processing. The rise of energy conservation goals within data centers has led industries to invest in micro mobile data centers, as they deliver adaptable solutions that combine dimensional flexibility with energy conservation advantages.

Strong national support for digital transformation and substantial cybersecurity measures encouraged industries to adopt micro mobile data centers throughout the U.S. The Federal Communications Commission (FCC) supports network expansions through its effort to encourage edge computing capabilities that depend on modular data center infrastructure. There is a high demand for micro data centers in Canada due to its smart city development and the expanding digital economy activities. Furthermore, the industry 4.0 and digitalization initiatives by the Mexican government support market expansion in this region.

Asia Pacific is expected to witness the fastest growth in the coming years. The rapid expansion of the IT sector highlights the need for micro mobile data centers. The rising government and public sector initiatives to support cloud adoption further contribute to the growth of the region's micro mobile data center market.

- In March 2024, the Thai government sanctioned USD 2.7 billion worth of investments in data centers and cloud services for the country's expanding tech sector.

The Ministry of Electronics and Information Technology in India works actively to promote data localization that boosts the demand for scalable data center solutions. Furthermore, the rising usage of IoT, blockchain, and AI technologies in various industries and rising smart city projects require localized processing solutions. The proliferation of IT infrastructure further boosts the need for micro mobile data centers.

Why did Europe grow rapidly in the micro mobile data center market?

Europe advanced consistently, fueled by the development of digital resources and the use of compact data centers, to sustain the sectors of manufacturing, healthcare, and financial services. The region was a leader in energy efficiency, which made the low-power requirements of micro data centers even more critical. The rise of IoT, automation, and AI tools all continued to drive a lot of companies toward edge-based systems.

Germany Micro Mobile Data Center Market Trends

Germany was the leader in the European region due to its strong industrial base and high rate of automation. Micro data centers were implemented in factories, logistics networks, and parks to process data and perform analytics in real time or near real time. Germany's stringent data regulations also limited where businesses could store data, which meant keeping everything closer to where it was needed. Growth on the edge of micro centers occurred as manufacturers updated machinery, expanded the use of the cloud, and began implementing 5G.

Why did Latin America experience significant growth in the micro mobile data center market?

Latin America experienced significant growth as companies required faster and more reliable handling of data for online services, retail, and telecom networks. Many markets experienced significant issues with connectivity to the internet, allowing micro data centers to aid with localized processing. The fintech industry and smaller digital businesses were also on the rise, as were smart farming applications, which encouraged adoption. Markets focused on inexpensive edge systems to increase processing speed and digital growth opportunities. New district opportunities also developed in tower sites, industrial areas, and in remote, urban, or rural locations.

Brazil Micro Mobile Data Center Market Trends

Brazil was leading all other countries with the largest digital economy and a greater market demand from fintech, telecommunications, and online retail. Digital acceleration occurred, utilizing micro data centers in areas with high-density urban populations and utilizing them in a low-cost manner in remote locations. There has also been a growth of investments as companies implemented cloud services and automation tools in their businesses.

Brazil has the largest population, increased digital behavior to access information and services, and many developing opportunities for coverage, making it the strongest and largest market opportunity for micro data center deployment in Latin America.

Why did the Middle East & Africa region grow rapidly in the micro mobile data center market?

The Middle East & Africa region underwent rapid development driven by growing digital transformation, smart city initiatives, and capital investment into telecom infrastructure. Many physiognomies developed micro data-linked centers in support of oil and gas sites, government services, and isolated industrial developments.

The paradigm shift towards cloud- and automation-based technologies accelerated demand for low-latency connected data centers, and the low-density populations in the region presented opportunities for networked applications and hot applications in tower networks and other lows around deployment zones of the desert and new economic technology investment zones.

The UAE Micro Mobile Data Center Market Trends

The United Arab Emirates was an outlier as it took the lead in ensuring a regional role in the Middle East & Africa region through its well-executed digital strategy, engagement with smart city implementations, and ongoing funding of state-of-the-art infrastructure. Micro data-linked centers were developed in public service capacity, retail, aviation, and financial sectors. Moreover, the nation was actively promoting prescribed edge computing to bolster AI programming and real-time applications.

Micro Mobile Data Center Market Companies

- Zella DC

- Vertiv Group Corp.

- Schneider Electric

- Rittal GmbH & Co.

- Panduit Corp.

- IBM Corporation

- Huawei Technologies Co., Ltd.

- Hewlett Packard Enterprise Development LP

- Eaton

- Dell, Inc.

Latest Announcements by Industry Leaders

- In March 2025, Microsoft has reaffirmed its commitment to advancing Malaysia's cloud and AI economy with the introduction of its upcoming hyperscale cloud region, named Malaysia West. This will be Microsoft's first cloud region in the country, strategically located in Greater Kuala Lumpur, and is scheduled to go live in the second quarter of 2025. Laurence Si, Managing Director of Microsoft Malaysia, stated, "With the rapid pace of innovation in Malaysia, the upcoming Malaysia West cloud region is not just a technological infrastructure; it is essential for powering the nation's growing AI economy. Local businesses and organizations will be able to innovate faster and more securely, driving the country's progress toward becoming the hub for cloud and AI growth in Southeast Asia.".

Recent Developments

- In April 2024, Vertiv, a global provider of critical digital infrastructure and continuity solutions, introduced the Vertiv SmartAisle 3, a micro modular data center system that leverages the power of artificial intelligence (AI). This system enhances operational intelligence and enables efficient operations within data center environments. Now available in Southeast Asia, Australia, and New Zealand, the SmartAisle 3 can be configured for a total IT load of up to 120 kW, making it ideal for a wide range of industries, including banking, healthcare, government, and transportation.

- In March 2024, Eaton announced the launch of an innovative new modular data center solution in North America. This solution is designed for organizations seeking to quickly meet the increasing demands for edge computing, machine learning, and AI. Eaton's SmartRack modular data centers can be deployed within a matter of days in various facilities, such as enterprise or colocation data centers, manufacturing plants, and warehouses.

Segments Covered in the Report

By Rack Unit

- Up to 20 RU

- 20 to 40 RU

- Above 40 RU

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

By Application

- Disaster Recover & Emergency Response

- Edge Computing

- Remote & Temporary Operations

- Others

By End-use

- BFSI

- Government and Defense

- IT and Telecom

- Manufacturing

- Oil & Gas

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting