List of Contents

Micro and Nano Programmable Logic Control (PLC) Market Size and Forecast 2025 to 2034

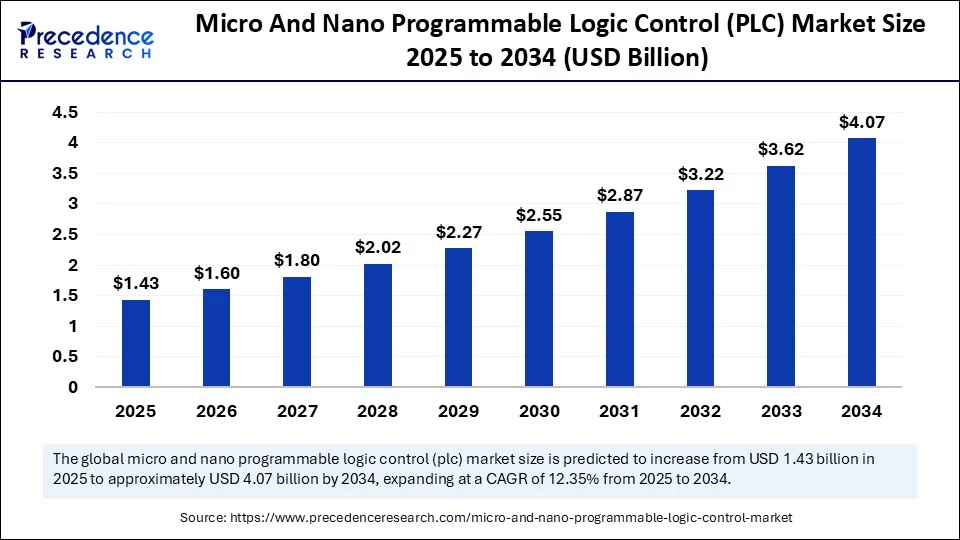

The global micro and nano programmable logic control (PLC) market size accounted for USD 1.27 billion in 2024 and is predicted to increase from USD 1.43 billion in 2025 to approximately USD 4.07 billion by 2034, expanding at a CAGR of 12.35% from 2025 to 2034. The market is experiencing substantial growth, driven by the increasing demand for compact, cost-effective automation solutions. The rising adoption of smart manufacturing and industrial Internet of Things (IoT) technologies further support market growth.

Micro and Nano Programmable Logic Control (PLC) MarketKey Takeaways

- In terms of revenue, the global micro and nano programmable logic control (PLC) market was valued at USD 1.27 billion in 2024.

- It is projected to reach USD 4.07 billion by 2034.

- The market is expected to grow at a CAGR of 12.35% from 2025 to 2034.

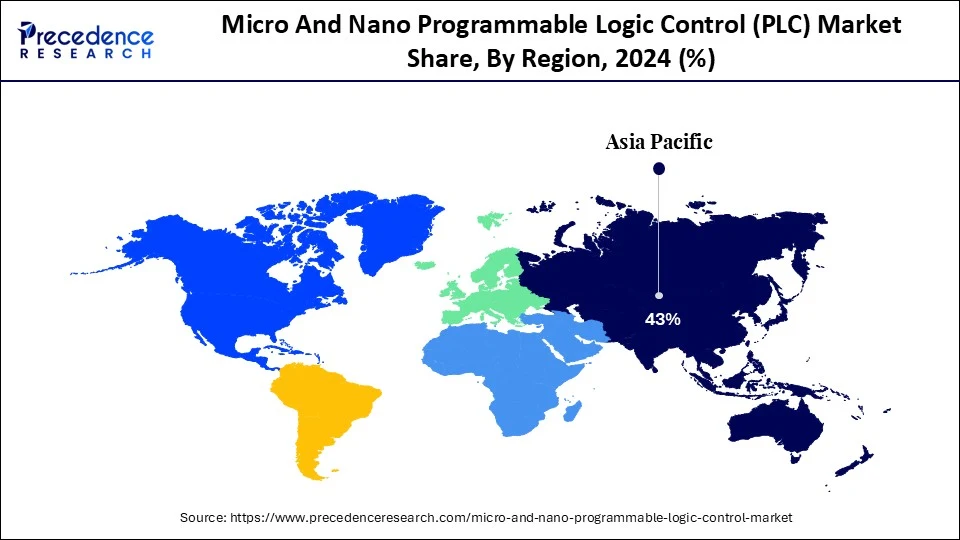

- Asia Pacific dominated the market with the largest share of 43% in 2024.

- Latin America is expected to grow at a significant CAGR from 2025 to 2034.

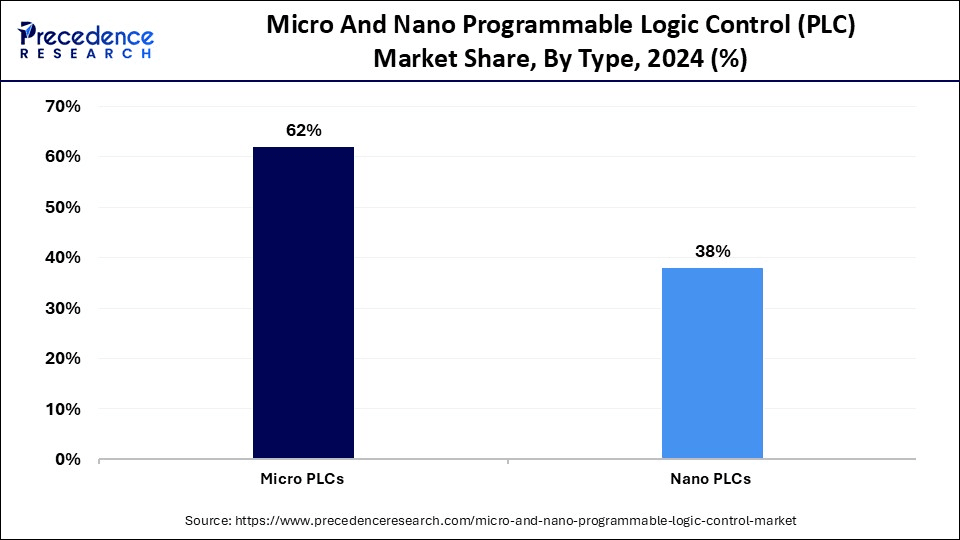

- By type, the micro PLCs segment held the biggest market share of 62% in 2024.

- By type, the nano PLCs segment is expected to grow at a significant CAGR from 2025 to 2034.

- By offering, the hardware segment captured the highest market share of 74% in 2024.

- By offering, the services segment is expected to experience rapid growth during the forecast period.

- By input/output (I/O) capacity, the 16-64 I/O segment contributed the major market share in 2024.

- By input/output (I/O) capacity, the expandable I/O systems segment is projected to grow at a significant CAGR between 2025 and 2034.

- By application, the machine control and packaging automation segment generated the highest market share of 39% in 2024.

- By application, the smart agriculture and irrigation systems segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By end user, the manufacturing SMEs (small & mid-sized enterprises) segment accounted for the significant market share of 46% in 2024.

- By end user, the agriculture tech providers segment is expected to grow at the fastest CAGR over the projected period.

- By communication protocol, the Modbus & Ethernet/IP segment held the biggest market share in 2024.

- By communication protocol, the IoT-enabled protocols segment is expected to expand at a significant CAGR from 2025 to 2034.

How Can AI Impact the Micro and Nano Programmable Logic Control (PLC) Market?

Artificial intelligenceis transforming the market by enhancing capabilities for predictive maintenance, process optimization, and real-time adaptation. AI-powered micro and nano PLCs can analyze data to predict potential failures, improve process efficiency, and respond to changing conditions instantly, leading to smarter, more efficient industrial operations. AI algorithms assess sensor data to forecast equipment failures before they happen, minimizing downtime and maintenance costs. Real-time monitoring and anomaly detection powered by AI can also reduce the risk of accidents and system failures. AI algorithms can analyze real-time data from PLCs to optimize industrial processes and improve efficiency.

Asia Pacific Micro and Nano Programmable Logic Control (PLC) Market Size and Growth 2025 to 2034

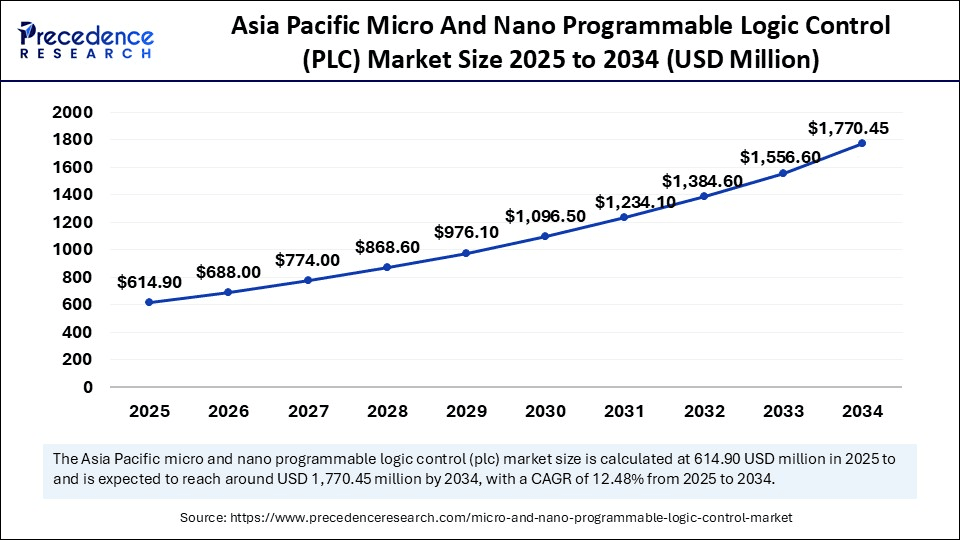

Asia Pacific micro and nano programmable logic control (PLC) market size was exhibited at USD 546.10 million in 2024 and is projected to be worth around USD 1,770.45 million by 2034, growing at a CAGR of 12.48% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

Asia Pacific dominated the micro and nano programmable logic control (PLC) market by capturing a 43% share in 2024. This is mainly due to rapid industrialization, government initiatives promoting industrial automation, and a strong manufacturing base, particularly in countries like China. The increased trend of smart homes and adoption of wearable technology further bolstered the growth of the market. Many nations in the region are experiencing rapid urbanization and industrialization, boosting the demand for automation solutions. The region has a large manufacturing base for electronic devices, making it a major consumer of PLCs. Governments around the region are actively promoting automation and Industry 4.0 initiatives, leading to increased investments in advanced automation technologies, including AI-driven systems, facilitating the long-term growth of the market in the region.

Why is Latin America Considered the Fastest-Growing Market?

Latin America is experiencing the fastest growth due to the increasing adoption of automation technologies across various industries, especially in manufacturing and energy generation. Regional market growth is also driven by government initiatives to modernize infrastructure and promote technological progress, along with investments in digital transformation. Additionally, the region has a growing, tech-savvy population who are investing heavily in digital technologies, in which PLCs play a critical role.

What Makes North America a Notable Market for Micro and Nano Programmable Logic Control (PLC)?

North America is a notable market for micro and nano programmable logic control (PLC), experiencing steady growth, driven by the adoption of Industry 4.0 technologies, high demand for compact automation solutions, and a robust industrial base. The region's high purchasing power, established logistics, and R&D investments support market growth. North America's extensive industrial infrastructure and numerous manufacturing plants provide a solid foundation for PLC adoption. The region is at the forefront of technological innovations, leading to advances in the capabilities of PLCs. The increasing infrastructure development is likely to boost the demand for PLCs.

What Opportunities Exist in Europe?

Europe is expected to emerge as a significant market for micro and nano programmable logic control (PLC). This is primarily due to a strong focus on industrial automation and electronics miniaturization. Supportive government policies encouraging the adoption of automation and smart solutions across industries are likely to propel market growth. Countries like Germany, the UK, France, and Italy have a well-established industrial sector and are major users of automation technologies. Additionally, EU's sustainability goals are encouraging the development and adoption of PLCs that consume less energy, creating immense opportunities in the market. The rising demand for smaller, more powerful PLCs that fit into compact machinery drives the growth of the market.

What Factors Contribute to the Micro and Nano Programmable Logic Control (PLC) Market in the Middle East & Africa?

The market in the Middle East & Africa is expected to grow due to the rapid industrialization, government efforts to promote automation, and increasing investments in smart infrastructure and technology. Many countries in the region are actively pursuing modernization, leading to higher adoption of PLCs. The oil & gas sector in the region particularly relies on PLCs to optimize production and reduce downtime. Growth in infrastructure development projects in transportation, water management, and energy sectors also contributes to the market's expansion.

Market Overview

The micro and nano programmable logic control (PLC) market refers to small automation controllers designed for logic-based tasks in space-constrained or cost-sensitive industrial and commercial settings. Micro PLCs usually handle a moderate number of I/O points (20–128), while Nano PLCs manage fewer (typically fewer than 20 I/O). They are commonly used in machine automation, packaging, HVAC, food processing, and smart building systems. Their affordability, compact size, ease of programming, and compatibility with IoT/Industry 4.0 make them vital in decentralized automation strategies. These devices control a broad range of industrial processes, from simple relay operations to complex automation sequences. The market is growing due to rising demand for industrial automation, the need for compact solutions, and increased adoption of IoT connectivity. Moreover, the increasing need for space-saving and energy-efficient controllers is expected to boost market growth in the upcoming years.

What are the Key Trends in the Micro and Nano Programmable Logic Control (PLC) Market?

- Increased Industrial Automation: Industries worldwide are investing in automation to improve efficiency, reduce costs, and boost productivity. Micro and nano Programmable Logic Controllers (PLCs) are essential components in this trend, providing scalable and economical automation solutions that are particularly beneficial for applications requiring smaller, more efficient control systems.

- Shift Towards Industry 4.0: The overall movement toward Industry 4.0, which emphasizes digital technologies, data analytics, and smart manufacturing, is also contributing to the growth and demand for the micro and nano PLC market.

- Ease of Programming and Scalability: Micro PLCs are recognized for their ease of programming and scalability, enabling them to manage complex processes while offering a cost-effective solution for various automation needs. This makes them appeal to businesses seeking to optimize their operations.

- Advancements in Technology: Ongoing advancements in PLC technology, such as improved connectivity options, enhanced programming interfaces, and built-in safety features, are also driving market growth by increasing the demand for advanced PLC solutions.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 4.07 Billion |

| Market Size in 2025 | USD 1.43 Billion |

| Market Size in 2024 | USD 1.27 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.35% |

| Dominating Region | Asia pacific |

| Fastest Growing Region | Latin America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Offering, Input/Output (I/O) Capacity, Application, End User, Communication Protocol, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Demand for Compact Automation Solutions

The main driver in the micro and nano programmable logic control (PLC) market is the increasing demand for compact automation solutions. This is driven by the need for higher efficiency, optimized production, and minimized downtime across various industries. As manufacturing expands in sectors like automotive, energy, and pharmaceuticals, there is a growing need for automation to boost efficiency and cut costs. Modern factories often have limited space, increasing demand for smaller, more adaptable PLCs such as micro and nano PLCs. Additionally, government support for initiatives like domestic manufacturing and smart factory development further encourages the use of micro and nano PLCs.

Restraint

Higher Initial Investment and Ongoing Maintenance Costs

The primary restraint in the micro and nano programmable logic control (PLC) market is the higher initial investment and ongoing maintenance costs, which create barriers for small and medium-sized enterprises. Implementing micro and nano PLCs can require significant upfront costs, particularly when upgrading or expanding existing infrastructure. This includes expenses for hardware, software, installation, and training. Moreover, the limited functionality and processing power of micro and nano PLCs compared to larger models can hinder their use in complex automation tasks, potentially leading to additional costs and impacting adoption rates.

Opportunity

Growing Use of Wireless Communication Technologies

The growing use of wireless communication technologies, such as Wi-Fi, Bluetooth, and cellular networks (like 5G and 6G), offers significant opportunities for micro and nano PLC makers to provide more flexible and adaptable automation options. Wireless PLCs enable remote access and system monitoring, allowing real-time adjustments and troubleshooting, which boosts operational efficiency and responsiveness. Additionally, wireless connectivity can facilitate seamless integration of PLCs with edge computing platforms, supporting local data processing and faster response times in automation systems.

Type Insights

What Made Micro PLCs the Dominant Segment in the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The micro PLCs segment dominated the market with the largest share in 2024. This is mainly due to their versatility, affordability, and suitability for a variety of applications. Micro PLCs can perform a wide range of control tasks, from simple on/off operations to more complex logic and sequencing. Their small size allows for easy integration into space-limited environments, which is a key advantage in modern manufacturing. Micro PLCs strike a good balance between features and size, making them ideal for many industrial automation tasks where space and cost are a concern. Additionally, they are generally programmed with user-friendly software, making them accessible to a broad user base and reducing development time.

The nano PLCs segment is expected to grow at the fastest rate in the upcoming period due to the rising demand for miniaturized systems for edge automation. This surge is due to their small size, affordability, and suitability for Industry 4.0 and IoT applications. Nano PLCs' compact design allows integration into devices and systems where larger PLCs are impractical, making them ideal for mobile and portable applications. They are well-suited for edge computing, where data processing occurs near the source, enabling quicker responses and less reliance on centralized systems. Their ability to handle complex control tasks in tight spaces, combined with lower power use, makes Nano PLCs perfect for distributed control and edge computing.

Offering Insights

How Does the Hardware Segment Dominate the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The hardware segment dominated the market in 2024. This is mainly because hardware plays a crucial role in automation. PLCs serve as the core of hardware. Their functionality relies heavily on hardware components like controllers, I/O modules, and communication interfaces, which are essential for performing automation tasks. Industries such as metals and mining, oil & gas, and manufacturing depend on durable, compact hardware solutions for process control in demanding environments. These components are critical in controlling machinery and processes across various sectors, making hardware the must have solution. The increased adoption of I/O modules and CPUs further created the need for PLCs. PLCs act as the brain of these hardware solutions, managing overall system operations by executing the control program. They interpret input signals and generate output signals by processing them according to the programmed logic.

The services segment is expected to grow at the highest CAGR during the projection period. The growth of the segment is attributed to the increasing need for data-driven decision-making in industrial automation. As PLCs become more complex, users require assistance with programming, maintenance, and troubleshooting. The rising integration of PLCs with cloud computing, IoT devices, and edge computing requires services related to data analytics. As PLCs become a crucial part of industrial automation, the demand for integration, maintenance, and training services increases, contributing to segmental growth.

Input/Output (I/O) Capacity Insights

Why Did the 16-64 I/O Segment Dominate the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The 16-64 I/O segment dominated the market in 2024 due to its versatility and suitability for a wide range of applications. PLCs with this I/O capacity offer enough input and output points to handle various tasks in small to medium-sized industrial processes. This capacity enables them to control multiple devices and sensors simultaneously, making them suitable for various applications, ranging from basic machine control to process monitoring. Additionally, the 16-64 I/O PLCs are ideal for managing and monitoring processes within small to medium-sized industrial setups. Compared to larger, more complex PLCs with higher I/O counts, they make automation accessible to a broader array of businesses, including small and medium-sized enterprises.

The expandable I/O systems segment is expected to grow at the fastest rate in the coming years, mainly because they adapt well to evolving industrial demands and are suitable for more complex and high-performance applications. These PLCs are designed for smaller to large-scale applications, which can have varied and shifting I/O requirements. Expandable I/O systems enable users to add or remove modules, such as digital I/O, analog I/O, or specialized function modules, as needed, without replacing the entire PLC. The ease of adding or removing I/O modules allows for expansion and avoids costly upgrades or replacements of PLCs.

Application Insights

What Made Machine Control & Packaging Automation the Dominant Segment in the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The machine control & packaging automation segment led the market with a major revenue share in 2024 due to the increased demand for compact, scalable, and flexible automation solutions in industries like food & beverage and pharmaceuticals. The increased need for automation, especially in the packaging industry, boosts the adoption of smaller, more efficient PLCs. Packaging machines often require precise control of multiple axes for tasks such as film feeding, product feeding, and cutting, which micro and nano PLCs can handle efficiently. These PLCs provide the same functionality as larger units but in a smaller footprint, making them perfect for space-constrained environments and complex control tasks.

The smart agriculture & irrigation systems segment is rapidly expanding because of the increasing need for efficient resource management and automation in farming. PLC-powered smart irrigation systems enable precise control of water and nutrient delivery, boosting yields while minimizing waste. Farmers can monitor and control irrigation remotely via mobile apps and web dashboards, improving convenience and responsiveness. Furthermore, these systems can adapt to changing weather and climate conditions, enabling farmers to mitigate risks associated with extreme weather events.

End User Insights

How Does the Manufacturing SMEs (Small & Mid-Sized Enterprises) Segment Dominate the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The manufacturing SMEs (Small & Mid-sized Enterprises) segment dominated the market in 2024 due to the heightened demand for cost-effective, space-saving automation solutions. Micro and nano PLCS are generally more affordable than traditional, larger PLCs, making them an accessible entry point into automation for SMEs. Since many SMEs operate in smaller facilities or have limited space for equipment, the compact size of micro and nano PLCs offers significant advantages. They also present a compelling alternative to larger, more expensive PLCs, fitting within the budget and space constraints that many SMEs face, and offering scalability. This allows SMEs to start with basic automation and expand their systems gradually as their needs develop.

The agriculture tech providers segment is projected to grow fastest during the forecast period, mainly because of the rising adoption of precision agriculture practices and IoT integration. These technologies provide valuable insights for farmers and enable informed decisions about planting, pest control, and other critical crop management activities. PLCs play a vital role in precision agriculture by automating systems like irrigation, fertilization, and harvesting, allowing real-time adjustments based on sensor data to optimize resource use and maximize yields. This segment's growth is further driven by the rising demand for more sustainable and efficient farming methods, which PLC automation and data-driven decisions support.

Communication Protocol Insights

What Made Modbus & Ethernet/IP the Dominant Segment in the Micro and Nano Programmable Logic Control (PLC) Market in 2024?

The Modbus & Ethernet/IP segment held the largest share of the market in 2024, largely because of their simplicity, cost-effectiveness, and ability to integrate with various industrial devices. Modbus performs well in smaller, less complex networks with straightforward implementation and troubleshooting, while Ethernet/IP offers high-speed communication for more demanding applications. Many PLC manufacturers prefer Modbus, ensuring compatibility and easy integration, often at a lower cost than proprietary protocols, making it an attractive choice for budget-conscious projects.

The IoT-enabled protocols segment is likely to experience the fastest growth over the forecast period, mainly because of their suitability for IoT applications and their ability to facilitate seamless data exchange between devices and systems, especially MQTT and OPC UA. MQTT's lightweight architecture and publish-subscribe model make it ideal for resource-constrained devices and networks with limited bandwidth. OPC UA provides a robust, platform-independent framework for industrial automation and interoperability. Combining MQTT and OPC UA through solutions like OPC UA over MQTT allows users to take advantage of both protocols' strengths to manage complex connected systems.

Micro and Nano Programmable Logic Control (PLC) Market Companies

- Siemens AG

- Mitsubishi Electric Corporation

- Rockwell Automation (Allen-Bradley)

- Schneider Electric

- OMRON Corporation

- ABB Ltd. – AC500-eCo series

- Panasonic Corporation

- Delta Electronics

- KEYENCE Corporation

- LS Electric (LSIS)

- Fuji Electric Co., Ltd.

- WEG Industries

- IDEC Corporation

- Horner APG

- B&R Industrial Automation (ABB Group)

- Kinco Automation

- Bosch Rexroth AG

- TECO Electric & Machinery Co., Ltd.

- Yokogawa Electric Corporation

- Autonics Corporation

Recent Developments

- In August 2024, Olis Robotics announced a comprehensive remote diagnostics solution for industrial automation at IMTS 2024 in Chicago, featuring advanced PLC capabilities. This solution offers video and telemetry-based diagnostics, helping technicians quickly identify causes of downtime, such as robot failures. By monitoring entire robotic cells, including PLCs and hardware like conveyors, users can remotely troubleshoot and reduce downtime effectively.

(Source:https://www.automation.com)

- In March 2024, WEG introduced a new compact PLC, the PLC410, tailored for OEMs in packaging and processing applications. While smaller than older models, it retains key features and supports up to 8 expansion cards for increased I/O, making it versatile for various needs. (Source: https://control.com)

- In December 2023, Arduino introduced the Opta, a secure, user-friendly micro-PLC designed for Industrial IoT applications. Developed with Finder, it allows professionals to enhance automation projects using Arduino and standard PLC programming languages like Ladder Logic and Function Block Diagram. Its STM32H747XI dual-core Cortex-M7 MCU enables real-time control and predictive maintenance, ensuring strong cybersecurity and easy deployment, supported by a variety of connectivity options and the Arduino Cloud. (Source:https://www.asteamtechno.com)

- In April 2023, Siemens announced its first virtual PLC, the Simatic S7-1500V, at the Hanover Fair. This virtual PLC addresses market demand for virtual hosting solutions. As part of Industrial Operations X, it integrates IT and software with automation to boost production flexibility in volatile markets and amid resource shortages. The hardware-independent virtual PLC can be centrally managed and supports scalable projects with open data interfaces, making integration with other IT solutions straightforward.(Source:https://store.arduino.cc)

Segments Covered in the Report

By Type

- Micro PLCs

- Ideal for small-to-medium automation systems

- Nano PLCs

By Offering

- Hardware

- CPU, I/O modules, communication ports

- Software

- Ladder logic programming, HMI integration

- Services

- Installation, maintenance, training, and integration

By Input/Output (I/O) Capacity

- <16 I/O (Nano PLC)

- 16–64 I/O (Dominant in Micro PLCs)

- 65–128 I/O (Micro PLC High-End)

- Expandable I/O Systems

By Application

- Machine Control & Packaging Automation

- HVAC & Building Automation

- Industrial Robotics & Conveyors

- Smart Agriculture & Irrigation Systems

- Food & Beverage

- Water Treatment & Pump Stations

- Small Material Handling Units

- OEM Equipment Integration

By End User

- Manufacturing SMEs (Small & Mid-sized Enterprises)

- Building Management Companies

- Utilities (Water/Energy Distribution)

- Automotive Components & Suppliers

- Consumer Electronics Assembly Units

- Agriculture Tech Providers

By Communication Protocol

- Modbus & Ethernet/IP

- PROFINET / PROFIBUS

- CANopen

- IoT-Enabled Protocols (MQTT, OPC UA)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client