Military Drones Market Size and Forecast 2025 to 2034

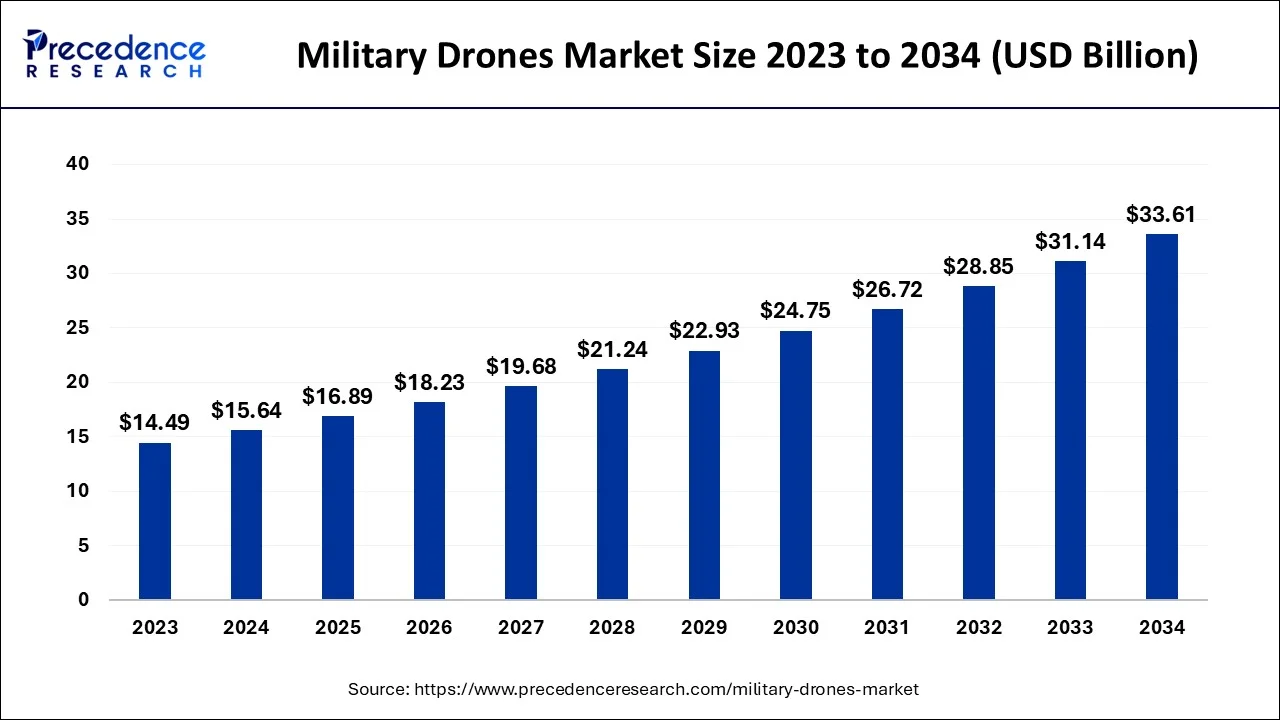

The global military drones market size accounted for USD 15.64 billion in 2024, and is projected to hit around USD 16.89 billion by 2934 and is anticipated to reach around USD 33.61 billion by 2034, growing at a CAGR of 7.95% from 2025 to 2034.

Military Drones Market Key Takeaways

- In terms of revenue, the market is valued at $16.89 billion in 2025.

- It is projected to reach $33.61 billion by 2034.

- The market is expected to grow at a CAGR of 7.95% from 2025 to 2034.

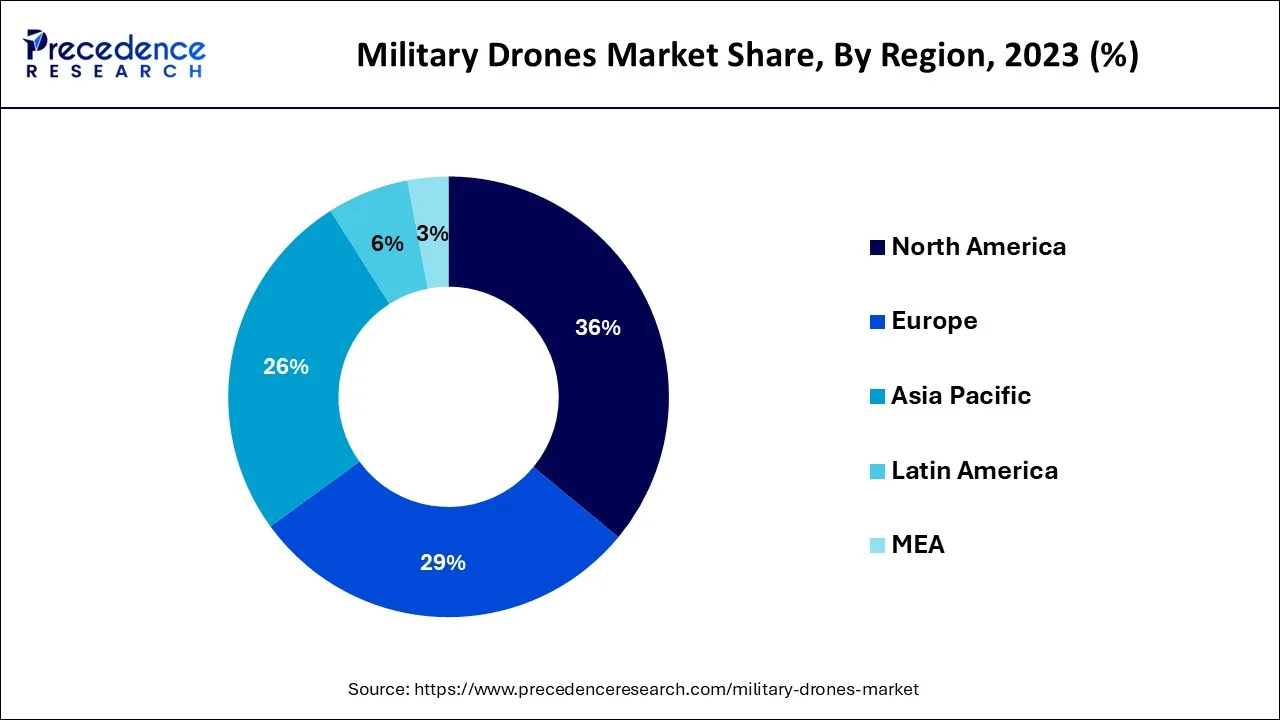

- North America is predicted to dominate the global market.

- The Asia-Pacific region is expected to expand at the largest CAGR of 15.40% between 2025 and 2034.

- By Type, the fixed-wing segment is predicted to generate the largest market share between 2025 and 2034.

- By Basis of Range, the extended visual line of sight segment is expected to record the highest market share between 2025 and 2034.

- By Technology, the remotely operated segment is projected to capture the biggest market share between 2025 and 2034.

- By Application, the ISRT segment is projected to generate the maximum market share between 2025 and 2034.

U.S. Military Drones Market Size and Forecast 2025 to 2034

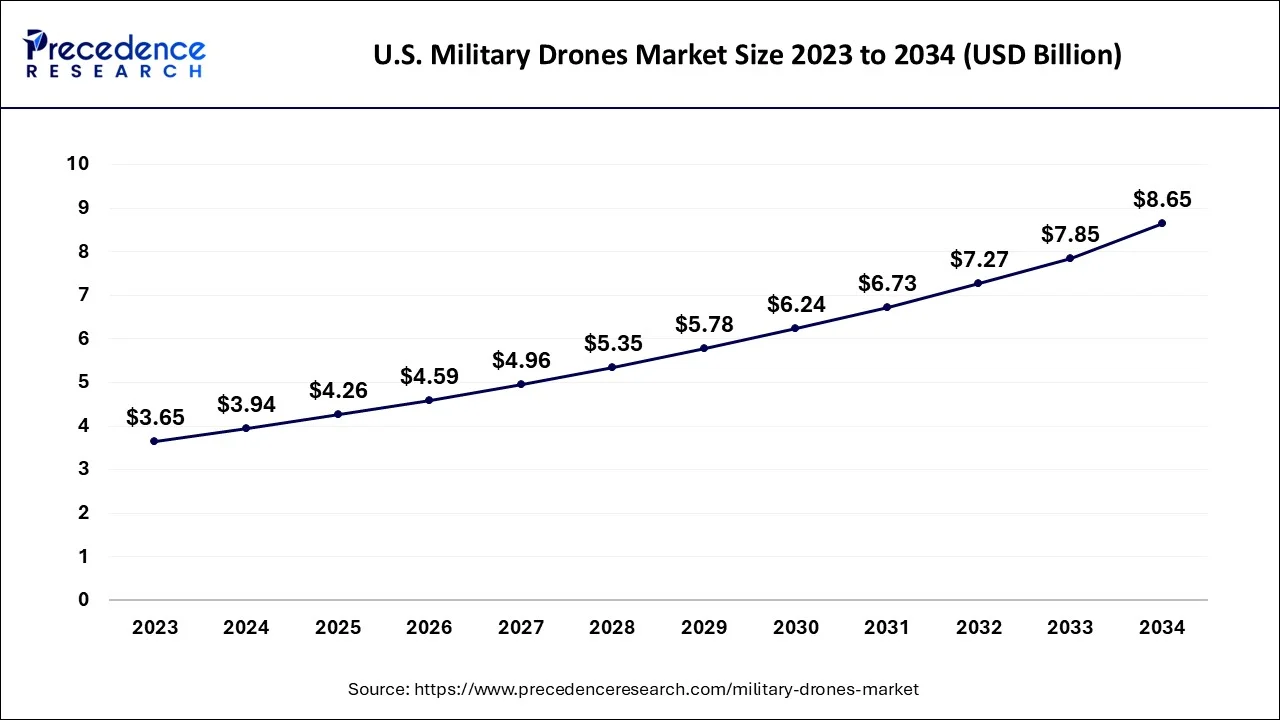

The U.S. military drones market size is estimated at USD 3.94 billion in 2024 and is expected to be worth around USD 8.65 billion by 2034, at a CAGR of 8.15% from 2025 to 2034.

North America dominates the market, primarily driven by several factors, including increasing demand for advanced ISR capabilities, growing investments in military modernization programs, and increasing deployment of drones for homeland security and law enforcement applications.

The surge in U.S. military spending is expected to contribute to the overall growth of the military drone market. For instance, according to the Facts and Figures published by the Aerospace Industries Association (AIA), the U.S. aerospace and defense industry generated more than $955 billion in sales in 2023, a 7.1% increase from the previous year. Commercial direct sales in 2023 totaled over USD 311 billion. The U.S. spends more on defense than any other country in the world. As per the global military spending published today by the Stockholm International Peace Research Institute (SIPRI). The United States military spending reached USD 877 billion in 2022, which was 39% of total global military spending and 3 times more than the amount spent by China.

Europe is a significant market for military drones, with Germany, the United Kingdom, and France being the major contributors to the market's growth. This is due to the increasing defense budgets, growing demand for advanced ISR capabilities, and the need to modernize military capabilities. Countries in Europe have increased their defense budgets in recent years to counter the growing security threats in the region, which has fueled the demand for military drones. The increasing demand for advanced ISR capabilities has also driven the growth of the Europe military drones market. UAVs equipped with advanced sensors and imaging technologies can provide real-time intelligence, surveillance, and reconnaissance (ISR) data, which is crucial for military operations.

The region in Asia-Pacific is anticipated to have the greatest CAGR of 15.40%.This is due to the increasing defense spending, growing security concerns, and the need to modernize military capabilities. Countries in the Asia-Pacific region are increasing their defense budgets to modernize their military capabilities, and drones are a key investment area. Moreover, growing regional security concerns have also led to increased demand for military drones. The use of drones for border surveillance, counter-terrorism operations, and maritime security has increased in recent years, driving the growth of the Asia-Pacific military drones market.

In October 2024, India and the U.S. concluded a USD 3.5 bn deal for the procurement of 31 MQ-9B armed High Altitude Long Endurance (HALE) Remotely Piloted Aircraft Systems (RPAS) manufactured by General Atomics through an inter-governmental agreement, via the Foreign Military Sales programme of the U.S.

Market Overview

The military drone market refers to the global market for unmanned aerial vehicles (UAVs) used for military purposes. These drones are used for various applications such as surveillance, reconnaissance, combat operations, target acquisition, and intelligence gathering. The military drone market includes both the production and sale of drones and associated services such as maintenance, training, and support. The market is growing rapidly due to the increasing demand for drones in military operations, technological advancements, and the development of new and more advanced drones with greater capabilities.

The market is driven by various factors, such as military drones providing real-time situational awareness to military commanders, enabling them to make informed decisions quickly and effectively. Drones can have advanced sensors, cameras, and other technologies that provide a detailed battlefield view. Using military drones can help reduce the risk to military personnel by allowing them to conduct operations remotely. This is particularly important in hazardous environments, such as those with high levels of enemy activity or exposure to chemical or biological hazards.

Furthermore, increasing geopolitical tensions and conflicts in various parts of the world have increased the demand for military drones for surveillance, reconnaissance, and combat operations. Military drones can be more cost-effective than traditional manned aircraft, requiring less maintenance, fuel, and support infrastructure. This can save money for militaries, which can then invest more resources into other areas of their operations. Also, the development of advanced technologies, such as artificial intelligence, machine learning, and advanced sensors, has led to the development of more sophisticated drones with greater capabilities, including longer ranges, higher payloads, and improved endurance, which will further drive demand in the military drone market.

However, technical limitations, regulatory challenges, cybersecurity threats and public perception are anticipated to impede market growth. The use of military drones is subject to various regulatory challenges, including restrictions on airspace usage, privacy concerns, and ethical issues surrounding autonomous systems. These challenges can limit the deployment of military drones in certain areas or for certain missions. Moreover, using military drones can be controversial and lead to negative public perception, particularly in cases where civilian casualties are reported. This can limit the deployment of military drones in certain areas or for certain missions and can also lead to restrictions on their usage.

The lockdown measures implemented by various governments in anticipation of the COVID-19 pandemic have disrupted supply chains and manufacturing processes, leading to delayed production and delivery of military drones. This has affected the operations of military forces, who may have had to rely on older or less capable drone systems. The pandemic has also increased demand for drone-based surveillance and delivery services, particularly in areas where human contact needs to be minimized. This has led to increased interest in military drones for these applications.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 33.61 Billion |

| Market Size in 2025 | USD 16.89 Billion |

| Market Size in 2024 | USD 15.64 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 7.95% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Range, Technology, Application and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increased demand for unmanned systems to brighten the market prospect

Unmanned systems, including military drones, have become increasingly popular due to their ability to operate in hazardous environments without risking the lives of military personnel. In addition, unmanned systems can provide persistent surveillance, reconnaissance, and strike capabilities, making them valuable assets for military operations. Using unmanned systems is particularly important in modern warfare, where conflicts are often asymmetric and require a more flexible and adaptable approach to combat. Military drones can be equipped with a wide range of sensors, cameras, and other technologies, allowing them to perform various missions, including intelligence gathering, target acquisition, and strike operations.

Thus, the demand for military drones has increased significantly in recent years, with many countries investing in developing and deploying these systems. The market for military drones is anticipated to grow in the coming years as militaries worldwide seek to enhance their capabilities and improve their effectiveness in combat operations.

Growing geopolitical tensions and conflicts

Military drones have become increasingly common in modern warfare, with many countries using drones for intelligence gathering, surveillance, reconnaissance, and strike operations. Drones provide a range of benefits, including the ability to operate in hazardous environments, conduct persistent surveillance, and strike targets with precision. Growing geopolitical tensions and conflicts have increased demand for military drones as countries seek to enhance their military capabilities and improve their ability to conduct operations in complex and challenging environments. Drones provide a way for countries to conduct military operations without risking their personnel, which is particularly important in asymmetric warfare, where adversaries often use unconventional tactics and strategies.

In addition to their use in traditional warfare, military drones are increasingly used in counter-terrorism operations and other security-related activities. They can be used to monitor borders, track terrorist activity, and provide situational awareness to security forces. Furthermore, Military drones, also known as unmanned aerial vehicles (UAVs), have become an integral part of modern warfare due to their ability to provide real-time intelligence, surveillance, and reconnaissance (ISR) capabilities. As a result, there has been a significant increase in the demand for military drones in recent years, particularly in regions that are experiencing conflict or heightened geopolitical tensions.

Key Market Challenges

Cybersecurity threats causing hindrances to the market

Military drones are vulnerable to cyber-attacks, compromising their performance or enabling adversaries to access sensitive information. Cybersecurity threats can limit the deployment of military drones in certain areas or for certain missions, particularly those involving sensitive or classified information. A cyber-attack on a military drone system can have serious consequences, including the loss of control of the drone or the loss of valuable data collected by the drone's sensors. Such attacks can also compromise the integrity of the drone's communication systems, making it more difficult for military forces to coordinate their operations.

Therefore, manufacturers of military drones are investing in cybersecurity measures to protect their systems from cyber-attacks. These measures include secure communication protocols, encrypted data transmission, and enhanced access controls to prevent unauthorized access to drone systems. Despite these efforts, cybersecurity threats remain a major concern for the military drone market as adversaries develop new, more sophisticated cyber-attack techniques. As a result, the development and deployment of military drones must be accompanied by strong cybersecurity measures to ensure their safe and effective operation.

Key Market Opportunities

Increased adoption of autonomous and swarm drones

The military drone market has seen a significant increase in the adoption of autonomous and swarm drones in recent years. Autonomous drones are capable of performing complex missions without human intervention, while swarm drones operate in groups and can coordinate their actions to achieve a common objective. This trend is creating new opportunities for manufacturers and suppliers of military drones. One of the key opportunities presented by the increased adoption of autonomous and swarm drones is in the area of intelligence, surveillance, and reconnaissance (ISR). Another opportunity presented by autonomous and swarm drones is in the area of logistics and supply chain management. Autonomous drones can be used to deliver supplies to troops in the field, while swarm drones can work together to transport larger payloads over longer distances.

Integration with artificial intelligence (AI) and machine learning (ML)

AI and ML algorithms can be used to analyze the vast amounts of data collected by drones and identify patterns and anomalies that may be of interest to military planners. For example, AI and ML can be used to detect and track enemy movements, identify potential threats, and provide real-time situational awareness to military personnel. The military drone market is increasingly integrating artificial intelligence (AI) and machine learning (ML) technologies to enhance the capabilities of unmanned aerial vehicles (UAVs). This trend is creating new opportunities for manufacturers and suppliers of military drones. In addition, AI and ML can be used to enhance the capabilities of drones for a wide range of other military applications, such as target acquisition, electronic warfare, and offensive and defensive operations.

Growing demand for drone-based logistics and transportation

The military drones market is experiencing a growing demand for drone-based logistics and transportation. This trend is creating new opportunities for manufacturers and suppliers of military drones. One of the key opportunities presented by the growing demand for drone-based logistics and transportation is in the area of supply chain management. Drones can be used to deliver supplies and equipment to troops in remote or hostile environments, reducing the logistical burden on military personnel and improving the speed and efficiency of military operations. Another opportunity presented by drone-based logistics and transportation is in the area of medical evacuation (medevac). Drones can be used to transport injured or wounded soldiers from the battlefield to medical facilities, reducing the time and risks associated with traditional evacuation methods.

Type Insights

On the basis of type, the military drones market is divided into fixed-wing, rotary-wing, and hybrid, with the fixed-wing segment accounting for most of the market. This is due to its ability to cover long distances, operate at high altitudes, and remain in the air for extended periods. Fixed-wing drones are typically used for surveillance, reconnaissance, and long-range strike missions. The choice of drone type depends on the specific mission requirements, with fixed-wing drones being more suitable for long-range missions, rotary-wing drones for short-range missions, and hybrid drones for missions that require a combination of both.

Range Insights

On the basis of the range, the military drones market is divided into visual line of sight, extended visual line of sight, and beyond line of sight, with extended visual line of sight accounting for most of the market. This is because its ability to operate an extended line of sight is becoming increasingly important in the military drone market, as it enables drones to operate in areas that are not accessible by ground troops or manned aircraft. This requires advanced communication and control systems, satellite-based navigation, and sensor technologies.

Technology Insights

On the basis of technology, the military drone market is divided into remotely operated, semi-autonomous, and autonomous, with the remotely operated segment accounting for most of the market. These drones are typically used for surveillance, reconnaissance, and strike missions and require a human operator to control their flight and payload. Also, drone technology depends on the specific mission requirements, with remotely operated drones being more suitable for missions that require human oversight and control, semi-autonomous drones for tasks that can be partially automated, and autonomous drones for missions that require full autonomy and independence.

Application Insights

On the basis of the application, the military drone market is divided into intelligence, surveillance, reconnaissance, and target acquisition (ISRT), combat operations, delivery and transportation, and others, with ISRT accounting for most of the market. This is because ISRT missions involve using drones to collect and analyze data about the operational environment, including the location and movement of enemy forces, terrain and weather conditions, and other factors that can affect military operations. Drones are well-suited for these types of missions due to their ability to operate at high altitudes, cover large terrain areas, and gather real-time data.

Military Drones Market Companies:

- Northrop Grumman Corporation

- Anduril Industries, Inc.

- Shield AI Inc.

- Animal Dynamics Ltd

- Elbit Systems Ltd.

- Asteria Aerospace Limited

- Teal Drones, Inc.

- Aeronautics Group

- Aeryon Labs Inc

- Israel Aerospace Industries

- Thales Group

- The Boeing Company

- Saab AB

- AeroVironment, Inc.

Recent Developments

- In May 2025, Slovak startup InoBat announced its plan to launch a battery designed for military drones and unmanned aerial systems. The introduction of the new battery strengthens Slovakia's position as a key player in technological innovations within the European Union and NATO.

- In May 2025, Tekever, a military drone-maker, unveiled its plan to invest £400m in the UK after winning a major contract with the country's Royal Air Force (RAF), as mounting geopolitical uncertainty draws governments and defence startups closer together. The British-Portuguese startup promises to create up to 1,000 new jobs as part of the deal

- In April 2024, Israel Aerospace Industries (IAI) and Aerotor Unmanned Systems signed a Memorandum of Understanding (MOU) that includes the development of products and promotion of their commercial cooperation. The agreement focuses on the engineering and marketing of Aerotor's Apus multicopter, featuring a heavy-fuel propulsion system for improved payload capacity, flight duration, and maneuverability.

- In January 2020, AeroVironment acquired Arcturus UAV, a leading provider of Group 2 and Group 3 unmanned aircraft systems.

- In October 2020, Kratos Defense & Security Solutions announced the launch of its new XQ-58A Valkyrie drone, designed to provide a low-cost, attributable unmanned aerial vehicle (UAV) for the U.S. Air Force.

- In January 2021, General Atomics Aeronautical Systems (GA-ASI) announced a strategic partnership with the Indian firm Adani Defense and Aerospace to manufacture drones in India.

- In March 2022, Huneed Technologies received a contract from General Atomics Aeronautical Systems, Inc. to manufacture and supply-Circuit Card Assemblies (CCA) for its unmanned aircraft.

Segments Covered in the Report

By Type

- Fixed Wing

- Rotary Wing

- Hybrid

By Range

- Visual Line of Sight

- Extended Visual Line of Sight

- Beyond Line of Sight

By Technology

- Remotely operated

- Semi-autonomous

- Autonomous

By Application

- Intelligence, Surveillance, Reconnaissance, and Target Acquisition

- Combat Operations

- Delivery and Transportation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting