What is the Mixed Signal IC Market Size?

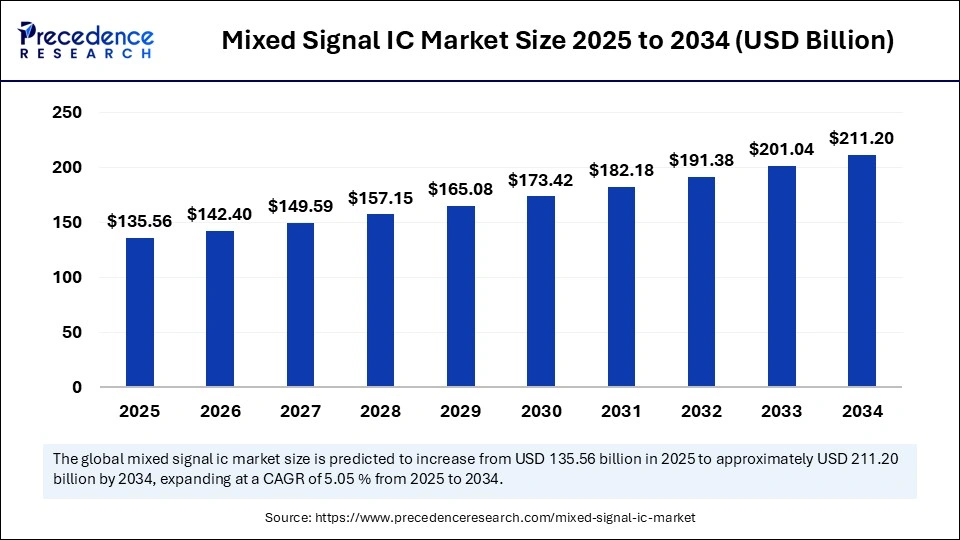

The global mixed signal IC market size accounted for USD 129.04 billion in 2024 and is predicted to increase from USD 135.56 billion in 2025 to approximately USD 211.20 billion by 2034, expanding at a CAGR of 5.05% from 2025 to 2034. The market is experiencing substantial growth due to the proliferation of the IoT, increased demand for advanced automotive technology, and the rollout of 5G networks. This expansion is further heightened by the requirement for devices that can efficiently process both real-world analog signals from sensors and high-speed digital data for complex computations.

Market Highlights

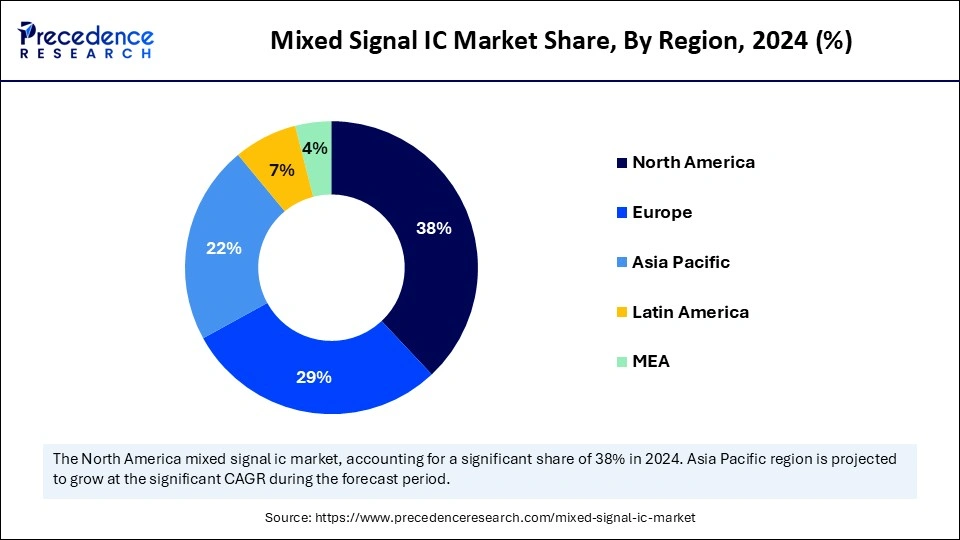

- North America dominated the largest mixed signal IC market with the largest market share of 38% in 2024.

- Asia Pacific is expected to witness the fastest CAGR of 10% during the foreseeable period.

- By type/function, the data converters held the largest market share of about 30% in 2024.

- By type/function, the sensor interface IC segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-use industry, the consumer electronics segment captured the biggest market share of 35% in 2024.

- By end-use industry, the automotive segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By device type/package, the analog-focused mixed signal ICs segment generated the major market share of 40% in 2024.

- By device type/package, the application-specific mixed signal ICs is expected to witness the fastest CAGR during the foreseeable period.

Market Size and Forecast

- Market Size in 2024: USD 129.04 Billion

- Market Size in 2025: USD 135.56 Billion

- Forecasted Market Size by 2034: USD 211.20 Billion

- CAGR (2025-2034): 5.05%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are the Mixed Signal ICs?

Mixed signal ICs (Integrated Circuits) combine both analog and digital circuits on a single chip, allowing them to process both types of signals efficiently. This technology is crucial in converting real-world analog signals like sound or temperature into digital data for processing and control, enabling functionality in a wide array of applications, including smartphones, automotive electronics, industrial control, consumer electronics, and IoT devices.

How Can AI Impact the Mixed Signal IC Market?

Artificial intelligence (AI) is transforming the mixed signal IC market by improving design automation, boosting performance and power efficiency, and speeding up testing and verification. AI tools can quickly analyze large datasets from simulation, verification, and testing stages, offering data-driven insights to enhance design quality and make testing more efficient. AI also allows designers to explore a much wider range of design options and settings than would be possible manually, resulting in more optimal solutions with better performance and efficiency.

What Are the Key Trends in the Mixed Signal IC Market?

- 5G Network Expansion: The high-speed, low-latency capabilities of 5G networks are essential for the success of AVs and connected mobility, generating a strong demand for sophisticated mixed-signal ICs that can handle advanced signal processing and data transmission.

- Autonomous and Connected Vehicles: The global adoption of autonomous vehicles is a major catalyst, as they rely on mixed-signal ICs for sensor fusion, real-time data processing, and seamless V2X communication to operate safely and efficiently.

- Enhanced Road Safety: Connected vehicles and intelligent transportation systems are improving road safety by enabling real-time data exchange and communication between vehicles and infrastructure, which necessitates reliable mixed-signal ICs to enable these safety features.

- Expanding Automotive Electronics: As vehicle features become more complex and integrated, the demand for mixed-signal ICs across various automotive applications, such as infotainment, connectivity, and safety systems, continues to surge.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 129.04 Billion |

| Market Size in 2025 | USD 135.56 Billion |

| Market Size by 2034 | USD 211.20 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type / Function, End-Use Industry, Device Type / Package, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growth of the Internet of Things (IoT) and Smart Devices

The main driver for the mixed signal IC market is the growth of the Internet of Things (IoT) and smart devices. These devices need mixed-signal ICs to connect the continuous analog signals from the physical environment with the discrete digital processing of devices, supporting applications from smartphones and wearables to industrial sensors and smart home systems. Moreover, the growing role of electronics in vehicles, especially in electric vehicles, demands complex mixed-signal ICs for power management, sensors, and other key functions.

Restraint

Rising Design Complexity and High Development Costs

The biggest restraint in the mixed signal IC market is the rising design complexity and high development costs, resulting from the integration of both analog and digital components onto one chip. Since integrating analog and digital circuitry onto a single chip is a demanding task, it requires a thorough understanding of both fields to ensure proper operation. This technical hurdle necessitates advanced simulation tools, specialized engineers, and extensive testing, which can discourage smaller companies and slow down innovation.

Opportunity

Advanced Mixed-Signal ICs: Energy Efficiency and Higher Performance

The key future opportunity in this market is developing mixed-signal ICs with better energy efficiency and higher performance. This trend is driven by the rapid expansion of IoT, 5G, and 6G wireless applications, electric and autonomous vehicles, and the booming wearable electronics and medical device sectors. The need for AI-powered sensor fusion in autonomous systems increases demand for mixed-signal ICs capable of accurately processing and combining complex data streams while reducing power use without sacrificing signal quality.

Segment Insights

Type / Function Insights

What Made the Data Converters Dominate the Mixed Signal IC Market in 2024?

The data converters segment led the market, holding about 30% of the share in 2024. This is primarily because they enable digital systems to interact with the real world's continuous signals, a fundamental need for modern electronics across sectors like IoT, automotive, healthcare, and consumer electronics, especially ADCs and DACs. ADCs and DACs are vital for bridging the gap between the continuous analog signals of the physical environment and the discrete digital signals processed by computers and other digital devices for precise measurement, high resolution, and low power consumption.

The sensor interface IC segment is expected to grow the fastest in the market. This is mainly due to the explosive increase in sensors across various industries. As IoT, industrial automation, automotive electronics, and connected medical devices become more common, the demand for advanced mixed-signal ICs to process and manage data from these sensors grows rapidly. Modern devices are integrating multiple sensor types, such as motion, pressure, and temperature sensors, to support more complex functions like sensor fusion.

End-Use Industry Insights

How Did the Consumer Electronics Segment Dominate the Mixed Signal IC Market in 2024?

The consumer electronics segment held about 35% of the market share in 2024. This is due to the rising demand for innovative, compact, and power-efficient devices like smartphones and smart home products, which need integrated solutions to combine analog and digital functions. Consumers expect smaller, portable, and more powerful devices, which require integrating multiple analog and digital functions onto a single chip to reduce size and enhance functionality for efficient signal processing and conversion.

The automotive segment is projected to be the fastest-growing area. This growth is driven by the increasing complexity of vehicles, fueled by advancements in electric vehicles, autonomous driving, and Advanced Driver-Assistance Systems (ADAS). Incorporating AI into vehicles also boosts the need for mixed-signal ICs to handle complex data processing. These features require more mixed-signal ICs for tasks such as sensor integration, power management, and real-time data handling, becoming a major market driver.

Device Type / Package Insights

How Will the Analog-Focused Mixed-Signal ICs Segment Lead the Mixed Signal IC Market in 2024?

The analog-focused mixed-signal ICs segment held around 40% of the market share in 2024. This is mainly because of the fundamental need for analog-to-digital conversion and signal conditioning in nearly all modern electronic devices, especially with the ongoing growth in IoT, automotive, and consumer electronics. Advances in CMOS technology offer scalability, low power consumption, and better integration, making these ICs cost-effective and high-performing for high-demand applications, enabling automation and efficiency.

The application-specific mixed-signal ICs segment is expected to grow at the fastest rate in the market. This is mainly because they offer highly integrated and optimized solutions for complex applications, giving them an advantage over general-purpose ICs. This growth is further fueled by the soaring demand for smart, connected, and highly specialized devices across various industries, including consumer electronics, medical, and industrial sectors.

Regional Insights

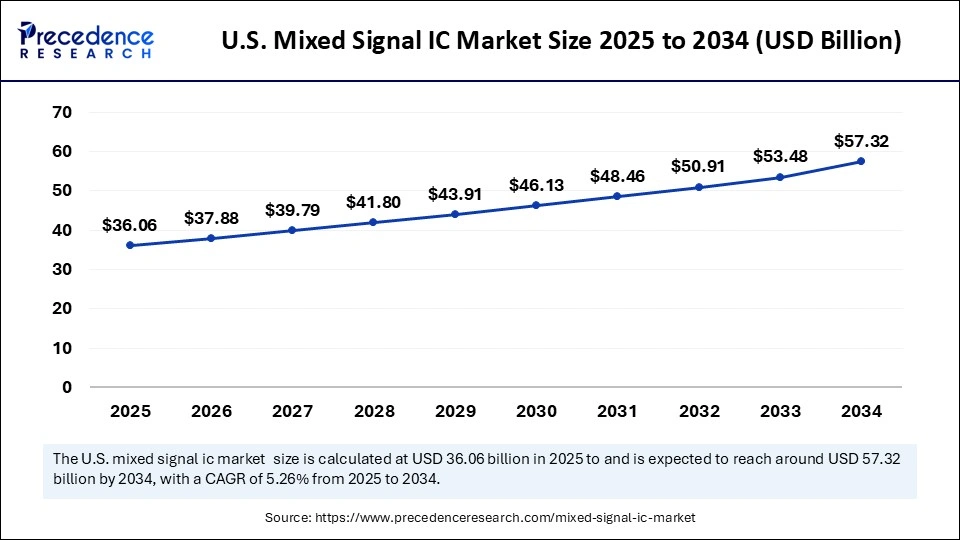

U.S. Mixed Signal IC Market Size and Growth 2025 to 2034

The U.S. mixed signal IC market size was evaluated at USD 34.32 billion in 2024 and is projected to be worth around USD 57.32 billion by 2034, growing at a CAGR of 5.26% from 2025 to 2034.

How Did North America Lead the Mixed Signal IC Market in 2024?

North America led the mixed signal IC market with about 38% of the share in 2024. This is mainly due to advanced infrastructure, a mature customer base with strong demand for connected devices, and government initiatives promoting domestic innovation and supply chain resilience, such as the CHIPS and Science Act. The U.S. government provides significant support for the semiconductor industry, encouraging domestic manufacturing and innovation to build a more secure supply chain. A well-developed and technologically advanced customer ecosystem in North America fuels demand for sophisticated mixed-signal solutions.

The U.S. Mixed Signal IC Market Trends

The U.S. plays an evolving role in the global market, mainly driven by technological innovation, R&D ecosystems, mature manufacturing facilities, and a skilled workforce. This growth is further supported by rising demand from IoT devices, consumer electronics, and advancements in automotive sectors like EVs and ADAS. Additionally, U.S. companies such as Analog Devices, Texas Instruments, Intel, and Broadcom are leading players in this market, influencing global supply chains.

Canada Mixed Signal IC Market Trends

Canada also occupies a unique position globally. Its focus is on niche areas like design, R&D, photonics, and AI-driven semiconductors within the mixed signal IC market, setting it apart from countries with large-scale fabrication capabilities. Leveraging a skilled workforce and research and development ecosystem in hubs like Toronto, Ottawa, and Montreal, Canada specializes in intelligent sensors and AI chips for applications including IoT and automotive.

Why is Asia Pacific Considered the Fastest-Growing Region in the Mixed Signal IC Market in 2024?

Asia-Pacific is experiencing the fastest growth for the foreseeable period. This is due to its large electronics manufacturing base, rapid industrialization, significant government support for semiconductor development, and growing demand for 5G, IoT, and automotive technologies. The expansion of industries and growing urban populations in countries like China and India are driving demand for new electronic devices and infrastructure. Governments in China, India, and other nations actively promote technological advancement through various policies, incentives, and investments.

Mixed Signal IC Market Companies

- Texas Instruments (TI)

- Analog Devices (ADI)

- ON Semiconductor

- STMicroelectronics

- Infineon Technologies

- Maxim Integrated (now part of ADI)

- NXP Semiconductors

- Renesas Electronics

- Cypress Semiconductor (Infineon)

- Broadcom

- Microchip Technology

- Skyworks Solutions

- Qualcomm

- MediaTek

- ROHM Semiconductor

- Dialog Semiconductor (Renesas)

- Semtech Corporation

- Silicon Labs

- InvenSense / TDK

- Cirrus Logic

Leaders' Announcement

- In May 2025, Infineon Technologies AG collaborated with NVIDIA. This collaboration is developing the next generation of power systems with central power generation of 800 V high-voltage direct current. Adam White, Division President, Power & Sensor Systems at Infineon, also commented that Infineon is driving innovation in artificial intelligence with increased energy-efficient power distribution with efficient power conversion.(Source: https://www.infineon.com)

Recent Developments

- In July 2025, Texas Instruments launched new generations of its TLV900x series operational amplifiers, offering features like enhanced signal integrity, low-noise performance, unity-gain stability, integrated RFI/EMI rejection filters, and a shutdown mode for low-power operation. These applications include smoke detectors, wearable electronics, and require low-voltage operation and a high capacitive load cost-effective solution for space-constrained applications.

(Source: https://www.mouser.in) - In November 2024, Renesas Electronics Corporation unveiled new AnalogPAK™ ICs, including lower-power and automotive-qualified devices, along with the industry's first programmable 14-bit SAR ADC. These devices are part of Renesas' GreenPAK™ Family of Programmable Mixed-Signal Matrix products that enable innovators to integrate many system functions while minimizing board space and power consumption.(Source: https://www.renesas.com)

Segments Covered in the Report

By Type / Function

- Data Converters (ADC/DAC)

- Power Management ICs (PMIC)

- RF / Wireless Communication ICs

- Sensor Interface ICs

- Clock & Timing ICs

- Audio & Video ICs

- Others

By End-Use Industry

- Consumer Electronics

- Automotive

- Industrial Automation & Control

- Telecommunications / Networking

- Healthcare / Medical Devices

- Others

By Device Type / Package

- Analog-Dominant Mixed Signal ICs

- Digital-Dominant Mixed Signal ICs

- Fully Integrated Mixed Signal ICs

- Application-Specific Mixed Signal ICs

By Region

- North America

- Europe

- Asia-Pacific

- Latin America & MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting