What is the Neuromorphic Chip Market Size?

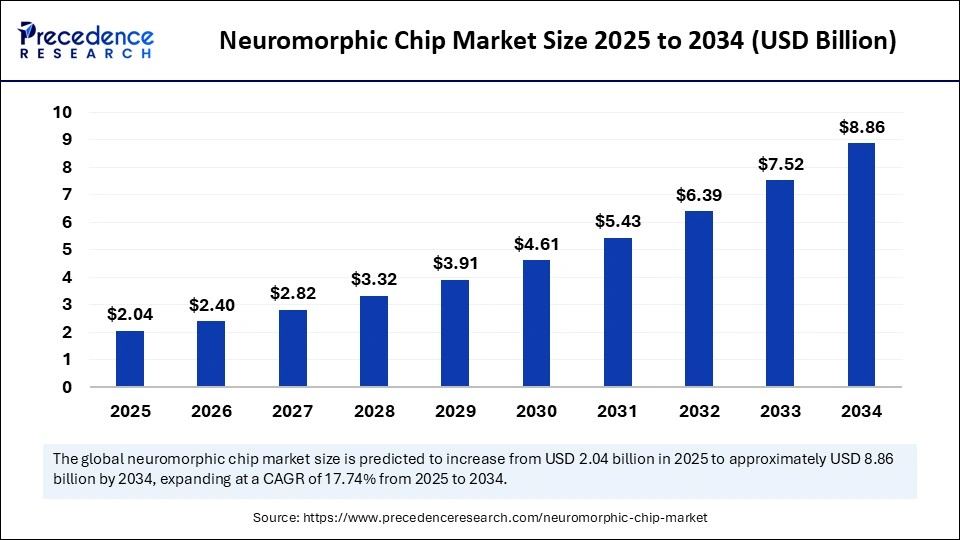

The global neuromorphic chip market size was calculated at USD 1.73 billion in 2024 and is predicted to increase from USD 2.04 billion in 2025 to approximately USD 8.86 billion by 2034, expanding at a CAGR of 17.74% from 2025 to 2034. The increasing demand for energy-efficient computing and development of autonomous systems are increasing the adoption of neuromorphic chips, which is likely to boost the market growth during the forecast period.

Market Highlights

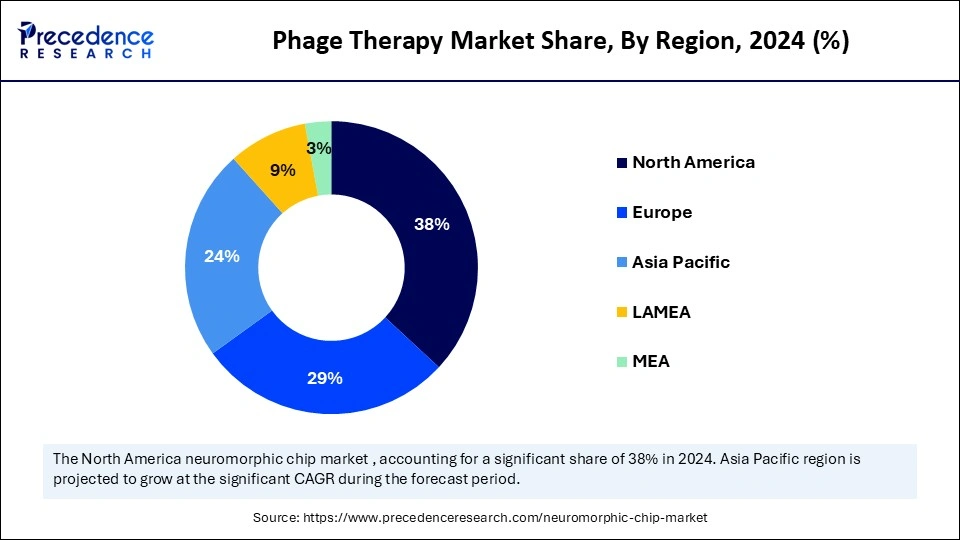

- North America dominated the market by holding more than 38% of market share in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By type, the digital neuromorphic chips segment contributed the largest market share in 2024.

- By type, the mixed-signal neuromorphic chips segment is expected to grow at the highest CAGR between 2025 and 2034.

- By architecture, the spiking neural networks (SNNs) segment led the market with the largest share in 2024.

- By architecture, the memristor-based chips segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By application, the image & signal processing segment led the market while holding the largest share in 2024.

- By application, the robotics & autonomous systems segment is expected to grow at a significant CAGR between 2025 and 2034.

- By end-user industry, the consumer electronics segment led the market while holding the largest share in 2024.

- By end-user industry, the automotive & transportation (autonomous vehicles) segment is expected to grow at the fastest rate between 2025 and 2034.

- By core technology, the CMOS-based neuromorphic chips segment led the market while holding the largest share in 2024.

- By core technology, the quantum-inspired neuromorphic chips segment is expected to grow at the hifgest CAGR between 2025 and 2034.

- By deployment mode, the edge-based neuromorphic processing segment led the market while holding the largest share in 2024.

- By deployment mode, the cloud-based neuromorphic processing segment is expected to grow at the fastest CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 1.73 Billion

- Market Size in 2025: USD 2.04 Billion

- Forecasted Market Size by 2034: USD 8.86 Billion

- CAGR (2025-2034): 17.74%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Neuromorphic Chips?

Neuromorphic chips refer to specialized semiconductor processors designed to mimic the architecture and functioning of the human brain, enabling ultra-efficient computation for AI, machine learning, and cognitive computing tasks. These chips integrate spiking neural networks (SNNs) and event-driven processing, offering low power consumption, real-time learning, and high adaptability. They are increasingly adopted in edge AI, robotics, autonomous vehicles, IoT, and next-gen computing systems.

Advancements in cutting-edge technologies like AINML is driving the adoption of neuromorphic chips across various industries like automotive, finance, and healthcare. The ability of neuromorphic chips to provide superior processing capabilities for advanced technologies makes them ideal for applications like robotics and autonomous vehicles.

Key Technological Shifts in the Neuromorphic Chip Market

Advancements in neuroscience and artificial intelligence are driving a technological paradigm shift in the neuromorphic chip industry. Cutting-edge technologies such as electroencephalography (EEG), virtual reality (VR), augmented reality (AR), eye tracking, and wearable neurotechnology devices are accelerating the adoption of neuromorphic chips. Furthermore, progress in neuromorphic computing research, increased utilization of spiking neural networks (SNNs), and the expansion of edge computing are fueling market growth. The development of hybrid neuromorphic systems enhances the efficient handling of both AI-specific and traditional workloads.

Key industry players like IBM, Qualcomm, BrainChip, Intel, and SynSense are heavily investing in brain-inspired hardware development. Their investments are enabling breakthroughs in energy-efficient, real-time processing capabilities and fostering the creation of software ecosystems that support applications in robotics, edge AI, and other advanced sectors.

Neuromorphic Chip Market Outlook

- Industry Growth Overview: Between 2025 and 2034, the neuromorphic chip industry is poised for rapid expansion, driven by advancements in AI, low-power processing, and edge computing. North America leads adoption, supported by a robust technological infrastructure and substantial investments in semiconductor R&D, fueling market growth.

- Sustainability Trends: Sustainability is becoming a critical focus in the industry due to rising demand for energy-efficient computing. Neuromorphic chips, with their brain-inspired architecture and low power consumption, are ideal for reducing carbon footprints and advancing eco-friendly technology solutions.

- Global Expansion: Asia Pacific and European countries are expected to witness remarkable growth, propelled by increased investments in technology innovation, R&D, and adoption of cutting-edge solutions. Emerging economies and sectors such as automotive are unlocking lucrative opportunities for global market expansion.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 1.73 Billion |

| Market Size in 2025 | USD 2.04 Billion |

| Market Size by 2034 | USD 8.86 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 17.74% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Architecture, Application, End-User Industry, Core Technology, Deployment Mode, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Digital Neuromorphic Chips Segment Lead the Market in 2024?

The digital neuromorphic chips segment led the neuromorphic chip market in 2024, driven by their high scalability and compatibility. These chips utilize digital CMOS neuromorphic hardware, allowing for seamless integration with existing systems. Their mature electronic design automation (EDA) support and easier software portability make them ideal for hardware solutions. The established maturity of digital neuromorphic chips facilitates straightforward software integration and portability.

The mixed-signal neuromorphic chips segment is expected to expand at the fastest rate in the upcoming period, driven by their unique ability to naturally capture synaptic dynamics through an analog-digital hybrid architecture. By combining the energy efficiency of analog processing with the precision and programmability of digital systems, these chips overcome the limitations of purely analog or digital designs. Their capability for low-power, real-time processing, especially in image and signal recognition for autonomous systems, enhances performance while reducing energy consumption. Additionally, mixed-signal neuromorphic chips are increasingly adopted in healthcare wearables, further fueling market expansion.

Architecture Insights

Which Architecture Dominates the Neuromorphic Chip Market?

The spiking neural networks (SNNs) segment dominated the market in 2024 due to the increased need for energy-efficient and real-time processing solutions. Spiking neural networks (SNNs) enable real-time processing by mimicking brain-like neural communications. This architecture is inspired by the brain's neural structure and functions. This architecture can operate with lower power consumption, making it ideal for edge devices and IoT applications.

The memristor-based chips segment is expected to grow at the fastest rate over the forecast period, driven by their energy efficiency and high performance. The memristor-based chips are designed to provide processing capabilities to overcome the limits of conventional architectures. These chips are well-suited for high-demand sectors, including AI and IoT devices for powerful edge computing, advanced robotics, and more efficient data processing.

Application Insights

What Made Image & Signal Processing the Dominant Segment in the Neuromorphic Chip Market?

The image & signal processing segment dominated the market in 2024 due to increased demand for high-quality imaging in various applications. The need for high-resolution imaging in smartphones, smart cameras, and tablets has increased. The growing adoption of digital image processing and 2D ISP is driving the use of neuromorphic chips for enhanced energy efficiency and high performance. The neuromorphic chip enables high-energy-efficient, low-latency, and real-time computations in image and signal processing devices.

The robotics & autonomous systems segment is likely to grow at the fastest rate in the coming years, driven by the increasing need for cutting-edge technologies such as real-time processing and energy efficiency. Neuromorphic chips enable the fulfillment of the computational requirements of RAS, such as real-time data processing, adaptive learning, and energy efficiency. The growing demand for edge AI in robotics and autonomous systems is further adding to in increasing use of neuromorphic chips.

End-User Industry Insights

What Made Consumer Electronics the Dominant Segment in the Market in 2024?

In 2024, the consumer electronics segment dominated the neuromorphic chip market, driven by increased consumer demand for smart devices. The demand for cutting-edge, energy-efficient computing solutions has increased in devices like wearables, smartphones, and smart home systems. This integration enables advanced image and voice recognition. Several manufacturing companies are investing heavily in the development of more compact, efficient, and integrated neuromorphic solutions to enhance user experiences and extend battery life. The ability of neuromorphic chips to process sensory data and perform tasks such as speech recognition and image processing makes them ideal for enhancing the functionality of consumer electronics.

The automotive & transportation (autonomous vehicles) segment is expected to grow at the fastest rate over the forecast period, driven by increased use of neuromorphic chips in autonomous vehicle technologies and advanced driver-assistance systems (ADAS). These chips enable the real-time processing of sensor data and provide quick decision-making capabilities. The low-power consumption of neuromorphic chips makes them suitable for automotive & transportation.

Core Technology Insights

Which Technology Dominates the Neuromorphic Chip Market?

The CMOS-based neuromorphic chips segment dominated the market in 2024 due to its maturity, cost-effectiveness, and scalability. This technology enables a mature fabrication process, reducing costs, improving manufacturability, and enhancing scalability. Power-sensitive edge AI applications are among the earliest adopters of this technology.

The quantum-inspired neuromorphic chips segment is expected to grow at the fastest CAGR in the market, driven by advancements in cutting-edge technologies like autonomous systems, AI, and edge computing. This technology accelerates performance and is energy-efficient to integrate in neuromorphic computing, improving efficiency, scalability, and high performance. The quantum-inspired neuromorphic chips technology enables ultra-low power consumption, making it ideal for battery-powered devices.

Deployment Mode Insights

Why Did the Edge-Based Neuromorphic Processing Segment Lead the Market in 2024?

The edge-based neuromorphic processing segment dominated the neuromorphic chip market in 2024, driven by the increasing need for real-time data processing and reduced latency. Applications such as autonomous efficiency, smart sensors, and robotics have increased the adoption of edge-based neuromorphic processing for enhanced efficiency and low latency. The adoption of on-device AI has driven the need for critical autonomous and IoT devices, leading to a shift in edge-based neuromorphic processing toward commercialization. The growing adoption of edge AI in robotics and autonomous systems is fueling the segment's growth.

The cloud-based neuromorphic processing segment is expected to expand at a significant rate over the forecast period, driven by increased adoption of cloud-based neuromorphic computing. The need for scalable and flexible cloud-based technologies has increased the adoption of cloud-based neuromorphic processing, driving the utilization of neuromorphic chips. These are scalable resources for large-scale model training and simulations that accelerate the adoption of neuromorphic chips. The cloud-based neuromorphic processing enables remote access to high-performance and centralized neuromorphic hardware.

Regional Insights

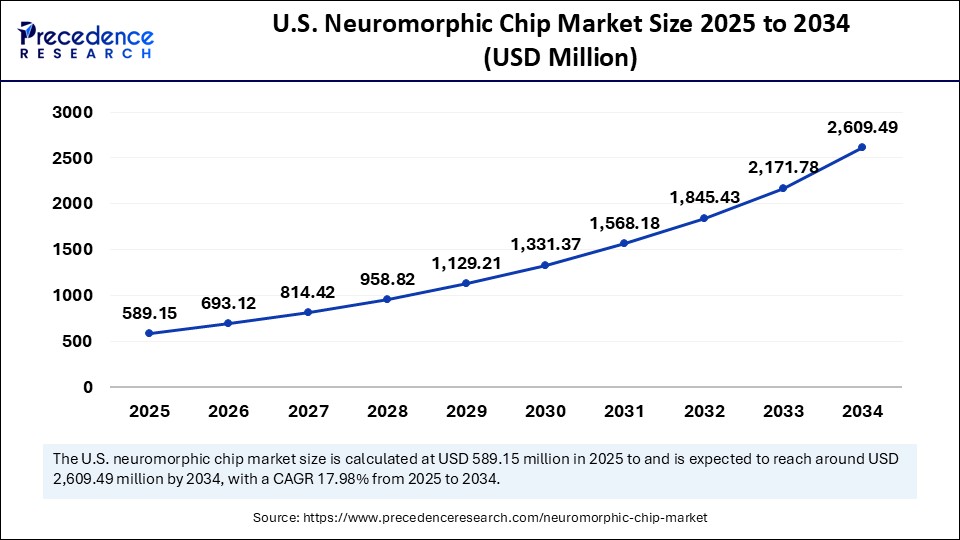

U.S. Neuromorphic Chip Market Size and Growth 2025 to 2034

The U.S. neuromorphic chip market size was exhibited at USD 499.62 million in 2024 and is projected to be worth around USD 2,609.49 million by 2034, growing at a CAGR of 17.98% from 2025 to 2034.

What Made North America the Dominant Region in the Neuromorphic Chip Market?

North America dominated the neuromorphic chip market in 2024, propelled by its unparalleled ecosystem of technological innovation and academic excellence. The region's leadership is underpinned by a convergence of world-class semiconductor giants and cutting-edge research hubs, with Silicon Valley serving as the epicenter of innovation in neuromorphic hardware and software. Strategic government backing and robust venture capital inflows have further fueled this fertile ground for advancement. The growing demand for AI acceleration across sectors, from defense to autonomous systems, drives widespread adoption.

Within North America, the U.S. remains the undisputed powerhouse, boasting a unique blend of industrial capital, intellectual resources, and national security imperatives that ensure sustained investment in brain-inspired computing. The strong presence of industry leaders, such as IBM and Intel, alongside significant government funding in the semiconductor sector, fuels market expansion. Additionally, ongoing commercialization efforts focused on high-efficiency, low-latency AI applications, ranging from consumer electronics to edge devices, are catalyzing significant innovation in the neuromorphic chip industry.

Why is Asia Pacific Considered the Fastest-Growing Region?

Asia Pacific is expected to register the fastest growth in the neuromorphic chip market, driven by a confluence of demographic dynamism and state-sponsored technological ambition. The region's rapid acceleration is fueled by relentless digitalization, expanding semiconductor fabrication capacity, and surging demand for energy-efficient AI systems. Governments across the bloc are investing heavily in neuromorphic research to reduce reliance on Western architectures. The growing appetite for smart infrastructure, robotics, and edge computing further catalyzes adoption. Indigenous enterprises are progressively narrowing the innovation gap with global competitors through bold technological advancements.

China is a major player in the market. Its robust state-led investment strategies, coupled with an aggressive pursuit of chip sovereignty, position it at the forefront of regional expansion. By integrating neuromorphic chip development into its national industrial strategy, China aims not only to participate but to attain preeminence in this transformative technology landscape.

Country-Level Investments & Funding for the Neuromorphic Chip Industry

| Country | Projects | Agenda & Investments |

| U.S. | Defence Advanced Research Projects Agency (DARPA) | In 2024, DARPA secured funds for research that drove advancements in autonomous robotics. Provides funds for high-risk, neuromorphic AI projects, including multi-million dollar allocation for research, and high rewards. |

| China | National AI Development Plan | The Chinese Government's AI plan allocated more than $75 billion by 2024 for AI R&D, with a strong focus on neuromorphic systems for smart cities and defense applications. |

| European Union | Horizon Europe | The NimbleAi project, a $10.8 million initiative under Horizon Europe, was funded for the development of a 3D neuromorphic chip in 2023. Horizon Europe is a primary research and innovation program that allocates funding for advanced computing, like neuromorphic projects, for the European Union. |

| The UK | Neuroware Center | In October 2025, a Euro 12.8 million center of Neuroware center was launched, which is led by University College London (UCL) to act as a national home for neuromorphic innovations. This center is supported by the Engineering and Physical Science Research Council (EPSRC). |

| Japan | $65 Billion Investments | The Japanese government invested approximately $65 billion (¥10 trillion) in November 2024, through 2030, for strengthening the country's semiconductor and AI chip sector. |

Neuromorphic Chip Market - Value Chain Analysis

- Raw Material Procurement (Silicon Wafers, Gases)

Raw material procurements for the development of neuromorphic chips include both conventional semiconductor fabrication materials and a wide array of cutting-edge materials.

Key Players: Samsung Electronics, SK Hynix, BrainChip Holdings Ltd., and Micron Technology.

- Distribution to OEMs and Integrators

Companies like Intel, IBM (TrueNorth), and SpiNNaker (SpiNNcloud) are collaborating with universities, research institutes, and governments for direct distributions and integrations. Intel Neuromorphic Research Community (INRC) and Hola Point system are major distributors of neuromorphic chips.

Key Players: Qualcomm Technologies, Samsung Electronics, IBM, and Intel.

- Lifecycle Support and Recycling

Lifecyle support for neuromorphic chips includes in-field performance and robustness, adaptive learning & self-optimization, and edge computing capabilities. Where recycling evolves around end-of-life material management of memristive materials, organic & bio-inspired materials, and rare elements.

Key Players: Intel, IBM, SynSense, and Prophesee.

Top Companies in the Neuromorphic Chip Market

Tier I – Major Players

These industry leaders dominate the neuromorphic chip landscape, both in terms of technological innovation and commercial adoption. Their substantial R&D investments, global presence, and strong IP portfolios allow them to shape industry trends and hold a significant cumulative market share.

- Intel Corporation

- IBM Corporation

- Qualcomm Technologies Inc.

- NVIDIA Corporation

- Huawei Technologies Co., Ltd.

Tier II – Mid-Level Contributors

These firms are emerging as key influencers in the neuromorphic ecosystem. While not dominant individually, they exhibit high innovation velocity and form the backbone of regional and application-specific deployments. Many have specialized offerings in edge AI, robotics, or spiking neural networks.

- BrainChip Holdings Ltd.

- SynSense AG (formerly aiCTX)

- General Vision Inc.

- GrAI Matter Labs

- Samsung Electronics (Emerging Division)

- Analog Devices Inc. (ADI)

Tier III – Niche and Regional Players

These companies are often focused on academic collaborations, defense-related contracts, or ultra-specific AI-on-edge applications. They may also be fabless semiconductor firms, university spinoffs, or early-stage startups with strong IP but limited scale.

- Eta Compute Inc.

- GyrFalcon Technology Inc.

- nepes Corporation

- Toshiba Corporation (R&D-focused initiatives)

- Vicarious FPC Inc.

- Applied Brain Research Inc.

Recent Developments

- In January 2025, BrainChip Holdings Ltd launched its Akida neural processor in an M.2 form factor, delivering ultra-low power, high-speed AI acceleration for edge devices. With a 1-watt power budget and event-based architecture, Akida enables real-time, incremental learning for edge AI applications in compact environments like industrial systems, factory hubs, and network devices.(Source: https://brainchip.com)

- In April 2024, Intel launched the world's largest neuromorphic system, Hala Point, for advancing sustainable AI research by using over 1,000 Loihi 2 chips. This chip supports more than a billion artificial neurons. Hala Point is a research prototype designed for tracking complex problems in scientific computing, logistics, and AI-driven city infrastructure fields. (Source: https://www.hpcwire.com)

Segment Covered in the Report

By Type

- Digital Neuromorphic Chips

- Analog Neuromorphic Chips

- Mixed-Signal Neuromorphic Chips

By Architecture

- Spiking Neural Networks (SNNs)

- Memristor-based Chips

- FPGA-based Neuromorphic Chips

- ASIC-based Neuromorphic Chips

By Application

- Image & Signal Processing

- Natural Language Processing

- Robotics & Autonomous Systems

- Edge AI & IoT Devices

- Cybersecurity & Pattern Recognition

- Healthcare & Wearables

By End-User Industry

- Consumer Electronics

- Automotive & Transportation (Autonomous Vehicles)

- Healthcare & Life Sciences

- Aerospace & Defense

- Industrial & Manufacturing

- IT & Telecom

By Core Technology

- CMOS-based Neuromorphic Chips

- Memristor-based Chips

- Quantum-inspired Neuromorphic Chips

By Deployment Mode

- Cloud-based Neuromorphic Processing

- Edge-based Neuromorphic Processing

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting