What is the Mono-Ethanolamine Market Size?

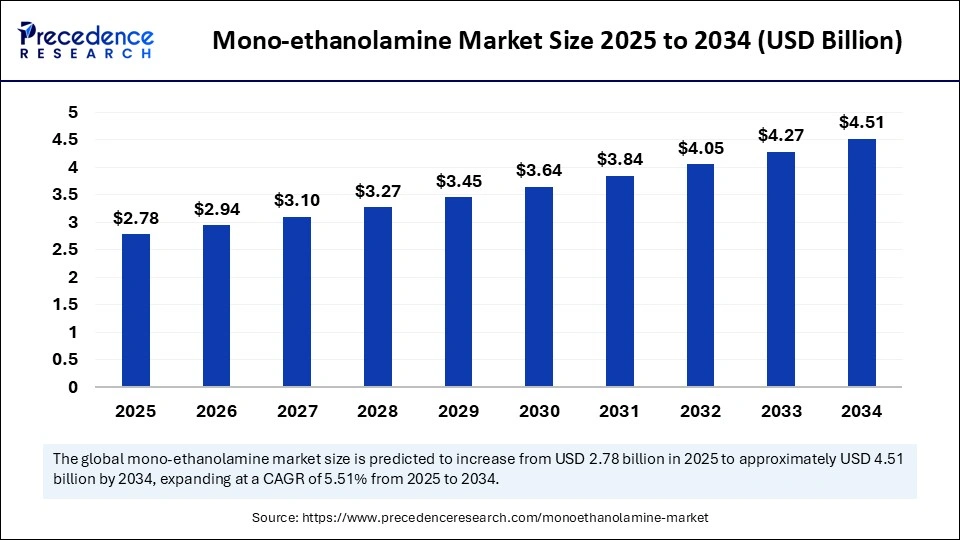

The global mono-ethanolamine market size is calculated at USD 2.78 billion in 2025 and is predicted to increase from USD 2.94 billion in 2026 to approximately USD 4.73 billion by 2035, expanding at a CAGR of 5.46% from 2026 to 2035. The mono-ethanolamine (MEA) market is an essential segment of the global chemical industry, driven by its wide use in detergents, gas treatment, cement grinding, and personal care products. Mono-ethanolamine is a key intermediate used to produce emulsifiers, surfactants, and corrosion inhibitors.

Market Highlights

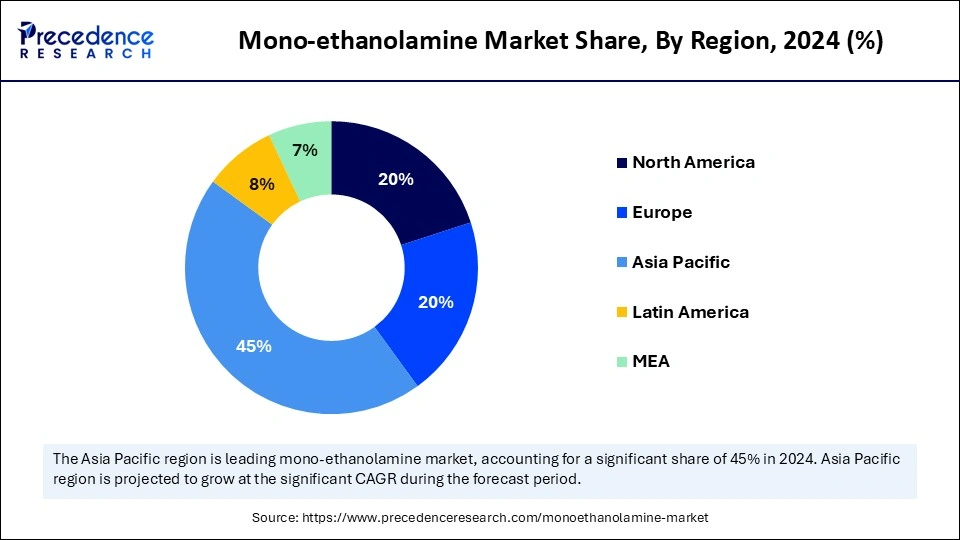

- Asia Pacific dominated the global market, accounting for 45% in 2025.

- The Middle East & Africa is expected to grow at the fastest CAGR from 2026 to 2035

- By application, the gas treating/acid-gas removal segment held the major market share of 35% in 2025.

- By application, the personal care & cosmetics segment is growing at a solid CAGR from 2026 to 2035.

- By product type/formulation, the aqueous MEA solutions segment accounted for a 30% market share in 2025.

- By product type/formulation, the blends & formulated products is poised to grow at a notable CAGR between 2026 and 2035.

- By purity/grade, the industrial/technical grade segment led the mono-ethanolamine market, accounting for 55% in 2025.

- By purity/grade, the cosmetic/personal care grade segment is expected to experience the fastest growth from 2026 to 2035.

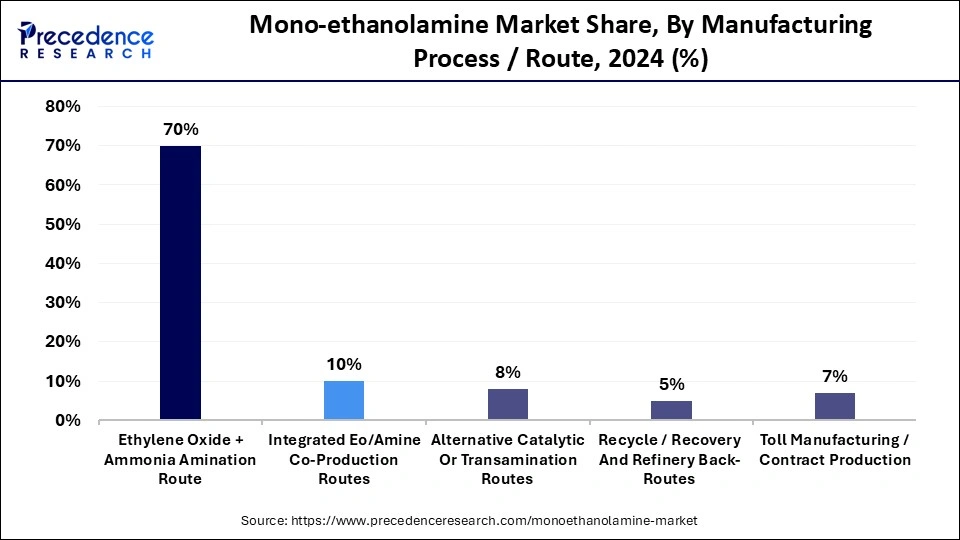

- By manufacturing process/route, the ethylene oxide + ammonia amination route segment held the largest market share of 70% in 2025.

- By manufacturing process/route, the toll manufacturing/contract production segment is growing at a healthy CAGR from 2026 to 2035

- By end-user/buyer industry, the oil & gas (natural gas, refineries) segment generated the highest market share of 33% in 2025.

- By end-user/buyer industry, the personal care & cosmetics manufacturers segment is set to grow at a remarkable CAGR from 2026 to 2035

- By distribution channel, the direct sales (bulk contracts with industrial customers) segment accounted for 50% of market share in 2025

- By distribution channel, the specialty formulators/compounders segment is projected to expand at a notable CAGR from 2026 to 2035

What is the Mono-Ethanolamine Market?

Mono-ethanolamine (MEA) is a primary ethanolamine, an organic chemical that contains both an amine and an alcohol functional group, used primarily as an intermediate and processing chemical across industries. It serves as a building block for surfactants and detergents, corrosion inhibitors, agrochemicals, and pharmaceuticals, and is widely used in gas-treating acid gas removal / COâ‚‚ and Hâ‚‚S scrubbing, textile, and metal-treatment applications. MEA is produced at an industrial scale by reacting ethylene oxide with ammonia and is supplied in technical grades for industrial end uses and in purer grades for chemical synthesis.

The mono-ethanolamine market is growing steadily, supported by rising industrialization, energy sector demand, and increased use in cleaning products. One of the major drivers is its use in gas sweetening processes to remove acidic gases like COâ‚‚ and Hâ‚‚S from natural gas. The personal care and household cleaning sectors also rely on MEA for creating mild yet effective formulations. However, the market faces regulatory challenges concerning emissions and worker safety, prompting investments in safer production technologies. The supply chain is evolving with better logistics and optimized sourcing of ethanol and ammonia, the key raw materials. Overall, the market maintains a stable growth trajectory as industries adopt cleaner formulations and efficient energy processes.

Key Technological Shift in the Market

The mono-ethanolamine market MEA industry is undergoing a gradual transformation toward cleaner and more efficient production methods. The use of advanced catalytic synthesis processes is improving yield and minimizing byproducts. Automation and process control systems are enhancing consistency and reducing energy consumption in large-scale plants. Another shift is toward bio-based ethanol sources, reducing dependency on fossil fuel-based feedstocks. Carbon capture technologies using MEA are gaining attention in power generation and refining sectors. These innovations are making MEA production more sustainable, reliable, and cost-effective, aligning with global decarbonization goals.

Market Key Trends

- Shaping the market is the rising focus on sustainability and environmental compliance. Industries are prioritizing low-toxicity and biodegradable chemicals, pushing MEA toward greener applications.

- Demand from carbon capture and storage (CCS) projects are increasing due to global emission-reduction goals. Additionally, manufacturers are emphasizing energy efficiency and resource optimization in their production processes.

- Another trend is the growing shift toward customized MEA blends for specific industrial uses. This diversification ensures flexibility in applications across construction, oil & gas, and personal care sectors.

Trade Analysis of the Mono-Ethanolamine Market

According to trade records, the global trade in mono ethanolamine consists of 11,389 total shipments exported globally, with China accounting for 1,997 shipments, Saudi Arabia accounting for 1,380 shipments, and the United States accounting for 1,173 shipments. The leading importer of mono ethanolamine is the United States, with 2,487 total shipments, followed by India with 2,144 total shipments, and Vietnam with 1,230 total shipments.

Mono-Ethanolamine Market Outlook

The MEA industry reflects the broader evolution of the global chemical sector toward greener and more efficient production. Its applications extend from gas purification and metal treatment to detergents and pharmaceuticals, making it a vital intermediate in numerous industrial processes. The industry's growth closely mirrors rising energy demand and urbanization, driving the need for cleaning and gas treatment solutions. Technological advancements are improving production efficiency while reducing environmental impact. Regulatory pressures are also shaping operational strategies, prompting companies to adopt safer, low-emission manufacturing methods. Overall, the MEA industry is transitioning toward a more sustainable and innovation-driven phase of growth.

Sustainability is becoming a central theme in the MEA market as producers and consumers alike focus on minimizing environmental footprints. Companies are investing in bio-based ethanol sources to replace fossil fuel-derived feedstocks, aligning with circular economy goals. Energy-efficient reactors and low-emission technologies are being introduced to make production cleaner and safer. The trend also extends to the use of MEA in carbon capture systems, where it helps reduce industrial COâ‚‚ emissions. Waste reduction, recycling, and responsible sourcing are becoming integral parts of corporate strategies. This sustainability-driven transformation is enhancing the industry's reputation while opening doors to new green market opportunities.

Major investments in the MEA market are primarily focused on capacity expansions, technological upgrades, and sustainability initiatives. Several companies are building or upgrading plants to improve efficiency and meet growing global demand. Governments are also supporting chemical infrastructure development through subsidies and favorable industrial policies. Investment is flowing into research aimed at developing bio-based MEA and improving carbon capture solutions. The energy and manufacturing sectors are key investors as they require large quantities of MEA for gas treatment and cleaning applications. These investments are not only driving growth but also helping the industry transition toward a more sustainable and self-sufficient ecosystem.

Startups and small-scale innovators are playing a growing role in building a sustainable MEA ecosystem. Many are focusing on bio-based ethanol production, waste-to-chemical conversion, and energy-efficient synthesis technologies. These initiatives aim to reduce carbon footprints while improving process economics. Collaborations between startups and large chemical firms are fostering innovation and knowledge sharing, accelerating the shift toward circular manufacturing. Governments and venture capitalists are providing funding to green startups that develop sustainable solvents and eco-friendly formulations. Together, these emerging players are shaping a more resilient and environmentally conscious MEA market for the future.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.78 Billion |

| Market Size in 2026 | USD 2.94 Billion |

| Market Size by 2035 | USD 4.73 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.46% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East & Africa |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Application, Product Type / Formulation, Purity / Grade, Manufacturing Process / Route, End-User / Buyer Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Mono-Ethanolamine MarketSegment Insights

Application Insights

The gas treating segment is dominating the mono-ethanolamine market, holding the share of 35%, due to this forming the backbone of the oil and gas refining process. Mono-ethanolamine sector is widely used to remove carbon dioxide and hydrogen sulfide from natural gas, ensuring cleaner fuel output. Its strong chemical affinity for acidic gases makes it a preferred absorbent in large-scale gas treatment units. Refineries rely on MEA-based systems to meet stringent emission regulations and improve fuel quality. Additionally, its role in post-combustion carbon capture is expanding with global decarbonization efforts. The reliability, cost-effectiveness, and adaptability of MEA in gas purification secure its dominance in industrial gas processing.

The personal care and cosmetics segment is the fastest-growing application with an expected CAGR of 5%, due to its use in emollients, surfactants, and pH regulators. Its mild chemical nature allows it to be safely incorporated into shampoos, creams, and cleansers. As consumer demand for gentle and skin-friendly products rises, MEA's role in formulations has expanded. The growing trend toward self-care and grooming products further boosts demand across emerging economies. Manufacturers are increasingly adopting cosmetic-grade MEA for its versatility and stability in formulations. With clean-label and eco-friendly beauty trends, this segment is expected to see continuous growth.

Product Insights

Aqueous MEA solutions dominate the mono-ethanolamine market by holding the share of 30%, due to their flexibility and efficiency across industrial processes. These solutions are used extensively in gas treatment, metal cleaning, and cement grinding aids. The ability to tailor concentration levels makes them suitable for both high-performance and general-purpose applications. Industrial users prefer aqueous forms for ease of handling and cost efficiency. Their consistent demand from refineries and power plants ensures steady market dominance. Moreover, advancements in solution stabilization are enhancing their shelf life and operational reliability.

The blends & formulated products segment is the fastest-growing, with a 15% CAGR, as industries seek customized solutions for specific needs. These formulations combine MEA with other amines to improve performance and reduce corrosion in gas treatment systems. Inhibited grades are gaining traction due to their improved safety and lower degradation rates. Companies are developing proprietary blends to optimize energy efficiency in COâ‚‚ capture and processing. Such innovations are helping end users reduce maintenance costs and enhance operational lifespan. As industries prioritize tailored chemistry, this segment continues to expand at a fast pace.

Purity/Grade Insights

The industrial-grade segment holds the largest share of 55% in the market for mono-ethanolamine, due to its extensive use in refineries, gas processing, and cleaning applications. It offers the right balance between purity and cost-effectiveness, making it ideal for large-scale use. Industries value this grade for its strong solvency, consistency, and ease of integration into existing systems. Its wide availability and compatibility with other industrial chemicals further enhance its dominance. Continuous improvements in refining and purification processes are boosting product quality. Overall, industrial-grade MEA remains the workhorse of the global market.

The cosmetic-grade/personal-care grade segment is set to be the fastest-growing at an 8% CAGR, due to the rising preference for mild and skin-safe chemical ingredients. Its refined purity makes it suitable for use in shampoos, lotions, and facial cleansers. As consumers become more conscious of product safety, cosmetic manufacturers are increasing MEA usage in controlled formulations. The growth of organic and dermatologically safe products further supports this segment. Additionally, technological improvements are enabling better-quality cosmetic-grade MEA with minimal impurities. This segment's expansion is closely tied to the booming global beauty and personal care market.

Manufacturing Process / Route Insights

The ethylene oxide and ammonia amination route remains the primary commercial process type for the mono-ethanolamine sector by holding share 70% because it is highly efficient, cost-effective, and capable of producing high-purity output. This method is well-established globally and supported by strong infrastructure in chemical manufacturing. The scalability of this process ensures consistent supply for industrial applications. Its integration with large petrochemical complexes reduces operational costs and improves material flow efficiency. Due to its reliability and high yield, this route continues to dominate global MEA production.

Toll manufacturing and contract production is set to be the fastest growing with a CAGR of 7% because smaller chemical firms and startups often outsource MEA synthesis to established manufacturers. This approach helps optimize costs and meet short-term market demand without heavy capital investment. Contract production also supports regional supply resilience, reducing dependency on imports. As global demand for customized MEA blends rises, toll production partnerships are becoming more common. This segment's agility and scalability make it one of the fastest-growing in the value chain.

End User / Buyer Industry Insights

The oil and gas industry segment is dominating the mono-ethanolamine market, holding a share of 33% due to its essential role in gas sweetening and refining. Mono-ethanolamine efficiently removes COâ‚‚ and Hâ‚‚S impurities, ensuring compliance with emission norms and improving product quality. The growing number of refining and natural gas projects sustains high consumption levels. With carbon capture technologies gaining attention, the demand for MEA in energy sectors is also rising. Its proven performance, low cost, and availability make it the preferred absorbent across global refineries. The continuous push for clean energy reinforces the dominance of this end-user segment.

Personal care manufacturers represent the fastest-growing end-user segment by holding a share of 22%, as global beauty and hygiene awareness expands. Mono-ethanolamine is used as a key ingredient in surfactants and emulsifiers that enhance product texture and performance. The increasing focus on mild and eco-friendly ingredients has boosted MEA's relevance in skincare and haircare products. As demand for self-care products rises in emerging markets, manufacturers are scaling up production using cosmetic-grade mono-ethanolamine. Innovative startups in cosmetics are also experimenting with MEA-based sustainable formulations. This growing consumer-centric trend is driving rapid expansion in the segment.

Distribution Channel Insights

Direct sales dominate the mono-ethanolamine market, accounting for 50% of sales, as bulk supply contracts ensure stable pricing and long-term partnerships between producers and end users. This channel allows manufacturers to optimize logistics and maintain steady cash flow. Large-scale buyers prefer direct procurement to ensure consistent product quality and availability. Direct sales also enable producers to offer customized concentrations and packaging formats. This model remains the backbone of industrial chemical distribution due to its efficiency and reliability.

Specialty formulators are the fastest-growing channel in the market as industries demand customized mono-ethanolamine-based solutions. These intermediaries develop blends and additives tailored for applications like cleaning, carbon capture, and cosmetics. Their agility and innovation help meet niche market requirements faster than traditional suppliers. As the focus shifts to performance-specific formulations, compounders are gaining more influence in the value chain. Small and medium enterprises increasingly rely on these channels for specialized needs. The segment's ability to deliver flexible, customer-oriented solutions drives its rapid market growth.

Mono-Ethanolamine MarketRegional Insights

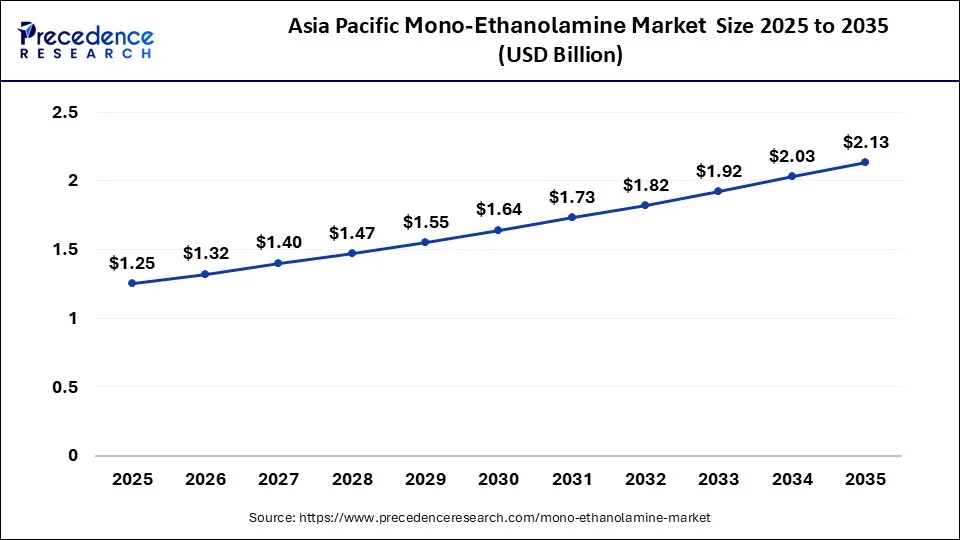

The Asia Pacific mono-ethanolamine market size is expected to be worth USD 2.13 billion by 2035, increasing from USD 1.25 billion by 2025, growing at a CAGR of 5.47% from 2026 to 2035

Why Asia Pacific is Dominating the Mono-Ethanolamine Industry?

Asia Pacific dominates the mono-ethanolamine industry with a 45% share, because it is driven by its strong industrial and manufacturing base. Countries like China, India, Japan, and South Korea have extensive demand for textiles, detergents, and gas treatment sectors. The region benefits from cost-effective labor, abundant feedstock availability, and expanding industrial infrastructure. Rapid urbanization and energy sector growth are fueling continuous MEA consumption. Local manufacturers are investing in expanding capacities to cater to regional and export demand. Additionally, environmental regulations are encouraging the adoption of improved production technologies.

China Mono-Ethanolamine Industry Analysis

China is the dominant in Asia Pacific region in the mono-ethanolamine sector due to its large-scale chemical manufacturing capacity and investments in carbon capture and industrial cleaning applications. India follows with growing demand from detergent and personal care industries. Japan and South Korea emphasize high-purity MEA for specialized uses like electronics and pharmaceuticals. Southeast Asian countries such as Indonesia and Vietnam are emerging as new markets with increasing industrialization. The combination of low production costs and rising domestic demand makes Asia-Pacific a key global supplier. This dominance is expected to continue as infrastructure and technology investments expand across the region.

The North America mono-ethanolamine market size has grown strongly in recent years. It will grow from USD 556.00 million in 2025 to USD 978 million in 2035, expanding at a compound annual growth rate (CAGR) of 6.36% between 2026 to 2035.

What is North America Showing Notable Growth in the Mono-Ethanolamine Market?

North America has shown notable growth in the mono-ethanolamine industry during 2025, with a 20% share, driven by strong industrial, environmental, and technological progress. The region's expanding oil and gas sector continues to rely heavily on MEA for natural gas sweetening and refinery gas treatment. The increased focus on carbon capture and storage (CCS) projects is also boosting MEA demand as industries work to reduce emissions. The presence of well-established chemical manufacturers and advanced processing facilities ensures consistent innovation and product availability. Additionally, the growing personal care and cleaning products industries are creating new avenues for MEA-based formulations. Supportive regulatory policies and sustainability goals are further strengthening market prospects across the region.

U.S. Mono-Ethanolamine Sector

The U.S. dominates the regional mono-ethanolamine market, driven by its large refinery base and rapid expansion of carbon capture initiatives. Canada is emerging as a strong participant with increasing investments in sustainable gas processing and environmental compliance technologies. Mexico's growing manufacturing and industrial sectors are also contributing to MEA consumption, especially in cleaning and industrial formulations. The U.S. market is characterized by the presence of major producers focusing on energy efficiency and low-emission technologies. Canada's focus on energy transition aligns with the use of MEA in eco-friendly and emission-reduction applications. Overall, North America's balance of industrial strength, environmental responsibility, and innovation makes it a critical contributor to the global MEA market's growth.

Middle East is the fastest-growing segment in the mono-ethanolamine space by holding the share of 8%, due to expanding oil & gas, construction, and manufacturing sectors. The use of MEA in gas sweetening for natural gas purification is a significant driver in Gulf nations. Governments are investing heavily in downstream chemical industries to diversify their economies beyond oil. This has led to the establishment of new chemical plants and partnerships with global firms. Moreover, rising population and urban development are driving demand for detergents and cleaning products. The region's focus on industrial self-sufficiency is further boosting MEA production capacity.

Saudi Arabia Mono-ethanolamine Market Analysis

Saudi Arab is dominating the Middle East region for the mono-ethanolamine sector due to expanding oil & gas, construction, and manufacturing sectors. The use of MEA in gas sweetening for natural gas purification is a significant driver in Gulf nations. Governments are investing heavily in downstream chemical industries to diversify their economies beyond oil. This has led to the establishment of new chemical plants and partnerships with global firms. Moreover, rising population and urban development are driving demand for detergents and cleaning products. The region's focus on industrial self-sufficiency is further boosting MEA production capacity.

Mono-Ethanolamine Market Value Chain

The primary raw materials for mono-ethanolamine market production are ethylene and ammonia, which react to form ethanolamine derivatives. Ethylene is often derived from petrochemical processes, while ammonia is produced from natural gas. Increasingly, companies are exploring bio-based ethylene derived from ethanol to reduce carbon footprints. Secure, cost-efficient sourcing of these materials is vital to market stability. Some manufacturers enter long-term contracts with suppliers to avoid price volatility. Regional self-sufficiency in feedstocks also enhances competitiveness in the MEA market.

Recent advancements in the mono-ethanolamine market production focus on energy efficiency and process optimization. New catalytic routes are minimizing waste generation and improving product yield. Automation and real-time monitoring systems ensure tighter control over reaction parameters, enhancing quality. The development of bio-based ethanol feedstocks supports sustainable production practices. Research efforts are also aimed at improving MEA’s performance in gas treatment and COâ‚‚ capture. These advancements collectively make the MEA industry more efficient and environmentally responsible.

Recent Developments

- On July 15, 2025, Dow Chemical announced a price increase on ethanolamines, including MEA, effective July 15, 2025, adjusting prices upward to account for feedstock cost changes and market demand dynamics. This launch is reflecting pricing strategies by major chemical producers. (Source- https://www.greenchemindustries.com)

- In October 2025, A petroleum tanker named Torm Agnes arrived at the Port of Ensenada on Mexico's Pacific coast, carrying nearly 120,000 barrels of diesel. Such a vessel was an unusual sight in this port, which is typically frequented by cruise ships, luxury yachts, and container vessels. Ensenada does not have the necessary infrastructure to safely offload flammable hydrocarbons, making the events that followed later that day even more unexpected.

- In October 2025, An extraordinary archaeological find in Aylesbury, England, has amazed both scientists and historians. Led by Oxford Archaeology, the excavation in Buckinghamshire uncovered a Roman-era egg that has miraculously remained intact for 1,700 years still containing its original liquid contents. Named the Aylesbury egg, it is thought to be the only surviving specimen of its kind anywhere in the world.

Mono-Ethanolamine Market Companies

BASF SE is one of the largest producers of monoethanolamine (MEA), offering high-purity grades used in gas treatment, detergents, and chemical intermediates. The companys focus on sustainable production and efficient amine recovery systems enhances its leadership in the global amines market.

Dow manufactures monoethanolamine as part of its extensive amines portfolio, catering to applications in gas sweetening, surfactants, and agricultural chemicals. The company’s commitment to innovation and advanced process technologies ensures consistent product quality and environmental efficiency.

Nippon Shokubai produces monoethanolamine for use in surfactants, detergents, and coatings. The company’s advanced manufacturing processes emphasize purity and performance, supporting applications in industrial and consumer chemical sectors.

Nouryon supplies MEA for use in personal care, cleaning agents, and gas treatment processes. Its sustainability-driven approach focuses on environmentally responsible production and tailored amine formulations for diverse industries.

SABIC is a key global supplier of ethanolamines, including monoethanolamine, primarily serving gas treating and industrial chemical markets. Its integrated petrochemical operations and strong global logistics support cost-efficient, large-scale production.

Sasol produces ethanolamines through its extensive chemical division, focusing on MEA for gas purification, surfactant production, and textile processing. Its vertically integrated operations and consistent quality make it a major supplier in Africa and global markets.

INEOS manufactures monoethanolamine as part of its intermediates and solvents division, emphasizing applications in gas treating and chemical synthesis. Its large-scale production capacity and technical expertise ensure reliability and competitiveness.

Lotte Chemical produces MEA for industrial and chemical manufacturing applications, leveraging advanced process control and quality assurance systems. The company serves growing demand across Asia for surfactants and gas treatment chemicals.

AkzoNobel supplies monoethanolamine for coatings, cleaning products, and specialty chemicals. The company’s focus on innovation and eco-friendly formulations supports its role in high-value chemical markets.

Huntsman is a leading global supplier of ethanolamines, offering MEA for gas treatment, agrochemicals, and industrial detergents. Its efficient production processes and global distribution network ensure strong market presence and customer reliability.

Petronas Chemicals produces monoethanolamine as part of its petrochemical product line, supplying to Southeast Asian markets. Its focus on integrated manufacturing ensures cost-effective, high-quality output for industrial applications.

Lubrizol uses MEA as a raw material in formulating additives and specialty chemicals. Its high-performance lubricant and coating products rely on MEA derivatives for stability and performance enhancement.

HELM AG distributes ethanolamines, including MEA, serving industrial customers worldwide. Its expertise in chemical logistics and supply chain management strengthens global access to high-quality MEA.

Mono-Ethanolamine MarketSegment Covered in the Report

By Application

- Gas Treating / Acid-Gas Removal

- Natural Gas Sweetening

- Refinery Gas Treating

- Post-combustion capture

- Surfactants & Detergents Intermediates

- Anionic Surfactant Intermediates

- Non-Ionic / Amine-Derived Surfactants

- Agrochemical Intermediates

- Herbicide & Pesticide Intermediates

- Fertilizer Additives

- Personal Care & Cosmetic

- Emollients & Surfactant Precursors

- Cosmetic Intermediates

- Pharmaceuticals & fine chemicals

- Active pharmaceutical intermediates (APIs) precursors

- Specialty Fine Chemicals

- Corrosion Inhibitors & Metal Treatment

- Metal Pickling/Neutralization Agents

- Corrosion Inhibitor Formulations

- Oil & gas (EOR, drilling fluids & formulations)

- Water treatment & wastewater treatment chemicals

- Amine-Based Scrubbing In Industrial Wastewater

- Conditioning & pH Control Additives

- Textile Processing & Finishing

- Dyeing Auxiliaries

- Fabric Treatment Chemistries

- Other Industrial Intermediates & Niche Uses

- Adhesives, Coatings, Mining Reagents, Lab Reagents

By Product Type / Formulation

- Aqueous MEA Solutions (Various Concentrations)

- Low-To-Mid Concentration Technical Solutions

- High Concentration Industrial Solutions

- Technical / Industrial Liquid Mea (Bulk)

- Reagent / Pharmaceutical Grade Mea (High Purity)

- Blends & Formulated Products (Amine Blends, Inhibited Grades)

- MEA + corrosion inhibitor blends

- Customized Gas-Treating Formulations

- Derivatives & Salts (Ethanolamine Salts, Stabilized Forms)

- Packaged / Retail Small Containers (Lab, Specialty)

By Purity / Grade

- Industrial / Technical Grade

- Custom / Contract-Manufactured Grades

- Reagent / Pharmaceutical Grade

- Cosmetic / Personal-Care Grade

- Analytical / Ultra-High Purity

- Food-Grade / Regulated Specialty

By Manufacturing Process / Route

- Ethylene Oxide + Ammonia Amination Route

- Integrated Eo/Amine Co-Production Routes

- Alternative Catalytic Or Transamination Routes

- Recycle / Recovery And Refinery Back-Routes

- Toll Manufacturing / Contract Production

By End User / Buyer Industry

- Oil & Gas (Natural Gas, Refineries)

- Chemical & Surfactant Manufacturers

- Agrochemical Producers

- Personal Care & Cosmetics Manufacturers

- Pharmaceuticals & Fine Chemical Producers

- Water & Wastewater Utilities / Industrial Water Processors

- Metalworking & Corrosion Treatment Shops

- Textile Mills & Finishers

- Other Industrial Buyers

By Distribution Channel

- Direct Sales

- Chemical Distributors & Traders

- Specialty Formulators/Compounders

- Toll Manufacturers/Contract Suppliers

- Retail / Packaged Sales (Small Drums, Lab Packs)

- E-Commerce/Online Specialty Channels

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting