What is the Multi-Tenant Data Centers Market Size?

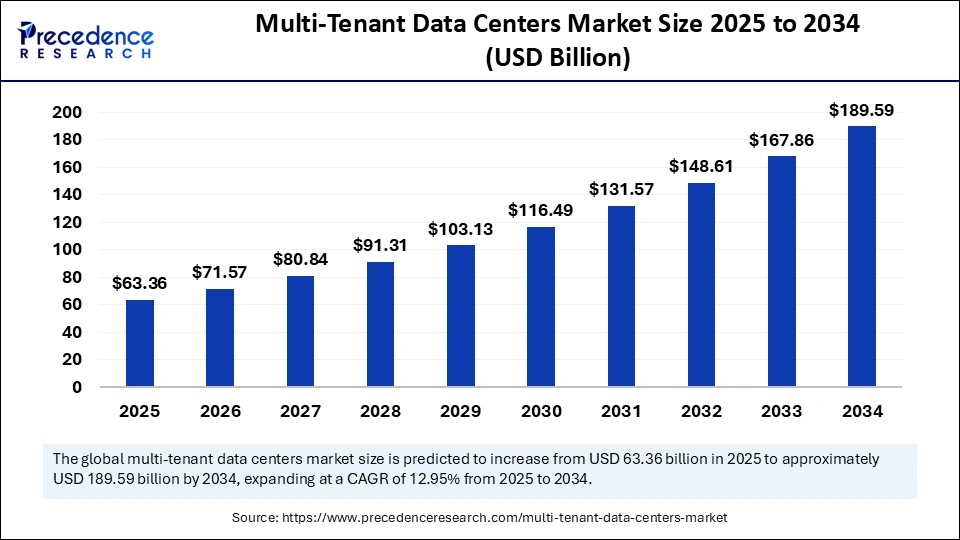

The global multi-tenant data centers market size is accounted at USD 63.36 billion in 2025 and predicted to increase from USD 71.57 billion in 2026 to approximately USD 189.59 billion by 2034, expanding at a CAGR of 12.95% from 2025 to 2034. The increasing demand for high-speed and low-latency data transmission with precise processing owing to recent technologies, growing adoption of cutting-edge technologies by businesses and SMEs looking for cost cost-efficient way to transfer data seamlessly, are prime reasons for the market's growth globally.

Multi-Tenant Data Centers Market Key Takeaways

- In terms of revenue, the global multi-tenant data centers market was valued at USD 56.10 billion in 2024.

- It is projected to reach USD 189.59 billion by 2034.

- The market is expected to grow at a CAGR of 12.95% from 2025 to 2034.

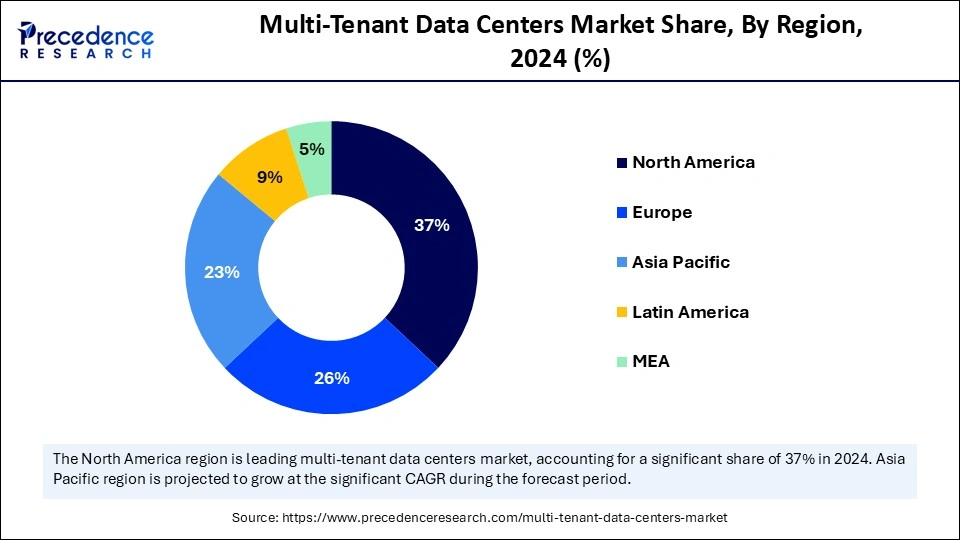

- North America dominated the multi-tenant data centers market with the largest market share of 37% in 2024.

- Asia Pacific is expected to witness the fastest CAGR during the forecasted years.

- By service type, the retail colocation segment held the largest market share in 2024.

- By service type, the hyperscale colocation segment is expected to witness the fastest CAGR during the foreseeable period.

- By data center type, the carrier-neutral MTDCs segment captured the highest market share in 2024.

- By data center type, the cloud-neutral MTDCs segment is expected to witness the fastest CAGR during the foreseeable period.

- By construction type, the greenfield MTDC segment contributed the biggest market share in 2024.

- By construction type, the modular & prefabricated MTDC segment is expected to witness the fastest CAGR during the foreseeable period.

- By end user, the cloud service providers segment generated the major market share in 2024.

- By end user, the content/OTT providers segment is expected to witness the fastest CAGR during the foreseeable period.

Scalability in the Infrastructure of the Digital Ecosystem

Cloud adoption is increasing, applications are becoming data hungry, and enterprises are undergoing digital transformation, all of which are increasing demand for the multi-tenant data center. Multi-tenant data centers allow businesses to share physical infrastructure and realize the benefit of dedicated IT environments at the same time. These benefits include cost optimization, scalability, and efficient energy use.

As companies expand their hybrid and edge computing initiatives, the multi-tenant data center will become critical in supporting low-latency connectivity and management of resources. Furthermore, their increasing role in supporting AI workloads, cloud computing model for hyperscale, and sustainability practices demonstrates its necessity in the architecture of digital infrastructure and ability to deliver operational agility and speed of technology advancement globally across industries.

How is AI Transforming the Multi-Tenant Data Centers Market?

Artificial intelligence can be highly beneficial for multi-tenant data centers in terms of its efficiency and resource management, which leads to sustainable energy usage. It is achievable through automation, predictive analytics, data analysis, and optimization by using intelligent AI models. AI helps to fine-tune and automate various basic yet crucial functions of data centers to run more efficiently with cost savings as well. Intelligent AI algorithms can detect the workload of tenants' data centers by recognizing their usage patterns, which understand distribution, computation, storage facilities, and dynamic networking resources. This resolves the over-provisioning of one tenant and reduces the impact of one tenant's energy usage on the other tenant's performance, which is a crucial factor in the multi-tenant data centers market.

What Are the Key Trends in the Multi-Tenant Data Centers Market?

- Edge computing and sustainability: The increasing growth of edge computing is due to growing demands for low-latency applications for energy savings and the prevention of data loss. Providers are placing more localized data processing, which is nearer to the users. AI is further integrated to leverage its benefits like resource management, increased security, identifying issues, and optimization of cooling systems for energy efficiency. This shift is highlighting the urgency of sustainable practices and the development of green data centers that are highly sophisticated, conscious of water usage, to not overburden natural resources like water.

- Cloud adoption with digitalization: Multi-tenant data center market is further witnessing a significant trend in ongoing digital transformation and businesses prioritizing to shift their services to a cloud platform to gain maximum efficiency, which leads to business growth by reaching maximum consumers. Organizations are looking for scalable and highly flexible infrastructure to support such platforms. Data storage and processing capabilities have become crucial aspects for data centers due to ongoing advancements and the launch of technologies like big data, streaming services, and IoT.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 189.59 Billion |

| Market Size in 2025 | USD 63.36 Billion |

| Market Size in 2026 | USD 71.57 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.95% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Data Center Type, Construction Type, End User / Tenant Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for scalable IT infrastructure

A significant driving factor for the multi-tenant data centers market includes growing demand for cost-effective and highly scalable IT infrastructure, which supports changes in consumers' demand for services and offers exact services without redundancy. The operational cost of building and maintaining data centers is huge and capital-intensive, which is not advisable for start-ups and SMEs due to their budget constraints.

Therefore, multi-tenant data centers offer a great possibility to expand such businesses without the need for their own data centers by offering reliable IT infrastructure with professional support. A business can start over a small amount of rack space and effectively strengthen its presence globally amidst fluctuating energy demands, and offer seamless services.

Restraint

Effects like “noisy neighbour”

Multi-tenant data centers share many benefits, especially for SMEs and start-ups. However, drawbacks like operational complexity issues, data privacy threats, and noisy Neighbour effects due to excessive computing by a single tenant can affect other tenants in terms of performance. This can be solved by implementing rules for the allocation and usage of resources. Also, various businesses working in a sensitive sector like legal jurisdiction, data compliance, and finance-related workings may need to adopt stringent privacy methods to secure their data, which might be vulnerable and open for illegal activities due to its internal copy in a data center in a shared resource environment.

Opportunity

Expansion of hyperscale data centers

A prominent opportunity that the multi-tenant data center market holds is increasing demand for hyperscale data centers due to emerging technologies like big data, AI/ML, and IoT, along with 5G adoption. Hyperscale data centers are designed to offer data and computation processes in large volumes. Hyperscale data centers are mainly handled and owned by leading cloud providers like Microsoft and Amazon Web Services to offer support for their public cloud systems.

Hyperscale data centers have at least 5000 servers along with thousands of square feet, which provide higher scalability, efficiency, and redundancy by leveraging innovations like automation processes and virtualization to meet the extensive demand of various technologies used in organizations. This creates a significant opportunity for the multi-tenant data centers to collaborate with hyperscale data centers and fulfill the infrastructure needs of leading tech giants who require vast amounts of space and strength to process huge datasets.

Service Type Insights

Why do retail colocation services majorly prefer the multi-talent data centers market?

The retail colocation segment held the largest market share in 2024. Retail colocations offer enterprises to lease small space with power addition to avoid the high capital investments which is majorly related to data center building and its Maintenace which causes huge cost savings and support SMEs and start-ups to expand without mandate of huge investment is a key factor. Retail colocations provide a faster deployment cycle as compared to larger solutions, fueling the segment's demand.

The hyperscale colocation segment is expected to witness the fastest CAGR during the foreseeable period of 2025-2034. The increasing growth of AI/ML models across different sectors like healthcare, finance, and manufacturing creates huge amounts of data that need processing and proper storage, and hyperscale facilities are built exactly for that. Hyperscale colocation offers high-density racks, highly advanced cooling systems for high-density GPUs, and power-optimized designs, which are crucial for high-performance computing.

Data Center Type Insights

What is offered by carrier-neutral MTDCs in the multi-tenant data centers market?

The carrier-neutral MTDCs segment held the largest market share in 2024. Carrier-neutral MTDCs provide flexibility and choice, along with cost effectiveness, as consumers can select from multiple services, offering them the best options for expected costs. High uptime and reliability can be achieved by offering access to various networks and providing cross-connects, carrier-neutral MTDCs. It also improved performance by using direct cross-connections within the facility, which avoids public internet usage and offers reduced latency with high speed for secured data transmission.

The cloud-neutral MTDCs segment is expected to witness the fastest CAGR during the foreseeable period. Cloud-neutral MTDCs provide environments where workloads can be easily shifted from one platform to another when necessary. This offers businesses to cope with their evolving businesses and their needs according to the most suitable cloud services. Also, cloud-neutral MTDCs act as an interconnection hub that supports direct connections to many network providers and allows the deployment of edge data processing nearer to users.

Construction Type Insights

How is greenfield construction helping the multi-tenant data centers market to expand globally?

The greenfield MTDC's segment held the largest market share in 2024. Greenfield build provides a unique approach to construct a facility from the ground upwards and creates an expected environment that exactly aligns with the requirements of multiple tenants without compromising on previously established infrastructure. Greenfield data centers are built with the potential to expand in the future, making it easier to scale up or down as per the client's requirement, which is crucial in the evolving digital landscape. By using greenfield construction type, operators can add the latest and most efficient technologies, aligned practices for better results, along with cooling practices that are eco-friendly.

The modular & prefabricated MTDC segment is expected to witness the fastest CAGR during the foreseeable period. This type of construction offers faster deployment, cost-effectiveness, with high scalability and flexibility. Prefabrication and modularity offer significant time savings as various components; devices are tested on a prior basis before quick assembly. Enterprise can add or reduce modules as per the requirement.

End User Insights

Why does cloud service require multi-tenant data centers?

The cloud service providers segment held the largest multi-tenant data centers market share in 2024. Cloud platforms require massive and scalable infrastructure to fulfill fluctuating demand, which offers highly cost-effective solutions instead of managing on-premises data centers. The increasing shift towards digital services and remote work has increased the dependency on cloud-based applications and infrastructure, which highlights the importance of multi-tenant data centers to support ongoing advancements like 5G, AI/ML, and the Internet of Things.

The content/OTT providers segment is expected to witness the fastest CAGR during the foreseeable period. Content creation and OTT platforms need massive data handling due to their millions of consumers and their demand for high-value streaming, and changing demand with every season. OTT needs to serve high-speed processing with low latency for better delivery of audio and video. Thus, they need to set their own data centers near their source or end-users, and multi-tenant data center facilities are highly recommended for this due to their convenience and affordability.

Regional Insights

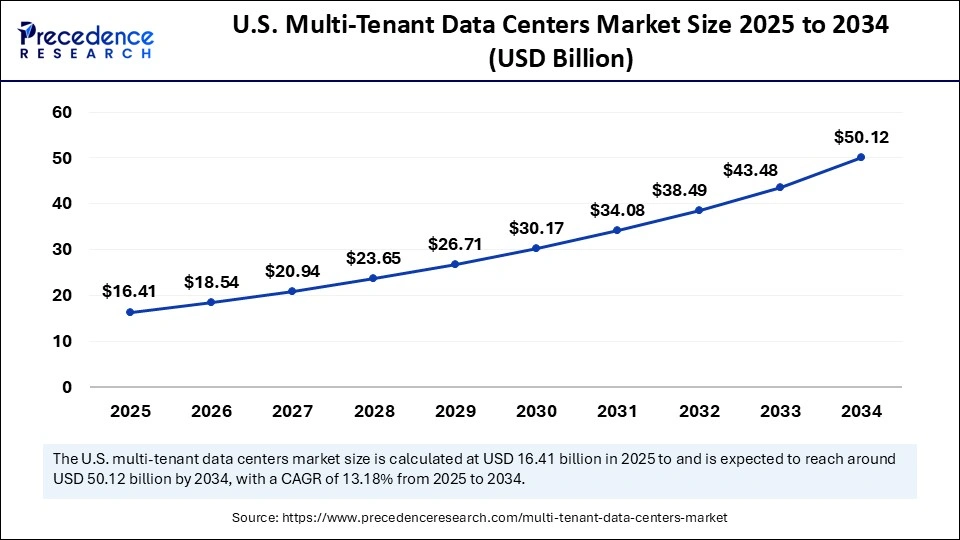

U.S. Multi-Tenant Data Centers Market Size and Growth 2025 to 2034

The U.S. multi-tenant data centers market size is exhibited at USD 16.41 billion in 2025 and is projected to be worth around USD 50.12 billion by 2034, growing at a CAGR of 13.18% from 2025 to 2034.

What are the key factors supporting the growth of the North America multi-tenant data centers market?

North America held the largest market share in 2024. The region's dominance can be attributed to several factors, such as tech leaders' presence and active launch of services, growing digital transformation with cloud computing, supportive business environment, well-established infrastructure, along with an abundance of land and power, which is highly crucial for the establishment and seamless workings of multi-tenant data centers. High adoption of cloud services is augmented by technologies like IoT, big data analytics, and AI/ML that need precise data processing and storage. The region has many tech giants like AWS, Google, and Microsoft, which are leading consumers of data center capabilities.

In addition to this, North America benefits from supportive government policies that provide help to data center operations with business expansion, and less stringent regulations make it easier to adopt, as compared to other regions. Multi-tenant data center growth in America further depends on its well-established IT sector, high-speed adoption of the internet, and dense connectivity infrastructure.

How is the Asia Pacific significantly contributing to the growth of the multi-tenant data centers market?

Asia Pacific is expected to witness the fastest CAGR during the forecasted years. The region is expanding due to growing adoption of cloud computing, artificial intelligence, and digital services, along with growing demand for localized data centers to reduce redundancy and seamless data transfer to align with evolving regulations for data privacy and safety. Leading countries like China, India, and other Southeast Asian countries are rapidly adopting cutting-edge technologies with robust infrastructure that supports the growth of e-commerce platforms, digital transactions, and streaming services is another key reason for the adoption of multi-tenant data centers in the Asia Pacific. Also, the strategic geographical location of the Asia Pacific region is serving as a gateway for Europe and North American markets, and for uninterrupted data transfer is further fueling the market growth in the region.

U.S. Multi-tenant Data Centers Market Trends:

The United States leads the multi-tenant data centers segment, spurred by widespread adoption of cloud services, significant hyperscale investments, and the growth of AI workloads. Key technology clusters, such as Silicon Valley, Northern Virginia and Dallas, contain large-scale facilities that are backed by both fiber connectivity and renewable energy growth. Demand is also increasing as enterprises move IT infrastructure to external providers to decrease expenses and increase scalability.

China Multi-tenant Data Centers Market Trends:

China is a rapidly growing market for multi-tenant data centers, fueled by government-mandated digital transformation and demand from e-commerce and cloud service providers. Beijing, Shanghai, and Shenzhen have emerged as the main data center locations. Domestic technology players like Alibaba Cloud and Tencent are investing heavily in hyperscale facilities, aided by favorable data localization policy and advancement of 5G and AI infrastructure.

Europe Multi-tenant Data Centers Market Analysis:

The multi-tenant data centers market in Europe is rapidly growing due to the rise in cloud services, regulatory compliance for data localization, and increasing digital transformation. This region of the world has strong connectivity networks, utilization of renewable energy sources, and government policies encouraging sustainable data centers. Germany leads Europe with a robust IT ecosystem, a large user base of enterprise clients, and a focus on green energy. Data center clusters such as Frankfurt serve to bolster Germany's position as a key connectivity hub for Europe.

Middle East and Africa Multi-tenant Data Centers Market Trends:

The MEA region has emerged as a strong market for multi-tenant data centers, driven by rapid digital transformation, smart city projects, and overall increased internet usage. Government backed diversification of economies and foreign direct investment are further driving infrastructure growth. In addition, new cloud services being adopted by enterprises and hyperscalers continue to improve the need for advanced data center facilities across Gulf States and throughout metropolitans in Africa.

- The UAE is the leader in the MEA region, with its visionary digital agenda, foreign direct investment policies, and geographical location within the world. Significant projects in Dubai and Abu Dhabi are driving the region to be a data center location in the MEA.

Value Chain Analysis

Power Generation

This step involves a complete process of creating and procuring energy for multi-tenant data centres with sustainable power.

Key players:Caterpillar, Cummins, TATA Power Solar, AWS, Google.

Distribution Network Management

This stage involves the management of energy generated and distribution towards expected points using multi-tenant data centres to the consumer's server rack that is allocated.

Key players:Eaton, Schneider Electric, ABB, and Vertiv

Energy Storage Systems

This stage prioritizes energy storage for backup, peak shaving, and incorporates renewable energy sources to shift from conventional energy sources to highly advanced and sustainable ones.

Key players:Hitachi Energy, ABB, Samsung SDI, LG Energy Solutions.

Multi-Tenant Data Centers Market Companies

- Equinix, Inc.

- Digital Realty Trust, Inc.

- CyrusOne, Inc.

- CoreSite Realty Corporation

- NTT Global Data Centers

- Iron Mountain Data Centers

- Global Switch

- China Telecom Global (CTG)

- China Mobile International (CMI)

- Telehouse (KDDI Group)

- QTS Realty Trust

- ST Telemedia Global Data Centers (STT GDC)

- Keppel Data Centers

- NEXTDC Limited

- Vantage Data Centers

Recent Developments

- In October 2024, Equinix planned to develop more than USD 15B JBV to proliferate Hyperscale data centers in the United States to accelerate evolving AI and cloud computing. Under the terms of the agreement, CPP Investments and GIC will each control a 37.5% equity interest in the joint venture, and Equinix will own a 25% equity interest. Each party has made equity commitments, and the joint venture also expects to take on debt to raise the total pool of investable capital to more than US$15 billion over time.(Source: https://www.equinix.com/newsroom)

- In December 2024, leading tech player Google and Intersect Power collaboratively planned to develop co-located energy parks having USD20 billion of renewables and storage systems. The first phase of the first co-located clean energy project is expected to be operational by 2026 and is anticipated to be fully complete by 2027.(Source: https://www.utilitydive.com)

Segments Covered in the Report

By Service Type

- Retail colocation (rack/cage-based, shared space)

- Wholesale colocation (dedicated suites, higher power capacities)

- Hyperscale colocation (custom-built for hyperscalers)

- Managed hosting & edge colocation

- Interconnection services (cross-connects, cloud on-ramps)

- Disaster recovery & business continuity suites

By Data Center Type

- Carrier-neutral MTDCs (multiple network providers)

- Carrier-specific MTDCs (owned by telecom operators)

- Cloud-neutral MTDCs (multi-cloud interconnection hubs)

- Specialized vertical MTDCs (finance, healthcare, etc.)

By Construction Type

- Greenfield MTDCs (new builds)

- Brownfield MTDCs (retrofit/upgrades)

- Modular & prefabricated MTDCs

- End User / Tenant Type

- Cloud service providers (CSPs, hyperscalers)

- Telecom operators & network providers

- Content & OTT providers (media/streaming)

- BFSI institutions

- Healthcare & life sciences

- Government & defense

- Enterprises across industries

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting