What is the Multimodal Transport Market Size?

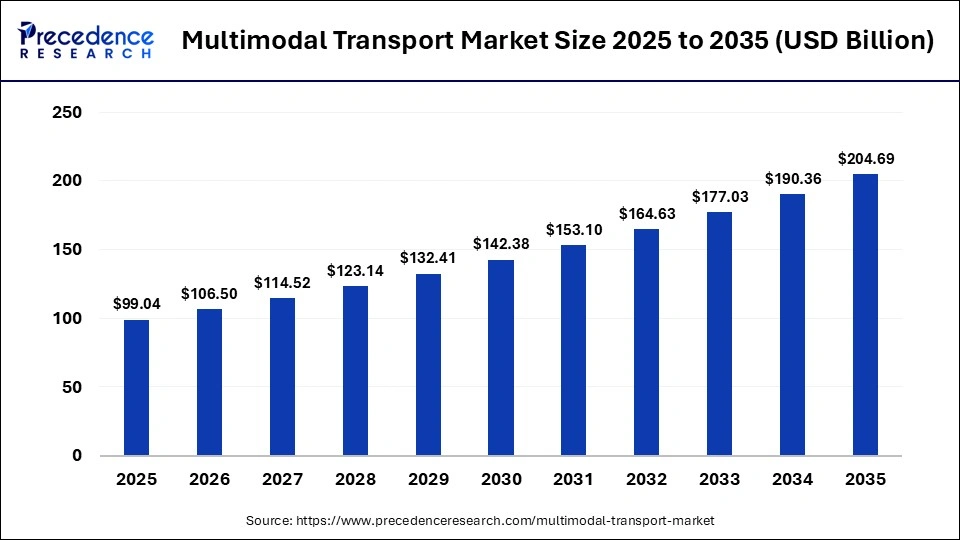

The global multimodal transport market size was calculated at USD 99.04 billion in 2025 and is predicted to increase from USD 106.5 billion in 2026 to approximately USD 204.69 billion by 2035, expanding at a CAGR of 7.53% from 2026 to 2035.The market is witnessing substantial growth due to a shift toward integrated, cost-efficient, and digitalized logistics solutions that enhance supply chain resilience, sustainability, and speed for global trade.

Market Highlights

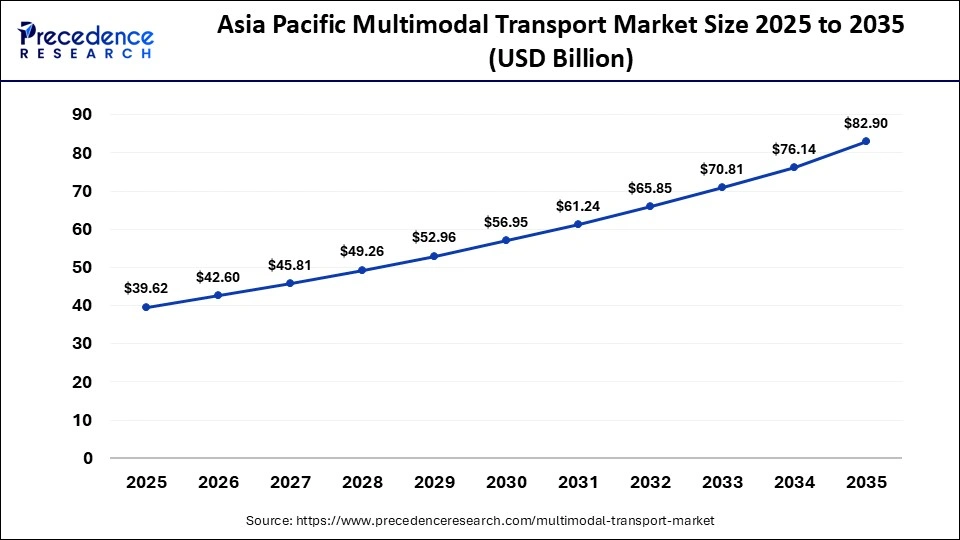

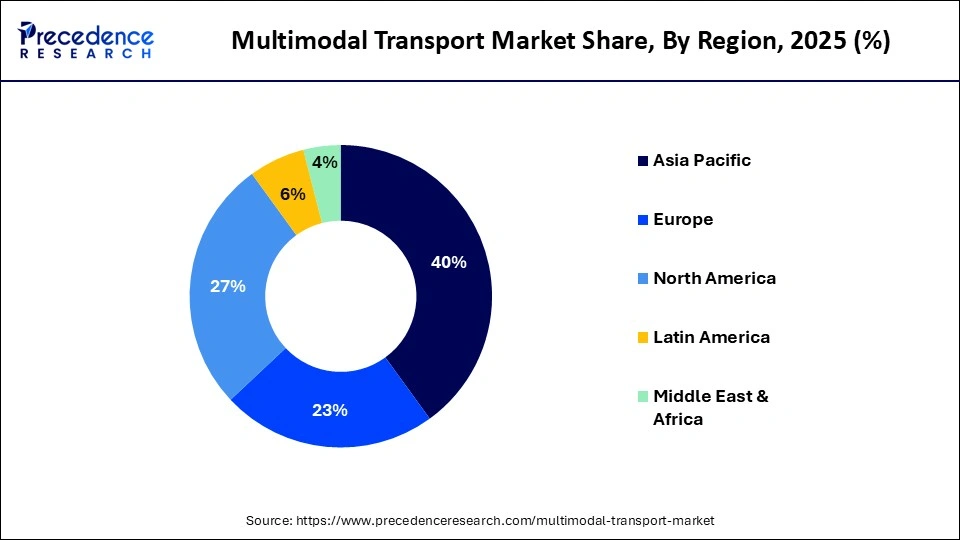

- Asia Pacific dominated the market with a major market share of around 40% in 2025 and is expected to grow at an 8% CAGR from 2026 to 2035.

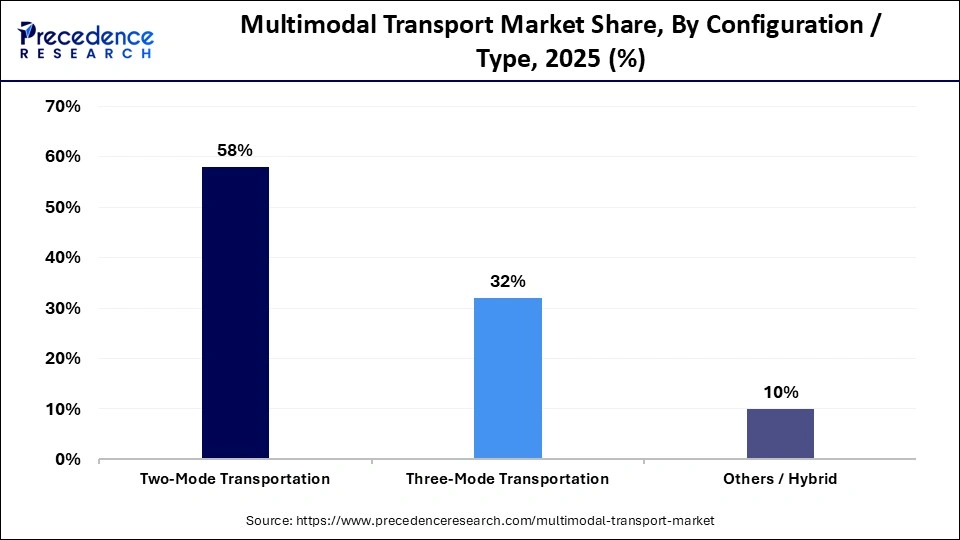

- By configuration/type, the two-mode transportation segment contributed the highest market share of around 58% in 2025.

- By configuration/type, the three-mode transportation segment is growing at a strong CAGR of 6.8% between 2026 and 2035.

- By transportation mode, the railroad segment held a major market share of around 33% in 2025.

- By transportation mode, the road-air segment is expected to expand at a notable CAGR of 6.5% from 2026 to 2035.

- By solution/service type, the cargo consolidation and freight forwarding segment captured the highest market share of about 38% in 2025.

- By solution/service type, the supply chain management segment is poised to grow at a healthy CAGR of 6.9% between 2026 and 2035.

- By end-use/industry, the retail and e-commerce segment generated the biggest share of around 28% in 2025.

- By end-use/industry, the chemicals and pharmaceuticals segment is expanding at the fastest CAGR of 6.7% between 2026 and 2035.

- By cargo type, the containerized cargo segment accounted for the largest market share of about 48% in 2025.

- By cargo type, the liquid & temperature-controlled segment is projected to grow at a solid CAGR of 7.0% between 2026 and 2035.

What is the Multimodal Transport Market?

The multimodal transport market refers to the logistics and freight movement industry that integrates two or more modes of transport, such as road, rail, sea, and air, under a single contract to deliver goods efficiently across domestic and international routes. It enhances supply chain resilience, cost efficiency, and transit reliability through coordinated modal handoffs and digital visibility tools. Growth is driven by rising global trade, the expansion of e-commerce, and investments in infrastructure and logistics technologies worldwide.

Increasing congestion and capacity constraints in single-mode transport networks are encouraging shippers to adopt multimodal solutions. Growing use of digital freight platforms and real-time tracking systems is improving coordination and transparency across transport modes. In parallel, sustainability goals and emission reduction targets are accelerating adoption of rail and sea freight integration within multimodal logistics frameworks.

How will AI transform the Multimodal Transport Market?

Artificial intelligence is transforming the multimodal transport market by optimizing routes, predicting maintenance needs, enhancing traffic flow, and automating operations, resulting in lower costs, higher efficiency, and improved safety. AI analyzes real-time traffic, weather conditions, and vehicle capacity to determine optimal routing across road, rail, sea, and air, reducing fuel consumption, transit time, and operational expenses. AI-powered traffic management systems dynamically adjust signals and reroute vehicles to ease congestion, while tools such as electronic data interchange and predictive analytics improve coordination between transport modes and strengthen supply chain resilience.

AI-enabled demand forecasting is improving capacity planning and asset utilization across logistics networks. Machine learning models are enhancing predictive maintenance for fleets and infrastructure, reducing downtime and disruptions. In parallel, AI-driven decision support systems are enabling faster, data-backed responses to supply chain volatility and cross-border transport challenges.

Major Trends in the Multimodal Transport Market

- Shift Towards Digital Control Towers and Visibility: The use of AI-powered platforms provides end-to-end visibility, connecting different modes like rail, road, and sea to allow for real-time tracking, proactive exception management, and dynamic rerouting.

- Advancements in AI and Automation: Machine learning is used for predictive analytics to forecast delays and optimize routes, while automated documentation, such as electronic bills of lading, reduces manual errors and speeds up customs.

- Increasing Sustainability Alignment: Digital tools help operators select the lowest-carbon, most efficient route, crucial for adopting greener practices like railroad or sea-rail combinations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 99.04 Billion |

| Market Size in 2026 | USD 17.82 Billion |

| Market Size by 2035 | USD 106.5 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.53% |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Configuration/Type, Transportation Mode, Solution/Service Type, End-Use/Industry, Cargo Type,and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Configuration/Type Insights

What Made the Two-Mode Transportation Segment Dominate the Multimodal Transport Market in 2025?

The two-mode transportation segment dominated the multimodal transport market with a share of around 58% in 2025. This stems from its superior balance of cost efficiency, reliability, and operational simplicity. This also enables shippers to utilize low-cost, high-capacity long-haul options, employing road transport only when necessary, thereby significantly reducing overall logistics costs. Road transport offers unparalleled and flexible door-to-door access to inland regions, factories, and retail distribution centers that may not be directly served by rail or sea, which is essential to maintaining Just-In-Time production and supply chain velocity.

The three-mode transportation segment is expected to experience the fastest growth, boasting a CAGR of 6.8%. This is due to increasing supply chain complexity, a heightened demand for flexibility, the rise of e-commerce, and sustainability benefits. Three-mode solutions facilitate the shifting of cargo between different transport modes to circumvent disruptions, access additional capacity, or meet service priorities, thereby enhancing supply chain agility. By optimizing the use of transportation modes, this approach also minimizes overall fuel consumption and emissions, aligning with environmental objectives.

Transportation Mode Insights

How Did the Rail-Road Segment Lead the Multimodal Transport Market in 2025?

The rail-road segment is anticipated to account for about 33% of the multimodal transport market share in 2025. This is due to its ability to combine the long-haul efficiency of rail with the last-mile flexibility of trucks. Rail transport is significantly more energy-efficient than road transport. As industries increasingly focus on reducing their carbon footprints to comply with environmental regulations, rail-road multimodal solutions are becoming more appealing. The growth of inland container depots and improved rail-linked logistics parks facilitates the seamless transfer of goods, reducing handling risks and costs.

The road-air segment is expected to grow the fastest, with a CAGR of 6.5%. This growth is driven by the demand for speed in e-commerce, the integration of faster road links with rapid air freight, and improved real-time tracking using technologies like GPS and telematics. The integration of road and air transport allows businesses to bypass disruptions in individual modes. ensuring continuity and reliability, a critical concern in complex global supply chains. This combination also enhances turnaround times and capacity.

Solution/Service Type Insights

Why Did the Cargo Consolidation and Freight Forwarding Segment Lead the Multimodal Transport Market in 2025?

The cargo consolidation and freight forwarding segment led the multimodal transport market with a share of around 38% in 2025 and is expected to grow in the coming years at a 6.9% CAGR. This is primarily because it offers essential cost efficiency, flexibility, and streamlined logistics by combining smaller shipments into full containers and integrating various transport modes. Efficiently linking modes such as rail and sea with road transport helps reduce overall carbon emissions, addressing growing environmental concerns. Furthermore, this approach allows businesses to access global markets with smaller volumes, adapting to irregular schedules and providing economical alternatives to full container load shipping.

The supply chain management segment is anticipated to experience the notable growth during the forecast period. This growth is mainly due to the shift toward digitally coordinated services, including AI-driven tracking, IoT sensors, and control towers for managing transitions between multiple transport modes. These technologies enable real-time tracking across sea, air, rail, and road, essential for providing transparency and reducing transit variability. As supply chains become more fragmented and geographically diverse, these solutions help optimize route planning, reduce inventory levels, and manage costs effectively.

End-Use/Industry Insights

How Did the Retail and E-commerce Segment Dominate the Multimodal Transport Market in 2025?

The retail and e-commerce segment dominated with a market share of approximately 28% in 2025. This is due to the growth of online shopping, the adoption of omnichannel models, and increasing expectations for faster delivery. These trends necessitate a combination of long-haul and localized transport solutions. The rise of D2C models and the expansion into smaller cities require adaptable logistics for frequent, smaller shipments to various locations. The significant increase in e-commerce demands requires coordinated movement from central warehouses to localized fulfillment centers to facilitate simple and cost-effective return processes.

The chemicals and pharmaceuticals segment is expected to witness the fastest growth, with a CAGR of 6.7%. This growth can be attributed to the surge in high-value, temperature-sensitive products that require complex, regulated, and precisely controlled logistics. The move toward biologics, gene therapies, and vaccines has created immense demand for specialized logistics that maintain specific temperatures and conditions. Also, globalized pharmaceutical production necessitates complicated cross-border flows, prompting companies to outsource to 3PLs and leverage multimodal networks for greater efficiency.

Cargo Type Insights

What Made the Containerized Cargo Segment Lead the Multimodal Transport Market in 2025?

The containerized cargo segment led with around 48% market share in 2025. This is mainly due to its standardization, efficiency, cost-effectiveness, and security, which enable seamless transfers between sea, rail, and road, reducing handling, theft, and costs. Economies of scale from stacking large vessels, plus reduced labor and theft, make it significantly cheaper than traditional methods. Sealed containers protect goods from damage, loss, and theft, lowering insurance costs and improving reliability. ISO-standardized containers fit common equipment globally, allowing quick loading and unloading.

The liquid & temperature-controlled segment is anticipated to experience the fastest growth with a CAGR of 7.0%, driven by the demand for enhanced product integrity, the surge in demand for perishable goods, and the adoption of advanced, specialized equipment. The increasing demand for temperature-sensitive biologics and vaccines requires precise, monitored, and uninterrupted cold chains, often necessitating active, intelligent, and real-time tracking across multiple transport modes to minimize manual handling and reduce transit times for compliance-sensitive cargo.

Regional Insights

What is the Asia Pacific Multimodal Transport Market Size?

The Asia Pacific multimodal transport market size is expected to be worth USD 82.90 billion by 2035, increasing from USD 39.62 billion by 2025, growing at a CAGR of 7.66% from 2026 to 2035.

How Did Asia Pacific Dominate the Multimodal Transport Market in 2025?

Asia-Pacific dominated the market for multimodal transport with around 40% market share in 2025 and is expected to sustain the growth during the forecast period with a CAGR of 8.0%. This is mainly due to its massive manufacturing base, booming e-commerce, rapid urbanization, and significant government investment in world-class infrastructure. The region is the world's factory, generating huge freight volumes for both import and export, demanding efficient movement between production centers and ports. Key economies like China, India, Japan, and ASEAN nations act as crucial nodes in global trade, needing efficient logistics for growing intra-regional trade.

India Multimodal Transport Market Trends

India plays a distinctive role within the region, primarily due to its strategic shift from road-dominant freight movement toward an integrated multimodal transport system aimed at lowering logistics costs and improving global competitiveness. Ongoing development of Multi-Modal Logistics Parks, Dedicated Freight Corridors, and national connectivity programs such as Sagarmala and Bharatmala is strengthening linkages between industrial hubs, ports, and consumption centers. These initiatives are supporting India's ambition to emerge as a major global manufacturing and trade hub through a more efficient and cost-effective supply chain backbone.

Rising private sector participation in logistics infrastructure is accelerating multimodal adoption across key industrial corridors. Increasing use of digital freight platforms is improving coordination between rail, road, and port operators. In parallel, policy focus on reducing logistics costs as a share of GDP is reinforcing sustained long-term growth of multimodal transport in India.

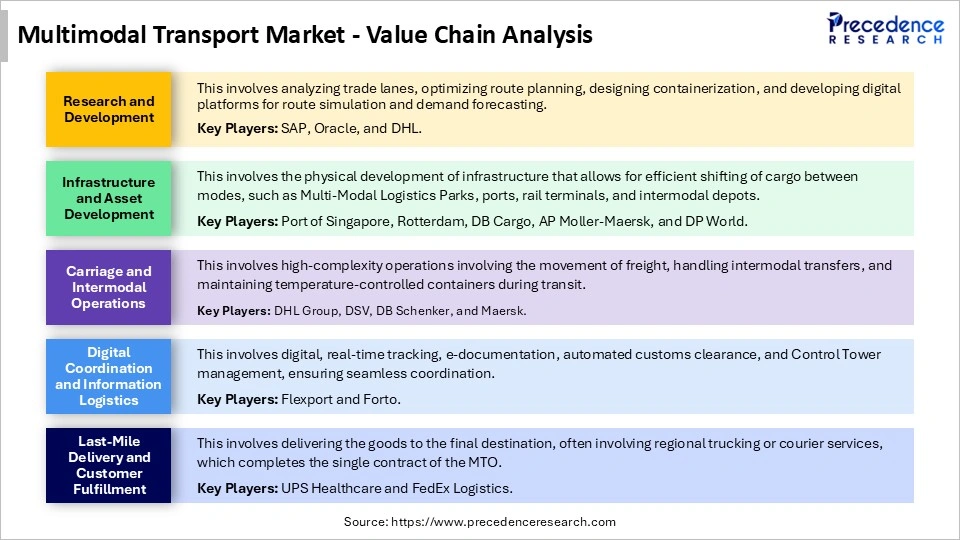

Multimodal Transport Market Value Chain Analysis

Who are the Major Players in the Global Multimodal Transport Market?

The major players in the multimodal transport market include DSV, Deutsche Post DHL Group, Kuehne + Nagel International AG, A.P. Moller-Maersk , Nippon Express Holdings, CMA CGM Group Marubeni Logistics Corporation, C.H. Robinson Worldwide, Inc,. GEODIS, XPO Logistics, Inc., NYK Line, Expeditors International, United Parcel Service (UPS), Hapag-Lloyd AG, KLN Logistics Group

Recent Developments

- In May 2025, Nippon Express Europe GmbH, part of NIPPON EXPRESS HOLDINGS, INC., participated in Transport Logistic 2025. This marks NX Europe's third consecutive appearance at the leading logistics trade fair. The NX Group will showcase its capabilities, featuring key companies like cargo-partner, APC Logistics, MD Logistics, and Simon Hegele Logistics. This participation represents growth, integration, and purpose, stated Shinichi Kakiyama, President of NX Europe, highlighting strong emphasis on sustainability.(Source: https://www.nipponexpress-holdings.com)

- In May 2024, Yamato Holdings Co., Ltd. launched a truck and rail international multimodal service linking Southeast Asia and Europe amid rising geopolitical risks that have extended maritime transport times significantly, impacting global logistics and costs.(Source: https://www.prnewswire.com)

- In March 2024, DP World introduced SARAL-2, a new multimodal service connecting Chennai and the National Capital Region. This service is the first daily rail freight offering of its kind, integrating coastal, rail, and truck operations to reduce carbon emissions by approximately 70% compared to road transport, aligning with India's PM Gati Shakti National Master Plan.(Source: https://www.dpworld.com

Segments Covered in the Report

By Configuration/Type

- Two-Mode Transportation

- Three-Mode Transportation

- Others / Hybrid

By Transportation Mode

- Rail–Road

- Road–Water

- Road–Air

- Others (Rail–Water, Air–Water)

By Solution/Service Type

- Cargo Consolidation & Freight Forwarding

- Supply Chain Management

- Truck Load & Intermodal Transport

- Shipping & Marine Logistics

- Courier & Express Services

By End-Use/Industry

- Retail & E-Commerce

- Manufacturing

- Chemicals & Pharmaceuticals

- Automotive

- Food & Beverages

- Oil & Gas

By Cargo Type

- Containerized Cargo

- Bulk Cargo

- Breakbulk

- Liquid & Temperature-Controlled

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting