What is the Nasal Polyposis Treatment Market Size?

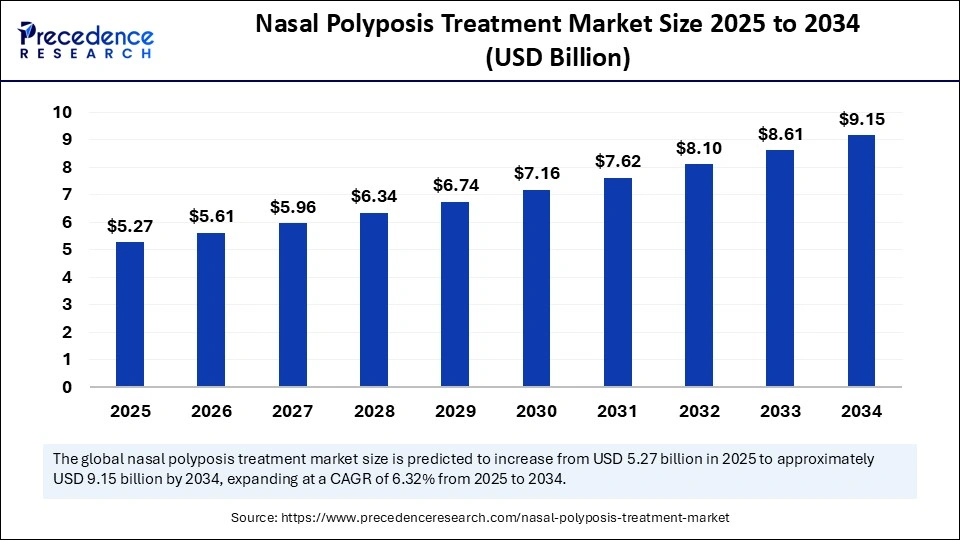

The global nasal polyposis treatment market size accounted for USD 5.27 billion in 2025 and is predicted to increase from USD 5.61 billion in 2026 to approximately USD 9.15 billion by 2034, expanding at a CAGR of 6.32% from 2025 to 2034. This market is growing due to the rising prevalence of chronic rhinosinusitis and the increasing adoption of biologic therapies for effective term management.

Market Highlights

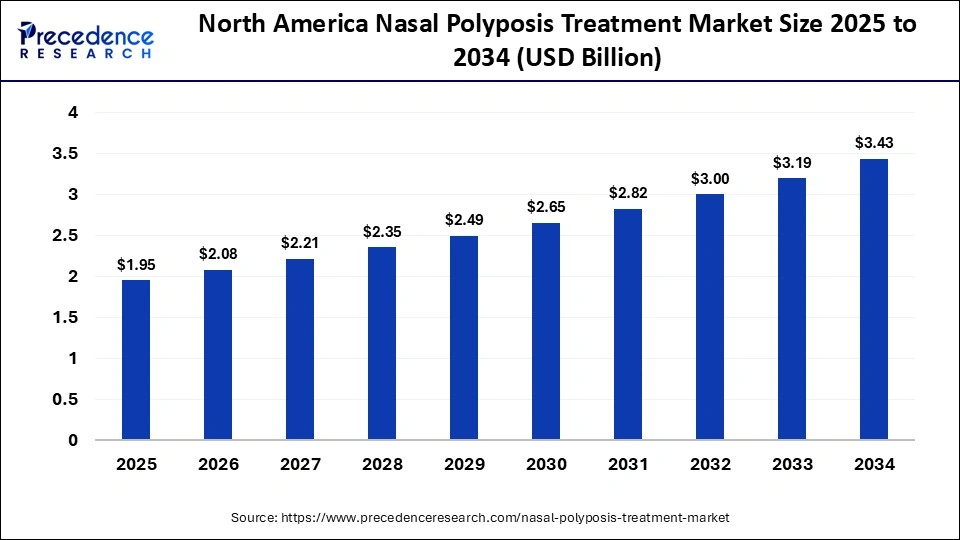

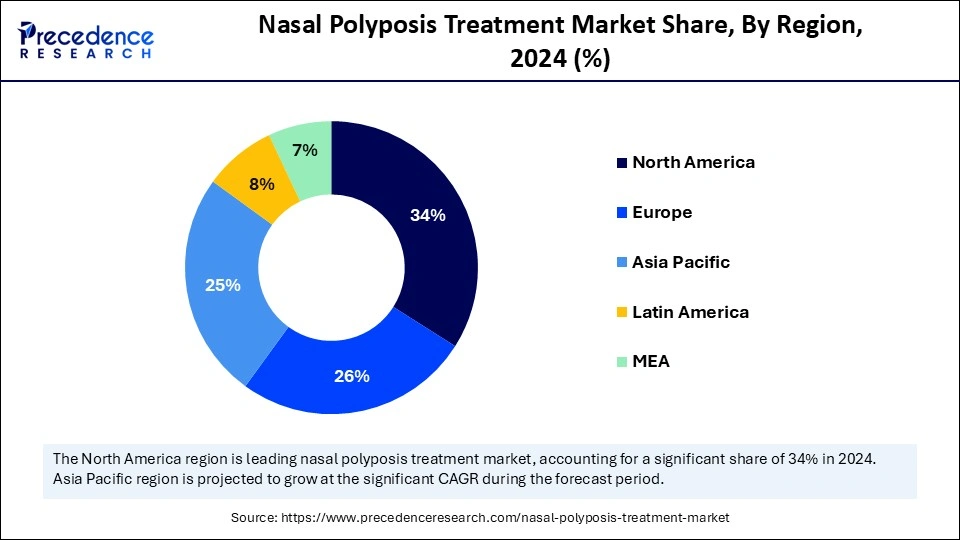

- North America dominated the market, holding the largest market share of 34% in 2024.

- The Asia Pacific is expected to grow at a notable rate from 2025 to 2034.

- By treatment modality, the pharmacotherapy devices segment held the largest market share of 55% in 2024.

- By treatment modality, the biologic therapies segment is growing at a strong CAGR between 2025 and 2034.

- By drug class, the corticosteroids segment contributed more than 45% of market share in 2024.

- By drug class, the biologics segment is expected to grow at the fastest rate from 2025 to 2034

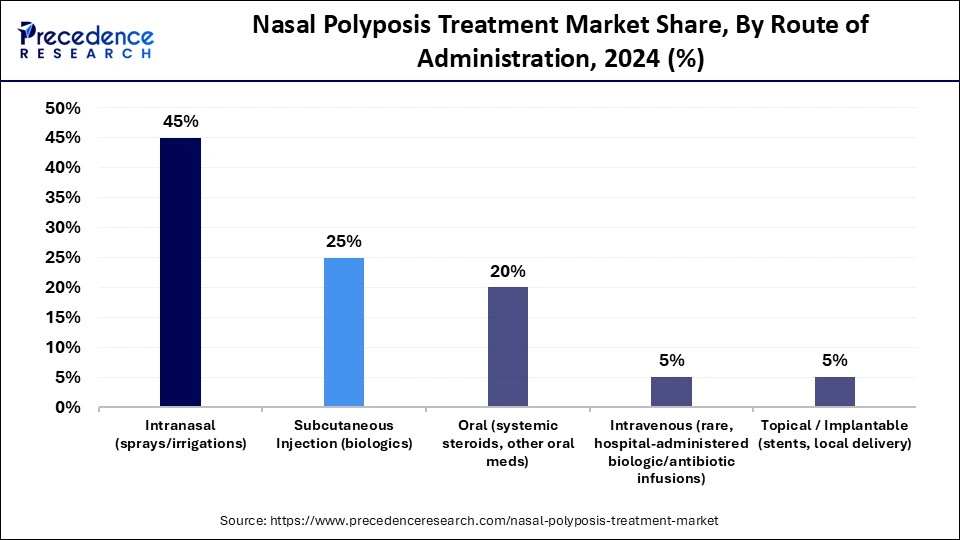

- By route of administration, the intranasal segment held the major market share of 45% in 2024.

- By route of administration, the subcutaneous injection segment is growing at a solid CAGR between 2025 and 2034.

- By patient segment/severity, the moderate CRSwNP segment accounted for the highest market share of 35% in 2024.

- By patient segment/severity, the severe/refractory CRSwNP segment is poised to grow at a healthy CAGR from 2025 to 2034.

- By prescriber/end user, the ENT/otolaryngology clinics & specialists segment led the nasal polyposis treatment market with a 45% share in 2024.

- By prescriber/ed user, the primary care/general practice segment is expected to grow at the fastest rate between 2025 and 2034.

Market Overview

Breathing Easier: How Biologics Are Transforming the Nasal Polyposis Treatment Market?

The nasal polyposis treatment market is witnessing steady growth as the number of people worldwide suffering from chronic rhinosinusitis with nasal polyps continues to rise. Adoption is being accelerated by growing knowledge of biologic treatments and their effectiveness in lowering inflammation and recurrence rates. Additionally, pharmaceutical companies are improving patient outcomes and treatment options through R&D investments.

Case Study: In Oct 2025, Amgen and AstraZeneca announced FDA approval of Tezspire (tezepelumab-ekko) as an add-on treatment for patients aged 12 and above with chronic rhinosinusitis with nasal polyps.

Key Technological Shifts in the Nasal Polyposis Treatment Market

- Rise of Biologic Therapies: By targeting the underlying inflammatory pathways (IL-4, IL-5, and IgE), targeted biologics like dupilumab, omalizumab, and Tezepelumab are transforming the treatment of nasal polyposis. The need for corticosteroids and surgery is greatly decreased by these medications.

- Precision Medicine & Biomarker-Based Treatment: Advances in molecular diagnostics are enabling the identification of specific biomarkers to tailor therapy for individual patients, improving treatment success rates and minimizing side effects.

Key Trends

- Rising Use of Biologics: Targeted biologics are replacing steroids and surgery, offering long-term relief with fewer side effects.

- Preference for Non-Surgical Options: Patients increasingly opt for medical therapies due to faster recovery and reduced recurrence.

- Expanding Clinical Pipelines: Leading pharma companies are advancing monoclonal antibody research for chronic rhinosinusitis with nasal polyps.

- Focus on Personalized Care: Precision medicine using biomarkers is enabling more tailored and effective treatments.

Nasal Polyposis Treatment MarketOutlook

The nasal polyposis treatment market is expanding due to rising CRSwNP cases and increased use of biologic therapies. Market demand is also being driven by better access to healthcare and improved diagnostics. Supportive reimbursement practices continue to encourage the use of treatments.

Businesses are working to reduce their environmental impact by focusing on eco-friendly packaging and greener manufacturing. The use of resource-efficient procedures and sustainable chemistry is growing in popularity. These initiatives support global objectives for the ethical production of healthcare.

With advancements in digital care tools, biologics, and nasal drug delivery, new biotech companies are springing up. The development of new products is being accelerated by partnerships with research institutions. Government initiatives and supportive funding are promoting the industrys explosive growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.27 Billion |

| Market Size in 2026 | USD 5.61 Billion |

| Market Size by 2034 | USD 9.15 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.32% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Treatment Modality, Drug Class, Route of Administration, Patient Segment / Severity, Prescriber / End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Nasal Polyposis Treatment Market Segments Insights

Treatment Modality Insights

Pharmacotherapy: The segment dominated the nasal polyposis treatment market in 2024 with a 55% share because of uses corticosteroids and antihistamines to effectively control inflammation and symptoms. It is the most favored first-line treatment due to its non-invasiveness, affordability, and accessibility.

Biologic Therapies: The segment is expected to be the fastest-growing market during the forecast period, as patients who are not responding to conventional medications can benefit greatly from targeted monoclonal antibodies. Reimbursement assistance and increased awareness are speeding up adoption. The segment expansion is also being fueled by recent approvals and ongoing clinical trials.

Endoscopic Sinus Surgery (ESS) & Surgical Interventions: The segment is showing strong growth because it offers long-term relief for patients with severe or recurring nasal polyps. Advances in minimally invasive techniques have made these procedures safer and more effective. Growing awareness and access to skilled specialists have also increased patient preference for surgical treatment options.

Drug Class Insights

Corticosteroids (Intranasal & Systemic): This segment dominated the market with a 45% share due to evidence that they can reduce nasal congestion and shrink polyps. Clinical recommendations back their widespread use in spray tablets and injectables. Their continued dominance is guaranteed by prescribers trust in them.

Biologics: The biologics segment is growing rapidly, targeting specific immune pathways for long-term relief. Increased approvals and patient preference for durable outcomes drive this growth. Technological innovation in antibody engineering is further boosting adoption.

Antibiotics/Antimicrobials: Antibiotics are gaining market growth as they help manage infections linked with nasal polyposis and sinus inflammation. Their quick action and wide availability make them a common first-line treatment. Increased prescription rates and ongoing research into combination therapies are also supporting their rising demand.

Route of Administration Insights

Intranasal (sprays/irrigations): The intranasal segment dominated the market in 2024 with a 45% share because it delivers medication directly to the affected area, providing prompt relief with few adverse effects. Strong adoption is guaranteed by its affordability and ease of use. Nasal sprays are widely available in pharmacies, which helps to sustain demand. Additionally, improvements in spray delivery systems are increasing treatment accuracy.

Subcutaneous Injection (biologics): This segment is expected to be the fastest-growing segment in the market during the forecast period, as injectables are required for biologics. Supporting this trend is the growing acceptance of home-based administration. To improve patient comfort, manufacturers are also developing easy-to-use devices. The segment capacity to guarantee consistent therapeutic delivery contributes to its growth.

Oral (systemic steroids, other oral meds): Oral medications, including systemic steroids, are showing growth as they provide convenient and effective relief for inflammation and polyp reduction. They are often preferred for initial or maintenance treatment due to easy administration. Expanding use of oral therapies in combination with other treatments is further boosting their demand in the market.

Patient Segment/ Severity Insights

Moderate CRSwNP: This segment dominated the market with a 35% share as patients respond favorably to medication and corticosteroids, lowering the need for surgery. Its high percentage is supported by early diagnosis. The position is further reinforced by the growing use of maintenance therapy. Stable dominance so facilitated by the higher frequency of moderate cases relative to severe forms.

Severe/refractory CRSwNP: This segment is growing rapidly because, in cases of resistance, biologics provide effective relief. This segment is growing due to the emphasis on long-term disease control. Adoption in complex cases is driven by mounting clinical evidence of better results. Rapid growth is further supported by growing physician awareness of biologic benefits.

Mild CRSwNP: The mild CRSwNP segment is growing as early diagnosis and awareness of nasal polyposis improve. Patients with mild symptoms often respond well to non-invasive treatments like nasal sprays and oral medications. This has increased the demand for accessible and affordable therapy options in this category.

Prescriber/End User Insights

ENT / Otolaryngology Clinics & Specialists: The ENT/otolaryngology clinics & specialists segment dominated the market with a 45% share, using both medical and surgical methods to treat complex nasal disorders. Their knowledge and availability of biology reinforced their power. Specialty clinics are becoming more prevalent worldwide, which supports this trend. Leadership is strengthening as more patients are referred to ENT specialists for cutting-edge treatments.

Primary Care / General Practice: The primary care/general practice segment is growing rapidly as nasal polyposis becomes more widely known. Nowadays, doctors use digital consultation tools and intranasal therapies to effectively treat mild cases. Early intervention is further encouraged by increasing access to reasonably priced medications. Additionally, primary care physician training programs are increasing the rates of diagnosis and treatment.

Nasal Polyposis Treatment Market Regional Insights

The North America nasal polyposis treatment market size is estimated at USD 1.95 billion in 2025 and is projected to reach approximately USD 3.43 billion by 2034, with a 6.43% CAGR from 2025 to 2034.

What Made North America Dominate the Nasal Polyposis Treatment Market?

North America dominated the market in 2024 due to the high prevalence of chronic rhinosinusitis with nasal polyps (CRSwNP), a sophisticated medical system, and widespread use of biologic treatments. Regional leadership continues to be supported by favorable reimbursement policies that increase patient awareness and by the presence of major pharmaceutical players. The region continued emphasis on clinical innovation and early disease detection strengthens its position as a dominant region.

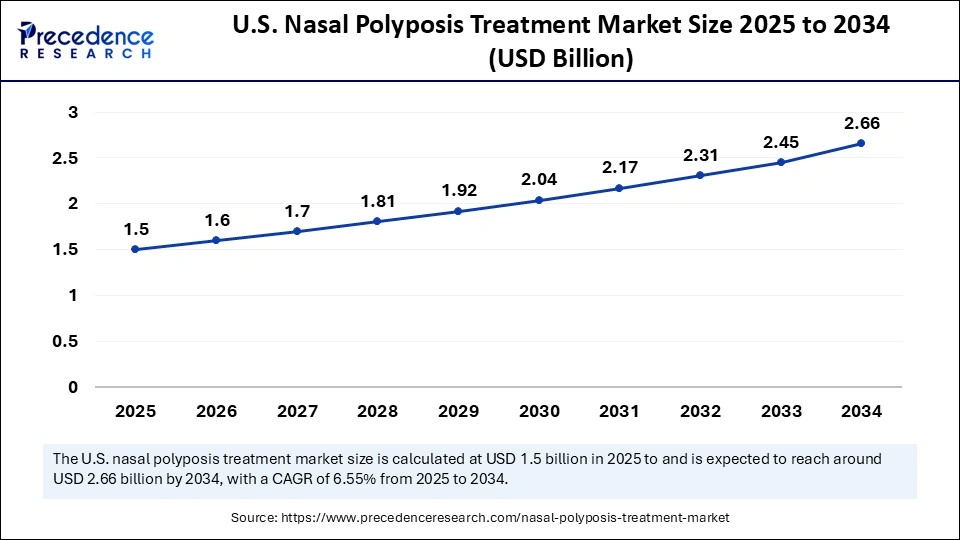

The U.S. nasal polyposis treatment market size is calculated at USD 1.50 billion in 2025 and is expected to reach nearly USD 2.66 billion in 2034, accelerating at a strong CAGR of 6.55% between 2025 and 2034.

How Is the U.S. Transforming the Nasal Polyposis Treatment Market?

The U.S. dominated the nasal polyposis treatment market in 2024 thanks to a robust healthcare system and the expanding use of cutting-edge biologic treatments. Steady demand has been driven by favorable reimbursement policies and a high number of CRSwNP diagnoses. Clinical trials, ongoing research, and early approvals of novel biologics are bolstering the nations dominance in international markets.

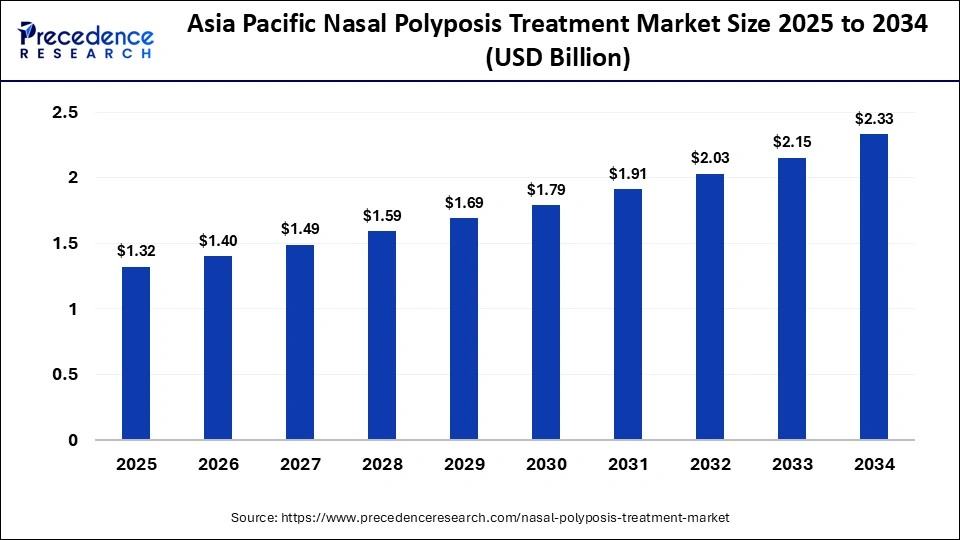

The Asia Pacific nasal polyposis treatment market size is expected to be worth USD 2.33 billion by 2034, increasing from USD 1.32 billion by 2025, growing at a CAGR of 6.51% from 2025 to 2034.

What Made Asia Pacific the Fastest Growing in the Nasal Polyposis Treatment Market?

Asia Pacific is expected to be the fastest growing market during the forecast period, driven by increased adoption of cutting edge treatment options, increased diagnosis rates, and improved access to healthcare. The region has also seen more investment from pharmaceutical companies expanding their presence. Together, these factors created a strong regulatory growth environment. Growth is being fueled by rising healthcare infrastructure investments and government programs to treat chronic respiratory diseases. The regions future market share is anticipated to be strengthened by increased patient awareness and greater accessibility to biologics.

India Nasal Polyposis Treatment Market Trends

India is witnessing rapid growth in the nasal polyposis treatment market because sinus-related disorders are becoming better known, and ENT specialists are more readily accessible. More people are seeking medical attention due to the availability of treatment options and the expansion of healthcare infrastructure. Significant market growth is anticipated in the upcoming years due to the gradual introduction of biologics and the growing acceptance of contemporary treatments.

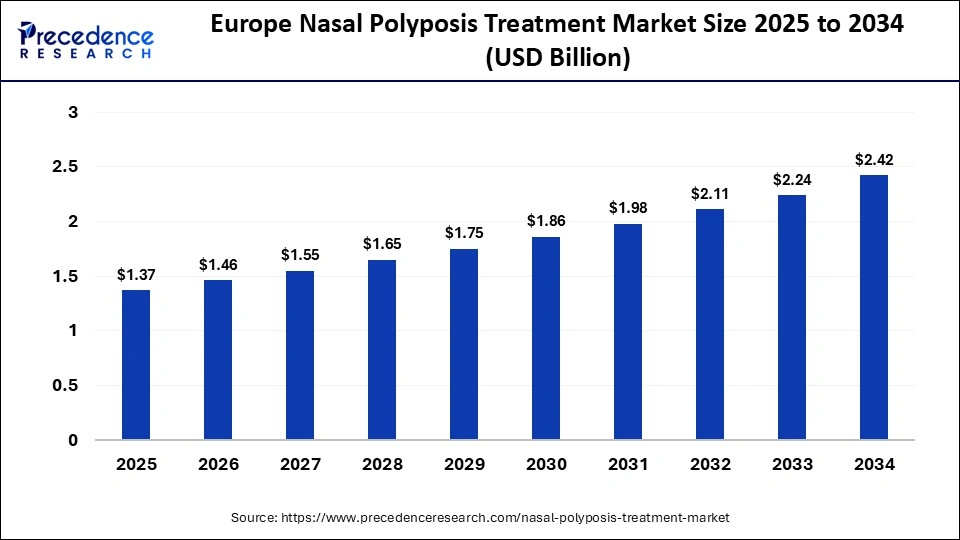

The Europe nasal polyposis treatment market size has grown strongly in recent years. It will grow from USD 1.37 billion in 2025 to USD 2.42 billion in 2034, expanding at a compound annual growth rate (CAGR) of 6.49% between 2025 and 2034.

Europe is becoming one of the fastest-expanding regions in the nasal polyposis treatment market, supported by a growing patient population and rising awareness of chronic rhinosinusitis with nasal polyps. The region is seeing strong adoption of advanced biologic therapies along with supportive reimbursement policies in major countries such as Germany, the UK, and France. Additionally, Europes well-established regulatory framework and active clinical research collaborations are accelerating the introduction of innovative treatments, further driving market growth and expanding patient access.

Nasal Polyposis Treatment Market Value Chain

Businesses are making significant investments in cutting-edge research to create novel treatments for inflammatory bowel disorders. Enhancing medication efficacy, minimizing side effects, and investigating new biologic pathways are among the focus areas. Discovery and innovation are being accelerated through partnerships with academic institutions and biotech companies

Clinical trials as well as regulatory clearance. The goal of ongoing clinical trials is to confirm the efficacy and safety of next-generation treatments. Regulatory agencies are streamlining approval procedures for promising oral medications and biologics. Before going on sale, this stage ensures that novel treatments meet strict quality and patient-safety requirements.

To improve patient adherence and disease management, healthcare providers are improving support programs. Follow-ups and individualized care are becoming easier thanks to telemedicine and digital monitoring platforms. To enhance overall patient outcomes, financial aid services, nutrition counseling, and counseling are being combined.

Nasal Polyposis Treatment Market Companies

Corporate Information

- Headquarters: Paris, France

- Year Founded: 2004 (through the merger of Sanofi Syntherlabo and Aventis)

- Ownership Type: Publicly Traded (Euronext: SAN; NASDAQ: SNY)

History and Background

Sanofi was established in 2004 through the merger of Sanofi Synthelabo and Aventis, creating one of the largest global pharmaceutical companies with a focus on vaccines, specialty care, and rare diseases. Over time, Sanofi has built a strong reputation in immunology, respiratory diseases, and inflammation-related disorders.

In the nasal polyposis treatment market, Sanofi has been a transformative force through the success of Dupixent (dupilumab), developed in partnership with Regeneron Pharmaceuticals. Dupixent, a monoclonal antibody targeting the interleukin-4 receptor alpha (IL-4Rα), was the first biologic therapy approved for the treatment of chronic rhinosinusitis with nasal polyposis (CRSwNP). It has redefined disease management by reducing polyp size, improving sense of smell, and decreasing the need for surgery or corticosteroids.

Key Milestones / Timeline

- 2004: Formed through the merger of Sanofi Synthelabo and Aventis

- 2015: Entered strategic collaboration with Regeneron for the development of biologic drugs targeting inflammatory pathways

- 2019: FDA and EMA approved Dupixent for CRSwNP, marking the first targeted biologic in nasal polyposis

- 2022: Expanded research pipeline with new monoclonal antibodies for respiratory inflammation

- 2024: Reported extended real-world data demonstrating long-term efficacy of Dupixent in nasal polyposis

Business Overview

Sanofi operates as a diversified global healthcare company focusing on specialty care, vaccines, and general medicines. In the nasal polyposis segment, Sanofi business centers on biologic therapies for chronic inflammatory diseases involving type 2 inflammation. The company continues to advance its immunology portfolio to address unmet needs in upper airway diseases.

Business Segments / Divisions

- Specialty Care (Sanofi Genzyme)

- Vaccines (Sanofi Pasteur)

- General Medicines

- Consumer Healthcare

Geographic Presence

Sanofi operates in over 100 countries with research and manufacturing facilities across France, the United States, Germany, and Singapore.

Key Offerings

Dupixent (dupilumab) Biologic treatment for chronic rhinosinusitis with nasal polyposis

Ongoing development of next-generation biologics targeting IL-13 and IL-33 pathways

Digital health tools supporting nasal polyposis patient monitoring and outcomes tracking

Financial Overview

Sanofi reports annual revenues exceeding 43 billion (approximately 47 billion USD), with its Specialty Care division, led by Dupixent, contributing significantly to revenue growth.

Key Developments and Strategic Initiatives

- April 2023: Reported long-term Dupixent data demonstrating sustained control of nasal polyp recurrence

- August 2023: Expanded immunology R&D collaboration with Regeneron for airway inflammatory diseases

- May 2024: Launched post-market registry to evaluate Dupixent outcomes in diverse CRSwNP populations

- January 2025: Began trials for a novel IL-13-targeted antibody for refractory nasal polyposis

Partnerships & Collaborations

- Long-term strategic alliance with Regeneron Pharmaceuticals for Dupixent development and commercialization

- Collaborations with ENT specialists and research hospitals for CRSwNP clinical data collection

- Partnerships with patient advocacy groups for awareness and education on biologic therapies

Product Launches / Innovations

- Dupixent approval for CRSwNP (2019)

- New biologic candidates under development for inflammatory airway diseases (2024)

- AI-driven digital adherence monitoring system for Dupixent patients (2025)

Technological Capabilities / R&D Focus

- Core technologies: Monoclonal antibody engineering, immunomodulation, and digital patient monitoring

- Research Infrastructure: Global R&D centers in France, the U.S., and Germany

- Innovation focus: Targeted immunotherapies for chronic inflammatory and allergic diseases

Competitive Positioning

- Strengths: Global biologics expertise, leadership in respiratory immunology, and robust partnership model

- Differentiators: First-mover advantage in CRSwNP biologic therapies with extensive real-world evidence

SWOT Analysis

- Strengths: Strong biologic pipeline, proven efficacy of Dupixent, and global reach

- Weaknesses: Dependence on Dupixent revenue growth

- Opportunities: Expansion into adjacent airway inflammatory indications

- Threats: Emerging competition from novel biologics and biosimilars

Recent News and Updates

- March 2024: Sanofi published new five-year Dupixent data confirming sustained CRSwNP remission

- July 2024: Announced expanded collaboration with Regeneron for next-generation anti-inflammatory biologics

- January 2025: Reported positive clinical trial results for a new biologic targeting IL-33 in nasal polyposis patients

Corporate Information

- Headquarters: Tarrytown, New York, United States

- Year Founded: 1988

- Ownership Type: Publicly Traded (NASDAQ: REGN)

History and Background

Regeneron Pharmaceuticals was founded in 1988 by Dr. Leonard Schleifer and Dr. George Yancopoulos with a focus on developing breakthrough biologic therapies based on advanced genetics and immunology. Over the past three decades, Regeneron has become a global leader in biotechnology innovation, developing monoclonal antibodies and genetic medicines that address chronic inflammatory and rare diseases.

In the nasal polyposis treatment market, Regeneron achieved a landmark breakthrough through the co-development of Dupixent (dupilumab) with Sanofi. Dupixent targets the IL-4 and IL-13 signaling pathways, which are key drivers of type 2 inflammation, offering the first biologic therapy for patients with chronic rhinosinusitis with nasal polyposis (CRSwNP). The therapy has significantly improved patient quality of life by reducing nasal congestion, restoring olfactory function, and preventing surgical interventions.

Key Milestones / Timeline

- 1988: Founded in Tarrytown, New York

- 2012: Entered collaboration with Sanofi for monoclonal antibody development

- 2017: Launched Dupixent for atopic dermatitis, later expanded to asthma and CRSwNP

- 2019: FDA and EMA approval of Dupixent for chronic rhinosinusitis with nasal polyposis

- 2023: Expanded Dupixent indication to include adolescent CRSwNP patients

- 2024: Advanced multiple next-generation biologics for respiratory inflammatory diseases

Business Overview

Regeneron operates as a biotechnology company specializing in monoclonal antibody therapies and genomic medicine. Within the nasal polyposis treatment market, Regeneron Dupixent has become a standard of care, driving strong growth in its immunology portfolio. The company continues to leverage its proprietary VelociSuite technologies to develop novel biologics that modulate immune pathways associated with chronic airway inflammation.

Business Segments / Divisions

- Immunology and Inflammation

- Ophthalmology

- Oncology and Rare Diseases

- Genetic Medicines

Geographic Presence

Regeneron operates globally with headquarters in the United States and manufacturing facilities in New York and Ireland, along with partnerships for worldwide distribution through Sanofi.

Key Offerings

- Dupixent (dupilumab) Biologic therapy for CRSwNP, atopic dermatitis, and asthma

- Next-generation biologics targeting IL-33 and TSLP for airway inflammation

- Genetic research platforms for identifying novel inflammatory disease targets

Financial Overview

Regeneron reports annual revenues exceeding 13 billion USD, with Dupixent contributing significantly through its multiple approved indications, including nasal polyposis.

Key Developments and Strategic Initiatives

- February 2023: Expanded Dupixent label to adolescent CRSwNP patients

- October 2023: Announced new antibody candidates targeting IL-33 for inflammatory airway disorders

- May 2024: Reported long-term CRSwNP efficacy data from Dupixent open-label extension studies

- January 2025: Advanced clinical trials of next-generation anti-inflammatory biologics for upper respiratory diseases

Partnerships & Collaborations

- Strategic partnership with Sanofi for co-development and global commercialization of Dupixent

- Collaborations with leading research institutions for inflammation and airway disease studies

- Alliances with healthcare systems for real-world outcomes monitoring and patient access programs

Product Launches / Innovations

- Dupixent expansion to CRSwNP (2019)

- New IL-33 biologic program entering late-stage trials (2024)

- Digital patient monitoring initiatives integrated into Dupixent therapy support (2025)

Technological Capabilities / R&D Focus

- Core technologies: VelociSuite antibody development platform, monoclonal antibody engineering, and genetic validation

- Research Infrastructure: R&D and manufacturing headquarters in Tarrytown, New York, with biologics facilities in Ireland

- Innovation focus: Next-generation anti-inflammatory antibodies, genomic medicine, and respiratory immunotherapy

Competitive Positioning

- Strengths: Proprietary antibody development platform, strong immunology pipeline, and proven collaboration success with Sanofi

- Differentiators: Deep expertise in biologic drug design and genetic validation for immune pathway targeting

SWOT Analysis

- Strengths: Industry leadership in monoclonal antibody innovation, strong Dupixent performance, advanced R&D

- Weaknesses: Heavy revenue reliance on Dupixent partnership

- Opportunities: Expansion into new airway inflammation indications and biologic diversification

- Threats: Competition from emerging IL-targeted therapies and market saturation

Recent News and Updates

- April 2024: Regeneron announced positive long-term Dupixent data showing durable CRSwNP control

- August 2024: Began clinical testing of next-generation anti-IL-33 biologic for refractory nasal polyposis

- January 2025: Reported real-world evidence showing reduced surgery rates and corticosteroid dependence in Dupixent-treated CRSwNP patients

Other Players in the Market

- GlaxoSmithKline (GSK): GSK is a global biopharma company that integrates science, technology, and advanced R&D to develop specialty medicines and vaccines. Its respiratory portfolio includes innovative treatments for chronic rhinosinusitis, asthma, and allergic conditions, leveraging biologics and inhalation technologies.

- Novartis: Novartis focuses on breakthrough therapies and advanced biologics, emphasizing precision medicine in respiratory, immunology, and chronic inflammatory diseases. The companys strategy combines deep scientific expertise with digital innovation to improve patient outcomes in airway and allergy-related disorders.

- F. Hoffmann-La Roche / Genentech: Roche and its U.S. biotechnology subsidiary Genentech are global leaders in pharmaceuticals and diagnostics, developing targeted biologic therapies for respiratory and immunological conditions. Their pipeline includes monoclonal antibodies and precision therapies addressing inflammation and tissue repair.

- AstraZeneca: AstraZeneca is a major player in respiratory and immunology therapeutics, with a portfolio addressing asthma, COPD, and chronic rhinosinusitis. The companys biologic Fasenra (benralizumab) and pipeline therapies target Type 2 inflammation, reflecting its leadership in precision respiratory care.

- OptiNose (OptiNose US): OptiNose develops nasal delivery-based therapeutics for upper airway diseases, including chronic rhinosinusitis with nasal polyps (CRSwNP). Its product XHANCE (fluticasone propionate) uses exhalation delivery technology to enhance drug deposition and efficacy in sinonasal disorders.

- Intersect ENT: Intersect ENT specializes in localized drug delivery implants for sinus and nasal inflammatory conditions. Its PROPEL and SINUVA steroid-releasing implants improve postoperative outcomes and reduce recurrence in patients with chronic rhinosinusitis, bridging pharmaceuticals and minimally invasive devices.

- Teva Pharmaceutical Industries: Teva offers a broad range of respiratory and immunology medicines, including inhalation therapies and biologics. Its focus on affordable treatment access and biosimilars supports management of chronic airway and allergic disorders globally.

- Merck & Co.: Merck develops immunomodulators, anti-inflammatory drugs, and vaccines addressing respiratory and allergic diseases. The company leverages advanced monoclonal antibody and immunotherapy platforms to develop targeted biologics for chronic rhinosinusitis and asthma.

- Pfizer : Pfizer portfolio includes anti-inflammatory biologics and immunotherapies addressing upper respiratory and allergic conditions. The company is expanding into precision inflammation medicine through mRNA and biologic innovation for respiratory health.

- Johnson & Johnson (Janssen): Janssen Pharmaceuticals develops biologic therapies targeting immune-mediated diseases, including nasal polyposis, asthma, and chronic sinusitis. Its IL-4 and IL-13 pathway inhibitors represent advancements in inflammatory airway disease management.

- Amgen: Amgen focuses on immunology and inflammation therapeutics, leveraging biologics that target cytokine signaling and immune cell regulation. Its research aims to address respiratory and inflammatory disorders through antibody engineering and precision biologic therapies.

- Bayer: Bayer provides pharmaceutical and consumer health products targeting respiratory and allergy relief, including nasal sprays and anti-inflammatory treatments. The company innovation pipeline includes novel intranasal and anti-inflammatory molecules for upper airway management.

- Sun Pharmaceutical Industries: Sun Pharma manufactures generic and specialty formulations in respiratory and allergy care. The company focuses on affordable access to intranasal corticosteroids, antihistamines, and inflammation-modulating therapies in emerging markets.

- Cipla: Cipla is a global leader in inhalation and nasal delivery systems, offering steroids, bronchodilators, and nasal decongestants. Its emphasis on innovative drug-device combinations strengthens its role in respiratory and allergy treatment segments.

- Takeda Pharmaceutical: Takedas immunology and inflammation division develops biologic and targeted small-molecule therapies for chronic inflammatory airway diseases. The companys focus on gut-lung axis and immune pathway research reflects its integrated approach to systemic inflammation.

- Lyra Therapeutics: Lyra develops bioabsorbable drug-eluting implants for chronic rhinosinusitis and nasal inflammation. Its LYR-210 and LYR-220 programs deliver continuous, localized therapy directly to sinus tissue, offering a novel alternative to systemic treatments.

- Allakos: Allakos focuses on monoclonal antibody therapies targeting eosinophilic and mast-cell-driven inflammation. Its investigational biologic lirentelimab (AK002) shows promise in treating chronic rhinosinusitis and allergic inflammatory diseases.

- Sandoz (Novartis Sandoz Division): Sandoz develops biosimilar and generic anti-inflammatory biologics, expanding patient access to therapies for respiratory and immune-mediated conditions. Its work in biosimilar monoclonal antibodies supports affordability and accessibility in chronic inflammatory disease management.

Recent Developments

- In Oct 2024, GSK announced positive Phase III results for its ultra-long-acting biologic Depemokimab in the ANCHOR-1 & ANCHOR-2 trials for CRSwNP.(Source:https://www.gsk.com)

- In June 2025, Dupixent (dupilumab) presented head-to-head Phase IV data showing superiority over Xolair (omalizumab) in CRSwNP with co-existing asthma.(Source:https://www.sanofi.com)

Nasal Polyposis Treatment Market Segments Covered in the Report

By Treatment Modality

- Pharmacotherapy

- Intranasal corticosteroids (sprays, suspensions)

- Systemic corticosteroids (short-course oral)

- Antibiotics (for secondary infection)

- Biologic Therapies

- Anti-IL-4/IL-13 (e.g., IL-4Rα antagonists)

- Anti-IL-5 / Anti-IL-5R agents

- Anti-IgE agents

- Endoscopic Sinus Surgery (ESS) & Surgical Interventions:

- Functional endoscopic sinus surgery (FESS)

- Polypectomy, revision surgery

- Adjunctive / Supportive Therapie

- Nasal saline irrigation, steroid irrigations, and topical antibiotics

- Aspirin desensitization (for AERD patients)

- Devices & Implants

- Drug-eluting stents, steroid-eluting implants, sinus balloons

By Drug Class

- Corticosteroids (Intranasal & Systemic)

-

- Fluticasone, Mometasone, Budesonide (intranasal)

- Prednisone / Prednisolone (systemic)

- Biologics (Monoclonal Antibodies)

- Anti-IL-4/IL-13 (dupilumab-type)

- Anti-IL-5 / IL-5R (mepolizumab/benralizumab-type)

- Anti-IgE (omalizumab-type)

- Antibiotics/Antimicrobials

- Leukotriene Modifiers & Anti-Histamines

- Nasal Decongestants & Symptomatic Agents

- Other (Off-label/Adjunct)

By Route of Administration

- Intranasal (sprays/irrigations)

- Subcutaneous Injection (biologics)

- Oral (systemic steroids, other oral meds)

- Intravenous (rare, hospital-administered biologic/antibiotic infusions)

- Topical / Implantable (stents, local delivery)

By Patient Segment/Severity

- Mild CRSwNP

- Moderate CRSwNP

- Severe / Refractory CRSwNP

- AERD / NSAID-exacerbated Respiratory Disease

- Pediatric-onset NP

By Prescriber/End-User

- ENT/Otolaryngology Clinics & Specialists

- Primary Care/General Practice

- Allergy & Immunology Clinics

- Hospital Inpatient/Emergency

- Ambulatory Surgery Centers (ESS procedures)

- Specialty Infusion/Injection Clinics

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting