Neurotech Devices Market Size and Forecast 2025 to 2034

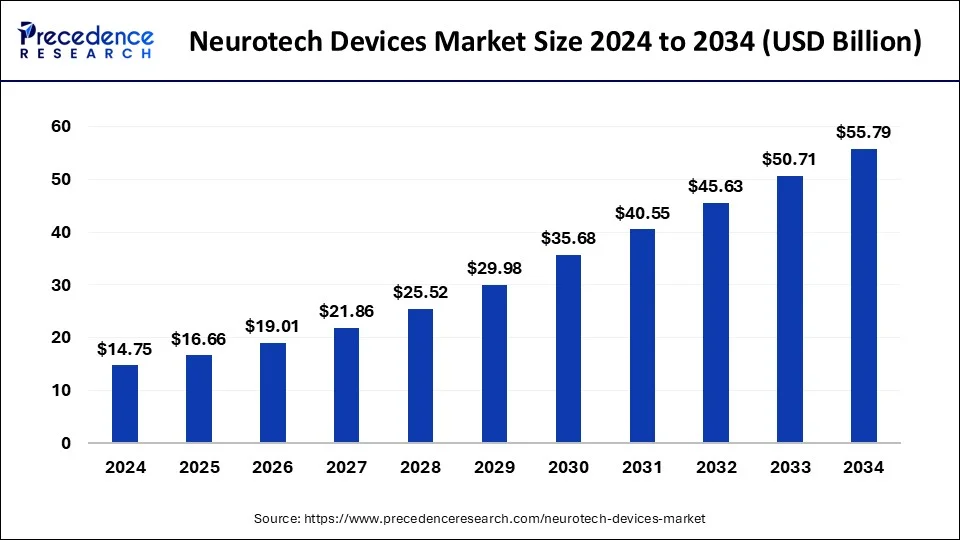

The global neurotech devices market size was estimated at USD 14.75 billion in 2024 and is predicted to increase from USD 16.66 billion in 2025 to approximately USD 55.79 billion by 2034, expanding at a CAGR of 14.37% from 2025 to 2034. The growth of the market can be attributed to theincreasing adoption of neurotechnology devices in various medical applications, including neurological disorders treatment and rehabilitation.

Neurotech Devices Market Key Takeaways

- The global neurotech devices market was valued at USD 14.75 billion in 2024.

- It is projected to reach USD 55.79 billion by 2034.

- The neurotech devices market is expected to grow at a CAGR of 14.37% from 2025 to 2034.

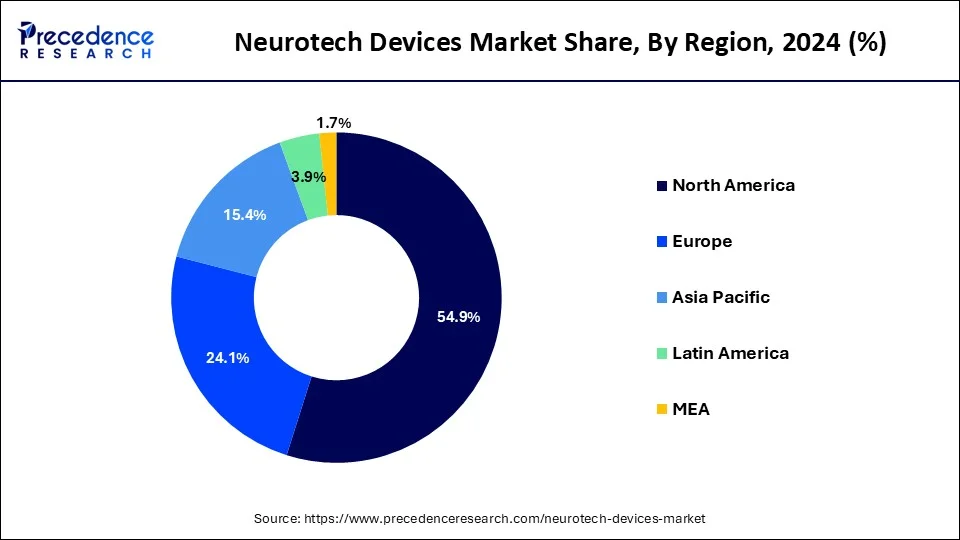

- North America dominated the global market with the largest market share of 54.9% in 2024.

- Asia Pacific is expected to have significant growth in the market during the forecast period.

- By product, the neurostimulation segment contributed the highest market share of 67.6% in 2024.

- By product, the neuroprostheses segment is expected to show substantial growth over the forecast period.

- By condition, the pain management segment captured the biggest market share of 57.9% in 2024.

- By end use, the hospital segment generated a major market share of 39.2% in 2024.

Role of Artificial Intelligence in the Neurotech Devices Market:

Artificial Intelligence (AI) is changing the neurotechn devices market, speeding up the accuracy, capability, and customizability of neurotech solutions. AI algorithms will be implemented into neurostimulation systems, brain-computer interfaces (BCIs), and neural diagnostic tools to interpret complicated brain signals using a different level of accuracy. Devices that can use AI will allow real-time brain mapping, adaptive stimulation, and predictive analytics, all of which improve patient outcomes along various conditions like epilepsy, Parkinson's, and depression.

AI also facilitates closed-loop communication among the connected sensors, that make devices adaptive to neural activity, ultimately making treatments more efficient. Machine learning models also help process data-rich sources such as EEGs, fMRIs and implants, to allow clinicians to see neurological data more meaningfully. As AI further enables automation, personalization, and decision-making, it is providing opportunities to change how neurotech devices are imagined, deployed, and managed, which is ushering in a new era of smart and responsive brain-health technologies in clinical and consumer spaces. Ethical considerations will be an ongoing discussion surrounding AI-enabled technologies in neural applications.

U.S. Neurotech Devices Market Size and Growth 2025 to 2034

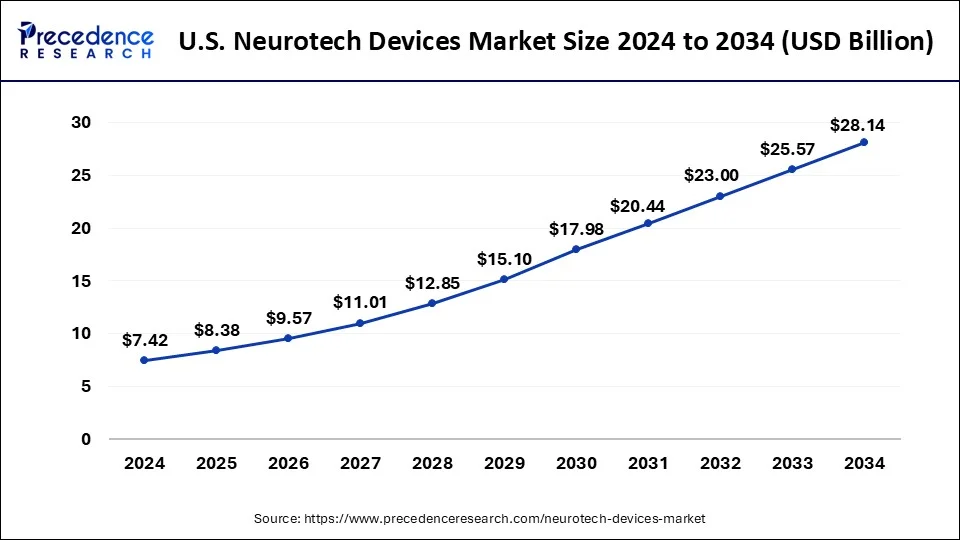

The U.S. neurotech devices market size reached USD 7.42 billion in 2024 and is expected to be worth around USD 28.14 billion by 2034 at a CAGR of 14.40% from 2025 to 2034.

North America leads the neurotech devices because of its healthcare infrastructure, awareness of neurological disorders, and commitment to neurotechnology R&D. North America benefits from a lot of support and funding, especially in the U.S., with the BRAIN Initiative and various angel groups. Several organizations, such as the NIH and DARPA, are still investing heavily in research in brain-computer interfaces, neurostimulation devices, as well as neuroprosthetics, and continue to push the envelope.

Advances in novel diagnostic and therapeutics in neurotechnology, especially in light of the high prevalence of diseases like Alzheimer's and Parkinson's disease as well as chronic pain disorders, means that demand for health advancements will only continue to grow. North America is also the world leader in healthcare framework development, funding, and regulation providing a level of oversight and trust that allows for rapid adoption in deploying cutting-edge medical technology and innovation.

The Asia-Pacific region is quickly becoming one of the fastest-growing markets in neurotechnology devices primarily due to increased health care investments, the increasing number of cases of neurological disorders and rapid adoption of technology. China, Japan, South Korea, and India are also making substantial investments into neuroscience research and brain-computer interfaces to fill the demand for advanced neurological care. The increase in incidents of Alzheimer's, Parkinson's and stroke cases and the expanding elderly demographic will lead to an increase in the uptake of neurostimulator and neuroprosthetic devices. Increased investments into healthcare infrastructure, heightened awareness of mental health, and government policies that support innovation also provide momentum for market growth.

The Asia-Pacific region has also seen a sizeable increase in the adoption of wearable neurotech for wellness and cognitive performance monitoring. The use of more locally manufactured and clinically tested neurotech, and an increase in the integration of digital health with the offerings from the wearable neurotech ecosystem, all signal established frameworks to allow the Asia-Pacific region to become a key innovation and commercialization player in the global neurotechnology devices market.

Europe is a key player in the global neurotechnology devices industry, driven by strong public health systems, an increasing incidence of neurological diseases, and a commitment to medical innovation. Neurostimulation and brain-computer interface technologies are being increasingly adopted in Europe, especially for the treatment of epilepsy, Parkinson's disease, and chronic pain. Many European countries are benefitting from coordinated initiatives like the Human Brain Project to foster research collaboration across borders, enabling accelerated development in neurotechnology across Europe.

Additionally, many EU countries have created favorable regulatory environments (e.g. CE Marking processes) to facilitate rapid access to new and innovative neurotechnology products. With increased investment in digital health and a growing awareness of the importance of mental and cognitive health, neurotechnology applications for clinical and consumer-oriented uses are in a good position to continue to grow. With an already strong academic and research base, Europe is well-intergrated into the future development, trial implementation, and rollout of next-generation neurotechnology devices.

Market Overview

The neurotech devices market is picking up speed as demand for more sophisticated solutions to monitor, diagnose and treat neurological disorders continues to grow. Increasing numbers of people suffering from disorders like Alzheimer's, epilepsy, depression and chronic pain are welcoming the adoption of neurotechnology devices like neurostimulation devices, brain-computer interfaces (BCIs) and neuroprosthetics. Technology advances, especially AI, machine learning and miniaturization are driving improvements in device accuracy, capability and patient outcomes. Interest in both therapeutic and cognitive apparatus non-invasive and wearable neurotechnology is growing.

As consumers embrace better health conscious and preventative approaches to mental health, the more they move outside the old idea of neurotechnology devices into the wellness and lifestyle market. With funding of neuroscience research supporting funds to develop products and a shift towards more integration of digital health environments, the is more potential for sustained growth of the neurotechnology devices market resulting from innovation.

Neurotech Devices Market Growth Factors

- The increase in neurological disorders such as epilepsy, Alzheimer's, and Parkinson's disease and chronic migraines is generating a substantial demand for advanced neurotech devices and product solutions.

- Because of technological advancements in brain-computer interfaces (BCIs), neuro-stimulation, and a multitude of AI-enhanced and AI-powered neural diagnostics, companies are creating devices that push boundaries related to device capabilities and accuracy.

- The increased use and acceptance of non-invasive and wearable neurotechnology devices is opening up opportunities in both clinical and consumer wellness markets.

- The increased funding for neuroscience research and biotechnology in the development of products is accelerating development and commercialization of many promising neurotechnology products and solutions.

- Increased integration of neurotechnology with digital health solutions, digital health platforms, and mobile apps is creating more forward-thinking solutions that are continuing to grow in popularity, improving accessibility and personalized health care solutions for patients/users.

- The increased percentage of elderly people in the world's population leads to increases in neurodegenerative conditions within the population, increasing long-term demand for neurotechnology products, solutions, and services.

- The better healthcare infrastructure and awareness of brain health is creating opportunities for early calls to action with neurotechnology consumer products and services.

- Positive regulatory approvals and growing interest from medtech companies has all increased the acceleration of new and innovative products and the development of the global neurotech market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 55.79 Billion |

| Market Size in 2025 | USD 14.75 Billion |

| Market Size in 2024 | USD 14.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.37% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Condition, End-user, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rising incidence of neurological disorders

The increasing incidence of neurological disorders like epilepsy, Alzheimer's disease, and migraine has substantially raised the demand for innovative neurotechnological devices that help to improve the quality of patients' lives. This creates a steady demand for the neurotech devices market. The rise in the burden of neurological disorders is mainly linked to the geriatric population and the rise in life expectancy. As life expectancy increases, people are more prone to developing neurological diseases.

- According to WHO, neurological diseases currently affect more than 1 billion people globally, with diseases like Alzheimer's and dementia creating an economic burden among such conditions.

- In March 2024, Labcorp (NYSE: LH), a provider of laboratory services, announced the release of a new blood test that detects phosphorylated tau 217 (pTau217), a biomarker for Alzheimer's disease. Physicians can now order this test and use it in clinical trials and research.

Restraint

Rise associated with technological processes

Neurotechnology brings up ethical dilemmas related to concepts like our sense of self or soul, which are deeply philosophical and often taken for granted. One major area of ethical discussion revolves around the idea of personhood, a more modern concept that encompasses the fundamental aspects of our identity. The rise in the burden of neurological disorders is mainly linked to the geriatric population and the rise in life expectancy. As life expectancy increases, people are more prone to developing neurological diseases.

Neurotechnology is both captivating and contentious because it aims to connect human brains with machines directly. However, in the neurotech devices market, some of the new methods, like using light stimulation for hearing aids or targeted inhibition during epileptic seizures, come with significant drawbacks. These techniques involve genetically modifying normal nerve cells to express light receptors, which requires altering the cells' genetic makeup using manipulated viruses.

Opportunities

Technological Advancements:

The neurotech devices market is being disrupted by ongoing technology development with an objective to improve neurological care. Groundbreaking progress in the field of brain-computer interfaces (BCIs) are improving links between the brain to hardware platforms providing greater avenues for motor restoration and sensory enhancement. Non-medical neurostimulation methodologies, e.g, transcranial magnetic stimulation (TMS) and transcranial direct current stimulation (tDCS), are being explored for treatment of depression, chronic pain and other cognitive disorders with relatively few side effects. Improvements in electrode design, and increase processing power all bode well for improvements in fittingness of neural recordings with a promotive response. Expandability of implantable devices and the patient management comfort provides increased patient choices for long-term monitoring and applied therapies via the integration of neurotech products and the wearables industry, as well as ultimately, professionalization. These advances to neurotech devices allow for greater reach of the device as well as improvements in safety, usability, and effectiveness.

Government Initiatives for Neurotech Devices Industry:

Globally, governments are facilitating the growth of the neurotech devices market by providing funding, regulatory processes and an ethical framework. For instance, the U.S. government's BRAIN Initiative invested billions in brain-related research, which has catalyzed new developments in brain-computer interfaces and neural monitoring systems. As well, government departments, national health agencies and other government organizations are funding neurotech R&D through grant programs and collaborations, which further expedites device development and clinical trials. In areas like Canada and the EU, governments are able to support new ventures through non-diluted funding as well as mentorship and innovation hubs on funding neurodiversity commercialization.

Additionally, regulatory agencies are bringing proposed and accepted guidelines to market for the safe adoption of neurotechnology in products, procedures, and for consumers. However, in other instances, legislation is even being introduced that deals with neuro-rights and cognitive data privacy, which collects data from a person's brain to drive product development. This form of legislation will help ensure ethics around brain data. These progressive developments in assistance from governments are increasing the pace of technological advances while also building trust with the public about the growth of neurotechnology and neurodiversity activities.

Product Insights

The neurostimulation segment dominated the neurotech devices market in 2024. The segment includes the spinal cord, vagus nerve stimulators, deep brain, and spinal cord, along with the electrical nerve stimulations. The dominance of the segment is linked to the rise in R&D activities along with the launches of new and better products for treatment. These factors contribute to the market expansion.

- In January 2024, US-based Nalu Medical raised $65m in a Series E financing round to further the development and commercialization of its neurostimulation system for chronic pain treatment.

In the neurotech devices market, the neuroprostheses segment is expected to show substantial growth over the forecast period. Neuroprostheses can restore sensory, motor, and some autonomic functions by stimulating different parts of the CNS, including the spinal cord, nerves, and the brain.

Neurotech Devices Market Revenue, By Product 2022-2024 (USD Million)

| Product | 2022 | 2023 | 2024 |

| Neurostimulation | 8,285.6 | 9,058.4 | 9,960.8 |

| Neuroprostheses | 2,376.8 | 2,615.7 | 2,904.0 |

| Neurosensing | 345.2 | 396.7 | 459.2 |

| Neurorehabilitation Devices | 1,052.0 | 1,218.6 | 1,421.7 |

Condition Insights

The pain management segment held the largest share in the neurotech devices market. Pain management drugs help ease discomfort from injuries, diseases, chronic conditions, and surgeries. They work by targeting inflammation caused by chemical agents, infections, or nerve damage. These drugs temporarily change the body's biochemical functions to provide relief. They can be tailored to specific organs or cells due to the protein content of certain tissues.

Pain management drugs come in over-the-counter and prescription forms to address various conditions. Over-the-counter options are good for relieving muscle aches, headaches, and arthritis. Prescription medications offer stronger relief for persistent or severe pain after injury or surgery. Opioids, some anti depressed and anti-seizure drugs, can also help alleviate pain.

- In April 2022, a major manufacturer of pain management drugs, Eli Lilly and Company, cleared the phase 2 trial of LY3526318, the transient receptor ankyrin 1. It is used to relieve chronic pain in patients.

End-use Insights

The hospital segment held a significant share of the neurotech devices market in 2024. The rise in hospital admissions globally, combined with suitable reimbursement policies for surgeries performed in hospitals, is the major factor contributing to the growth of the market. Hospitals are also equipped with various innovative equipment to make smoother minimally invasive neurological treatments for patient care and management. Furthermore, hospitals provide safe, quick, and efficient treatments for better patient outcomes.

Neurotech Devices Market Revenue, By End-use 2022-2024 (USD Million)

| End-use | 2022 | 2023 | 2024 |

| Hospitals | 4,792.4 | 5,245.1 | 5,780.2 |

| ASCs | 3,296.5 | 3,653.3 | 4,076.6 |

| Homecare Facilites | 2,409.2 | 2,681.7 | 3,005.5 |

| Others | 1,561.6 | 1,709.4 | 1,883.2 |

Neurotech Devices Market Companies

- Boston Scientific Corporation

- BrainCo, Inc

- Cochlear Limited

- Control Bionics, Inc

- LivaNova PLC

- Medtronic plc

- Nihon Kohden Corporation

- Natus Medical Incorporated

- Integra LifeSciences

- Blackrock Microsystems

- NeuroSigma, Inc.

- NeuroVigil Inc.

- Neuralink Corp.

- Abbott Laboratories

- Advanced Bionics AG

Recent Developments

- In July 2025, Audrey Crews became the first public recipient of Neuralink's brain computer interface implant. Through this chip, she controlled a cursor, typed, drew, and even signed her name marking a watershed moment in thought based digital interaction.

(Source- Mass Device) - In March 2025, at University of Washington, neurosurgeons implanted a flexible electrode device developed by CorTec GmbH to help restore movement in stroke survivors. This clinical trial began with a 52 year old patient and aims to assess safety across multiple participants.

(Source- axios) - In April 2025, Precision Neuroscience received FDA clearance for its minimally invasive Layer 7 Cortical Interface, a 1,024 electrode array used in 37 patients to date, enabling short term cortical implants for diagnostic and functional mapping.

(Source- Fierce Biotech) - In January 2024, Rune Labs, a precision neurology software and data company, announced a strategic round of US$ 12 million, increasing the total amount raised by the company to over US$42 million.

Segments Covered in the Report

By Product Type

- Neuroprosthetics

- Neural stimulators

- Neurorehabilitation

- Neurosensing

By Condition

- Pain Management

- Parkinson's Disease

- Cerebral Palsy

- Cognitive Disorders

- Epilepsy

- Incontinence

- Migraine

- Hearing Conditions

- Chronic Pain

- Spinal Cord Injury

- Stroke Traumatic Brain Injury Others

- Traumatic Brain Injury

- Others

By End-user

- Hospitals

- Ambulatory Surgical Center

- Diagnostic Centers

- Ambulatory Surgical Center

- Home Care Facilities

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting