What is the Oligonucleotides Market Size?

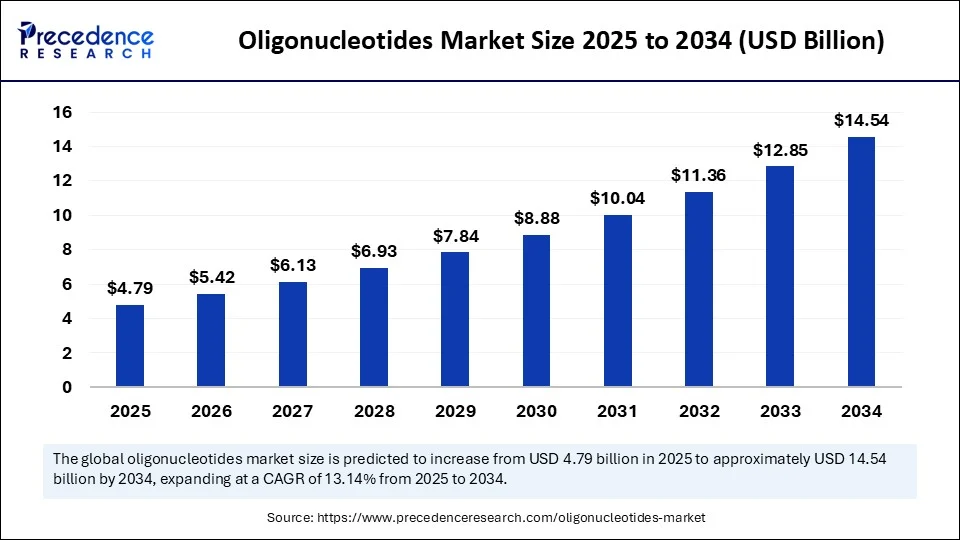

The global oligonucleotides market size is calculated at USD 4.79 billion in 2025 and is predicted to increase from USD 5.42 billion in 2026 to approximately USD 14.54 billion by 2034, expanding at a CAGR of 13.14% from 2025 to 2034.

Oligonucleotides Market Key Takeaways

- North America dominated the oligonucleotides market in 2024.

- By region, Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By product type, the therapeutic oligonucleotides segment held a significant share in 2024.

- By product type, the diagnostic oligonucleotides segment is anticipated to show considerable growth over the forecast period.

- By application, the drug discovery & development segment captured the biggest market share in 2024.

- By application, the RNA-based therapeutics segment is anticipated to show considerable growth over the forecast period.

- By manufacturing technology, the solid phase oligonucleotide synthesis segment contributed the highest market share in 2024.

- By manufacturing technology, the microarray-based synthesis segment is anticipated to show considerable growth over the forecast period.

- By end-user, the pharmaceutical and biotechnology companies segment generated the major market share in 2024.

- By end-user, the contract manufacturing organizations segment is anticipated to show considerable growth over the forecast period.

- By sales channel, the direct sales segment held the largest market share in 2024.

- By sales channel, the online platforms segment is anticipated to show considerable growth over the forecast period.

- By delivery mode, the injectable segment accounted for remarkable market share in 2024.

- By delivery mode, the intranasal segment is anticipated to show considerable growth over the forecast period.

Market Overview

The oligonucleotides market includes synthetic short strands of nucleotides (DNA or RNA), typically consisting of 15–25 bases, that are used across a variety of life sciences, diagnostics, and therapeutics applications. These molecules are vital in gene expression studies, antisense therapy, PCR, next-gen sequencing (NGS), diagnostics, and targeted drug delivery. With the increasing use of personalized medicine, molecular diagnostics, and RNA-based therapeutics, oligonucleotides have become a cornerstone of modern biotechnology and pharmaceutical research.

The oligonucleotides market is experiencing expansion due to growing requirements of individualized medication, rising incidences of hereditary diseases, and the development of RNA drugs. Innovations in the technologies used in the synthesis and delivery systems have increased the stability and efficacy of oligonucleotides, leading to an increase in their application in diagnostics, therapeutics, and research. Also, the expansion is being facilitated by more investments by the government and the private sector in the fields of genomics and molecular biology research.

How is AI Integration Transforming the Oligonucleotides Market?

The Artificial intelligence is making a major impact on the market because it is speeding up the research, expanding the efficiency of the design, and streamlining the development of therapeutics. Newer AI techniques allow selecting and developing target-specific oligonucleotides fast and at a lower cost during the initial phases of drug development. Within clinical development, AI-based analytics facilitate the stratification of patients that can be utilized to facilitate more effective personalized treatment approaches. Moreover, the connectivity with the bioinformatics systems will increase data interpretation and communication between the clinical faster decision-making.

What Factors Are Fueling the Rapid Expansion of the Oligonucleotides Market?

- Developments in Personalized Medicine and Gene Therapy: Antisense and RNA-based technologies are finding their way more frequently in the targeted therapy of cancers and rare genetic diseases. This tendency corresponds to the movement towards the precision medicine field, which has increased the need for oligonucleotides in clinical practices and the scope to treat some complex, gene-related diseases.

- Increasing Numbers of Genetic and Chronic Diseases: The rising cases of genetic disorders, cancer, and chronic diseases have boosted the demand for accurate diagnosis and treatment instruments. The specificity of gene targeting using oligonucleotides is critical to the achievement of a particular outcome, thus increasing the value of oligonucleotides in the creation of disease-molecular-based treatments.

- Innovations in Oligonucleotide Synthesis: The advances in synthesis and automation have made oligonucleotide production more scalable, high-purity, and cost-effective. Such advances facilitate the use in therapeutics and diagnostics, expanding the possibility of the use of oligonucleotide-based solutions to research institutions and pharmaceutical companies and enhancing the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.54 Billion |

| Market Size in 2025 | USD 4.79 Billion |

| Market Size in 2026 | USD 5.42 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Manufacturing Technology, End-User, Delivery Mode, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Genetic Disorders

The increased rate of genetic disorders, such as cancer and rare genetic diseases, as well as other chromosome abnormalities, has contributed immensely to the expansion of the oligonucleotide market. Very short fragments of DNA or RNA called oligonucleotides are critical to the development of the molecular diagnostics and precision therapy that treat a particular genetic mutation. The need to find oligonucleotide-based solutions is gathering speed as genomic-based research provides new insight into the molecular basis of diseases and facilitates in development of the next generation methods of treating them. Other technologies like antisense oligonucleotides, small interfering RNA (siRNA), and CRISPR-Cas-based systems require highly purified oligonucleotides to give the desired gene modulation, editing, and silencing. Consequently, the rising burden of genetic conditions spurs demand for healthcare services as well as sustained research, development, and investment in the oligonucleotide market.

Restraint

Concerns regarding the complexity of therapeutic

The development of therapeutic oligos is very complex, which is one of the major inhibitors in the oligonucleotides market. Such molecules are very precise and sensitive, and it is quite difficult to design, produce, and deliver them. Therapeutic oligonucleotides have been known to be unstable in the body, easily degraded, have low cellular uptake, and find it hard to get to the target tissue, which hinders their therapeutic efficacy. Also, they can activate immune systems or result in side effects unless they are well-designed. Their production in bulk and preservation of quality and uniformity is also a technical challenge and costly. These issues demand high technologies, the highest regulatory compliance, and great investment in research and development. Due to this, the development of oligonucleotide-based therapies for the market is a long and expensive process.

Opportunity

Rapid Adoption of Antisense Oligonucleotides

An improving acceptance of antisense oligonucleotides (ASOs) as anticancerous agents provides an encouraging chance for the oligonucleotides market. ASOs are functional based on the recognition of specific sequences of messenger RNA. This specific activity means that it is possible to silence certain oncogenes or other mutated genes that contribute to tumor formation, and it provides a greater degree of precision to the conventional chemotherapy and radiation-based approaches. The continuous studies, favorable legal frameworks, and increasing investments into RNA-based treatment contribute to boosting the clinical progress and integration of ASOs, providing them as an essential opportunity in the transforming environment of cancer treatment management.

Segment Insights

Product Type Insights

Why does the therapeutic oligonucleotide segment lead the oligonucleotide market?

The therapeutic oligonucleotide segment led the market and accounted for the largest revenue share in 2024, which can be attributed to the increased popularity of precision medicine and targeted therapy. Synthetic DNA or RNA strands are short, designed to bind particular genetic sequences and thus act on genes or RNA transcripts via direct interaction, either inhibiting, fixing, or repressing their expression. The growth of the segment is also being propelled by antisense oligonucleotides, small interfering RNAs (siRNAs), and aptamer advancements. Drug developers are putting more emphasis on RNA-based drugs as well as gene-based therapies, and therapeutic oligonucleotides are gaining more support. This segment gains advantage in the market through the increasing number of clinical trials and the growing pipeline of biotech that confirms its leading position in the global market.

The diagnostic oligonucleotides segment is expected to grow at a significant CAGR over the forecast period due to the enhanced demand for early and accurate disease diagnosis. In molecular diagnosis, oligonucleotides are used as probes, or primers, to identify particular DNA or RNA sequences that can be related to genetic abnormalities, infectious pathogens, and cancer biomarkers. Their extreme specificity and binding capacity to the target sequences in a short period imply their invaluable use in both diagnostic (PCR, qPCR, microarrays, and next-generation sequencing) procedures. The market is also being fuelled by technological changes, notably in the fields of point-of-care and rapid diagnostic testing.

Application Insights

Why did drug discovery & development contribute the most revenue in 2024?

The drug discovery & development contributed the most revenue in 2024 and is expected to dominate throughout the projected period. Drugs based on oligonucleotides, such as antisense oligonucleotides, siRNA, and aptamers, provide a path-breaking solution in modern treatment in the form of a targeted therapy. These small DNA or RNA molecules can bind to precise genetic sequences with great specificity and can allow researchers to inhibit the expression of a particular gene or correct gene mutation, or suppress the expression of disease-causing genes. Such accuracy is particularly useful in the treatment of complicated diseases like cancer, neurodegenerative diseases, and rare diseases. The rising cases of clinical trials, regulatory approvals, and investment in genetic medicines are driving up the great demand, making the segment a leader in the market.

The RNA-based therapeutics segment is expected to grow substantially in the oligonucleotides market due to the increased genetic research, the rising pipeline of RNA-based therapies, etc. Such therapies employ short sequences of RNA or oligonucleotides to alter the expression of a gene, usually by inhibiting the translation of mRNA, degrading or mis-splicing of faulty RNA. This can be used in the curing of many diseases like inherited disorders, cancer, and viral infections. Companies that deal with pharmaceuticals and biotechnology are investing a lot in RNA platforms, and agencies are increasingly proactive in supporting these new therapies. Due to the growing research in knowledge and more advanced delivery technology, RNA-based therapeutics are bound to have a transformative impact on the future of precision medicine.

Manufacturing Technology Insights

Why did the solid phase oligonucleotide synthesis segment lead the oligonucleotides market in 2024?

The solid phase oligonucleotide synthesis segment led the oligonucleotides market and accounted for the largest revenue share in 2024. The technology has since acquired gold-standard status as the method of choice to prepare synthetic DNA and RNA molecules to be utilized in a number of applications, such as therapeutics, diagnostics, and research settings. The procedure creates the ability to control the nucleotide length and order accurately and customize accordingly to end-user requirements. This trend towards the growing applications of oligonucleotides in gene therapies, molecular diagnostics, and personalized medicine has further strengthened this segment. Its versatility with different chemical transformations, as well as its increased throughput, leads to a high rate of its application in the pharmaceutical and biotechnology industries.

The microarray-based synthesis segment is expected to grow at a significant CAGR over the forecast period. Microarray-based synthesis contrasts with solid phase synthesis, which creates oligonucleotides one at a time, and therefore is far better suited to genomics research, drug discovery, and synthetic biology experiments. The method is especially useful when generating libraries of oligos is paramount, like in the case of CRISPR screening and next-generation sequencing (NGS), and gene expression studies. The developments in photolithographic technologies and the technology of inkjet printing have also furthered the efficacy and precision of this technology. Moreover, with the increasing need for precision medicine and large-scale genomic endeavors, the scalability and speed of microarray-based synthesis are making it a possible solution.

End-User Insights

Why did pharmaceutical & biotechnology companies contribute the most revenue in 2024?

The pharmaceutical & biotechnology companies contributed the most revenue in 2024 and are expected to dominate throughout the projected period. These firms are important players throughout the entire value chain that is drug discovery and preclinical development, scale-up and manufacturing of oligonucleotide-based therapeutics, manufacturing of oligonucleotide-based therapeutics at scale and commercialization of oligonucleotide-based therapeutics. The pharma titans, as well as fresh biotechnology companies, are throwing their lot on oligonucleotide platforms because of their promise to treat genetic diseases, cancer, or rare diseases. With the growth of personalized and RNA-based medicines, drug companies are increasing the representation of oligonucleotide drugs in the pool, which shows revenue boost and technology development in the pharmaceutical and biotechnological sectors.

The contract manufacturing organizations segment is expected to grow substantially in the oligonucleotides market because of the growing levels of outsourcing within the pharmaceutical and biotech organizations. Oligonucleotide-based drugs require special facilities, technical competence, and demand of high regulatory requirements, and it would be difficult to perform them in-house by many companies. CMOs offer end-to-end solutions to include custom synthesis, scale production, purification, formulation/quality control, and regulatory. CMOs are increasingly coming up with strategic alliances with drug developers so that drugs can be developed and commercialized in a shorter period. The CMOs in facilitating innovation and increasing the speed of delivery of the oligonucleotide-based solutions.

Delivery Mode Insights

Why did the injectable segment lead the oligonucleotides market in 2024?

The injectable segment led the oligonucleotides market and accounted for the largest revenue share in 2024. There is also injecting administration, which is usually intravenous, subcutaneous, or intramuscular, which makes the delivery of the therapeutic agents into the systemic circulation swift and in a controlled form, resulting in better bioavailability and better therapy outcomes. This approach is imperative to antisense oligonucleotides, small interfering RNAs, and aptamers adopted in treating severe diseases like cancer, rare genetic diseases, and viruses. The injection promotes specific administration and dose management, lowering the possibility of the drug being degraded by intestinal enzymes.

The intranasal segment is expected to grow at a significant CAGR over the forecast period. Antisense oligonucleotides and CpG oligonucleotides targeting neurological diseases, e.g., Alzheimer's and Parkinson's, as well as respiratory diseases such as asthma and pulmonary fibrosis. Furthermore, it does not pass through the first-pass effect, which increases the stability level and bioavailability of the drug. Due to continuous research and innovations in the nasal drug delivery systems, such as nanoparticles and gels, this pathway is becoming more practical for oligonucleotide therapies. With increased demand for non-invasive treatment measures by patients, there is a high possibility that the intranasal segment may emerge as the growth driver of the market.

Sales Channel Insights

Why did direct sales contribute the most revenue in 2024?

The direct sales contributed the most revenue in 2024 and are expected to dominate throughout the projected period. The research institutions, diagnostic labs, biotechnology, and pharmaceutical companies tend to purchase directly from manufacturers to get quality, authenticity, and reliability. There is also the benefit that direct sales facilitate strategic co-planning for the suppliers and the end-users in the long term, helping them to collaborate in the R&D and product development. Such benefits entail the use of direct sales when it comes to bulk orders as well as unique uses.

The online platforms segment is expected to grow substantially in the oligonucleotides market due to the rising digitalization, convenience of e-commerce. A method's evaluation of online sources of oligonucleotide products readily reveals access to a large selection of standard and non-standard products, as well as the availability of research-use-only (RUO) products and custom product synthesis. Using these sites, the researchers, academics, and small laboratories make simple comparisons of products, verify the specifications, and place orders anywhere in the world almost instantaneously. The emergence of digital procurement that has been driven by the ease of use of the interfaces, secure e-payments, and order tracking in real-time, is augmenting customer experience and market penetration.

Regional Insights

Why did North America dominate the oligonucleotides market in 2024?

North America held the dominating share of the oligonucleotides market in 2024. The large pharmaceutical and biotechnological organizations, high research infrastructure, and great needs in newer and more effective therapeutic and diagnostic devices. North America has attractive regulatory environments and investment opportunities that support clinical trials and speed the development of oligonucleotide-based therapies. Oligonucleotide use in the treatment of complex and rare diseases is further being encouraged by the country's dedication to improving healthcare and the inclusion of the government in aiding biopharmaceutical research.

The US, being the highest contributor to the North American market, is a pioneer in genomic research, therapeutic product development, and development of biotechnology. The prevalence of R&D expenditures, as well as a large number of oligonucleotides in personalized medicine, molecular diagnostics, and gene editing technologies such as CRISPR, has been used to support the prevalence of countries. The gradual rise in the incidence of genetic disorders and cancer in the U.S. also makes the country a target market for innovation and commercialization in the field.

Why is the Asia Pacific region expected to grow at the fastest CAGR?

Asia Pacific is estimated to grow at the fastest CAGR during the forecast period due to the rising interest of the major industry players in expanding to emerging markets to achieve higher profitability. Countries such as Japan, China, and India are leading in this expansion process with several efforts to enhance both oligonucleotide synthesis and application. The area has been witnessing a massive advance in the field of genomics, along with massive use of sequencing and polymerase-chain-reaction-market (PCR) technologies, necessities of molecular diagnostics, and gene-based therapeutics. The favourable government policies, the increase in healthcare infrastructure, and the addition of both public and private investment in biotechnology serve as further catalysts for the market.

The increase in the size of the Chinese pharmaceutical and biotechnology sector is supported by government initiatives meant to make more investments in genomics and personalized care. The need for oligonucleotides in the country is growing since these are valuable in the production of personalized medicines and more advanced diagnostics regarding chronic and genetic diseases. Moreover, with better cooperation of local industries with international biotech firms, the transfer of technology has occurred faster, and advanced oligonucleotide synthesis technology has become accessible.

What factors are influencing Europe's oligonucleotides market share?

The European market is expected to account for a substantial market share in 2024, owing to the robust pharmaceutical and biotechnological industries and advanced research facilities, as well as stringent regulatory standards of the region. The current evolution towards the development of personalized medicine, the rise of chronic and genetic illnesses, and the progression of molecular diagnostics are also contributing factors to the increase in the need for oligonucleotide-based technologies. Europe is also a leader in terms of strong public and private research funds that are used in genomics and rare diseases research.

In Europe, the United Kingdom sits at the centre of the market, due to its well-established life sciences industry and prominence in genomic medicine. The government has invested in genomics, including the Genomics England and UK Biobank initiatives that have further fostered the utilisation of oligonucleotides in the development of diagnostics and therapeutics. Strategic alliance between educational institutions, biotechnology organizations, and health care facilities that are rapidly accelerating clinical practice is in the process of becoming very instrumental in driving innovation.

Regional Insights

What Potentiates the Growth of the Oligonucleotides Market in Latin America?

The market in Latin America is expanding because of the increasing adoption of molecular diagnostics (such as PCR, qPCR, and NGS) in public health programs, which boosts the demand for oligonucleotide reagents. Regulatory agencies like the Brazilian Health Regulatory Agency oversee advanced therapies like gene therapies. Many biotech companies, particularly in Brazil, Mexico, and Argentina, are investing in biotech infrastructure and genomics research, significantly supporting market growth. Brazil leads the Latin American market due to its rapidly expanding biotech and genomics R&D, which is driving higher demand for oligonucleotide synthesis in research and drug development.

What Opportunities Exist in the Middle East and Africa?

The Middle East and Africa (MEA) region offers significant opportunities for the oligonucleotides market, fueled by government efforts to promote nucleic acid therapeutics and support the synthetic biology industry. Growing investment in biotechnology and genomics across major markets like the UAE, Saudi Arabia, and South Africa is increasing demand for oligonucleotide-based diagnostics and treatments. Saudi Arabia stands out as a key contributor to the market due to government-led initiatives and funding for research and development in molecular diagnostics and infectious diseases. Additionally, rising collaborations between biotechnology and pharmaceutical companies further drive regional market growth.

Oligonucleotides Market Companies

- Ionis Pharmaceuticals – A pioneer in antisense oligonucleotide therapeutics, driving innovation and commercial adoption of oligo-based drugs.

Alnylam Pharmaceuticals – Advances the market through development and commercialization of RNAi-based oligonucleotide therapies. - Bio-Synthesis Inc. – Provides custom oligonucleotide synthesis services for research, diagnostics, and therapeutic development.

- Thermo Fisher Scientific – Supplies large-scale oligo synthesis platforms, custom oligos, and reagents used across research and clinical applications.

- Eurofins Genomics – Offers high-throughput DNA and RNA oligo synthesis for molecular biology, diagnostics, and pharma R&D.

- Integrated DNA Technologies (IDT) – A global leader in custom oligo manufacturing, supporting genomics, PCR, CRISPR, and NGS workflows.

- Biogen – Collaborates in developing oligonucleotide-based neurological therapies, expanding clinical use of antisense technologies.

- Sarepta Therapeutics – Develops exon-skipping oligonucleotide drugs for rare neuromuscular disorders, boosting therapeutic adoption.

- Nitto Denko (Nitto Avecia) – Specializes in GMP oligonucleotide contract manufacturing for large-scale therapeutic production.

- Bioneer Corporation – Produces synthetic oligos and qPCR reagents used in diagnostics, molecular biology, and biotech R&D.

- LGC Biosearch Technologies – Supplies high-quality specialty oligos, probes, and fluorescent dyes for advanced diagnostics and research.

- GE Healthcare – Supports the market through bioprocessing technologies used for purification and manufacturing of oligonucleotide therapeutics.

- TriLink BioTechnologies – Provides modified nucleic acids, mRNA, and GMP-grade oligos essential for advanced therapeutics and diagnostics.

- Bio-Techne Corporation – Offers reagents, probes, and nucleic acid technologies supporting oligo-based research and diagnostic assays.

- Exiqon (QIAGEN) – Delivers microRNA-focused oligonucleotide tools and assays for gene expression research and diagnostics.

- GeneDesign, Inc. – A contract manufacturer specializing in high-purity GMP oligonucleotides for clinical and commercial applications.

- Agilent Technologies – Supplies oligo synthesis platforms, genomics tools, and high-quality custom oligos for research and diagnostics.

- Roche Diagnostics – Utilizes oligonucleotide probes and primers across its diagnostic platforms, strengthening clinical adoption.

- AstraZeneca (via Ionis collaborations) – Accelerates the development and commercialization of antisense oligonucleotide therapies through strategic partnerships.

- GenScript Biotech Corporation – Provides comprehensive oligonucleotide synthesis services supporting global research, diagnostics, and therapeutic development.

Recent Developments

- In February 2025, Jawaharlal Nehru India Centre for Advanced Scientific Research organized the first Nucleic Acid Therapeutics Regional Meeting. The conference encouraged industry- and academic-based research in the formation of oligonucleotide therapeutics.

(Source: https://www.oligotherapeutics.org) - In January 2025, Maravai LifeSciences purchased pertinent property and intellectual rights of Molecular Assemblies (MAI). The technology, Fully Enzymatic Synthesis (owned by Molecular Assemblies), will upgrade oligonucleotides and mRNA production functions at TriLink BioTechnologies.

(Source: https://investors.maravai.com)

- In December 2024, Co-Dx with CoSara Diagnostics Pvt. Ltd commissioned an oligonucleotide synthesis facility in Ranoli, India. In line with the Make in India program, the factory will produce Co-Primers oligos in-house. (Source:https://www.stocktitan.net)

Segment Covered in the Report

By Product Type

- Therapeutic Oligonucleotides

- Antisense Oligonucleotides

- Small Interfering RNA (siRNA)

- MicroRNA (miRNA)

- Aptamers

- Immunostimulatory Oligonucleotides

- Diagnostic Oligonucleotides

- Probes

- Primers

- Molecular Beacons

- Research Oligonucleotides

- Custom DNA Oligos

- Custom RNA Oligos

- Modified Oligos

By Application

- Drug Discovery & Development

- Molecular Diagnostics

- Gene Therapy

- Research Applications (PCR, qPCR, NGS, etc.)

- RNA-based Therapeutics

- Cancer & Rare Disease Diagnostics

By Manufacturing Technology

- Solid Phase Oligonucleotide Synthesis

- Solution Phase Synthesis

- Microarray-Based Synthesis

- Enzymatic Synthesis

By End-User

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

- Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Contract Manufacturing Organizations (CMOs)

By Delivery Mode

- Injectable

- Oral

- Intranasal

- Transdermal

By Sales Channel

- Direct Sales

- Distributor/Third-Party Sales

- Online Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting