Omega 3 Prescription Drugs Market Size and Forecast 2025 to 2034

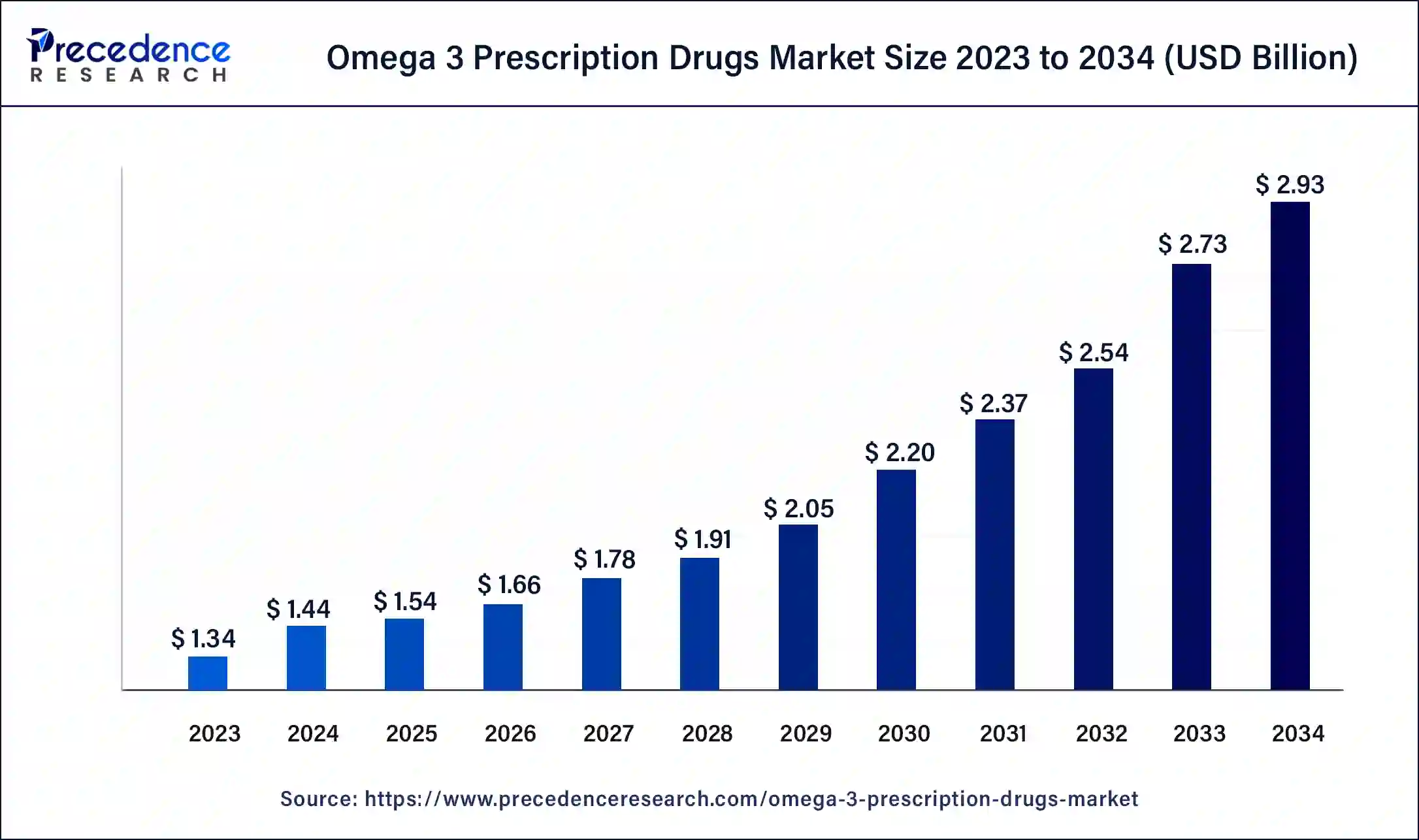

The global omega 3 prescription drugs market size was calculated at USD 1.44 billion in 2024 and is expected to reach around USD 2.93 billion by 2034, expanding at a CAGR of 7.36% from 2025 to 2034. The North America omega 3 prescription drugs market size reached USD 630 million in 2024. The rising concerns related to the maintenance of cholesterol levels are also expected to drive theomega 3 prescription drugs market.

Omega 3 Prescription Drugs Market Key Takeaways

- The global omega 3 prescription drugs market was valued at USD 1.44 billion in 2024.

- It is projected to reach USD 2.93 billion by 2034.

- The omega 3 prescription drugs market is expected to grow at a CAGR of 7.36% from 2025 to 2034.

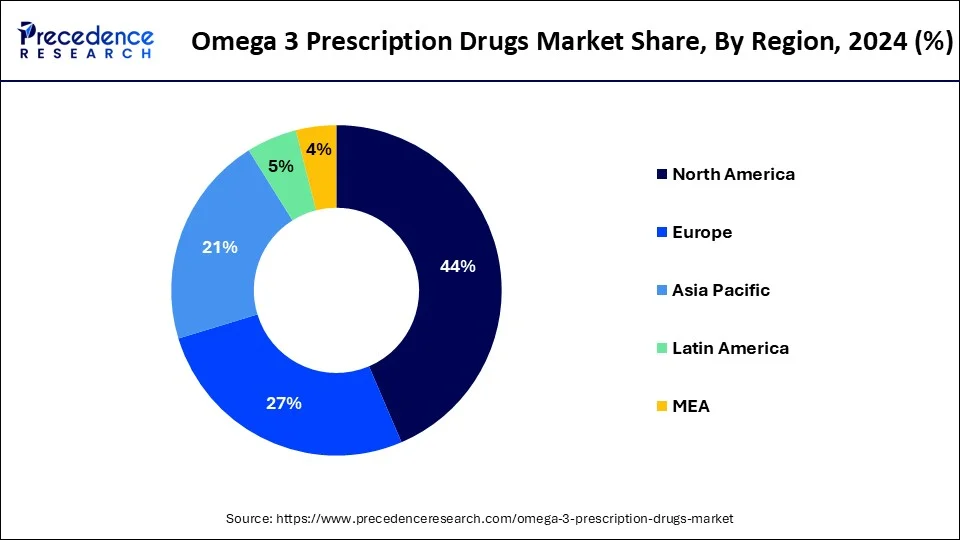

- North America has accounted highest revenue share of 44% in 2024.

- Asia Pacific is expected to experience the fastest growth in the market during the period studied.

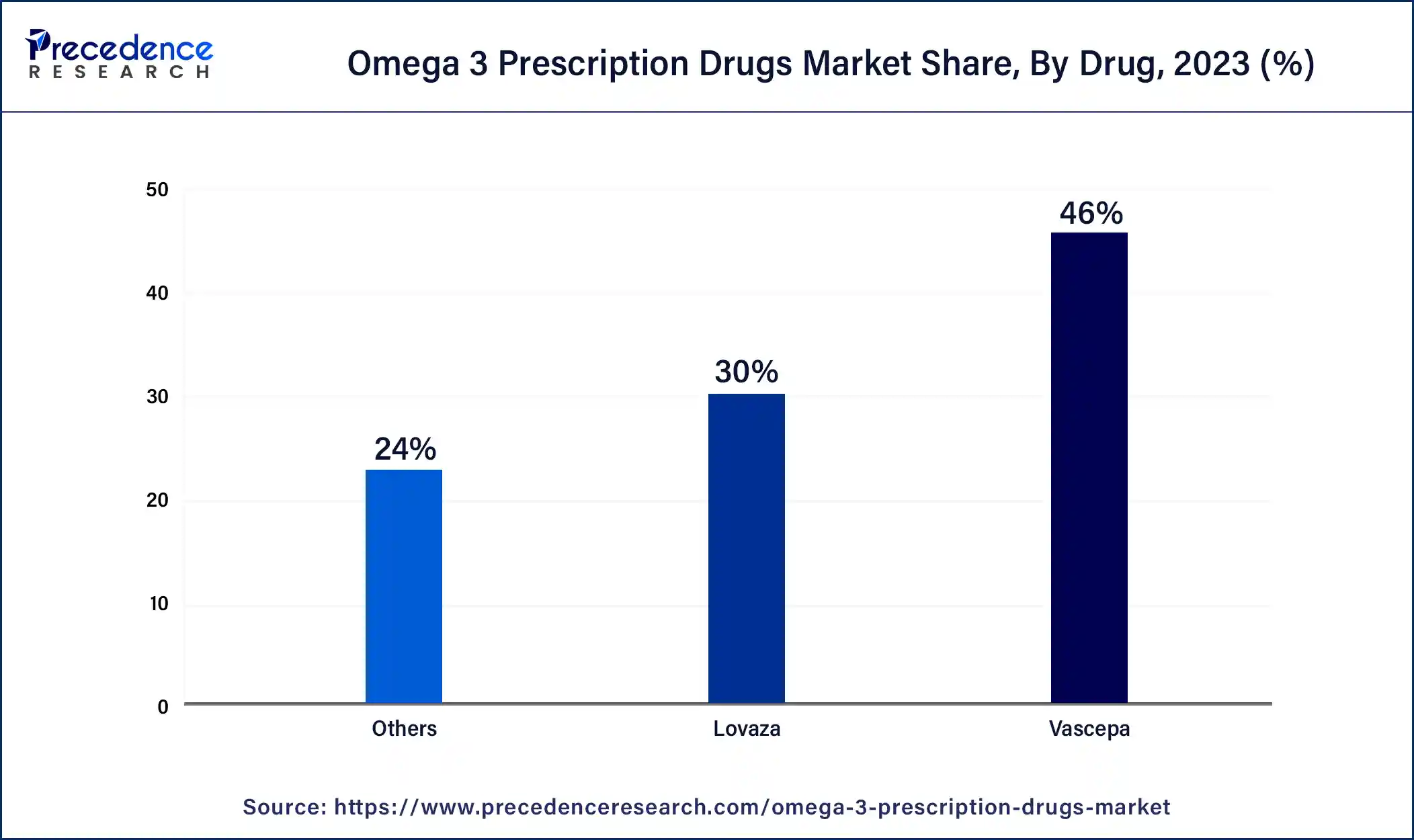

- By drug, the Vascepa segment has accounted 46% revenue share in 2024.

- By drug, the others segment is expected to grow at the fastest rate in the market over the forecast period.

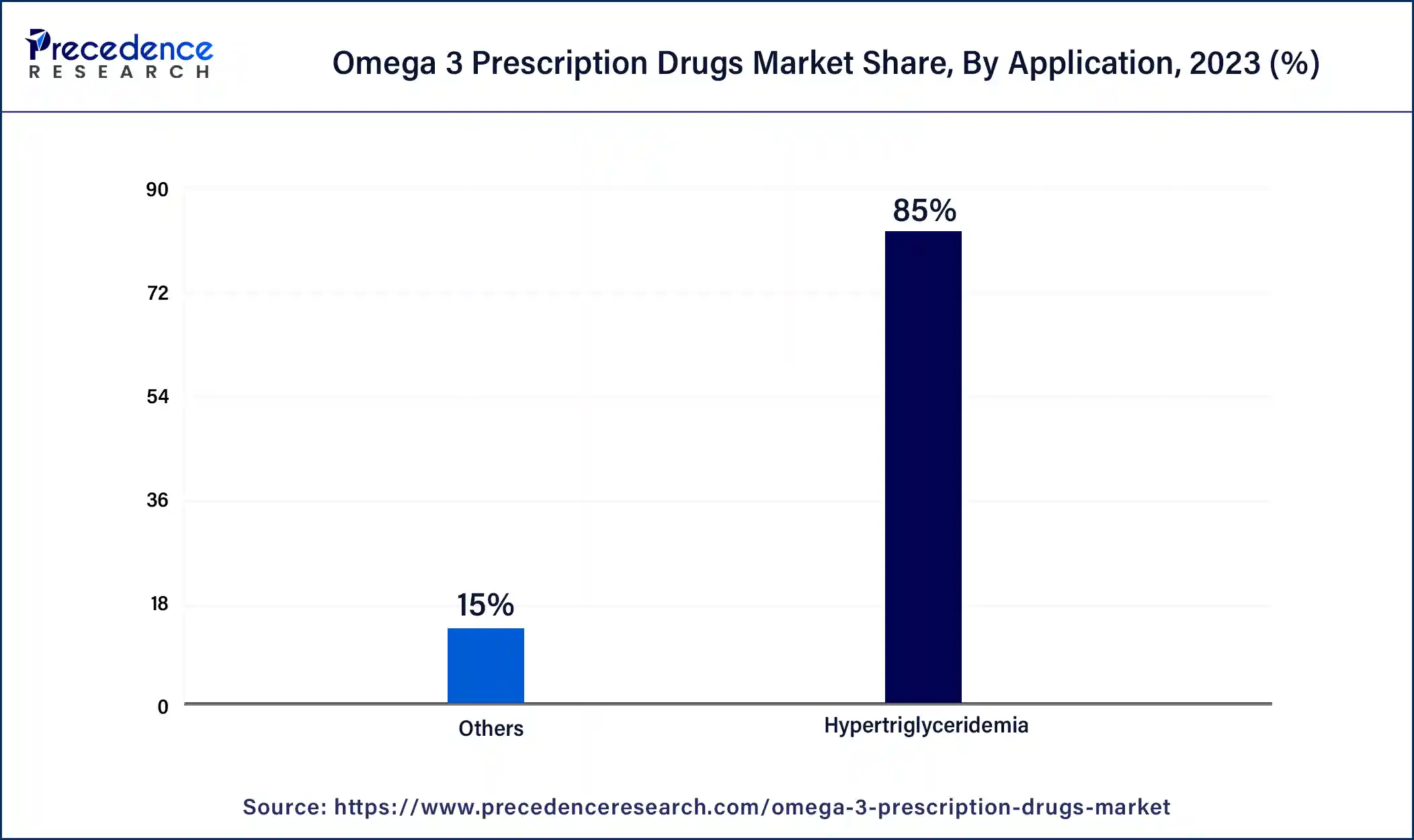

- By application, the hypertriglyceridemia segment has accounted 85% revenue share in 2024.

- By application, the others segment is expected to grow at the fastest rate in the market during the forecast period.

- By distribution channel, in 2024, the retail pharmacy segment has held largest share of 54%.

- By distribution channel, the hospital pharmacy segment is expected to show the fastest growth in the market over the projected period.

U.S. Omega 3 Prescription Drugs Market Size and Growth 2025 to 2034

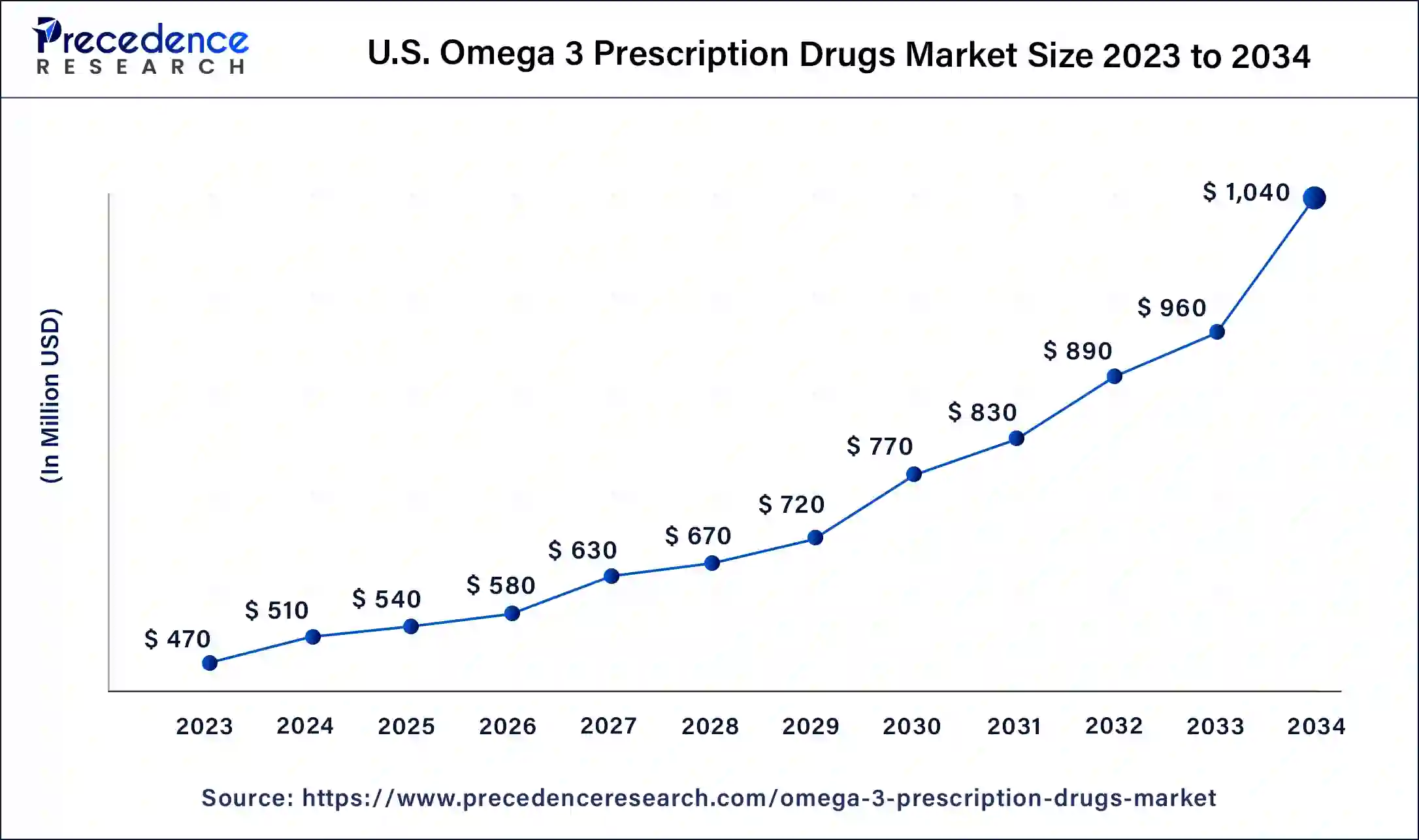

The U.S. omega 3 prescription drugs market size was exhibited at USD 510 million in 2024 and is projected to be worth around USD 1,040 million by 2034, poised to grow at a CAGR of 7.39% from 2025 to 2034.

North America dominated the omega 3 prescription drugs market in 2024. Many leading pharmaceutical companies involved in omega-3 drug development are in North America. Firms invest heavily in marketing, clinical trials, and research and development, enhancing the availability and adoption of prescription omega-3 medications. Moreover, the U.S. holds the largest share of the omega-3 prescription drug market, while Canada represents the fastest-growing market within the region.

Asia Pacific is expected to experience the fastest growth in the omega 3 prescription drugs market during the period studied. In recent years, diabetes mellitus has surged as a major health issue among the Asian population. Cardiovascular disease (CVD), a leading cause of death and a significant side effect in diabetic patients, has become a major concern. Furthermore, High levels of low-density lipoprotein cholesterol are a key risk factor for CVD. Growing awareness about the importance of lowering triglyceride levels is driving industry growth in this region.

- In June 2024, South Korean company Daewoong Bio launched a hyperlipidemia treatment, CRA-TG Soft Capsule.Daewoong Bio's CRA-TG Soft. Cap. (Courtesy of Daewoong Bio) CRA-TG combines the hyperlipidemia drug rosuvastatin and unsaturated fatty acid omega-3. Omega-3 is used as a dietary supplement to reduce triglyceride levels in patients with high triglycerides.

Market Overview

The omega 3 prescription drugs market encompasses the sales of EPA (eicosapentaenoic acid) and DHA (docosahexaenoic acid). Market values are measured at the 'factory gate' level, reflecting the worth of goods sold by manufacturers, whether to intermediaries such as downstream manufacturers, wholesalers, distributors, and retailers or directly to end consumers. Omega-3 prescription drugs are known to reduce blood triglyceride levels, a fat-like substance, and increase the levels of beneficial cholesterol (HDL) in the body. Omega-3 fatty acids, which can be sourced from food or supplements, are essential nutrients that support overall health and are vital for the construction of cell membranes.

Omega 3 Prescription Drugs Market Growth Factors

- Obesity is one of the major driving factors that can lead to diabetes, thereby driving the omega 3 prescription drugs market growth.

- The high triglyceride levels amongst most of the population are expected to drive the demand for the omega 3 prescription drugs market.

- Industry players are focusing on developing novel drugs for the treatment of various diseases, which are expected to fuel the omega 3 prescription drugs market growth.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 2.93 Billion |

| Market Size in 2025 | USD 1.54 Billion |

| Market Size in 2024 | USD 1.44 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.36% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing awareness of the health benefits

The omega 3 prescription drugs market is being significantly driven by the increasing awareness of the health benefits associated with omega-3 three fatty acids. These essential nutrients, found in certain foods and supplements, have gained considerable attention due to their potential to enhance health and well-being. The benefits of omega-3 fatty acids for cardiovascular health are particularly well-documented. However, they have been shown to lower blood pressure, reduce lipid levels, and diminish the risk of arrhythmias, all of which are linked to a higher risk of heart disease. Given their potential to mitigate heart disease, one of the leading causes of death worldwide, omega-3 fatty acids have garnered considerable interest from individuals seeking to improve their cardiovascular health.

- In May 2024, MegaFood, a certified B Corporation and 1% for the Planet member that crafts planet-first vitamins and minerals, announced the launch of Omega 3-6-9, a plant-powered complex with a unique array of key 3-6-9 fatty acids and 600 mg of Omega-3 for heart, brain, vision, and joint support. Sourced with the environment in mind, Omega 3-6-9 is made from a duo of farm-traceable Ahiflower and fish-free algae oil to minimize the impact on marine ecosystems.

Restraint

Inconsistent fish capture

Market growth is constrained by inconsistent fish capture, which requires the extraction of omega-3 fatty acids. The rising demand for fish from various sources reduces its availability at lower costs. The increasing presence of environmental contaminants, metals, and hazardous pollutants in fish makes it unsafe for consumption, further limiting the market's expansion. Also, stricter fishing practices and regulations to protect fish species are expected to affect the omega 3 prescription drugs market raw materials supply.

Opportunity

Rising adoption of innovative products

The omega 3 prescription drugs market is currently experiencing a significant increase in the adoption of innovative products, marking a key trend. Leading manufacturers in this sector are focusing strategically on developing new products to strengthen their positions in the market. Major players are particularly concentrating on launching capsules that aim to reduce the body's triglyceride production. These capsules are often made from gelatin or similar materials and contain a specific dosage of medication, nutrients, or active ingredients, offering a convenient method for ingestion. This focus on product innovation is creating new opportunities within the market.

- In October 2022, the European Commission approved plant-based omega-3 products from DSM for use as substitutes for fish and animal-derived sources across the EU. DSM asserts that these products bolster the nutritional profile of plant-based foods while facilitating the creation of fish, such as products derived from animals.

Drug Insights

The Vascepa segment dominated the global omega 3 prescription drugs market in 2024. The expansion of this segment is largely due to the wide adoption of Vascepa, an FDA-approved treatment for patients with elevated triglyceride levels. Approved by the FDA for severe hypertriglyceridemia, Vascepa (icosapent ethyl) has been endorsed based on robust clinical evidence demonstrating its effectiveness in reducing high triglyceride levels, a significant risk factor for cardiovascular diseases. Moreover, this strong clinical support has instilled confidence in physicians, which leads them to recommend Vascepa to patients with this condition.

- In August 2023, Amarin entered into an exclusive marketing and commercialization agreement with Neopharm for VAZKEPA in the State of Israel, Gaza, the West Bank, and the territories of the Palestinian Authority. The agreement for VAZKEPA capsules comes after approval from Israel's Ministry of Health (MOH) Pharmaceuticals Division.

The others segment is expected to grow at the fastest rate in the omega 3 prescription drugs market over the forecast period. It includes Lovaza, the first omega-3 prescription drug approved by the FDA, which is a highly effective medical-grade supplement used to manage high triglyceride levels. The growth of this segment is also fueled by the widespread availability of generic alternatives and the increasing adoption of Lovaza among the target demographic.

Application Insights

The hypertriglyceridemia segment led the omega 3 prescription drugs market in 2023. Several FDA-approved omega-3 fatty acid prescription products are designed to complement the diet in lowering triglyceride levels in patients with severe hypertriglyceridemia. These include products such as Epanova, Omtryg, and Lovaza, which contain both DHA and EPA. The increased accessibility of these treatments is contributing to the growth of this market segment.

- In March 2023, Hikma Pharmaceuticals, a multinational pharmaceutical company, introduced the Icosapent Ethyl Capsules, 0.5g, in the U.S. market. This product is specifically indicated for lowering triglyceride levels in adults afflicted with severe hypertriglyceridemia, containing eicosatetraenoic acid (EPA), acknowledged for its efficacy in reducing triglycerides.

The others segment is expected to grow at the fastest rate in the omega 3 prescription drugs market during the forecast period. This is because omega-3 prescription drugs have demonstrated promising efficacy in reducing triglyceride levels, with research indicating their broad benefits in managing cardiovascular risks and lowering cholesterol levels. As public awareness of healthy living rises, the adoption of these omega-3 drugs is anticipated to grow. This increase in usage is expected to drive further expansion of the market segment.

Distribution Channel Insights

The retail pharmacy segment held the largest share of the omega 3 prescription drugs market in 2023. Pharmacists, as highly skilled medical professionals, provide valuable advice and guidance to patients. They address concerns or questions, explain dosage instructions, and educate patients about the benefits of omega-3 prescription medications, which improve patient adherence and outcomes. Hence, the uptake of omega-3 prescription drugs is projected to rise, which leads to further growth in this market segment.

The hospital pharmacy segment is expected to show the fastest growth in the omega 3 prescription drugs market over the projected period. This can be attributed to the expertise of experienced physicians who strive to minimize prescription errors and ensure prompt access to medications. Managing cardiovascular diseases is facilitated by medications from hospital pharmacies, which cater to both in-patient and out-patient needs. Additionally, focusing on generic drugs has emerged as a successful strategy for fostering overall industry growth.

Omega 3 Prescription Drugs Market Companies

- Abbott

- Amarin Pharmaceuticals Ireland Ltd.

- GSK plc (GlaxoSmithKline plc)

- Natrapharm, Inc. (Patriot Pharmaceutical Corp.)

- Viatris, Inc.

- Grupo Ferrer Internacional, S.A.

- Camber Pharmaceuticals, Inc.

- Dr. Reddy's Laboratories Ltd.

- Zydus Group

- Hikma Pharmaceuticals PLC

Recent Developments

- In February 2023, Edding, the commercialization partner of Amarin for Vascepa in China, announced the acceptance of a new drug application by NMPA. The industry is facing a threat with the entry of generic drugs in the U.S., which is adversely influencing the sales of prescription products, such as Vascepa.

- In May 2023, Amarin reported a plunge in sales by 33%, owing to the slashed prices by the company to compete with the generics. Moreover, industry players are focusing on developing novel drugs for the treatment of related disease conditions.

Segments Covered in the Report

By Drug

- Vascepa

- Lovaza

- Others

By Application

- Hypertriglyceridemia

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting