What is the Omics-Based Clinical Trials Market Size?

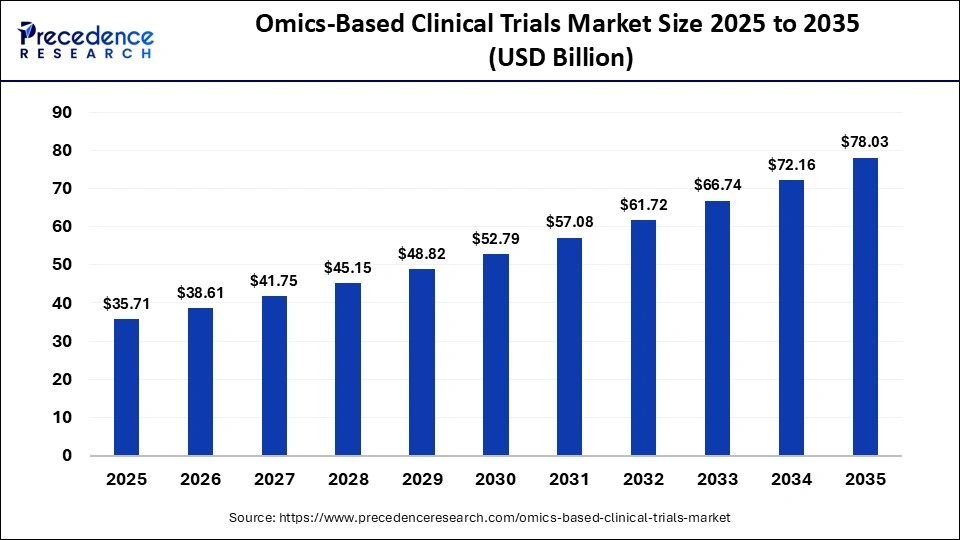

The global omics-based clinical trials market size is calculated at USD 35.71 billion in 2025 and is predicted to increase from USD 38.61 billion in 2026 to approximately USD 78.03 billion by 2035, expanding at a CAGR of 8.13% from 2026 to 2035. The market for omics-based clinical trials is driven by the adoption of precision medicine, biomarker-driven studies, multi-omics integration, and increasing collaboration between biotech firms and research institutions.

Market Highlights

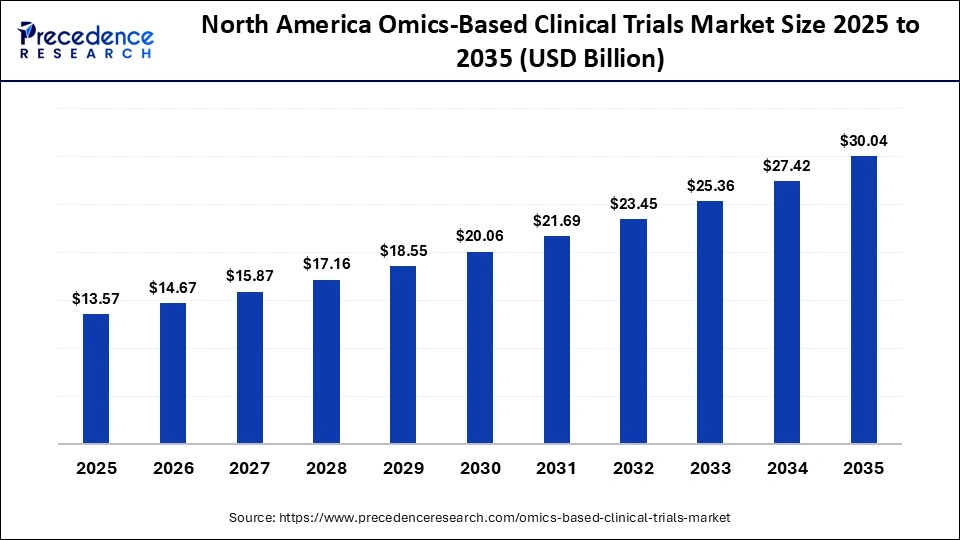

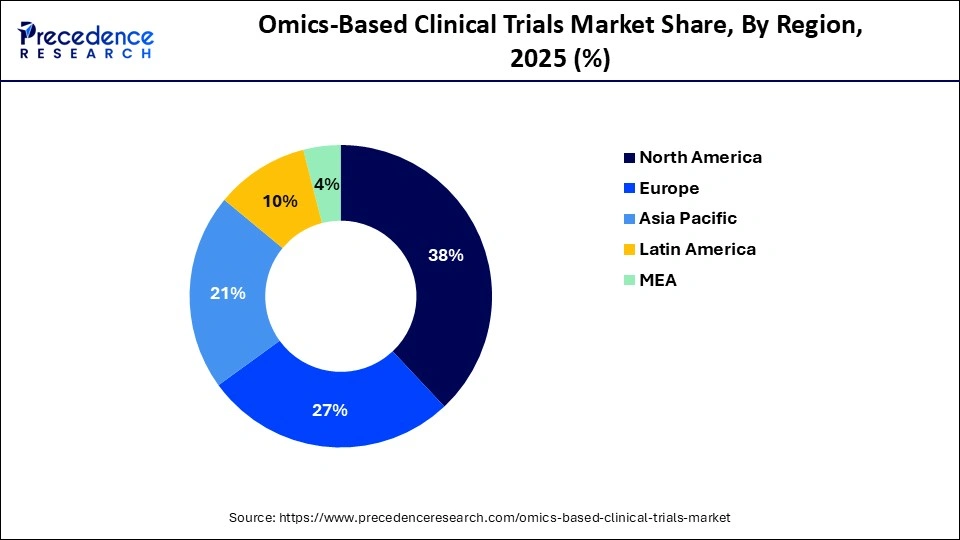

- North America led the global market, holding more than 38% of market share in 2025.

- The Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By omics type, the genomic segment contributed the biggest market share in 2025.

- By omics type, the multi-omics segment is growing at a strong CAGR between 2026 and 2035.

- By study phase, the phase II segment dominated and held the biggest market share in 2025.

- By study phase, the phase I segment is expected to grow at the fastest CAGR from 2026 to 2035.

- By application, the oncology segment captured the highest market share in 2025.

- By application, the rare & genetic diseases segment is expanding at a significant CAGR between 2026 and 2035.

- By end-user, the pharmaceutical companies segment dominated the market in 2025.

- By end-user, the biotechnology companies segment is poised to grow at the fastest CAGR between 2026 and 2035.

- By service type, the omics data generation segment held the major market share in 2025.

- By service type, the bioinformatics & data analytics segment is expected to expand at the highest CAGR between 2026 and 2035.

Does Omics Have the Potential to Change How We Conduct Clinical Trials?

The omics-based clinical trials market leverages the integration of multiple omics technologies (genomics, proteomics, transcriptomics, and metabolomics) in clinical research to inform patient selection, treatment response, and outcome prediction. The success of omics-based trials is founded on the collection of high-throughput biological data to enable precision-based clinical trial designs.

As the market for omics-based clinical trials continues to grow, there has been a trend toward drug developers utilizing targeted therapies and establishing biomarker based clinical trials. Improvements in the capabilities of next generation sequencing (NGS), integrated multi-omics platforms, and bioinformatics have contributed to increased data depth and improved the overall clinical relevance of omics datasets. Enhanced collaboration between contract research organisations (CROs), technology companies, and research institutes will provide additional support for the establishment of omic-based clinical trial designs. The successful integration and interpretation of multi-omic data will continue to be an important area that defines the competitive advantage in this rapidly developing marketplace.

Artificial Intelligence Is Changing How Omics-Based Clinical Trials Are Used in Precision Medicine

Through the integration and analytics of millions of genomic, proteomic, transcriptomic, and other biological data, researchers can gain new insights and identify previously unrecognized biomarkers. As such, the role of artificial intelligence in supporting the development of a more precise therapeutic approach to medicine will be transformative. Through adaptive trial design and improvements to established methods for identifying trial-eligible patients from complex datasets, advanced genomic AI tools will enable more precise patient stratification and automate multi-omics data analytics.

- In January 2025, Nvidia partnered with Illumina to apply genomics and AI technologies to analyze and interpret multi-omic data in drug discovery, clinical research, and human health during the 43rd Annual J.P. Morgan Healthcare Conference.

Additionally, AI-based tools are expected to enhance prediction accuracy and rapidly accelerate biomarker identification for clinical trials. Recent U.S. FDA approvals of AI tools for liver disease clinical trials underscore the growing importance of AI across drug development workflows. This, in addition to these recent innovations, will expedite the development of personalized medicine through faster, more efficient clinical trials.

Policy-Driven Expansion of Omics-Based Clinical Trials Market Studies

- Overview of the Market: Omics-based clinical trials are the application of genomics, proteomics, and metabolomics to improve patient stratification, biomarker validation, and therapy response assessments. This alignment of trials with precision medicine will apply the principles of data-driven clinical research.

- Global Expansion: The growth of government-funded population genomics and multi-omics initiatives in the United States, Europe, and Asia is producing more locations for conducting such trials, increasing the number of different types and ethnicities participating in these trials, and facilitating international collaboration regarding omics-related clinical study initiatives.

- Growth of Publicly Funded Initiatives: Numerous national entities are continuing to allocate significant amounts of funding for multi-omics research infrastructure, the creation of biobanks, and the implementation of longitudinal cohort studies. These funds align with the objectives of assisting in the integration of omics into the design and conduct of clinical trials.

- Support of Regulatory and Policy Bodies: Regulatory bodies are starting to recognise the value of utilising biomarker-guided clinical trials and genomic endpoints, to promote adaptive trial designs, as well as to facilitate ethical use of omics data within the framework of clinical research.

- Growth of Digital and Data Infrastructure: By way of federal funding related to the expansion of high-performance computing, datasets that national health departments, and bioinformatics hold, the capability of performing the necessary data analyses of large-scale omics trial datasets is being improved.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 35.71 Billion |

| Market Size in 2026 | USD 38.61 Billion |

| Market Size by 2035 | USD 78.03 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Omics Type, Study Phase, Application, End-user, Service Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Omics Type Insights

What Led Genomics to Dominate the Omics-Based Clinical Trials Market?

Genomics: This segment has become the leader in the omics-based clinical trials market, through its extensive applications in drug discovery, patient stratification, and companion diagnostics. Regulatory agencies are now more accepting of genomic biomarkers for enrolment and validation of clinical endpoints during the clinical trial process. The increase in the availability of large-scale genomic data, driven by falling sequencing costs and standardised workflows, has made Genomics the most operationally mature omics discipline and the most widely utilised for clinical trial design.

Multi-Omics (Integrated Platforms): This segment is expected to grow at the highest CAGR over the forecast period, as clinical trials are expanding beyond single-layer biological insights. By integrating genomics with transcriptomics, proteomics, and metabolomics, these advanced forms of biology are specifically designed to better characterise diseases and predict how patients will respond to treatments, providing greater accuracy and more detailed working models of disease states. Advances in integrated data processing, artificial intelligence-driven analytics, and cloud computing are facilitating the faster adoption of multi-omics, particularly in complex diseases, where single-omic approaches have limitations in capturing the biological diversity inherent in these diseases.

Study Phase Insights

What Makes Phase II Lead the Omics-Based Clinical Trials Market?

Phase II: This segment dominated the market in 2025, as omics-based clinical trials often begin in Phase II because the purpose of these studies is to validate the biomarker and provide proof of concept. At this stage, omics tools are important for determining target engagement in the patient population, understanding variability in patient responses, and optimizing dose. As a result, sponsors of Phase II clinical trials use omics data to minimise the risk of study failure in later phases, thereby making Phase II the phase in which the largest volume of data is collected on an omics indication and the most critical strategic phase for omics utilisation.

Phase I: This segment represents the fastest-growing area in omics-based clinical research as more and more early-phase clinical studies begin utilising molecular profiling technology for the first time. In addition to assessing the safety of a potential drug compound, first-in-human clinical studies now use omics technology to evaluate pharmacodynamics, provide insight into several early biological signals, and assess the patient's genetic and metabolic make-up. The move toward precision therapeutics and adaptive trial designs has led to earlier acceptance of omics technologies for drug development, driving a biological, rather than purely safety-based, approach in phase I clinical trials.

Application Insights

Why Are There More Oncology-Based Omics Trials than Any Other Disease Sector?

Oncology: This segment is the dominant application in the omics-based clinical trials market in 2025, driven by the strong correlation among molecular changes across genomic, transcriptomic, and proteomic data and the ability to deliver new therapies to patients with cancer. The most prevalent cancer research area at this time is cancer research, which includes using the latest omics-based markers to select patients for clinical trials, track patient resistance to treatment, and monitor patient responses.

Rare & Genetic Diseases: Rare diseases and genetic disorders are the fastest-growing area for the omics-based clinical trials market, as advances in omics technology enable researchers to diagnose and develop therapies for patients with previously uncharacterized diseases. Utilizing whole-genome and multi-omics sequencing enables the identification of mutations that cause disease in small patient populations. Additionally, regulatory incentives, orphan drug programs, and increased advocacy efforts are helping to accelerate the development of clinical omics trials for rare and genetic diseases.

End User Insights

What Makes Pharmaceutical Companies Pioneers in the Omics-Based Clinical Trials Market?

Pharmaceutical Companies: The pharmaceutical industry leads in omics for clinical trials due to its strong pipelines and deep pockets for funding. Companies involved in pharmaceutical development are utilising omics for target validation, improved success rates in clinical trials, and support for regulatory submissions. Furthermore, the large pharmaceutical companies all possess in-house genomics and bioinformatics capabilities, which lend themselves to a greater integration of omics in the development of multiple therapies and across all stages of development.

Biotechnology Companies: Biotech companies are becoming the fastest growing end users of omics-based clinical trials. The continued shift in innovation from larger, established pharmaceutical companies to smaller, science-based businesses has led to an increase in the number of biotech companies created around omics-based platforms and precision medicine approaches. Additionally, strategic partnerships between biotech firms, platform licensing, and the advent of virtual trials enable them to adopt advanced omics technologies more easily, given their limited operational capabilities.

Service Type Insights

What Causes Omics Data Generation to Be a Prominent Service for the Omics-Based Clinical Trials Market?

Omics Data Generation: The omics data generation segment dominated the market in 2025, with the largest market share, driven by the increasing difficulty in producing and processing omics data through sequencers, proteomics, and metabolomics trials. The processing of samples and data generated from omics trials forms the foundation for the operational processes used in these trials. The ongoing improvements in sequencing completeness and accuracy, as well as increases in throughput, will continue to create a sustainable market for omics data generation across all areas of medical research.

Bioinformatics & Data Analytics: Bioinformatics and data analytics are the fastest-growing segment of the omics-based clinical trials market, as the complexity of omics data continues to grow exponentially. As such, the amount of data generated by multi-omics clinical trials is significant and requires sophisticated AI-assisted analysis to derive meaning from these vast datasets. Increasingly, sponsors are outsourcing data analysis to specialized companies that can interpret the data efficiently to provide actionable insights, expedite product development, and produce regulatory-grade evidence for product approval.

Regional Insights

How Big is the North America Omics-Based Clinical Trials Market Size?

The North America omics-based clinical trials market size is estimated at USD 13.57 billion in 2025 and is projected to reach approximately USD 30.04 billion by 2035, with a 8.27% CAGR from 2026 to 2035.

Why is North America Dominating the Omics-Based Clinical Trials Market?

North America hosts more omics-based clinical trials than any other region, primarily because it has a mature precision medicine infrastructure, a high concentration of global pharmaceutical and biotechnology companies, and deeply established sequencing and molecular profiling capabilities. Academic medical centers and large hospital networks across the United States and Canada routinely integrate genomics, transcriptomics, and proteomics into trial design, enabling early patient stratification and biomarker-driven enrollment. This tight linkage between clinical research and molecular diagnostics allows omics data to be generated, analyzed, and applied within the same care and research settings, reducing delays between discovery and clinical validation.

Regulatory clarity further strengthens this leadership position. The U.S. Food and Drug Administration has issued multiple guidances supporting biomarker-based development, adaptive trial designs, and enrichment strategies, which directly enable omics-driven studies in oncology, rare diseases, and immunology. The region also benefits from extensive biobank infrastructure, including hospital-linked biorepositories and national initiatives that store genomically annotated biospecimens tied to longitudinal clinical outcomes.

What is the Size of the U.S. Omics-Based Clinical Trials Market?

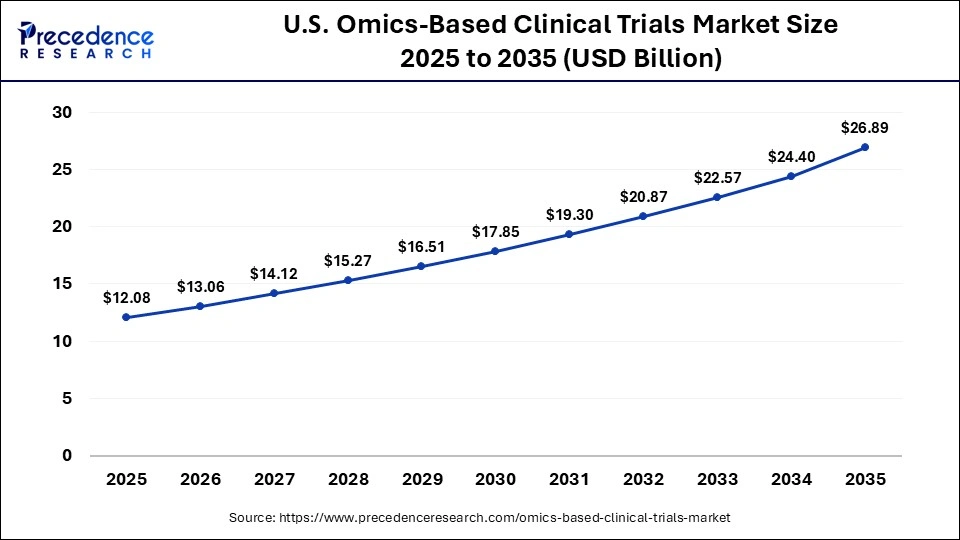

The U.S. omics-based clinical trials market size is calculated at USD 12.08 billion in 2025 and is expected to reach nearly USD 26.89 billion in 2035, accelerating at a strong CAGR of 8.33% between 2026 and 2035.

U.S. Omics-Based Clinical Trials Market Trends

The United States maintains a leadership position due to its large concentration of research hospitals, sustained federal support for genomics initiatives, and a long-standing role in drug discovery and development. Federal programs such as the National Institutes of Health's All of Us Research Program, launched in 2018 to enroll over one million participants, have created one of the most comprehensive population-scale genomic and health data resources globally. These initiatives support early and widespread adoption of multi-omics technologies, including genomics, transcriptomics, proteomics, and metabolomics, within pharmaceutical research and clinical development workflows.

In parallel, the U.S. benefits from extensive patient enrollment in longitudinal disease registries and real-world evidence databases managed by academic medical centers, cancer institutes, and integrated health systems. Advanced bioinformatics platforms are routinely used to manage and analyze these high-dimensional datasets, enabling target identification, biomarker discovery, and patient stratification. Companion diagnostics play a critical role in this ecosystem, particularly in oncology and rare disease trials, where FDA-cleared or approved diagnostic tests are co-developed to guide therapy selection and monitor treatment response.

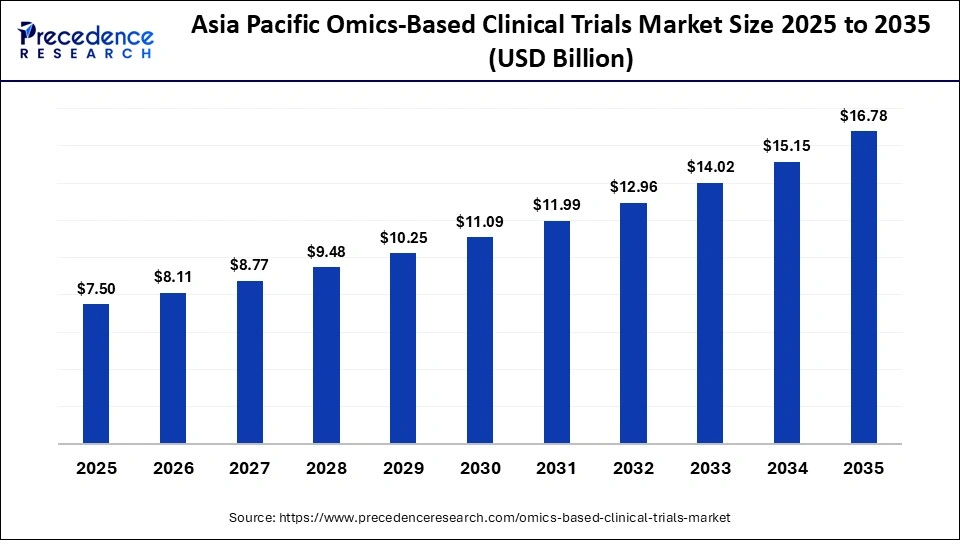

What is the Asia Pacific Omics-Based Clinical Trials Market Size?

The Asia Pacific omics-based clinical trials market size is expected to be worth USD 16.78 billion by 2035, increasing from USD 7.50 billion by 2025, growing at a CAGR of 8.39% from 2026 to 2035.

Why Is the Asia Pacific Experiencing Fastest Growth Omics-Based Clinical Trials Market?

The expansion of genomic research infrastructure and the growth of government-supported precision medicine initiatives in these countries, along with large patient cohorts with high genetic diversity, have driven the rapid growth of omics-based clinical trials in the Asia-Pacific region. Many countries in the Asia-Pacific have invested in building their sequencing capabilities, developing centralized laboratory systems, and implementing digital health systems to facilitate the design of biomarker-driven clinical trials. Improving regulatory harmonization, accelerated ethics approval processes, and increasing collaboration between global sponsors and local research centres are hastening the start of clinical trials in the Asia-Pacific region.

China Omic-Based Omics Trials Market Trends

China is the leading country in the Asia-Pacific region for omics-driven clinical research, supported by comprehensive government-sponsored genomics programs, rapid scaling of clinical trial service capabilities, and widespread adoption of multi-omics technologies across oncology and rare disease studies. National initiatives such as the Precision Medicine Initiative, launched in 2016 and coordinated funding through the Ministry of Science and Technology, have accelerated population-scale sequencing, biomarker discovery, and translational research. These programs prioritize cancer genomics, inherited disorders, and complex chronic diseases, directly feeding omics data into clinical trial pipelines.

China's extensive hospital networks further reinforce this leadership. Large tertiary hospitals and academic medical centers routinely participate in multicenter clinical trials, supported by in-country sequencing infrastructure and centralized data platforms. Domestic sequencing capacity allows genomic, transcriptomic, and proteomic analyses to be performed locally at scale, reducing dependency on cross-border data transfer and accelerating trial timelines. The country has demonstrated strong enrollment of participants in large, multiplex trials, supported by centralized patient registries, integrated electronic medical record systems, and streamlined ethics review processes.

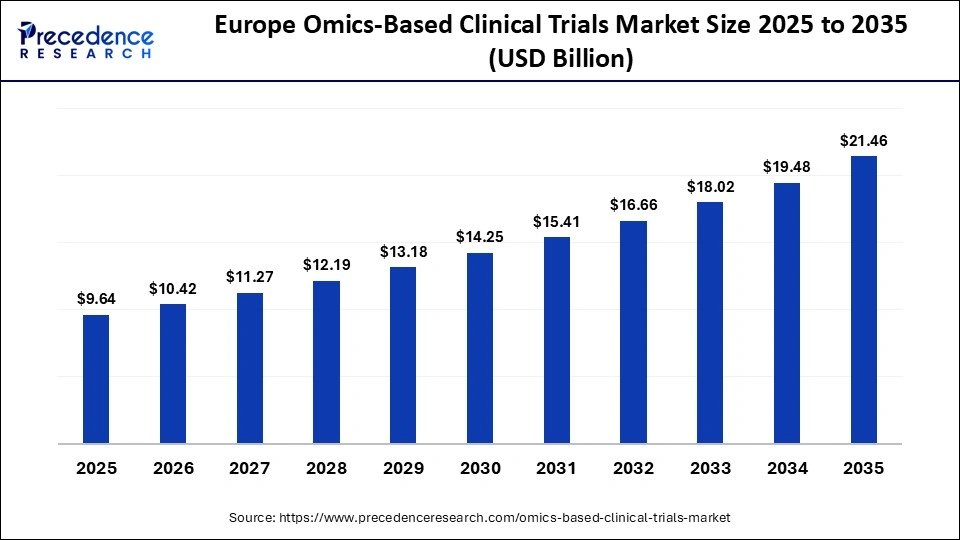

What is the Europe Omics-Based Clinical Trials Market Size and Growth Rate?

The Europe omics-based clinical trials market size has grown strongly in recent years. It will grow from USD 9.64 billion in 2025 to USD 21.46 billion in 2035, expanding at a compound annual growth rate (CAGR) of 8.33% between 2026 and 2035.

How Is Europe Entering a New Era of Omics-Based Clinical Trials Market?

Europe is considered a fast-growing area for omics-based clinical trials research, driven by strong academic research support, established transnational medicine programs, and the increasing use of genomics in clinical decision-making. The centralized regulatory framework established by most European countries also encourages cross-country collaboration on trials through centralized funding and supports the development of biobanks with standardized clinical data practices.

In July, 2025, the organisational unit (OU) Core Facilities of the Medical University of Vienna announced the successfully acquisition of funding from the highly competitive FFG's infrastructure call. Funds of EUR 2.5 million were made available to implement the MOONSHOT project (Multi-Omics for Optimizing Novel biomarker Signatures in High-throughput for Omics-based Translational precision medicine). The objective of the project is to create a brand-new platform for the discovery and validation of biomarkers that will set new standards in translational and personalized medicine.

With continued government support for precision oncology and rare disease research, researchers can conduct detailed biomarker analyses and conduct longitudinal, multi-omic studies. However, differences in national approval processes and healthcare systems for clinical trials across European countries affect the duration and complexity of trial conduct.

Germany Omics-Based Clinical Trials Market Trends

Germany is the leading European country in the adoption of omics research and technologies, particularly in oncology and personalized medicine programs. This leadership is underpinned by the country's highly advanced hospital-based research system and a dense network of nationally coordinated translational research centers. Institutions such as the German Cancer Consortium and the German Cancer Research Center integrate genomics, transcriptomics, and proteomics into clinical workflows, enabling close alignment between molecular discovery and patient care. These centers operate in partnership with university hospitals, allowing omics data to be generated and validated within regulated clinical environments.

Germany places strong emphasis on clinical quality, data accuracy, and methodological rigor, which is essential for complex and high-cost clinical research involving multi-omic biomarkers. Strict adherence to standardized laboratory practices, validated analytical pipelines, and data integrity requirements supports reliable biomarker qualification and reproducibility. This focus aligns well with advanced trial designs that depend on molecular stratification, companion diagnostics, and longitudinal data analysis. As a result, Germany continues to serve as a reference market in Europe for high-complexity omics-driven research and precision medicine development.

Why Is the Middle East & Africa Region Accelerating the Adoption of Omics-Based Clinical Trials?

Emerging regions for omics-based clinical trials are the Middle East and Africa, supported by targeted national genomics initiatives, improved research infrastructure, and increased policy focus on precision medicine. Certain countries are providing funding for population genomics programs, advanced sequencing facilities, and digital health platforms to conduct biomarker-driven studies. Areas of growth are primarily restricted to oncology, rare genetic disorder research, and inherited disease research, where the prevalence of local disease and genetic diversity contribute to a strong scientific foundation. Although trial activity across the region is not yet uniform, the continued expansion of public-private collaboration and the creation of regional research networks are gradually strengthening the omics trial readiness in some regions.

UAE Omics-Based Clinical Trials Market Trends

The United Arab Emirates is the leader of this region, with strong government-supported genome programs, extensive hospital infrastructure, and a clear regulatory framework for genomics research. With the national initiatives and investments in precision medicine, omics-based biomarker studies are currently at the earliest stages of development and translation.

Why Is Latin America Emerging in Omics-Based Clinical Trials?

Latin America is fast becoming a premier destination for Omics-based clinical trials. The continued development of clinical research frameworks, expansion of academic genomics programs, and increased implementation of precision medicine strategies are driving the growth of omics-based clinical trials in the region. The genetic diversity of populations within the region enables a streamlined process for recruiting patients to participate in oncology and chronic disease clinical trials. Although Infrastructure maturity varies across countries, the growing collaboration between local CROs and research institutions throughout the region is improving the quality and reliability of these trials.

Brazil Omics-Based Clinical Trials Market Trends

Brazil is the primary centre of omics-based clinical research in Latin America, due to its large base of clinical trial activity, the strength of its public research institutions, and the ongoing expansion of its capabilities in genomics research. The implementation of academic hospitals, population-based studies, and newly developed regulatory coordination will facilitate the execution of complex omics-based clinical trials in Brazil.

Top Players in the Omics-Based Clinical Trials Market and Their Offerings

- Parexel International (MA) Corporation

- Thermo Fisher Scientific Inc.

- Charles River Laboratories

- ICON plc

- SGS Sociwete Generale de Surveillance SA

- Eli Lilly and Company

- Pfizer Inc.

- Laboratory Corporation of America

- Novo Nordisk A/S

- Rebus Biosystems, Inc.

Recent Developments

- In April 2024, Signios Bio launched its AI-driven bioinformatics and advanced multiomics platform, rebranding to accelerate precision medicine and drug discovery with integrated multi-omic analyses for novel biomarkers and therapeutic insights.(Source: https://www.businesswire.com)

- In January 2025, Enhanc3D Genomics introduced a suite of 3D multi-omics solutions using its proprietary platform to provide high-resolution, genome-wide data across drug discovery stages, enhancing target identification and disease mechanism insights.(Source: https://www.news-medical.net)

- In December 2025, Valinor secured US$ 13 million in seed funding to deploy AI trained on matched multi-omic and clinical data to predict patient responses and reduce clinical trial failures, potentially speeding drug development and lowering R&D costs.(Source: https://hitconsultant.net)

Segments Covered in the Report

By Omics Type

- Genomics

- Transcriptomics

- Proteomics

- Metabolomics

- Epigenomics

- Microbiomics

- Multi-Omics (Integrated Platforms)

By Study Phase

- Phase I

- Phase II

- Phase III

- Phase IV

By Application

- Oncology

- Rare & Genetic Diseases

- Neurology

- Cardiovascular Diseases

- Immunology & Inflammatory Disorders

- Infectious Diseases

- Metabolic Disorders

By End-user

- Pharmaceutical Companies

- Biotechnology Companies

- Contract Research Organizations (CROs)

- Academic & Research Institutes

- Hospitals & Clinical Research Centers

By Service Type

- Trial Design & Biomarker Strategy

- Sample Collection & Biobanking

- Omics Data Generation

- Bioinformatics & Data Analytics

- Regulatory & Submission Support

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting