What is the Orthobiologics Market Size?

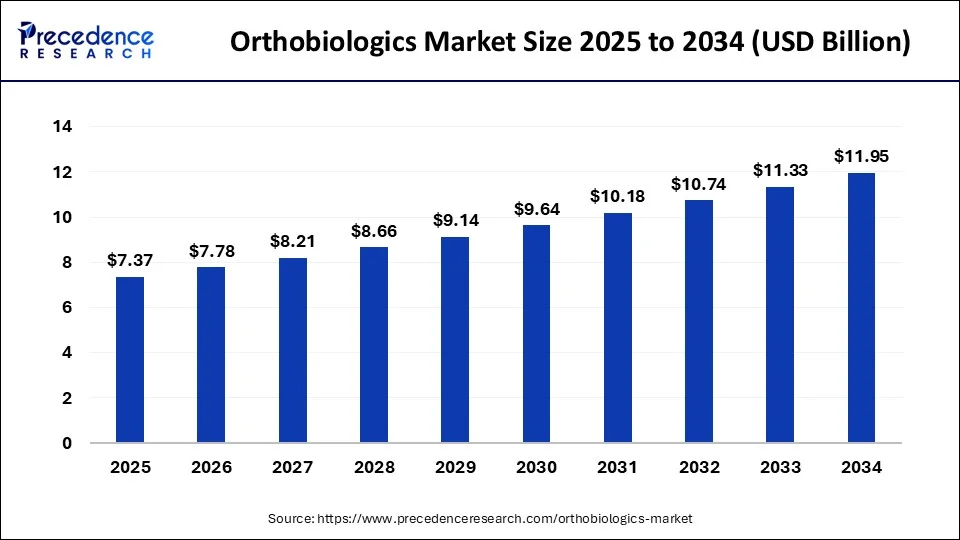

The global orthobiologics market size is calculated at USD 7.37 billion in 2025 and is predicted to increase from USD 7.78 billion in 2026 to approximately USD 12.55 billion by 2035, expanding at a CAGR of 5.47% from 2026 to 2035.

Market Highlights

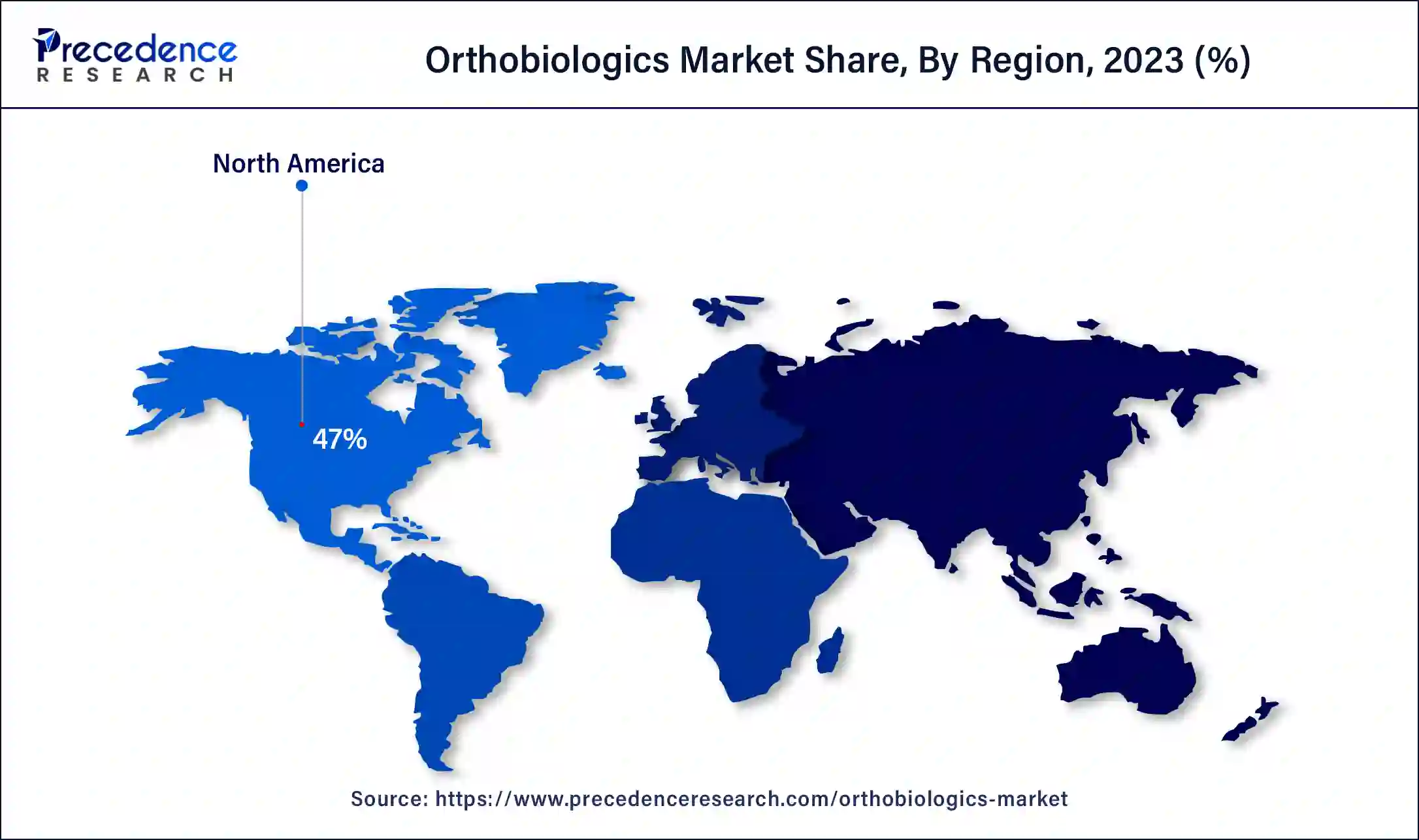

- North America dominated the orthobiologics market with the largest market share of 47% in 2025.

- Europe is expected to grow at the fastest rate in the market over the studied period.

- By product, the viscosupplementation segment has contributed more than 40% of market share in 2025.

- By product, the stem cell therapy segment is expected to grow at the fastest rate in the market over the forecast period.

- By application, the spinal fusion segment accounted for the largest market share of 51% in 2025.

- By application, the reconstructive surgery segment is expected to grow at a significant rate in the market over the forecast period.

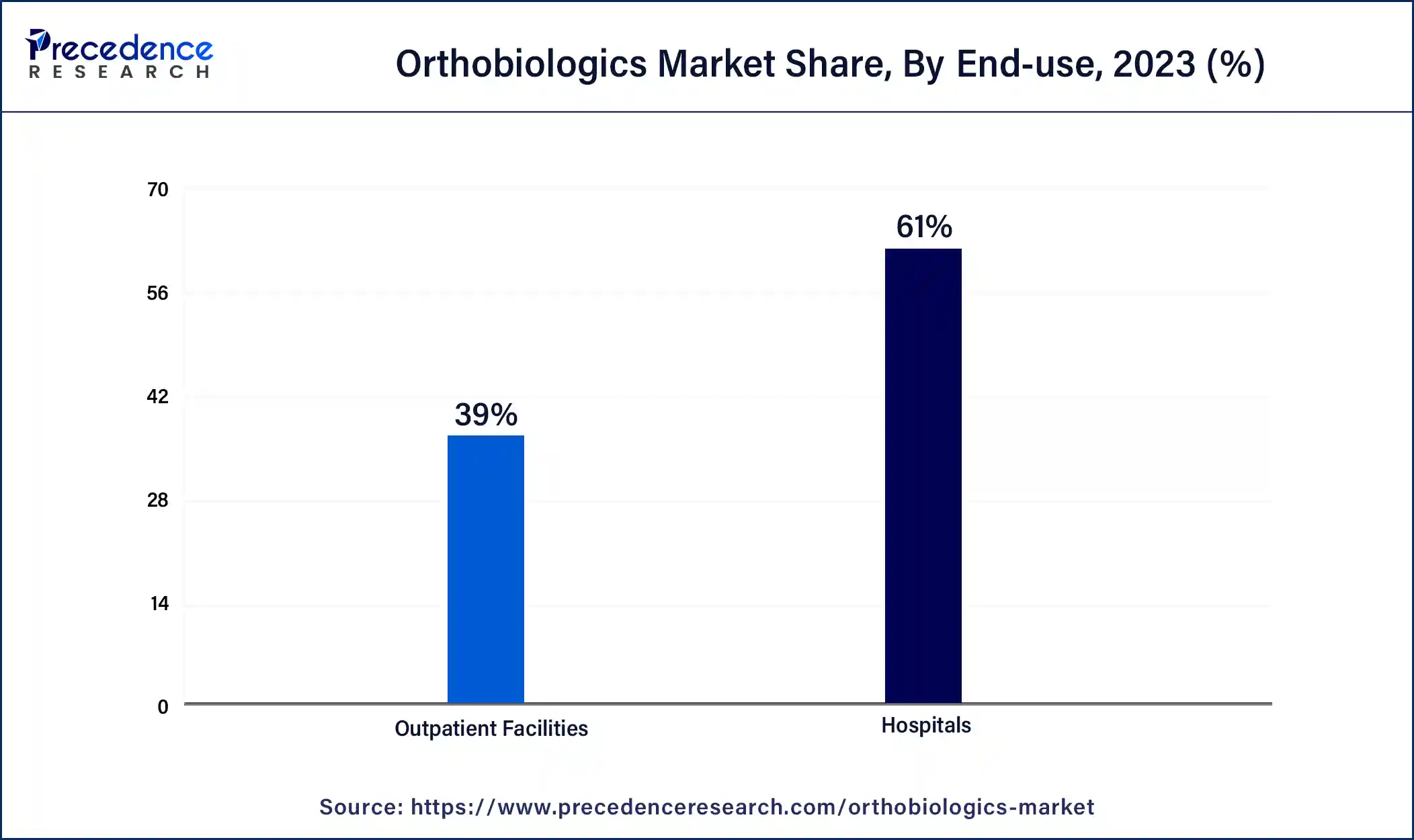

- By end-use, the hospital segment has held a major market share of 61% in 2025.

- By end-use, the outpatient facilities segment is expected to grow rapidly in the market during the forecast period.

Market Overview

The increasing prevalence of orthopedic procedures coupled with the growing geriatric population is the major factor fostering the orthobiologics market growth.Orthobiologics, also known as regenerative cellular therapies, encompass products that contain or secrete growth factors to aid tissue healing, alleviate pain, and restore normal function. Various orthobiologics available in the market operate through different mechanisms. Autologous orthobiologics are derived from the patient's own body, where, under suitable conditions, they divide to form precursor cells. These products are utilized in treating conditions like fracture recovery and spinal fusion and are available for various body parts, including the hip, knee, ankle, spine, and wrist. Orthobiologics primarily facilitates faster injury healing.

Orthobiologics Market Growth Factors

- Rising cases of road accidents will drive down the demand for orthobiologics, which can lead to the orthobiologics market growth.

- The increasing number of spinal and orthopedic procedures is expected to drive market growth further.

- High growth potential in developing nations and growing demand for advanced treatment can fuel the orthobiologics market growth shortly.

Orthobiologics Market Outlook

The orthobiologics market is expected to witness strong growth, driven by the rising prevalence of musculoskeletal disorders such as osteoporosis, arthritis, and spinal deformities. A growing number of orthopedic operations and trauma repairs are generating demand for biologic bone grafts and synthetic bone substitutes.

Sustainability and innovation are transforming the orthobiologics landscape, with increased emphasis on bioactive, resorbable, and environmentally friendly graft materials. Companies are also investing in research and development to create biodegradable scaffolds and synthetic grafts that do not rely solely on traditional animal products. Regulatory support for safer, sustainable biologics is fueling innovation in the orthobiological market.

Leading orthobiologics companies are actively expanding their geographic reach to take advantage of regional opportunities and regulatory benefits. Companies, including NuVasive, have improved their distribution networks in Asia-Pacific, targeting hospitals that perform numerous spinal fusion surgeries. Meanwhile, market growth in emerging economies is fueled by increasing middle-class healthcare spending and improved access to advanced surgical treatments in countries like India, Brazil, and Southeast Asia.

Major investors in the market include large medical device companies like Stryker Corporation, Zimmer Biomet, and DePuy Synthes (Johnson & Johnson), which drive the market by funding research, product development, and acquisitions in biologic treatments like stem cell therapies, PRP (Platelet-Rich Plasma), and bone graft substitutes. Additionally, venture capital firms and private equity investors are increasingly supporting startups and biotech firms focused on regenerative medicine and biologics, helping accelerate innovations and the commercialization of advanced orthobiologic solutions.

Orthobiologics Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 7.37 Billion |

| Market Size in 2026 | USD 7.78 Billion |

| Market Size by 2035 | USD 12.55 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.47% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising prevalence of orthopedic disorders

Over the past decade, there has been a significant rise in the prevalence of orthopedic disorders. Poor dietary habits and inadequate physical activity can disrupt the body's balance, exacerbating these issues. This susceptibility intensifies with age, particularly affecting individuals aged 60 and above, who are more prone to conditions such as arthritis. Those with osteoarthritis in this demographic often endure joint pain and strain in areas like the lower back, hips, and knees. The population of older adults has expanded due to advancements in healthcare, improved life expectancy, and the availability of more sophisticated treatment options. Hence, the increasing incidence of Orthopedic diseases is expected to drive growth in the orthobiologics market.

- In May 2024, OssDsign AB announced that the company would continue its successful penetration of the U.S. orthobiologics market. To date, 5,000 patients have been treated with the innovative nano synthetic bone graft OssDsign Catalyst. The continuous and rapid increase in treated patients is a strong testament to how well OssDsign Catalyst has been received in the U.S. market since its launch in August 2021.

Restraint

Surging prices for orthobiologics-based treatments

The orthobiologics market's growth could be hampered by increasing patient preference for minimally invasive procedures in the coming years. Additionally, challenges may arise from the adverse impacts associated with Bmp-based therapies. The market expansion might face further constraints due to anticipated price increases in orthobiologics treatments. Stringent production regulations, Complex manufacturing processes, and high operational costs also pose significant challenges to market growth.

Opportunity

The Increase in healthcare expenditure

The orthobiologics market is experiencing significant growth in emerging countries like South Africa, India, and China. These nations are compelled to enhance their healthcare sectors due to the smoothly expanding elderly population, rising per capita incomes, large patient numbers, and heightened awareness. Furthermore, there has been an increase in investment in healthcare infrastructure and facilities within these economies. Although sleep apnea machines are highly effective, their success is limited to a small percentage of cases due to their reliance on consistent use and medical supervision.

- In March 2022, the orthobiologics partnership between MTF Biologics and Orthofix Medical, Inc. expanded. The arrangement includes an expansion agreement for the development of a demineralized bone matrix (DBM), which Orthofix will market under the Legacy brand name and extend Orthofix's exclusive marketing rights to the Trinity allograft line until 2032.

Segment Insights

Product Insights

The viscosupplementation segment led the orthobiologics market in 2025. The growing number of osteoarthritis patients and the frequent introduction of new products are expected to drive market growth. Viscosupplementation with hyaluronic acid injections is a popular treatment for osteoarthritis due to its ease of administration and high tolerance, which supports market expansion. Also, the significant demand for minimally invasive surgical treatments and their high acceptance among patients are also considered key factors contributing to market growth.

The stem cell therapy segment is expected to grow at the fastest rate in the orthobiologics market over the forecast period. The global increase in healthcare spending and the raised focus on personalized medicine have fostered a conducive environment for the growth of the stem cell therapy market. Also, progress in biotechnology and regenerative medicine has paved the way for novel techniques and products within the stem cell therapy sector.

- In January 2023, DiscGenics, Inc., a clinical-stage biopharmaceutical company focused on developing cell-based regenerative therapies, announced that the U.S. Food and Drug Administration (FDA) granted regenerative medicine advanced therapy (RMAT) designation to injectable disc cell therapy (IDCT or rebonuputemcel), an injectable, allogeneic discogenic progenitor cell therapy for the treatment of symptomatic lumbar degenerative disc disease (DDD).

Application Insights

The spinal fusion segment accounted for the largest share of the orthobiologics market in 2025. The benefits of orthobiological products in spinal fusion, such as rapid cell stimulation for bone formation, reduced hospital stays, and fewer follow-up visits, are key factors driving the segment's growth. The increasing number of spinal fusion surgeries globally further boosts the segment's market share. Moreover, leading companies with extensive orthobiologics portfolios for spinal fusion and the growing number of approvals for new products in this area are anticipated to propel market growth in the coming years.

- In February 2022, Orthodox Medical launched a synthetic bioactive bone graft solution, Opus BA, for cervical and lumbar spine fusion procedures. With the solution's full market launch, the company has expanded its synthetic bone growth offerings. Acting as a scaffold, Opus BA allows the bone to grow across the surface and is reabsorbed and replaced with natural bone while healing.

The reconstructive surgery segment is expected to grow at a significant rate in the orthobiologics market over the forecast period. This can be attributed to the rising demand for reconstructive surgery induced by an aging population and a surge in musculoskeletal disorders, which is contributing to the segment's expansion. Moreover, Orthobiologics presents a promising option for improving bone healing, facilitating soft tissue repair, and restoring joint function, thus driving their increased use in reconstructive procedures.

End-use Insights

The hospital segment held the largest share of the orthobiologics market in 2025. A key factor behind the market share dominance is the increasing utilization of orthobiological products in diverse spinal and reconstructive surgeries performed in hospitals. Furthermore, the segment's growth is anticipated to be supported by hospitals' easy access to a wide range of orthobiologics and their specialized patient care. The segment's share is bolstered by frequent readmissions, high patient turnover, and substantial procedure volumes.

The outpatient facilities segment is expected to grow rapidly in the orthobiologics market during the forecast period. This trend is fueled by the rising preference for ambulatory care and same-day surgeries. These facilities offer a convenient and cost-effective solution for patients undergoing minor orthopedic procedures or receiving treatments for sports injuries.

Regional Insights

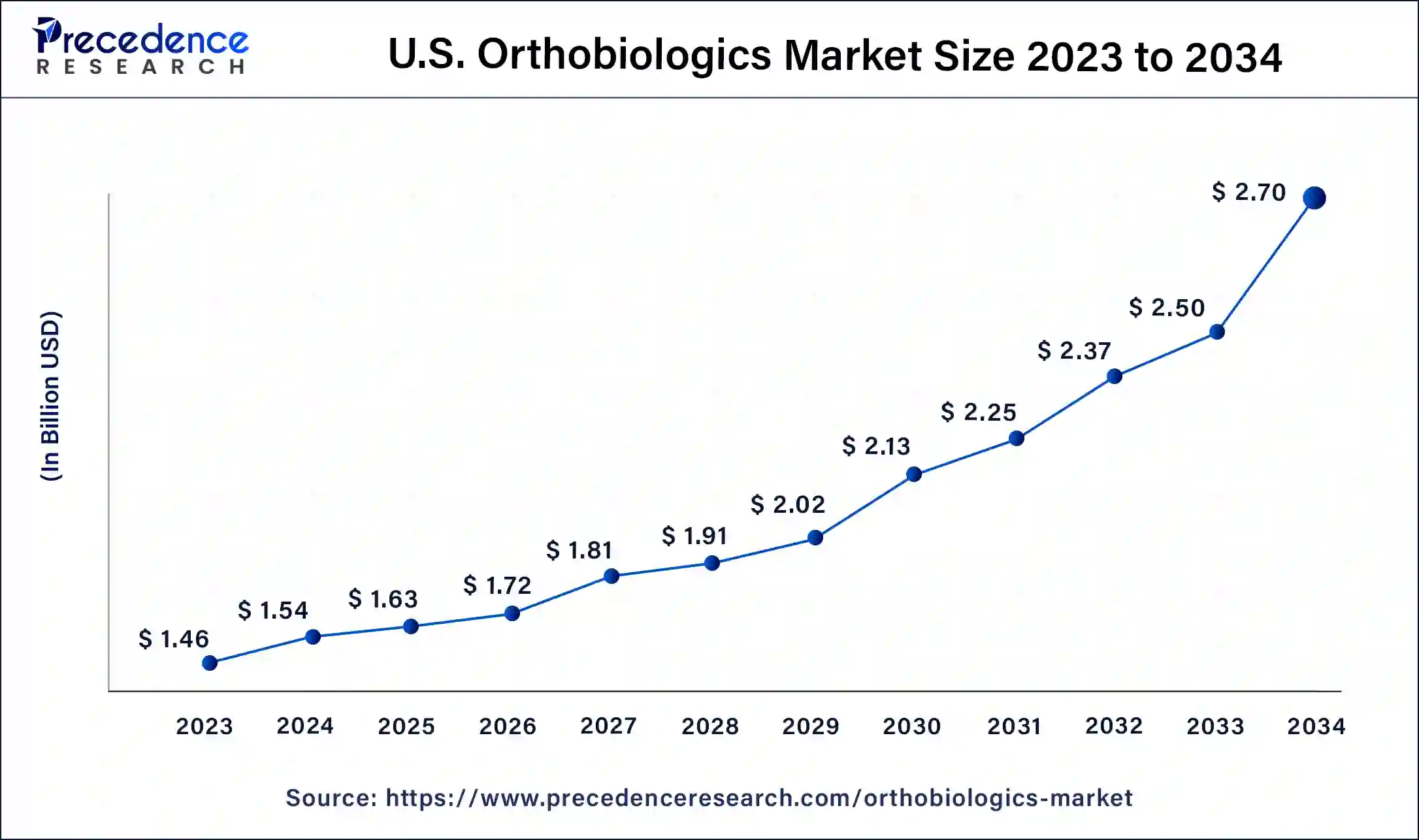

The U.S. orthobiologics market size is exhibited at USD 1.63 billion in 2025 and is projected to be worth around USD 2.85 billion by 2035, growing at a CAGR of 5.75% from 2026 to 2035.

The U.S. market is experiencing steady growth as demand increases for biologic solutions that support tissue regeneration, bone healing, and recovery from musculoskeletal injuries, driven by a rising prevalence of orthopedic conditions such as osteoarthritis and fractures among an aging population. Innovation in advanced biomaterials, stem cell-based therapies, and minimally invasive treatment options is broadening clinical applications and enhancing patient outcomes, helping to expand market adoption.

North America dominated the orthobiologics market in 2024. The rise in degenerative bone disease cases and the increasing popularity of outpatient orthopedic procedures are major contributors to market growth. North America leads the market, largely due to the presence of numerous major companies. The market's projected growth is also driven by an aging population.

- In 2023, the U.S. orthobiologics market held the largest share within North America. The region's strong focus on technological innovation and research continually produces improved orthobiologic products.

- In September 2023, Ossdsign plots a new future as pure play for the U.S.-focused ortho biologics business. Ossdsign AB will abandon its 3D-printed cranial reconstructive implant business to focus on U.S. sales of its Ossdsign Catalyst, an off-the-shelf nano synthetic bone graft that offers gross margins of 90% or better. The new strategy sharply reduces the capital required before the company projects, achieving a positive cash-flow position.

Europe is expected to grow at the fastest rate in the orthobiologics market over the studied period. European market players' strong emphasis on R&D investments and research initiatives, along with favorable health reimbursement policies for bone grafting procedures and a sharp rise in spinal injuries, are projected to boost the demand for orthobiologics in the coming years.

Within Europe, Germany held the largest share of the orthobiologics market, while the UK was the fastest growing. The UK market is expected to see significant growth during the forecast period. The increasing acceptance of orthobiologics as an effective treatment option is driving this market expansion.

- In June 2024, Octane Medical Group, through its new venture Octane Biotherapeutics (BioTx), acquired 100% shares of the global orthobiologics business from its long-term partner, B. Braun. The acquisition, consisting of the two companies TETEC AG in Germany and Aesculap Biologics, LLC. in the United States, establishes Octane as an international leader in regenerative medicine.

Asia Pacific is expected to experience notable growth in the market due to the rising access to orthopedic care and increasing disposable incomes in countries such as China, India, and Japan. Increasing healthcare infrastructure investments and rising incidences of orthopedic conditions due to aging populations and lifestyle changes are also driving the market. Additionally, the growing adoption of advanced healthcare technologies, the expansion of medical tourism, and the region's focus on regenerative medicine are contributing to the rising demand for orthobiologics treatments such as stem cell therapies, PRP, and tissue engineering.

China is a key player in the orthobiologics market due to its expansive urban hospital networks and rising disposable incomes, which improve access to orthopedic surgeries. The market is further bolstered by government initiatives to enhance healthcare services, an increasing influx of medical tourists, and a large patient population, all of which contribute to China's leadership in the regional market.

The market in Latin America is driven by the increasing demand for minimally invasive and regenerative orthopedic solutions, particularly bone graft substitutes and biologic therapies. The region's high incidence of road accidents and occupational injuries is further propelling this demand, with Brazil leading the market due to rising traumatic injuries, sports-related accidents, and a growing need for bone grafts and biologic therapies. The steady growth is also supported by government investments in healthcare infrastructure and gradual improvements in reimbursement systems.

Brazil Orthobiologics Market Trends

The region is witnessing substantial growth due to its large population, strong public and private healthcare systems, and increasing incidence of trauma and sports-related injuries. Regulatory developments and academic research collaborations are gaining traction, fostering innovation and driving the regional market forward. Technological advancements in regenerative medicine, including improved biologic formulations and delivery systems, are enhancing therapeutic outcomes and encouraging adoption in hospitals and specialty clinics.

The Middle East & Africa (MEA) is expected to experience an opportunistic rise in the market in the coming years, driven by the development of specialized orthopedic and trauma hospitals, especially in the Gulf countries and South Africa. International collaborations, the import of advanced biologic products, and regulatory reforms are also creating opportunities for market expansion. In the UAE, market growth is fueled by the establishment of high-end orthopedic centers in cities like Dubai and Abu Dhabi, increasing access to regenerative therapies such as bone grafts, synthetic substitutes, and allografts. Growing patient awareness of minimally invasive procedures further positions the UAE as a key market within the region.

Saudi Arabia Orthobiologics Market Trends

Increasing rates of road traffic accidents, a growing prevalence of obesity and osteoarthritis, and expanding access to private healthcare are driving the region's market landscape. The country is also actively investing in modern healthcare technologies, which helps to push market development even more. Rising prevalence of sports injuries, osteoarthritis, and age-related orthopedic issues is driving demand for biologic solutions such as platelet-rich plasma (PRP), stem-cell therapies, and bone graft substitutes that promote natural tissue healing.

Orthobiologics Market - Value Chain Analysis

The foundation of orthobiologics lies in sourcing biologic and synthetic materials used for bone and tissue regeneration. This includes allograft bone, demineralized bone matrix (DBM), stem cells, platelet-rich plasma (PRP), growth factors, and synthetic bone substitutes.

Key Players: AlloSource, RTI Surgical, NuVasive, Zimmer Biomet

Processed biologics are combined with proprietary delivery systems or carriers, including bone graft substitutes, scaffolds, or injectable formulations. Manufacturers also produce device-integrated biologics for spinal, trauma, or joint repair.

Key Players: Medtronic PLC, Globus Medical, DePuy Synthes

Products undergo regulatory evaluation (e.g., FDA, CE marking) and clinical validation to ensure safety, efficacy, and market readiness. This stage is critical for biologics due to patient-safety concerns and regenerative medicine regulations.

Key Players: NuVasive, Bone Biologics Corp., K2M Group Holdings

Finished orthobiologic products are distributed to hospitals, surgical centers, and orthopedic clinics, often via specialized medical distributors or directly by the manufacturer.

Key Players: Cardinal Health, Medline, Henry Schein Medical, and Direct Sales from manufacturers

Orthobiologics Market Companies

NuVasive specializes in minimally invasive spine surgery, integrating advanced biologics such as allografts and synthetic graft substitutes to support spinal fusion and degenerative-disc treatments.

Arthrex offers a broad orthobiologics portfolio including allograft bone grafts, viable bone matrices, platelet-rich plasma systems, and biologic soft-tissue repair solutions for joints, spine, and extremities.

Globus develops implants and graft-enabling systems for spine, trauma, and reconstruction surgeries, combining hardware with biologics to enhance bone and tissue regeneration.

Bone Biologics focuses on regenerative therapies, producing novel grafts and cell-based treatments aimed at promoting bone regeneration and faster clinical recovery.

K2M provides spinal device systems and complementary bone graft solutions, including osteobiologic products designed for spinal fusion and reconstructive procedures.

Orthofix offers cellular bone allografts, demineralized bone matrix fibers and putties, synthetic grafts, and bone-growth stimulators for spine fusion, trauma repair, and orthopedic regeneration.

Bioventus focuses on biologic therapies to support bone healing, osteoarthritis treatment, and rehabilitation, delivering clinically driven orthobiologic products for bone repair and joint care.

Medtronic integrates spinal and orthopedic device solutions with bone graft substitutes and growth-factor biologics, providing regenerative spinal and orthopedic therapies.

As part of Johnson & Johnson, DePuy offers allografts, bone graft substitutes, and demineralized bone matrix products alongside joint, trauma, and spinal implants.

Recent Developments

- In August 2024, Johnson & Johnson's Velys active robotic-assisted system (Velys Spine) has officially launched in the United States. It was developed by DePuy Synthes, J&J's orthopedics company, in collaboration with eCential Robotics, and it is designed for planning and instrumenting spinal fusion procedures across the cervical, thoracolumbar, and sacroiliac spine. (Source: https://www.pharmexec.com)

- In September 2024, Stryker completed its acquisition of care.ai. This strategic move reflects Stryker's commitment to digital transformation, potentially revolutionizing surgical practices and improving patient outcomes. The integration of AI into surgical workflows may also enhance operational efficiencies, thereby providing Stryker with a competitive edge in the market. (Source:https://www.stryker.com)

- In September 2023, Bone Biologics, Corp. Announced positive interim results from the Phase 2 clinical trial of its stem cell therapy for osteoarthritis.

- In October 2023, NuVasive Inc. Launched Simplify Disc Technology, a next-generation interbody fusion device with simplified instrumentation.

- In November 2023, Arthrex, Inc. Launched the Eclipse Meniscal Repair System, a suture-based technique for meniscal repairs.

Segments Covered in the Report

By Product

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation

- Synthetic Bone Substitutes

- Stem Cell Therapy

By Application

- Spinal Fusion

- Trauma Repair

- Reconstructive Surgery

By End-use

- Hospitals

- Outpatient Facilities

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting