What is the Orthopedic Software Market Size?

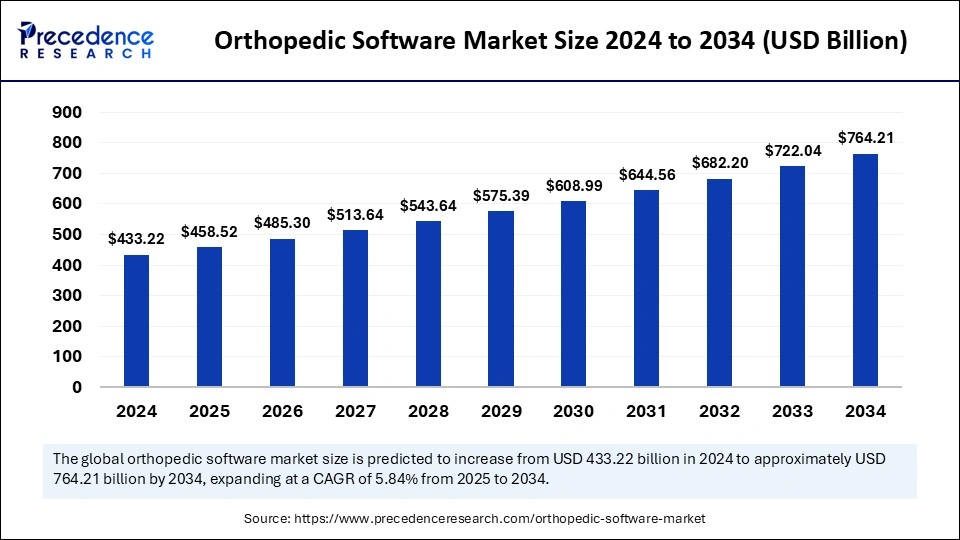

The global orthopedic software market size is calculated at USD 458.52 billion in 2025 and is predicted to increase from USD 485.30 billion in 2026 to approximately USD 764.21 billion by 2034, expanding at a CAGR of 5.84% from 2025 to 2034.

Orthopedic Software Market Key Takeaways

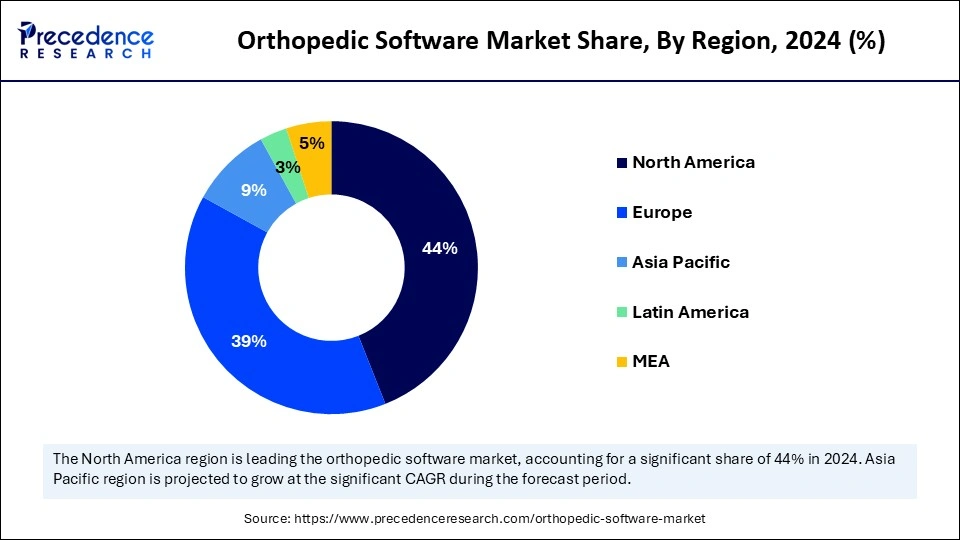

- North America dominated the global market with the largest market share of 44% in 2024.

- Asia Pacific is expecting substantial growth during the predicted period.

- By product, the orthopedic EHR segment contributed the highest market share of 26% in 2024.

- By product, the digital templating/preoperative planning segment expects the fastest growth during the predicted period.

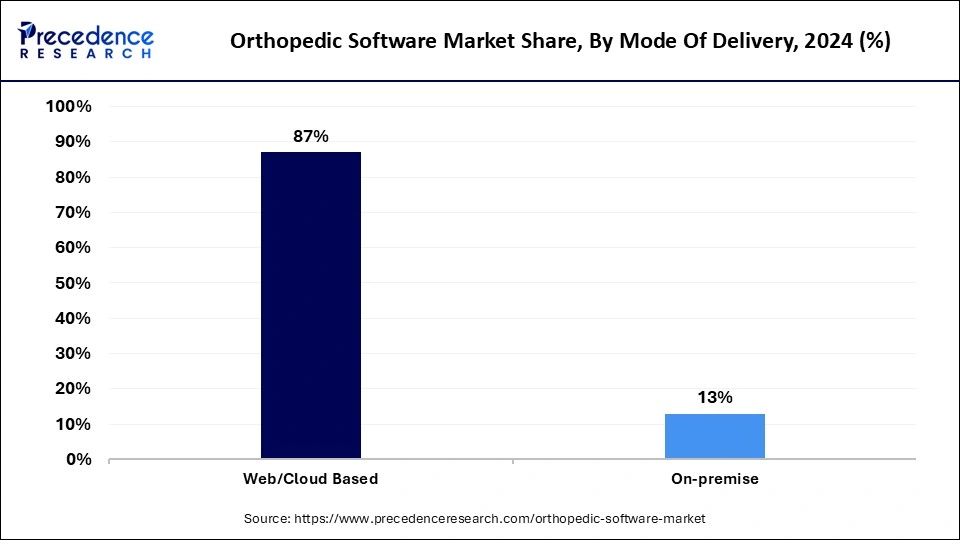

- By mode of delivery, the web/cloud-based software segment captured the biggest market share of 87% in 2024.

- By mode of delivery, the on-premises software segment expects notable growth in the forecast period.

- By application, the orthopedic surgery segment generated the major market share in 2024.

- By application, the fracture management segment will grow at the fastest CAGR during the predicted period.

What is Orthopedic Software?

Orthopedic software is the modern tool or technology that transforms the overall operations of orthopedic treatment and applications. It is one of the electronic health records that is used by orthopedic medical practices and a number of orthopedic physicians. The software provides features like enhanced security, device convenience, patient portals, transcriptions, e-prescribing, reporting, and others. It enables tracking, maintaining, and updating the medical records of patients on a regular basis.

What is the Impact of Artificial Intelligence (AI) in the Orthopedic Software Market?

The integration of artificial intelligence into the orthopedic software market is transforming overall operations and improving efficiency. The integration of artificial intelligence into orthopedic applications aims to improve predictive models, diagnostics, risk prediction, and medical image analysis. AI can offer a personalized treatment plan to meet the demands of orthopedic patients. AI possesses potential opportunities in orthopedic treatment, such as AI-assisted surgery, implants developed using AI, AI-based remote patient monitoring, and AI-guided pain management.

- In February 2025, Evergen, a major CDMO meeting the new standards in innovations and tissue engineering for fulfilling the patient demand of regenerative medicine, launched the new AI-powered image processing software for the CT bone graft scans advance analysis.

What are the Growth Factors in the Orthopedic Software Market?

- Increasing cases of orthopedic conditions: The rising prevalence of orthopedic conditions or bone-related issues in old, aged people and the increasing number of road accidents that lead to severe injuries in bone drive the demand for orthopedic surgery and boost the demand for data management tools for the healthcare workers drives the growth of the market.

- Increasing healthcare infrastructure: The increasing demand for robust healthcare infrastructure worldwide and the digitization across the healthcare infrastructure is contributing to the technological expansion in software development, accelerating the growth of the orthopedic software market.

- Government interventions: The rising government participation in the healthcare infrastructure and the technological integration into healthcare devices and software to improve efficiency accelerates the growth of the market.

Orthopedic Software Market Outlook

- Industry Growth Overview: Market growth rates during 2025-2030 are expected to be quite high due to increasing surgical volumes, adoption of AI-related diagnostic solutions, and demand for workflow improvement from hospitals. Growth is further supported by the overall digital transformation in North America, Europe, and Asia-Pacific, where providers are moving toward integrated/value-based systems of care.

- Sustainability Trends: Sustainability is influencing software adoption, including cloud-based platforms that reduce hardware waste, energy-efficient data centers, and less paper-based documentation. Vendors are also pouring resources into low-resource imaging algorithms and remote patient management tools that can reduce traveling emissions and improve long-term care efficiency.

- Global Expansion: Major companies are moving into new and emerging regions to take advantage of the increasing volume of orthopedic cases and benefit from progressive digital health regulations. Companies are solidifying their positions in Southeast Asia, Eastern Europe, and the Middle East by partnering with hospitals and launching localized surgical planning and EMR-interoperable solutions.

- Large Investors: Interest from both private equity and strategic investors is on the rise, largely due to the opportunity for recurring revenue, high switching costs, and increasing reliance on digital planning tools in the clinical environment. Major firms are funding companies seeking to mobilize AI-assisted surgery, orthopedic analytics, and cloud-native practice management platforms.

- Startup Ecosystem: The orthopedic software startup ecosystem is generating momentum, with new companies targeting 3D surgical planning, AR/VR training modules, and automated imaging interpretation. Examples include Pixee Medical (France) and Formus Labs (New Zealand), both of which have attracted significant venture capital funding by providing precision, speed, and cost-effective solutions

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 764.21 Billion |

| Market Size in 2025 | USD 458.52 Billion |

| Market Size in 2026 | USD 485.30 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.84 % |

| Dominated Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Mode Of Delivery, Application and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rising digitization

The increasing adaptation of orthopedic software market services physicians for transforming paper-based management into digital records. It allows the easy transfer of medical charts, records, and test results across different healthcare environments. Digitization offers several benefits over orthopedic treatment, such as providing customized treatment plans and templates, streamlining procedural, allowing remote accessibility, providing digital imagery which helps in an easy recovery process, enhancing patient engagement and experience, seamless analytics and reporting, and helps in providing quality treatment to the patients.

Restraint

Lack of professional

The lack of knowledge about the software and the insufficient number of skilled professionals who can handle the technology limit the growth of the orthopedic software market.

Opportunity

Technological advancements in orthopedic treatment applications

The rising technological adaptation into healthcare applications and the integration of innovative technologies into orthopedic surgeries and other diagnostics are driving growth opportunities in the market expansion. The modernization in orthopedic treatment with the integration of the latest technologies like 3D printing, robotic-assisted surgery, augmented reality, smart orthopedic implants and wearables, telemedicine, orthobiologic treatments, wearables, health monitors, and others are boosting the growth of the market.

Segment Insights

Product Insights

The orthopedic EHR segment dominated the orthopedic software market in 2024. The orthopedic EHR is a modern tool or product that is used in the orthopedic process; it helps in addressing all the clinical requirements of orthopedic patients. There are several benefits associated with EHR in orthopedics, such as patient imagery management, in which the staff can easily access and store the digital imagery of patients; it provides real-time insights into the treatment and recovery process. EHR often provides specialty-specific requirements such as helping patients with the proper assistance with the diagnostic and treatment procedures.

The digital templating/preoperative planning segment expects the fastest growth in the market during the predicted period. The orthopedic digital templating software efficiently helps in orthopedic implants; this helps physicians to analyze the accurate replacements or size of the implants as per the anatomy of patients. Digital templating also helps in planning the surgeries by providing a preview of how the implant will work in the body.

Mode Of Delivery Insights

The web/cloud-based software segment led the orthopedic software market in 2024. Web/cloud-based software is software that works remotely on a secure server with internet services. It is the modern form of software delivery system that reduces the need for the on-premises software infrastructure. It allows easy access to patient data from any location, eliminates the downtime or disruption for server maintenance, reduces upfront costs, and provides high security over data. The web/cloud-based software enhances productivity with more efficiency and streamlines prescription management.

The on-premises software segment expects notable growth in the forecast period. The increasing acceptance of the software provides all the clinical requirements in orthopedics with cost-effectiveness and efficiency. The rising investment in the on-premises healthcare software deployment accelerates the growth of the segment.

Application Insights

The orthopedic surgery segment dominated the orthopedic software market in 2024. The increasing number of orthopedic surgeries owing to the rising geriatric population and the number of accidents is driving the demand for technologically advanced orthopedic software to help physicians in the diagnostics and treatment of the disease. In old age, arthritis is the most common type of bone-related issue, which causes the need for orthopedic surgeries. Additionally, the rising sports culture in the world sometimes causes sports injuries in the players, who end up getting orthopedic surgeries for recovery, which also boosts the segment growth and causes the growth of the market.

The fracture management segment expects the fastest growth during the predicted period. Orthopedic software plays an important role in fracture management by providing easy access to imagery and data exchange, which provides efficiency in fracture management. There are several leading players investing in the advancement of imagery software, which helps in the early diagnosis of trauma.

Regional Insights

U.S. Orthopedic Software Market Size and Growth 2025 to 2034

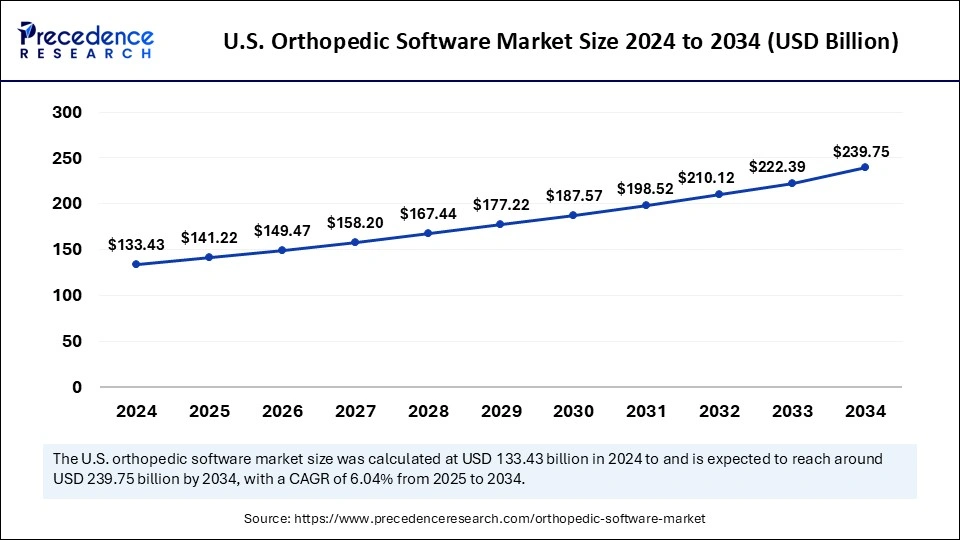

The U.S. orthopedic software market size is exhibited at USD 141.22 billion in 2025 and is projected to be worth around USD 239.75 billion by 2034, growing at a CAGR of 6.04% from 2025 to 2034.

North America dominated the orthopedic software market in 2024. The growth of the market is attributed to the rising implementation of technologies in the healthcare sector and the continuous expansion of the healthcare infrastructure with the support of government investment and policies. Regional countries like the United States have a higher presence of technology leaders associated with healthcare technologies and the various technological integrations into healthcare, such as telehealth, mHealth, eHealth, and others.

Asia Pacific is expecting substantial growth in the orthopedic software market during the predicted period. The growth of the market is owing to the rising economic stability in the population and the rising healthcare infrastructure due to the increasing population, especially the increased number of geriatric populations that are more likely to have bone-related issues and cause the demand for orthopedic surgeries. The increasing cases of bone-related issues, accidents, and sports injuries contribute to the growing demand for orthopedic software across the region.

North America: U.S. Orthopedic Software Market Trends

The U.S. market is being driven by rapid digitization in hospitals and clinics, with cloud-based surgical planning tools gaining traction for pre- and post-operative care. The rise in musculoskeletal disorders, particularly in an aging population, is fueling demand for more efficient and precise orthopedic EHR, PACS, and templating solutions. Advanced imaging technologies, AI, and 3D modeling are increasingly integrated into orthopedic planning software to improve surgical accuracy and patient outcomes.

Asia Pacific: China Orthopedic Software Market Trends

China's market is experiencing strong growth driven by rapid digitization across hospitals and increasing adoption of cloud-based platforms for orthopedic data management. Demand for advanced surgical planning tools is rising as healthcare providers integrate AI-enabled imaging, 3D modeling, and precision analytics into orthopedic procedures. The market is also benefiting from the growing burden of musculoskeletal disorders, which is pushing institutions to adopt software that improves diagnosis, surgical accuracy, and postoperative monitoring.

Why did Europe Grow Gradually in the Orthopedic Software Market?

The European market experienced gradual growth as hospitals adopted digital technologies to enhance surgical accuracy and patient management processes in the healthcare sector. The market focused on data security, which prompted healthcare providers to adopt certified orthopedic software. High rates of orthopedic surgery, along with a growing geriatric population, were also contributors to the growing market for orthopedic software in hospitals. A strong regulatory effort led vendors and providers of orthopedic surgical systems to develop safer, high-quality systems for orthopedic surgery.

Germany Orthopedic Software Market Trends

Germany led the European market as its advanced healthcare system saw hospitals rapidly adopt digital tools into their orthopedic practices. Hospitals used orthopedic surgical software for pre-surgical planning, imaging, and efficient workflow automation. Government-backed and supported programs to increase electronic health records (EHRs) also resulted in increased utilization of orthopedic software.

The country is investing in robotics and the use of AI and, as a result, is generating a strong demand for orthopedic software that provides integrated orthopedic tools to help with pre-planning, enhance productivity, and improve the patient's overall experience.

Why did Latin America Grow Gradually in the Orthopedic Software Market?

Latin America demonstrated gradual growth, as hospitals began to implement orthopedic software to assist them with rising surgery volumes. Countries with improving economic conditions were able to direct financial spending toward new digital health enterprises. The increased incidence of orthopedic injuries and sports-related injuries fueled the demand for imaging and surgical planning software systems. Also, new opportunities arose in low-cost cloud-based systems, mobile applications, and tele-orthopedic platforms.

Brazil Orthopedic Software Market Trends

Brazil continued to lead the regional market because of the increased volume of orthopedic surgical procedures and the increased rate of digital medical system adoption. Private hospitals are investing in new imaging and surgical planning systems. Additionally, increased sports programs resulting in more sports-related injuries also impact demand. Governments in Brazil have been promoting the widespread utilization of electronic records, which encourages wider adoption of software systems.

Why did the Middle East and Africa Grow Rapidly in the Orthopedic Software Market?

Countries in the Middle East and Africa have invested in new modern hospital systems, and medical technology has advanced. The number of orthopedic procedures increased alongside lifestyle diseases and injuries. Governments invested in digital health technologies that encouraged hospitals to use orthopedic imaging and planning tools. There were many opportunities in low-cost, cloud-based systems, AI diagnostics, and digital platforms in private hospital settings. Medical tourism in Gulf countries created a greater demand for high-quality orthopedic software.

The UAE Orthopedic Software Market Trends

The UAE was the leader in the market in the region, driven by strong investments in advanced hospital systems and medical tourism. Providers accepted high-end orthopedic planning, imaging, and record-keeping systems. The government has promoted digital health technology that has encouraged a quicker uptake. Surgeons relied heavily on precise tools for performing joint and spine surgery. There were greater opportunities for robotic-linked software, cloud-based tools for planning, AI imaging tools, and more tools used in large private hospitals.

Top Orthopedic Software Applications

| ChartLogic | A leading software developed for orthopedic practices and popular EHR among orthopedic physicians. The software is integrated with orthopedic-specific templates and flow sheets for orthopedic surgeons. |

| TraumaCad | A cloud-based orthopedic planning software that can be used remotely, anywhere, anytime. It is designed to automatically generate pre-surgical reports such as implant information, patient images, measurements taken, and comments. |

| mediCAD | It is a premium software solution for transforming the orthopedic workflow; it provides 3D models, 3D planning, and medical imaging. |

| AdvancedMD | It is the leading EHR software solution for orthopedic practices for the diagnostics and treatment of patients with orthopedic conditions. |

| Healthray | An EMR software for the orthopedic, which is designed to streamline the documentation process and other orthopedic applications. |

| Ezovion | Orthopedic practice management is designed to enhance patient engagement, patient care, post-patient care, and other orthopedic applications. |

| Clinicea | An orthopedic software that offers pre-built templates for Knee pain, Osteoarthritis, Low back pain, Fracture, Ankle sprain, Carpal Tunnel Syndrome, Pre-op visits, Cellulitis, and other orthopedic applications. |

Orthopedic Software Market Companies

- IBM

- CureMD Healthcare

- GreenWay Health LLC

- Brainlab AG

- Medstrat

- Materialise

- NextGen Healthcare LLC

- DrChrono, Inc

- Allscripts Healthcare, LLC

- athenahealth (acquired by Hellman & Friedman and Bain Capital)

- Stryker

- Exactech, Inc.

- OPIE Software

Latest Announcement by Industry Leaders

- In May 2023, Stryker launched the Ortho Q Guidance system, designed for surgical guidance and planning for the knee and surgical procedures and can be easily controlled by sterile field surgeons.

Recent Developments

- In February 2025, Children's Specialized Hospital (CSH), a subsidiary of the Pediatric Orthopedic program and Children's Health Network at RWJBarnabas Health (RWJBH), launched the unique Pediatric Orthopedic Multidisciplinary Program.

- In October 2024, THINK Surgical, the United States-based orthopedic robot developer, won the Medical Device Excellence Awards 2024 in the category of Innovation and Product Launches to Orthopedic Surgery.

- In September 2024, Arthrex, a leading player in medical education and minimally invasive surgical technology, announced the launch of OrthoPedia Patient, a digital platform that provides an easy and accessible video for patients covering the insights of orthopedic conditions and treatments.

Segments Covered in the Report

By Product

- Digital Templating/Preoperative Planning Software

- Orthopedic EHR

- Orthopedic Practice Management

- Orthopedic PACS

- Orthopedic RCM

- Others

By Mode Of Delivery

- Web/Cloud Based

- On-premises

By Application Insights

- Orthopedic Surgeries

- Fracture Management

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting