What is the Paper Bottles Market Size?

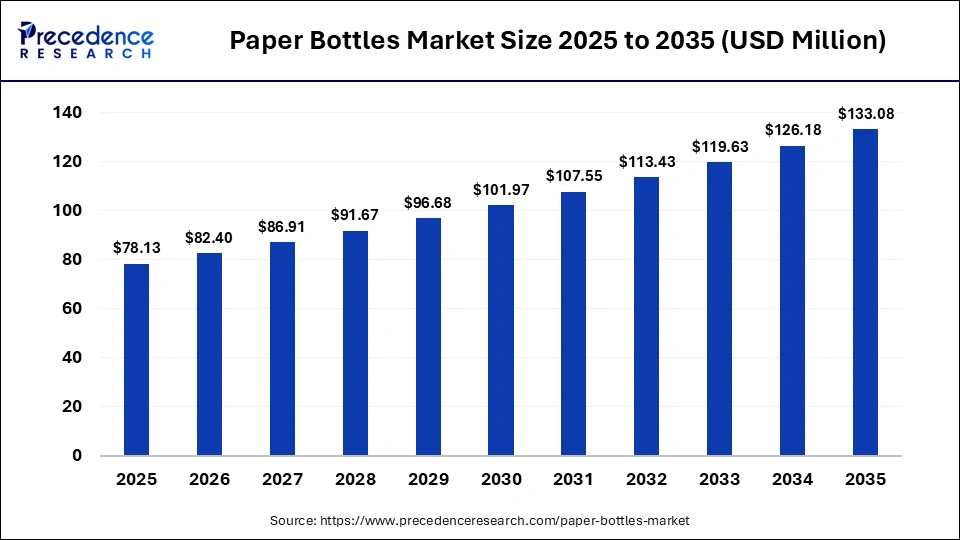

The global paper bottles market size was calculated at USD 78.13 billion in 2025 and is predicted to increase from USD 82.40 billion in 2026 to approximately USD 133.08 billion by 2035, expanding at a CAGR of 5.47% from 2026 to 2035. This market is growing due to rising demand for sustainable, plastic-free packaging solutions driven by environmental regulations and eco-conscious consumers.

Market Highlights

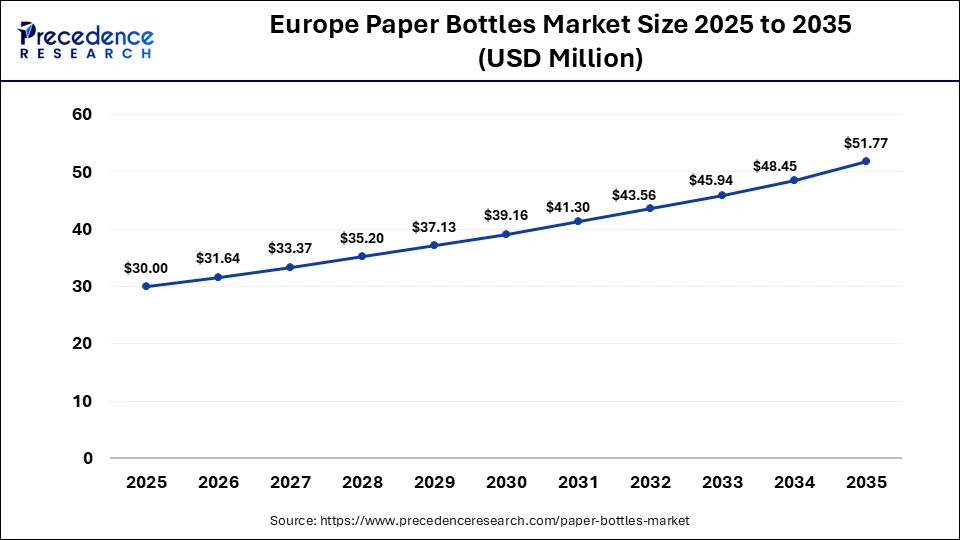

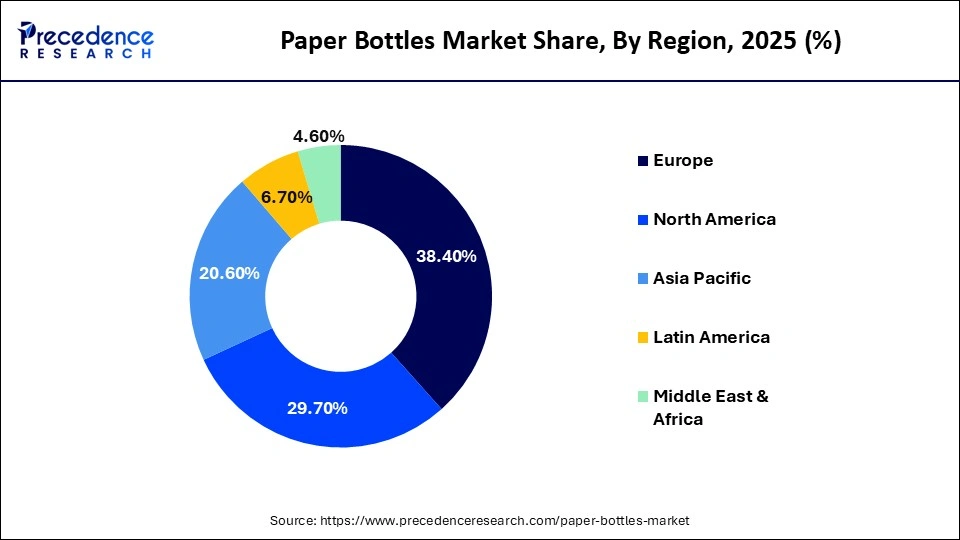

- Europe dominated the global paper bottles market with a 38.40% share in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 6.40% between 2026 and 2035.

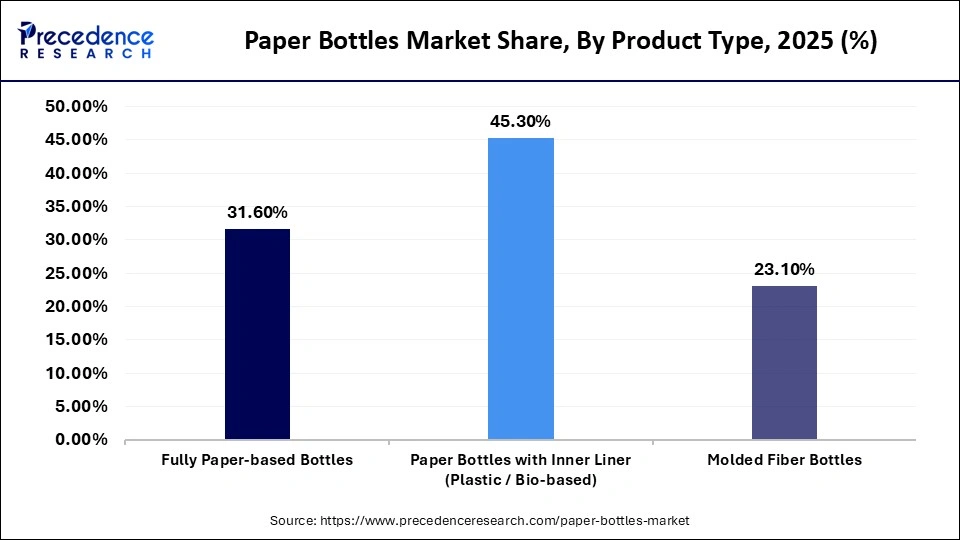

- By product type, the paper bottles with inner liner segment generated the biggest market share of 45.30% in 2025.

- By product type, the molded fiber bottles segment is expected to grow at the fastest CAGR of 6.40% between 2026 and 2035.

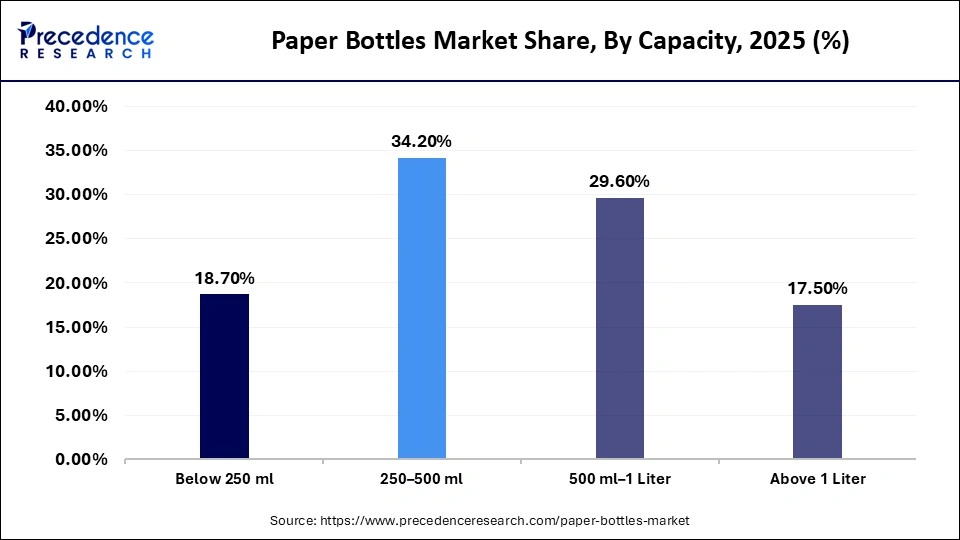

- By capacity, the 250 to 500 ml segment contributed the highest market share of 34.20% in 2025.

- By capacity, the 500 ml to 1 liter segment is expected to grow at a healthy CAGR of 5.10% between 2026 and 2035.

- By end-use industry, the beverages segment dominated the market with a 41.80% share in 2025.

- By end-use industry, the personal care & cosmetics segment is expected to expand at a notable CAGR of 5.90% from 2026 to 2035.

- By application, the single-use packaging segment contributed the highest market share of 56.90% in 2025.

- By application, the refillable packaging segment is growing at a strong CAGR of 610% between 2026 and 2035.

- By distribution channel, the direct sales to brand owners segment held a major market share of 52.10% in 2025.

- By distribution channel, the e-commerce segment is expected to expand at a notable CAGR of 6.20% from 2026 to 2035.

Why is the Paper Bottles Market Gaining Momentum?

The paper bottles market is witnessing strong growth as eco-friendly packaging options become more popular among consumers and brands to decrease plastic waste. Adoption of single-use plastics in household personal care and beverage products is accelerating due to corporate sustainability pledges and growing regulatory pressure. Technological developments in paper-based barrier coating are expanding their commercial use by enhancing their durability and liquid-holding capacity.

How is AI Transforming the Market?

Artificial intelligence is transforming the paper bottles market by optimizing design, production, and sustainability throughout the value chain. AI-powered analytics enable predictive quality control, ensuring barrier coatings and structural integrity meet safety and durability standards. It also supports process automation and resource efficiency, reducing waste, energy consumption, and production costs. Additionally, AI helps brands understand consumer preferences and usage patterns, allowing for personalized, eco-friendly packaging designs and faster innovation in sustainable solutions.

What are the Current Major Trends Influencing the Market?

- Growing adoption of plastic-free and biodegradable packaging by global FMCG and beverage brands.

- Rising use of paper bottles for water, juices, and alcoholic beverages is a sustainability statement.

- Advancements in barrier coatings and inner linings to improve liquid resistance and shelf life.

- Increased brand differentiation through eco design and minimalistic packaging.

- Strong push from government regulations and corporate ESG goals supporting paper-based alternatives.

- Increasing consumer willingness to pay a premium for environmentally responsible packaging solutions.

- Expansion into beverage packaging is driven by growing consumer acceptance of eco-friendly alternatives for water, juices, and alcoholic drinks.

- Development of fully recyclable and plastic-free barrier coatings allows paper bottles to safely store liquids while maintaining sustainability.

- Rising demand from personal care and cosmetic brands reflects a focus on reducing plastic use and enhancing brand image.

- Growth in emerging markets is fueled by environmental regulations, urbanization, and increasing awareness of sustainable consumption.

- Strategic collaborations between packaging innovators and FMCG companies accelerate product testing, scaling, and commercial launches.

- Use of paper bottles for premium and eco-luxury branding enables differentiation through sustainability-led packaging design.

- Corporate ESG and net-zero commitments encourage companies to adopt renewable and low-carbon packaging solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 78.13 Billion |

| Market Size in 2026 | USD 82.40 Billion |

| Market Size by 2035 | USD 133.08 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.47% |

| Dominating Region | Europe |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Capacity, End-use Industry, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

What made paper bottles with inner liner the dominant segment in the market in 2025?

The paper bottles with inner liner segment dominated the paper bottles market, accounting for 45.30% share in 2025. This is because they provide barrier protection against oxygen, moisture, and leaks. The inner liner preserves product safety and shelf life while allowing compatibility with liquids like drinks, household liquids, and personal hygiene products. This design is the recommended option for widespread commercial adoption since it enables brands to switch from plastic bottles to paper-based substitutes without sacrificing performance.

The molded fiber bottles segment is expected to grow at the fastest CAGR of 6.40% in the market during the forecast period, driven by the growing need for packaging options that are completely plastic-free and compostable, because molded fiber bottles are lightweight, biodegradable, and have a strong eco-friendly branding appeal. Brands that cater to consumers who care about sustainability are increasingly using them. Adoption in premium and niche product categories is being accelerated by ongoing advancements in molding technology and strength enhancement.

Capacity Insights

Why did the 250 to 500 ml segment dominate the paper bottles market in 2025?

The 250 to 500 ml segment dominated the market while holding the largest share of 34.20% in 2025 because functional drinks, personal care products, and beverages all use it extensively. This size is perfect for single-serve and on-the-go applications because it strikes the right balance between portability, convenience, and controlled consumption. Its dominance was greatly influenced by consumer preferences for moderate packaging sizes and its compatibility with retail shelving.

The 500 ml to 1 liter segment is expected to expand at a notable CAGR of 5.10% in the market during the forecast period, driven by increasing demand for family-size beverages, refill packs, and bulk personal care products. Growing preference for value-sized and reduced packaging frequency. Especially in urban households and food services channels, is supporting the expansion of this segment. Sustainability-driven bulk purchasing trends further reinforced its growth trajectory.

End Use Industry Insights

What made beverages the leading segment in the paper bottles market in 2025?

The beverages segment led the market, accounting for 41.80% of the total share in 2025. This is because of the widespread use of paper bottles by beverage brands. With increasing pressure on beverage companies to reduce plastic usage, paper bottles offer an eco-friendly and visually appealing alternative. Market leadership is further strengthened by high consumption volumes and frequent launches of products in sustainable packaging formats.

The personal care & cosmetics segment is expected to grow at the fastest CAGR of 5.90% in the market during the forecast period, motivated by the growing demand for eco-friendly cosmetics and personal care items. Paper bottles are being used by brands more frequently to adhere to environmental regulations and improve eco-conscious branding. Premium skincare, haircare, and refill-friendly product lines that use paper-based packaging solutions further drive growth.

Application Insights

What made single-use packaging the dominant segment in the paper bottles market in 2025?

The single-use packaging segment dominated the market, accounting for 56.90% of the total share in 2025. This is because it addresses the high demand for convenient, on-the-go beverage and personal care products. Brands increasingly prefer eco-friendly, disposable alternatives to traditional plastic bottles to meet sustainability goals and regulatory pressures. Additionally, the segment benefits from high production volumes, lower costs, and widespread consumer adoption, reinforcing its market leadership.

The refillable packaging segment is expected to grow at the fastest CAGR of 6.10% in the market during the forecast period, driven by consumer shift toward zero waste and circular economy initiatives. Paper bottles that can be refilled are being introduced by brands in an effort to decrease packaging waste and promote recurring purchases. Adoption is being accelerated by consumer acceptance of refill systems and supportive government policies.

Distribution Channel Insights

Why did the direct sales to brand owners segment dominate the paper bottles market in 2025?

The direct sales to brand owners segment dominated the market, accounting for 52.10% share in 2025, as manufacturers prefer direct partnerships to ensure customization, quality control, and supply chain efficiency. This channel allows packaging suppliers to collaborate closely with brands on design, material innovation, and sustainability targets. Large volume contracts and long-term supply agreements further reinforced dominance.

The e-commerce segment is expected to grow at the fastest CAGR of 6.20% in the market during the forecast period, supported by the rise of direct-to-consumer brands and online sustainable product launches. Digital platforms enable easy access to innovative packaging solutions, especially for startups and eco-focused brands. Increased online procurement and global reach are accelerating growth in these channels.

Regional Insights

What is the Europe Paper Bottles Market Size and Growth Rate?

The Europe paper bottles market size has grown strongly in recent years. It will grow from USD 30.00 billion in 2025 to USD 51.77 billion in 2035, expanding at a compound annual growth rate (CAGR) of 5.61% between 2026 and 2035.

What made Europe the Dominant Region in the Paper Bottles Market in 2025?

Europe dominated the paper bottles market with 38.40% share in 2025. This is mainly due to stringent environmental regulations, strong sustainability initiatives, and high consumer awareness regarding plastic reduction. The region has a well-established packaging industry and early adoption of eco-friendly innovations, which encourages beverage, personal care, and cosmetic brands to shift to paper bottles. Additionally, government incentives and corporate ESG commitments further accelerated the deployment of renewable and recyclable packaging solutions across Europe.

Germany Paper Bottles Market Trends

Germany remains a key contributor to the European market, driven by early adoption of eco-friendly packaging solutions, strict sustainability regulations, and high consumer environmental awareness. Beverages and personal care companies have been encouraged to switch to paper based bottles formats by the nation well established recycling infrastructure and stringent plastic reduction regulations. Sustainable packaging innovations are actively supported by German consumer which encourages brands to invest in high-end paper bottle solutions with inner liners.

What makes Asia Pacific the fastest-growing region in the paper bottles market?

Asia Pacific is expected to grow at the fastest CAGR of 6.40% in the market during the forecast period, driven by growing environmental consciousness, packaged beverage consumption, and urbanization. Sustainable packaging alternatives are being actively promoted by governments and brands in nations. Strong market growth is further supported by the region's growing middle-class population and expanding manufacturing base.

India Paper Bottles Market Trends

The market in India is growing due to the government's growing emphasis on cutting back on single-use plastics, growing urbanization, and rising consumption of packaged beverages. Adoption is being accelerated by urban consumers' growing awareness of sustainable packaging and the growth of eco-conscious brands. The nations' rapidly expanding FMCG personal care and beverage industries are actively investigating paper bottles as a substitute for plastic packaging.

Who are the Major Players in the Global Paper Bottles Market?

The major players in the paper bottles market include Frugalpa, PaBoCo, Pulpex, Rypax, The Absolut Company, Paper Water Bottle, Ecologic (Ecologic Brands Inc.), Unilever plc, Kagzi Bottles, and Choose Packaging

Recent Developments

- In January 2026, Frugalpac announced a strategic call to global retailers to expand the distribution of its "Frugal Bottle" following a surge in consumer demand. The company is accelerating the commercial rollout of its recycled paperboard packaging for the wine and spirits industry to meet international inquiries. This initiative underscores the rapid market growth and scalability of low-carbon paper bottle solutions in the global retail sector.

- In January 2026, Frugalpac announced a partnership with Rhea Distilleries to launch the "Rhea" paper bottle, India's first commercially produced paper bottle. This launch was unveiled during a UK trade delegation led by Prime Minister Keir Starmer. The initiative reflects the growing international demand for sustainable paper packaging alternatives. You can read the full analysis at Frugalpac.

Segments Covered in the Report

By Product Type

- Fully Paper-based Bottles

- Paper Bottles with Inner Liner (Plastic / Bio-based)

- Molded Fiber Bottles

By Capacity

- Below 250 ml

- 250-500 ml

- 500 ml-1 Liter

- Above 1 Liter

By End-use Industry

- Beverages

- Personal Care & Cosmetics

- Household & Cleaning Products

- Food & Condiments

- Pharmaceuticals & Nutraceuticals

By Application

- Single-use Packaging

- Refillable Packaging

- Premium/Specialty Packaging

By Distribution Channel

- Direct Sales to Brand Owners

- Packaging Distributors & Converters

- E-commerce

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting