Perishable Prepared Food Market Size and Forecast 2025 to 2034

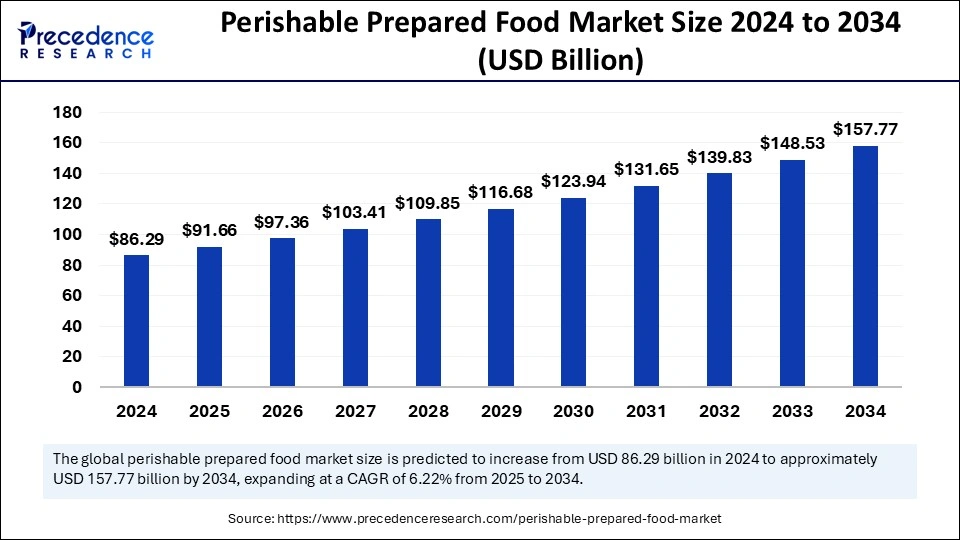

The global perishable prepared food market size accounted for USD 86.29 billion in 2024 and is predicted to increase from USD 91.66 billion in 2025 to approximately USD 157.77 billion by 2034, expanding at a CAGR of 6.22% from 2025 to 2034. The increasing urbanization across the globe is the key factor driving the growth of the market. Also, the expansion of retail channels, coupled with the surge in disposable income of the majority of the population, can fuel market growth further.

Perishable Prepared Food Market Key Takeaways

- Asia Pacific dominated the perishable prepared food market in 2024.

- North America is expected to grow at the fastest CAGR over the period studied.

- By type, the peeled or cut fruits and vegetables segment dominated the market in 2024.

- By type, the processed food segment is expected to grow at the fastest CAGR over the forecast period.

- By application, the confectionery and bakery segment dominated the market by holding the largest share in 2024.

- By application, the fruit-based beverages segment is anticipated to show the fastest growth during the projected period.

- By distribution channel, the online segment held the largest market share in 2024.

- By distribution channel, the offline segment is expected to grow at the fastest rate over the projected period.

Impact of Artificial Intelligence (AI) on Improving the Perishable Prepared Food Market

Artificial Intelligence algorithms process customer preferences, historical data, and market trends to forecast future demand, allowing companies to optimize manufacturing and inventory levels, reducing waste and ensuring timely delivery. Furthermore, AI-driven logistics platforms can streamline delivery routes, decreasing transit times and minimizing the risk of damage during transportation. AI-driven vision systems can detect defects in food products to ensure only high-grade products reach consumers.

- In October 2024, Fresh Technologies, the world's leading fresh food technology company, announced the launch of its first solution for distribution centers, Afresh DC Forecasts. The new AI-powered DC Forecasts offer the first-ever fresh-specific technology solution for DC buyers that automatically compiles the data the buyers must consider every day to forecast upcoming orders from the stores they serve.

Market Overview

The perishable prepared food market consists of processed food items with a short shelf life because of the perishable properties of their ingredients, which require cater handling and storage methods to keep them fresh and safe. The market emphasizes foods that are supposed to decay, spoil, or become unsafe to administer if not frozen or refrigerated. The food items include fish, dairy products, fresh meat, poultry, and cooked leftovers. These foods can be distributed online or through offline distribution channels.

Perishable Prepared Food Market Growth Factors

- The increasing health and wellness trend among the health-conscious population is expected to boost market growth soon.

- The increasing demand for convenience foods, especially with the increase of dual-income households.

- The expansion in emerging markets will likely contribute to market growth over the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 157.77 Billion |

| Market Size in 2025 | USD 91.66 Billion |

| Market Size in 2024 | USD 86.29 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.22% |

| Dominated Region | Asia Pacific |

| Fastest Growing Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, Distribution Channel, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Changing consumer preferences

The perishable prepared food market is being extensively driven by shifting consumer preferences, such as increasing demand for convenience, preference for fresh, high-grade ingredients, and health-conscious choices, along with the desire for sustainability and transparency. In addition, consumers are increasingly becoming aware of the environmental effects of their food choices, such as carbon footprint, food waste, and responsible sourcing.

- In July 2024, Upshop and Invafresh announced their merger, marking a significant milestone in the food retail industry. Together, they aim to address major food sector challenges: availability, affordability, and waste. The united entity, Upshop, aims to empower communities worldwide by enabling better access to fresh, safe, and affordable food, regardless of whether it's prepared, perishable, or shelf-stable.

Restraint

Supply chain hurdles

The perishable prepared food market heavily depends on a reliable and efficient supply chain to ensure the availability of packaging materials, ingredients, and distribution channels. Disturbance in this system, including transportation issues and natural disasters, can impact the manufacturing and distribution of perishable prepared food products. These hurdles can potentially lead to product shortages, delays, and raised costs, negatively impacting market growth.

Opportunity

Product development and innovation

Major players in the perishable prepared food market are extensively developing and innovating new products to meet changing consumer demands. Furthermore, they are launching organic, healthier, and nutritionally balanced solutions, tailored to specific dietary preferences, like vegan, gluten-free, or allergen-free products. These ongoing innovations are fuelling consumer interest and creating lucrative opportunities in the market soon.

- In February 2024, Kolkata-based Tastes2plate (T2P), an inter-city perishable food delivery start-up, launched in Ahmedabad. The company began operations in Kolkata in 2019 and expanded its business to different cities. Initially, the service was available only to restaurants.

Type Insights

The peeled or cut fruits and vegetables segment dominated the perishable prepared food market in 2024. The dominance of the segment can be attributed to the increasing demand for these food products from consumers all across the globe. These items are generally pre-cut and pre-washed for ease of use. Additionally, they are specifically designed to provide consumers with convenience, high nutrition, and flavor while keeping the same degree of freshness. Research is ongoing to create innovative technologies and techniques to further enhance the shelf life and quality of these products.

The processed food segment is expected to grow at the fastest rate over the forecast period. The growth of the segment can be credited to the surge in urbanization, increasing incomes, and shifting consumer preferences, with an emphasis on packaged foods and convenience. Also, innovative government policies such as Pradhan Mantri Kisan SAMPADA Yojana in India provide funding for the establishment of food processing units in the country.

- In November 2024, FPS Food Process Solutions ("FPS") and OptiCept Technologies launched their state-of-the-art PEF system, specifically designed for the solid food processing industry. The patented OptiCEPT Solid Series combines hygienic design and robust construction with next-generation PEF technology to ensure optimal treatment while maintaining a minimal footprint in energy efficiency.

Application Insights

In 2024, the confectionery and bakery segment dominated the perishable prepared food market by holding the largest share. The dominance of the segment is owing to the increasing urbanization, disposable incomes, and shifting consumer preferences. Additionally, there is an increasing demand for healthier options, such as gluten-free,low-sugar, and organic products, which are boosting innovation in the confectionery and bakery sectors.

The fruit-based beverages segment is anticipated to show the fastest growth during the projected period. The growth of the segment is due to the growing shift toward healthier lifestyles, coupled with the advancements in processing and packaging, which lead to increased demand for nutrient-rich, natural, and convenient options. The ongoing introduction of innovative products and flavor varieties by key players is propelling segment growth further.

- In September 2024, Grupo Jumex and AriZona Beverages Company, both leading brands in the beverage industry, announced the launch of Jumex Hard, a malt-based 'Hard Nectar' inspired by consumers' growing trend of mixing Jumex fruit nectars with alcohol.

Distribution Channel Insights

The online segment held the largest perishable prepared food market share in 2024. The dominance of the segment can be linked to the increase in online food delivery services with an emphasis on home-cooked meals and ready-to-eat food services. Consumers are seeking hassle-free and quick solutions for their busy lifestyles, which leads to a rise in demand for ready-to-eat options. Moreover, the expansion of online food delivery platforms has made it convenient for consumers to access this food from their homes.

The offline segment is expected to grow at the fastest rate over the projected period. The growth of the segment can be driven by the rapid expansion of offline retail channels, such as grocery stores, supermarkets, and convenience stores in developing countries around the world. Furthermore, offline cold storage settings, such as refrigeration systems and physical warehouses, are essential for maintaining the safety and quality of perishable prepared foods, driving lucrative segment growth shortly.

Regional Insights

Asia Pacific dominated the perishable prepared food market in 2024. The dominance of the region can be attributed to the rise in the middle-class population, the ongoing urbanization, along the shifting dietary habits in developing countries such as China and India. Furthermore, the growth of modern retail channels and the impact of Western dietary habits drive market expansion in the region soon.

China Market Trends

In Asia Pacific, China led the market, owing to the ongoing expansion of the e-commerce sector and the rising penetration of advanced retail formats, which have made fruit beverages highly available to consumers in the country. Also, the country's wide fruit supply strengthens the production of fruit beverages in the nation.

North America is expected to grow at the fastest rate in the perishable prepared food market over the period studied. The growth of the region can be credited to the strong presence of major market players and a wide retail network in the region. Moreover, the region is distinguished by busy lifestyles and an increased demand for sophisticated food options. The United States and Canada are major markets in the region.

- In March 2025, Savor, the pioneering food company that creates pure, versatile, and sustainable fats directly from carbon without the need for conventional agriculture, announced the commercial launch of its animal-and-plant-free butter, the first product made from a game-changing platform that has captivated chefs and food manufacturers from coast to coast.

U.S Market Trends

In North America, the U.S. dominated the perishable prepared food market by holding the largest market share. The dominance of the region can be driven by well-established distribution networks, such as hypermarkets, supermarkets, and online channels in the region, that ensure easy accessibility of fruit beverages to consumers.

Perishable Prepared Food Market Companies

- ConAgra Brand Inc.

- Tutila Ahara Pvt. Ltd.

- Kraft Heinz Company

- Green Mill Restaurants LLC

- Regal Kitchen Foods Ltd.

- BRF S.A.

- Nestle SA

- Nomad Foods Ltd.

- Kerry Group plc

- FiveStar Gourmet Foods Inc.

- Others

Latest Announcements by Market Leaders

- In March 2025, Kandhari Global, one of Coca-Cola India's biggest bottlers, announced its largest acquisition to date: a new plant from Hindustan Coca-Cola Beverages Pvt. Ltd in Sanand, Gujarat. The New Delhi-based Kandhari Global's growing ambitions follow Coca-Cola's ongoing divestment of its bottling operations in India, allowing its local partners to gain wider control to bottle and sell its beverages in the country.

- In May 2024, Campbell Soup Company announced plans as part of an ongoing effort to invest in and transform its supply chain to fuel business growth, improve return on invested capital, and enhance the overall effectiveness and efficiency of its manufacturing and distribution network.

Recent Developments

- In April 2024, Tropicana unveiled a new brand identity, the Tropicana Special Start range. The Special Start range includes 3 100% pure pressed fruit juices: Pink Grapefruit, Pineapple, and Sanguinello Blood Orange.

- In March 2023, Conagra Brands acquired Chef Solutions, a leading provider of frozen and microwavable foods. The acquisition will help Conagra expand its presence in the microwavable foods market.

- In June 2023, Campbell Soup Company announced that it would be investing USD 100 million in its microwavable foods business. The investment will be used to develop new products and expand distribution.

Segments Covered in the Report

By Type

- Peeled or Cut Vegetables, Fruits and Vegetables

- Processed Food

- Prepared Meals

- Other Perishable Prepared Food Manufacturing

By Application

- Confectionery and Bakery

- Jams and Preserves

- Fruit-based Beverages

- Dairy

- Other Applications

By Distribution Channel

- Online

- Offline

By Geography

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting