What is Pharmaceutical Contract Manufacturing Market Size?

The global pharmaceutical contract manufacturing market size is estimated at USD 194.54 billion in 2025 and is predicted to increase from USD 207.18 billion in 2026 to approximately USD 351.55 billion by 2034, expanding at a CAGR of 6.76% from 2025 to 2034.

Market Highlights

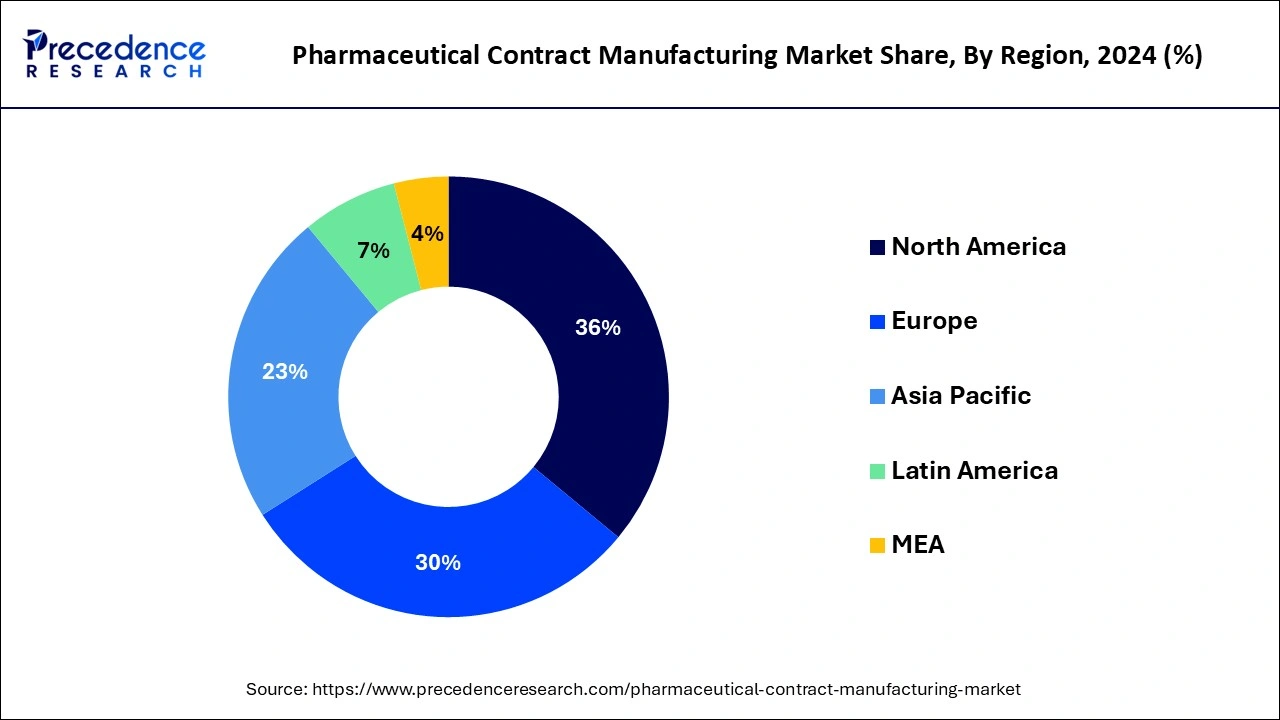

- North America contributed 36% of market share in 2024.

- Asia-Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By service, the pharmaceutical manufacturing services segment has held the largest market share of 33% in 2024.

- By service, the drug development services segment is anticipated to grow at a remarkable CAGR of 8.9% between 2025 and 2034.

- By end-user, the big pharmaceutical companies segment generated over 42% of revenue share in 2024.

- By end-user, the small & mid-sized pharmaceutical companies segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

Pharmaceutical contract manufacturing market offers a collaborative arrangement where a pharmaceutical company outsources the production of drugs or medical products to a specialized third-party manufacturer. Instead of handling the entire manufacturing process in-house, the company entrusts certain or all aspects of production to a contract manufacturing organization (CMO). This outsourcing model allows pharmaceutical companies to benefit from the expertise, infrastructure, and efficiency of CMOs, often leading to cost savings and quicker production timelines.

Contract manufacturers may offer services ranging from drug formulation and development to actual production, packaging, and quality control. This approach enables pharmaceutical companies to focus on research, marketing, and other core activities, while leveraging external manufacturing capabilities for efficient and scalable production of their products.

Pharmaceutical Contract Manufacturing Market Data and Statistics

- In January 2020, Celltrion, a South Korean biosimilar manufacturer, revealed plans to invest $514 million over five years in constructing a new facility in Wuhan, China. This state-of-the-art biologics plant is anticipated to boast a substantial capacity of 120,000 liters.

- According to Evaluate Pharma's projections for 2026, Roche, headquartered in Switzerland, is expected to allocate a substantial $14 billion for pharmaceutical research and development (R&D). Other major players, such as Merck, Pfizer, and Johnson & Johnson, also anticipate high R&D expenditures.

- In December 2022, RedHill Biopharma confirmed that Recipharm would continue the commercial manufacturing of Talicia, a medication designed for H. pylori infection treatment, through 2026. RedHill and Recipharm have maintained a close collaboration since 2015, jointly developing and manufacturing Talicia, which comprises delayed-release capsules containing omeprazole magnesium, amoxicillin, and rifabutin (10 mg/250 mg/12.5 mg).

Pharmaceutical Contract Manufacturing MarketGrowth Factors

- A major growth factor for the pharmaceutical contract manufacturing market is the increasing trend among pharmaceutical companies to outsource manufacturing processes. This allows companies to focus on core competencies like research and development while leveraging the expertise and capabilities of contract manufacturers.

- Contract manufacturing provides flexibility in production scale and cost advantages, making it an attractive option for pharmaceutical companies. By outsourcing manufacturing, companies can adapt to changing market demands and control costs more effectively.

- The growing demand for biologics and biosimilars has fueled the expansion of contract manufacturing services. Biologics often require specialized manufacturing facilities and expertise, and contract manufacturers play a crucial role in meeting this demand.

- The globalization of the pharmaceutical industry has led to increased cross-border collaborations in manufacturing. Companies seek contract manufacturing partners globally to access new markets, comply with regional regulations, and take advantage of cost-effective manufacturing locations.

- The pharmaceutical industry's shift towards more complex drug formulations, including high-potency drugs and specialized delivery systems, has driven the need for advanced manufacturing technologies. Contract manufacturers equipped with these capabilities are in high demand to meet the evolving requirements of pharmaceutical products.

- As regulatory standards become more stringent, pharmaceutical companies are increasingly relying on contract manufacturers with expertise in navigating complex regulatory landscapes. Contract manufacturers that demonstrate a commitment to quality assurance and compliance contribute significantly to the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 194.54 Billion |

| Market Size in 2026 | USD 207.18 Billion |

| Market Size by 2034 | USD 351.55 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.76% |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Service and By End User and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Globalization of the pharmaceutical industry

The globalization of the pharmaceutical industry has significantly boosted the demand for pharmaceutical contract manufacturing. As pharmaceutical markets expand globally, companies seek to tap into diverse regions and benefit from cost-effective manufacturing locations while promoting the growth of pharmaceutical contract manufacturing market. This trend is driven by the need to comply with varying regulatory standards across different countries and gain access to new markets. Contract manufacturing enables pharmaceutical companies to overcome logistical challenges associated with international production by partnering with manufacturers with established facilities in strategic locations.

Moreover, the globalization trend fosters collaborations between pharmaceutical companies and contract manufacturers, allowing for the exchange of expertise and the efficient utilization of resources. By leveraging the capabilities of contract manufacturers worldwide, pharmaceutical companies can navigate the complexities of international markets, accelerate time-to-market, and ensure a more streamlined and cost-effective approach to meet the growing demands of a globalized pharmaceutical landscape.

Restraint

Dependency on contract manufacturers

Dependency on contract manufacturers serves as a notable restraint in the pharmaceutical contract manufacturing market. Overreliance on external partners can create vulnerabilities for pharmaceutical companies. Issues like capacity constraints, financial stability concerns, or disruptions in the supply chain of contract manufacturers may impact the timely and reliable production of pharmaceutical products. This dependency exposes pharmaceutical companies to potential risks, as any challenges faced by the contract manufacturer can directly affect the availability and delivery of essential medications, potentially leading to delays in product launches and market distribution.

Moreover, a high level of dependence limits the flexibility of pharmaceutical companies to swiftly adapt to market changes or unforeseen circumstances. Companies may face challenges in managing and mitigating risks associated with external manufacturing partners, necessitating careful strategic planning to ensure a resilient and responsive supply chain in the pharmaceutical contract manufacturing landscape.

Opportunity

Advanced manufacturing technologies

Advanced manufacturing technologies are opening new avenues in the pharmaceutical contract manufacturing market, creating opportunities for enhanced efficiency and innovation. The adoption of cutting-edge processes, such as continuous manufacturing and digitalization, allows contract manufacturers to optimize production, reduce costs, and improve overall manufacturing agility. Companies investing in these technologies position themselves as attractive partners for pharmaceutical firms seeking modern and streamlined manufacturing solutions.

Moreover, advanced manufacturing technologies enable contract manufacturers to offer flexibility in production, adapting quickly to changing market demands. The implementation of innovative techniques enhances the precision of drug manufacturing, ensuring higher quality standards. As the pharmaceutical industry continues to evolve, contract manufacturers embracing advanced technologies can not only meet the industry's current demands but also stay at the forefront of future developments, making them key players in the dynamic landscape of pharmaceutical contract manufacturing.

Regional Insights

Service Insights

The pharmaceutical manufacturing services segment held the highest market share of 33% in 2024. Pharmaceutical manufacturing services in the contract manufacturing market encompass the production and processing of pharmaceutical products by external service providers. This segment includes drug formulation, development, and manufacturing, allowing pharmaceutical companies to outsource these critical processes. A growing trend in this segment involves increased demand for specialized services, such as biopharmaceutical manufacturing and advanced drug delivery systems. Contract manufacturers offering flexibility, scalability, and expertise in these areas are witnessing heightened demand, reflecting the industry's evolution towards more complex and innovative pharmaceutical products.

The drug development services segment is anticipated to witness rapid growth at a significant CAGR of 8.9% during the projected period. In the pharmaceutical contract manufacturing market, the drug development services segment encompasses a range of services provided by contract manufacturers to assist pharmaceutical companies in the development of new drugs. This includes activities such as formulation development, process optimization, and pre-clinical and clinical trial support. A notable trend in this segment is an increasing demand for integrated drug development services, where contract manufacturers collaborate closely with pharmaceutical companies from early development stages, offering comprehensive solutions to accelerate the drug development process and enhance overall efficiency.

End-user Insights

The big pharmaceutical companies segment held a 42% market share in 2024.The big pharmaceutical companies segment in the pharmaceutical contract manufacturing market refers to major drug manufacturers outsourcing their production to specialized contract manufacturing organizations (CMOs). This segment is characterized by prominent players seeking cost-effective and efficient manufacturing solutions.

A notable trend in this segment involves strategic collaborations between big pharmaceutical companies and CMOs to leverage external expertise and facilities, enabling the former to focus on core competencies like research and development while ensuring timely and scalable production through outsourcing. This trend fosters innovation and flexibility in the dynamic pharmaceutical contract manufacturing landscape.

The small & mid-sized pharmaceutical companies segment is anticipated to witness rapid growth over the projected period. The small and mid-sized pharmaceutical companies segment in the pharmaceutical contract manufacturing market includes businesses with relatively modest production capacities. A growing trend within this segment involves these companies increasingly outsourcing manufacturing processes to specialized contract manufacturers.

This allows smaller pharmaceutical firms to leverage the expertise and infrastructure of contract manufacturers, focusing their resources on research, development, and market expansion. The trend reflects a strategic shift among smaller players, emphasizing cost-effective and flexible manufacturing solutions provided by contract manufacturing partners.

Regional Insights

U.S.Pharmaceutical Contract Manufacturing Market Size and Forecast 2025 to 2034

The U.S. pharmaceutical contract manufacturing market size is estimated at USD 49.12 billion in 2025 and is anticipated to reach around USD 89.48 billion by 2034, growing at a CAGR of 6.85% from 2025 to 2034.

North America held the largest market share of 36% in 2024due to its robust pharmaceutical industry, technological advancements, and a high demand for outsourcing. The region's well-established regulatory framework ensures quality and compliance. Additionally, a concentration of major pharmaceutical companies seeking cost-effective and specialized manufacturing services contributes to North America's dominance. The presence of skilled workforce, advanced infrastructure, and a favorable business environment further solidify the region's position as a key player in the pharmaceutical contract manufacturing market.

Asia-Pacific is poised for rapid growth in the pharmaceutical contract manufacturing market due to its cost-effective manufacturing capabilities, skilled workforce, and regulatory compliance. Many pharmaceutical companies are leveraging the region's infrastructure and expertise for outsourced manufacturing. The increasing demand for generic drugs, and biopharmaceuticals, and the globalization of pharmaceutical supply chains contribute to the region's prominence. As a hub for contract manufacturing services, Asia-Pacific offers a competitive advantage, attracting pharmaceutical firms seeking efficient and scalable production solutions.

Meanwhile, Europe is experiencing significant growth in the pharmaceutical contract manufacturing market due to several factors. The region is home to established contract manufacturers with advanced infrastructure and expertise. Increased outsourcing by pharmaceutical companies to streamline production and control costs, coupled with a focus on biopharmaceuticals and advanced manufacturing technologies, contributes to this growth. Additionally, the globalization of the pharmaceutical industry and the need for flexible, regulatory-compliant manufacturing solutions further drive the expansion of contract manufacturing services in Europe.

Pharmaceutical Contract Manufacturing Market Companies

- Lonza Group

- Catalent, Inc.

- Patheon (Now part of Thermo Fisher Scientific)

- Recipharm AB

- Boehringer Ingelheim

- Dr. Reddy's Laboratories

- Jubilant Life Sciences

- Fareva

- Vetter Pharma

- Evonik Industries

- WuXi AppTec

- Pfizer CentreOne

- Almac Group

- AbbVie Contract Manufacturing

- Samsung Biologics

Recent Developments

- In September 2022, Lonza Group entered into a partnership with Touchlight, a biotechnology company, to enhance its comprehensive mRNA manufacturing capabilities by incorporating an additional source of DNA.

- In February 2022, Thermo Fisher Scientific collaborated with Moderna, Inc. to facilitate the large-scale production of Moderna's COVID-19 vaccine, Spikevax, and other experimental mRNA therapies in its development pipeline.

- In January 2023, Catalent played a crucial role in supporting the manufacturing process for Sarepta's advanced gene therapy candidate, delandistrogene moxeparvovec (SRP-9001), designed to address Duchenne muscular dystrophy.

Segments Covered in the Report

By Service

- Pharmaceutical Manufacturing Services

- Pharmaceutical API Manufacturing Services

- Pharmaceutical FDF Manufacturing Services

- Drug Development Services

- Biologic Manufacturing Services

- Biologic API Manufacturing Services

- Biologic FDF Manufacturing Services

By End User

- Big Pharmaceutical Companies

- Small & Mid-Sized Pharmaceutical Companies

- Generic Pharmaceutical Companies

- Other End Users (Academic Institutes, Small CDMOs, and CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting