Pharmacy Inventory Management Software Solutions and Cabinet Market Size and Forecast 2025 to 2034

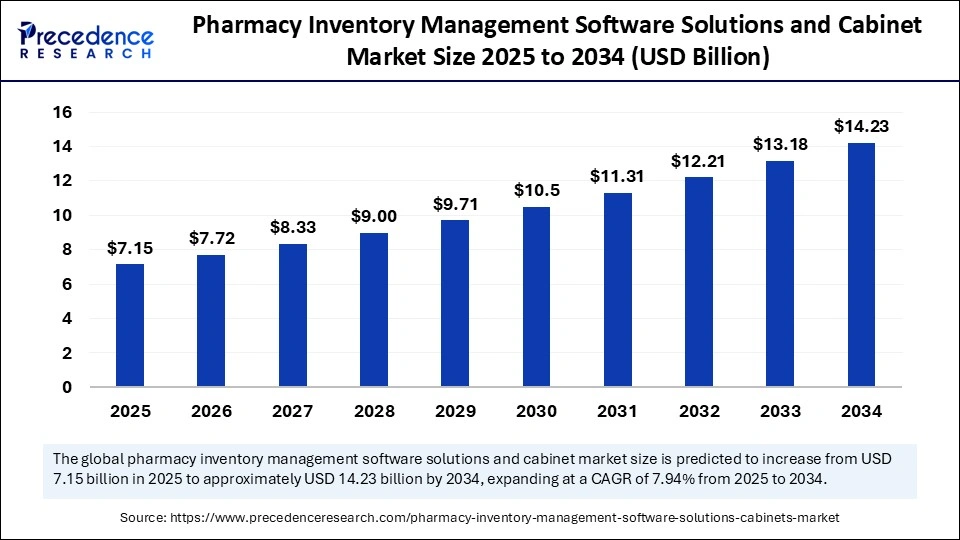

The global pharmacy inventory management software solutions and cabinet market size accounted for USD 6.63 billion in 2024 and is predicted to increase from USD 7.15 billion in 2025 to approximately USD 14.23 billion by 2034, expanding at a CAGR of 7.94% from 2025 to 2034. The increasing demand for medications, rising volume of prescriptions, and regulatory compliance are driving the growth of this market.

Pharmacy Inventory Management Software Solutions and Cabinet Market Key Takeaways

- The pharmacy inventory management software solutions and cabinet market was valued at USD 6.63 billion in 2024.

- It is projected to reach USD 14.23 billion by 2034.

- The market is expected to grow at a CAGR of 7.94% from 2025 to 2034.

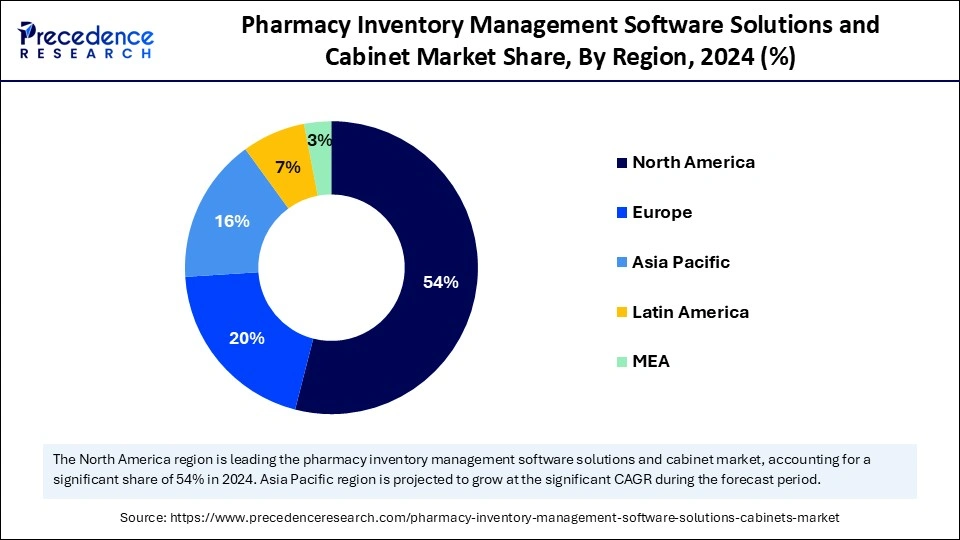

- North America dominated the global market with the largest share of 54% in 2024.

- Asia-Pacific is estimated to expand at the fastest CAGR during the forecast period of 2024-2033.

- By deployment mode, the cloud-based segment captured the biggest market share in 2024.

- By deployment mode, the on-premises segment is expected to grow at the fastest CAGR in the coming years.

- By application, the inventory management segment contributed to the major market share in 2024.

- By application, the pharmacy automation segment is expected to expand at a significant CAGR during the forecast period.

- By type, the software solutions segment held the highest market share in 2024.

- By type, the cabinets segment is expected to grow at the fastest CAGR between 2025 and 2034.

- By end-user, the hospitals and clinics segment accounted for largest market share in 2024.

- By end-user, the pharmacies segment is expected to grow at the fastest CAGR in the upcoming period.

- By technology, the RFID (Radio Frequency Identification) segment held the major market share in 2024.

- By technology, the automated dispensing systems segment is expected to expand at the fastest rate during the forecast period.

Impact of AI on the Pharmacy Inventory Management Software Solutions and Cabinet Market

The integration of artificial intelligence in pharmacy inventory managementsoftware and cabinets has completely transformed their functionality and features. It has added extremely crucial features such as predictive demand forecasting, automated reordering, real-time tracking, and expiry alerts. These additions have reduced errors and improved accuracy, ultimately enhancing patient safety. Various AI algorithms analyze historical data, providing valuable insights such as seasonal demand and real-time market scenarios, which can impact medicine demand. This allows for proactive stock management, avoiding shortages of life-saving drugs.

AI systems automate drug ordering based on storage capacity, eliminating manual intervention and human error. The systems also provide timely notifications for expiring medications, enabling proper management and discarding of dead stock. Based on data analytics, high-demand drugs can be sufficiently stocked, ensuring patient access during critical times. These factors significantly enhance the efficiency of pharmacy inventory management.

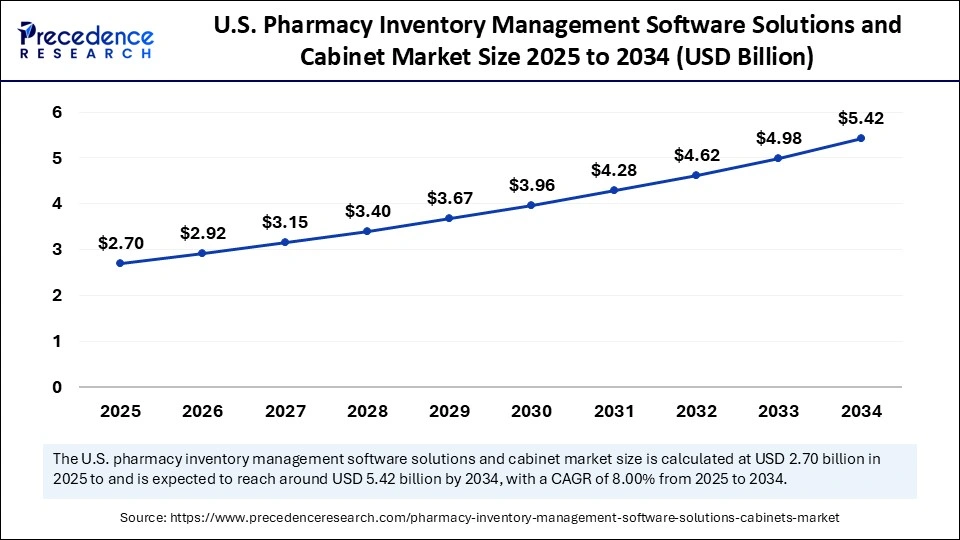

U.S. Pharmacy Inventory Management Software Solutions and Cabinet Market Size and Growth 2025 to 2034

The U.S. pharmacy inventory management software solutions and cabinet market size was exhibited at USD 2.51 billion in 2024 and is projected to be worth around USD 5.42 billion by 2034, growing at a CAGR of 8.00% from 2025 to 2034.

What Made North America the Dominant Region in the Market?

North America dominated the pharmacy inventory management software solutions and cabinet market by holding the largest share in 2024. The dominance of North America is linked to its robust healthcare infrastructure, high technology adoption, and a technology-driven ecosystem. Large-scale investments enable the application of pharmacy inventory management software solutions. Continuous research and development ensure this market's continued dominance. Key market players are mostly in the United States, and government support and regulations for automated inventory systems are also present. The need for high accuracy due to stringent regulatory compliance makes deploying these systems essential to ensure patient safety.

Asia Pacific Pharmacy Inventory Management Software Solutions and Cabinet Market Trends

Asia Pacific is expected to grow at the fastest rate in the coming years. There is rising technology penetration in pharmacy management systems due to growing pharmacy chains, rising prescription volumes, and increased healthcare expenditure. The need for sophisticated healthcare services is driving massive growth in pharmacy inventory management systems. With the increasing prevalence of various life-threatening diseases like diabetes, cardiovascular diseases, and other chronic diseases, there is a high demand for personalized medicine. This creates the need for efficient inventory management systems. Data on diseases like diabetes, heart disease, and respiratory illnesses provides insights into drug manufacturers to streamline production. Countries like India, China, and Japan are increasingly investing in pharmacy inventory management systems due to the rapid growth of retail pharmacy Sector.

European Pharmacy Inventory Management Software Solutions and Cabinet Market Trends

Europe is considered to be a significantly growing area. There is rising investments in healthcare and pharmacy management technology, driven by the increasing complexity of medicines and the need for efficient management tools. The aging population and prevalence of diseases are creating high demand for pharmacy and healthcare services. Strict regulations and compliance requirements are boosting the adoption of advanced inventory management solutions. Efficient systems improve operational efficiency, reduce costs, and ensure safety, which is critical in this market.

Market Overview

Pharmacy inventory management software solutions and cabinets are basically systems employed for inventory automation within pharmacies, frequently incorporating automated dispensing cabinets. These systems provide a range of features, including real-time inventory tracking, automated ordering capabilities, expiry date tracking, and comprehensive analysis of inventory data. This analysis encompasses detailed insights such as the sales patterns of specific medications in particular quantities during specific seasons, which is invaluable for precise decision-making. Furthermore, these systems facilitate the seamless integration of electronic prescriptions.

The primary driver behind the growth in the pharmacy inventory management software solutions and cabinet market is the increasing demand for greater efficiency and the reduction of operational costs. This market is witnessing the integration of various advanced technologies with pharmacy inventory management software solutions, such as automation, robotics, RFID technology, and cloud-based solutions, which are collectively enhancing the overall performance of these systems to an advanced level.

Pharmacy Inventory Management Software Solutions and Cabinet MarketGrowth Factors

- The increased prescription volume in pharmacies is boosting the need for accurate inventory management solutions.

- The integration of advanced technologies, such as dispensing cabinets, automation, and software, are streaming operations.

- With the use of data analytics, valuable insights can be derived, and these insights are highly valuable in making decisions regarding medication storage and inventory management.

- The rising demand for automated systems to provide accurate medications boost the growth of the market.

- The integration of cloud services with inventory management software offers remote access and greater flexibility in managing inventory.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 14.23 Billion |

| Market Size in 2025 | USD 7.15 Billion |

| Market Size in 2024 | USD 6.63 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment, Application, Type, End User, Technology, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increased Prescription Volume

The increased volume of prescriptions has made automation essential in pharmacy inventory management. Human processing increases the risk of errors, which can jeopardize patient safety. Automated systems, utilizing technologies like RFID and QR codes, are highly effective in addressing this, ensuring accuracy, precision, and efficiency in inventory management and dispensing operations. The system reduces labor costs and speeds up operations, making it highly cost-effective. It improves workflow efficiency, allowing pharmacists to focus on clinical activities. These factors are driving the growth of the pharmacy inventory management software solutions and cabinet market.

Restraint

Significant Initial Investment

Pharmacy inventory management software and cabinets are capital-intensive. Pharmacy inventory management relies heavily on advanced technologies, like robotics and AI-driven automation, which requires significant investment in specialized hardware and software. This increases the overall cost of the system. Handling and deploying pharmacy inventory management systems require maintenance of existing systems and technically educated staff, leading to high deployment and training costs. This cost factor creates barriers for small independent pharmacies, limiting the adoption of inventory management systems.

Opportunity

Increasing Need for Efficiency, Accuracy, and Automation

The increasing need to enhance operational efficiency creates immense opportunities in the pharmacy inventory management software solutions and cabinet market. Pharmacy inventory management systems enhance operational accuracy and efficiency, ultimately reducing costs. These systems feature secured storage, automatic dispensing capabilities, and real-time monitoring, enabling tracking of the inventory. All these features are encouraging pharmacies to adopt these systems

These systems, with the integration of artificial intelligence, are highly effective in pharmacy management due to their capability to optimize inventory. They provide insights based on historical sales data to determine medication storage needs, optimizing resource utilization while ensuring timely medicine availability. Crucial features include drug safety measures, expiry date management, and automated ordering. These advancements are essential for pharmacies to meet market expectations and stay relevant.

Deployment Mode Insights

Why did the Cloud-based Segment Dominate the Market?

The cloud-based segment dominated the global pharmacy inventory management software solutions and cabinet market with the largest share in 2024. The segment's dominance stems from its flexibility and scalability. Cloud solutions offer remote accessibility, making them the preferred choice for pharmacies with multiple branches. Cloud-based systems eliminate on-premises infrastructure maintenance, making the service cost-effective. Data security measures provided by the service provider offer an additional benefit.

The on-premises segment is expected to grow at the fastest rate during the forecast period. The growth of the segment is attributed to rising concerns over data security. The adoption of on-premises solutions is mainly driven by heightened cyber threats. Strict data security regulations, particularly for sensitive healthcare data, have led many pharmacy organizations to opt for on-premises solutions. These solutions enable pharmacies to have greater control data, reducing the risks of data theft.

Application Insights

How Does the Inventory Management Segment Dominate the Market in 2024?

The inventory management segment dominated the pharmacy inventory management software solutions and cabinet market in 2024. The key attribute behind this dominance is the ability of pharmacy inventory management software solutions to enhance operational accuracy and efficiency and reduce costs. Accurate inventory management, integrated with automation and robotics, is increasingly important for regulatory compliance. Data analytics is a game-changer in inventory management, particularly in big pharmacy chains. These solutions enable pharmacies to optimize their inventory management operations.

The pharmacy automation segment is expected to expand at a significant CAGR during the forecast period. The increasing volume of medication prescriptions and their complexity necessitate high accuracy, precision, and speed. Manual staff errors are addressed by pharmacy automation, which provides high-speed, accurate operational efficiency using tools like barcode and RFID systems, ensuring safety and improving operational efficiency, providing high operational efficiency.

Type Insights

What Made Software Solutions the Dominant Segment in the Market in 2024?

The software solutions segment dominated the pharmacy inventory management software solutions and cabinet market with a major revenue share in 2204. Software solutions offer high flexibility and scalability. These solutions can be seamlessly integrated with other healthcare tools, enabling real-time inventory monitoring, prediction of future needs, and remote access via cloud technology. This is essential for big pharmacy chains with multiple branches, facilitating efficient operational coordination.

The cabinets segment is expected to grow at the fastest rate in the upcoming period, driven by high demand for secure storage, robotics, AI, and automation integration. Automated cabinets with smart sensors, biometric access, and cloud connectivity attract pharmacies, especially those with large volumes. These cabinets ensure proper handling of sensitive medications with accurate light and temperature control.

End-User Insights

Why did the Hospitals and Clinics Segment Dominate the Market?

The hospitals and clinics segment dominated the global pharmacy inventory management software solutions and cabinet market in 2024. This is mainly due to the high scale of operations in hospitals and clinics for medicines. Inventory management software enables hospitals and clinics to optimize operations, provide efficient handling while reducing the risk of medication errors, and ensures regulatory compliance. Inventory management software solutions help staff reduce burden by streamlining operations and focusing on crucial tasks.

The pharmacies segment is expected to grow at the fastest CAGR in the upcoming period. The growth of the segment is attributed to the rising volume of prescription. There is a high need for automation to streamline workflows. As a result, the adoption of QR codes and RFID is rising in pharmacies for accurate medication tracking, error avoidance, and safety. Moreover, the continuously increasing demand for medicines is expected to drive segmental growth.

Technology Insights

What Made RFID the Dominant Segment in the Pharmacy Inventory Management Software Solutions and Cabinet Market in 2024?

The RFID segment dominated the market with a major share in 2024. This is due to its high importance in ensuring the security and trackability of medicines in large facilities, particularly for pharmacies or organizations with massive operations. In supply chain management and dealing with counterfeit medicines, RFID technology is highly efficient, and its electronic readability makes operational efficiency highly precise and accurate.

The automated dispensing systems segment is expected to expand at the fastest rate during the forecast period. Due to the high accuracy and efficiency of automatic dispensing systems, their popularity is continuously increasing. Rising orders and demand can be fulfilled safely and precisely with these systems, which use AI and robotics, making them highly efficient, accurate, and cost-effective by reducing labor costs.

Pharmacy Inventory Management Software Solutions and Cabinet Market Companies

- Medication Management Solutions (US)

- FUJIFILM Holdings Corporation

- ARxIUM

- BD (Becton, Dickinson and Company)

- Swisslog Healthcare

- Ziehm Imaging

- Capsa Healthcare

- Sentry Healthcare

- Accuform

- Talyst

- Cerner Corporation

- CareFusion

- Cardinal Health

- Omnicell

- McKesson Corporation

Recent Developments

- In December 2024, Cencora launched Accelerate Pharmacy Solutions, a unified portfolio of solutions designed to help hospital and health systems streamline operations. Accelerate Pharmacy Solutions brings together Cencora's suite of pharmacy and supply chain solutions, including specialty drug purchasing and cost management strategies to logistics, transport, supply chain, and inventory management solutions.

(Source: https://www.businesswire.com) - In December 2024, Swisslog Healthcare entered into a partnership with BD to offer hospital pharmacies a new approach to end-to-end medication management that combines robotics from Swisslog Healthcare with world-class inventory management and workflow software from BD. The partnership aims to address the growing need for sophisticated and robust robotic pharmacy automation systems in hospitals throughout North America.

(Source: https://www.businesswire.com)

Segments Covered in the Report

By Deployment

- Cloud-Based

- On-Premises

By Application

- Inventory Management

- Procurement Management

- Pharmacy Automation

- Patient Management

By Type

- Software Solutions

- Cabinets

By End-User

- Hospitals and Clinics

- Pharmacies

- Long-Term Care Facilities

By Technology

- RFID (Radio Frequency Identification)

- Barcode Scanning

- Automated Dispensing Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting