Plastic Straps Market Size and Forecast 2025 to 2034

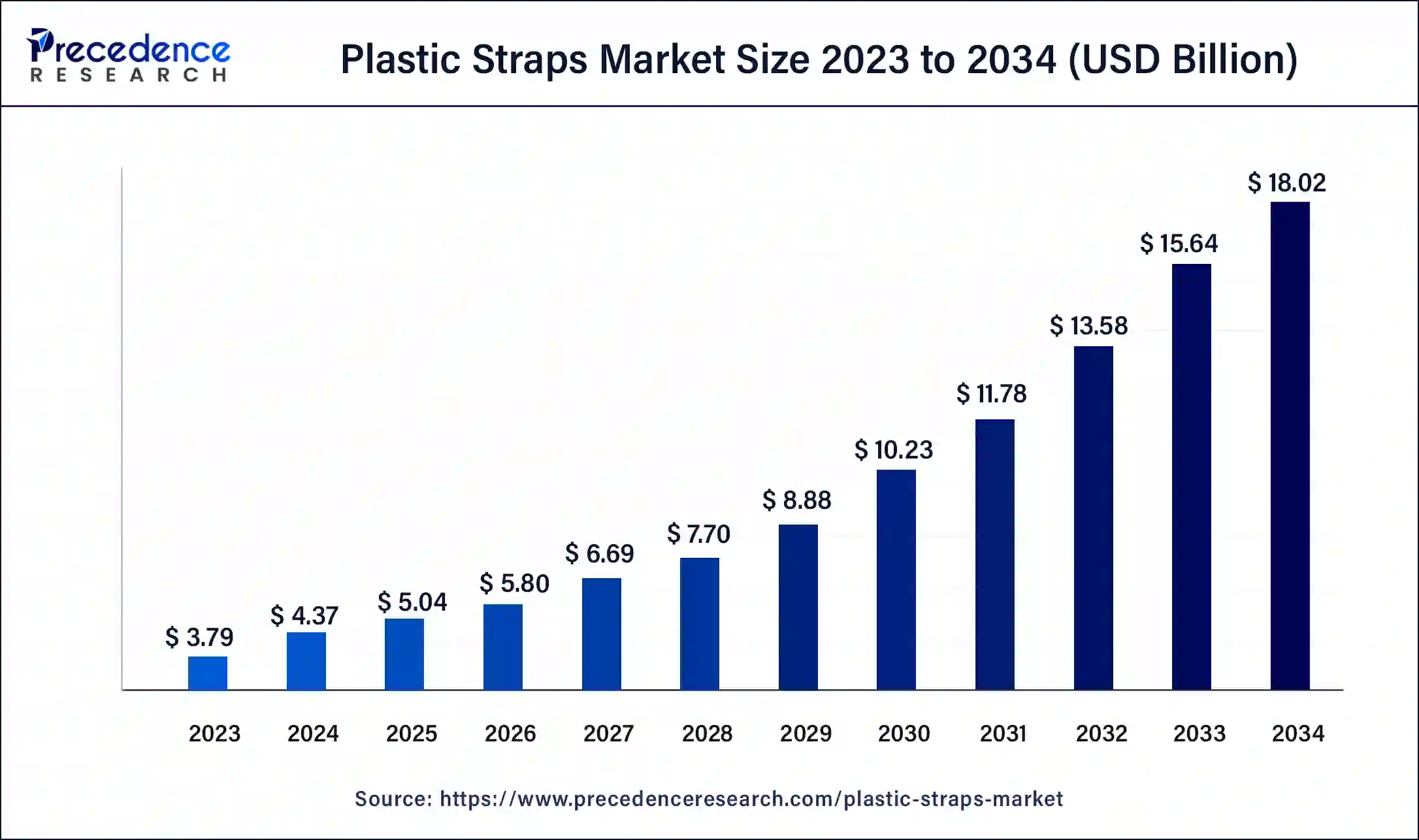

The global plastic straps market size was estimated at USD 4.37 billion in 2024 and is predicted to increase from USD 5.04 billion in 2025 to approximately USD 18.02 billion by 2034, expanding at a CAGR of 15.22% from 2025 to 2034. The increasing packaging industries, e-commerce expansion, enhanced recycling infrastructure, logistic sector expansion, heavy material transportation, online delivery, logistics, manufacturing, construction, supply chain, etc., driving the growth of the market

Plastic Straps Market Key Takeaways

- In terms of revenue, the global plastic straps market was valued at USD 4.37 billion in 2024.

- It is projected to reach USD 18.02 billion by 2034.

- The market is expected to grow at a CAGR of 15.22% from 2025 to 2034.

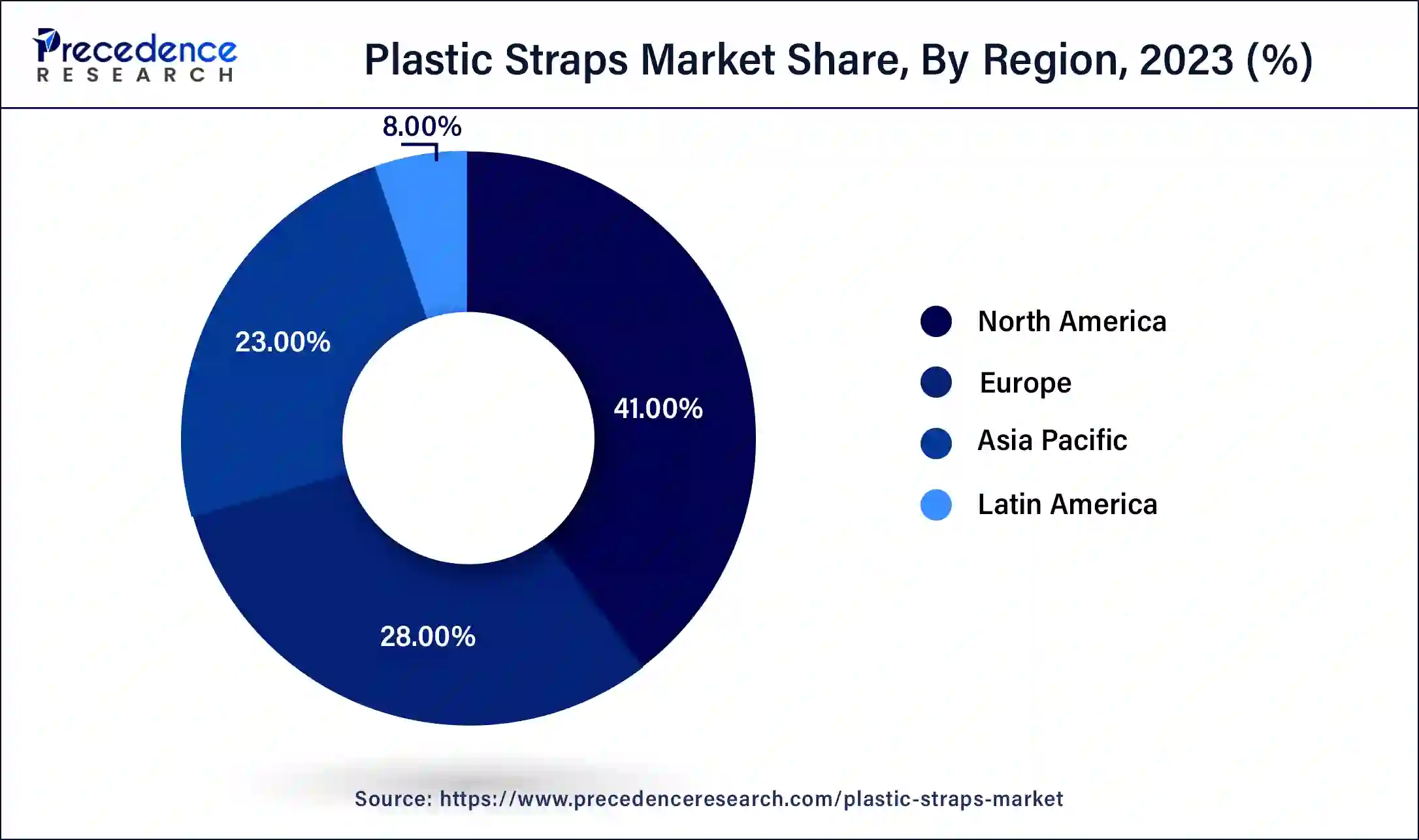

- North America dominated the plastic straps market with the largest market share of 41% in 2024.

- Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034.

- By type, the polyester segment dominated the market in 2024, and the segment is anticipated to be the fastest-growing during the forecast period.

- By type, the polypropylene segment is expected to be growing significantly during the forecast period.

- By application, the wood segment is estimated to be the fastest-growing during the forecast period.

- By end-use, the industrial logistics and warehouse segment dominated the plastic straps market in 2023, and the segment is anticipated to be the fastest-growing during the forecast period.

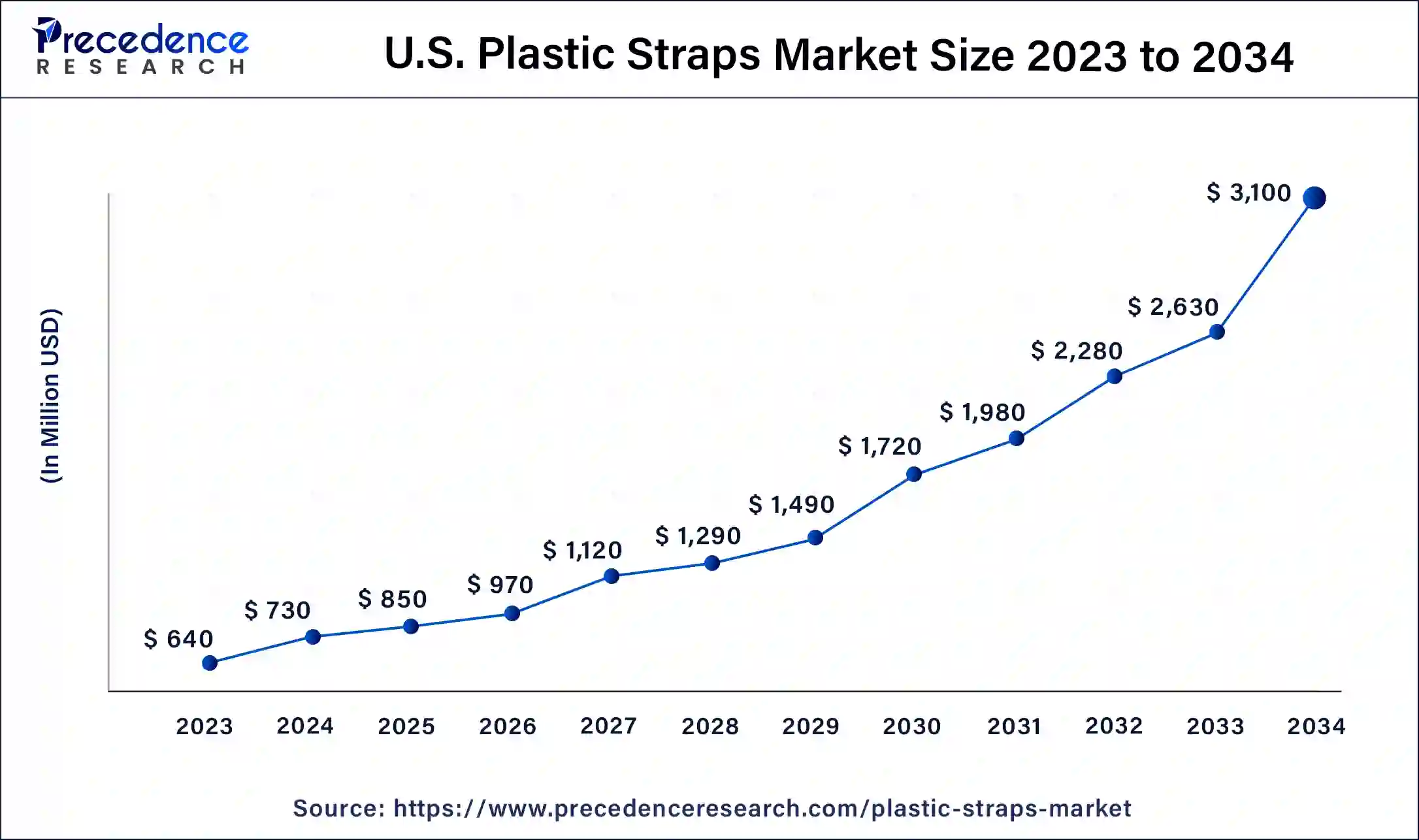

U.S. Plastic Straps Market Size and Growth 2025 to 2034

The U.S. plastic straps market size was exhibited at USD 1.25 million in 2024 and is projected to be worth around USD 5.27 billion by 2034, poised to grow at a CAGR of 15.48% from 2025 to 2034.

North America dominated the plastic straps market in 2024. The materials of plastic packaging are making it more sustainable to transport, which is raising the demand for plastic straps in the market. The increasing use of advanced products is a trend that, together, significantly raises the market size. The availability of additional major players fueled the growth of the market.

- In August 2024, according to a report published by GREENBRIDGE. Saving, safe, smart: converting steel strapping to GREENBRIDGE polyester (PET) strapping. In the industrial packaging and load securement world, strapping material choice is crucial. Industries using steel strapping include metals, recycling, agriculture, paper and printing, glass, automotive, timber and lumbar, construction, etc.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2024-2034. In manufacturing sectors, multinational investments are advancing economies. Packaging manufacturer's goal is to expand both their clientele and global presence to meet necessities in this sector. Plastic straps become more popular due to the increasing e-commerce industry and people's increased demand for online shopping and home delivery, which contributes to the growth of the plastic straps market.

- In July 2023, in India, a new Fire Boltt Gladiator Plus smartwatch was launched by Fire Boltt, and it has an AMOLED Display, a battery life of up to 7 days, and a rectangular design. The smartwatch is offered in nylon/silicon strap and metal strap form.

Market Overview

The plastic straps market refers to the buying and selling of plastic straps, which is a high tensile strength banding material that is used for a wide variety of packaging applications, plastic tote security, bundling, carton closing, and tying together both unpalletized and palletized material for in-plant transfer and shipment. The benefits of plastic straps include not eroding over time and being non-corrosive, it can withstand wear and tear, high elongation with low break loads force in lbs., and it is more affordable than HR nylon and polyester.

Plastic Straps Market Growth Factors

- The benefits of plastic straps are that they will not erode over time and are non-corrosive, they can withstand wear and tear, etc., contributing to the growth of the plastic straps market.

- It also includes high elongation with less break load force in lbs., which is more affordable than HR nylon and polyester.

- Resistant to corrosion and rust, safer to handle than steel strap, maintains tension over time, and is durable and strong.

- The applications for plastic straps include tying together both unpalletized and palletized materials for in-plant transfer and shipment, plastic tote security, etc.

What is the role of AI in Plastic Strap?

The use of artificial intelligence (AI) plays an important role in the plastic industry, including the production and use of plastic straps. The benefits of AI use in plastic straps include quality control and detection of defects, reduced downtime and maintenance costs, supply chain optimization, ensures that plastic strips are produced and delivered effectively, production of plastic straps is more sustainable, etc., contributing to the growth of the plastic straps market.

- In September 2022, a new alternative to plastic shrink wrap, ‘Hug & Hold, ' which is a recyclable 100 percent paper-based packaging solution to wrap and transport PET beverage bottles, was launched by Mondi. The product has been validated for an automated packaging solution.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 18.02 Billion |

| Market Size in 2025 | USD 5.04 Billion |

| Market Size in 2024 | USD 4.37 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.22% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Growing demand for plastic straps in many industries

The growing demand for plastic straps in many industries, the transportation of heavy materials, online delivery, e-commerce, pharmaceutical, electronic, food, and beverage, has led to an increase in contributing to the growth of the plastic straps market. The benefits of plastic straps used for packaging include sustainability and recyclability, branding and customization, ease of application, resistance to weather conditions, palletized shipments, the packaging of heavy and bulky items, etc.

- DuBose Strapping, Inc. provides products like strapping and strapping equipment, including plastic strapping and steel strapping, for industries including:

- Metals

- Lumbar Industry

- Brick: Block

- Fibers: Cotton

- Paper: Corrugated

- Can: Bottle

- Industrial Manufacturing

Restraint

Presence of alternative materials

The presence of alternative materials, the high cost of raw materials, lower tensile strength compared to steel straps, susceptibility to degradation from weather exposure and extreme temperatures, etc., can hamper the plastic straps market growth. The alternatives for plastic straps include textile straps, metal straps, fabric straps, polypropylene ropes, paper straps, etc., which can restrain the market's growth.

Opportunity

Future of plastic strap

The future of plastic straps includes the benefits of customized printing on plastic straps, can be developed with chemical resistance, will not rot or rust, self-adjusting, cost-effective, easy to handle, is stronger than steel, efficiently reduces strapping-related worker mishaps, etc., helps to the growth of the plastic straps market. Plastic straps are the heroes of the packaging world. Logistic sector expansion and increased recycling infrastructure will help the market's growth in the future.

Type Insights

The polyester segment dominated the plastic straps market in 2024, and it is anticipated to be the fastest-growing segment during the forecast period. The benefits of polyester strapping include shock absorbing, ecological adhesive resin, UV resistant and weatherproof, the hotmelt lamination allows controlled unrolling, environmentally responsible glue resin, strong and durable, lightweight, re-pensionable, adaptability, weather resistant, gentle on delicate surfaces and edges, cost savings, eliminated damaged costs, fewer material costs, safer alternative to steel strapping, performance and durability, polyester strapping and environment, load stability, elastic memory, etc. The applications of polyester straps include heavy-duty agriculture packaging, construction,logistics, transportation, manufacturing and distribution, recycling, consistent performance, and packaging of materials from lightweight to heavy-duty instruments.

- In September 2024, the presence of the EQ family of laptop cases and backpacks, which are manufactured by using PCR (Post Consumer Recycled) polyester materials, was launched by a worldwide leader of desktop computing and mobility solutions, Kensington, for home office, IT, and business professionals.

The polypropylene segment is expected to be growing significantly during the forecast period. The benefits of polypropylene (PP) strapping include a smooth surface for easy application, durability, and flexibility, suitability for light to medium duty applications, resistance to moisture, rust, and corrosion, highly tensile strength for securely holding heavy loads, cost-effective, easy to handle and lightweight, good elasticity, durable, versatility, etc. help to the growth of the plastic straps market. Polypropylene plastic strapping is designed for light and medium-duty applications like carton closure and reinforcement, bundling, unitizing, and palletizing. Polypropylene strapping may hold items weighing up to 400 kilograms, mainly those with light elastic properties. Polypropylene straps are available in many widths; the most common options are 19 mm, 15 mm, and 12 mm straps.

- In July 2024, a brand-new strap, giving its auto lock technology an inventive twist-a swivel feature, was launched by D'Addario. The new brand strap is made of polypropylene, which is non-padded, and has a length of 35.5” to 59.5” and a 2” width.

Application Insights

The wood segment is estimated to be the fastest-growing during the forecast period. The plastic strap plays an important role in the wood/lumber industry. The wood/lumbar industry needs durable and secure strapping materials to bundle and transport wood-based products efficiently, which helps the growth of the plastic straps market.

In the wood industry, polypropylene straps are a popular choice because of their reliability and affordability. Propylene straps are cost-effective for wood businesses, which makes them a practical choice that needs a high quantity of strapping materials, and it makes a balance between affordability and strength. The propylene strap is lightweight, which makes it easy to handle during transport and packaging. Polypropylene strap is moisture resistant, which helps to maintain bundle integrity and prevent deterioration.

End-use Insights

The industrial logistics and warehouse segment dominated the plastic straps market in 2024, and the segment is anticipated to be the fastest-growing during the forecast period. The plastic strap provides superior protection and logistics, ensuring that the products remain intact at the time of transit. In many manufacturing and industrial environments, securing products for transportation and storage is important. In many industries, plastic straps are used in warehouse settings, automotive, metalworking, food and beverage industries, shipping and logistics, construction, etc.

- In July 2023, an innovative paper band for food bundles and multipacks to reduce unnecessary plastics was launched by a global leader in sustainable paper and packaging, Mondi, in collaboration with Swiss converter ATS-Tanner.

- In June 2024, to reduce the plastic banana packaging budget supermarket, Aldi UK initiated a trial. The pilot was launched at selected stores across the country in the Midlands, South East, South West, and English North East.

- According to a sustainability report of Mosca GmbH in 2022, it offers a complete portfolio of holistic end-of-life systems for transport packaging, which includes consumables, stretch wrappers, and strappings.

- Moscsza in numbers 2022, Founding year-1966, production sites-6, 27-subsidiaries, 273 Mio. € turnover (global), 70% export rate, 1250 employees worldwide, 599 employees in Germany.

- Networks and membership include:

- Packaging Valley

- Pack4Sustainability

- Verband Deutscher Maschinen- und Anlagenbauer (VDMA)

- Ethik Society

- EcoVadis

- Duale Hochschule Baden Wurttemberg (DHBW)

Plastic Straps Market Companies

- Samual Son and Co. Ltd.

- S.K. INDUSTRIES INDORE

- Ruparel Polystrap Pvt. Ltd.

- Plastex Extruders Ltd.

- PAC Strapping Products Inc.

- Mosca GmbH

- HANGZHOU YOUNGSUN INTELLIGENT EQUIPMENT CO. LTD.

- Duravant LLC.

- DuBose Strapping, Inc.

- Cyklop International

- Crown Holdings Inc.

- CORDSTRAP BV

- Auto Strap India

- AptarGroup, Inc.

- IPG

- North Shore Strapping Inc.

- CONSENT

- LINDER Seevetal

- Sistemas De Embalaje Sorsa S.A.

- FROMM Holding AG

- Polychem Corporation

- TEUFELBERGER

- SAMHWAN STEEL, Co., Ltd.

- Scientex Berhad

- AptarGroup, Inc.

Recent Developments

- In October 2023, Repsol and Signode launched a ready-to-use strap for high-tenacity applications made of polypropylene (PP) compound with 30 percent recycled content. The recycled content evidently enhanced the product's carbon footprint by 9%.

- In October 2023, a line of sustainable RFID tags was launched by Avery Dennison Smartrac. A plastic strap is used for the memory chip attachment, representing 5% of the material, which makes it 95% plastic-free.

- According to a report published in January 2024, two years ago, the world's first system for collecting and taking back used plastic strapping was launched by re-strap GmbH. After two years of innovation, the industry has now started to develop high-quality secondary raw materials according to customer specifications to improve recyclate rates of usage in plastic products.

Segments Covered in the Report

By Type

- Polyester

- Polypropylene

- Nylon

- Paper

- Composite

- Corded & Woven Straps

By Application

- Wood

- Paper

- Food & Beverages

- Textiles

- Others

By End-use

- Industrial Logistics & Warehouse

- Food & Beverage

- Corrugated Cardboard

- Paper

- Building & Construction

- Metal

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting