What is the Polyimide Films Market Size?

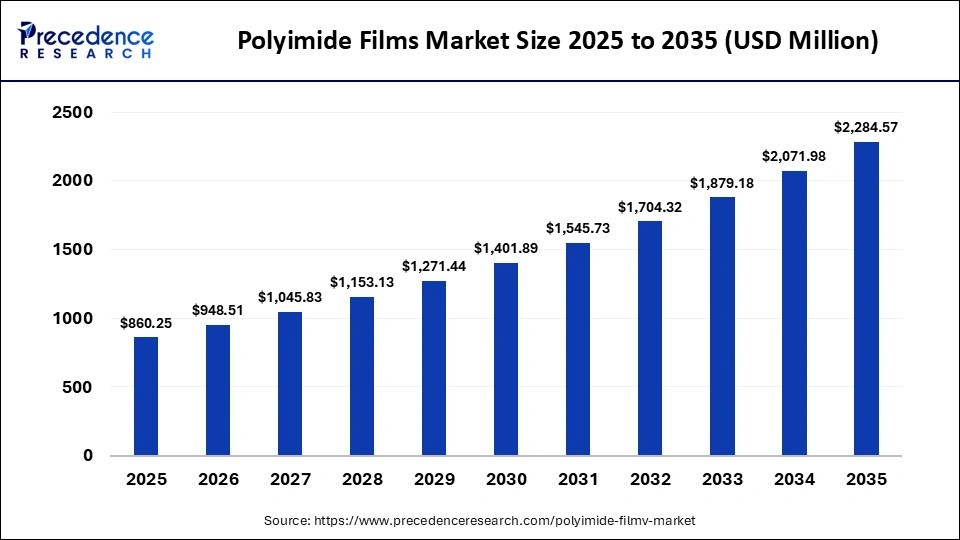

The global polyimide films market size accounted for USD 860.25 million in 2025 and is predicted to increase from USD 948.51 million in 2026 to approximately USD 2,284.57 million by 2035, expanding at a CAGR of 10.26% from 2026 to 2035. The market is driven by the growing demand for polyamide films from the packaged food industry, along with the increasing sales of smart TVs worldwide.

Market Highlights

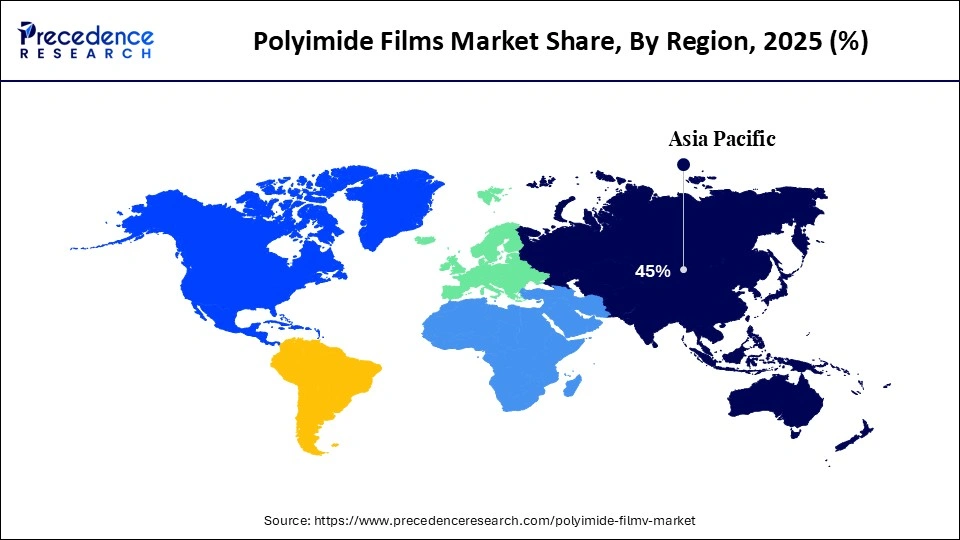

- Asia Pacific led the polyimide films market with the biggest market share of 45% in 2025.

- North America is expected to grow at the highest CAGR during the forecast period.

- By type, the coated polyimide films segment held the largest share of the market in 2025.

- By type, the thermally conductive polyimide film segment is expected to expand at the highest CAGR during the forecast period.

- By application, the flexible printed circuits segment held the largest share of the market in 2025.

- By application, the wires & cables segment is expected to grow at a considerable CAGR between 2026 and 2035.

- By end-use industry, the electronics segment held the highest share of the market in 2025.

- By end-use industry, the aerospace segment is expected to expand at the fastest CAGR during the forecast period.

Market Overview

The polyimide films market is a crucial segment of the advanced materials sector. This market deals with the production and distribution of high-quality polyimide films. These films are a range of aromatic polymer films that come with enhanced chemical stability and superior electrical insulation. These films offer significant advantages across various applications, including flexible printed circuits, insulation for wires and cables, pressure-sensitive tapes, and motors/generators, due to their durability, lightweight nature, and ability to withstand extreme temperatures. The increasing use of polyimide films for manufacturing medical devices, along with the growing expansion of the advanced materials industry in developed nations, is driving the market.

How is AI Impacting the Polyimide Films Market?

Artificial intelligence has reshaped the landscape of the advanced materials sector. In the advanced materials industry, AI enhances predictive modelling, reducing operational cost, improving sustainability, and enabling rapid material discovery. Thus, polyimide film companies have been deploying AI in their manufacturing units to improve defect detection capabilities, processing optimization, enable predictive maintenance, and accelerate innovation. AI is also improving process control and quality assurance in production lines, using real‑time monitoring to detect defects and ensure consistency, which lowers waste and improves yield. Additionally, AI‑driven demand forecasting and supply chain optimization help producers better align production with end‑market needs, particularly in electronics, automotive, and aerospace segments where precision and reliability are crucial.

- In October 2025, Celanese Corporation launched an AI-based platform. This AI-enabled platform is developed to accelerate the design of advanced materials.

Polyimide Films Market Trends

- Growing Demand from Electronics & Flexible Devices: Polyimide films are increasingly used in flexible printed circuits, displays, and wearable electronics due to their excellent thermal stability, flexibility, and dielectric properties, supporting the trend toward miniaturization and lightweight designs.

- Growing Sales of Smartphones: The sales of smartphones have increased rapidly in various countries, such as China, Canada, the UAE, and India, thus increasing the demand for polyimide films. According to the International Data Corporation (IDC) Worldwide Quarterly Mobile Phone Tracker, around 322.7 million units of smartphones were sold in the third quarter of 2025 globally.

- Novel Product Launches: Market players are engaged in launching high-quality polyimide solutions for the end-user industries. For instance, in July 2025, Toray launched STF-2000. STF-2000 is an advanced photosensitive polyimide solution that finds application in the electronics industry.

- Rising Production of Commercial Vehicles: The production of vehicles has grown significantly in several nations, including Germany, the U.S., and China, thus increasing the application of polyimide films. According to the OICA, around 3091486 commercial vehicles were produced in China during 2025.

- Innovation in Coated and Composite Film Solutions: New product developments, including surface‑modified, adhesive‑coated, and composite polyimide films, are enhancing adhesion, mechanical strength, and application specificity, particularly in pressure‑sensitive tapes and specialty fabricated products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 860.25 Million |

| Market Size in 2026 | USD 948.51 Million |

| Market Size by 2035 | USD 2,284.57 Million |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.26% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the Coated Polyimide Films Segment Dominate the Polyimide Films Market?

The coated polyimide films segment dominated the polyimide market with the largest share in 2025. This is due to the increased use of coated polyimide films for manufacturing flexible printed circuits (FPCs) and medical devices, along with their application in the 3D printing sector. The demand for these polyimide films has increased from the aerospace sector to manufacture wires and cables. As a result, market players shifted their focus in opening new production units to increase the production of coated polyimide films. Moreover, numerous advantages of coated polyimide films, including thermal stability, superior adhesion capabilities, flux resistance, and high dielectric strength, are boosting their adoption in various applications, maintaining the segment's leadership.

The thermally conductive polyimide film segment is expected to grow at the highest CAGR during the forecast period. This is due to the surging demand for thermally conductive polyimide film to manufacture insulating pads, motor slot liners, and heater circuits. Additionally, the growing application of conductive polyimide films in the aerospace industry for manufacturing insulating components of aircraft, as well as their rising use in the automotive sector, is positively contributing to the segmental growth. Moreover, several characteristics of thermally conductive polyimide films, such as superior thermal management, enhanced durability, high temperature stability, and chemical resistance capabilities, are boosting their adoption.

Application Insights

What Made Flexible Printed Circuits the Leading Segment in the Polyimide Films Market?

The flexible printed circuits segment led the market with a major share in 2025. This is due to the increased use of high-quality polyimide films as an insulation layer in flexible printed circuits (FPCs), as well as the surging application of flexible printed circuits in pacemakers and smart watches. Also, the increasing demand for flexible printed circuits from the automotive sector to manufacture LED lights and safety sensors, along with their numerous applications in the consumer electronics sector, is playing a vital role in maintaining segmental growth. The rising focus of the polyimide films manufacturers to develop colored films for the FPCs has boosted the growth of this segment.

The wires & cables segment is expected to grow at a considerable CAGR between 2026 and 2035. The growth of this segment is driven by the growing usage of colorless polyimide films in wire production to act as a high-performance material that delivers superior dielectric strength, improved thermal resistance, and enhanced chemical stability. Also, the increasing focus of cable manufacturers to join hands with advanced materials companies to use high-quality polyimide solutions for manufacturing coaxial cables is contributing significantly to the growth of this segment. Surging investment by cable manufacturers in opening new testing centers in several countries, including Germany, China, and the U.S., is expected to drive the segmental growth.

End-Use Industry Insights

Why Did the Electronics Segment Dominate the Polyimide Films Market?

The electronics segment dominated the polyimide films market in 2025. This is due to the increased use of high-quality polyimide films for the production of flexible printed circuit boards (FPC) and advanced displays. Rapid investment by electronics manufacturers for opening new production centers, along with the increasing sales of laptops and smart watches, has driven segmental growth. Additionally, continuous innovation in electronics, such as foldable devices and advanced sensors, has increased the reliance on polyimide films as a reliable and durable material.

The aerospace segment is expected to grow with the fastest CAGR during the forecast period. This is due to the surging demand for advanced polyimide films to manufacture insulating wires for spacecraft, as well as the growing investment by advanced materials companies to manufacture lightweight components for aircraft. Numerous government initiatives aimed at developing the aerospace sector, coupled with technological advancements in aircraft maintenance centers, are playing a prominent role in driving segmental growth. Additionally, strict safety and performance standards in aerospace applications make polyimide films a preferred choice over alternative polymers.

Regional Insights

What is the Asia Pacific Polyimide Films Market Size?

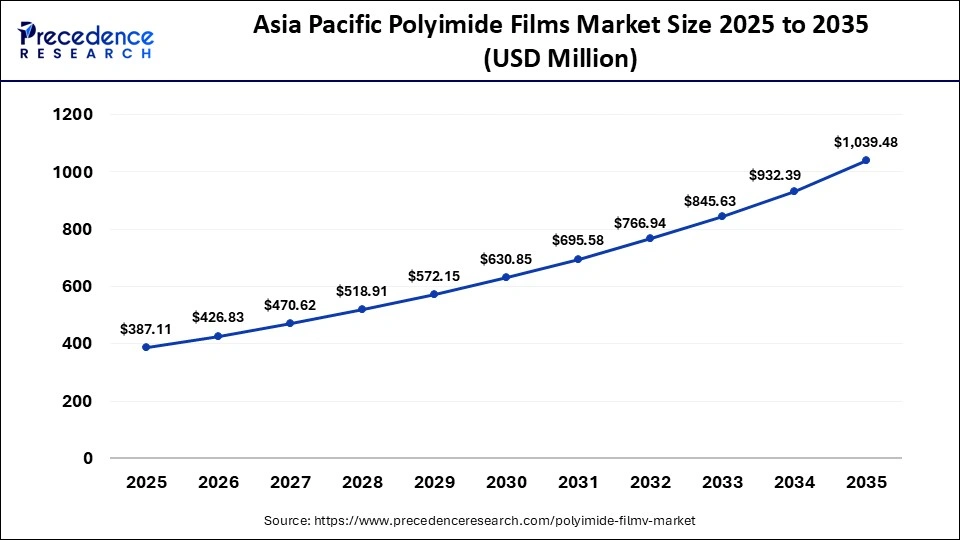

The Asia Pacific polyimide films market size is expected to be worth USD 1,039.48 million by 2035, increasing from USD 387.11 million by 2025, growing at a CAGR of 10.38% from 2026 to 2035.

What Made Asia Pacific the Dominant Region in the Polyimide Films Market?

Asia Pacific dominated the polyimide films market by capturing the largest share in 2025. This region's dominance in the market is attributed to the rising sales of foldable smartphones in numerous countries, such as India, China, South Korea, and Japan, along with technological advancements in the advanced materials industry. There is a high demand for polyimide films from the packaging sector. The rapid expansion of the 5G infrastructure has boosted the demand for high-quality polymers, supporting market growth. Moreover, the presence of various polyimide film companies, such as Taimide Tech. Inc., Shinmax Technology Ltd., Asahi Kasei, Arakawa Chemicals Industries Inc., and Ube Industries Ltd., which are focusing on business expansions and product launches, is likely to sustain the region's position in the market.

- In August 2025, Asahi Kasei announced to expand its photosensitive polyimide (PSPI) production capacity in Japan. These polyimides find application in the semiconductor sector across the APAC region.

China Polyamide Films Market Trends

China is a prominent contributor to the Asia Pacific polyimide films market. This is due to the abundance of high-quality raw materials used in the production of polyimide films, as well as the growing production and sales of smartphones. Moreover, technological advancements in the automotive industry, along with the surging demand for pressure-sensitive tape from e-commerce brands, are positively contributing to the market.

What Makes North America the Fastest-Growing Region in the Market?

North America is expected to expand at the fastest CAGR during the forecast period. This is mainly due to the growing demand for colorless polyimide films from the medical device companies in the U.S., Canada, and Mexico, as well as numerous research activities performed by the chemical companies for discovering advanced materials. Additionally, numerous government initiatives aimed at strengthening the aerospace sector, coupled with the rapid adoption of solar energy sources from the industrial sector, are positively contributing to market growth. Moreover, the surging emphasis of several market players, such as DuPont de Nemours and Company, FLEXcon Company, Inc., and 3M Company, to launch high-quality polyimide films and open new production centers, is expected to accelerate the growth of the polyimide films market in this region.

- In May 2024, 3M announced an investment of around US$ 67 million. This investment is made to inaugurate a new production center in Nebraska, U.S.

U.S. Polyimide Films Market Analysis

The U.S. leads the polyimide films market in North America. This is due to the increasing use of polyimide films in the aerospace sector for manufacturing thermal blankets and satellite components. Moreover, the rapid expansion of the automotive industry, along with technological advancements in the electronics sector, is playing a prominent role in shaping the industry in a positive direction.

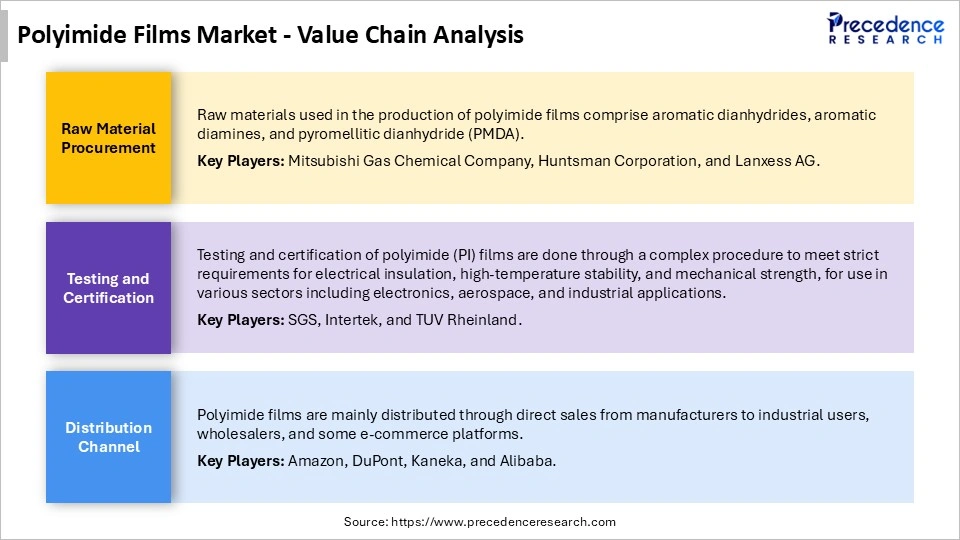

Polyimide Films Market Value Chain Analysis

Who are the Major Players in the Global Polyimide Films Market?

The major players in the polyimide films market include Dupont, Kaneka Corporation, Taimide Tech. Inc., Ube Industries Ltd., Toray Industries, Inc., Saint-Gobain, 3M Company, Nitto Denko Corporation, Mitsubishi Gas Chemical Company Inc., Arakawa Chemical Industries, Ltd., Evertech Envisafe Ecology Co., Ltd., Flexcon Company, Inc., Industrial Summit Technology Corporation, SKC, Parafix Tapes & Conversions Ltd., Anabond Limited, Circuit Components Supplies, Polyonics, Inc, Dunmore Corporation, Kolon Industries, Inc., and Taiflex Scientific Co. Ltd.

Recent Developments

- In December 2025, FUJIFILM launched ZEMATES. ZEMATES is a new range of polyimide films that finds application in semiconductor packaging.(Source: https://www.indianchemicalnews.com)

- In November 2025, Sichuan Aoniu (SAEM) announced to expand its colorless polyimide (CPI) thin film production in Shuangliu, Chengdu, China. These colorless polyimide films will be used in numerous sectors, such as foldable smartphones, flexible displays, aerospace, and high-end manufacturing. (Source: https://www.stocktitan.net)

- In July 2025, Arkema launched Zenimid. Zenimid is a new class of ultra-high-performance polyimide films that are used in numerous sectors, including automotive, aerospace, and electronics.(Source: https://www.arkema.com)

Segments Covered in the Report

By Type

- Coated Polyimide Film

- Thermally Conductive Polyimide Film

By Application

- Flexible Printed Circuits

- Specialty Fabricated Products

- Pressure-sensitive Tapes

- Wires & Cables

- Motors/Generators

By End-Use Industry

- Electronics

- Automotive

- Aerospace

- Solar

- Labelling

- Others (Medical, Mining & Drilling)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting