ADAS Simulation Market Revenue to Attain USD 9.87 Bn by 2035

ADAS Simulation Market Revenue and Trends 2026 to 2035

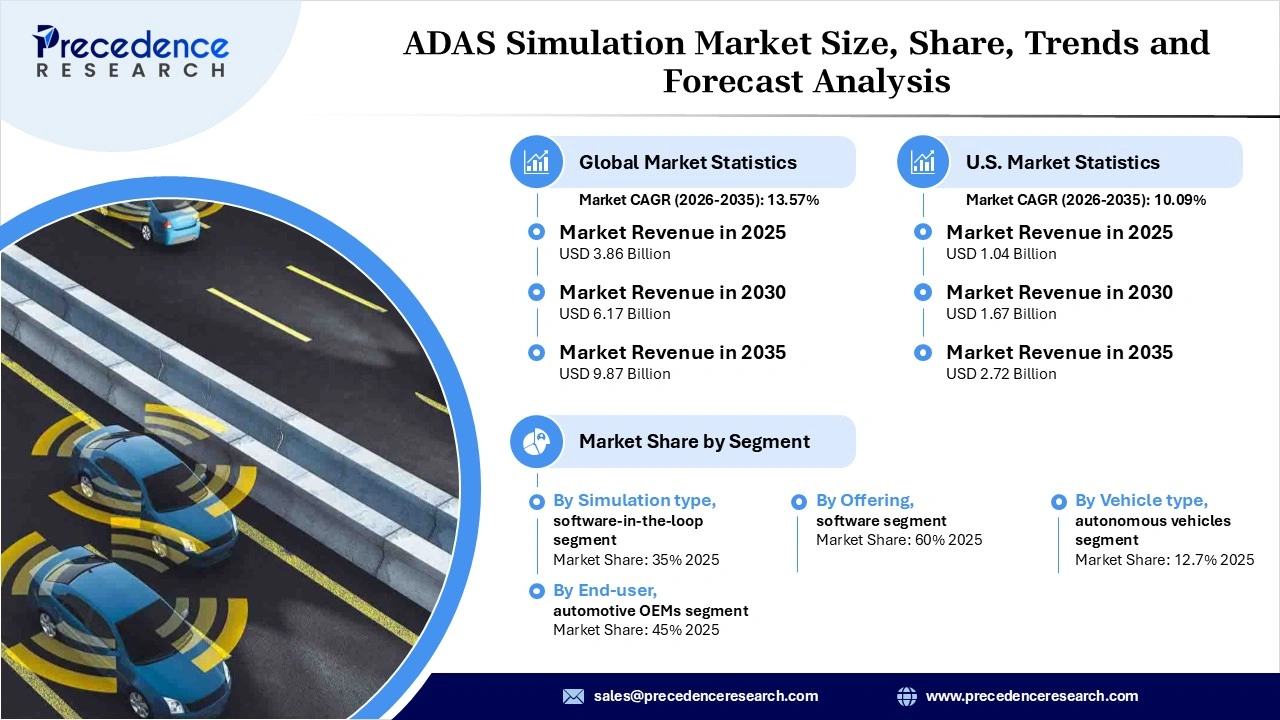

The ADAS simulation market revenue surpassed USD 3.86 billion in 2025 and is predicted to attain around USD 9.87 billion by 2035 with a CAGR of 13.57% during the forecast period. This market is experiencing unprecedented growth, driven by the rising concerns about road safety and the stringent safety mandates.

What are the Factors That Have a Significant Contribution to the Growth of the ADAS simulation market?

The rising demand for autonomous vehicles and rapid technological innovation, such as AI Artificial Intelligence (AI)/ Machine Learning (ML), is the major driver, contributing to the overall growth of the market during the forecast period. ADAS simulation enables validation of complex Advanced Driver Assistance Systems (ADAS) in virtual environments using Software-in-the-Loop (SIL) and Hardware-in-the-Loop (HIL) testing to ensure regulatory compliance. Several prominent automakers are increasingly relying more on virtual testing and less on road trials. The market’s growth is also primarily supported by the growing need to replace costly and time-consuming physical road testing.

Segment Insights

- simulation type Insights, the software-in-the-loop (SiL) segment held the highest market share of around 35% in 2025, owing to the growing need for faster, safer validation of automated driving systems. The software-in-the-loop (SiL) method plays an important role in the automotive industry as OEMs are increasingly shifting toward building software-defined vehicles that enable features and functions primarily through software. SiL enables cost-effective testing of compiled control code within simulated environments, which is crucial for Software-Defined Vehicles (SDVs).

- offering Insights, the software segment contributed the highest market share of about 60% in 2025, owing to its efficient role in developing, testing, and validating advanced driver-assistance system (ADAS) algorithms. Virtual testing in software significantly lowers the costs and time associated with real-world physical road testing.

- vehicle type Insights, the passenger cars segment accounted for the largest market share of around 55% in 2025. The high production volumes of passenger cars led to the integration of standard safety features and higher automation levels, particularly in mid-range and luxury vehicles. Passenger vehicles are increasingly transitioning toward Software-Defined Vehicles (SDVs). Passenger cars are required to comply with strict regulatory requirements, such as the EU's General Safety Regulation and NCAP protocols.

- end-user Insights, the automotive OEMs segment held a dominant market share of around 45% in 2025. Automotive OEMs are the major end users in the market. Automotive Original Equipment Manufacturers (OEMs) are shifting from physical road tests to virtual validation to accelerate the development of safer and more advanced driver-assistance systems. By leveraging simulation, OEMs significantly reduce the need for physical prototypes and extensive on-road testing and comply with stricter safety regulations like NCAP.

Regional Insights

North America dominated the market by capturing the largest share of 38% in 2025. The region is home to the tech giants and automotive giants, including Tesla, General Motors, Ford, and NVIDIA, leveraging simulation for virtual testing of millions of miles. The region's dominance is primarily driven by the growing demand for Software-Defined Vehicles (SDVs), strict vehicle safety regulations, the growing need to validate complex ADAS systems (like Level 2 and above), rapid AI adoption, increasing demand for higher automation, and rising shift towards virtual testing (SiL, HiL, DiL) and cloud-based simulation.

On the other hand, the Asia Pacific region is a rapidly growing region for the ADAS simulation market. China leads the ADAS simulation market, owing to the robust presence of autonomous vehicle developers and tech giants. The growth of the region is driven by the expanding digital infrastructure, growing need for virtual testing of complex and autonomous vehicle systems, increasing concerns about road safety, stringent regulatory compliance, and rising government initiatives to support the development of better simulation tools.

ADAS simulation Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 3.86 Billion |

| Market Revenue by 2035 | USD 9.87 Billion |

| CAGR from 2026 to 2035 | 13.57% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments:

- In December 2025, dSPACE, a global leader in simulation and validation solutions for automotive development, announced a new collaboration with OMNIVISION, a well-known developer of CMOS image sensor technologies, aimed at strengthening the way advanced driver assistance systems (ADAS) and autonomous driving (AD) functions are developed and validated. Under this partnership, realistic models of OMNIVISION’s automotive camera sensors are being integrated into dSPACE’s AURELION platform, a physics-based simulation environment used for virtual testing of complex vehicle systems.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7423

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344