Battery Leasing-as-a-Service Market Revenue to Attain USD 17.98 Bn by 2033

Battery Leasing-as-a-Service Market Revenue and Trends 2025 to 2033

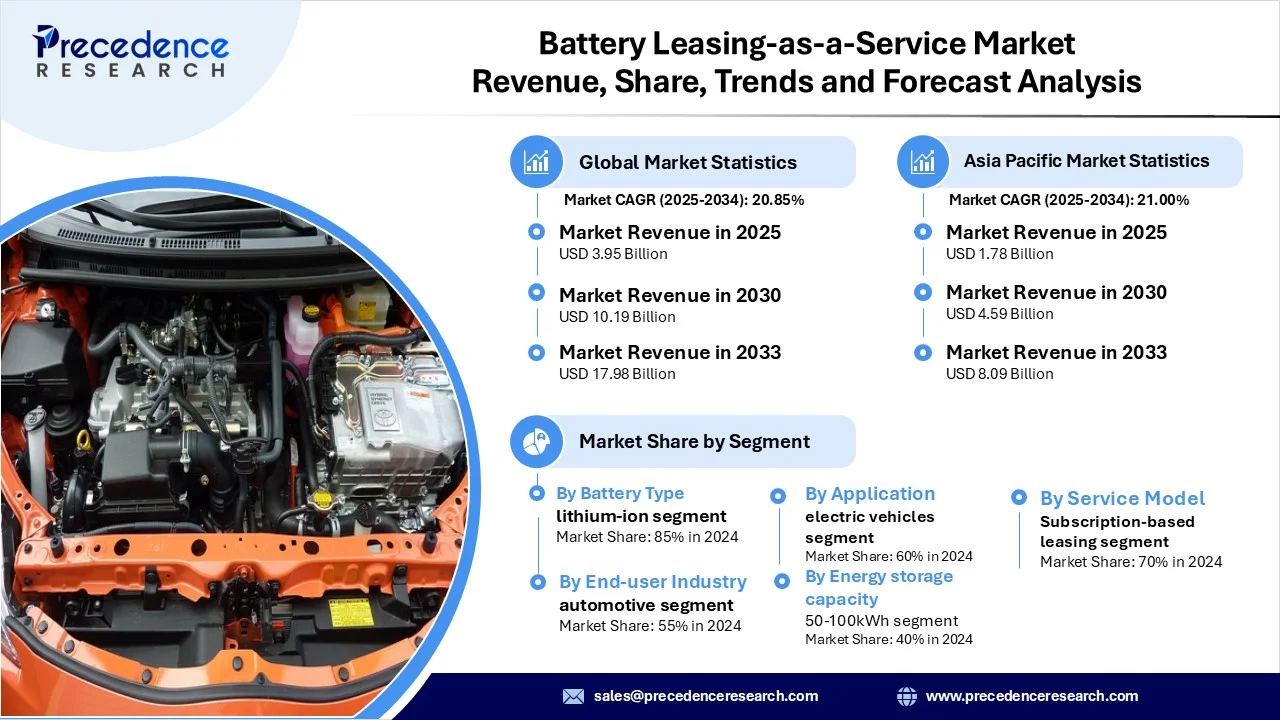

The global battery leasing-as-a-service market revenue reached USD 3.95 billion in 2025 and is predicted to attain around USD 17.98 billion by 2033 with a CAGR of 20.85%. The growth of the market is driven by its affordability and accessibility to a broader consumer base, often incorporating battery swapping services, where users can quickly exchange a depleted battery for a fully charged one at designated stations.

Battery Leasing-as-a-Service Market: Key Drivers & Emerging Opportunities

The Battery Leasing-as-a-Service market encompasses a network of companies that offer electric vehicle (EV) batteries for lease or subscription instead of outright purchase with the vehicle. This model significantly boosts EV adoption by lowering upfront costs, as it separates battery ownership from the vehicle purchase, making EVs more accessible. Additionally, government policies such as stricter emissions regulations and incentives further encourage the adoption of EVs and these models. Advancements in battery technology, including improved energy density and reduced costs, enhance the attractiveness of these solutions. Battery swapping stations help alleviate range anxiety and downtime, thereby increasing EV adoption, especially in commercial fleets that are seeking cost-effective and sustainable transportation solutions.

Segment Insights

- By battery type, the Lithium-Ion (Li-ion) segment led the market due to its superior characteristics, such as higher energy density, longer lifespan, and faster charging capabilities, all of which cater to the needs of the rapidly growing EV sector.

- By application, the electric vehicle (EV) segment dominated the market as it alleviates concerns associated with high upfront costs and long-term ownership issues related to EV batteries, including battery degradation and resale value.

- By service models, the subscription-based leasing model held a dominant position as it addresses major barriers to EV adoption, particularly the high upfront costs and worries regarding long-term battery degradation.

- By end-user industry, the automotive sector is the leading market player, as it directly tackles significant challenges to EV adoption, including the high cost of batteries and battery longevity, offering consumers more accessible and affordable options.

- By energy storage capacity, the 50–100 kWh segment dominated the market, as it delivers the right balance of affordability, performance, and operational requirements for a large portion of both the commercial and consumer EV markets.

Regional Insights

Asia-Pacific region currently leads the Battery Leasing-as-a-Service market, thanks to proactive government policies, a dense urban landscape that favors two- and three-wheelers, and strong local industry leadership. Countries such as China, Japan, and India are spearheading electric vehicle adoption, including both passenger vehicles and commercial fleets. The presence of major battery manufacturers and innovative EV companies, such as China’s CATL and BYD, Taiwan’s Gogoro, and India’s Sun Mobility, contributes to a robust local ecosystem for this market.

North American region is expected to experience the fastest growth during the forecast period, driven by supportive government initiatives, substantial investments in battery manufacturing, and efforts to reduce the total cost of ownership for electric vehicles. The increasing variety of EV models from major automakers has created a significant demand for battery leasing services. Commercial fleets, including delivery vans, taxis, and public transit systems, are quickly electrifying their operations to meet sustainability goals.

Battery Leasing-as-a-Service Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 3.95 Billion |

| Market Revenue by 2033 | USD 17.98 Billion |

| CAGR from 2025 to 2033 | 20.85% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Battery Leasing-as-a-Service Market Companies

- NIO Inc.

- Gogoro Inc

- XPENG Inc.

- SAIC Motor Corporation Limited

- VinFast Auto Ltd.

- CATL (Contemporary Amperex Technology Co. Limited)

- Tesla, Inc.

- Ample Inc.

- Sun Mobility

- Battery Swap

- Gogoro Network

- ChargePoint, Inc

- Shell Recharge Solutions:

- ABB Ltd.

- Envision AESC

Recent Development

- In January 2025, the EV solutions startup Urja Mobility launched its B2C battery leasing program, targeting e-rickshaw drivers in ten cities across the country. The initiative, known as the Smart Opex Model, provides drivers access to Lithium-Ion batteries, which offer longer life cycles, minimal maintenance, and improved thermal performance compared to traditional Lead Acid options, according to the company.

(Source: https://www.business-standard.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6934

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344