What is the Battery Leasing-as-a-Service Market Size?

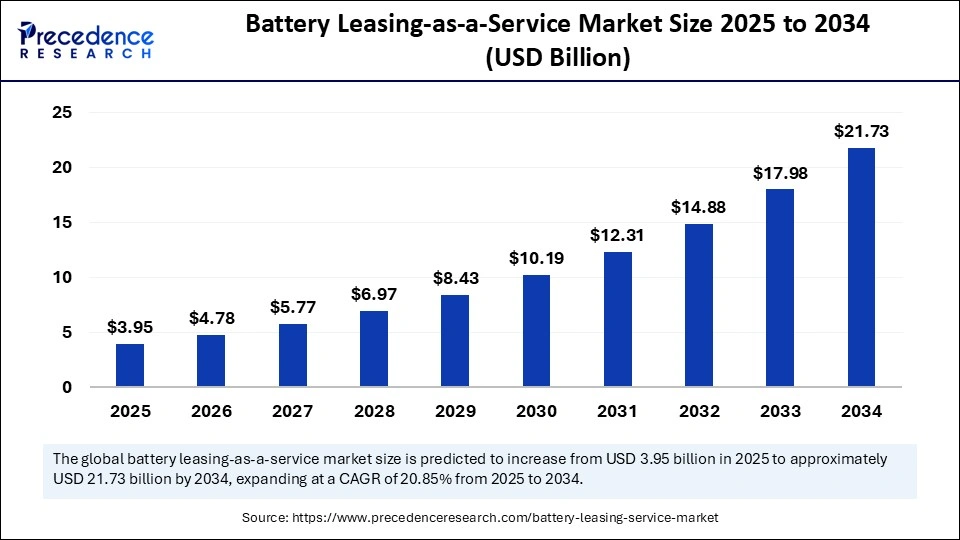

The global battery leasing-as-a-service market size accounted for USD 3.27 billion in 2024 and is predicted to increase from USD 3.95 billion in 2025 to approximately USD 21.73 billion by 2034, expanding at a CAGR of 20.85% from 2025 to 2034. The market is growing due to rising demand for affordable electric mobility solutions and reduced upfront costs for consumers and businesses.

Market Highlights

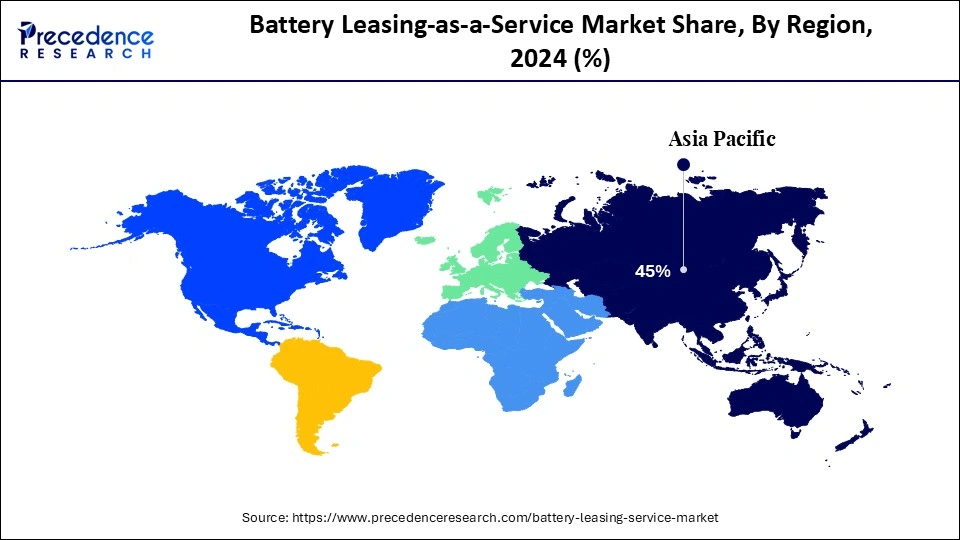

- Asia Pacific dominated the market, holding the largest market share of 45% in 2024.

- North America is expected to grow at the fastest rate during the forecast period.

- By battery type, the lithium-ion segment held the largest share of the market at 85% in 2024.

- By battery type, the solid-state batteries segment is expected to grow at the fastest rate during the forecast period.

- By application, the electric vehicles segment held the largest share at 60% in 2024.

- By application, the energy storage systems segment is projected to grow at the fastest rate in the battery leasing-as-a-service market.

- By service model, the subscription-based leasing segment held the largest share of 70% in 2024.

- By service model, the battery swapping services segment is the fastest-growing segment

- By end-user industry, the automotive segment held the largest share of the battery leasing-as-a-service market at 55% in 2024.

- By end-user industry, the telecommunications segment is projected to grow at the fastest rate in the market.

- By energy storage capacity, the 50-100kWh segment held the largest share of the market at 40% in 2024.

- By energy storage capacity, the over 200 kWh segment is expected to grow at the fastest rate during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 3.27 Billion

- Market Size in 2025: USD 3.95 Billion

- Forecasted Market Size by 2034: USD 21.73 Billion

- CAGR (2025-2034): 20.85%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

What is the Battery Leasing-as-a-Service Market?

The battery leasing-as-a-service market is growing as flexible leasing models lower EV costs. Adoption is being accelerated by government support, growing EV usage, and AI-enabled battery management. Collaborations between energy suppliers and automakers enhance the ecosystem even more.

- In December 2024, CATL announced swappable EB batteries and new swapping stations.(Source: https://www.reuters.com)

What is the impact of AI on the Battery Leasing-as-a-Service Market?

AI makes it possible for more intelligent asset management, predictive maintenance, and optimized operations. It is revolutionizing the battery leasing as a service market by lowering costs, enhancing dependability, and boosting customer confidence. Real-time battery health monitoring, degradation prediction, lease term adaptation, and swap/charging operation optimization are all made possible by AI systems, which assist leasing providers in better managing battery lifespan and minimizing downtime.

- In July 2025, U Power Limited announced the inauguration of Southeast Asia's first operational AI-integrated smart battery swapping station in Phuket, Thailand.(Source: https://www.prnewswire.com)

Battery Leasing-as-a-Service Market Outlook

- Industry Growth Overview: The battery leasing-as-a-service market is growing because of the growing need for energy storage and electric vehicle solutions that are economically adaptable and effective. Because of the strong infrastructure for battery manufacturing, encouraging government policies, and quick adoption of EVs, the performance, dependability, and lifecycle management of batteries are being improved by advanced AI-enabled battery management systems and predictive maintenance, which has increased the appeal of leasing for both fleet operators and consumers.

- Sustainability Trends: Companies focus on eco-friendly practices, including battery recycling, reuse, and the adoption of greener materials to reduce environmental impact. Integration of smart monitoring ensures efficient battery utilization and longevity. Compliance with regional regulations and safety standards ensures reliable, responsible, and sustainable operations across the BaaS ecosystem.

- Global Expansion: Partnerships, joint ventures, and the regional rollout of battery leasing and swapping infrastructure are ways that businesses grow. Partnerships with energy suppliers, battery producers, and automakers spur innovation and smooth service delivery. Regional presence is strengthened, and EV adoption is supported by initiatives.

- Major Investors: Key players include EV manufacturers such as Tesla, NIO, and Volkswagen, along with battery companies like CATL, LG Energy Solution, and BYD. Automotive and energy companies invest in battery R&D, AI-enabled management platforms, and sustainable leasing models. Strategic partnerships with fleet operators and regional governments further enhance market growth and adoption of BaaS solutions.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 3.27 Billion |

| Market Size in 2025 | USD 3.95 Billion |

| Market Size by 2034 | USD 21.73 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 20.85% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Battery Type, Application, Service Model, End-User Industry, Energy Storage Capacity, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising EV Adoption

The need for battery leasing services is rising in direct proportion to the increasing popularity of electric vehicles among fleets and consumers. Leasing companies can provide flexible solutions to manage battery lifecycle and lessen ownership burden as more EVs are put on the road. This tendency is especially noticeable in cities where electric scooters and shared transportation are becoming more popular. Battery leasing makes battery replacements easy and contributes to steady EV operation without interruption.

- In January 2025, Urja Mobility launched AI-enabled battery leasing for e-rickshaws in 10 Indian cities.(Source: https://telematicswire.net)

High Upfront Battery Costs

Batteries are a significant portion of EV costs, making the upfront purchase expensive for individual consumers and fleet operators. Battery leasing reduces this financial barrier by spreading costs over time. This model encourages EV adoption, particularly for commercial fleets and two-wheelers, by making it more economically viable. Leasing also ensures access to the latest battery technology without frequent large investments.

Restraints

Battery Standardization Issues

It's challenging to standardize testing and swapping services because different EV models use different battery sizes, chemistries, and voltages. Adoption may be slowed by compatibility problems and decreased customer convenience caused by a lack of universal standards. To support varied EV fleets, businesses need to make investments in a variety of battery types or adapters.

Regulatory & Policy UncertaintiesChanges in government policies, subsidies, or import/export regulations can impact the economies of battery leasing. Inconsistent or evolving regulations across regions may increase compliance costs and complicate market expansion strategies for leasing providers.

Opportunities

Partnership and Collaborations

Collaborations between automakers, energy providers, and battery manufacturers offer opportunities for integrated solutions, expanding service coverage, and customer base. Joint ventures can also drive innovation in battery swapping, modular batteries, and smart energy management.

- In July 2025, Sun Mobility partnered with fleet operators to provide flexible battery leasing and AI-powered monitoring.

(Source: https://www.business-standard.com)

Sustainability and Circular Economy Initiatives

In line with sustainability and environmental objectives, battery leasing encourages recycling, reuse, and effective lifecycle management. Businesses that provide green leasing and swapping options can profit from consumer demand for sustainable mobility and green policies.

Segmental Insights

Battery Type Insights

What Made the Lithium-Ion Segment Dominate the Battery Leasing-as-a-Service Market in 2024?

Lithium-ion segment dominated the battery leasing-as-a-service market with an 85% share since they are perfect for electric vehicles (EVs) because of their high energy density, longer lifespan, and lighter weight. Their dominant market position is a result of their extensive adoption and well-established infrastructure. Their dominant market position is a result of their extensive adoption and well-established infrastructure. They also provide cost-effectiveness and predictable performance, which facilitates the implementation of leasing models. Strong Li-ion battery supply chains also facilitate regional scalability.

Solid-state batteries are growing faster as they offer higher energy densities, faster charging times, and improved safety compared to traditional Li-ion batteries. With ongoing R&D, these batteries are expected to lower thermal risks and extend battery lifecycle. This makes them increasingly attractive for premium EVs and commercial fleets seeking performance advantages.

- In May 2024, Blue Solutions, a subsidiary of Bollore, announced plans to invest 2 billion in a gigafactory in France to produce solid-state batteries for electric vehicles, targeting a 1,000 km driving range and 20-minute charging times.(Source: https://www.reuters.com)

Application Insights

Why Did the Electric Vehicles Segment Dominate the Market in 2024?

The electric vehicles segment dominated the battery leasing-as-a-service market with a 60% share, motivated by the need for economical battery management and the expanding use of electric mobility solutions. Leasing batteries guarantees long-term dependability while lowering upfront costs for fleet improvements, giving EV owners access to more advanced technologies without having to make significant financial commitments.

Energy storage systems are growing rapidly in the battery leasing-as-a-service market as they contribute to energy security, renewable energy integration, and supply and demand balance in power grids. Growing expenditures in smart grids and renewable energy projects are driving the demand. For industrial and utility-scale users, ESS solutions in conjunction with leasing models lower upfront capital expenditure.

Service Model Insights

Why Did the Subscription-Based Leasing Segment Dominate the Market in 2024?

Subscription-based leasing is the leading service model, with a 70% share, offering consumers flexibility and reducing upfront costs associated with battery ownership. This model encourages broader EV adoption by lowering financial barriers. It also allows providers to manage battery lifecycle effectively and ensure maintenance compliance. Continuous software updates and remote monitoring further enhance reliability.

Battery swapping services are growing rapidly in the market, particularly in areas where EV adoption is high, since they reduce vehicle downtime and offer rapid battery replacements. Fleet managers can also optimize operating schedules by using swapping stations. For commercial and shared mobility fleets, this model guarantees continuous service and facilitates long-distance travel. Battery management and swap efficiency are further enhanced by the combination of AI and IoT.

- In June 2025, Hero MotoCorp launched a battery subscription model for its VIDA VX2 electric scooter, aiming to reduce the upfront costs of EV ownership. The flexible “pay-as-you-go” plan was officially launched on July 1, 2025.(Source: https://economictimes.indiatimes.com)

End User Industry Insights

What Made the Automotive Segment Dominate the Battery Leasing-as-a-Service Market in 2024?

The automotive segment is dominating the market with a 55% share, owing to the need for effective battery solutions and the rising demand for electric vehicles. Reduced warranty risks and predictable battery lifecycle management are advantageous to automakers. Customers who choose to lease an automobile can also upgrade to newer battery technologies as they become available, and programs to electrify the fleet further solidify dominance in the market.

The telecommunications sector is experiencing rapid growth in BaaS adoption, utilizing energy storage solutions to ensure a reliable power supply for data centers and communication networks. Telecom companies are increasingly relying on backup batteries to prevent downtime. This has opened opportunities for leasing providers to offer scalable battery solutions. Remote monitoring and predictive maintenance ensure operational continuity and reduce energy management costs.

Energy Storage Capacity Insights

What Made 50–100 kWh Dominate the Battery Leasing-as-a-Service Market?

The 50-100 kWh segment is dominating the market with a 40% share because they are most used in electric vehicles, providing a balance between range and vehicle weight. These capacities suit passenger vehicles and light commercial vehicles effectively. Leasing providers focus on this range to maximize compatibility and operational efficiency. Standardization in this segment also helps simplify maintenance and swapping operations.

The over 200 kWh segment is growing rapidly as batteries support long-distance transportation and industrial energy requirements by offering increased storage and range. For fleet operators, leasing options for these batteries lower the initial outlay of funds. Advanced monitoring systems prolong the lifecycle of such high-capacity units and optimize usage.

Regional Insights

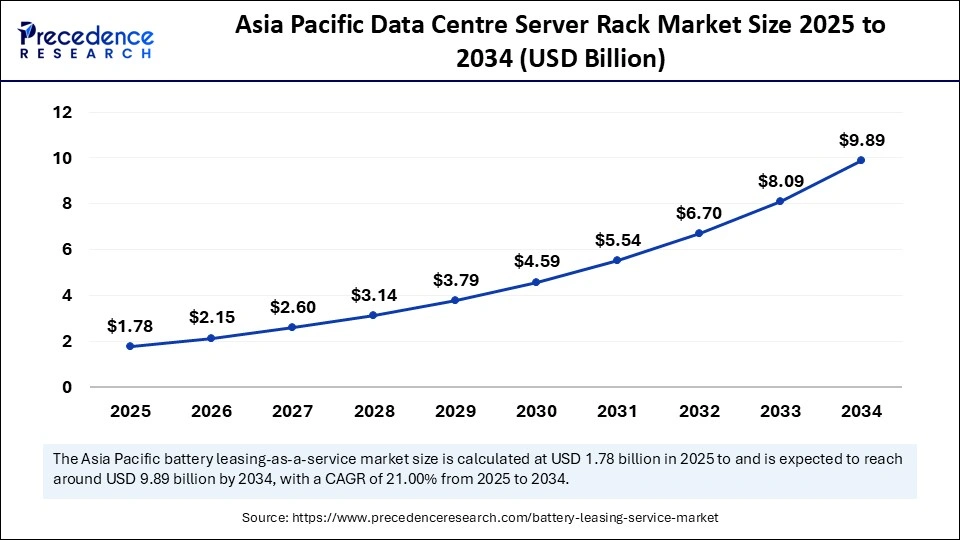

Asia Pacific Battery Leasing-as-a-Service Market Size and Growth 2025 to 2034

The Asia Pacific battery leasing-as-a-service market size was exhibited at USD 1.47 billion in 2024 and is projected to be worth around USD 9.89 billion by 2034, growing at a CAGR of 21.00% from 2025 to 2034.

What Made Asia Pacific Dominate the Battery Leasing-as-a-Service Market in 2024?

Asia Pacific dominated the battery leasing-as-a-service market with a 45% share, driven by substantial investments in battery infrastructure, government incentives, and the quick adoption of EVs. Important battery suppliers and manufacturers are also based in the area. Urbanization and a high level of e-mobility consumer interest serve to strengthen dominance. Initiatives for cooperation between automakers and energy suppliers enhanced their market presence even more.

- In January 2025, Urja Mobility launched AI-enabled battery leasing for e-rickshaw operators across multiple Indian cities, expanding its presence in the Asia Pacific region.(Source: https://telematicswire.net)

North America is growing rapidly in 2024, driven by rising EV adoption and clean energy-promoting government policies. Infrastructure for changing and swapping is seeing an increase in investment. To improve operational efficiency, the area is also implementing AI-enabled battery management systems. Market expansion is also aided by the integration of renewable energy sources and the growth of commercial EV fleets.

The U.S. is actively investing in battery leasing infrastructure, with significant funding directed toward enhancing domestic EV battery production and recycling capabilities. Billions have been set aside by the government to support vital battery manufacturing through programs like the Inflation Reduction Act and the bipartisan infrastructure law. Reducing dependency on outside sources and strengthening the domestic EV ecosystem are the goals of these initiatives.

Country-level Investments & Funding Trends for the Battery Leasing-as-a-Service Market

| Country | Investment Trends | Funding Trends | Government Initiatives & Policies |

| China | Leading in BaaS with investments in battery swapping and EV fleets. | Significant funding for battery infrastructure and EV adoption |

Subsidies and incentives promoting EV adoption and battery leasing models. |

| United States | Growing investments in EV infrastructure and battery leasing services. | Private and public funding for battery leasing platforms and fleets | Policies promoting clean energy and reduced carbon emissions |

| India | Increasing investments in EV infrastructure and battery leasing | Funding from the government and private sector for battery swapping solutions | Policies encouraging electric mobility and pollution reduction. |

| Europe | Heavy investments in battery manufacturing and EV infrastructure | Grants and loans from the EU and national governments for BaaS initiatives | European Green Deal and other policies are accelerating electric mobility |

Battery Leasing-as-a-Service Market Companies

- NIO Inc.: Chinese EV manufacturer pioneering battery-swapping technology and premium electric cars.

- Gogoro Inc.: Taiwan-based leader in electric scooters and battery-swapping ecosystems.

- XPENG Inc.: Chinese smart EV company focusing on autonomous driving and fast-charging innovations.

- SAIC Motor Corporation Limited: China's largest automaker with strong investments in EVs and battery technologies.

- VinFast Auto Ltd.: Vietnamese EV manufacturer expanding globally with battery leasing and flexible charging models.

- CATL (Contemporary Amperex Technology Co. Limited): World's largest EV battery maker, supplying major global automakers.

- Tesla, Inc.: Leading EV manufacturer offering proprietary battery packs, Supercharger network, and energy storage solutions.

- Ample Inc.: U.S.-based startup developing modular, robotic battery-swapping solutions for EVs.

- Sun Mobility: Indian company providing battery-swapping infrastructure for electric two- and three-wheelers.

- Battery Swap Technologies: Focused on battery-swapping stations and modular battery design for EV fleets.

- Gogoro Network: Gogoro's battery-swapping platform powering electric scooters across Asia.

- ChargePoint, Inc.: U.S. leader in EV charging infrastructure with a vast global charging network.

- Shell Recharge Solutions: Oil & energy giant Shell's EV charging arm, offering fast-charging and home charging solutions.

- ABB Ltd.: Swiss engineering firm providing high-power EV fast chargers and grid integration solutions.

- Envision AESC: Global battery manufacturer supplying advanced lithium-ion batteries for EVs.

Recent Developments

- In June 2025, Hero MotoCorp launched a battery subscription model for its VIDA VX2 electric scooter to reduce upfront costs.

(Source: https://m.economictimes.com) - In August 2025, Ather Energy introduced an affordable BaaS model for its Rizta and 450e scooters, along with extended buyback and warranty options.

(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Battery Type

- Lithium-Ion (Li-ion)

- Nickel Metal Hydride (NiMH)

- Solid-State Batteries

- Lithium Iron Phosphate (LiFePOâ‚„)

- Sodium-Ion Batteries

By Application

- Electric Vehicles (EVs)

- Energy Storage Systems (ESS)

- Portable Electronics

- Telecommunications

- Uninterruptible Power Supplies (UPS)

- Consumer Electronics

- Industrial Equipment

- Aerospace

By Service Model

- Subscription-Based Leasing

- Pay-Per-Use Leasing

- Battery Swapping Services

- Hybrid Models (Combination of Subscription and Swapping)

By End-User Industry

- Automotive

- Telecommunications

- Energy and Utilities

- Residential

- Commercial and Industrial

- Consumer Electronics

- Military and Defense

- Healthcare

By Energy Storage Capacity

- Less than 50 kWh

- 50–100 kWh

- 100–200 kWh

- Over 200 kWh

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting