Biopharmaceutical CMO and CRO Market size To Attain USD 236.5 Bn By 2032

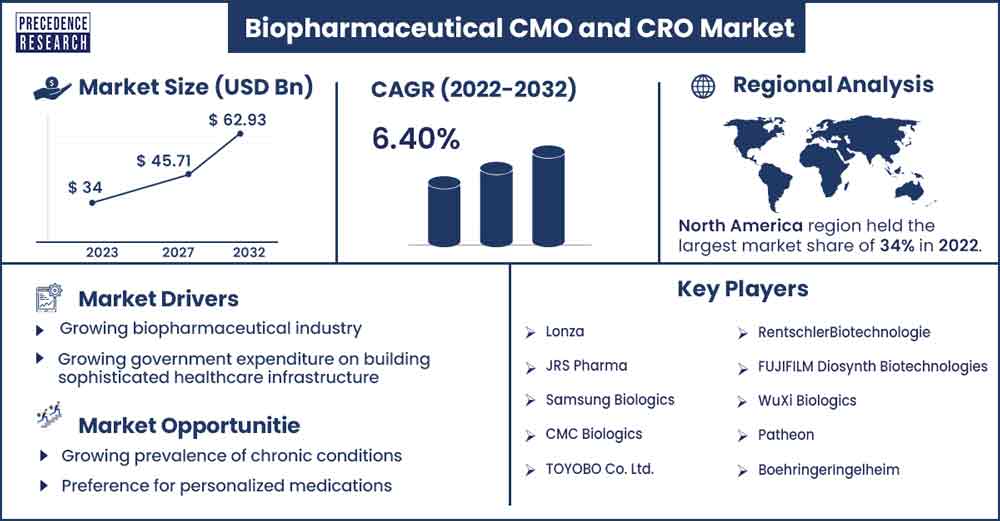

The global biopharmaceutical CMO and CRO market size surpassed USD 36.01 billion in 2023 and is projected to attain around USD 62.93 billion by 2032, growing at a CAGR of 6.40% from 2023 to 2032.

Market Overview

Biopharmaceutical contract manufacturing organizations (CMOs) and contract research organizations (CROs) provide outsourcing services to the biopharmaceutical industry. They help pharmaceutical and biotech companies needing more expertise, facilities, or resources. These organizations offer various services, including contract development and manufacturing of biologics, process development and optimization, analytical testing, and regulatory support. Challenges such as the complexity of biological substances, the need for specialized skills and tools, and the desire to reduce costs and increase efficiency affect the industry.

The market for biopharmaceutical CMOs and CROs is expected to grow significantly in the coming years, driven by several key factors. A significant factor is the growing trend of pharmaceutical companies outsourcing their drug research and production to focus on core competencies and reduce costs. In addition, growing biologics and biosimilars requires specialized manufacturing expertise that many companies may need to gain. Expanding into new markets will further support this expected growth, particularly in Asia, where the demand for high-quality biopharmaceutical services is increasing.

- In February 2023, Enzene Biosciences, a subsidiary of Alkem Laboratories, began shipping the biosimilar adalimumab to treat autoimmune diseases such as rheumatoid arthritis and ankylosing spondylitis. Enzene Biosciences hopes that the introduction of continuous manufacturing technology will help reduce the cost of treating rheumatoid arthritis for millions of Indian patients.

- In November 2022, Sanofi and Insilico Medicine signed a $1,200 million drug development agreement, a significant development. This strategic collaboration will allow Sanofi to leverage Insilicon's AI platform to advance drug development for up to six new targets. In 2023, the revenue from the pharmaceutical CDMO Market in Japan was USD 4.59 billion.

- In 2023, the market revenue for India's pharmaceutical CDMO reached USD 15.63 billion.

Regional Snapshot

North America holds the largest biopharmaceutical CMO and CRO market share during the forecast period. This is due to increased chronic diseases, demand for generics and biologics, biosimilars, and investment in the biopharmaceutical industry.

- In September 2022, Pfizer announced a multi-year partnership with CytoReason to use CytoReason's artificial intelligence technology in Pfizer's drug development programs. This collaboration aims to support the development of new disease models and the creation of high-resolution models in various therapeutic areas.

US CMOs have expanded their services from core manufacturing to full range to meet market and outsourcing needs. The US pharmaceutical industry and continued growth and the growing trend of large pharmaceutical companies outsourcing profit margins while concentrating on their core competencies are driving the market in the country. In addition, the Canadian pharmaceutical industry is growing significantly, supported by Canada's business-friendly environment and government initiatives; the pharmaceutical industry is known for its innovation, making it an essential part of the Canadian economy.

- In March 2023, Hong Kong-based Pantheon Lab, which focused on developing digital humans using artificial intelligence (AI), revealed that it had received funding from New World Development. The company is ready to cooperate with the real estate developer in various projects.

- In February 2023, Labcorp, a major global life sciences company, announced that the expected spin-off from its clinical development business would be Fortrea. Following the LabCorp spin-off, Fortress will operate as an independent, publicly traded global CRO providing end-to-end drug and medical device development services.

Biopharmaceutical CMO and CRO Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 36.01 Billion |

| Projected Forecast Revenue by 2032 | USD 62.93 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 6.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Mergers and collaborations

There have been many mergers in the biopharmaceutical industry in recent years, and the contract manufacturing and service sector is set to expand due to these mergers. The emergence of new drugs, advances in bioprocessing methods, and the changing bio/pharma landscape are expected to pressure contract biomanufacturers. Alternative business models are introduced to meet the demands of stakeholders and customers.

Global market collaborations

The global biopharmaceutical CMO and CRO market is growing due to the trend of outsourcing in the biopharmaceutical industry. Operated by Baxter's BioPharma Solutions (BPS) business unit, the facility collaborates with leading pharmaceutical and biotechnology companies to develop and contract pharmaceutical products, particularly injectable drugs.

This trend is driven by the increasing prevalence of cancer and age-related diseases, global generic production capacity growth, and biologics development. As a result, industry players are focusing on developing biological APIs and expanding their API manufacturing capabilities. These developments create favorable opportunities for CMOs in the biopharmaceutical and small molecule API sectors. This trend is expected to continue and even strengthen during the forecast period.

Restraint

Stringent regulatory practices

One of the significant challenges expected to hinder the growth of the global biopharma CMO and CRO market is strict rules and regulations. A regulatory framework regulated explicitly by the Food and Drug Administration (FDA) creates and oversees CROs. The FDA can hold these CROs directly responsible for the sponsor's obligations concerning the investigational new drug application. Ensuring that clinical trials are appropriately managed and that good clinical practice and harmonization guidelines are followed is critical to the CRO. Despite these regulatory challenges, there is a growing interdependence between CMOs and CROs to improve productivity and efficiency.

Opportunities

Growing prevalence of chronic conditions

The increasing global incidence of chronic diseases presents significant growth opportunities for biopharma CMO and CRO market players. The growing burden of chronic diseases has led to a rising demand for safe and effective medicines, which has accelerated the process of drug discovery and development.

- In May 2023, Alkem Oncology introduced Cetuxa, the world's first cetuximab biosimilar for head and neck cancer. Cetuxan was researched and manufactured in Finland by Enzene Biosciences Limited, the biological arm of Alkem Laboratories.

Preference for personalized medications

The advent of personalized medicine has made the traditional one-size-fits-all model obsolete. In response to industry efforts to make clinical trials more accessible and patient-friendly, technology has become an essential part of contract organizations. To stay competitive and provide complete solutions to clients, CROs are pioneers in implementing the latest technologies and tools. The integration of these advanced technologies has proven to benefit CROs by improving their efficiency and accelerating research, ultimately contributing to the growth of the CRO market.

Expansion of the pharmaceutical industry

The rapid expansion of the biopharma industry promises lucrative opportunities for players in the biopharma CMO and CRO markets. The outsourcing trend is also growing with the biopharmaceutical industry's rapid growth. For instance, according to the India Brand Equity Foundation (IBEF), India's biotechnology industry is expected to reach around $150 billion by 2025 and could reach $270-300 billion by 2030. Furthermore, by 2025, India's biotechnology sector will constitute 19% of the global market.

Recent Developments

- In June 2023, the Public Investment Fund (PIF) of the Kingdom of Saudi Arabia launched Lifera, a commercial contract development and manufacturing organization (CDMO). As Saudi Arabia's sovereign wealth fund, PIF's mission is to make strategic investments and partnerships to improve the country's #039 supply chain, skills, resource development, medicine, job opportunities, and technology transfer from global private sector partners.

- In February 2023, Lunaphore and Sirona Dx announced a strategic collaboration to make Sirona Dx the first CRO to provide Lunaphore with a flagship COMET space biology platform. This collaboration aims to complement Sirona Dxand's portfolio of research services, serving the various needs of researchers and biopharmaceutical companies in multiple disciplines.

Key Market Players

- Lonza

- JRS Pharma

- Samsung Biologics

- CMC Biologics

- TOYOBO Co. Ltd.

- RentschlerBiotechnologie

- FUJIFILM Diosynth Biotechnologies

- WuXi Biologics

- Patheon

- BoehringerIngelheim

- PRA Health Sciences

- LabCorp

Market Segmentation

By Service

- Contract Manufacturing

- Process Development

- Upstream

- Downstream

- Fill & Finish Operations

- Analytical & QC studies

- Packaging

- Process Development

- Contract Research

- Inflammation & Immunology

- Cardiology

- Oncology

- Neuroscience

- Others

By Source

- Mammalian

- Non-Mammalian

By Product

- Biologics

- Vaccines

- Monoclonal antibodies (MABs)

- Recombinant Proteins

- Antisense, RNAi, & Molecular Therapy

- Others

- Biosimilars

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1289

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308