Bioprocess Validation Market Revenue to Attain USD 1,080.86 Mn by 2033

Bioprocess Validation Market Revenue and Trends 2025 to 2033

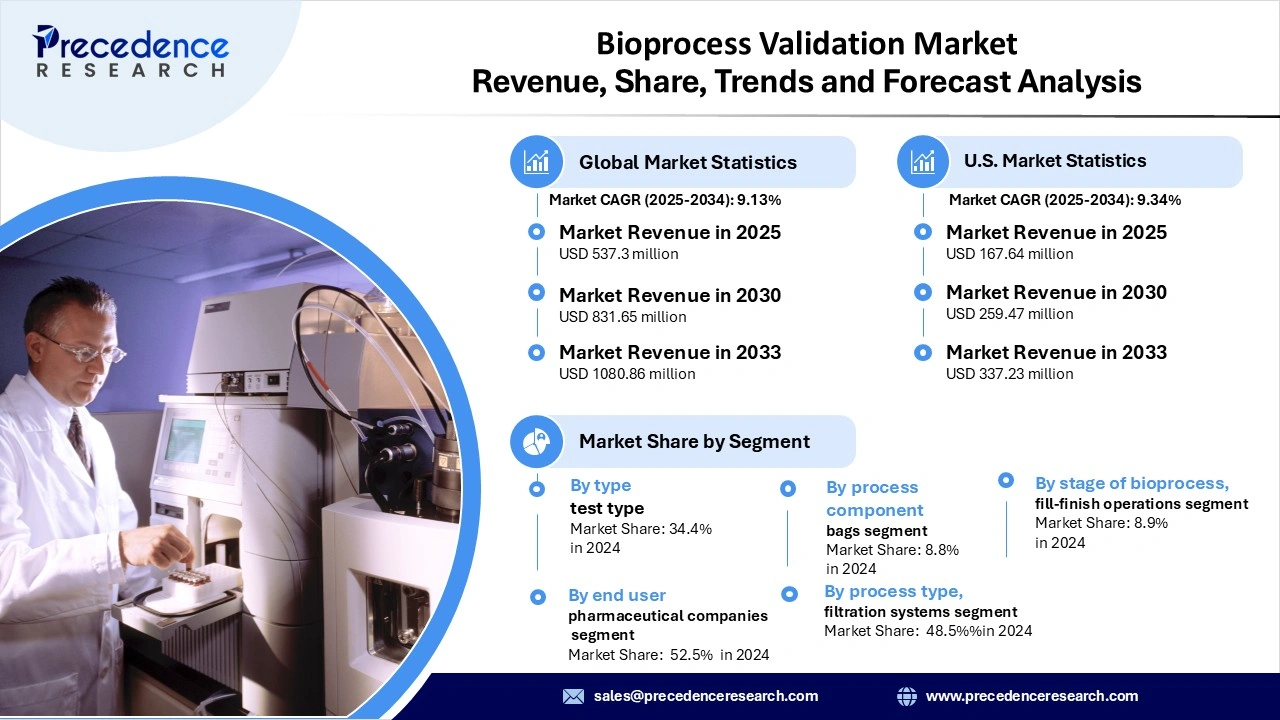

The global bioprocess validation market revenue is valued at USD 537.30 million in 2025 and is expected to attain around USD 1,080.86 million by 2033, growing at a CAGR of 9.13% during forecast period. The market growth is driven by the rising adoption of biologics, biosimilars, vaccines, and cell & gene therapies, combined with increasingly stringent regulatory mandates from authorities such as the FDA, EMA, and PMDA that require robust process validation protocols, advanced analytics, extractables & leachables testing and extensive process documentation to ensure product quality, safety, and efficacy.

What are the key drivers enabling the growth of the market?

The bioprocess validation market is on the rise for multiple reasons. Firstly, the surge in biologics and biosimilars demands a comprehensive, end-to-end validation of manufacturing workflows, from upstream to downstream processes. Secondly, heightened regulatory oversight from bodies like the FDA, EMA, and ICH compels industry players to ensure full compliance with regulations regarding safety, extractables & leachables, viral contamination, and process integrity.

Thirdly, the growing use of single-use technologies and modular continuous-bio processing platforms introduces new validation requirements and challenges, particularly concerning disposable systems and filtration components. Fourthly, there's significant outsourcing to contract manufacturing organizations (CMOs/CDMOs) and contract research organizations (CROs) for cost efficiency, scalability, and specialized expertise. Finally, the move towards digital, automated, and advanced analytics (real-time monitoring, PAT, AI) for more efficient and reliable validation workflows will be increasingly relied upon.

Segment Insights

- By test type, the microbiological testing segment dominated the market in 2024, as microbiological testing is critical for verifying sterility and preventing contamination throughout the bioprocess lifecycle.

- By process component, the filters segment held the largest market share in 2024, as filtration, through sterile filters, integrity filters, and single-use systems, is essential for microbial and viral removal and is highly regulated during validation processes.

- By stage of bioprocess, the upstream bioprocessing segment led the market in 2024, since upstream processes (e.g., cell culture, media preparation, bioreactor control) are particularly vulnerable to impurities and variability, making validation vital to ensuring quality.

- By end-user, biotechnology & pharmaceutical companies dominated the market in 2024, as they are the primary developers of biologics, vaccines, and advanced therapies, and are required to conduct or commission validations to meet regulatory, safety, and quality standards.

- By process type, the validation of filtration systems segment was the market leader in 2024, reflecting the critical role of filtration (e.g., sterile, viral, and endotoxin clearance filters) in maintaining product purity, safety, and compliance across the bioprocessing workflow.

Regional Insights

North America registered dominance in the bioprocess validation market in 2024 due to several key factors. The region boasts a well-established biopharma infrastructure, which includes a high concentration of biotech and pharmaceutical companies. This, coupled with strong regulatory oversight, particularly from the FDA, and substantial investments in R&D, has fueled the demand for thorough validation services within the existing CDMO and manufacturing facilities. These elements collectively contribute to North America's leading position in the market.

Asia Pacific is expected to experience the most rapid growth, primarily due to the expansion of biomanufacturing hubs. This growth is also fueled by increased outsourcing to local CROs/CDMOs, regulatory harmonization, and government investments in bioprocessing infrastructure. These efforts aim to facilitate local production of biologics and vaccines.

Bioprocess Validation Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 537.30 Million |

| Market Revenue by 2033 | USD 1,080.86 Million |

| CAGR from 2025 to 2033 | 9.13% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Development

- In November 2024, Sartorius Stedim Biotech launched its new Center for Bioprocess Innovation in Marlborough, Massachusetts. This facility specializes in process development, optimization, and validation services, particularly serving cell and gene therapy customers and GMP early-stage clinical manufacturing. (Source: https://www.sartorius.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7030

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344