What is the Bioprocess Validation Market Size?

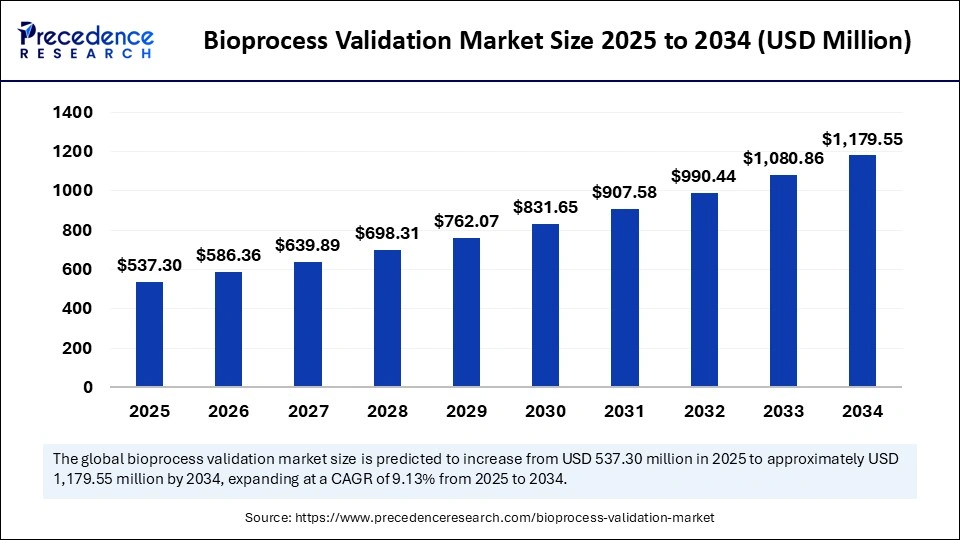

The global bioprocess validation market size is calculated at USD 537.30 million in 2025 and is predicted to increase from USD 586.36 million in 2026 to approximately USD 1,179.55 million by 2034, expanding at a CAGR of 9.13% from 2025 to 2034. The market is experiencing substantial growth due to the increasing adoption of advanced biomanufacturing technologies, including cell and gene therapies. This demand is further fueled by the need for platforms capable of aggregating and analyzing multi-source data in real time to support Continued Process Verification (CPV) and meet regulatory compliance requirements. The integration of smart sensors (IoT) and AI is accelerating workflow automation and process optimization, ensuring consistent product quality and safety.

Market Highlights

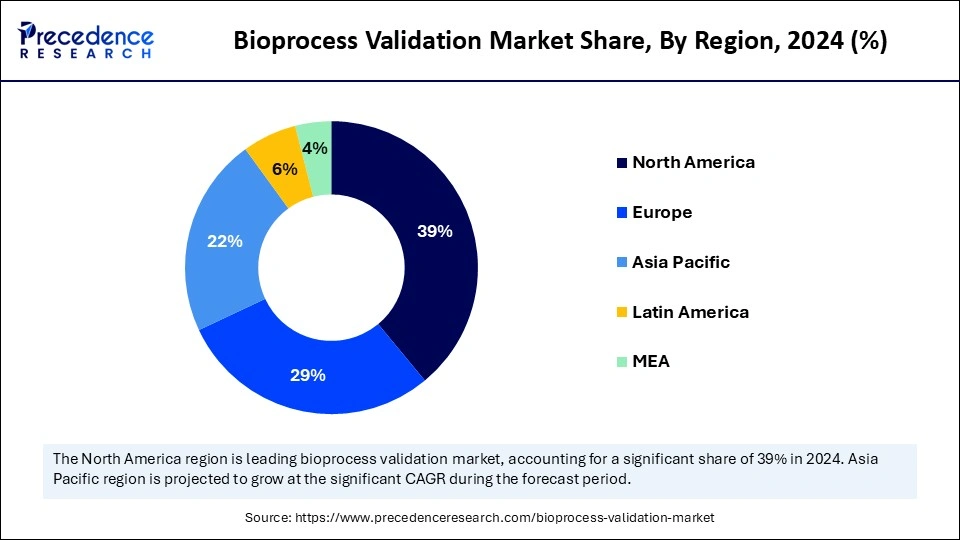

- North America accounted for the largest market share of 39% in 2024.

- Asia Pacific is expected to register the fastest CAGR of 9.1% from 2025 to 2034.

- By test type, the microbiological testing segment held the largest market share of 34.4% in 2024.

- By test type, the extractables & leachables testing segment is expected to grow at a CAGR of 9.0% from 2025 to 2034.

- By process component, the filters segment dominated the market with a 36.4% of market share in 2024.

- By process component, the media containers & bags segment is expanding at a solid 8.8% CAGR from 2025 to 2034.

- By stage of bioprocess, the upstream bioprocessing segment led the market with a 52.1% share in 2024.

- By stage of bioprocess, the fill-finish operations segment is expected to expand at a strong 8.9% CAGR from 2025 to 2034.

- By end-user, the biotechnology & pharmaceutical companies segment held the major market share of 52.5% in 2024.

- By end-user, the contract development & manufacturing organizations (CDMOS) segment is expected to grow at a CAGR of 9.6% between 2025 and 2034.

- By process type, the validation of filtration systems segment contributed the highest market share of 48.5% share in 2024.

- By process type, the cleaning validation segment is growing at a 9.2% CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 537.30 Million

- Market Size in 2026: USD 586.36 Million

- Forecasted Market Size by 2034: USD 1,179.55 Million

- CAGR (2025-2034): 9.13%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Bioprocess Validation?

Bioprocess validation is a critical component of biopharmaceutical manufacturing that ensures a biological product is consistently produced and controlled according to quality standards and regulatory requirements. The bioprocess validation market includes services, systems, and consumables used to confirm the safety, consistency, and compliance of biopharmaceutical manufacturing processes. It involves qualification, process validation, and cleaning validation steps to meet regulatory standards set by agencies like the FDA and EMA. Key applications include producing biologics, vaccines, and biosimilars. Increasing biopharmaceutical production, strict regulatory requirements, and rising outsourcing of validation activities to specialized service providers drive market growth.

How is AI Impacting the Bioprocess Validation Market?

Artificial intelligence (AI) is revolutionizing the bioprocess validation market by shifting from retrospective analysis to real-time, predictive, and automated validation methods. It accelerates processes, improves quality control, and enhances overall regulatory compliance by leveraging data from advanced sensors, digital twins, and machine learning models. AI analyzes continuous data streams from bioprocesses to detect deviations and anomalies that could impact product quality immediately. Overall, continuous monitoring helps maintain a validated state throughout the process.

Bioprocess Validation Market Outlook

- Industry Growth Overview: The bioprocess validation market is projected for significant growth between 2025 and 2034, driven by the expanding global biopharmaceutical market, especially complex biologics like cell and gene therapies. Strict regulatory demands for quality and safety, along with the rising adoption of advanced biomanufacturing technologies, are propelling market expansion.

- Digital Transformation (Bioprocessing 4.0): This trend involves the deep integration of digital technologies and data, utilizing AI, machine learning, and digital twins to accelerate process design, enable real-time monitoring, and automate quality control. It drives higher efficiency and precision throughout manufacturing.

- Global Expansion: Leading bioprocess validation players are expanding geographically, particularly into high-growth regions such as Asia Pacific and Latin America. The growth of local biomanufacturing and outsourcing activities, particularly by CDMOs in China and India, further supports the market.

- Major Investors: Significant investment is flowing from strategic investors and life science firms, drawn by the market's strong demand, high-margin services, and compliance-driven growth. Key players like Thermo Fisher Scientific, Danaher Corporation (Pall/Cytiva), and Merck KGaA are acquiring and investing in advanced validation technologies.

- Startup Ecosystem: The startup landscape is maturing, with innovation centered on digital solutions for validation, including cloud-based platforms, AI-driven analytics, and real-time process monitoring. These emerging firms are attracting funding by offering efficient, data-driven solutions that address the increasing complexity of biopharmaceutical manufacturing.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 537.30 Million |

| Market Size in 2026 | USD 586.36 Million |

| Market Size by 2034 | USD 1,179.55 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.13% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Test Type, Process Component, Stage of Bioprocess, End-User, Process Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Test Type Insights

What Made Microbiological Testing the Dominant Segment in the Market in 2024?

The microbiological testing segment dominated the bioprocess validation market while holding about 34.4% share in 2024. This is due to microbial contamination poses a fundamental risk to the safety and effectiveness of biological products like vaccines, gene therapies, and antibodies. Since biopharmaceuticals are created using living cells or organisms, they are vulnerable to contamination at all manufacturing stages, from raw materials to the final product. For sterile products like injectables, any contamination can cause life-threatening infections, making sterility assurance a top priority. It also led to batch failures, product recalls, and supply chain disruptions.

The extractables & leachables (E&L) testing segment is expected to grow at the fastest CAGR of 9.0% during the projection period. This is due to the rapid adoption of single-use bioprocessing systems and increasingly strict regulatory oversight. The growing complexity of biologics, cell therapies, and gene therapies also requires more extensive validation to ensure product safety. The main goal of E&L testing is to protect patient safety. Regulatory agencies and pharmaceutical companies are increasingly emphasizing the need to identify and measure potential leachables that could negatively impact the drug's stability, quality, or safety.

Process Component Insights

How Does the Filters Segment Dominate the Bioprocess Validation Market?

The filters segment dominated the market with the largest share of 36.4% in 2024. This is because filters are crucial for ensuring the sterility, purity, and safety of pharmaceutical products, which is a non-negotiable regulatory requirement. The rise of complex biologics, like monoclonal antibodies and cell therapies, along with the adoption of single-use technologies, has made filter validation a complex yet essential process for manufacturers. The filtration market is continually evolving with advances in membrane materials, designs, and automated testing methods.

The media containers & bags segment is likely to grow at a CAGR of 8.8% in the upcoming period. This is due to the increasing use of single-use technologies (SUTs). These disposable products, mainly plastic bags, provide numerous advantages over traditional stainless-steel equipment, driving their adoption and creating the need for specialized validation services. They are preferred for producing complex, high-value products because they significantly reduce the risk of cross-contamination and require lower initial capital investment.

Stage of Bioprocess Insights

Why Did the Upstream Bioprocessing Segment Lead the Bioprocess Validation Market?

The upstream bioprocessing segment led the market with a 52.1% share in 2024. This is because it is the foundational and most complex stage of biomanufacturing. Critical decisions and parameters established during upstream processing, such as cell line selection, media optimization, and bioreactor control, have a ripple effect on all subsequent downstream steps. Ensuring quality and consistency early on is vital for the entire process to produce a safe, effective, and high-quality final biopharmaceutical product. Validating the upstream process also helps mitigate significant financial and operational risks.

The fill-finish operations segment is expected to grow at a CAGR of 8.9% over the forecast period, mainly due to strict regulations, increasing complexity of modern biopharmaceuticals, and the adoption of new technologies like SUS and advanced automation. This is a high-risk step where failure can compromise an entire batch, so validation services are highly sought after. There is a growing trend of using pre-filled syringes, cartridges, and other advanced delivery systems instead of traditional vials to ensure container closure integrity, with very strict guidelines for the aseptic fill-finish process.

End-User Insights

Why Did Biotechnology & Pharmaceutical Hold the Largest Share of the Bioprocess Validation Market in 2024?

The biotechnology & pharmaceutical companies segment held the largest market share of 52.1% in 2024. This is largely due to their central role in developing and manufacturing complex biologics, biosimilars, vaccines, and advanced therapies such as cell and gene therapies. These products demand rigorous process validation to meet stringent global regulatory requirements imposed by agencies like the FDA and EMA, ensuring safety, efficacy, and consistency across large-scale production. Biopharma companies require rigorous validation to guarantee the safety, efficacy, and consistent quality of their products, which range from complex biologics to vaccines and gene therapies. These companies invest heavily in research and development to bring new therapies to market, ensuring new bioprocesses are reliable, reproducible, and compliant with regulatory standards.

The contract development and manufacturing organizations (CDMOs) segment is expected to expand at the fastest CAGR of 9.6% in the upcoming years because of outsourcing trends driven by cost savings, access to specialized expertise, scalability, and rising demand for complex biologics. The shift towards advanced biopharmaceuticals such as monoclonal antibodies, cell and gene therapies, and mRNA vaccines requires highly specialized manufacturing processes. CDMOs possess the experience and infrastructure needed to handle these complex products, making them essential for companies lacking in-house expertise.

Process Type Insights

What Made Validation of Filtration Systems the Leading Segment in the Bioprocess Validation Market?

The validation of filtration systems segment led the market with a 48.5% share in 2024. This is mainly because of its central role in ensuring the safety, purity, and quality of biopharmaceutical products. Strict and evolving regulatory requirements, combined with a rising demand for complex biological drugs like vaccines and cell and gene therapies, make robust filter validation an essential step. Filtration is often the final and most critical sterilization process for many sterile drugs, preventing contamination and ensuring product safety. Overall, proper validation helps identify potential filter failures before they happen.

The cleaning validation segment is expected to grow at the fastest CAGR of 9.2%, mainly due to increased regulatory scrutiny, the rising complexity of biologics, and greater adoption of risk-based and digital technologies. Global regulators such as the U.S. FDA and EMA are enforcing more stringent cleaning validation rules. Manufacturers and regulators are shifting from manual, paper-based validation to digital and automated solutions to improve accuracy, consistency, and speed.

Regional Insights

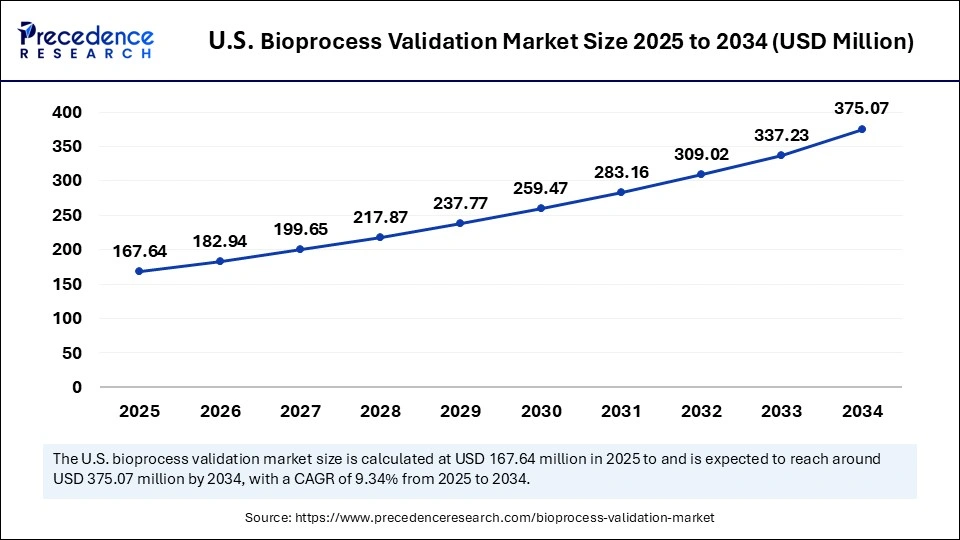

U.S. Bioprocess Validation Market Size and Growth 2025 to 2034

The U.S. bioprocess validation market size is evaluated at USD 167.64 million in 2025 and is projected to be worth around USD 375.07 million by 2034, growing at a CAGR of 9.34% from 2025 to 2034.

How Did North America Dominate the Bioprocess Validation Market in 2024?

North America maintained a dominant position in the market by capturing a 39% share in 2024. This is due to its strict regulatory environment, a thriving biopharmaceutical sector with heavy investment in R&D, and a strong infrastructure for advanced technologies. The U.S. FDA and Health Canada enforce rigorous regulations and GMP standards. This demands comprehensive, ongoing bioprocess validation to ensure the safety, purity, and efficacy of biological products, which fuels the demand for these services. North America remains a hub for innovation in biomanufacturing, with widespread adoption of advanced technologies, automation, and continuous bioprocessing, all of which require specialized validation protocols.

U.S. Bioprocess Validation Market Trends

The U.S. is a major contributor to the North American bioprocess validation market, propelled by its strong biopharmaceutical industry, strict regulatory requirements, and leadership in technological innovation. The FDA establishes and enforces rigorous validation standards that require manufacturers to ensure product safety and quality throughout the entire lifecycle of a biopharmaceutical. The development of advanced therapies, such as cell and gene therapies, also demands specialized validation processes, reinforcing the U.S. as a primary driver of market trends and expansion.

Why is Asia Pacific Considered the Fastest-Growing Region in the Bioprocess Validation Market?

Asia Pacific is expected to be the fastest-growing region in the market, growing with a CAGR of 9.1%. This is mainly due to the rapid expansion of the biopharmaceutical industry, increasing healthcare investments, supportive government initiatives, and a strategic focus on outsourcing. Countries like China, India, and South Korea have emerged as major hubs for biologics, biosimilars, and vaccine production. The adoption of advanced bioprocessing technologies and a rising demand for validation services are driving this growth. Regulatory agencies in the region are progressively aligning with international standards, such as GMP, to meet regulatory requirements and ensure product safety.

India Bioprocess Validation Market Trends

India is becoming a significant player in the global market, primarily due to its expanding biopharmaceutical manufacturing capabilities, strong government support, and cost-effective outsourcing options. With a focus on biosimilars, vaccines, and biologics, India is poised for substantial growth, attracting both domestic and international investments in bioprocess validation infrastructure. The CDSCO oversees the quality of these products, aligning with global standards to enhance international market access and build credibility.

What Factors Support the Growth of the European Bioprocess Validation Market?

The market in Europe is expected to grow at a notable rate in the foreseeable period, driven by a robust biopharmaceutical industry, stringent regulatory frameworks, and significant investments in biotechnology research. Countries such as Germany, the UK, and Switzerland are key contributors, benefiting from established biomanufacturing capabilities. The growing need for biosimilars in Europe boosts the demand for validation services, as manufacturers must perform extensive validation to demonstrate comparability and meet regulatory standards.

Germany Bioprocess Validation Market Trends

Germany is emerging as a key force in the market due to stringent quality standards mandated by the EMA. Additionally, the country boasts a strong industrial infrastructure, in-depth expertise in pharmaceutical innovation, and substantial investments in research and development. The market is further driven by the production of high-value biologics and vaccines, the increasing adoption of single-use technologies, and the implementation of advanced process automation.

Bioprocess Validation Market Value Chain Analysis

- Research & Development (R&D)

R&D focuses on innovating advanced bioprocessing and validation techniques, such as single-use technologies and analytical methods (HPLC, MS, PCR), to ensure product safety, quality, and regulatory compliance.

Key Players: Thermo Fisher Scientific, Sartorius AG, Merck KGaA, Danaher Corporation, and Charles River Laboratories.

- Raw Material and Equipment Manufacturing

This stage involves the production of critical components for biomanufacturing, including single-use systems, bioreactors, filters, and media bags. These products must be validated for safety and performance before use in drug manufacturing.

Key Players: Merck KGaA, Thermo Fisher Scientific, Sartorius AG, Danaher Corporation (Pall Corporation), and Eurofins Scientific.

- Biopharmaceutical Manufacturing

Here, biopharmaceutical companies and CDMOs use the validated processes and equipment to produce biotherapeutics, such as monoclonal antibodies, vaccines, and cell and gene therapies. Validation is critical throughout the manufacturing process to ensure consistent quality.

Key Players: Thermo Fisher Scientific Inc., Merck KGaA, Sartorius AG, Danaher Corporation, and Lonza Group AG.

Testing and Validation Services

Specialized testing and validation services are provided to verify that each stage of the bioprocess meets regulatory standards. Services include extractables/leachables testing, microbiological testing, and integrity testing. This can be performed in-house or outsourced.

Key Players: Charles River Laboratories, SGS S.A., Eurofins Scientific, and Lonza Group AG.

- Distribution and End-Use

Validated biopharmaceutical products are distributed to hospitals, clinics, and pharmacies. The end-users of bioprocess validation are primarily pharmaceutical and biotechnology companies and CDMOs that require validation services to comply with GMP and ensure product safety.

Key Players: Deutsche Post DHL Group, UPS Healthcare, FedEx Healthcare Solutions, Cryoport Systems, WuXi AppTec, and Catalent.

Regulatory Landscape of the Bioprocess Validation Market

| Region | Regulatory Body | Validation Approach & Key Focus |

| U.S. | FDA (Food and Drug Administration) | Lifecycle approach (Process Design, Qualification, CPV) focused on being risk-based and scientifically sound. |

| EU | EMA (European Medicines Agency) | Lifecycle approach (traditional, QbD-enhanced, or hybrid) focused on risk management and a Quality System. |

| Japan | PMDA (Pharmaceuticals and Medical Devices Agency) | Aligns with ICH lifecycle principles, focusing on quality risk management (QRM). |

Top Companies Operating in the Bioprocess Validation Market

Tier I: Market Leaders

These companies are major providers of bioprocess validation services, with wide product/service portfolios, global reach, and strong R&D / regulatory alignment.

| Company | Key Offerings |

| Thermo Fisher Scientific | Full spectrum validation: equipment qualification, software platforms, analytical testing, extractables & leachables, microbiology, service labs. |

| Merck KGaA | Validation solutions for GMP manufacturing, single use systems, filtration, residuals/extractables, instrumentation, global presence. |

| Sartorius AG | Upstream/downstream single use validation, AI/automation enabled platforms, filter integrity, media, process qualification & continued process verification. |

Tier II: Established & Strong Regional/Niche Players

These firms are strong contributors, often with specialization or strong regional presence, especially in certain test types or geographies.

| Company | Key Offerings |

| Eurofins Scientific | Sterility & microbial detection, contract validation services, proficiency testing, regulatory support especially in the EU. |

| Pall Corporation (Danaher) | Process component validation including filters, single use & reusable systems; integrity testing and services. |

| SGS S.A. | Audit, certification, testing labs, regulatory compliance validation services across multiple regions. |

Tier III: Emerging, Niche or Smaller Players

These are companies with smaller or more specialized segments, regional players, or emerging service providers.

| Company | Key Offerings |

| Lonza Group | Validation for cell & gene therapy, viral safety, continuous bioprocess systems. |

| WuXi AppTec / WuXi Biologics | Outsourced validation, contract development & testing for biosimilars / vaccines. |

| Charles River Laboratories | Analytical method validation, extractables/leachables, toxicology / viral clearance support. |

| Others (Cobetter Filtration, DOC S.r.l., Meissner Filtration Products, Toxikon, etc.) | Specialized filtration, integrity / extractables test kits, regional labs. |

Recent Developments

- In February 2025, Thermo Fisher Scientific announced its agreement to acquire Solventum's Purification & Filtration business for approximately USD 4.1 billion. This acquisition is expected to enhance Thermo Fisher's capabilities in biologics development and manufacturing, aligning with their strategic goal of delivering value to customers and shareholders.(Source: https://ir.thermofisher.com)

- In November 2024, Sartorius Stedim Biotech opened a new Center for Bioprocess Innovation in Marlborough, Massachusetts. This facility aims to promote collaboration and co-development in bioprocess workflows, particularly for cell and gene therapies. CEO René Fáber stated that the center would leverage its expertise to accelerate the paths of customers to clinical trials, accommodating over 120 bioprocessing experts.(Source: https://www.sartorius.com)

Exclusive Analysis on the Bioprocess Validation Market

The bioprocess validation market is entering a phase of strategic inflection, underpinned by structural tailwinds across biopharmaceutical manufacturing, particularly in cell and gene therapies, biosimilars, and personalized biologics. The regulatory mandate for process robustness, coupled with ICH Q8-Q11 alignment, has transformed validation from a compliance cost center into a strategic enabler of commercial scalability. This repositioning unlocks significant opportunities for market incumbents and new entrants to capitalize on validation-as-a-service models, particularly through continued process verification (CPV) frameworks.

Emerging technologies such as PAT (Process Analytical Technology), digital twins, single-use systems, and AI-enabled sensor ecosystems are accelerating the adoption of real-time release testing (RTRT) and driving demand for intelligent validation platforms that integrate data integrity, predictive analytics, and compliance automation. Moreover, the push for global harmonization of cGMP regulations, especially across APAC and LATAM, is expanding the Total Addressable Market (TAM) for validation service providers and tool manufacturers.

In addition, the shift from batch to continuous bioprocessing introduces novel validation challenges, thus creating whitespace for innovation in modular validation protocols, risk-based validation planning, and hybrid virtual commissioning approaches. Key players that can offer integrated validation suites, covering upstream/downstream, filtration integrity, leachables/extractables, and cleaning validation, stand to capture disproportionate value through long-term CDMO partnerships.

With increasing VC/private equity investments into CDMOs, the validation market is expected to remain a mission-critical bottleneck that demands scalable, tech-forward, and regulation-resilient solutions, making it one of the most undervalued, yet high-growth nodes in the biomanufacturing value chain.

Segments Covered in the Report

By Test Type

- Extractables & Leachables Testing

- Integrity Testing

- Microbiological Testing

- Cleaning Validation

- Sterilization Validation

- Filter Element Performance Testing

By Process Component

- Filters

- Bioreactors

- Media Containers & Bags

- Freezers & Refrigerators

- Mixing Systems

By Stage of Bioprocess

- Upstream Bioprocessing

- Downstream Bioprocessing

- Fill-Finish Operations

By End-User

- Biotechnology & Pharmaceutical Companies

- Contract Development & Manufacturing Organizations (CDMOs)

- Research Organizations

- Academic Institute

By Process Type

- Validation of Filtration Systems

- Cleaning Validation

- Process Simulation Tests

- Analytical Method Validation

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content