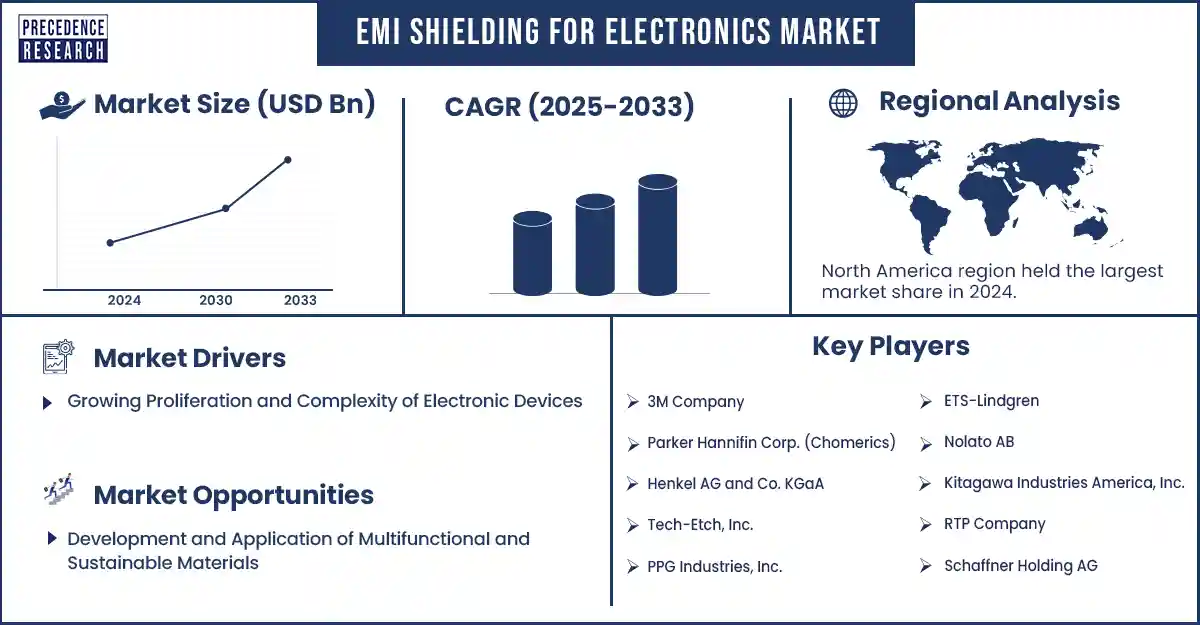

EMI Shielding for Electronics Market Revenue and Forecast by 2033

EMI Shielding for Electronics Market Revenue and Trends 2025 to 2033

The EMI shielding for electronics market is expanding as industries adopt shielding solutions to minimize interference in smart devices, automotive systems, and telecom equipment. The EMI shielding for electronics market is rising due to increasing electromagnetic interference from growing device density, 5G adoption, and stringent regulatory standards for electronic safety and performance.

Key drivers responsible for the growth of EMI Shielding for Electronics Market

The primary factors driving growth of the EMI shielding for electronics market include rapid growth in consumer electronics, increased electromagnetic pollution, and increasingly stringent regulatory standards for electromagnetic compatibility (EMC). As devices are becoming smaller and more capable, the need for effective EMI shielding materials, such as conductive coatings, gaskets and metal enclosures, is growing. The growth of wireless communications technologies (5G, IoT, automotive radar) is also a push towards an even greater use of EMI materials that can help to reduce this signal interference and ultimately provide reliability to electronics devices. In addition, the growth of electric vehicles (EV), plus the increased use of sophisticated medical equipment, which will also have implications for performance EMI shielding in light of demanding safety and functionality standards, will continue to further drive growth in the EMI shielding for electronics market.

Segment Insights

- By material type, metal foils and sheets have the largest share of this market since metal foils and sheets have the highest conductivity, durability, and overall lowest cost.

- By product/technique, Board-level shielding (cans/lids) leads the EMI shielding market as it contains exact, and compact protection for high-performance electronic components.

- By application, consumer electronics and mobile devices account for the largest part of the demand for EMI shielding, as they are contributing factors for miniaturization, performance requirements, and more wireless options.

- By end-user industry, electronics OEMs are leading the demand, due to more complicated devices, regulatory requirements, and the desire for more interference-free performance.

- By distribution channel, direct-to-OEMs/Tier-1s account for the largest market for EMI shielding as they provide value of customized EMI shielding solutions, faster integration into devices, and increased supply chain efficiency.

Regional Insights

Asia-Pacific is the leading region for EMI shielding for electronics as it is home to many key manufacturing centers, strong consumer demand for electronics, and fast rapid industrialization of economies in Asia-Pacific including China, Japan and South Korea. The Asia-Pacific region has a large OEM presence, very low production costs, and a growing market that needs more advanced shielding.

North America is the fastest growing region due to increased spending on 5G infrastructure, electric vehicles and aerospace technologies. Increasing regulatory standards for electromagnetic compatibility and innovation that drive more EMI shielding use in the United States and Canada makes North America a key growth area.

EMI Shielding for Electronics Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD billion/trillion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In November 2023, AMETEK, Inc. introduced the CDN 3063A C100.1, the first-ever 3 phase Teseq coupling network featuring a switchable current range offering enhanced flexibility in EMC testing environments. (Source: https://www.ametek-cts.com)

EMI Shielding for Electronics Market Key Players

- 3M Company

- Parker Hannifin Corp. (Chomerics)

- Henkel AG and Co. KGaA

- Laird Performance Materials (acquired by DuPont)

- PPG Industries, Inc.

- Tech-Etch, Inc.

- ETS-Lindgren

- Nolato AB

- Kitagawa Industries America, Inc.

- RTP Company

- Schaffner Holding AG

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6702

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344