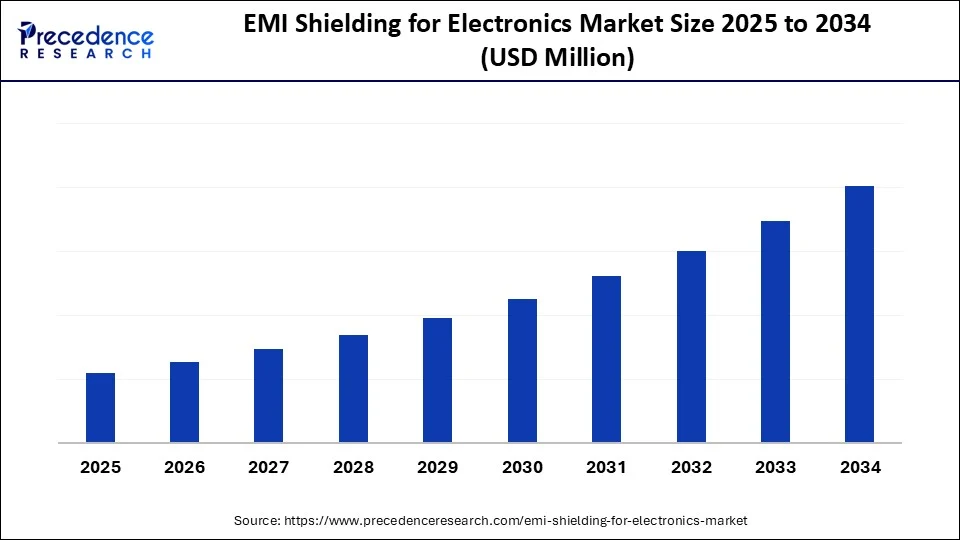

EMI Shielding for Electronics Market Size and Forecast 2025 to 2034

The EMI shielding for electronics market is evolving with advancements in shielding materials and techniques to meet the requirements of next-gen electronic products. The market is currently experiencing significant growth due to the increasing demand for electromagnetic interference protection in consumer electronics and automotive systems. The market is further supported by increasing adoption of 5G technology, IoT devices, and advanced electronic components. Furthermore, technological advancements in shielding materials and coatings are projected to fuel market expansion.

EMI Shielding for Electronics Market Key Takeaways

- Asia Pacific dominated the EMI shielding for electronics market with the largest market share of 45% in 2024.

- North America is expected to witness the fastest CAGR during the foreseeable period.

- By material type, the metal foils and sheets (copper, aluminum, stainless steel) segment held the biggest market share of 32% in 2024.

- By material type, the absorber materials and advanced composites (ferrites, magnetically loaded polymers) segment is projected to grow at a notable CAGR between 2025 and 2034.

- By product/technique, the board-level shielding (cans, lids, frames) segment captured the highest market share of 38% in 2024.

- By product/technique, the coatings for plastic housings and absorbers segment is expected to witness the fastest CAGR during the foreseeable period.

- By application, the consumer electronics and mobile devices segment contributed the highest market share of 40% in 2024.

- By application, the automotive and EV/ADAS segment is expected to witness the fastest CAGR during the foreseeable period.

- By end-user industry, the electronics OEMs (smartphones, PCs, wearables) segment held the maximum market share of 45% in 2024.

- By end-user industry, the automotive OEMs/Tier-1s segment is expected to witness the fastest CAGR during the foreseeable period.

- By distribution channel, the direct-to-OEMs/Tier-1s segment generated the major market share of 55% in 2024.

- By distribution channel, the EMS/ODM design-in channel segment is anticipated to grow at a significant CAGR from 2025 to 2034.

How Can Impact the EMI Shielding for Electronics Market?

Artificial intelligence (AI) is transforming the electromagnetic interference (EMI) shielding in electronics by accelerating the design and development of new shielding materials, improving the accuracy and efficiency of EMI testing, and optimizing the performance of shielding solutions for sensitive AI-powered devices. AI-powered systems can analyze large datasets from EMI test receivers to identify interference patterns, monitor electromagnetic emissions in real-time, and provide automated strategies for interference mitigation. AI can simulate the electromagnetic environment of complex systems, allowing for more effective placement of shielding components and the development of novel shielding designs.

Market Overview

The global EMI shielding market for electronics encompasses various materials, components, and techniques designed to prevent electromagnetic interference and ensure electromagnetic compatibility (EMC) in electronic systems. Solutions in this market include metal foils, board-level cans, conductive coatings and paints, gaskets and elastomers, conductive fabrics and tapes, absorbers, and composite laminates. These are utilized across a range of applications, including consumer devices, telecommunications and 5G equipment, automotive and electric vehicles (EVs), industrial IoT, medical devices, aerospace and defense, as well as data center computing. The growth of this market is driven by several factors, including the increasing density of electronics, higher frequencies associated with 5G and millimeter wave technologies, the electrification of vehicles, stricter EMC regulations, and a need for lightweight shielding solutions suitable for plastic enclosures.

What Are the Trends in the EMI Shielding for Electronics Market?

- Stricter Compliance and Regulations:Heightened awareness and stringent government regulations regarding electromagnetic compatibility (EMC) necessitate effective shielding solutions to mitigate electromagnetic pollution and guarantee device safety and performance.

- Expansion of the Automotive Industry:The expanding automotive electronics sector, including advanced driver-assistance systems (ADAS) and anti-lock braking systems (ABS), requires high-performance EMI shielding to safeguard the safety and reliability of critical components.

- Telecommunications and 5G:The rollout of 5G networks and telecommunication infrastructure demands effective shielding to maintain signal quality and prevent interference that could impact network performance.

- Rapidly Growing Healthcare Sector: The rise of electronic medical devices, imaging equipment, and connected healthcare infrastructure makes EMI shielding essential for the safe and reliable operation of sensitive medical equipment.

- Technological Advancements: Innovations in materials science, including the development of nanomaterials and advanced conductive polymers, are paving the way for more effective and versatile EMI shielding solutions, further propelling market growth.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product/Technique, Application, End-User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Proliferation and Complexity of Electronic Devices

The main driver behind the EMI shielding for electronics market expansion is the growing proliferation and complexity of electronic devices. This is particularly visible in the deployment of 5G networks and the rise of electric and autonomous vehicles (EVs/AVs). These advancements necessitate robust EMI shielding to maintain signal integrity and avert interference. The higher frequencies utilized in 5G networks and the expansion of the Internet of Things (IoT) generate more intense and complex electromagnetic signals, which demand stronger shielding solutions. As electronic devices shrink and become more intricate, their internal components are increasingly susceptible to interference, resulting in a rising demand for sophisticated EMI shielding solutions.

Restraint

High Cost Associated with Advanced Materials and Their Implementation

A primary challenge in this market is the high cost associated with advanced materials and their implementation. The increasing complexity and miniaturization of electronic devices require tailored and sophisticated shielding solutions. Advanced materials like conductive fabrics and specialized composites can be expensive, leading to higher production costs for manufacturers, particularly in cost-sensitive consumer electronics. Moreover, integrating EMI shielding into product design and manufacturing processes adds complexity, potentially resulting in longer lead times and elevated production costs.

Opportunity

Development and Application of Multifunctional and Sustainable Materials

A key opportunity in the EMI shielding for electronics market lies in the development and application of multifunctional and sustainable materials to meet the growing demands of interconnected technologies and stricter regulations. This includes exploring the use of nanomaterials such as graphene and carbon nanotubes for enhanced shielding, as well as creating eco-friendly and recyclable shielding solutions. Additionally, integrating multiple functions, such as sensing capabilities, into shielding materials represents a significant trend. The incorporation of nanomaterials like graphene and carbon nanotubes offers superior shielding effectiveness, enabling more compact and high-performance solutions for smaller devices.

Material Type Insights

What Made the Metal Foil and Sheets Segment Lead the EMI Shielding for Electronics Market in 2024?

The metal foil and sheets segment led the market in 2024. This is mainly because metals naturally have high electrical conductivity and the ability to reflect and absorb electromagnetic (EM) radiation, providing superior shielding compared to other materials like polymers or coatings. Metal sheets are highly durable and reliable, which is crucial for many critical applications such as aerospace and medical devices, where safety and consistent performance are essential. The inherent properties of metals deliver high electromagnetic shielding effectiveness (SE), capable of reducing a significant amount of EM radiation even at thin foil thicknesses, making them a versatile solution for shielding across various industries.

The absorber materials and advanced composites segment is growing the fastest due to the rising demand for lightweight, high-performance, and specialized EMI shielding solutions driven by advancements in nanotechnology, the proliferation of complex electronics in automotive and consumer devices, and the need for flexible, thin shielding materials. Nanomaterials like carbon nanotubes, graphene, and magnetic nanoparticles provide superior, high-performance shielding in an ultra-thin and lightweight form, which is vital for modern electronics. Progress in absorber materials allows for tailored engineering solutions targeting specific frequency ranges, such as ferrite-based absorbers for lower frequencies that offer optimized performance.

Product/Technique Insights

How Did the Board-Level Shielding Segment Lead the EMI Shielding for Electronics Market in 2024?

The board-level shielding segment led the market in 2024. This is mainly because of miniaturization trends, where dense electronics require localized, effective shielding to prevent intra-device interference and ensure reliability. As devices become smaller, the risk of EMI from closely packed, high-frequency components increases, necessitating targeted shielding solutions right at the source. Solutions like cans and lids provide cost-effectiveness, easy application, and reduced weight compared to larger, system-level shields. The demand for robust, integrated solutions for smartphones, laptops, and other compact devices has driven this segment's dominance, with recent developments focusing on hybrid materials and simplified application processes.

The coatings for plastic housings and absorbers segment is expected to grow rapidly due to increasing demand for lightweight, cost-effective, and versatile EMI shielding solutions for plastic-enclosed electronics. This growth is driven by factors such as the expansion of 5G and IoT devices, automotive advancements, and strict regulatory requirements. These coatings deliver effective shielding without the weight and design limitations of traditional metal enclosures, while new nanomaterials and techniques improve their performance and adaptability for complex modern devices, providing broader protection across various frequencies.

Application Insights

How Did the Consumer Electronics and Mobile Devices Segment Dominate the EMI Shielding for Electronics Market in 2024?

The consumer electronics and mobile devices segment led the market in 2024. This is mainly due to the rapid growth of interconnected, high-performance devices like smartphones, wearables, and IoT gadgets, which need strong shielding to maintain signal integrity and prevent interference in crowded electromagnetic environments, especially with the rise of 5G and Wi-Fi 6 technologies. Modern electronic devices are more sensitive and have more complex, compact designs, making them more vulnerable to EMI and requiring enhanced protection. The ongoing trends of automation, digitization, and the Internet of Things (IoT) are further accelerating the adoption of digital devices.

The automotive and EV/ADAS segment is expected to experience the fastest growth. This surge is mainly because the growing complexity of electronic systems in EVs, autonomous vehicles, and advanced driver-assistance systems creates significant EMI challenges. EVs generate substantial EMI from high-power components like motors and inverters, while ADAS relies on numerous sensors, radar, cameras, and communication systems that are sensitive to interference. This complexity requires robust EMI shielding to prevent malfunction and ensure passenger safety. Stricter global regulations on emissions and electromagnetic compatibility are also compelling manufacturers to adopt advanced shielding solutions.

End-User Industry Insights

What Made the Electronics OEMs Segment Lead the EMI Shielding for Electronics Market in 2024?

The electronics OEMs segment was dominant in 2024. This is largely because consumer electronics need reliable solutions to prevent signal interference from the increasing number of small, high-performance, interconnected devices like smartphones and wearables. The rising complexity and sensitivity of modern electronic systems, fueled by 5G, automation, and IoT trends, demand sophisticated EMI shielding to ensure reliability and compliance with strict regulations. Global safety standards also require devices to meet specific EMI emission and immunity levels, driving demand for advanced shielding.

The automotive OEMs/Tier-1s segment is projected to be the fastest-growing end-user during the forecast period. This growth is driven by the proliferation of advanced electronics in EVs and autonomous driving systems, which demand extensive shielding to prevent electromagnetic interference (EMI) affecting sensitive components. The growth is further fueled by increased vehicle complexity, government incentives for EV adoption, and the need for reliable performance in vehicle electronics such as ADAS, infotainment, and V2X modules. Government initiatives and strict emission standards are pushing the adoption of electric vehicles, which in turn boosts the need for EMI shielding in the automotive industry.

Distribution Channel Insights

How Did the Direct-To-OEMs and Tier-1 Suppliers Segment Dominate the EMI Shielding for Electronics Market in 2024?

The direct-to-OEMs and Tier-1 suppliers segment led the market in 2024. This dominance is mainly because it enables customized solutions for critical electronic components, facilitates direct technical collaboration on complex product designs, and ensures compliance with strict industry standards for high-reliability applications like automotive and aerospace. OEMs and Tier-1 suppliers require highly specialized EMI shielding solutions tailored to their specific, often complex, electronic designs. Collaboration ensures that shielding materials and designs meet precise requirements. This direct approach simplifies the supply chain for large manufacturers, promotes innovation, and ensures the timely integration of shielding technology into final products, especially in advanced EV components and next-generation aerospace systems.

The EMS/ODM design-in channel segment is the fastest-growing in the market as it aligns with the increasing complexity, miniaturization, and technological innovation in electronic devices like IoT and 5G gadgets. EMS/ODM companies often design and manufacture these devices, integrating EMI shielding early in the product development process. This proactive approach optimizes performance, reduces costs, and allows rapid market entry for OEMs. EMS and ODM firms offer comprehensive services, from concept and design to manufacturing and assembly, ensuring EMI shielding is incorporated as a core part of the final product.

Regional Insights

How Did the Asia Pacific Region Dominate the EMI Shielding for Electronics Market in 2024?

Asia-Pacific currently dominates the EMI shielding for electronics market, primarily due to its status as a global manufacturing hub for electronics. This dominance is further supported by strong demand from rapidly growing sectors, including consumer electronics, telecommunications, and electric vehicles. Government initiatives promoting innovation, cost-effective production, and increased research and development (R&D) are contributing to this growth.

Policies in the Asia Pacific actively support technological innovation and provide incentives for local manufacturing, further bolstering the market. An increasing focus on miniaturization, lightweight designs, and advanced materials such as conductive coatings, metal composites, and nanomaterials also fuels R&D and market expansion. Lower production costs in the region, combined with a robust manufacturing infrastructure, attract global demand for EMI shielding solutions.

- In May 2023, PPG announced a USD 44 million investment to upgrade five powder coating facilities in the U.S. and Latin America to meet the rising demand for sustainably advantaged products. “This focus on powder coatings allows us to lead in the fastest-growing coatings technology,” said Marizeth Carvalho, global director of powder coatings.(Source: https://www.ppg.com)

China EMI Shielding for Electronics Market Trends

China holds a dominant and multifaceted role in the market. The country's vast manufacturing base drives global demand for EMI shielding materials used in consumer electronics, automotive components, and telecom infrastructure, particularly with the rollout of 5G. Simultaneously, China's large domestic market and rapid advancements in EVs and IoT devices intensify the need for high-performance shielding solutions within its borders. This dual dynamic of production and consumption, supported by government initiatives and significant R&D investments, positions China as a central driver of market growth, despite challenges such as fierce local competition and intellectual property risks.

India EMI Shielding for Electronics Market Trends

India is evolving within the global market, largely driven by its burgeoning electronics manufacturing sector and the widespread rollout of 5G infrastructure. Government initiatives like Make in India and the production-linked incentive scheme are attracting investments and boosting local electronics production across various segments, including consumer electronics, EVs, and defense. The proliferation of connected devices, smart technologies, and advanced automotive electronics is increasing the demand for high-performance EMI shielding solutions to ensure reliability and regulatory compliance.

Why is North America Considered the Growing Region in the EMI Shielding for Electronics Market in 2024?

North America is the fastest-growing region in the EMI shielding for electronics market during this forecast period. This growth is attributed to significant government investments in defense and data centers, rapid adoption of electric vehicles and advanced electronics, and strict regulatory requirements for electromagnetic compatibility. There is also a growing demand for EMI shielding in medical devices and healthcare applications, driven by increased innovation and the need to ensure the reliability and safety of electronic medical equipment.

The growing adoption of EVs in North America necessitates robust EMI shielding to prevent interference between electronic components within vehicles and external electromagnetic fields. The early adoption of advanced electronics, such as 5G, IoT devices, and smart home technologies, further contributes to the region's high demand for innovative shielding materials and solutions.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics)

This encompasses the sourcing and supply chain for various materials used to block electromagnetic interference in electronic devices. Raw materials range from traditional metals like copper and aluminum used in enclosures and foils, to modern composites and flexible materials such as conductive coatings, carbon-based fillers (graphene, nanotubes), and particle-filled silicones for gaskets.

Key Players: Parker Hannifin Corporation, Henkel AG and Co. KGaA, Laird Performance Materials, Tech-Etch, Inc., RTP Company

- Component Fabrication and Machining

This involves the design, manufacturing, and application of specialized, precisely engineered conductive or magnetic materials that form a protective barrier around sensitive electronic devices. Through processes like cutting, bending, molding, and applying conductive coatings, companies in this market create EMI shielding solutions as gaskets, metal enclosures, and tapes.

Key Players: Parker Hannifin, Laird, Henkel AG and CO. KGAA, PPG Industries Inc.

- Testing and Certification

The testing, conducted by accredited third-party labs, involves measuring both the device's radiated and conducted emissions, as well as its immunity to external electromagnetic disturbances. Successful certification is essential for product reliability, safety, and market access, making the ecosystem of testing services a vital part of the electronics industry.

Key Players: Eurofins E&E, CSA Group, DEKRA, TÜV SÜD, Henkel AG and Co. KGaA

- Installation and Commissioning

This focuses on the specialized services required to integrate, test, and validate EMI shielding solutions for electronics. Driven by increasing device complexity, 5G proliferation, and stringent EMC regulations, this market ensures electronic products function reliably without electromagnetic interference.

Key Players: Henkel AG and Co. KGaA, Laird Technologies, Parker Hannifin, ETS-Lindgren

- Distribution and Sales

The distribution and sales ecosystem includes raw material suppliers, manufacturers like 3M and Henkel, and distributors like DigiKey, serving end-users in consumer electronics, automotive, and healthcare. Products like conductive coatings, gaskets, and tapes are sold through various channels to meet the diverse shielding needs of these industries.

Key Players: Tech-Etch, Inc., Schaffner Holding AG, Laird Technologies, Parker Hannifin

- Maintenance and After-Sales Service

These services refer to the crucial practice of restoring and maintaining the integrity of a device's EMI protection during and after service. During repairs or internal component replacement, a product's native shielding, which uses conductive materials like gaskets, coatings, or specialized tapes, can be compromised.

Key Players: Henkel AG and Co. KGaA, PPG Industries, Inc., Parker Hannifin, Dow Inc., Schaffner Holding AG

- Product Lifecycle Management

Product lifecycle management for the market manages the entire lifecycle of shielding solutions, from initial design and material selection to manufacturing, implementation, and eventual disposal. It integrates people, data, processes, and business systems to ensure electronic devices meet EMC standards in an increasingly wireless and miniaturized world.

Key Players: Siemens Digital Industries Software, Dassault Systèmes, Laird Performance Materials, Leader Tech Inc.

EMI Shielding for Electronics Market Comapnies

- 3M Company

- Parker Hannifin Corp. (Chomerics)

- Henkel AG and Co. KGaA

- Laird Performance Materials (acquired by DuPont)

- PPG Industries, Inc.

- Tech-Etch, Inc.

- ETS-Lindgren

- Nolato AB

- Kitagawa Industries America, Inc.

- RTP Company

- Schaffner Holding AG

Leaders' Announcement

- In January 2025, Mobix Labs, Inc. acquired SCP Manufacturing, which boosted its operational efficiency and market presence in the aerospace and defense sectors. “This acquisition is key to redefining our industry with essential technologies, stated CEO Fabian Battaglia. SCP supplies critical components for military platforms and commercial applications.(Source: https://www.businesswire.com)

Recent Developments

- In February 2025, Tech Etch launched the 2100 Series EMI Shielding Tape to address modern electromagnetic interference challenges. This dual-layered knitted wire mesh tape offers flexibility and effectiveness, making it suitable for irregular surfaces and applications such as cable shielding. “Our 2100 Series delivers the signature Tech Etch quality with enhanced versatility,” said Mark Strangie, Vice President of Sales and Marketing.

(Source: https://techetch.com) - In February 2025, Molex introduced a new range of EMI-filtered interconnects and RF components designed for aerospace and defense applications. This lineup includes D-Sub Pi adapters and fixed RF coaxial attenuators. “These innovations enhance system reliability while providing a comprehensive solution for demanding environments,” noted Steven DeFrancesco, general manager of RF at Molex.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Material Type

- Metal Foils and Sheets

- Conductive Coatings and Paints

- Conductive Fabrics and Tapes

- EMI Gaskets and Elastomers

- Laminates and Composites

- Absorber Materials and Advanced Composites

- Conductive Polymers and Inks

By Product/Technique

- Board-Level Shielding

- Cable Shielding

- Enclosure/Housing Shielding

- Coatings for Plastic Housings and Absorbers

- Gaskets, O-rings, and Vent Panels

- Conductive Tapes and Adhesives

- Absorbers and Noise Suppression Sheets

By Application

- Consumer Electronics and Mobile Devices

- Telecom and 5G/Networking Infrastructure

- Automotive and EV/ADAS

- Industrial Electronics and IoT

- Medical Devices

- Aerospace and Defense

- Data Centers and High-Performance Computing

By End-User Industry

- Electronics OEMs

- Telecom Equipment Vendors

- Automotive OEMs and Tier-1s

- Industrial OEMs and Automation

- Medical OEMs

- Aerospace and Defense Primes

By Distribution Channel

- Direct to OEMs/Tier-1s

- Distributors and Value-Added Resellers

- EMS/ODM Design-In Channels

- Online/E-procurement Platforms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting