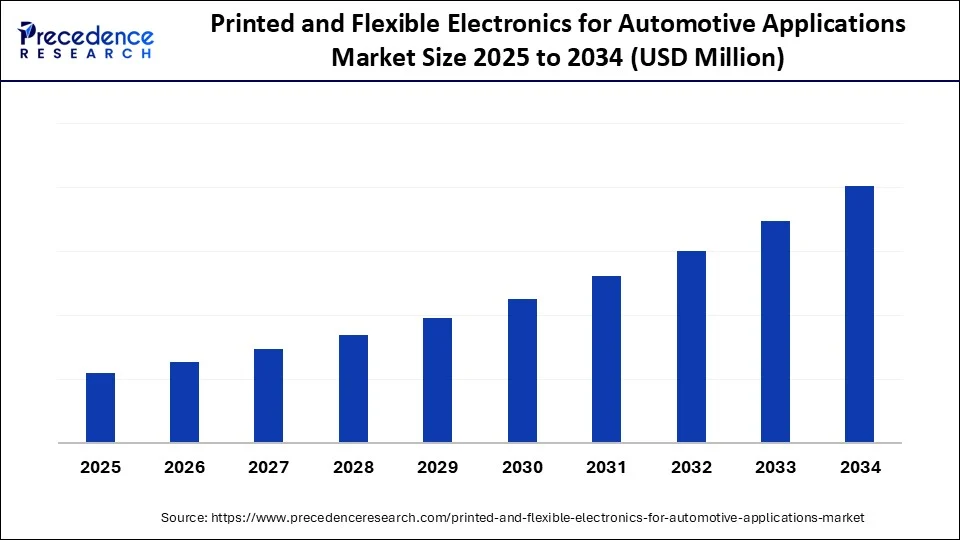

Printed and Flexible Electronics for Automotive Applications Market Size and Forecast 2025 to 2034

Discover how the printed and flexible electronics for automotive applications market is driving smarter, lighter, and more efficient vehicles. The market growth is attributed to rising demand for lightweight, energy-efficient electronic systems that enhance functionality, safety, and design flexibility in next-generation vehicles.

Printed and Flexible Electronics for Automotive Applications MarketKey Takeaways

- Asia Pacific dominated the global printed and flexible electronics for automotive applications market in 2024.

- The Middle East and Africa is expected to grow at the fastest CAGR from 2025 to 2034.

- By component type, the printed sensors segment held the major market share in 2024.

- By component type, the printed heaters segment is projected to grow at a significant CAGR between 2025 and 2034.

- By material type, the conductive inks segment contributed the biggest market share in 2024.

- By material type, the dielectric and encapsulation materials segment is expanding at a significant CAGR in between 2025 and 2034.

- By manufacturing techniques, the screen printing segment led the market in 2024.

- By manufacturing techniques, the roll-to-roll (R2R) segment is expected to grow at a significant CAGR over the projected period.

- By vehicle type, passenger vehicles contributed the highest market share in 2024.

- By vehicle type, electric vehicles segment is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the interior electronics (HMI, ambient lighting, HVAC controls) segment held the major market share in 2024.

- By end user, the lighting (OLED tail lamps, dashboards) segment is projected to grow at the highest CAGR between 2025 and 2034.

- By end use, the OEM segment accounted for the major market share in 2024.

- By end use, the aftermarket & retrofit services segment is projected to grow at the fastest CAGR between 2025 and 2034.

Impact of Artificial Intelligence on the Printed and Flexible Electronics for Automotive Applications Market

Artificial Intelligence is the key to enhancing printed and flexible electronics applications in the automotive field, supporting smarter design, faster development, and more reliable systems. Due to the assistance of AI-based tools, engineers can design flexible circuits that choose optimal placement and patterns in vehicles. The testing of sensors, antennas, and lights after Printing can be simulated by predictive modeling and greatly diminish time-probationary periods. Furthermore, in quality control, machine learning is also used by automotive suppliers, where defects in a print are detected using computer vision during the roll-to-roll printing process.

Market Overview

The printed and flexible electronics for automotive applications market includes the design, manufacturing, and integration of thin, lightweight, bendable electronic components onto flexible substrates for automotive systems. These electronics are fabricated using additive or roll-to-roll (R2R) printing processes, enabling new form factors, weight savings, and cost-effective electronics integration in interiors, infotainment, lighting, safety systems, powertrains, and EV battery management. This market represents a convergence of materials science, advanced manufacturing, and automotive innovation, supporting the transition to smart, electric, and lightweight vehicles.

The needs and demands for real-time monitoring of vehicle health surge, which is expected to translate into increased growth of printed and flexible electronics in the market. These thin-film circuits and sensors are directly integrated onto flexible substrates, enabling lightweight and conformable vehicle components that can be used in automotive systems. The Organic and Printed Electronics Association (OE-A) estimated a 13% growth in revenue for 2024, compared to 2023, as well as another 17% growth in 2025, with more than 50% of industry players planning production investments. Roll-to-roll printable heater and sensor modules were noted as suitable for battery conditioning, as they increase electric vehicle efficiency and safety. Furthermore, the increasing levels of in-cabin biosensing and built-in adaptive controls are likely to spur market growth.

(Source: https://oe-a.org)

Printed and Flexible Electronics for Automotive Applications Market Growth Factors

- Growing Demand for Automotive Interior Personalization: Rising consumer expectations for customized ambient lighting, HMI layouts, and display aesthetics are boosting the adoption of flexible electronics for tailored cabin experiences.

- Driving Innovation in In-Mold Electronics (IME): The integration of printed circuitry into molded interior panels is fueling next-generation design capabilities, enabling compact, multifunctional surfaces in vehicles.

- Rising Integration of Transparent Conductive Films: The increasing use of transparent conductive materials in head-up displays and smart windows is propelling demand for flexible electronics with high optical clarity.

- Boosting Demand for Real-Time Vehicle Health Monitoring: The adoption of printed strain and temperature sensors for predictive maintenance and component diagnostics is growing across both ICE and EV platforms.

Market Scope

| Report Coverage | Details |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Middle East and Africa |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component Type, Material Type, Manufacturing Technique, Vehicle Type, Application Area, End Use and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How is the Shift Toward Electric Vehicles Driving the Integration of Printed and Flexible Electronics in Automotive Systems?

The increasing demand for vehicle electrification is expected to drive the adoption of printed and flexible electronics in automotive systems, fueling the market. The electrification of vehicles and the subsequent rise in demand for electrification contribute to the increasing use of printed and flexible electronics in automotive systems. Automakers are focusing on lightweight or space-saving parts to increase the battery range and enhance the integration capabilities of an electric vehicle's (EV) system.

Achieving the above goals is facilitated by printed electronics, including flexible circuit boards, pressure sensors, and heating elements. This allows for minimizing the width and complexity of conventional wiring harnesses. At the start of 2024, Fraunhofer FEP claimed success in the development of thin-film encapsulation technologies. These are optimized for flexible OLEDs and circuit layers utilized in EV dashboards and ambient lighting. As the manufacturers of EVs expand their production to Asia, Europe, and North America, tier-1 suppliers are integrating flexible electronics to increase functionality and ease of design. Furthermore, the high demand for flexible sensor systems that match the signal transformation of the automotive industry with structural battery architecture is fueling the market.

(Source: https://www.oled-info.com)

Restraint

Material Compatibility Issues with Existing Automotive Systems Hamper Market Expansion

Material compatibility limitations with existing automotive systems are expected to hamper the market. Interfacing is often problematic when integrating printed electronics into existing automotive architectures due to concerns regarding bonding, thermal management, and electrical interfaces. Conventional systems with metal or glass substrates have contrasting mechanical and thermal properties to flexible substrates. These inefficiencies cause mismatch integration, and special adhesives, protection layers, or insulating layers are required, thus further hampering the market.

Opportunity

How are Scalable and Cost-Effective Manufacturing Methods Boosting the Use of Printed Electronics in the Automotive Industry?

High demand for cost-efficient manufacturing solutions is estimated to boost the implementation, creating immense opportunities for printed electronics in automotive applications market. The application of printed electronics in automobiles is estimated to increase due to the high demand for cost-effective manufacturing solutions. Processes, such as roll-to-roll and additive manufacturing, scale printed electronics production and make it cheaper to manufacture with shorter lead times.

Automotive Tier I companies enjoy such advantages that they can adapt to high-stress production cycles without compromising product and design flexibility. In 2024, the Centre for Process Innovation (CPI UK) successfully validated the roll-to-roll printing of functional circuits. These are being incorporated into automotive touch and lighting modules and, in the process, save more than 30% of energy and materials. Furthermore, novel integration techniques for multilayer printed electronics in control units can realize time savings in assembly without degradation, further propelling the market.

Component Type Insights

Why Did the Printed Sensors Dominate the Market in 2024?

The printed sensors segment dominated the printed and flexible electronics for automotive applications market in 2024 due to the widespread popularity of these sensors in various systems, including safety, comfort, and performance. The car makers have implemented location sensors using pressure, temperature, and closeness into several contorted and compact interior surfaces in zones. This helps with driver monitoring systems, seat occupancy, and the control of HVAC.

The sensors could feature lightweight and flexible form factors that proportionally fit into irregular. Some of the major OEMs, such as Ford, BMW, and Hyundai Mobis, integrated printed pressure and capacitive touch sensors to reinforce advanced driver-assistance systems (ADAS) and user interface functions.

In June 2025, Sony Semiconductor Solutions Corporation (SSS) announced the launch of the IMX479, a stacked direct Time of Flight (dToF) SPAD depth sensor designed for automotive LiDAR systems, offering high-resolution and high-speed performance.Furthermore, such developments underscore that printed sensors are at the forefront of fulfilling increasingly intense real-time needs, further fueling their demand in the coming years.

(Source: https://www.engineering.com)

The printed heaters segment is expected to grow at the fastest rate in the coming years, owing to the increasing emphasis on energy-efficient thermal control in vehicles. Its parts allow for energy-efficient, low-voltage heating of individual sections, such as chairs and steering wheels. Printed heaters minimize the impact on the vehicle's power system, as they allow for precise control of the heat with minimal power consumption. Furthermore, firms such as DuPont, LG Electronics, and TE Connectivity have developed heater-integrated modules that enhance interior comfort and battery efficiency, thereby boosting segment growth.

Material Type Insights

How Does the Conductive Inks Segment Dominate the Market in 2024?

The conductive inks segment held the largest revenue share of the printed and flexible electronics for automotive applications market in 2024. This is due to their secure low-resistance electrical pathway connecting numerous printed automotive elements. Silver-based inks remained a material of preference where quick signaling was necessary, such as in driver-assistance systems and infotainment controls. Moreover, these efforts were signs of the long-term momentum in the technology and the wide acceptance of conductive inks in high-precision, mission-critical automotive electronics.

The dielectric & encapsulation segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing demand for durability, insulation, and environmental protection in flexible automotive electronics. Such materials shield printed circuitry against moisture, heat, and physical abuse. Furthermore, these developments indicate a clear trend toward versatile, safeguarding material systems such as dielectric and encapsulation materials.

Manufacturing Technique Insights

What Made Screen Printing the Dominant Segment in the Printed and Flexible Electronics for Automotive Applications Market in 2024?

The screen printing segment dominated the market with a significant share in 2024, primarily due to its extensive use in commercial printing of durable and economical printed parts for automobiles. The process enabled the application of thick, durable conductive layers, thereby facilitating the development of printed heaters and touch sensors integrated into dashboards, seats, and control panels. Automotive manufacturers started using screen printing to manufacture capacitive touch panels and printed heating film for EV models. Additionally, screen printing was dominant due to its repeatability, low cost, and scalability, especially of components in the coming years.

The roll-to-roll (R2R) sub-segment is expected to grow at the highest CAGR in the upcoming period. It may create the capacity to produce lightweight, flexible electronics materials at high speed and on a large scale. This is an ongoing printing technology that enables the production of multilayered electrical components and OLED lighting strips on flexible substrates.

Recently, the Holst Centre and IMEC announced pilot-line-level upgrades, which have resulted in improved registration accuracy and print uniformity for large-format R2R systems, targeting next-generation vehicle interiors. Such capability to help with complex designs, resulting in minimal waste output and a fast turnaround, is expected to accelerate the implementation of R2R printing within connected and energy-efficient vehicle systems.

Vehicle Type Insights

Why Does the Passenger Vehicles Segment Dominate the Market in 2024?

The passenger vehicles segment held the largest revenue share in the printed and flexible electronics for automotive applications market in 2024, as evidenced by the incorporation of printed and flexible electronics in infotainment systems, HVAC controls, and motorist-help interfaces. In mid-range and high-range passenger cars, automakers concentrated on the user experience by designing responsive touch surfaces, ambient lighting, and materials infused with sensors. Furthermore, the growing number of passenger vehicles is expected to fuel the segment growth in the coming years.

The electric vehicles segment is expected to grow at the fastest rate during the projection period due to the increasing demand for lightweight, energy-efficient, and space-saving electronic solutions. The EV platforms extensively utilize a flexible foundation to monitor battery and thermal control and simplify in-cabin controls. In 2024, printed heaters and flexible circuit assemblies were tested at the National Renewable Energy Laboratory (NREL) and CPI UK, confirming the efficiency of the system when integrated into EV battery packs and climate control systems.

Firms like LG Electronics, Hyundai Mobis, and Tesla have invested in printed sensing technologies for inverters and power electronics enclosures to optimize thermal dissipation and space. In 2024, at the TechBlick event, CEA-Leti presented printed encapsulated electronic elements designed to enable high-voltage EV systems. BMWK Germany also announced funding investments in R&D for low-mass printed modules to extend EV range and modularity. Additionally, the advanced roadmap towards EV production suggests that the integration of printed and flexible electronics will play a central role in creating more efficient vehicles.

Application Area Insights

What Made Interior Electronics the Dominant Segment in the Market in 2024?

The interior electronics segment dominated the printed and flexible electronics for automotive applications market in 2024. This is primarily due to the increasing addition of printed and flexible components to human-machine interfaces (HMI), ambient lighting, and HVAC control systems. Vehicle manufacturers focused on providing multi-sensory cockpit experiences through printed capacitive touch sensors and electroluminescent films. Additionally, the scalability and adaptability of this circuitry across infotainment, ease, and safety tools further fuels the segment in the coming years.

The lighting segment is projected to grow at a rapid pace in the market in the coming years, owing to soaring consumer demand for new illumination sources that are energy-efficient and flexible in design and appearance. Printed OLEDs, bendable electroluminescent strips, and agglomerated micro-LED arrays. They are allowing ultra-thin programmable lighting panels in the dash, tail lamps, and cabins. Automotive-grade printed OLED tail lights reach matching luminance over highly complex shapes. This is aimed at application in electric cars, occupancy utility vehicles (SUVs), and crossovers. Moreover, printed lighting solutions are expected to lead adoption rates in premium, electric, and autonomous vehicle systems, thereby further boosting the segment.

End Use Insights

Why Did the OEMs Segment Lead the Market?

The OEMs segment held the largest revenue share in the printed and flexible electronics for automotive applications market in 2024, as they are at the forefront of incorporating printed and flexible electronics into vehicle systems assembled in the factory. These suppliers worked closely with car makers to pre-implant printed sensors, touch interaction elements, and heating elements in the first manufacturing step of the vehicle.

These parts also help to meet automotive-qualified standards, and system design integrations are compromised. In 2024, Continental, Bosch, and Denso increased production of integrated printed modules for infotainment and thermal management systems on several passenger and electric vehicles. Moreover, the higher throughput and quality control of OEM-oriented production, achieved through screen and roll-to-roll printing, further fuels the segment.

The aftermarket & retrofit services segment is expected to grow at the highest CAGR in the coming years, owing to increasing consumer demand for customized vehicles, accessories, and smart additions. Printed electronics offer low-weight, cost-effective solutions to add premium lighting, infotainment, and interior ambient control to older vehicle models. Furthermore, the growing demand for cost-effective vehicle improvement solutions and the surge in availability of plug-and-play printed kits will fuel the market.

Regional Insights

What Made Asia-Pacific the Dominant Region in the Market?

The Asia Pacific led the printed and flexible electronics for automotive applications market, capturing the largest revenue share in 2024, driven by increased vehicle and electronic component production. The region is the largest manufacturing hub, with the increased development and adoption of electric and connected cars. Large economies, such as China, Japan, and South Korea, have focused on the adoption of printed sensors, OLED lights, and in-cabin flexibility in circuits, both in passenger cars and electric cars. In 2024, China Automotive Technology and Research Center (CATARC) and Japan's NEDO announced pilot projects in field testing of printed pressure sensors and printed heater modules to control thermal management in EVs.

Major local producers of equipment, such as LG Electronics, Samsung, and Panasonic, actively cooperated with carmakers to integrate printed electronics in user interfaces. ITRI, Taiwan, and KITECH, South Korea, also demonstrated roll-to-roll and screen-printed circuit modules that fit curved interior surfaces in a high-volume model. Additionally, incremental developments and intelligent factory production expenditures will further strengthen the position of the Asia-Pacific region as it heads into the next product cycle.

The Middle East & Africa is anticipated to grow at the fastest rate in the market during the forecast period, owing to an increase in investments in automotive assembly, clean mobility systems, and smart manufacturing facilities. Governments in the UAE, Saudi Arabia, and South Africa have initiated strategic projects to attract EV manufacturers and facilitate automotive localization. Local manufacturers considered partnerships with global vendors, including Bosch and DuPont, to fabricate printed electronics assembly lines tailored to the desert environment, where resistance to heat and reliability are crucial parameters.

TechBlick MENA 2024 exhibited an upward trend in demand for retrofitting transport companies in the commercial sector with printed ambient lighting solutions, in line with national targets to achieve smart mobility goals. CSIRO and Fraunhofer FEP have also provided technical assistance to printed thermal interfaces. They have been tested on CSIRO Middle Eastern fleet vehicles to show greater durability against solar load simulations. Furthermore, continuous funding and local manufacturing incentives will accelerate the adoption of printed electronics in both the public and private transportation sectors in the Middle East and Africa.

Printed and Flexible Electronics for Automotive Applications Market Companies

- TE Connectivity

- LG Display Co., Ltd.

- TactoTek

- DuPont de Nemours, Inc.

- Canatu Oy

- Panasonic Holdings Corporation

- Toppan Inc.

- Molex (Koch Industries)

- Henkel AG & Co. KGaA

- E Ink Holdings Inc.

- FlexEnable Ltd.

- Samsung Display

- Nissha Co., Ltd.

- Printed Electronics Ltd. (PE Ltd.)

- PolyIC GmbH & Co. KG (KURZ Group)

- Nano Dimension Ltd.

- QustomDot

- Agfa-Gevaert Group

- Blue Spark Technologies

- Voltera Inc.

Recent Developments

- In January 2024, Infineon Technologies and Aurora Labs introduced AI-powered solutions at CES 2024 to enhance the safety and reliability of critical vehicle systems using printed and flexible electronic integration. The partnership leverages Aurora Labs' LOCI AI on Infineon's AURIX TC4x MCUs to enable predictive performance management across braking, steering, and airbag modules.

- In May 2025, Printed Electronics Now highlighted the market's evolution from basic printed circuits to advanced flexible hybrid electronics, where printed and silicon-based components are integrated. This shift has accelerated commercial adoption in automotive interiors and system-level electronics, marking a major transformation in how automakers apply printed electronics.

- In March 2025,Renesas Electronics launched the DA14533, a compact, automotive-qualified Bluetooth Low Energy SoC. Designed for tire pressure monitoring, keyless entry, and wireless sensor networks, it supports extended temperatures and reduced power consumption—expanding the role of printed and flexible electronics in battery management and vehicle connectivity systems.

(Source: https://www.inkworldmagazine.com)

(Source: https://www.inkworldmagazine.com)

(Source: https://www.renesas.com)

Segments Covered in the Report

By Component Type

- Printed Sensors

- Pressure, temperature, occupancy, humidity, etc.

- Printed Antennas

- Flexible Displays

- Printed Heaters

- OLED/LED Lighting Panels

- Flexible Batteries and Supercapacitors

- Printed Circuits/Interconnects

By Material Type

- Conductive Inks (silver, copper)

- Substrates (PET, PEN, polyimide, paper)

- Organic Semiconductors

- Dielectric & Encapsulation Materials

By Manufacturing Technique

- Screen Printing

- Inkjet Printing

- Gravure & Flexographic Printing

- Aerosol Jet & 3D Printing

- Roll-to-Roll (R2R) Printing

By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Electric Vehicles (EVs)

By Application Area

- Interior Electronics (HMI, ambient lighting, HVAC controls)

- Infotainment & Displays

- Battery & Energy Storage (BMS, flexible batteries)

- ADAS & Safety Sensors

- Smart Surfaces & Decorative Panels

- Lighting (OLED tail lamps, dashboards)

By End Use

- OEMs (Tier 1 Automotive Suppliers)

- Aftermarket & Retrofit Services

- R&D Labs and Prototyping Facilities

By Region

- Asia-Pacific

- Europe

- North America

- South America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting