Satellite-based 5G Network Market Size and Forecast 2025 to 2034

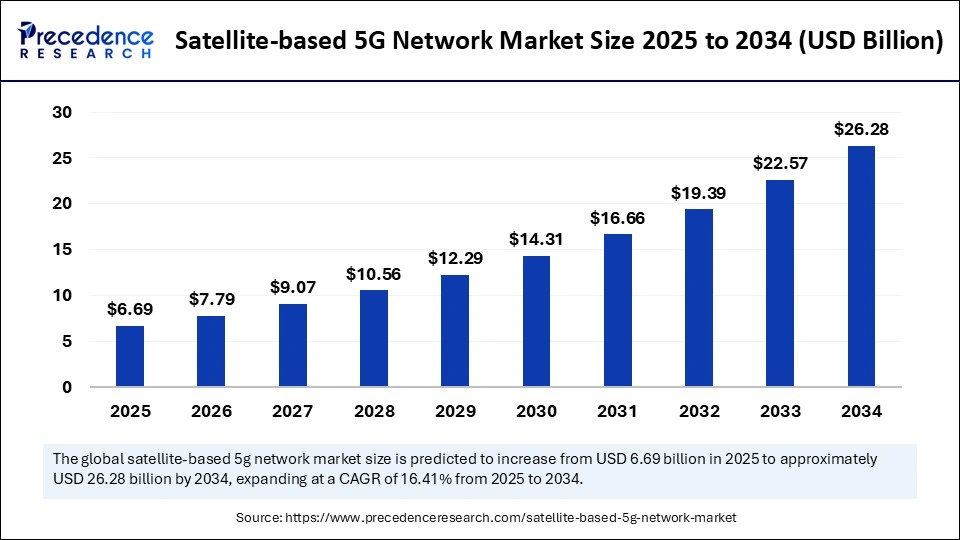

The global satellite-based 5G network market size accounted for USD 5.75 billion in 2024 and is predicted to increase from USD 6.69 billion in 2025 to approximately USD 26.28 billion by 2034, expanding at a CAGR of 16.41% from 2025 to 2034.The market growth is attributed to the increasing need for reliable, high-speed connectivity in remote and underserved regions.

Satellite-based 5G Network Market Key Takeaways

- In terms of revenue, the market is valued at $ 6.69 billion in 2025.

- It is projected to reach $ 26.28 billion by 2034.

- The market is expected to grow at a CAGR of 16.41% from 2025 to 2034.

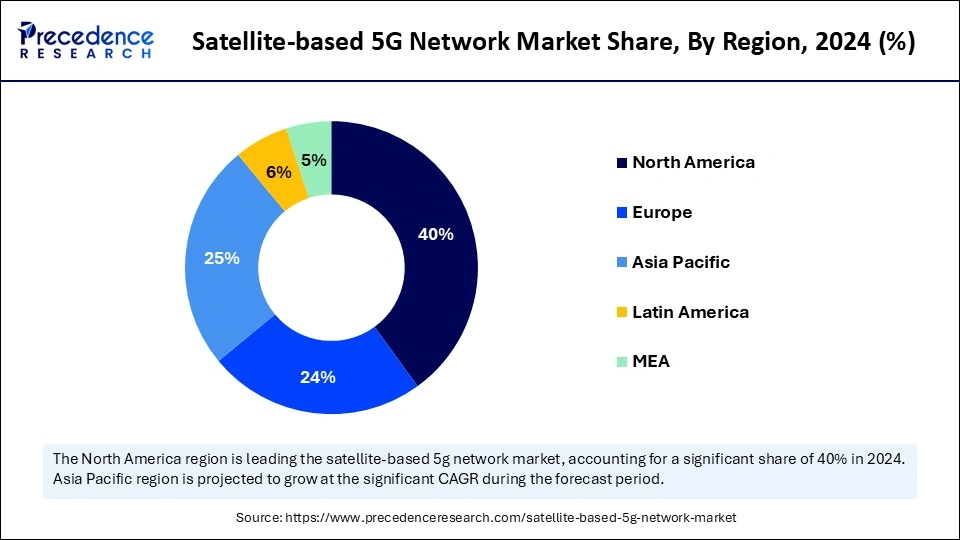

- North America dominated the global market with the largest revenue share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR from 2025 to 2034.

- By application, the telecommunication segment held the major revenue share in 2024.

- By application, the emergency services segment is projected to grow at a CAGR between 2025 and 2034.

- By end use, the aerospace segment contributed the biggest revenue share in 2024.

- By end use, the maritime segment is expanding at a significant CAGR between 2025 and 2034.

- By technology, the low earth orbit segment dominated the market in 2024.

- By technology, the geostationary orbit segment is expected to grow at a significant CAGR over the projected period.

- By infrastructure, ground stations dominated the global market with the largest share in 2024.

- By infrastructure, satellite networks is expected to grow at a notable CAGR of from 2025 to 2034.

Impact of Artificial Intelligence on the Satellite-based 5G Network Systems

AI is a key factor in modernizing the satellite-based 5G network market, as it boosts development, boosts performance and makes operations simpler. Satellite providers use artificial intelligence to guide data routes, forecast when networks be filled and improve the delivery of information. AI is included in cybersecurity, it helps find unusual activity and act upon it immediately, which builds stronger resilience for the network. Furthermore, the AI also enables predictive care of spacecraft parts which keeps downtime to a minimum and lengthens the life of assets.

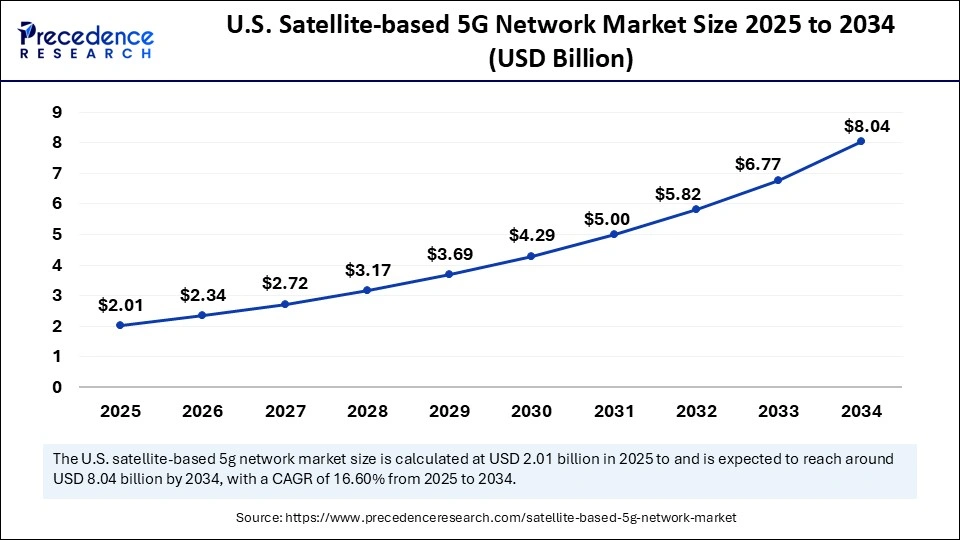

U.S. Satellite-based 5G Network Market Size and Growth 2025 to 2034

The U.S. satellite-based 5G network market size was exhibited at USD 1.73 billion in 2024 and is projected to be worth around USD 8.04 billion by 2034, growing at a CAGR of 16.60% from 2025 to 2034.

Which Region Dominated the Satellite-Based 5G Network Market in 2024?

North America led the satellite-based 5G network market by holding more than 40% of revenue share in 2024, due to extensive investments in satellite-based 5G and a firm commitment to supporting innovation and good regulation. Both the United States and Canada promoted advancements in satellite networks using AI for network management and new, advanced satellite constellations. Federal agencies such as the Federal Communications Commission, introduced new rules in 2024 that encourage harmonized use of the spectrum and less complicated licensing for satellite providers.

According to GSMA Intelligence and SIA in 2024, satellite and telecom companies are forming more alliances to improve network reliability and expand service in other areas. Both NASA and the ESA stressed that North America takes the lead in building hybrid systems that use satellites and ground capabilities. Additionally, the use of satellite 5G for secure communications by the aerospace and defense sectors in North America increased demand.

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to urbanization, growing digital investments and demand for greater connectivity from a rising population. Countries, such as China, India, and Japan made satellite an important part of 5G to bring service to places where terrestrial networks have difficulties.

What are the Major Breakthroughs in Asian Satellite-based 5G Network Industry?

ITU reports released in 2024 singled out Asia Pacific as leading the world in reforming band use and working together on satellite programs spanning national borders. The Global Mobile Suppliers Association (GSA) stressed that close connections between governments and companies are helping to build networks faster. Furthermore, the Asia Pacific is leading in using satellite-based 5G with internet of things IoT devices, mainly for smart cities and industrial applications, which further boost the market growth in this region.

(Source: https://www.itu.int)

Europe is expected to hold a notable revenue share, as European nations agreed on consistent spectrum policies for the benefit of satellite-based network technology. ESA has played an important part in improving satellite technology, funding efforts to combine satellites with current 5G infrastructure. The International Telecommunication Union (ITU) pointed out Europe's work on building new satellites and strong ground systems for low-delay applications. Furthermore, the authorities made licensing easier for satellite operators and telecom providers by streamlining the process in 2024, thus further propelling the market.

Market Overview

Increasing need for easier worldwide communication and exceptionally reliable 5G service leads to growth in the satellite-based 5G network sector. Use of satellite 5G links satellite communication with terrestrial 5G to provide cellular service to places where traditional networks do not work well. Such technology depends on LEO, MEO, and GEO satellites to ensure swift and reliable internet that's needed for driverless cars, distant healthcare, and growing smart towns. Satellite 5G deployment globally is speeding up, facilitated by largely to better use of spectrum and stronger integration between satellites and ground stations.

- In 2024, the FCC stressed that increasing satellite services is crucial to bringing internet access to rural Americans. Furthermore, the growing need for ongoing connection in emergency situations, the military and IoT boosts market development.

(Source: https://www.thefai.org)

Growth Factors

- Rising Demand for Global Connectivity: Growing need for seamless internet access in remote areas is driving the expansion of satellite-based 5G networks.

- Boosting IoT and Smart Device Integration: Increasing deployment of connected devices is propelling demand for low-latency, high-speed satellite communication solutions.

- Growing Adoption of Edge Computing: The rise in edge data processing is fueling the need for reliable satellite backhaul networks to support decentralized applications.

- Propelling Defense and Security Communications: Heightened focus on secure and resilient military networks is boosting investments in satellite-based 5G infrastructure.

- Increasing Commercial Aviation Connectivity: Rising expectations for in-flight internet and operational data exchange are driving aerospace sector adoption of satellite 5G.

- Fueling Maritime Digital Transformation: Expanding smart shipping and offshore operations are propelling demand for continuous satellite communication coverage.

- Advancements in Satellite Technology: Breakthroughs in satellite miniaturization and AI-enabled network management are boosting efficiency and scalability of satellite 5G systems.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 26.28 Billion |

| Market Size in 2025 | USD 6.69 Billion |

| Market Size in 2024 | USD 5.75 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application Outlook, End Use Outlook, Technology Outlook, Infrastructure Outlook, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is Satellite-Enabled 5G Driving the Expansion of Global Connectivity?

Increasing demand for global connectivity is expected to accelerate the market growth in the coming years. As demand for connection across the globe goes up, the use of satellite-powered 5G services likely rise fast. Lack of strong earth-based networks in remote places means there is a big chance for satellites to fill in the technology gap. The need for instant data flow in ocean, air and rescue operations encourages investment in satellite 5G. Oil and gas, mining and agriculture use satellite networks to carry out IoT deployments in big, isolated regions.

According to the International Telecommunication Union (ITU), in 2024, many people across the world still have problems getting reliable broadband, showing how vital it is for satellite networks to help close the gap. In early 2024, the European Space Agency (ESA) said that satellites in Low Earth Orbit (LEO) allowed communication delays of less than 20 milliseconds, allowing near-Earth speeds almost everywhere. Additionally, the Advances in technology and rules are encouraging satellite technology is expected to fuel the market.

Restraint

High Deployment and Operational Costs Hamper Expansion of Satellite-Based 5G Networks

High deployment and operational costs are expected to slow the expansion of satellite-based 5G networks, thus hindering the market. Setting up and maintaining constellations in space needs a big investment in equipment parts, deployment, and infrastructure on the ground. The task of joining satellite systems with terrestrial 5G networks makes the overall cost of deployment increase. Operators regularly have expenses linked to acquiring spectrum licenses, caring for satellites, and modernizing their systemsFurthermore, many developing regions need strong satellite 5G, but limited budgets hinder them and further hampering the market.

Opportunity

How Are Government and Private Investments Driving the Expansion of Satellite-Based 5G Networks?

High investments by governments and private enterprises are anticipated to create immense opportunities for the players competing in the market. Using satellite communication, national defense and space agencies improve both their safety and advantage over possible threats. Telecommunications businesses are spending large amounts to build hybrid networks that use both satellite and terrestrial 5G features to expand their reach.

Flows of capital from venture capital and private equity aid innovative startups in satellite manufacturing, satellite launch, and the building of ground stations. According to the Satellite Industry Association (SIA), in 2024, there was a major rise in satellite projects funded by governments and an increase of around 30% in budgets directed at space communication technology. Furthermore, the streamlined licensing process put in place by the government space commission for next generation satellite deployment, thus further boosting the market.

Application Insights

Telecommunication segment dominated the satellite-based 5G network market during the forecasting period, as people and businesses want strong mobile connections worldwide. To reach places where other networks do not work well, telecommunications firms connected satellites to their ground-based 5G infrastructure. Smartphones, IoT gadgets, and streaming services send a large amount of data, all helped by 5G through the use of satellites. GSA found in 2024 that more companies in the industry are combining their efforts to launch hybrid networks powered by satellites and telecom networks. Furthermore, GSMA Intelligence pointed out that telecom operators raised their investments in satellite services, thus further driving the market.

(Source: https://gsacom.com)

The emergency services segment is projected to lead the market in the future years, owing to the urgent requirement for dependable and strong networks during disasters. Satellite networks allow for immediate data communication needed during search and rescue operations, medical care far from hospitals and disaster tracking. Governments and their regulatory partners put money and efforts into upgrading emergency communication. Moreover, the rise in resources for satellite terminals with 5G technology, helping agencies respond quickly and cooperate, thus further facilitating the segment.

(Source: https://www.kratosdefense.com)

By End Use Analysis

Why Is the Aerospace Sector Leading the Satellite-Based 5G Market in 2024?

Aerospace segment held the largest revenue share in the satellite-based 5G network market during the forecasting period, due to the growing demand for speed and reliability in aviation activities. Satellite 5G has been made a priority by airlines and manufacturers to help passengers use the internet smoothly and improve communication among staff.

Using LEO satellites has decreased the delay issues found in satellite communication which has made many aerospace applications possible. During 2024, the FAA and EASA set rules to help aerospace businesses use satellites when sending information. Additionally, the trend of partnerships building between satellite operators and aerospace businesses is building to make next-gen connectivity solutions, thus further propelling the market in this sector.

(Source:https://www.easa.europa.eu)

Maritime sub-segment is projected to lead the market in the coming years, owing to the higher demand for better international trade and offshore system connections. Vessels in remote ocean zones obtain constant communication thanks to 5G satellites which help with navigation, safety and monitoring of cargo. Major maritime industries rely on IoT and satellites to keep an eye on their engines, the weather and logistics, all in real time. New regulations and team efforts among industries have made it possible to quickly build 5G infrastructure on ships, responding to tough new safety and environmental standards. Furthermore, the as per the Euroconsult and SIA, increasing investments are going toward adding more satellites in space to help the marine industry meet demands, further fuelling the market.

By Technology Analysis

Why Is the LEO Segment Dominating the Satellite-Based 5G Market?

Low earth orbit (LEO) segment dominated the satellite-based 5G network market. LEO satellites help reduce the time a signal needs to reach various areas. More providers have been deploying vast satellites or LEO, to deliver internet connections to hard-to-reach places. Bandwidth efficiency and the ability to recover well from errors were increased by the advanced use of beamforming and phased-array antennas. In 2024, GSA found that leading operators sent a growing number of LEO satellites into space to increase where 5G could be used. Moreover, the FCC moved faster in 2024 with issuing new licenses to support rapid growth in satellite networks, allowing LEO to solidify its dominating position.

(Source: https://gsacom.com)

Geostationary orbit (GEO) sub-segment is projected to lead the satellite-based 5G network market in the coming years, owing to their location, almost 36,000 kilometers above Earth, GEO satellites maintain constant contact with set regions and are perfect for broadcasting. Satellites now use high-throughput methods and divided coverage areas to greatly increase the amount of bandwidth available in GEO. In 2024, the FCC made changes to its rules to allow for a greater number of GEO satellite use and the sharing of spectrum. Additionally, its advances on onboard processing technology make geostationary orbit satellites capable of managing increasing data flow of 5G, further fuelling their demand for satellite-based 5G networks market.

(Source: https://www.federalregister.gov)

By Infrastructure Analysis

Why Did Ground Stations Dominate the Satellite-Based 5G Market in 2024?

Ground stations segment dominated the market with the largest revenue share in the satellite-based 5G network market during the forecasting period, due to their importance in connecting with satellite and terrestrial networks. Businesses upgraded their ground stations to manage the rising amounts of data from 5 G-powered constellations. Such stations are becoming efficient and dependable to improvements in antennas and tracking, which have made the switch from satellite to ground services nearly seamless.

- In 2024, ITU pointed out that upgraded ground stations played an important role in achieving the required low latency and fast transmission rates. Furthermore, the organizations, including the FCC, made it simpler for companies to get ground station licenses, which helped networks to grow rapidly, further facilitating the market growth.

(Source: https://www.itu.int)

Satellite networks segment is seen to grow at the owing to the greater use of satellites and improved network technology. High number of companies are moving toward launching satellites in Low Earth Orbit (LEO) and Medium Earth Orbit (MEO). This is helping improve their ability to connect to places across the globe with less delay.

Artificial intelligence and machine learning are used to manage satellite networks, they improve how resources are shared and help find faults which raises the network's quality. According to the ESA, satellite operators and telecom companies are working together to ensure their networks be used together smoothly. Furthermore, developments in communication between satellites make data delivery stronger and more reliable, allowing satellites to play a stronger role in building infrastructure.

Satellite-based 5G Network Market Companies

- Amazon

- China Satcom

- Comtech Telecommunications Corp.

- Eutelsat

- GlobalStar

- Hughes Network Systems

- Inmarsat

- Intelsat

- Iridium Communications

- L3Harris Technologies

- OneWeb

- SES S.A.

- SpaceX

- Telesat

- Viasat

Recent Developments

- In June 2025, Rohde & Schwarz will host its fifth Satellite Industry Day, spotlighting the intersection of 5G NTN and satellite testing. The event will feature industry experts addressing key challenges in NTN evolution and the transition toward 6G. Following a keynote by Christina Gessner, Executive Vice President of Test & Measurement, Reiner Stuhlfauth will explore the technological hurdles and testing strategies essential to 5G NTN implementation. Goce Talaganov will delve into market trends and performance testing solutions for NTN-enabled devices, with a focus on ensuring compliance and reliability across a wide array of use cases.

(Source: https://www.eletimes.com) - In February 2025, India advanced toward launching satellite-based internet services with a successful 5G NTN trial conducted by Eutelsat Group. The test leveraged Eutelsat OneWeb's LEO satellite constellation and was executed in line with 3GPP Release 17 standards. The trial, involving global technology partners such as MediaTek, ITRI, Sharp, and Rohde & Schwarz, demonstrated seamless 5G connectivity using Ku-band service links and Ka-band feeder links on Airbus-manufactured satellites, signaling a breakthrough in terrestrial-satellite integration.

(Source: https://apacnewsnetwork.com) - In December 2024, the European Space Agency (ESA) and Telesat achieved a critical milestone by establishing a real-time 5G NTN link via a LEO satellite operating in the Ka-band. This landmark demonstration highlighted the feasibility of delivering mobile-like connectivity through satellite infrastructure, unlocking new opportunities in telehealth, emergency response, autonomous mobility, and in-flight broadband.

(Source: https://www.esa.int)

Latest Announcements by Industry Leaders

In February 2025

Announcement - WISeKey International Holding, a global leader in cybersecurity, AI, and IoT, has announced the 2025 satellite launch schedule for its subsidiary WISeSat, reinforcing its commitment to secure satellite-based IoT communications. The launch series, set to begin in June 2025 in collaboration with SpaceX, will deploy next-generation WISeSat satellites equipped with post-quantum-ready security to guard against emerging cyber threats. Carlos Moreira, WISeKey founder and CEO, emphasized the strategic importance of this initiative. "These new launches represent a major step forward in securing IoT communications for the future. By integrating SEALSQ's Post-Quantum Chips with WISeKey's trusted Root of Trust, we are ensuring that WISeSat remains a leader in satellite cybersecurity. Our goal is to provide a quantum-resistant, globally connected IoT ecosystem that meets the security challenges of tomorrow."”

(Source: https://www.iot-now.com)

Segments covered in the report

By Application Outlook

- Emergency Services

- IoT Connectivity

- Military and Defense

- Telecommunication

By End Use Outlook

- Aerospace

- Automotive

- Maritime

- Smart Cities

By Technology Outlook

- Geostationary Orbit

- Low Earth Orbit

- Medium Earth Orbit

By Infrastructure Outlook

- Data Processing Centers

- Ground Stations

- Satellite Networks

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting