Functional Food Ingredients Market Size to Rise USD 167.5 Billion By 2030

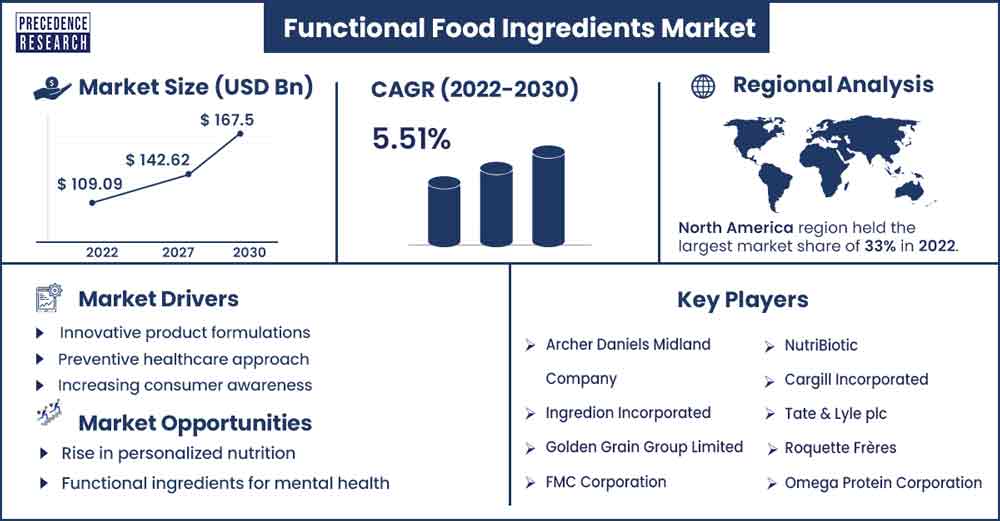

The global functional food ingredients market size surpassed USD 109.09 billion in 2022 and is expected to rake around USD 167.5 billion by 2030, poised to grow at a CAGR of 5.51% from 2022 to 2030.

Market Overview

The functional food ingredients market is experiencing a paradigm shift as consumers increasingly prioritize health and wellness. This market is focused on elements of foodstuff that have several roles beyond their nutritional value. Functional ingredients may be driven from natural sources or produced synthetically to cater to specific requirements in a food product or beverage.

The functional food ingredients market is witnessing robust growth, fueled by a global surge in health-conscious consumer behavior. Functional ingredients, known for their health-promoting properties, are integral to a wide array of food and beverage products. From probiotics and omega-3 fatty acids to antioxidants and plant-based proteins, the market is diverse, catering to evolving consumer preferences for nutrition-packed choices.

Regional Snapshot

North America dominates the functional food ingredients market, driven by a health-conscious population, a robust food industry, and a focus on preventive healthcare. The region boasts a large portfolio of foods and beverages, with a variety of foreign options being added due to the growing cross-cultural exposure. Add to this the growing awareness of nutrition and health in the wake of the pandemic; the functional ingredients market has experienced tremendous growth. Moreover, innovations in product formulations and a strong regulatory environment ensuring quality solidify the consumer's confidence in the market.

Asia-Pacific experienced significant growth propelled by the growing middle-class population, increased awareness of nutritional benefits, and a rising trend of incorporating functional ingredients in traditional diets. This region holds the record for countries with the highest population as well as ethnic diversity. This diversity, in combination with the growing census, opens lucrative opportunities for market players. Several companies have established massive production plans to cater to the growing masses. Salary arbitrage practices by global players further promote businesses in the region, with companies outsourcing a significant portion of their product lifecycle to countries like India and China. Moreover, the growing popularity of native cuisines due to digital exposure allows companies to collaborate with international entities.

- In August 2023, Arla Foods Ingredients and Zhongbai Xingye Food signed a distribution agreement to cater to the Chinese food and nutrition markets. The collaboration strengthens their existing relationship and expands Arla Foods Ingredients' presence in China.

Functional Food Ingredients Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 115.1 Billion |

| Projected Forecast Revenue by 2030 | USD 167.5 Billion |

| Growth Rate from 2022 to 2030 | CAGR of 5.51% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2022 to 2030 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Health and wellness trends

The overarching trend towards health and wellness is a powerful driver of the functional food ingredients market. Consumers are increasingly prioritizing nutrition that goes beyond basic sustenance. Functional ingredients, known for their health-promoting properties, are integral to meeting the demand for foods that contribute to overall well-being.

Innovative product formulations

Innovation in product formulations is a significant driver, with food and beverage manufacturers investing in research and development to create products that resonate with health-conscious consumers. From fortified snacks to functional beverages, the industry is witnessing a surge in creative approaches to incorporating beneficial ingredients.

Preventive healthcare approach

A shift towards preventive healthcare is influencing consumer behavior, leading to a growing interest in functional foods. Consumers are proactively seeking products that offer specific health benefits, such as immune support, heart health, and digestive wellness. This preventive approach is a key driver of the market’s expansion.

- In July 2023, increased focus on gut health has driven the popularity of products containing probiotics, with innovations in delivery formats and strains.

- In April 2022, Bioberica, a life science company, launched new ingredients in the Vitafoods Europe held in Geneva to enter two new health areas: digestive health and skin and beauty.It has also unveiled a range of new functional food applications for its Collavant n2 native type II collagen ingredient for joint health.

Increasing consumer awareness

Greater awareness among consumers regarding the link between diet and health is driving the demand for functional food ingredients. Information dissemination through various channels, including social media, has empowered consumers to make informed choices, leading to a surge in the adoption of functional foods.

Restraints

Cost implications

One of the significant restraints in the functional food ingredients market is the cost associated with incorporating certain functional ingredients. Premium and specialty ingredients can be expensive, impacting the overall cost of production. This poses a challenge in making functional products accessible and affordable to a broader consumer base.

Regulatory compliance

Navigating regulatory frameworks and ensuring compliance with varying standards based on different regions is a complex task for food manufacturers. The need to meet stringent regulations for health claims and labeling, especially as consumers demand transparency, adds a layer of complexity and potentially slows down product development and launch timelines.

Opportunities

Rise in personalized nutrition

The concept of personalized nutrition presents a significant opportunity in the functional food ingredients market. Tailoring products to individual nutritional needs, health conditions, and lifestyle preferences allows for a more targeted approach. Customized solutions based on age, dietary requirements, and specific health goals can cater to a diverse consumer base.

Plant-based innovations

The rise of plant-based diets provides a fertile ground for innovation in the functional food ingredients space. Plant-derived ingredients, such as proteins, fibers, and antioxidants, align with both health and sustainability trends. Developing plant-based alternatives for traditional functional ingredients opens avenues for capturing a growing market segment.

- In September 2023, GoodMills Innovation unveiled a range of plant-based products at Food Ingredients Europe. The offerings included VITATEX textures, SMART legume flours, and a slow milling range for clean-label baked goods. SpermidineEvo, a natural wheat germ concentrate for nutraceuticals, was also introduced.

Functional ingredients for mental health

An emerging opportunity lies in formulating functional food products that address mental health and well-being. Ingredients with recognized cognitive benefits, such as omega-3 fatty acids, adaptogens, and certain vitamins, can be incorporated into products designed to support cognitive function and stress reduction.

- In December 2023, Lactocore Group and Ingredia SA collaborated on innovative functional food ingredients to alleviate mood disorders in humans and animals. The partnership aimed to develop a new product using dairy proteins, particularly Lactocore's proprietary milk peptide hydrolysate.

Clean label trends

Consumers are increasingly seeking transparency and simplicity in food products. Embracing clean label trends by avoiding unnecessary additives and artificial ingredients presents an opportunity for brands to build trust with consumers. Clean-label products with easily understandable ingredient lists can appeal to a health-conscious audience.

Innovative delivery formats

Exploring innovative delivery formats for functional ingredients can enhance consumer convenience and appeal. From fortified beverages to functional snacks and easy-to-use supplements, diversifying product formats allows for increased market penetration and consumer engagement.

Immunity-boosting products

Given the heightened focus on health and wellness, there is a notable opportunity to develop products that specifically target immune health. Functional ingredients known for their immune-boosting properties, such as vitamins, minerals, and certain botanicals, can be strategically incorporated into products to meet consumer demand.

Browse: Functional Drinks Market Will See Record Break Revenue

Recent Developments

- In October 2022, Teijin Limited launched the Teijin Meguro Institute Co., Ltd. to strengthen the company's development and manufacturing of probiotics for use in functional foods.

- In October 2023, Korean researchers unveiled NaturaPredicta, an AI model accelerating the identification of healthy functional food ingredients. Using natural language processing and BioBERT, it compared the functionalities of botanical ingredients, bypassing preclinical or clinical tests and streamlining the development of innovative functional foods.

Key Market Players

- Archer Daniels Midland Company

- Ingredion Incorporated

- Golden Grain Group Limited

- FMC Corporation

- Omega Protein Corporation

- NutriBiotic

- Cargill Incorporated

- Tate & Lyle plc

- Roquette Frères

Market Segmentation

By Type

- Probiotics

- Proteins & amino acids

- Phytochemicals & plant extracts

- Prebiotics

- Fibers& specialty carbohydrates

- Omega-3 fatty acids

- Carotenoids

- Vitamins

- Minerals

By Source

- Natural

- Animal

- Microbial

- Plant

- Synthetic

By Product

- Maltodextrin

- Probiotics

- Polydextrose

- Modified Starch

- Pectin

- Omega-3 (epa, dha, ala)

- Omega-6

- Conjugated Linoleic Acid

- Rice Protein

- Protein Hydrolysate

- Mung Bean Protein

By Health Benefits

- Gut health

- Cardiovascular health

- Bone health

- Immunity

- Nutritive health

- Weight management

- Other health benefits

By Application

- Food

- Infant food

- Dairy products

- Bakery products

- Confectionery products

- Snacks

- Meat & other products

- Other food applications (breakfast cereal and flours)

- Beverages

- Energy drinks

- Juices

- Health drinks

- Personal Care

- Pharmaceuticals

- Animal Feed

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1811

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308