High Barrier Packaging Films Market Revenue to Attain USD 28.24 Bn by 2033

High Barrier Packaging Films Market Revenue and Trends 2025 to 2033

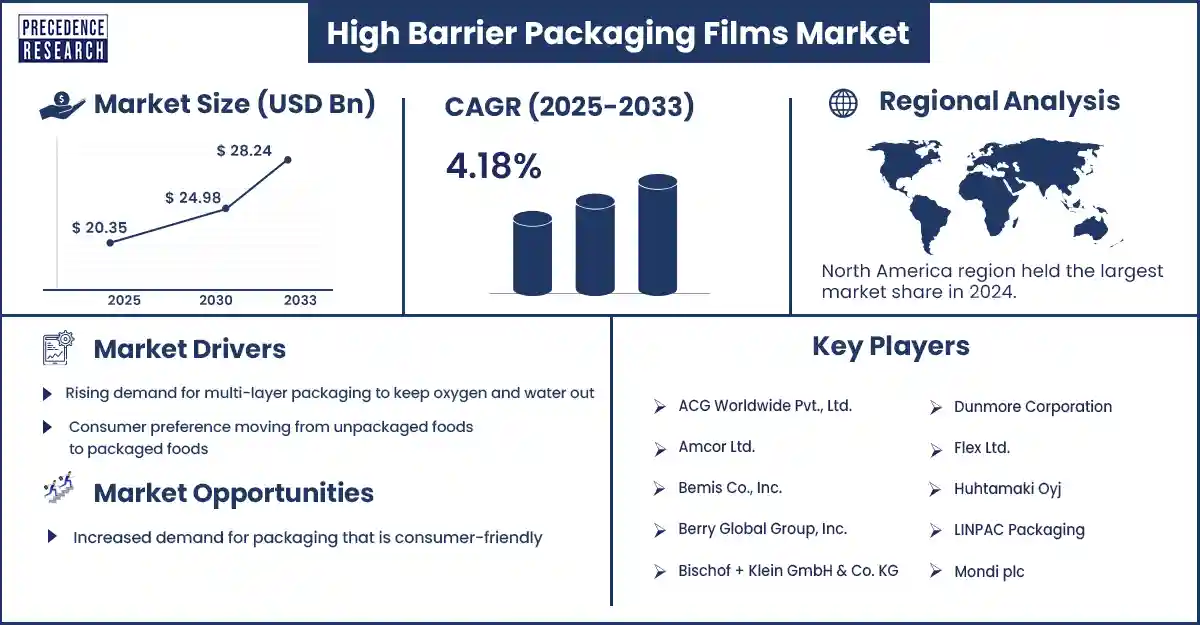

The global high barrier packaging films market revenue reached USD 20.25 billion in 2025 and is predicted to attain around USD 28.24 billion by 2033 with a CAGR of 4.18%. The growth of the market is attributed to the rising demand for protective and convenient packaging solutions in various industries.

Market Overview

High-barrier packaging films present an alternative to glass and metal packaging. They prevent oxygen, moisture, light, and other outside environmental variables from reaching packaged goods and impacting integrity. They demonstrate efficacy when packaging pharmaceutical, food, and personal care products while contributing to sustainability considerations. As the industry looks to push the boundaries of packaging that produce a sustainable future, barrier packaging films fit well into innovative packaging development.

High-barrier packaging films exhibit superior features like lightweight and high performance. These films are available in an extensive range of sizes and shapes, such as flexible pouches, bags, or wraps, which are an attractive option for packaging manufacturers and brand owners. There is a strong focus on lessening food waste and enhancing and refining food supply chains, promoting the continued development of barrier films in packaging. Market stakeholders are further investing in recyclable or renewable materials to meet consumers’ demand for sustainable packaging.

Major Trends in the High Barrier Packaging Films Market

Eco-conscious Branding

With growing consumer concern for the environment, eco-friendly branding has become a major marketing trend. Brands are increasingly highlighting the ability of recyclable, compostable, or bio-based high-barrier films to gain competitive advantages. There is a growing opportunity to develop high-barrier films from renewable and recyclable materials, such as bio-based polymers and mono-material structures.

Customized and Premium Packaging

The trend toward premium and customized packaging is rising. This provides opportunities for high-barrier films that can be tailored to specific product requirements and consumer preferences. Many manufacturers and brands are now taking advantage of premium printing capabilities of high-barrier films to produce visually appealing packaging that attracts consumers' attention. Customized packaging also helps improve brand identity.

Rising Demand from the Food and Pharmaceutical Industries

With the rising consumption of packaged foods, the need for protective packaging is rising in the food industry. High-barrier films are essential for maintaining the quality and extending the shelf life of these products. The pharmaceutical industry also requires high-barrier films for packaging sensitive drugs and medications. These films protect products from moisture, oxygen, and light, ensuring product efficacy and safety.

Reports of the highlights of the High Barrier Packaging Films Market

Material insights

The plastic segment held the major share of the market in 2024. Plastic is a widely used material in the packaging industry due to its unique features, such as high tensile strength, electrical insulation properties, transparency, flexibility, and gas and odor barrier properties. Plastic has largely been used to prevent the spoilage of food, nutrients, beverages, drugs, and cosmetic products. Barrier films, especially made from plastic, prevent gas and water permeability. Since plastic does not react with external factors, it preserves the flavor and natural characteristics of packaged items.

Product Insights

The bags and pouches segment led the market in 2024 and is expected to continue its upward trajectory during the forecast period. This is due to the increased requirement for bags and pouches in various industries. Bags and pouches are preferred for their high barrier properties, cost-effectiveness, and lightweight as compared to other products. They are used in the food & beverage, cosmetic, personal care, and pharmaceuticals industries.

Technology insights

The multi-layer films segment is likely to grow at the fastest rate in the coming years due to their high efficiency. Multi-layer films are produced using many extruders and specialized dies. Multi-layer high-barrier packaging is produced using a variety of substrates and polymers. There is continuous demand for multi-layer films in the food and pharmaceutical industries due to their additional barrier.

Application Insights

The food and beverage segment is projected to dominate the market during the forecast period. The food and beverage industry utilizes high-barrier packaging films to package, store, and transport various products such as alcoholic and non-alcoholic beverages, meat, ready-to-eat meals, bakery products, fish, dairy products, confections, and fruits & vegetables. Compared to other sectors, the demand and usage of high-barrier packaging films are high in the food and beverage industry. Stringent regulations regarding food safety and quality further boost the demand for high-barrier films in the food and beverage industry.

Regional Insights

Asia Pacific held the largest share of the high barrier packaging films market in 2024 due to rapid urbanization and industrialization. With rapid urbanization, the demand for packaged food and drinks is rising, creating the need for protective packaging. The rapid expansion of the pharmaceutical industry and the rising production of pharmaceuticals support market growth. The region has a robust packaging industry. There is high demand for packaging products in various industries, bolstering the regional market growth.

North America held a considerable share of the market in 2024 and is expected to witness significant growth during the projection period, spurred by a mature packaging industry and stringent regulations regarding the safety of food and pharmaceutical products. There is a high consumption of packaged foods, especially ready-to-eat meals, snacks, and processed foods, boosting the demand for packaging films. Moreover, the growing demand for sustainable packaging solutions drives the development of high-barrier films made from recyclable or bio-based materials.

High Barrier Packaging Films Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 20.35 Billion |

| Market Revenue by 2033 | USD 28.24 Billion |

| CAGR from 2025 to 2033 | 4.18% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In March 2024, Berry Global entered into a acquisition with a flexible packaging firm to increase their high-barrier film portfolio and expand its product lines and market position.

- In March 2024, TOPPAN Inc. and India-based TOPPAN Speciality Films Private Limited (TSF) have developed GL-SP. This barrier film uses biaxially oriented polypropylene (BOPP) as the substrate and is suitable for packaging of dry contents.

High Barrier Packaging Films Market Key Players

- ACG Worldwide Pvt., Ltd.

- Amcor Ltd.

- Bemis Co., Inc.

- Berry Global Group, Inc.

- Bischof + Klein GmbH & Co. KG

- Dunmore Corporation

- Flex Ltd.

- Huhtamaki Oyj

- LINPAC Packaging

- Mondi plc

- Polyplex Corporation Ltd.

- ProAmpac

- Schur Flexibles Holding GesmbH

- Sealed Air Corporation

- Shrinath Rotopack Pvt Ltd.

- Toray Plastics (America), Inc.

Market Segmentation

By Material

- Plastic

- Metal

- Oxide

By Product

- Bags And Pouches

- Trays Lidding Films

- Wrapping Films

- Blister Packs

- Others

By Technology

- Multi-Layer Films

- Sustainable Barrier Coating Films

- Besela Barrier Films

- Others

By Application

- Food And Beverages

- Pharmaceutical

- Personal Care and Cosmetics

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @ https://www.precedenceresearch.com/sample/2995

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344