Industrial Automation and Control Systems Market Size, Report 2032

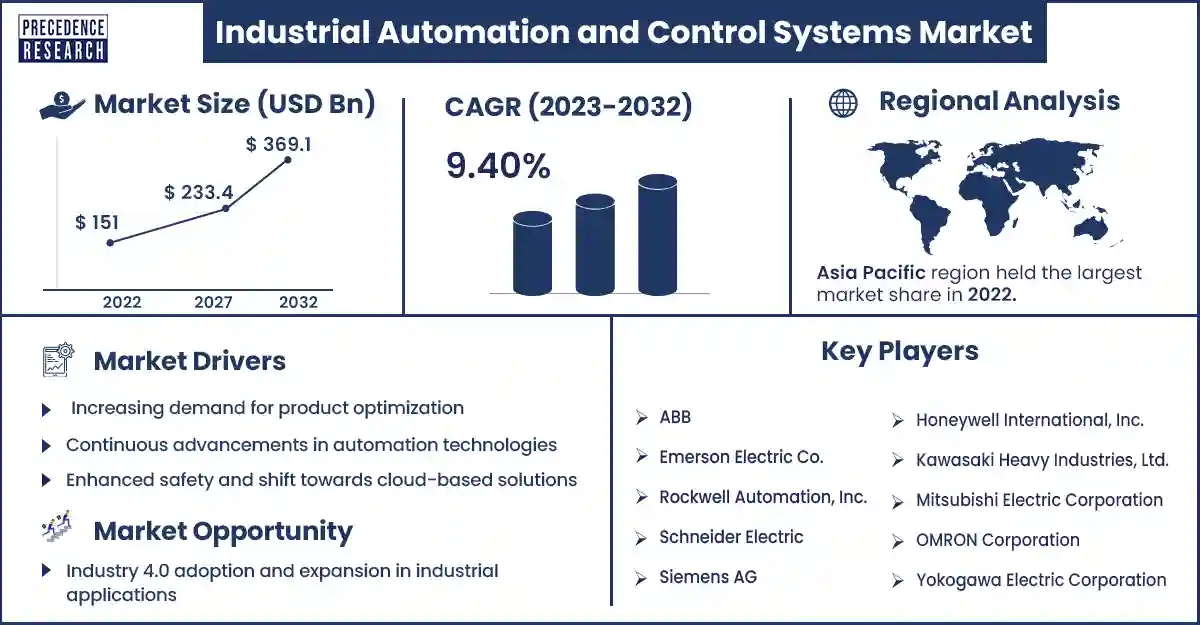

The global industrial automation and control systems market size was exhibited at USD 164.44 billion in 2023 and is anticipated to touch around USD 369.1 billion by 2032, expanding at a CAGR of 9.40% during the forecast period from 2023 to 2032.

Market Overview

The industrial automation and control systems market encompasses a wide range of technologies, solutions, and services to automate processes, optimize production efficiency, and enhance operational control in industrial settings. Automation describes a wide range of technologies that reduce human intervention in processes, mainly by predetermining decision criteria, subprocess relationships, and related actions, as well as embodying those predeterminations in machines. Automation has been achieved by mechanical, hydraulic, pneumatic, electrical, electronic devices, and computers, usually combined. Complicated systems, such as modern factories, airplanes, and ships, typically use combinations of all of these techniques. The benefits of automation include labor savings, reduced waste, savings in electricity and material costs, and improvements to quality, accuracy, and precision.

The industrial automation and control systems market has experienced significant growth in recent years and is expected to continue expanding. Factors driving market growth include the increasing adoption of automation technologies across various industries, such as automotive, manufacturing, food and beverage, pharmaceuticals, and oil and gas.

The market encompasses a diverse range of products and solutions, including programmable logic controllers (PLCs), distributed control systems (DCS), supervisory control and data acquisition (SCADA) systems, human-machine interface (HMI) devices, industrial robots, and industrial cybersecurity solutions. Technological advancements drive innovation and growth in the market. Industry 4.0 initiatives, the Internet of Things (IoT), cloud computing, big data analytics, artificial intelligence (AI), and machine learning (ML), are transforming manufacturing processes, enabling real-time monitoring, predictive maintenance, and intelligent decision-making. Integrated automation solutions, digital twins, and innovative manufacturing platforms enhance operational efficiency, flexibility, and competitiveness in the industrial sector.

Regional snapshots

Asia Pacific dominated the industrial automation and control systems market in 2023. The fast expansion of the manufacturing sector, particularly in nations like China, Japan, and South Korea, has made the Asia Pacific region a vibrant hub for industrial automation. Utilizing Industrial Internet of Things (IoT) technology to enhance production efficiency and enable smart manufacturing is a major focus in Asia Pacific.

The incorporation of automation and digital technologies into China's industries is emphasized by the country's ambitious "Made in China 2025" project. Machine learning and artificial intelligence are becoming more and more popular, especially in South Korea and Japan. Significant investments are being made in the region's industrial automation, namely in the electronics, automotive, and robotics sectors. Governments and businesses are working together to develop strong cybersecurity frameworks as cybersecurity becomes more and more prominent in the region as connectivity improves.

Industrial Automation and Control Systems Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 164.44 Billion |

| Projected Forecast Revenue by 2032 | USD 369.1 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.40% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for product optimization

With the rise of Industry 4.0 and the Industrial Internet of Things (IIoT), there’s a growing emphasis on optimizing processes for efficiency, productivity, and cost-effectiveness. Automation and control systems enable this optimization by providing real-time data monitoring, analytics, and control capabilities. Industries across manufacturing, oil and gas, utilities, and transportation sectors are under pressure to reduce operational costs and improve efficiency. Automation solutions help achieve this by streamlining advanced monitoring and control mechanisms that mitigate risks and improve workplace safety.

Technological advancements

Continuous advancements in automation technologies, including sensors, actuators, control systems, and data analytics, drive innovation in the industrial automation and control systems market. These advancements enable more sophisticated automation solutions to handle complex processes and tasks with higher precision and reliability.

Integrating robotics and artificial intelligence (AI) technologies into industrial automation systems revolutionizes manufacturing and other industries. These technologies enable autonomous operations, predictive maintenance, and adaptive control, further enhancing efficiency and productivity, which drives the industrial automation and control systems market.

Enhanced safety and shift towards cloud-based solutions

Safety regulations in chemicals, pharmaceutical, and energy industries are becoming increasingly stringent. Automation and control systems help ensure compliance with safety standards by implementing advanced monitoring and control mechanisms that mitigate risks and improve overall workplace safety. The adoption of cloud computing in industrial automation is gaining momentum due to its scalability, flexibility, and cost-effectiveness. Cloud-based automation solutions offer advantages such as remote monitoring, centralized management, and access to advanced analytics tools, driving their adoption across various industries.

Restraints

High initial investment costs and complexity of integration

Implementing automation and control systems often requires substantial upfront investment in hardware, software, and infrastructure. This cost can be prohibitive for small and medium-sized enterprises (SMEs) or companies operating on tight budgets, slowing down adoption rates. Integrating automation solutions into existing infrastructure can be complex and challenging, especially in legacy systems or environments with heterogeneous equipment. Compatibility issues, interoperability concerns, and the need for extensive customization can prolong deployment times and increase costs.

Cybersecurity risks and workforce training

As industrial automation systems become more interconnected and digitized, they become vulnerable to cyber threats like malware, ransomware, and data breaches. Ensuring robust cybersecurity measures to protect sensitive data and critical infrastructure is a constant challenge for organizations, requiring ongoing investment in security technologies and protocols. The rapid evolution of automation technologies demands a workforce with specialized skills in programming, data analytics, and cybersecurity. However, a shortage of skilled professionals in these fields makes it difficult for companies to recruit and retain talent. Investing in workforce training and development programs is essential to address this skills gap.

Opportunities

Industry 4.0 adoption and expansion in industrial applications

The ongoing adoption of industry 4.0 principles, driven by the convergence of digital technologies with traditional industrial processes, presents vast opportunities for automation vendors. Solutions that enable real-time data collection, analysis, and decision-making, such as advanced sensors, edge computing, and cloud platforms, are in high demand to support intelligent manufacturing initiatives. The proliferation of connected devices and sensors in industrial environments, known as the Industrial Internet of Things (IIoT), opens up new automation and control systems opportunities. IIoT enables remote monitoring, predictive maintenance, asset tracking, and other innovative applications that enhance operational efficiency and productivity.

The rapid growth of robotics and autonomous systems

The increasing demand for robotics and autonomous systems across manufacturing, logistics, healthcare, and agriculture creates opportunities for automation vendors creates opportunity for the industrial automation and control systems market. Collaborative robots (cobots), autonomous vehicles, drones, and robotic process automation (RPA) solutions are being deployed to automate repetitive tasks, improve safety, and augment human labor.

Energy efficiency and sustainable initiatives

The growing emphasis on sustainability and energy efficiency in manufacturing, utilities, and transportation creates opportunities for automation solutions that optimize resource usage and reduce environmental impact. Energy management systems, smart grids, and process optimization algorithms help organizations achieve sustainability goals while improving profitability.

Cybersecurity solutions and services

With the increasing digitization and connectivity of industrial systems, there is a growing demand for cybersecurity solutions and services to protect critical infrastructure from cyber threats. Opportunities exist for automation vendors to offer robust cybersecurity solutions tailored to the unique requirements of industrial environments, including threat detection, vulnerability assessment, and incident response.

Recent Developments

- In February 2023, Schneider Electric and Capgemini collaborated to accelerate 5G industrial automation, supported by Qualcomm.

- In April 2023, Rockwell Automation launched FactoryTalk Optix in Asia Pacific India - English – APAC.

- In December 2023, Mitsubishi Electric launched a 2,200 MINR Manufacturing Plant for Factory Automation Systems.

- In January 2024, BEN launched New AI assistants for the automotive industry, which was marketed as BENAuto for its NADA debut.

Major Key Players

- ABB

- Emerson Electric Co.

- Rockwell Automation, Inc.

- Schneider Electric

- Siemens AG

- Honeywell International, Inc.

- Kawasaki Heavy Industries, Ltd.

- Mitsubishi Electric Corporation

- OMRON Corporation

- Yokogawa Electric Corporation

- General Electric

Market Segmentation

By Component

- HMI

- Industrial Robots

- Control Valves

- Sensors

- Others

By Control System

- DCS

- PLC

- SCADA

- Others

By Vertical

- Aerospace & Défense

- Automotive

- Chemical

- Energy & Utilities

- Food & Beverage

- Healthcare

- Manufacturing

- Mining & Metal

- Oil & Gas

- Transportation

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1344

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308