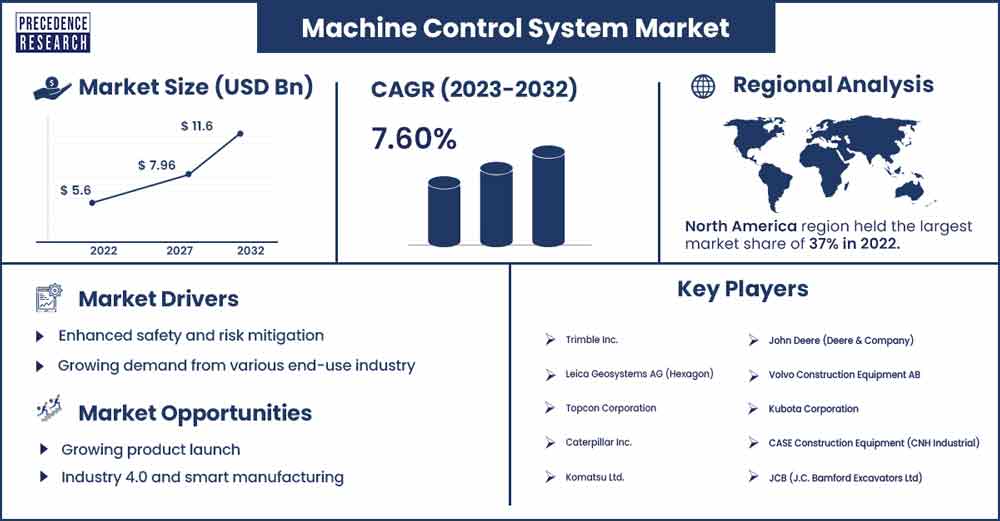

Machine Control System Market To Rake USD 11.60 Bn By 2032

The global machine control system market size reached USD 5.6 billion in 2022 and is projected to be worth around USD 11.60 billion by 2032, growing at a CAGR of 7.60% during the forecast period from 2023 to 2032.

Market Overview

A machine control system refers to a system that manages and regulates the operation of machinery or equipment. It is designed to control various aspects of a machine's functions, such as movement, speed, positioning, and other relevant parameters. The primary goal of a machine control system is to ensure precision, efficiency, and reliability in the operation of the machine. There are various components associated with machine control systems including sensors and feedback devices, control algorithms, actuators, Human Machine Interface (HMI), communication systems, and others.

The machine control system market is driven by several variables which include increasing automation in industries, technological advancements, demand for precision and efficiency, growing infrastructure development, increasing demand for precision agriculture, and others. In addition, the growing product launch is expected to influence the market revenue growth over the anticipated timeframe.

- For instance, in November 2023, AV-Ops Center, the first remote monitoring and administration solution designed exclusively to maximize Composer-based DSP audio and control systems, was made available by Symetrix, Inc. An easy-to-use dashboard displays real-time information from the system components through AV-Ops Center, a cloud-based service.

- According to the U.S. Bureau of Labor Statistics, 2.8 million nonfatal occupational illnesses and injuries were reported by employers in the private sector in 2022, an increase of 7.5 percent from 2021. The growth in diseases, up 26.1 percent to 460,700 cases, and injuries, up 4.5 percent to 2.3 million instances, is what is responsible for this surge.

Regional Insights

North America holds the dominating share of the machine control system market; the region is observed to sustain its position in the market. The market growth in the region is attributed to the growing construction sector. The region has been experiencing growth in the construction industry, with various infrastructure projects contributing to the demand for machine control systems. The use of these systems in construction equipment such as bulldozers and excavators, helps improve accuracy and efficiency in earthmoving operations.

- For instance, approximately 300,000 miles (483,000 km) of transcontinental highways, including roughly 40,000 miles (64,000 km) of multilane, limited-access roadways, have been funded by the US government. While Mexico's roadways connect the two nations, Canada provides a coast-to-coast path.

The US hold the largest market share in the region, the growth in the US market is attributed to the presence of major companies such as Trimble Inc., Caterpillar Inc., and others. These players are actively producing innovative products in the market. For instance, in October 2023, the Caterpillar ECS, a family of integrated, networked, and scalable controllers, was introduced by Caterpillar Inc.

Customers may manage their energy demands with the Cat ECS, from a simple set of generators to integrated, full-site microgrid solutions that connect various assets. Additionally, in the US, precision farming techniques are becoming more and more common. A growing number of farmers are turning to machine control systems for precision planting, irrigation, and harvesting because they want to maximize resources and raise farm output as a whole.

Machine Control System Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6 Billion |

| Projected Forecast Revenue by 2032 | USD 11.60 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 7.60% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Drivers

Enhanced safety and risk mitigation

Machine control systems can contribute to the reduction of workplace accidents that cause workers' compensation claims to be costly, take team members away from the job, diminish productivity, and may even result in breaches of the Occupational Safety and Health Administration. By increasing visibility and awareness, this technology aids crews in accomplishing these vital goals by empowering members to foresee and avert potentially hazardous situations before they arise.

For instance, work sites may be busy places with lots of machinery moving around, thus the proximity sensors in the devices are essential in assisting operators in avoiding collisions. As a result, it is anticipated that these advantages would fuel market expansion for machine control systems.

Growing demand from various end-use industry

Throughout the projected period, the market is anticipated to develop at a rapid pace due to the growing demand from a variety of end-use industries. machine control systems are being used by a variety of end-use sectors for usage in mining, agriculture, and other activities. For instance, this technology makes equipment navigation and guidance easier than ever in the agriculture sector by intuitively monitoring and mapping field data in real time. Key features include yield monitoring, water management, video camera input, and assisted steering, which relieves the operator of much of the load. Additionally, it may be used in a variety of mining-related applications, including site location, fleet and asset management, Geotech monitoring, and others.

Restraints

Training requirement

The effective use of machine control systems often requires specialized training for operators and maintenance personnel. This training incurs additional costs and downtime during the learning curve, and some industries may face challenges in finding skilled personnel. Therefore, this is expected to hinder the market growth during the forecast period.

High initial investments

Laser scanning, GNSS, GIS, and robotics are only a few of the methods and safety precautions that the machine control system offers the sectors. Businesses engaged in the transportation of raw materials from one place to another require machine control systems. The entire cost of the installation gradually increases since sophisticated technology is required to operate a safe plant and execute a control system properly. These instruments handle more dangerous conditions and difficult environments.

However, in addition to indirect expenses such as installation, certification, licensing, energy costs for maintenance, and human costs for technical staff, the system has a significant upfront cost. Therefore, it is anticipated that the large initial expenditure will impede market expansion.

Opportunities

Growing product launch

The growing product launches are expected to offer a lucrative opportunity for market development during the forecast period. For instance, In February 2023, ABB introduced its most recent version of the ABB AbilityTM Symphony® Plus distributed control system (DCS) to help the water and power industries further with their digital transformation. With over 40 years of expertise in complete plant automation, Symphony® Plus' most recent version will help clients' digital journeys even more by offering a safe and straightforward OPC UA1 connection to the Edge and Cloud that doesn't interfere with basic automation and control features.

Industry 4.0 and smart manufacturing

The Industry 4.0 revolution, characterized by the integration of digital technologies into manufacturing processes, provides opportunities for machine control systems. Smart manufacturing environments benefit from advanced control systems that improve efficiency, flexibility and product quality.

Recent Developments

- In February 2023, a new edge controller reinforcement learning service was launched by Yokogawa Electric Corporation. The Factorial Kernel Dynamic Policy Programming (FKDPP) AI algorithm is used in this autonomous control service for OpreXTM Realtime OS-based Machine Controllers (e-RT3 Plus). Depending on the needs of the end user, the service includes packaged software in addition to an optional consulting service and/or training program. Worldwide distribution of this software is underway, and the first provision of consulting and training will take place in Japan, with more markets to follow.

- In September 2023, SYSPRO, a global supplier of industry-specific ERP (Enterprise Resource Planning) software, announced the immediate release of the most recent version of the SYSPRO ERP Platform, SYSPRO 8 2023. With an emphasis on superior quality control, smooth automation, better warehouse functioning, and greater security and connectivity, the update includes over two dozen new capabilities and features. Additionally, the solution enhances the already-skilled SYSPRO Embedded Analytics to further strengthen its predictive capabilities.

Key Market Players

- Trimble Inc.

- Leica Geosystems AG (Hexagon)

- Topcon Corporation

- Caterpillar Inc.

- Komatsu Ltd.

- John Deere (Deere & Company)

- Volvo Construction Equipment AB

- Kubota Corporation

- CASE Construction Equipment (CNH Industrial)

- JCB (J.C. Bamford Excavators Ltd)

- Hitachi Construction Machinery Co., Ltd.

- Doosan Bobcat Inc.

- Liebherr Group

- SANY Group Co., Ltd.

- Wacker Neuson SE

Market Segmentation

By Component

- Total Station

- GNSS

- Laser Scanners

- Sensor

By Equipment Type

- Excavators

- Graders

- Loaders

- Dozers

- Scrapers

- Others

By Industry Vertical

- Infrastructure

- Commercial

- Residential

- Industrial

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3317

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308