Microprocessor Market To Rake USD 185.39 Billion By 2032

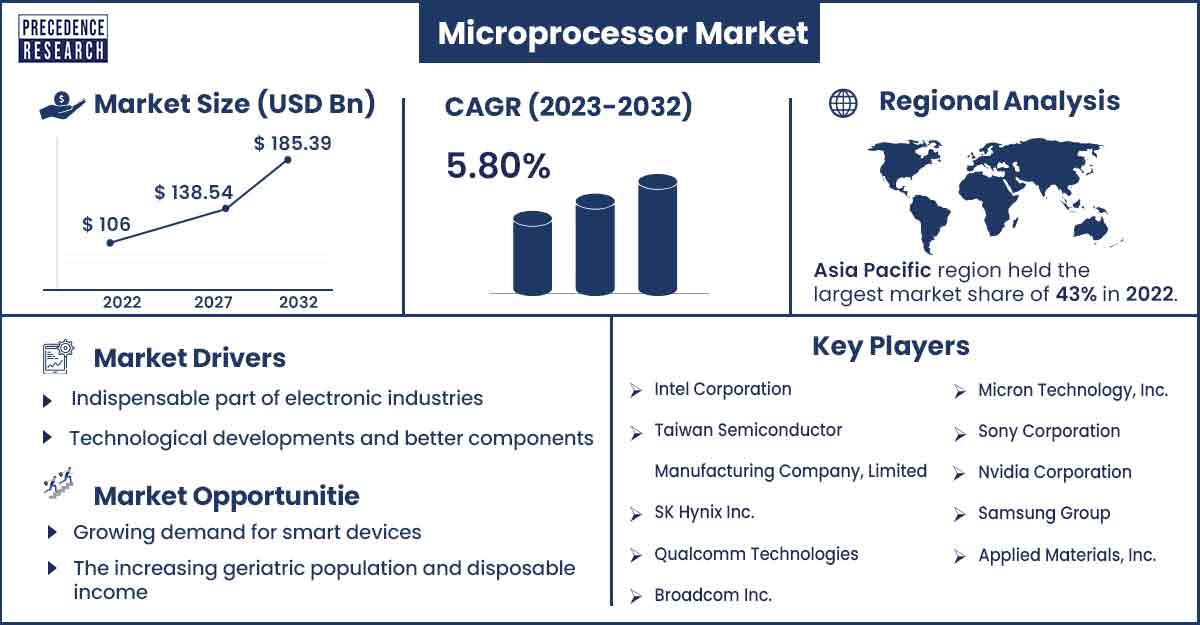

The global microprocessor market size surpassed USD 106 billion in 2022 and is expected to rake around USD 185.39 billion by 2032, poised to grow at a CAGR of 5.80% from 2023 to 2032.

Market Overview

A microprocessor, or central processing unit (CPU), is a crucial computer component, serving as the system's brain. Housed on a microchip, it comprises millions of tiny components like diodes, semiconductors, and resistors. Microprocessors are vital in various electronic devices, such as servers, tablets, smartphones, and embedded systems.

The global microprocessor market is witnessing growth fueled by the growing demand for augmented reality, virtual reality applications and devices, digital cameras, and gaming consoles. Additionally, adopting smart home products, including smart locks, fire and smoke alarm systems, and smart speakers, contributes to this trend. The increasing purchasing power of the middle class, particularly in emerging countries like India and Brazil, further supports the expected growth of this market.

The rapid expansion of the Internet of Things (IoT), along with the growing data center sector, are significant factors driving the increased usage of microprocessors. With the practicality and cost-effectiveness of collecting data from a broader range of devices, organizations face challenges in managing the complexity and volume of information generated by IoT products and platforms. Moreover, various components within the IT infrastructure, such as uninterruptible power supply (UPS) systems, power distribution units (PDUs), and cooling units, rely on microprocessors in various capacities. Adopting micro-data centers offers several advantages, including reduced transactional costs, enhanced functionality, and increased storage capacity.

- By 2026, there could be approximately 7,516 million smartphone users. The rising demand for cell phones drives manufacturers to develop more efficient products.

- According to Ericsson, smartphone subscriptions will increase from 6,260 million in 2021 to 7,790 million by 2028.

Regional Snapshot

Asia-Pacific appears to lead the microprocessor market due to various favorable conditions. The region hosts significant semiconductor manufacturers like Samsung, SMIC, and TSMC, which are known for producing revolutionary microprocessors across the globe. The area is also known to benefit from a vast and developing consumer electronics sector that encompasses IoT devices and smartphones, which fuels the demand for microprocessors.

Moreover, Asia-Pacific countries, especially China, are heavily investing in data centers, AI, and 5G infrastructure, causing a marked requirement for refined microprocessors. Combined with its rich manufacturing capabilities, deep tech ecosystem, and extending technological investments, Asia-Pacific stands at the forefront of the global microprocessor market.

China is expected to maintain a dominant position in the microprocessor market due to the presence of a considerable consumer base for the electronics and automotive manufacturing industries. China Association of Automobile Manufacturers found in its April 2022 update that around 996,000 passenger cars and 210,000 commercial vehicles were produced in the country. India hopes to have achieved heavy-grade commercial silicon production and design victories by December 2023.

- The government of India has inked five Memorandums of Understanding with companies such as Sony India, ISRO, BEL, and others to promote the usage of the Shakti and Vega RISC-V microprocessors, which were created in-house.

- In November 2023, SK Hynix Inc. announced that it had started supplying its customers with 16-gigabyte packages of Low Power Double Data Rate 5 Turbo (LPDDR5T), the fastest mobile DAM available today that can transfer 9.6 gigabits per second.

- In November 2023, Samsung claimed the title of the world's most innovative company with an impressive innovation score of 9.25 out of 10, driven by the registration of 8,513 patents in 2022. Apple secured the second position with a score of 9.03 and 2,313 patents.

Microprocessor Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 111.62 Billion |

| Projected Forecast Revenue by 2032 | USD 185.39 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.80% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Indispensable part of electronic industries

The microprocessor market is experiencing growth driven by increasing demand for enhanced processing capabilities across various sectors, such as data centers, artificial intelligence, gaming, and edge computing. Advanced microprocessors are essential for efficiently processing large volumes of data in data centers, supporting complex algorithms in AI applications, providing sophisticated performance for gaming CPUs and GPUs, and enabling real-time decision-making in edge computing. Key players launch improved technologies in response to the market's demand for more powerful computing solutions.

- In October 2023, Intel introduced its fourteenth-generation desktop processors, led by the Intel Core i9-14900K with up to 24 cores and 32 threads.

Technological developments and better components

The growing demand for microprocessors can also be attributed to technological advancements in televisions (including smart TVs), laptops, and speakers. These devices are designed to provide superior sound quality and immersive visual experiences such as 4K and 8K viewing. Architects and graphic designers use low-cost workstations that depend on microprocessors for image-processing applications involving 2D and 3D images. Executing complex algorithms necessary for these tasks is possible using specialized microprocessors. Several key organizations are actively investing in advanced technology to gain a competitive edge over other companies.

- In April 2022, Keysight Technologies, a prominent tech company specializing in design and validation solutions, revealed that SK Hynix had opted for Keysight's integrated Peripheral Component Interconnect Express (PCIe) 5.0 test platforms. This decision aims to expedite the development of memory semiconductors crucial for designing cutting-edge products, handling large data volumes, and supporting high data rates.

Restraint

High costs associated with procuring raw materials and shipments

Although the microprocessor market is expanding due to technological advancements and the increasing popularity of consumer electronics, several obstacles impede its overall expansion. The rise in sales of low-cost mobile devices, the decrease in shipments of individual computers, and elevated raw material costs are among these obstacles.

Opportunities

Growing demand for smart devices

Microprocessors are pivotal in improving the overall performance of smartphones, and as the prevalence of these devices continues to rise, so does the demand for microprocessors. Integrating IoT and AI chips in server processors aims to reduce microprocessor unit costs. These chips find applications in connected devices, data centres, and public clouds, facilitating efficient data transfer within IT organizations. The growth of the smartphone and tablet market drives increased demand for microprocessors, with these chips enhancing device speed and efficiency.

The cell phone and tablet markets grow quickly, driving expanded interest in chips. The business is supposed to grow because of the rising prevalence of cell phones. Information demonstrates that over 75% of cell phone proprietors worldwide use cell phones. Since microchips are pivotal in upgrading cell phone speed and productivity, they fundamentally add to the general presentation of these gadgets. Any cell phone's presentation, speed, and proficiency are intently attached to the exhibition of its chip. Addressing the challenge of creating accessible microprocessor structures to program and deliver excellent performance without requiring significant user investments has concerned modern supercomputers

The increasing geriatric population and disposable income

The growing aging population, increasing per capita disposable income, and focus on the quality of life are closely linked to healthcare spending. Long-life expectancies have significantly increased worldwide as the elderly population has grown, leading to various health issues. Electronic healthcare systems like real-time patient monitoring, wireless body monitoring, and remote health monitoring rely heavily on microprocessors. For instance, in nerve integrity monitors, embedded chips translate electromyographic (EMG) impulses into audible and visual signals during operations. This enhances patients' satisfaction and contributes to reducing clinical costs. This trend creates opportunities for growth in the market.

Growing environmental awareness

Environmental concerns drive the microprocessor market, with a growing demand for energy-efficient processors aligned with global sustainability targets. Manufacturers focus on improved performance technologies while minimizing power usage and heat production. These energy-efficient chips are crucial for eco-friendly computing practices and are prevalent across various sectors. Both companies and consumers seeking environmentally responsible solutions contribute to the rising market for energy-efficient chips.

- In June 2023, AMD collaborated with Amazon Web Services to introduce Amazon EC2 M7a featuring fourth-generation AMD EPYC processors.

Recent Developments

- In July 2023, Intel held a press conference in Beijing, introducing the deep learning processor Habana Gaudi 2 to the Chinese market. The purpose of this processor is to enhance AI training and inference performance. Chinese artificial intelligence server companies, including Inspur, New H3C, and xFusion, are expected to launch server products equipped with the Gaudi 2 processor.

- In December 2023, Intel Corporation announced its plans to launch its latest processors specifically designed for AI technology. This event is expected to strengthen Intel's position as a significant contributor to the AI industry alongside competitors like Nvidia Corp. and Advanced Micro Devices Inc.

Key Market Players

- Intel Corporation

- Taiwan Semiconductor Manufacturing Company, Limited

- SK Hynix Inc.

- Qualcomm Technologies

- Broadcom Inc.

- Micron Technology, Inc.

- Sony Corporation

- Nvidia Corporation

- Samsung Group

- Applied Materials, Inc.

Market Segmentation

By Technology

- CISC

- RISC

- ASIC

- Superscalar

- DSP

By Application

- Smartphones

- Personal Computers

- Servers

- Tablets

- Embedded Devices

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1287

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308