Nutraceutical Excipients Market Revenue to Attain USD 8.42 Bn by 2033

Nutraceutical Excipients Market Revenue and Trends 2025 to 2033

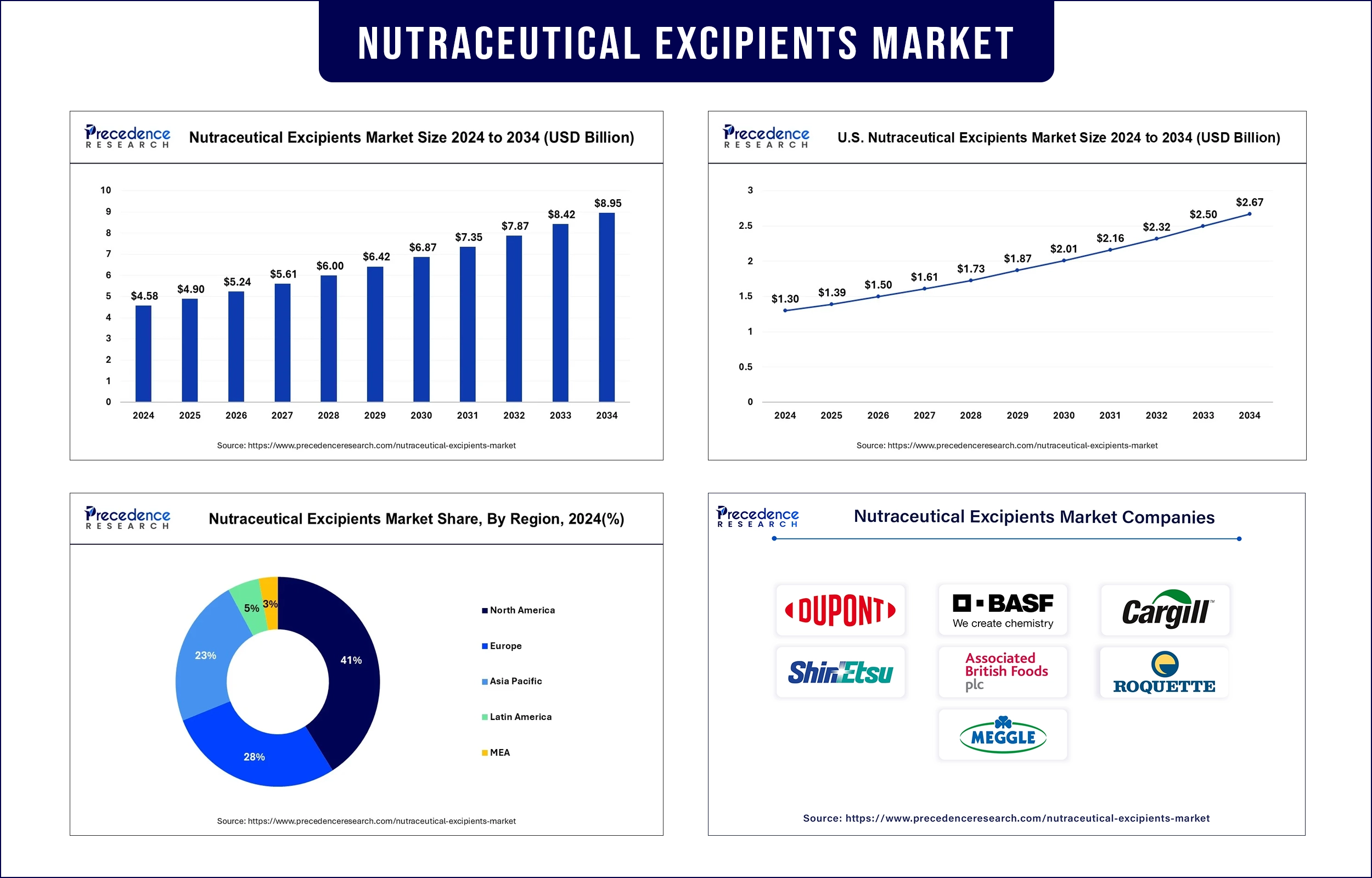

The global nutraceutical excipients market revenue was valued at USD 4.90 billion in 2025 and is expected to attain around USD 8.42 billion by 2033, growing at a CAGR of 6.93% during forecast period. The global market is projected to experience strong growth driven by the rising consumer demand for functional foods and dietary supplements.

Market Overview

Exclusively used within dietary supplements and functional foods are substances that belong to the nutraceutical excipients market, as they surpass the active ingredient. Stable final products and enhanced bioavailability and taste benefits from these excipients that fulfill important functions. Market expansion takes place because of growing public health consciousness and the move towards disease prevention services.

The World Health Organization (WHO) reports that noncommunicable diseases (NCDs) constitute 74% of international mortality rates, demonstrating why people are turning to nutraceuticals for disease prevention and health maintenance.

The future outlook of nutraceutical excipients depends on ongoing technological progress within natural excipient source identification, clean label regulations, and encapsulation systems development. Manufacturers with regulatory agencies form successful partnerships to create advanced nutraceutical products through their improved collaboration pipeline that delivers safe and effective products with strong consumer market acceptance.

Report Highlights

- By functionality, the binder segment is a dominant player and is anticipated to have the biggest impact on the nutraceutical excipients market. Binders play a crucial role in maintaining the integrity, consistency, and cohesiveness of tablets and capsules, ensuring that the active ingredients are evenly distributed and stable throughout shelf life. The fillers and diluents also hold a significant position in the market. Diluents help increase the volume of formulations to ensure accurate and consistent dosing of active ingredients, especially when dealing with potent bioactives present in very small quantities.

- By product, the probiotics segment held the largest market share. Probiotic formulations require highly specialized excipients that protect live microorganisms during manufacturing, storage, and gastrointestinal passage. Excipients such as prebiotic fibers and protective polymers enable better survival rates of probiotics, thereby enhancing their functional efficacy in maintaining gut health and supporting immune function.

- By form, the dry segment held a dominant market share than the liquid version. Dry excipients, such as powders and granules, offer advantages like longer shelf life, greater stability, and easier handling during manufacturing processes. They also allow for innovative applications such as capsules, sachets, and functional foods where moisture-sensitive bioactives are involved.

Market Trends

Growing Demand for Natural and Clean Label Excipients

The market shows rising consumer interest in using natural plant-derived excipients due to their preference for choosing substances that are free of synthetic additives. Manufacturers need to develop excipients from natural, organic, and sustainable resources due to increasing market demand. Organic and minimally processed excipients witness increased market demand because of growing clean label trends. The increasing need for transparency and sustainability in excipient development leads nutraceutical brands to work together with regulatory bodies.

- A 63% majority of consumers prioritize 'natural' statements when they buy health products based on the IFIC 2023 survey results.

Advancements in Controlled-Release Technologies

New delivery technologies for controlled-release improve how well nutrients are absorbed by the body while also prolonging the effectiveness of nutraceuticals. Two primary technologies have emerged for controlled delivery through hydrophilic matrices and multi-layer tablets. The U.S. Food and Drug Administration (FDA) acknowledged controlled-release excipients as vital for personalizing nutrition strategies when they gave their emphasis in 2024. The increasing demand for convenient and effective health solutions drives advanced excipient technologies to become the defining components of the next nutrition-centric product developments.

Rising Focus on Personalized Nutrition

The market demand for flexible excipients increases because of the growing industry focus on individualized nutrition approaches based on personal genetic, health, and lifestyle characteristics. Personalized nutrition approaches employ custom-tailored excipients, as these substances provide modifiers that enable controlled drug release, mask unpleasant tastes, and maximize benefits according to individual requirements. The combination of genetic information with lifestyle data alongside new excipient discovery methods shapes future nutraceutical product development.

- The Food and Agriculture Organization (FAO) issued a 2024 report, which states that personalized nutrition stands as a critical preventive healthcare method requiring flexible excipients for customized formulation development.

Regulatory Support for Nutraceutical Innovations

Various international regulatory bodies are promoting the manufacturing of nutraceutical products by using standardized safety guidelines and effectiveness criteria. Innovative excipient approvals now have more streamlined processes from both the U.S. FDA and the European Food Safety Authority, which enables quicker market entry. Moreover, the new regulatory standards strengthen manufacturers' capacity to create innovative products in a responsible way, which safeguards both product results and consumer safety.

- The U.S. FDA released revised dietary supplement excipient policies in 2024, which aimed to boost effectiveness and make excipient ingredients transparent regarding allergies.

Regional Outlooks

North America

North America is expected to maintain its dominant position in the nutraceutical excipients market, supported by high consumer health awareness, strong regulatory frameworks, and significant investment in R&D. Active systems development for nutraceutical delivery and a substantial number of consumers interested in functional nutrition drive the success of the U.S. market. Furthermore, the proactive ecosystem, strong research institutions, and regulatory bodies enable North America to maintain its progress in the nutraceutical excipients sector.

- As part of its support for innovation, the U.S. Food and Drug Administration (FDA) modified its Nutrition Labeling and Education Act during 2024 to enhance transparency in excipient processing origins.

Europe

Europe is anticipated to experience the fastest growth in the nutraceutical excipients market due to the expansion of health-conscious individuals and the aging population ages and demand for functional foods and supplements. The European Food Safety Authority maintains its role in fortifying health claim regulations to provide consumers with greater peace of mind regarding nutraceutical products. The rise in European Union countries adopting sustainability and natural ingredient procurement initiatives enhances market demand for easily recognizable excipients. Furthermore, the area's market expansion for public healthcare campaigns supported by nutritional literacy programs and government efforts aimed at promoting healthy eating again.

Nutraceutical Excipients Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 4.90 Billion |

| Market Revenue by 2033 | USD 8.42 Billion |

| CAGR | 6.93% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market News

- In November 2024, Clariant announced its participation at CPHI India, scheduled from November 26-28 in Delhi NCR. The Company plans to showcase its latest healthcare solutions, emphasizing its “Made in India” product portfolio and the capabilities of its Benthically operations.

- In October 2023, the Lubrizol Corporation announced that its Carbopol polymers received new EU food-grade approval, opening an opportunity for nutraceutical manufacturers to differentiate their product portfolio and introduce novel claims. Carbopol Polymers provide multifunctional benefits, enabling the creation of smaller, easier-to-swallow tablets and nutrient delivery.

Nutraceutical Excipients Market Key Players

- DuPont

- BASF SE

- Cargill Inc

- Shin-Etsu Chemical Co Ltd

- Associated British Foods

- Roquette Freres

- Meggle Group Wasser

- Kerry Group PLC

- Fuji Chemical Industries Co Ltd

- PharmatransSanaq AG

- Pioma Chemicals

- Gattefosse

- Ingredion Plc

- Sensient Technologies

- W.R. Grace & Co

- Omya

- Grain Processing Corp

Market segmentation

By Functionality

- Binder

- MCC

- HPMC

- HPC

- Disintegrants

- Crosspovidone

- Croscarmellose

- Fillers & Diluents

- Coating Agent

- Flavoring Agent

- Lubricants

- Others

By Product

- Prebiotics

- Probiotics

- Proteins & Amino Acids

By Type

- Artificial

- Natural/Organic

By Form

- Dry

- Liquid

By End Use

- Protein and Amino Acids

- Omega 3 Fatty Acids

- Vitamins

- Minerals

- Prebiotics and Probiotics

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/1912

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344