Oncology Information System Market Revenue to Attain USD 6.00 Bn by 2033

Oncology Information System Market Revenue and Trends 2025 to 2033

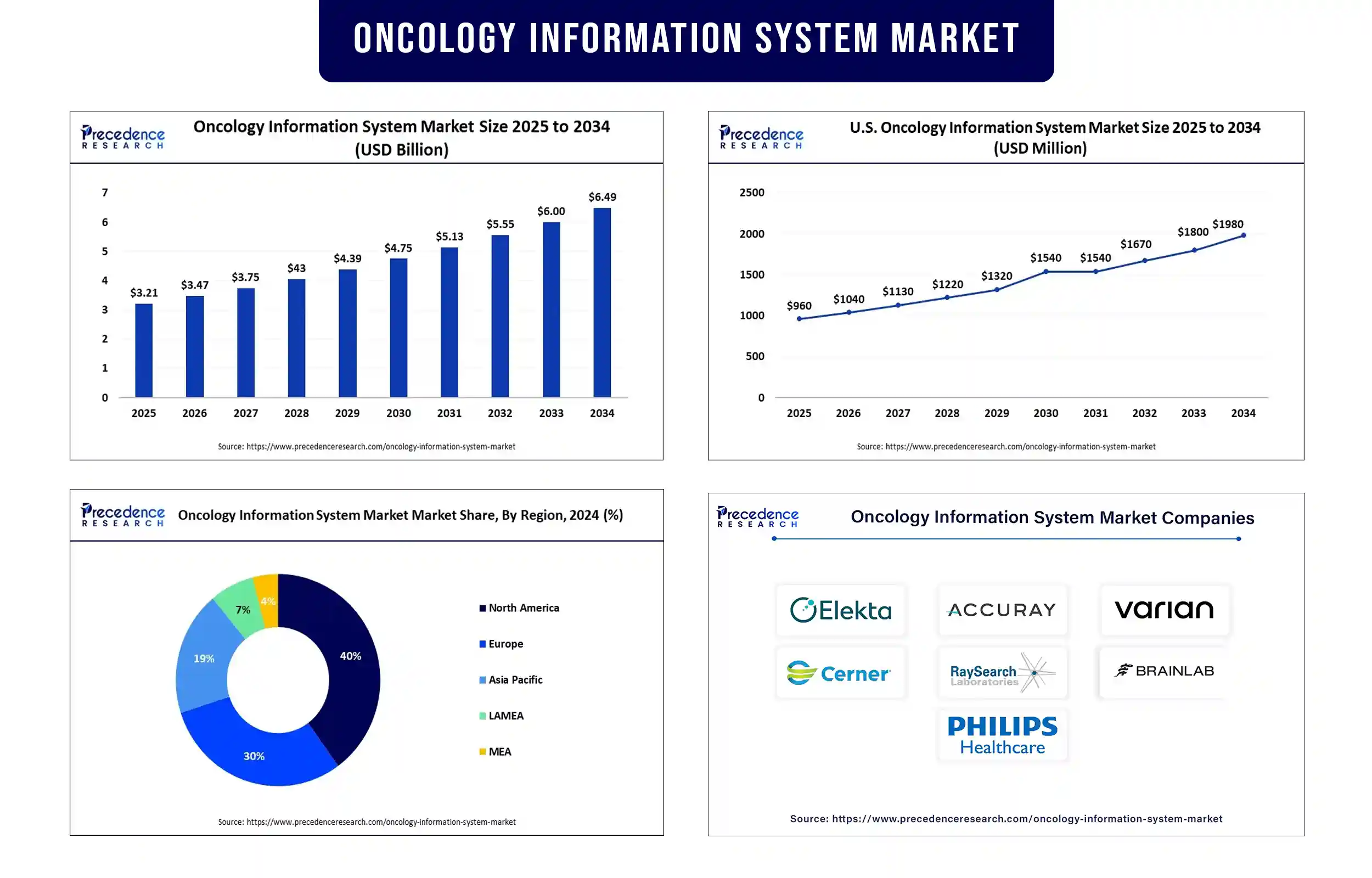

The global oncology information system market revenue reached USD 3.21 billion in 2025 and is predicted to attain around USD 6.00 billion by 2033 with a CAGR of 8.13%.

Market Overview

The oncology information system market has been witnessing rapid growth due to the increasing global burden of cancer. There is a higher need for efficient management of large datasets, such as patient records and treatment regimens, which is boosting the growth of the market. This virtual software ecosystem supports the transdisciplinary complexities of clinical, administrative, and operational workflows in the oncology encounter. The transition of care in health systems and the increased use of data to drive decision-making are also supporting market growth.

Oncology information system (OIS) helps track patient activity and plan treatments, such as radiation therapy and chemotherapy, resulting in improved outcomes. The increasing use of electronic health records and associated policies promoting digital healthcare transformation further enhance the market attractiveness. As the oncology care ecosystem continues to advance from a clinical to a value-based model of care, the demand for secure and interoperable oncology information system solutions also increases.

Major Trends in the Oncology Information System Market

AI and Predictive Analytics Integrations

One of the significant trends in the market is the integration of Artificial Intelligence (AI) and predictive analytics to revolutionize cancer treatments. Oncology information system platforms are being increasingly equipped with AI algorithms, enabling healthcare providers to analyze large amounts of clinical and patient information to anticipate treatment results. Therefore, there is a better capability to make decisions related to cancer care, which ultimately personalizes cancer care for patients by identifying the most effective therapy for individual patients.

Cloud-Based OIS

There is a rapid shift toward cloud-based oncology information systems for their scalability, enhanced data sharing abilities, and remote access capabilities. Cloud deployment provides oncology centers with a secure and compliant method for managing patient information and allows all departments to access data regardless of location. These solutions further lower infrastructure costs while improving security. Cloud solutions enable remote access, allowing hospitals and small outpatient clinics to access patient data and fostering collaboration.

Expansion of Telehealth and Remote Monitoring

Another important trend impacting the market for oncology information system is the increasing integration of telemedicine capabilities. In response to the post-pandemic, oncology information system vendors are articulating platforms that facilitate virtual care, remote tracking of patients’ symptoms, and follow-up of patients’ treatment. The Idea of continuing care with fewer visits to the hospital is becoming even more crucial for cancer patients who are immunocompromised.

Report Highlights of the Oncology Information System Market

Product Insights

The software segment held the largest share of the market in 2024. This is mainly due to the increased need to decrease medical errors and control the ongoing financial burden of cancer care to improve the quality of oncology care services. Software is essential in any cancer information system, facilitating data collection, analysis, and processing. The software provides detailed insights into patient health data, which can then be used to develop personalized therapies. On the other hand, the services segment is expected to expand at the fastest rate during the forecast period. With the increasing adoption of oncology information systems, the need for installation, management, consultation, and training services is rising.

Application Insights

The radiation oncology segment led the market in 2024 and is expected to grow at a significant CAGR over the forecast period. The increase in radiosurgery increases the need for radiation oncology. Radiological departments are generating a lot of data about cancer, creating the need for OIS. OIS is essential to manage radiation therapy treatment plans and delivery.

End-user Insights

The hospitals segment contributed the most market share in 2024. This is mainly due to increased patient volumes receiving cancer treatment. Hospitals remain dominant in delivering cancer treatments due to the availability of advanced diagnostics, and surgical and drug-delivering instruments. With many patients preferring to receive care from hospitals, there is a high adoption rate of OIS.

Regional Insights

North America registered dominance in the oncology information system market with the largest revenue share in 2024. This is mainly due to the region's advanced healthcare system, facilitating the rapid adoption of OIS. The increased integration of OIS with other technologies like electronic health records further bolstered the growth of the market in the region.

Asia Pacific is expected to expand at the fastet rate in the coming years. This is mainly due to the rising number of cases of cancer and the high demand for targeted cancer therapies. Governments around the region are making efforts to modernize health infrastructures and improve access to healthcare services, supporting the market' growth. The uptick in cancer incidence, access to medical technologies, and increased knowledge around data-led treatments and plans are influencing the market. The growing demand for cancer care presents opportunities for market expansion.

Oncology Information System Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 3.21 Billion |

| Market Revenue by 2033 | USD 6.00 Billion |

| CAGR from 2025 to 2033 | 8.13% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In October 2023, at ASTRO 2023, Varian medical systems launched its next-generation oncology information system intending to combine data and resources across oncology specialities. It enables care teams to have a more complete view of their patients.

- In July 2023, RaySearch Laboratories launched RayCare 2023B, an updated version of its oncology information system, which features integrated management of radiotherapy treatment processes and a new workspace for managing treatment courses.

Oncology Information System Market Key Players

Elekta AB

Accuray Inc.

Varian Medical Systems

RaySearch Laboratories

Cerner Corp.

BrainLab

Philips Healthcare

Prowess, Inc.

DOSIsoft S.A.

ViewRay Inc.

MIM Software

Flatiron

McKesson Corporation

Siemens Medical Solutions, Inc.

Market Segmentation

By Product

- Software

- Services

By Application

- Medical Oncology

- Radiation Oncology

- Surgical Oncology

By End User

- Hospitals

- Research Centers

- Specialty Clinics

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/3019

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344