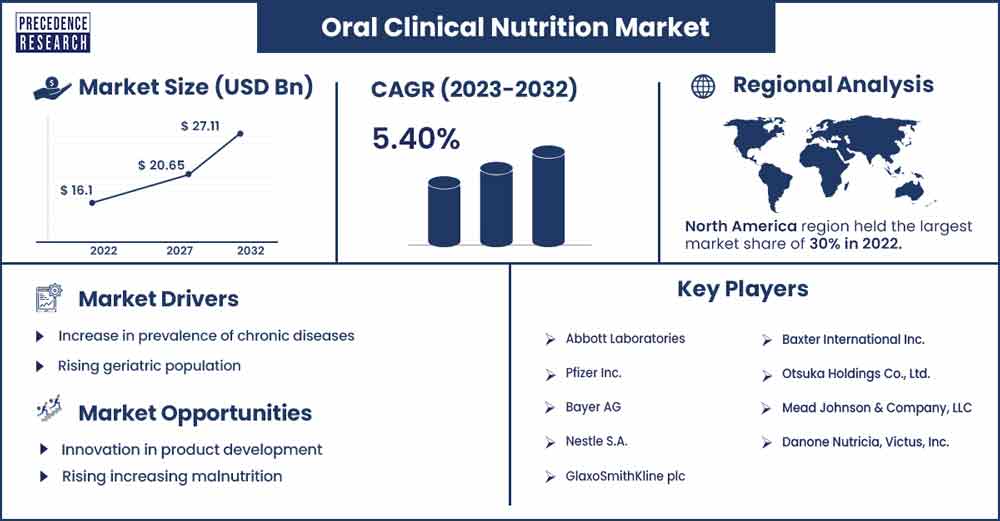

Oral Clinical Nutrition Market To Attain Revenue USD 27.11 Bn By 2032

The global oral clinical nutrition market size surpassed USD 16.1 billion in 2022 and is projected to attain around USD 27.11 billion by 2032, growing at a CAGR of 5.40% from 2023 to 2032.

Market Overview

The oral clinical nutrition sector represents a vibrant domain within the healthcare landscape dedicated to expanding its nutritional portfolio, including proteins, minerals, iron, calcium, vitamin supplements, and nutritional beverages using plant-based foods to fight against chronic disorders and boost immunity. An unhealthy or sedentary lifestyle leads to an increasing burden of several health issues, including chronic diseases, lack of nutrition, obesity, autoimmune diseases, and neurological diseases. Oral clinical nutrition provides additional nutrients such as proteins, vitamins, and carbohydrates in semi-solid, powder, or liquid forms for oral consumption. Oral nutritional supplements (ONS) are extensively used during acute or chronic illness for individuals unable to meet required nutritional levels through the oral diet alone.

Oral nutritional supplements complement nutritional intake, prevent the risk of malnutrition in patients, and reduce health complications and hospital admissions. ONSs are available over the counter in supermarkets, online, and in pharmacies, but most of the products can only be purchased through prescription, following advice from a dietitian. In recent years, the oral clinical nutrition market has gained significant momentum due to its excellent nutritional health benefits. It helps alleviate the risk of chronic disorders and enhances the performance of the body.

Several elements, including the increasing prevalence of chronic conditions, rising demand for personalized fitness supplements, elevated healthcare expenditure, growing incidence of malnutrition, rising consumer awareness of nutritional health benefits such as nutrition-rich diets, healthy ageing, and others, drive the market. Moreover, increasing research and development activities of new oral clinical nutrition supplements, rising adoption of ONSs among the adult population, and innovation and new product development by key market players are anticipated to propel the market’s growth.

- In October 2023, Danone announced an investment of USD 15.8 million in Turkey's factory for medical nutrition products as a part of factory expansion. The Lüleburgaz plant expansion is for the Fortinel and Fortini brands of medical nutrition products.

- In September 2023, Hermes Pharma GmbH announced an investment of USD 23.6 million in its manufacturing facilities to boost the production of orally disintegrating granules, chewable tablets, lozenges, instant drinks, and effervescent. The investment will support new equipment, production and storage capacity, and greater operational efficiency to meet the increasing market demand for user-friendly oral dosage forms.

- In November 2023, Viome Life Sciences announced the acquisition of the digital wellness company Naring Health to expand personalized nutrition offerings and further its goal of bringing at-home diagnostics to the masses. Through the acquisition, Naring will provide Viome with access to clinical and molecular data to fuel its efforts in personalizing health and medicine.

Regional Insights

North America is expected to hold the largest market share during the forecast period. The growth of this region is attributed to the presence of prominent clinical oral nutritional product manufacturers, the growing adult population, growing awareness of the significance of dietary benefits, rising investments in the research and development activities of oral clinical nutrition supplements, ascending healthcare expenditure, and increasing prevalence of chronic disorders such as Alzheimer’s, cancer, diabetes kidney diseases, and others.

The U.S. market has undergone substantial expansion due to rising demand for personalized nutritional products, the presence of sophisticated healthcare infrastructure, robust focus on wellness resulting in rising product adoption, and rising innovation in product development.

- In June 2022, Glanbia Nutritionals announced the launch of TechVantage, a new functionally optimized nutrient technology platform. The in-house technologies within the TechVantage are NutraSheild, Microcencapsulations, UniTrit Triturations, and Granuplex Granulations, each of which has its specific benefits.

Oral Clinical Nutrition Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 16.89 Billion |

| Projected Forecast Revenue by 2032 | USD 27.11 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.40% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing prevalence of chronic disorders

The rapidly rising incidence of chronic disorders is expected to spur the demand for oral clinical nutrition products in upcoming years. The most prevalent chronic diseases such as cancer, diabetes, kidney diseases, Alzheimer’s, Dysphagia, and other nutrition deficiencies. According to the May 2023 report of the Centers for Disease Control and Prevention, 6 out of every 10 US citizens live with at least one chronic disease such as stroke, cancer, heart disease, or diabetes.

Nutritional benefits are gaining significant attention due to their multiple medical benefits in treating diseases and promoting better well-being. The emerging benefits of preventive healthcare solutions are encouraging people to take their health into their own hands by consuming proper nutrition. As a result, the rising prevalence of chronic disorders is contributing towards the growth of the global oral clinical nutrition market.

Rising geriatric population

The increasing geriatric population across the globe is anticipated to fuel the market’s expansion during the forecast period. The pace of population aging is growing faster than in the past. According to the World Health Organization report published in October 2022, one in six people worldwide will be 60 years or over by 2030. By 2050, the world’s population of sixty years and older is expected to be more than 2 billion. The adult aging population is susceptible to reduced muscle and bone strength, vitamins, apathy, lower immunity, hypertension, diabetes, and calcium deficiency, which results in increasing demand for oral clinical nutrition products. Thereby driving the market’s growth.

Restraint

High cost and low consumer awareness

The high cost of supplements is anticipated to restrain the oral clinical nutritional market's expansion during the forecast period. The longer consumption of these supplements causes liver and bone toxicity. In addition, a shortage of consumer awareness in low to average-income economies is likely to hamper the growth of the global oral clinical nutritional market during the forecast period.

Opportunities

Product launches and partnership

The growing product launches are expected to create a lucrative opportunity for the market in the upcoming years. In addition, nutritional supplements are produced in numerous innovative flavors and are highly preferred by patients. For instance, In October 2023, Optimum Nutrition announced the launch of Clear Protein, a brand-new product that uses the latest technology to create an apparent protein shake. This 100% plant protein isolate delivers a delicious fruity flavor while packing a powerful punch of 20g of high-quality Protein in every serving to support training and daily nutrition goals. Clear Protein comes in two refreshing flavors: lime sorbet and juicy peach.

Rising increasing malnutrition

The increasing number of cases of malnutrition globally increases the importance of nutritional products. ONS help prevent malnutrition and are beneficial for individuals suffering from an extended infection or half-starved patients to improve their nutritional situation. According to the World Health Organization report in December 2023, 462 million people are underweighted globally. The increase in deficiency diseases is expected to spur the demand for oral clinical nutrition products during the forecast period.

Recent Developments

- In August 2022, Abbott announced the launch of its new Ensure Gold, the first oral nutritional supplement powder in Thailand with HMB, to help the rapidly growing ageing population prevent or slow age-related muscle loss. This nutrition supplement provides essential nutrients to support older adults’ muscles and overall health.

- In October 2022, Hologram Sciences entered into a strategic partnership with Maeil Health Nutrition to bring personalized nutrition services to Korea.

- In August 2023, the FDA announced the approval of ZURZUVAE (zuranolone), the first and only oral treatment approved for women with postpartum depression, and issued a complete response letter for major depressive disorder.

Oral Clinical Nutrition Market Players

- Abbott Laboratories

- Pfizer Inc.

- Bayer AG

- Nestle S.A.

- GlaxoSmithKline plc

- Baxter International Inc.

- Otsuka Holdings Co., Ltd.

- Mead Johnson & Company, LLC

- Danone Nutricia, Victus, Inc.

Segments Covered in the Report

By Stage

- Adults

- Pediatrics

By Indication

- Alzheimer’s

- Nutrition Deficiency

- Cancer Care

- Diabetes

- Chronic Kidney Diseases

- Orphan Diseases

- Dysphagia

- Pain Management

- Malabsorption/GI Disorder/Diarrhea

By Sales Channel

- Online Sales

- Retail Sales

- Institutional Sales

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3368

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 9197 992 333