Protein Engineering Market Revenue to Attain USD 17.83 Bn by 2033

Protein Engineering Market Revenue and Trends 2025 to 2033

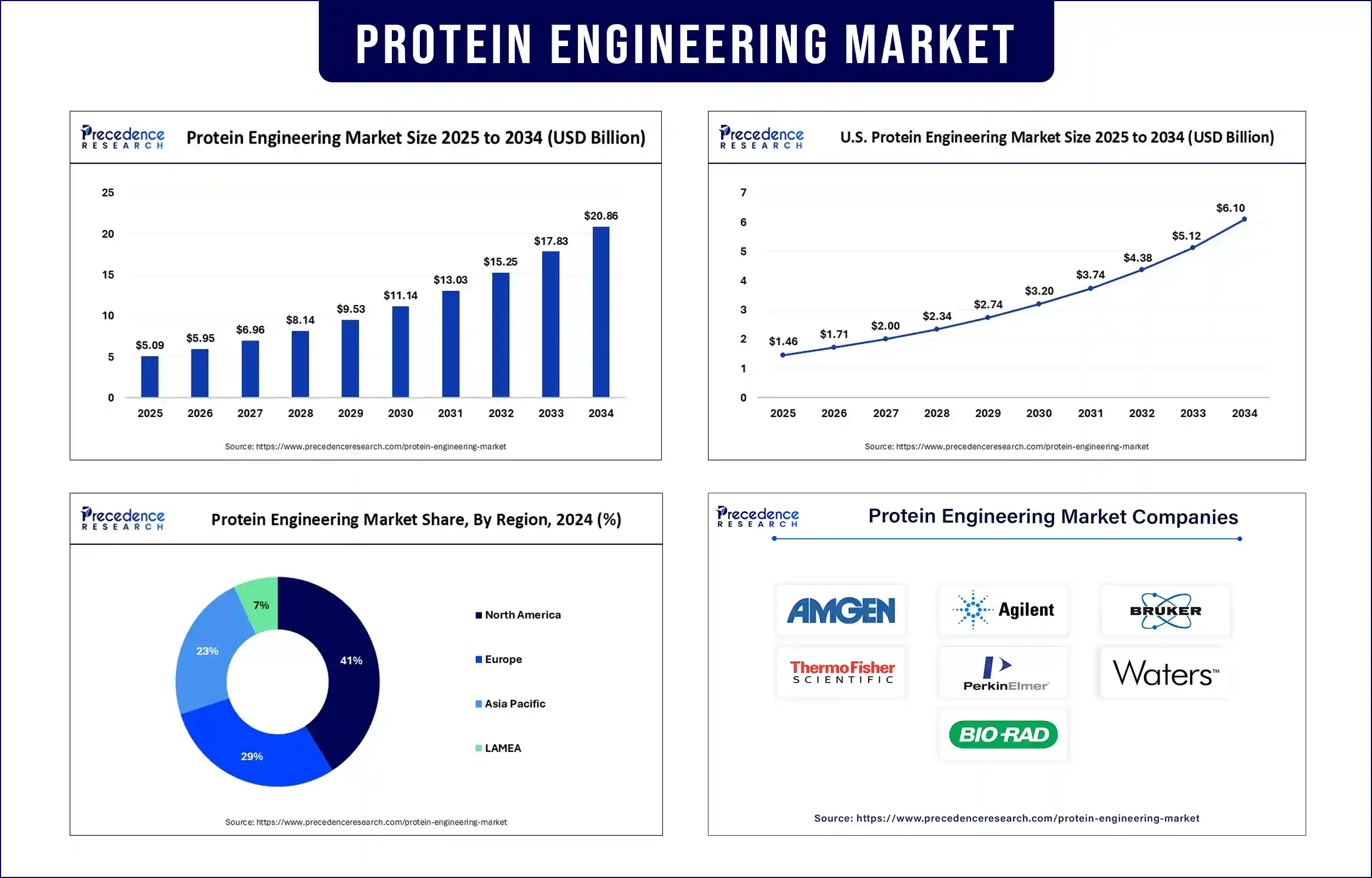

The global protein engineering market revenue is reached USD 5.09 billion in 2025 and is predicted to attain around USD 17.83 billion by 2033 with a CAGR of 16.97%. The global protein engineering market is projected to witness significant growth, driven by the increasing demand for novel therapeutics, advancements in synthetic biology, and the growing adoption of protein-based drugs. Enhanced drug discovery processes and the evolution of genome editing technologies continue to accelerate market growth.

Market Overview

Protein engineering refers to the technologies and methods adopted for designing and modifying proteins for enhancing their function or developing a new set of proteins. These engineered proteins are widely used in biopharmaceuticals, enzymes, and diagnostics. The increasing preference for protein-based therapies in the treatment of chronic and genetic diseases is likely to boost the growth of the market. The National Institutes of Health (NIH) reports that more than 400 protein therapeutics are still in the clinical development phase, which is an indication of solid momentum in research in the area. In 2024, the U.S. FDA approved several engineered protein drugs for oncology and rare diseases, which marked the rising clinical significance of such medications. The market is further strengthened by synthetic biology platforms, where one can accurately manipulate proteins to create new enzyme pathways that can be used in medicine and sustainable chemical production.

Protein Engineering Market Trends

Rising Demand for Biologics

Protein engineering allows the production of biologics that block the disease-specific pathways, reducing the off-target effects. According to the report released by WHO in 2024, targeted protein therapies are increasingly advised in such conditions as rheumatoid arthritis, multiple sclerosis, and some cancers. There is a need for accurate treatment methods, resulting in investment in research on engineered therapeutic proteins. Advances in engineering proteins for better predictable pharmacokinetics and reduction in immunogenicity still drive the innovation.

Advancements in Technology

Artificial intelligence (AI) is changing the way protein engineering is done by providing the prediction of protein folding, sequence optimization, and modeling the interactions. In 2024, a team of researchers used AI platforms such as AlphaFold to predict complex enzyme structures. The FDA stated that AI-assisted protein engineering had greatly expedited the creation of enzyme therapy for rare metabolic disorders. AI’s high speed of analyzing immense datasets allows for accurate alterations in protein sequences, which make them effective and stable. Moreover, machine learning algorithms are being incorporated into drug discovery pipelines to predict protein-protein interactions.

Expanding Scope of Applications

Apart from healthcare, engineered proteins are making their way in industrial biotechnology. Enzyme engineering increases catalytic efficiency, stability, and specificity in meat processing, the production of biofuels, and the treatment of wastes. According to the U.S. Department of Energy report released in 2024, there has been an increase in biomass conversion yields by more than 30% as a result of introducing enzymes in the biorefineries. These applications are important for creating greener and more sustainable industrial systems. Enzyme-driven treatment technology was noted as a good alternative to common chemical disinfectants in decentralized waste systems.

Emerging Use in Gene Therapy and Vaccines

Engineered proteins are major contributors to the delivery of genes and the latter generation vaccines. Protein engineering allows the generating of stable and immunogenic vaccines. The FDA approved various protein-engineered adjuvants that promote the immune response in mRNA and recombinant vaccines for infectious diseases. These improvements are making vaccines more thermostable. Furthermore, researchers are using protein to quickly substitute antigens and react to developing threats devised by viruses in order to gain more strength.

Report Highlights of the Protein Engineering Market

Product Insights

The instruments segment held the maximum market share in 2024. This is mainly due to the widespread use of advanced equipment in protein crystallization, purification, and characterization across research and production facilities. Instruments used for high-throughput screening and real-time structural analysis continue to support faster, more efficient experimentation in academic and industrial settings.

Technology Insights

The rational protein design segment dominated the market with the largest share in 2024. This approach enables precise modification of protein structures based on computational modeling and known functional data. Rational design remains central to therapeutic protein development, especially for antibody engineering, enzyme optimization, and fusion protein construction.

Protein Type Insights

The monoclonal antibodies segment led the market with the largest share in 2024. This is mainly due to their increased use in targeted therapies, particularly in oncology and autoimmune conditions. Advancements in bispecific and antibody-drug conjugates (ADCs) also highlight innovation within this segment.

End-user Insights

The pharmaceutical & biotechnology companies segment held the largest share of the market in 2024. These organizations heavily invest in protein engineering for drug discovery, development, and biologics manufacturing. They benefit from access to cutting-edge technologies, strong funding pipelines, and collaborations with research institutes and government agencies.

Regional Outlook

North America held the largest share of the protein engineering market in 2024. This is mainly due to its well-established biotech industry, high R&D investment, and favorable regulatory frameworks. There is a high demand for protein therapeutics. According to a report by the FDA's Center for Drug Evaluation and Research (CDER), there was a significant increase in the number of new drugs approved in 2024, including protein therapeutics. Protein engineering improvements also helped decrease the time required for vaccine development. Regulatory authorities have also shifted their focus to biological innovation. Furthermore, the rising demand for life-saving protein therapeutics, especially in oncology and rare diseases, is likely to sustain the region’s position in the market.

Asia Pacific is projected to experience the fastest growth during the projection period due to expanding biomanufacturing capabilities, increasing government funding in biotechnology R&D, and a rising burden of chronic diseases. The WHO Regional Office for South-East Asia recorded an upswing in inter-regional partnerships to increase regional capability for recombinant protein vaccines and therapies. The NIH also funded collaborative research programs in 2024 with Asian academic institutions to promote the precision of protein design of common infectious ailments and heritable disorders.

Protein Engineering Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 5.09 Billion |

| Market Revenue by 2033 | USD 17.83 Billion |

| CAGR from 2025 to 2033 | 16.97% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Protein Engineering Market News

- In February 2025, Capgemini announced in February 2025 a groundbreaking generative AI methodology for protein engineering, powered by a specialized protein large language model (pLLM). With a patent pending, this innovative approach dramatically reduces the number of data points required to design protein sequences by over 99%. By leveraging generative AI, Capgemini aims to significantly cut R&D time and costs, enabling clients to pursue biosolutions that were previously impractical due to resource constraints.

- In January 2025, Bio-Techne, a global leader in life science tools and reagents, introduced a new portfolio of designer proteins in January 2025, developed using advanced AI design platforms and protein evolution workflows. Released under its R&D Systems brand, the lineup includes IL-2 Heat Stable Agonist, Activin A Hyperactive, and FGF Basic Heat Stable, available for both research and GMP-grade therapeutic applications, as well as new Wnt/RSPO agonist proteins designed to support regenerative medicine and cellular therapies.

- In September 2024, Ginkgo Bioworks marked a major milestone, with the launch of two AI-based solutions developed in collaboration with Google Cloud. The first is an industry-first protein large language model offering unprecedented access to Ginkgo’s proprietary data for drug discovery. The second is a model API that connects biological AI models directly with machine learning scientists. This API is publicly accessible via Ginkgo's website, with enterprise access available through Google Cloud’s Vertex AI Model Garden.

Protein Engineering Market Key Players

- Amgen, Inc.

- Agilent Technologies

- Bruker Cor.

- Thermo Fisher Scientific, Inc.

- PerkinElmer, Inc.

- Waters Corp.

- Bio-Rad Laboratories

- Merck KGaA

- Danaher Corp.

- GenScript Biotech Corp.

Market Segmentation

By Product

- Instruments

- Reagents

- Software & Services

By Technology

- Rational Protein Design

- Directed Evolution

- Hybrid Approach

- De Novo Protein Design

- Others

By Protein Type

- Insulin

- Monoclonal Antibodies

- Vaccines

- Colony Stimulating Factor

- Coagulation Factors

- Other Proteins

By End-User

- Academic Research Institutes

- Contract Research Organizations

- Pharmaceutical & Biotechnology Companies

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @https://www.precedenceresearch.com/sample/2767

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com|+1 804 441 9344