Storage Area Network (SAN) Market Revenue to Attain USD 34.8 Bn by 2033

Storage Area Network (SAN) Market Revenue and Trends 2025 to 2033

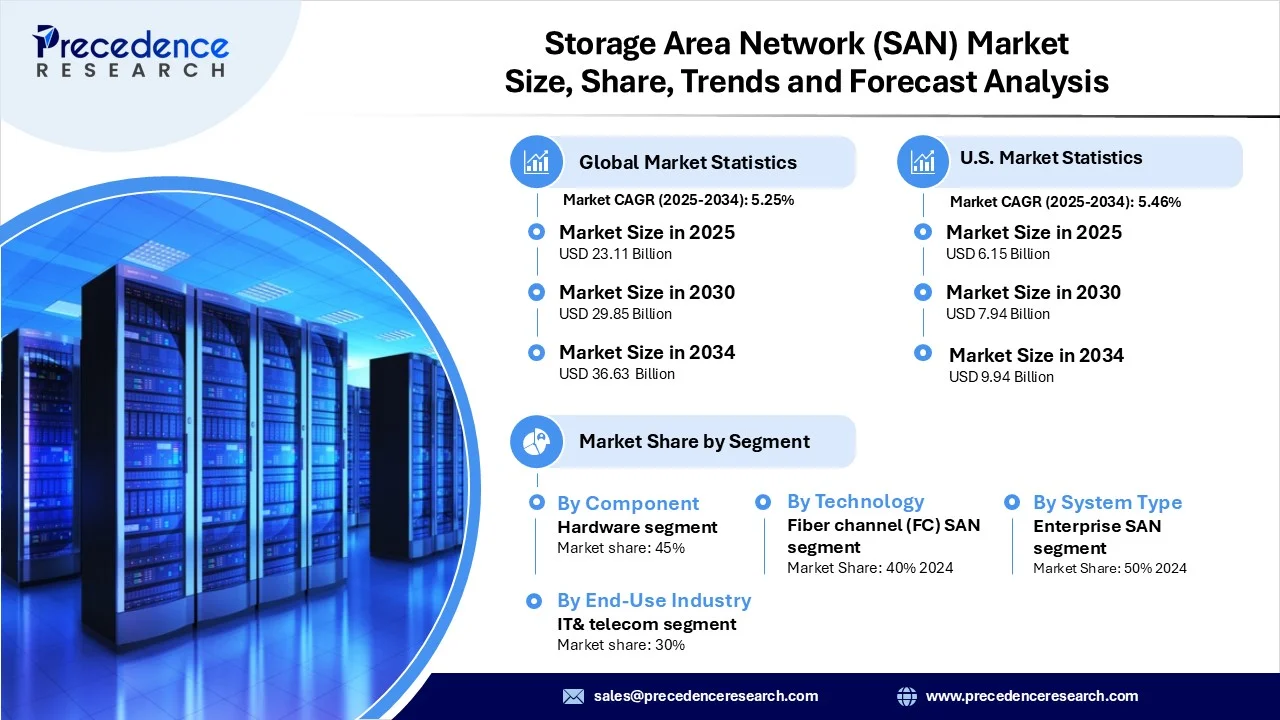

The global storage area network (SAN) market revenue reached USD 23.11 billion in 2025 and is predicted to attain around USD 34.8 billion by 2033 with a CAGR of 5.25%. This market is witnessing robust growth as enterprises are increasingly seeking high-performance, scalable, and secure storage solutions to manage surging data volumes and support digital transformation initiatives.

What are the Key Factors Influencing the Growth of the Storage Area Network (SAN) Market?

The market is experiencing significant growth due to the rising demand for ultra-low-latency, high-throughput data access, which is essential for mission-critical workloads. The shift toward hybrid and multi-cloud environments encourages SAN adoption, as businesses seek smooth integration between on-premises storage and cloud solutions. Rapid advancements in AI, machine learning, edge computing, and IoT networks have significantly increased data volumes, necessitating high-performing, scalable storage infrastructures. Strict data governance and security regulations across industries compel organizations to invest in secure, centralized storage solutions like SANs. Moreover, ongoing innovations in storage hardware and network fabric technologies (e.g., NVMe over Fabrics, high-speed FC switches) are enhancing SAN performance and reducing total cost of ownership, ultimately boosting market growth.

Segment Insights

- By component, the hardware (switches, HBAs, servers) segment held the largest share of the market in 2024, as it plays a critical role in establishing and maintaining high-speed, reliable data transfer within enterprise storage infrastructures.

- By technology, the Fibre Channel (FC) SAN segment dominated the market in 2024 due to its high adoption, driven by its high reliability, low latency, and superior performance in handling mission-critical enterprise workloads.

- By system type, the enterprise SAN segment led the storage area network (SAN) market in 2024 due to the increased adoption of data centers among enterprises. IT enterprises are increasingly seeking robust, high-throughput, scalable storage for managing workloads, contributing to segmental growth.

- By end-use industry, the IT & telecom segment contributed the largest market share in 2024 due to the industry's high reliance on centralized high-performance storage infrastructures to handle terabytes of data daily. Moreover, its massive data generation, high-performance computing needs, and demand for uninterrupted data access bolstered the segment.

Regional Insights

North America dominated the storage area network (SAN) market while holding the largest share in 2024. This is primarily due to the extensive digital transformation of enterprises, the high adoption of cloud environments among businesses, and significant investment in large-scale data center modernization. The U.S. and Canada are at the forefront of SAN innovation, with early adoption of advanced protocols and architectures. There is a strong focus on data sovereignty, which further solidifies the region's market leadership.

The Asia Pacific is emerging as the fastest-growing market, driven by expanding IT infrastructure, increasing cloud adoption, and substantial investments in smart city programs across China, India, and Southeast Asia. The region's growing data center ecosystem and enterprise modernization initiatives are significantly increasing SAN deployments.

Storage Area Network (SAN) Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 23.11 Billion |

| Market Revenue by 2033 | USD 34.8 Billion |

| CAGR from 2025 to 2033 | 5.25% |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Development

- In February 2024, Microsoft announced the general availability of its iSCSI-based Azure Elastic SAN, a fully managed, cloud-native SAN solution. Initially previewed in October 2022, the GA release adds features like performance and capacity monitoring via Azure Monitor Metrics and misconfiguration prevention through Azure Policy. (Source: https://www.infoq.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6757

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344